Your Guide to Day Trading Stock Scanners in 2026

Welcome to the future of day trading. If you're planning to succeed in 2026, your success will hinge less on staring at charts all day and more on using smart technology to do the heavy lifting. As the markets get faster and more complex, the best day trading stock scanners in 2026 have become absolutely essential. These tools aren't just a nice-to-have anymore; they're the bare minimum for staying in the game.

Why a Modern Stock Scanner Is a Trader's Most Critical Asset

Forget about delayed data and clunky, basic filters. In 2026, the speed of information is what separates the winners from the losers, and you need tools built for the sheer velocity of today's markets. Trying to find trades manually is like trying to catch raindrops in a hurricane—you're going to miss far more than you catch. A high-performance scanner is your automated lookout, tirelessly sifting through thousands of stocks to find the exact setups that fit your strategy.

This guide will show you how these tools have evolved, integrating real-time data feeds, predictive AI filters, and deep customization to meet modern demands. The shift is already happening. We've seen a staggering 78% increase in the daily active users of advanced scanners compared to just a few years ago. Platforms like ChartsWatcher, developed in Germany, are at the forefront, giving professional traders over 200 filter options for momentum plays. Think VWAP distance and MOMO squeeze detectors that can spot potential breakouts up to 25% faster than older, legacy tools.

From Optional Tool to Your Trading Co-Pilot

A modern scanner is much more than just a list of stocks ticking up or down. It's a dynamic system designed to cut through the market noise and instantly flag high-probability opportunities.

Think of it like this: A basic stock list is a paper map. A modern scanner is a live GPS with real-time traffic updates. One shows you the roads; the other guides you to your destination, helping you avoid all the jams along the way.

For a day trader, this translates into tangible benefits:

- Saving Time: It automates the hunt for setups, freeing you up to focus on what matters: analysis and execution.

- Improving Discipline: When your trades are based on pre-set, data-driven rules, you take emotion out of the equation.

- Expanding Opportunities: A scanner can watch thousands of stocks and hundreds of conditions simultaneously—something no human could ever hope to do.

This screenshot from the ChartsWatcher platform shows what a typical multi-window dashboard looks like.

Here, you can see real-time alerts, top gainer lists, and specific stock charts all in one place. It's a centralized command center for your entire trading day. We'll get into the nitty-gritty of the best scanner setups later on, but if you want a head start, check out our guide on the top 8 day trading stock scanners in 2025.

Must-Have Features of a Modern Stock Scanner

To keep up in the 2026 markets, your scanner has to be more than just a scrolling list of tickers. Think of it as your strategic co-pilot, crunching an insane amount of data in real-time to give you an actual edge. These aren't just "nice-to-haves"; they're the non-negotiable parts of a professional day trader's cockpit.

Trying to trade without them is like showing up to a Formula 1 race on a bicycle. Sure, you're moving, but you're not even in the same game. The core features we're about to break down all work together, giving you the speed, accuracy, and insight needed to compete.

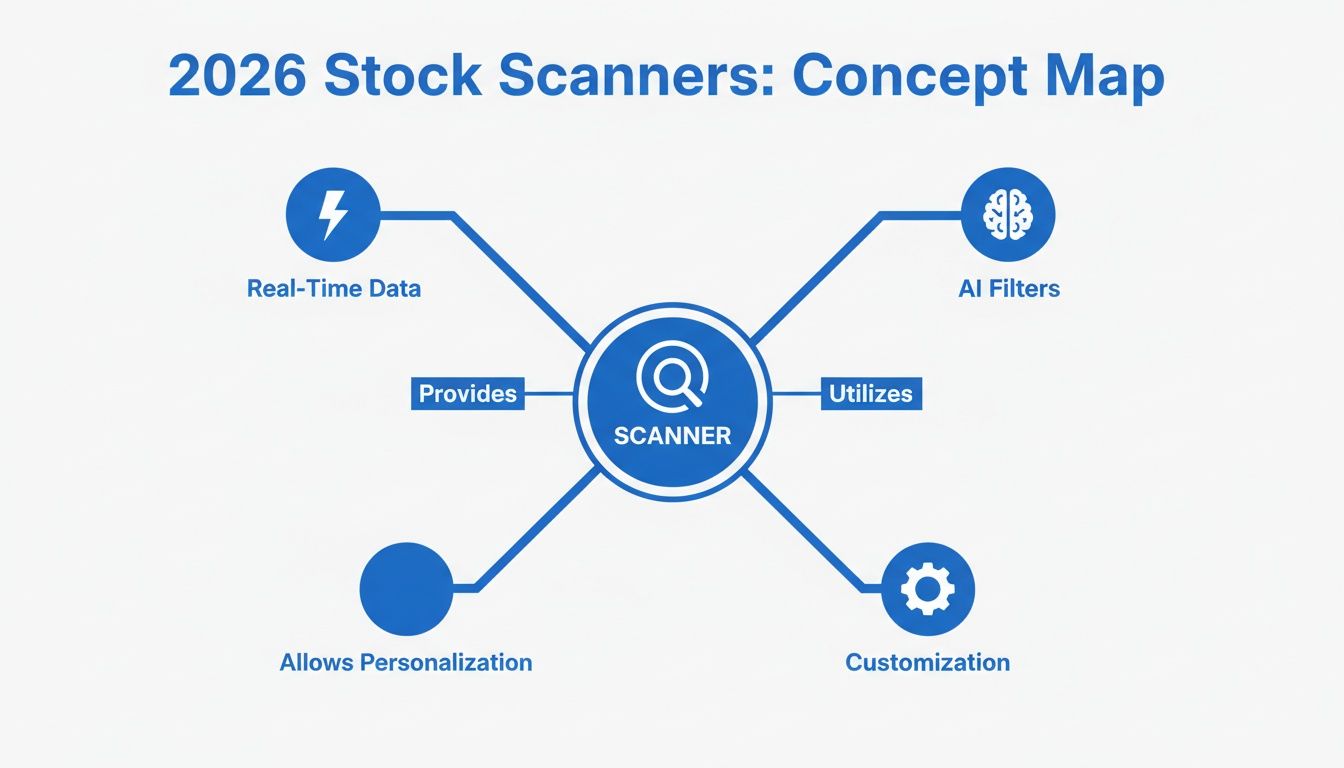

This visual map lays out the essential pillars of a modern scanner. It shows how everything—from real-time data to AI-driven filters and deep personalization—builds on a solid foundation.

It's a simple but powerful concept: without a bedrock of fast, reliable data, even the most advanced AI filters and custom dashboards are basically useless. Each piece supports the others to form a complete, high-performance trading system.

Real-Time Data and Low Latency

The single most critical part of any day trading stock scanner in 2026 is the quality of its data feed. This isn't just marketing fluff. It’s the central nervous system of your entire trading operation.

Imagine trying to play a competitive online game with a five-second lag. You’d be reacting to things that already happened, making it impossible to win. Trading is no different. A scanner with delayed data is showing you the past, which leads to chasing entries and fumbling your exits.

Low latency—the fancy term for minimal delay—is what separates the pro-level tools from the rest. It's your guarantee that the price, volume, and order flow you see on your screen is what's happening right now. In a market where setups can appear and vanish in a heartbeat, this is your lifeline.

AI-Powered and Predictive Filters

With thousands of stocks making moves every second, a basic filter like "price is up 5%" just doesn't cut it anymore. Today's scanners lean on artificial intelligence (AI) and machine learning to deliver smarter, context-aware filters that help you spot high-probability setups before the crowd does.

Think of an AI filter as a highly trained research assistant. Instead of just dropping a phone book on your desk, it highlights three specific people you should call and tells you exactly why they're relevant to your current goal.

These advanced filters can spot complex patterns that are nearly impossible for the human eye to catch in real-time. As AI becomes standard in every professional field, it pays to understand where it's headed; you can explore some of the top AI tools shaping 2026 to get a sense of the broader trend. This is what allows a scanner to go from just showing you raw data to actually helping you interpret what it means.

A few examples of these next-gen filters include:

- Momentum Squeeze Detectors: These pinpoint stocks where volatility is tightening up, often the calm before an explosive breakout.

- Relative Volume Surges: This filter flags stocks trading at a volume many times higher than their normal average, a classic sign of unusual institutional interest.

- Catalyst Scanners: Using natural language processing, these tools scan news wires and social media for market-moving events the second they break.

Deep Customization and Multi-Window Dashboards

Every trader's strategy is different, so your scanner should bend to your will, not the other way around. Forget one-size-fits-all layouts; they’re a recipe for inefficiency. The ability to build customizable, multi-window dashboards is the mark of a truly professional platform.

This means you can design a dedicated workspace for every phase of your trading day. Maybe you have one layout for hunting pre-market gappers, another for keeping tabs on your open positions, and a third for your end-of-day review. This kind of personalization clears the mental clutter and keeps the most critical information right in front of you, letting you focus on execution.

The evolution of day trading stock scanners in 2026 has pushed scanning speeds to new levels. Top-tier platforms now offer sub-5-second refresh rates that capture 95% of intraday opportunities—a massive 150% improvement from older tech. ChartsWatcher is a perfect example of this in action, giving traders the tools to build custom dashboards with heatmaps, newsfeeds, and toplists that can scan over 10,000 stocks across US, EU, and Asian markets in under 10 seconds.

How to Choose the Right Trading Scanner for You

Picking the right trading scanner isn’t like buying a gadget off the shelf; it's more like hiring a key member of your trading team. The goal isn't to chase the scanner with the most bells and whistles. It's about finding the one that slots perfectly into your unique trading style and daily routine.

Let's be honest: the perfect tool for a lightning-fast scalper is probably useless for a swing trader who plans their moves over days. This means you have to get real about what you actually need. Are you hunting for quick momentum pops that last seconds? Or are you looking for stocks coiling up for a big breakout? Each strategy demands a completely different set of tools.

First, Define Your Trading Identity

Before you even glance at a pricing page, you need to know who you are as a trader. Your strategy is the blueprint that dictates which features matter and which are just expensive distractions. Getting this wrong is a fast track to frustration and wasted money.

Start by asking yourself some direct questions:

- What’s your game plan? Are you a momentum chaser, a reversal player, a gap-and-go specialist, or do you trade off news catalysts?

- How long are you in a trade? Seconds, minutes, or hours? The shorter your timeframe, the more critical sub-second data speed becomes.

- Where do you trade? Are you sticking to major US exchanges, or do you venture into OTC markets, options, or international stocks?

Your answers build a profile. For instance, a momentum scalper absolutely requires a low-latency scanner with instant alerts and Level 2 data. A swing trader, on the other hand, might care more about powerful end-of-day scanning and solid backtesting features than tick-by-tick speed.

Look Beyond the Shiny Feature List

A scanner packed with incredible features is worse than useless if it crashes right before you enter a trade. Once you know what you need, it's time to vet the less glamorous—but arguably more important—aspects of the platform. Think of this as checking the foundation of a house.

Here are the non-negotiables:

- Platform Stability and Reliability: Does the software have a reputation for freezing during the opening bell chaos? Dig into user reviews and forums to see what real traders say about downtime and lag.

- Data Accuracy: Where is the data coming from? Professional-grade platforms use direct feeds from the exchanges. Cheaper tools often use delayed or bundled data, which is a deal-breaker for serious day trading.

- Customer Support: When things inevitably go wrong, how fast can you get help? Look for platforms with responsive support via live chat or phone. An unresolved technical glitch can be a very expensive problem.

A scanner is only as strong as its weakest link. Mind-blowing AI filters mean nothing if they’re running on delayed data, and a slick interface is worthless if the platform freezes when you need it most.

Understanding Pricing and Finding True Value

In 2026, stock scanner pricing generally breaks down into three tiers. It's crucial to understand what you're actually getting for your money at each level so you can make a smart investment that matches your ambition and budget.

Let's take a look at the different types of scanners available and what you can expect from each.

2026 Stock Scanner Feature Comparison

A comparison of essential features across different types of stock scanners available in 2026, helping traders match tools to their specific needs.

| Feature | Basic/Free Scanners (e.g., Finviz) | Mid-Tier Scanners (e.g., TradingView) | Professional Scanners (e.g., ChartsWatcher) |

|---|---|---|---|

| Data Speed | 15+ minute delay, unsuitable for day trading. | Real-time data is standard, but latency can vary. | Direct-feed, low-latency data for millisecond accuracy. |

| Filter Complexity | Basic technical and fundamental filters. | Hundreds of indicators, but limited custom logic. | AI/ML-powered filters, complex multi-conditional scanning. |

| Customization | Limited to pre-set scans and basic layouts. | Good layout customization, some scriptable alerts. | Fully customizable multi-window dashboards, scripting. |

| Alerts | Simple price-based alerts, often with delays. | Robust server-side alerts on technical conditions. | Complex, multi-condition alerts deliverable via multiple channels. |

| Backtesting | Basic or non-existent backtesting capabilities. | Decent backtesting, but often limited historical data. | Comprehensive backtesting against years of tick data. |

| Market Coverage | Primarily major US exchanges. | Broad coverage of global stocks, crypto, and forex. | Deep coverage including US equities, OTC, options, and more. |

This table shows a clear progression. While free tools are great for learning the ropes, their delayed data makes them unsuitable for active trading. Mid-tier scanners offer a solid step up, but professional platforms like ChartsWatcher provide the speed, depth, and intelligence required for traders who need a true competitive edge.

Platforms like ChartsWatcher often offer tiered plans that align with this structure, which is great for traders looking to grow. You can start on a more affordable plan to get access to professional-grade real-time data, and then upgrade later to unlock the really advanced stuff like comprehensive backtesting and AI-driven analytics once your strategy calls for it. This way, you're only ever paying for the tools you're actually using.

Dialing In Your Scanner for Peak Performance

Owning a powerful scanner is just the first step. The real magic happens when you transform it from a generic tool into a precision-guided trading machine. Think of it this way: the default settings are like a factory-spec race car. To actually win, you have to tune the engine, adjust the suspension, and dial it in for the specific track you're on.

Your scanner is no different. You need to configure it to actively hunt for the exact setups that fit your strategy. It stops being a passive data feed and becomes an active partner, constantly sifting through the market chaos to find your edge.

Let's get practical. I'm going to walk you through a couple of my favorite scan templates—or "recipes"—that you can build out for 2026. I won't just tell you what filters to use, but the strategic thinking behind each one.

Recipe 1: The Pre-Market Gapper Scan

This is your morning bread and butter. The goal is to find stocks making big moves before the opening bell, usually because of earnings or some major overnight news. These "gappers" are magnets for morning volatility and give you clear price levels to trade against.

Here's the setup:

- Market Session: Pre-Market

- Price: > $5 (This is just to filter out the super-volatile, unpredictable penny stocks.)

- % Change from Previous Close: > +5% OR < -5% (This catches significant gaps in both directions.)

- Pre-Market Volume: > 100,000 shares (We need to see real money and interest behind the move, not just a few random orders.)

- Relative Volume: > 2.0 (This confirms the stock is trading at least twice its normal volume for this time of day—a huge sign of unusual interest.)

Running this scan lets you build a clean, focused watchlist before the market opens. You can map out your plan calmly instead of chasing every random spike in the first five minutes of chaos.

Recipe 2: The Mid-Day Momentum Breakout Scan

Once the morning rush dies down, the market tends to settle and show its true hand. This scan is designed to pinpoint stocks that are breaking out to new intraday highs with a sudden burst of volume, signaling that a real trend might be taking hold.

Think of this scan as a market seismograph. It's built to ignore the background noise and only alert you when the ground really starts to shake, signaling a potentially big move.

Filter Configuration for Breakouts:

- Time of Day: After 10:30 AM ET (Give the market some time to sort itself out and establish a direction.)

- Price Condition: Making a New High of Day (This is the core signal we're looking for.)

- 5-Minute Volume Spike: > 200% of its average 5-minute volume (This is our confirmation. The breakout needs to be powered by a surge of buying pressure.)

- Float: < 100 Million Shares (Stocks with a lower float tend to move much more explosively when big volume comes in.)

This is the perfect setup for traders who focus on trend continuation and want to find high-probability entries when the market is a bit less frantic.

Building Your Multi-Window Dashboard

A truly pro setup isn't just about one perfect scan. It's about creating a trading cockpit where everything works together. Modern platforms like ChartsWatcher are built for this, letting you design multi-window dashboards for different phases of the trading day.

For instance, your "Market Open" layout might look like this:

- Window 1: The results from your Pre-Market Gapper scan, ticking in real-time.

- Window 2: A 1-minute chart that's linked to your scanner. Click a ticker, and the chart instantly updates.

- Window 3: A real-time news feed, filtered to only show headlines for the stocks on your gapper list.

- Window 4: A broad market index chart, like the SPY, to keep an eye on the overall market mood.

Later, you can flip to a "Mid-Day Analysis" layout that swaps the gapper scan for your momentum breakout scanner. This kind of organization keeps you focused on what matters, right when it matters. If you're looking for more ideas to customize your setup, exploring some of the best stock screener settings can give you a great starting point.

Finally, remember that your scanner is only as good as the connection feeding it data. To really squeeze every last drop of performance out of it, looking into specialized managed network edge solutions can help ensure your data pipeline is as fast and stable as possible. It’s the foundation everything else is built on.

So, Do Scanners Actually Make You More Money?

Let's get right to it. Does paying for a premium scanner really put more cash in your trading account? The short answer is yes, absolutely—but it’s not a magic profit button. A professional-grade scanner is an engine for efficiency and discipline. It helps you find opportunities you'd otherwise miss and, just as importantly, keeps you away from trades you shouldn't be taking in the first place.

Think of it like fishing. You could spend all day casting a single line, hoping for a lucky bite. Or, you could use a high-tech sonar system that shows you exactly where the schools of fish are, how big they are, and where they're headed. A scanner gives you that same systematic edge, turning trading from a game of guesswork into a process of calculated execution.

Quantifying the Scanner Advantage

The benefits of using the right day trading stock scanners in 2026 aren't just talk; they show up on the P&L. The biggest advantage comes from automating the most brutal, time-sucking part of a trader's day: finding something worth trading. Instead of mindlessly clicking through hundreds of charts, a scanner does the heavy lifting for you. This frees up your mental energy to focus on what really matters—analyzing the setup and managing your risk.

This automation has a huge impact on profitability by cutting down on emotional mistakes. When your watchlist is built on a set of cold, hard rules you defined earlier, you're way less likely to chase some random "hot" stock or jump into a trade out of FOMO. Your scanner becomes a disciplined gatekeeper, only letting setups that meet your criteria get through.

The biggest leak in a trader's account isn't a bad strategy—it's the emotional cost of inconsistency. A scanner enforces the discipline that our human brains are wired to ignore, leading to a much smoother, more predictable equity curve.

By constantly feeding you a stream of high-probability opportunities, a scanner systematically stacks the odds in your favor. It’s not about winning every single trade. It's about improving your overall win rate and the quality of your entries over hundreds of trades.

The Data-Driven Bottom Line

The numbers from 2026 tell a pretty clear story. A recent statistical analysis showed that day trading stock scanners boosted profitability by 32% for traders who consistently used AI-enhanced filters. That advantage gets even bigger when you factor in features like the backtesting module in platforms such as ChartsWatcher, which can run a strategy through over 1,000 scenarios daily to see if it holds up before you risk a single dollar.

The performance gap is stark. According to industry benchmarks, 68% of professional traders who used multi-screen scanner configurations reported 18% annualized returns. Compare that to just 7% for non-scanner traders. If you want to go deeper, you can explore the research behind these numbers to see the full market impact. You can discover more insights about the stock scanner market from Mometic's analysis.

This data really confirms one simple truth: buying a quality scanner isn't an expense. It's a strategic investment designed to give you a better return through a few key metrics:

- Increased Win Rate: By filtering out the junk and only showing you A+ setups.

- Tighter Risk Management: By flagging clear, data-based entry and exit points.

- Time Savings: By automating hours of manual chart-flipping, giving you more time to refine your actual strategy.

At the end of the day, a premium scanner like ChartsWatcher pays for itself. It does this not just by finding you winning trades, but by stopping you from making the costly emotional errors and missing the obvious opportunities that slowly bleed an account dry.

Common Scanner Mistakes and How to Avoid Them

Even the most tricked-out day trading stock scanners in 2026 can be a liability if you don't know how to handle them. A high-performance scanner doesn't print money; it just magnifies the results of your decisions, for better or worse. Too many traders stumble into the same old traps, turning this incredible tool into a source of frustration and expensive misclicks.

The first pitfall is a classic: analysis paralysis. With hundreds of potential filters at your fingertips, it’s all too easy to try and build the "perfect" scan by piling on dozens of conditions. What you often end up with is a scanner so specific it never finds a single trade, or one so complicated you have no idea why it's flagging a certain stock.

Another rookie mistake is chasing every single alert that pops up. A scanner is designed to flag potential opportunities, not give you direct buy and sell orders. Treating every ping as a command to jump in is a fast track to overtrading, racking up commissions, and getting chopped up by bad entries.

The Myth of the Magic Profit Button

We need to get one thing straight: a scanner is not some magic "profit button." It's a tool for identification, not a replacement for a rock-solid trading plan. It can't manage your risk, it can't control your emotions, and it certainly can't read the broader market context for you.

A scanner is like a world-class fishing sonar. It can show you exactly where the fish are, but it can't bait your hook, cast your line, or reel them in for you. That part still requires skill, patience, and a well-practiced technique.

Relying on the scanner alone, without doing your own homework on why a stock is moving, is a critical error. Is that stock breaking out because of a major news catalyst, or is it just a random, unsustainable spike in a sketchy low-float name? The scanner won't tell you the difference.

Integrating Your Scanner into a Cohesive Plan

To sidestep these blunders, you have to weave your scanner into a complete trading plan that puts discipline and risk management front and center. Your scanner should serve your strategy, not the other way around.

Here’s how to make sure your scanner stays a powerful ally:

- Keep It Simple: Start with just a few core filters that define your absolute A+ setup. You can always add more layers later, but you need to master the basics first.

- Confirm, Don't Chase: When an alert fires, that's the beginning of your work, not the end. Pull up the chart, check the news, and confirm the setup actually fits your rules before you even think about placing an order.

- Context is King: Always be aware of the overall market trend. That beautiful breakout setup you found is far more likely to fail in a weak, bearish market.

At the end of the day, a tool like ChartsWatcher is built to enhance your decision-making process, not do the thinking for you. By understanding these common mistakes, you can ensure your scanner acts as a precision instrument that filters for opportunity, rather than a crutch that leads to impulsive and costly errors. Your success hinges on the synergy between your skill as a trader and the tool's capabilities.

Got Questions About Day Trading Scanners? We’ve Got Answers.

Jumping into the world of day trading scanners can feel a bit overwhelming, so let's clear the air. Here are some straightforward answers to the questions I hear most often from traders looking to get set up for 2026.

What Is the Single Most Important Feature?

Hands down, it's the quality and speed of the real-time data. Everything else is just noise if the data is slow.

In markets that move in the blink of an eye, a few seconds of lag means you're trading yesterday's news. This is how you miss perfect entries or, even worse, get trapped in panicked, late exits that blow up your account.

Always, always look for scanners that deliver true, tick-by-tick data with sub-second refresh rates. This low-latency stream is the absolute foundation. All the fancy features—AI filters, instant alerts, you name it—are built on top of it. Without that speed, even the most advanced analytics are completely useless to a day trader.

Think of it this way: a powerful scanner with slow data is like a world-class race car stuck in rush-hour traffic. It has all the potential in the world, but its core function is completely bottlenecked by its environment.

Can I Really Succeed at Day Trading Without a Stock Scanner?

Let's be blunt: while it's technically possible, trying to day trade without a scanner in 2026 puts you at an almost insurmountable disadvantage.

Your job is to find specific, fleeting setups among thousands of stocks. Doing that manually is simply beyond human capacity. A scanner is your eyes on the entire market, automating a process that would otherwise be impossible.

Trying to trade without one is like showing up to a Formula 1 race on foot. You might be a phenomenal runner with a brilliant strategy, but you just can't keep up with the technology everyone else is using to win.

How Does Backtesting Actually Make Me a Better Trader?

Backtesting is your private trading simulator. It lets you test-drive your strategies against historical market data without risking a single dollar of real capital.

Instead of just hoping a new strategy works in a live, unpredictable market, you can see how it would have performed over weeks, months, or even years of past data. And you can do it in minutes.

This process gives you the hard data on a strategy's potential profitability, its maximum drawdown (i.e., its worst-case losing streak), and its overall win rate. It helps you tweak your filters and entry/exit rules based on evidence, not emotion. Ultimately, that data gives you the confidence to pull the trigger with discipline when your money is actually on the line.

Are Free Stock Scanners Good Enough for Serious Trading?

Free scanners are great for one thing: learning the absolute basics of scanning or maybe doing some slow, end-of-day research. For serious day trading, they are a liability.

The main issues? They almost always have severely delayed data (often 15 minutes or more), very limited filtering options, and none of the professional tools like real-time alerts or backtesting.

Professional day trading is a game of speed and precision. That's something only paid, professional-grade platforms can provide. The investment in a premium tool is easily paid for by preventing just one bad trade you might have taken based on old, unreliable information.

Ready to stop trading with one hand tied behind your back? ChartsWatcher provides the institutional-grade, low-latency data and advanced filtering you need to compete in today's market.