Top 8 Day Trading Stock Scanners in 2025

Elevate Your Day Trading with Powerful Stock Scanners

Day trading demands rapid identification of market opportunities. This listicle presents eight powerful day trading stock scanners to streamline your workflow and pinpoint potential trades. These tools cut through market noise, saving you valuable time and effort. Discover the strengths and weaknesses of ChartsWatcher, Trade Ideas, ThinkorSwim, Finviz, StocksToTrade, TradingView, Scanz, and TC2000. This guide will help you select the perfect day trading stock scanner to boost your 2025 trading performance, regardless of your experience level.

1. ChartsWatcher

ChartsWatcher is a sophisticated day trading stock scanner designed for precision and flexibility, catering to the needs of professional traders, analysts, and investors. Developed in Germany, this platform stands out for its highly customizable multi-window dashboards. Users can populate their screens with up to eight different tile types, including alerts, top lists, interactive charts, news feeds, and watchlists, enabling them to create a truly personalized trading environment tailored to their specific strategies. This level of customization is crucial for day traders who need to react quickly to market fluctuations and monitor multiple data streams simultaneously. The dynamic interface allows for synchronization across these tiles, meaning a change in one tile, such as selecting a specific stock, will automatically update the information displayed in other relevant tiles. This streamlines analysis and facilitates faster, more informed decision-making, a critical advantage in the fast-paced world of day trading.

For example, a day trader focusing on momentum trading could configure their dashboard to display real-time price charts, Level 2 data, news feeds related to their chosen stocks, and a custom alert system triggered by specific volume spikes or price breakouts. This integrated view allows them to seize opportunities quickly and manage risk effectively. ChartsWatcher’s extensive alert and filter options further enhance this capability, covering a wide range of trading scenarios, from simple price changes to complex candle patterns. This allows traders to develop intricate strategies based on technical indicators, fundamental data, and even news sentiment. The platform also offers robust backtesting capabilities, enabling users to test their strategies on historical data before deploying them in live markets. This feature helps refine strategies and improve confidence in trading decisions. Learn more about ChartsWatcher and how it can help elevate your day trading success.

One of ChartsWatcher’s key strengths is its accessibility. The platform offers tiered pricing plans, starting with a fully functional free plan ideal for beginners. This free version provides access to core scanning features, allowing new traders to familiarize themselves with the platform and develop their skills before upgrading to a paid subscription. The Pro Plan caters to more experienced traders and institutions, offering advanced features like extended backtesting capabilities and full import/export functionality for sharing configurations. While the free plan is a great starting point, it's worth noting that some advanced features are restricted to paid subscriptions. Another potential limitation is the lack of a dedicated mobile app, which could hinder traders who prefer mobile trading.

Real-time data updates every 10 seconds, coupled with interactive charts and synchronized tiles, create a highly responsive and integrated trading workflow. ChartsWatcher continuously adds new filters and alerts, demonstrating its commitment to staying at the forefront of day trading technology. While pricing and specific technical requirements are not explicitly detailed here, visiting the ChartsWatcher website will provide further information on these aspects. For traders seeking an edge in today's competitive markets, ChartsWatcher offers a compelling suite of tools designed for informed and efficient day trading. You can find more information on their official website: https://chartswatcher.com.

2. Trade Ideas

For day traders seeking a cutting-edge advantage, Trade Ideas stands out as a premier AI-powered stock scanner. This platform leverages sophisticated machine learning algorithms to sift through massive amounts of market data, identifying potential trading opportunities in real-time. What sets Trade Ideas apart is its "Holly" AI, a virtual trading assistant that constantly runs dozens of pre-built and back-tested strategies, generating trade ideas throughout the trading day. This makes it an invaluable tool for both novice and experienced day traders looking to capitalize on market volatility. Trade Ideas offers unparalleled scanning capabilities that empower traders to find high-probability setups quickly and efficiently, making it a top contender among day trading stock scanners.

One of the platform's key strengths is its highly customizable scanning parameters. With over 500 filters, including technical indicators, fundamental data, and social media sentiment, traders can fine-tune their scans to pinpoint specific trading setups that align with their individual strategies. This level of granularity allows traders to filter out the noise and focus on the most promising opportunities. Real-time alerts and notifications, delivered across multiple devices, ensure that traders never miss a critical market movement. This is especially beneficial for day traders who need to react quickly to changing market conditions. For those looking to test and refine their strategies, Trade Ideas provides a robust simulated trading environment. This allows traders to backtest their strategies against historical data and optimize their approach without risking real capital. This platform excels in identifying momentum stocks and breakout patterns, making it a popular choice for day traders employing these strategies.

While the platform offers a wealth of features and advanced functionalities, it's worth noting that Trade Ideas is relatively expensive compared to other day trading stock scanners on the market. The pricing structure is tiered, with various subscription levels offering different features and access to Holly. Potential users should check the Trade Ideas website for current pricing details. Additionally, the sheer volume of data and features can be overwhelming for new users. There is a learning curve associated with mastering the platform, so dedicating time to explore the software and its functionalities is crucial. Technical requirements are minimal, with the platform accessible through a web browser, ensuring compatibility across different operating systems.

Features:

- AI-powered scanning with proprietary algorithms

- Holly AI - automated trading assistant

- Real-time alerts and notifications

- Customizable scanning parameters with over 500 filters

- Simulated trading environment

Pros:

- Most advanced scanning technology in the industry

- Comprehensive alerts and notification system

- Excellent for finding momentum stocks and breakouts

- Robust backtesting capabilities

Cons:

- Relatively expensive

- Steep learning curve for new users

- Can be overwhelming with the amount of data presented

Website: https://www.trade-ideas.com/

Trade Ideas earns its place on this list due to its powerful AI-driven scanning capabilities, real-time alerts, and extensive customization options. While it may not be the most budget-friendly option, its sophisticated features and the potential for identifying high-probability trades make it a valuable tool for serious day traders willing to invest in their success.

3. ThinkorSwim by TD Ameritrade

ThinkorSwim is a robust platform frequently mentioned in discussions about day trading stock scanners. Developed by TD Ameritrade, it provides a comprehensive suite of tools for scanning, charting, and analyzing the stock market. Its powerful scanning capabilities make it a favorite among day traders seeking an edge in fast-moving markets. This platform empowers traders to pinpoint opportunities using custom scans based on technical indicators, fundamental data, and even options criteria, making it a versatile tool for various trading styles. The fact that it's free for TD Ameritrade account holders adds to its appeal, offering professional-grade tools without additional subscription fees.

For day traders, ThinkorSwim's real-time scanning capabilities are indispensable. Imagine you're looking for stocks breaking out of their pre-market range. Using ThinkorSwim's Stock Hacker tool, you can define specific criteria, such as price exceeding the pre-market high with increasing volume. The scanner will then alert you in real-time as these opportunities arise, allowing you to react swiftly. With over 300 filtering criteria, the level of customization is impressive, allowing for incredibly precise scans tailored to your specific day trading strategy. Beyond simple price and volume filters, you can screen for complex technical indicators like moving averages, relative strength index (RSI), and Bollinger Bands, among others.

ThinkorSwim also shines in its integration with other trading tools. Charts, analysis tools, and order entry are all seamlessly integrated within the platform, minimizing the need to switch between different applications. This streamlines the entire trading process, from identifying opportunities through execution. The integrated paper trading functionality is also a valuable asset for both new and experienced traders. It allows you to test and refine your scanning strategies risk-free, using simulated funds before deploying them in live markets.

While ThinkorSwim offers significant advantages for day trading stock scanners, it's important to be aware of its potential drawbacks. The platform's complexity can be daunting for beginners, and the learning curve is steep. Navigating the extensive features and customization options requires time and effort. Additionally, ThinkorSwim can be resource-intensive, potentially causing lag on less powerful computers, particularly during periods of high market volatility.

Key Features & Benefits:

- Custom scanner with over 300 filtering criteria: Target highly specific trading setups.

- Stock Hacker tool: Quickly find opportunities based on pre-defined or custom scans.

- Real-time scanning with customizable alerts: Never miss a trade with instant notifications.

- Integrated with charting and analysis tools: Streamlines workflow from analysis to execution.

- Paper Trading: Practice strategies risk-free.

- Free for TD Ameritrade customers: Provides professional-grade tools at no additional cost.

Pros & Cons:

- Pros: Free for TD Ameritrade customers, highly customizable scan parameters, integrated platform, excellent educational resources.

- Cons: Complex interface, resource-intensive, occasional lag during high volatility.

ThinkorSwim’s comprehensive features, real-time scanning capabilities, and free access for TD Ameritrade users secure its position as a top choice for day trading stock scanners. While its complexity can be challenging for beginners, its power and flexibility make it a valuable tool for serious day traders. Its inclusion in this list is a testament to its ability to help traders identify and capitalize on fleeting opportunities in the market.

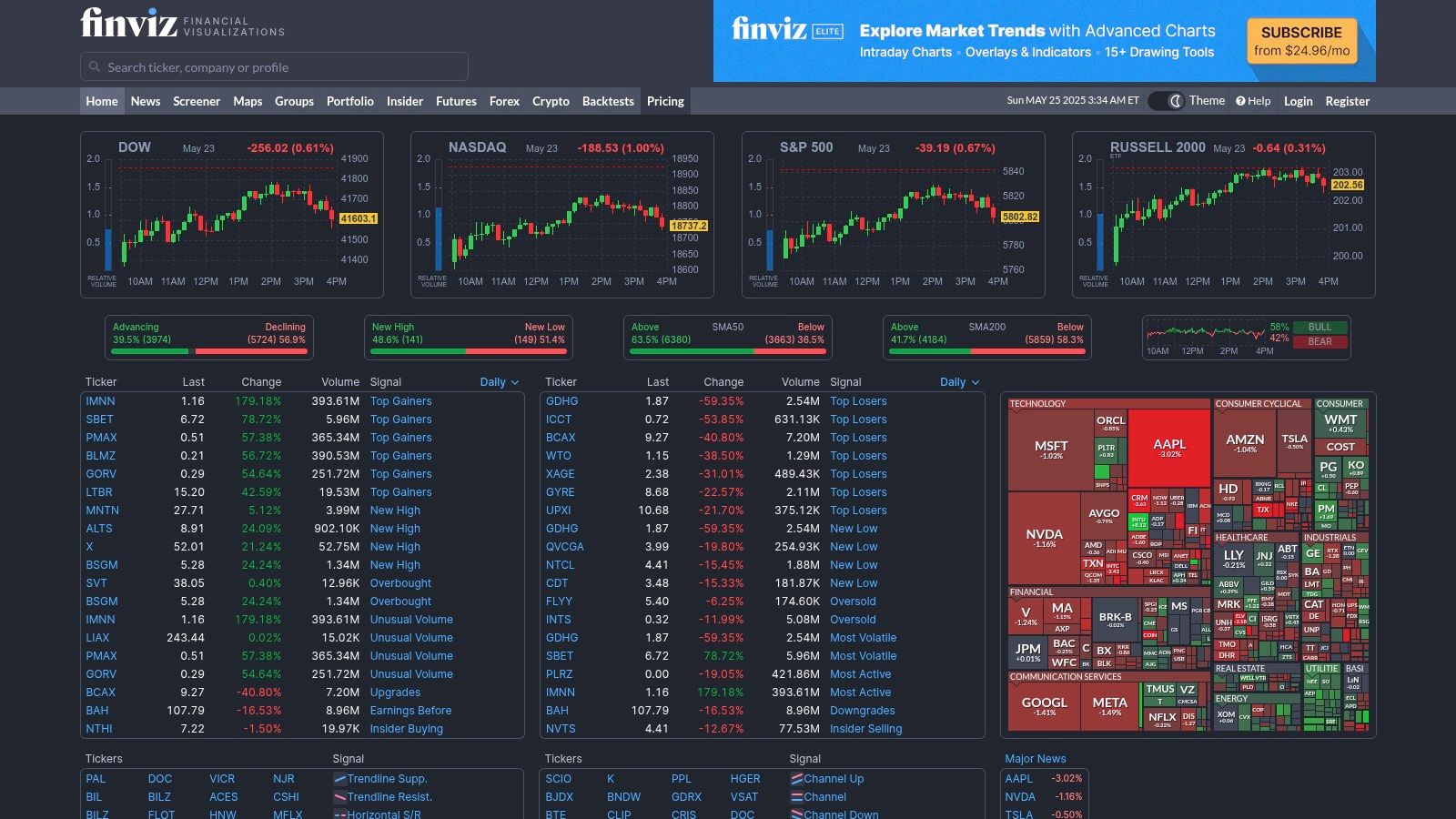

4. Finviz

Finviz (Financial Visualizations) is a highly popular choice among day trading stock scanners, especially appreciated for its user-friendly interface and clear visual presentation of market data. This platform empowers traders to quickly identify potential opportunities using a variety of technical and fundamental filters. Whether you're a seasoned professional or just starting out, Finviz's intuitive design and comprehensive features make it a valuable tool for navigating the complexities of day trading. Its blend of free and premium features caters to a wide range of needs, solidifying its position as a go-to resource for many in the trading community.

One of Finviz's most compelling features for day traders is its visual stock screener. The interface allows you to quickly filter stocks based on over 60 technical and fundamental criteria, including performance, valuation, ownership, and financial strength. This allows you to pinpoint stocks matching your specific trading strategies within seconds. For example, you could screen for stocks gapping up with unusual volume, showing relative strength against the market, and having a positive earnings surprise – all crucial elements for a successful day trade. The platform also provides heat maps and visual representations of market sectors, offering a quick overview of market trends and sector performance, which is invaluable for day trading decisions. Pre-built screeners for common trading strategies, such as "Day Trader" and "Swing Trader," further streamline the process.

While the free version of Finviz offers a significant amount of functionality, including delayed market data and basic screening capabilities, the Elite version provides the real-time data feed crucial for day traders. This real-time data ensures you're acting on the most up-to-the-minute information, maximizing your potential for profit. The Elite version also unlocks additional features such as backtesting, portfolio tracking, and correlation analysis, making it a comprehensive suite for serious day traders. While other platforms like TradingView might offer more advanced charting and technical indicators, Finviz strikes an excellent balance between functionality and user-friendliness, making it a suitable choice for both beginners and experienced day trading stock scanners users.

Key Features for Day Traders:

- Intuitive visual stock screening: Quickly filter stocks based on a wide array of technical and fundamental data.

- Real-Time Data (Elite): Essential for making informed day trading decisions.

- Heat maps and visual market representation: Easily visualize market trends and sector performance.

- Pre-built screeners: Streamline the process of finding stocks matching specific strategies.

- Backtesting (Elite): Test and refine your trading strategies using historical data.

Pros:

- Free version available with substantial functionality.

- User-friendly and easy to learn.

- Excellent visual representation of market data.

- Good balance of technical and fundamental filters.

Cons:

- Free version has delayed data (20 minutes).

- Limited customization compared to some competitors.

- Fewer advanced technical indicators than specialized platforms.

Pricing: Free version available; Finviz Elite subscription required for real-time data and advanced features (pricing available on their website).

Website: https://finviz.com/

Finviz earns its place on this list because it offers a robust and accessible platform for day trading stock scanning. Its intuitive design, combined with powerful filtering capabilities and visual market representations, makes it an excellent tool for identifying potential day trading opportunities. While the free version offers a great starting point, the Elite version provides the real-time data and advanced features necessary for serious day traders.

5. StocksToTrade

StocksToTrade is a comprehensive day trading stock scanner designed specifically for active traders seeking fast-moving opportunities in the market. Built by experienced traders, it understands the unique needs of this fast-paced trading style and offers tools tailored to identify momentum stocks, breakouts, and other short-term trading setups. It aims to consolidate all the essential resources a day trader needs – charting, news, social media sentiment, and Level 2 data – into a single, powerful platform. This makes it a strong contender for any serious day trader looking to streamline their workflow and capitalize on volatile market conditions.

One of StocksToTrade's key strengths lies in its built-in stock scanning functionality. Users can customize parameters to create highly specific scans tailored to their individual trading strategies. For instance, traders focusing on low-float stocks or penny stocks can filter for specific price ranges, volume spikes, and percentage changes. The platform's proprietary Oracle algorithm helps identify potential breakouts by analyzing real-time price and volume action, providing traders with an edge in anticipating significant price movements. This is crucial for day trading, where timing is everything.

Beyond technical scanning, StocksToTrade integrates news scanning with keyword filtering, enabling traders to quickly identify news catalysts that may be driving market activity. It also incorporates social media trend analysis, allowing users to gauge the sentiment surrounding specific stocks and sectors. This feature is particularly valuable in today's market, where social media can significantly influence stock prices. The integration of Level 2 data and time & sales provides further insights into order flow and market depth, helping traders make more informed decisions.

Features:

- Built-in stock scanning with customizable parameters

- Oracle algorithm for identifying potential breakouts

- Integrated news scanner with keyword filtering

- Social media trend analysis

- Level 2 data and time & sales integration

Pros:

- Designed specifically for day trading strategies

- Excellent for penny stock and low-float stock scanning

- Intuitive interface with trader-friendly design

- Strong integration of news and social sentiment data

Cons:

- Relatively expensive monthly subscription (currently starting at $189.95/month)

- Limited broker integration options

- Some advanced features require additional paid add-ons

Implementation/Setup Tips:

- Take advantage of the platform's paper trading feature to test your scanning strategies before risking real capital.

- Explore the pre-built scan templates and customize them to fit your specific needs.

- Utilize the educational resources offered by StocksToTrade to maximize your understanding of the platform and day trading principles.

Comparison with Similar Tools:

While other platforms offer similar features, StocksToTrade differentiates itself with its focus on day trading, particularly for small-cap and volatile stocks. Compared to more generalized scanners, StocksToTrade's Oracle algorithm, news and social media sentiment analysis, and Level 2 integration offer a more specialized and integrated toolkit designed specifically for the demands of day trading.

StocksToTrade deserves its place on this list because it offers a powerful and dedicated platform for day traders. Its focus on speed, comprehensive data integration, and trader-centric design makes it a valuable tool for those seeking to profit from intraday market fluctuations. While the cost might be a consideration, the potential benefits for serious day traders could outweigh the investment. You can explore more about StocksToTrade on their website: https://stockstotrade.com/

6. TradingView

TradingView is a robust platform widely recognized for its advanced charting tools, but it also boasts a powerful stock scanner ideal for day trading. This scanner allows users to filter stocks based on a wide range of technical indicators, chart patterns, and even fundamental data. This flexibility makes it a highly versatile tool for day traders who need to quickly identify opportunities in fast-moving markets. Whether you're looking for stocks breaking out of resistance levels, experiencing unusual volume spikes, or exhibiting specific candlestick patterns, TradingView's scanner can help you pinpoint potential trades. It also provides access to global markets, ensuring you're not limited to just your local exchange. What truly sets TradingView apart is its social community aspect. Traders can share and discover custom scans and indicators, fostering a collaborative environment where you can learn from others and refine your own day trading strategies.

One of the key strengths of TradingView for day trading stock scanners is its customizability. The platform’s proprietary Pine Script programming language empowers users to create their own indicators and scans, tailoring the platform to their specific trading styles and strategies. For example, you could create a scan that identifies stocks with a relative strength index (RSI) above 70 and a positive moving average crossover, signaling potential overbought conditions and upward momentum, respectively. This level of customization is invaluable for day traders who often rely on very specific criteria for entering and exiting trades. You can Learn more about TradingView to maximize its potential.

TradingView offers a tiered subscription model. A free basic version provides access to core features, making it an accessible entry point for beginners. However, real-time data and advanced scanning features, essential for day trading, require a paid subscription. Higher-tier plans unlock more advanced features, such as custom alerts and increased data limits. While the platform generally works well across devices, including mobile, complex scans can sometimes cause slower loading times, something to consider if speed is critical to your day trading strategy.

Compared to other day trading stock scanners, TradingView stands out with its comprehensive charting integration. The seamless transition between scanning and charting is a significant advantage, allowing you to quickly analyze potential trades in more detail without switching platforms. While platforms like Finviz offer similar screening capabilities, they often lack the depth of charting tools and community engagement that TradingView provides. This integrated approach simplifies the workflow for day traders, enabling them to move efficiently from identifying potential setups to executing trades.

Pricing: Free basic version, paid subscriptions for real-time data and advanced features.

Technical Requirements: Internet connection, modern web browser, or mobile app.

Implementation Tips:

- Start with pre-built scans and gradually explore custom indicators.

- Utilize the social community to discover and learn from other traders' strategies.

- Backtest your scanning criteria to ensure they align with your trading plan.

- Be mindful of potential delays when running complex scans, especially during volatile market conditions.

TradingView deserves its place on this list due to its blend of powerful scanning capabilities, advanced charting tools, and a vibrant community. Its customizability, coupled with global market access, caters to the diverse needs of day traders seeking an edge in today’s dynamic markets. While the free version is a good starting point, serious day traders will likely benefit from a paid subscription to unlock the platform's full potential.

7. Scanz (formerly EquityFeed)

Scanz (formerly EquityFeed) is a dedicated stock scanning platform built for the demands of day trading. It distinguishes itself through real-time market data delivery and advanced filtering options crucial for identifying fast-moving opportunities. Whether you're a professional trader, financial institution, or an independent investor, Scanz provides the tools needed to navigate the complexities of the stock market, making it a powerful contender amongst day trading stock scanners. Specifically designed for day traders, Scanz prioritizes speed and accuracy, delivering real-time data with minimal latency, which can be the difference between capitalizing on a fleeting opportunity and missing out entirely.

Scanz offers two primary products: News Streamer and Breakouts. News Streamer allows traders to track breaking news that could impact stock prices, providing a vital edge in anticipating market movements. Breakouts, on the other hand, focuses on identifying specific trading opportunities based on pre-defined technical indicators and real-time price and volume analysis. This dual approach caters to both news-driven and technically-focused day trading strategies.

Its strength lies in scanning penny stocks and low-priced securities exhibiting unusual activity, a niche where its speed and precision shine. This makes it a compelling tool for traders focused on these volatile markets. Features such as pre-market and after-hours scanning further extend the trading day, allowing users to identify potential setups before the regular market opens and after it closes. Advanced filtering for price, volume, and volatility helps traders refine their search for specific opportunities. Customizable workspaces allow for tailored setups for different trading strategies, catering to both novice and experienced traders. Comprehensive time and sales data coupled with Level 2 integration provides valuable insight into market depth and order flow, aiding in more informed trading decisions.

Pros:

- Extremely fast data delivery with minimal latency: Crucial for day trading where split-second decisions matter.

- Excellent for OTC and penny stock trading: Specifically designed to handle the volatility and fast-paced nature of these markets.

- Powerful filtering capabilities for day trading setups: Allows for precise identification of opportunities based on specific criteria.

- Intuitive layout with multi-monitor support: Enhances the user experience and facilitates efficient workflow.

Cons:

- Higher price point than some competitors: May be a barrier for some traders, especially those starting out.

- Primarily focused on US markets: Limits its use for traders interested in international markets.

- Limited fundamental data compared to some alternatives: While it excels at technical analysis, it may not be as comprehensive for fundamental analysis.

While the pricing isn't publicly available on the website, reports from various sources suggest that Scanz is a premium service, reflecting its specialized features and real-time data capabilities. Potential users should contact Scanz directly for detailed pricing information and to determine if it fits their budget. Technical requirements include a stable internet connection and a computer capable of handling real-time data streams.

Compared to more general stock screeners, Scanz stands out with its focus on speed and real-time data, features paramount for day trading. Platforms like Finviz or TradingView offer broader market coverage and fundamental data but may lack the specialized tools and speed that Scanz delivers for active day traders.

To get started with Scanz, visit their website, explore the features, and sign up for a trial or demo to experience the platform firsthand. Investing time in learning the software's functionalities and customizing the workspace to your specific trading style is crucial for maximizing its potential. Experimenting with different scanning criteria and backtesting strategies is highly recommended.

8. TC2000

TC2000 is a robust and comprehensive platform designed for day trading stock scanners, charting, and technical analysis. It empowers traders to create highly specific scans based on technical indicators, fundamental data, and even custom conditions. One of TC2000's standout features is its unique condition wizard, enabling traders to build complex scans without needing programming skills. This makes it accessible to both novice and experienced traders looking to refine their day trading strategies.

For day traders, speed and accuracy are crucial. TC2000 addresses this with its EasyScan technology and visual condition builder. Imagine you're looking for stocks breaking out above their 20-day moving average with increasing volume. With TC2000, you can visually build this scan in minutes, without writing a single line of code. Real-time streaming watchlists and alerts keep you informed of market movements, ensuring you don't miss any trading opportunities. Customizable technical indicators and drawing tools allow for in-depth chart analysis, further enhancing your ability to pinpoint potential trades. The platform also caters to advanced users with its Personal Formula Language, providing the flexibility to create custom scans tailored to individual trading strategies. This is particularly useful for experienced day traders who have developed their own proprietary indicators or scanning criteria.

While several platforms offer day trading stock scanners, TC2000 distinguishes itself through a balance of power and usability. Competitors like Trade Ideas offer similar scanning capabilities but come at a premium price. Thinkorswim, while free with a TD Ameritrade account, can be daunting for new users due to its complex interface. TC2000 bridges this gap, offering a robust feature set within an intuitive interface, making it suitable for traders of all experience levels. Its strong combination of technical and fundamental filters allows for a more holistic approach to stock selection. For instance, you could scan for stocks with a positive price-to-earnings ratio that are also showing bullish technical patterns, creating a powerful confluence of factors.

Pricing and Technical Requirements: TC2000 offers tiered subscriptions, with higher tiers unlocking more advanced features. Specific pricing can be found on their website. The software is primarily desktop-based, though a web version is also available. It's worth noting that the desktop application can be resource-intensive, requiring a reasonably powerful computer for optimal performance.

Implementation Tips: Start with pre-built scans available within TC2000 to familiarize yourself with the platform. Then, gradually explore the condition wizard to create custom scans based on your trading strategy. Take advantage of the paper trading feature to test your scans before deploying them with real capital.

Pros:

- Intuitive scan building interface for non-programmers

- Excellent balance of power and usability

- Strong combination of technical and fundamental filters

- Good value for feature set compared to competitors

Cons:

- Advanced features require higher subscription tiers

- Limited to US and Canadian markets

- Desktop software can be resource-intensive

Website: https://www.tc2000.com/

TC2000 deserves a place on this list because it offers a compelling solution for day traders seeking powerful yet easy-to-use scanning capabilities. Its unique combination of features, intuitive interface, and competitive pricing makes it a valuable tool for anyone looking to enhance their day trading stock selection process.

Day Trading Stock Scanner Comparison

| Software | Core Features & Tools | User Experience & Quality ★ | Value & Pricing 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| 🏆 ChartsWatcher | Multi-window dashboards, real-time data, backtesting | ★★★★☆ Highly customizable, synced tiles | Free to Pro plans, accessible for all levels | Pro traders, analysts, investors | Config sync, 8 tile types, 10-sec updates |

| Trade Ideas | AI scanning, Holly AI assistant, 500+ filters | ★★★★★ Industry-leading tech | 💰 High cost, premium pricing | Active day traders | AI-driven strategies, automated trading |

| ThinkorSwim (TD Ameritrade) | 300+ filters, Stock Hacker, paper trading | ★★★★☆ Professional but complex | 💰 Free with TD Ameritrade account | TD Ameritrade customers, pros | Full trading platform integration |

| Finviz | Visual screeners, heat maps, 60+ filters | ★★★★☆ User-friendly, easy to learn | Free basic, Elite real-time paid | Beginners to intermediate | Visual market sector heatmaps |

| StocksToTrade | Momentum scanner, news & social sentiment, Level 2 data | ★★★★☆ Intuitive for day trading | 💰 Premium monthly subscriptions | Day traders focusing on low-float stocks | Oracle breakout algorithm, social media trend analysis |

| TradingView | Custom scans, Pine Script, cloud-based, social sharing | ★★★★☆ Smooth cross-device use | Free basic, tiered subscriptions | Retail traders & global investors | Strong social community + scripting |

| Scanz (formerly EquityFeed) | Real-time streaming, pre/post market, Level 2 data | ★★★★☆ Extremely fast, multi-monitor | 💰 Higher price, niche US markets | Day traders, OTC/penny stock traders | Focus on OTC & penny stocks, news streamer |

| TC2000 | EasyScan builder, technical/fundamental scans, brokerage | ★★★★☆ Balanced power/usability | 💰 Mid-tier pricing, value for features | US/Canada traders | Visual condition builder, personal formula scans |

Find Your Perfect Day Trading Stock Scanner

Choosing the right day trading stock scanner is paramount to success in the fast-paced world of day trading. We've explored eight powerful tools—ChartsWatcher, Trade Ideas, ThinkorSwim, Finviz, StocksToTrade, TradingView, Scanz, and TC2000—each offering unique features and capabilities. Key takeaways include understanding the importance of real-time data, customizable alerts, and backtesting functionalities, and how these features can significantly impact your trading decisions. Remember to consider your individual trading style, budget, and technical expertise when making your selection. For example, if you're a beginner, a user-friendly platform like TradingView might be a good starting point. More experienced traders seeking advanced AI-powered insights might gravitate towards Trade Ideas. Alternatively, platforms like Finviz offer free access to powerful screening capabilities, providing an excellent entry point for those exploring day trading stock scanners.

Beyond the functionalities of the scanner itself, consider how discoverability impacts your potential audience. Building high-quality backlinks is crucial for improving your stock scanner's website ranking. For more information on backlink strategies and how they impact SEO, check out this helpful resource: how many backlinks you need to rank. Source: How many backlinks do i need to rank? Data & Tips from Outrank

Ultimately, the ideal day trading stock scanner empowers you to identify opportunities, manage risk, and make informed decisions with confidence. With the right tool in hand, you can navigate the complexities of the market and strive for consistent profitability.

Ready to elevate your day trading with a powerful and customizable stock scanner? Explore ChartsWatcher, a leading platform designed specifically for day traders, offering real-time alerts, advanced charting tools, and much more. Visit ChartsWatcher today to discover how it can enhance your trading strategy.