What is a stock screener? Boost Your Investing

What is a Stock Screener: Your Digital Investment Compass

A stock screener is a powerful tool for investors. It helps filter through thousands of stocks to identify potential investment opportunities. Think of it as a search engine designed specifically for the stock market. Instead of researching each company individually, you can set your criteria and instantly see a narrowed-down list of matching stocks. This makes finding investments aligned with your strategy more efficient.

This filtering process allows you to focus on companies meeting your specific needs. You might be interested in companies with a certain market capitalization, dividend yield, or technical indicators like the Relative Strength Index (RSI). TradingView offers a robust platform for utilizing these indicators. This targeted approach is especially useful for managing a diverse portfolio that reflects your investment goals.

For example, a stock screener can help you narrow your search to companies with a market capitalization above $1 billion and a price-to-earnings ratio below 20. This detailed filtering simplifies a complex and time-consuming process. Learn more about stock screeners here: What is the Stock Screener?

Why are Stock Screeners Important?

With over 5,000 publicly traded companies listed on major U.S. exchanges as of 2023, finding the right investments can be challenging. Stock screeners make this process manageable. They empower investors to sort through this vast number of potential investments and identify promising candidates. The use of stock screeners has increased significantly over the past decade due to the rise of user-friendly digital platforms.

Stock screeners also streamline investment research, which can often be overwhelming. Instead of manually analyzing thousands of companies, investors can automate the initial filtering process. This allows you to focus on a smaller, more relevant group of stocks.

Additionally, stock screeners help quickly evaluate the quantitative aspects of potential investments. They use fundamental metrics to uncover financial health, including elements like earnings growth, revenue trends, and debt levels. Screeners can also use technical indicators like moving averages or RSI to find potential momentum and price patterns. Access to this detailed information is crucial for making informed investment decisions.

Essential Features That Power Effective Stock Screeners

Understanding the core features of a stock screener is crucial for unlocking its full potential. These tools go beyond simple filtering; they're powerful engines driving informed investment choices. Let's explore the key components that distinguish basic screeners from those that can truly elevate your investment process.

Filtering Capabilities: The Heart of a Stock Screener

At its core, a stock screener's primary function is filtering. This means setting specific parameters to narrow down the vast universe of potential investments. These parameters can range from straightforward metrics like market capitalization and share price to more nuanced factors like price-to-earnings ratio (P/E) and earnings per share (EPS).

-

Fundamental Metrics: These concentrate on the financial well-being and performance of a company. Think revenue growth, profit margins, and debt levels.

-

Technical Indicators: These analyze price and volume data to pinpoint trends and patterns. Popular examples include moving averages, relative strength index (RSI), and Bollinger Bands.

Customizable Templates and Screening Strategies

Effective stock screeners empower users to save and reuse their screening criteria. This not only saves valuable time but also ensures consistency in your investment approach. Many platforms also offer pre-built templates designed for various investment strategies.

-

Growth Investing: These templates prioritize metrics like high earnings growth and robust revenue trends.

-

Value Investing: These templates highlight low P/E ratios, high dividend yields, and other signs of undervaluation.

Different Strategies, Different Screens

Stock screeners are remarkably versatile in their ability to support a wide range of investment strategies. For growth-focused investors, a screener can be configured to filter for stocks with high earnings growth rates, such as companies exceeding 20% year-over-year growth. Value investors, on the other hand, can use screeners to identify undervalued stocks by focusing on criteria like low price-to-earnings ratios, often below industry averages, and high dividend yields, perhaps exceeding 4%. Furthermore, screeners can pinpoint stocks with stable financial metrics like a debt-to-equity ratio below 1.0, a common indicator of financial stability. The evolution of stock screeners has led to the inclusion of over 167 filters, enabling highly customized searches. Learn more about the benefits of using a stock screener: Why Use a Stock Screener?

To better understand how these criteria are used, let's examine a table outlining common screening parameters:

Common Stock Screening Criteria

This table outlines the most frequently used screening parameters across different investment strategies, showing how they're typically applied.

| Criteria Category | Specific Metrics | Typical Ranges | Strategy Application |

|---|---|---|---|

| Valuation | Price-to-Earnings (P/E) Ratio | Below 15 | Value Investing |

| Valuation | Price-to-Book (P/B) Ratio | Below 1 | Value Investing |

| Growth | Earnings Per Share (EPS) Growth | Above 20% | Growth Investing |

| Growth | Revenue Growth | Above 10% | Growth Investing |

| Financial Health | Debt-to-Equity Ratio | Below 1.0 | Value Investing, Risk Management |

| Financial Health | Return on Equity (ROE) | Above 15% | Quality Investing |

| Momentum | Relative Strength Index (RSI) | Above 70 (Overbought) or Below 30 (Oversold) | Momentum Trading |

| Technical | Moving Averages (50-day, 200-day) | Crossovers | Trend Following |

Key takeaways from this table include the importance of P/E and P/B ratios for value investors, the focus on growth metrics like EPS and revenue growth for growth investors, and the use of financial health metrics like debt-to-equity ratio for both value investors and those focused on risk management.

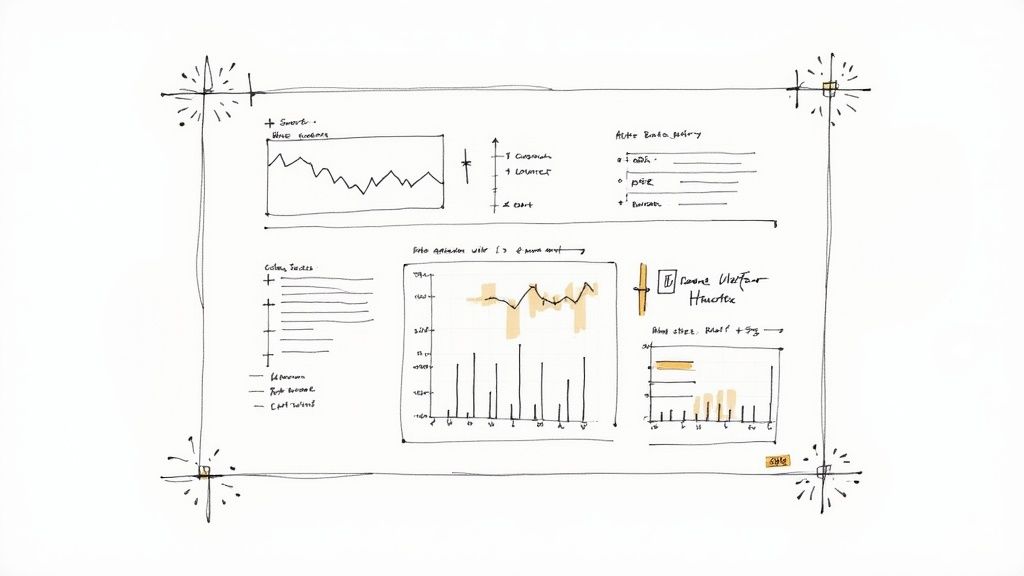

Visualization and Integration: Turning Data Into Action

Modern stock screeners often incorporate visualization tools such as charts and graphs. These tools help investors quickly grasp the filtered data and make more informed decisions. Integration with other investment platforms, like brokerage accounts, further streamlines the investment workflow. This seamless integration allows for a smooth transition from identifying potential investments to executing trades, enabling you to act swiftly on insights derived from your custom screening criteria.

How Stock Screeners Transform Your Investment Process

Stock screeners have become indispensable tools for modern investors. They represent a significant change in how we analyze and approach the market. These powerful platforms automate the research process, allowing you to move beyond tedious manual analysis.

This automation means you can spend more time on in-depth research of promising companies. Instead of sifting through mountains of data, you can focus your energy where it matters most. This allows for a more strategic and targeted investment approach.

Efficiency Gains: From Hours to Minutes

Manually filtering through thousands of stocks based on specific criteria is a daunting task. It could take hours, even days, to compile a list of potential investments. With a stock screener, this process is condensed to mere minutes.

This dramatic increase in efficiency allows you to react swiftly to market fluctuations. You can seize opportunities as they appear and capitalize on market movements. In today's dynamic market, this speed and agility is a powerful advantage.

This efficiency is essential for navigating the complexities of the modern stock market. Thousands of companies are listed across numerous exchanges, making manual analysis nearly impossible. Stock screeners simplify this complexity. They automate the initial filtering process, allowing you to concentrate on a curated selection of stocks.

For example, you can quickly identify healthcare stocks with a dividend yield above 3% and a price-to-book ratio below 2. This can help you uncover potentially undervalued, yet stable companies. Learn more about what a stock screener is. This streamlined approach allows you to focus on important qualitative factors such as management quality and overall industry trends.

Overcoming Bias and Maintaining Discipline

Our psychology plays a significant role in investment decisions. We're all susceptible to cognitive biases and emotional reactions, which can impact our investment choices. Stock screeners help minimize these influences.

They introduce a systematic and objective approach to stock selection. By setting predefined criteria, you reduce the risk of impulsive decisions based on fear or greed. This disciplined approach encourages better investment outcomes over the long run.

Uncovering Hidden Opportunities

Stock screeners are excellent tools for uncovering hidden investment gems. They systematically scan the market based on your specific criteria, identifying promising companies you might otherwise overlook. This capability expands your scope of potential investments, leading to a more diversified portfolio.

By applying your investment criteria across the entire market, you move beyond familiar territory. This broadens your investment horizon and increases your chances of discovering hidden gems. This broader view can help you create a more diversified and resilient portfolio, especially crucial during times of market volatility. Maintaining disciplined screening parameters helps you stay true to your strategy, promoting long-term investment success.

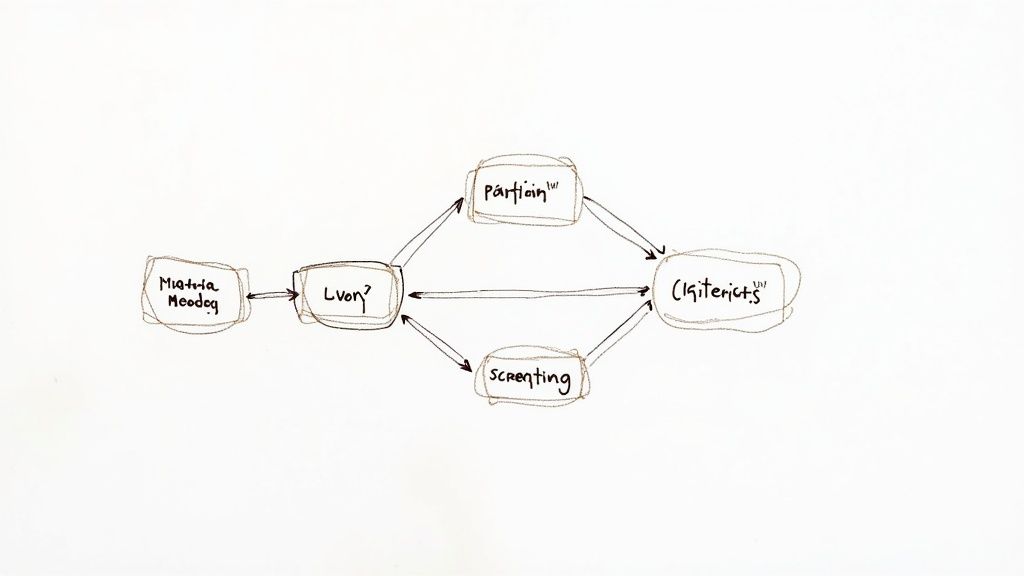

Stock Screeners vs. Scanners: Choosing Your Perfect Tool

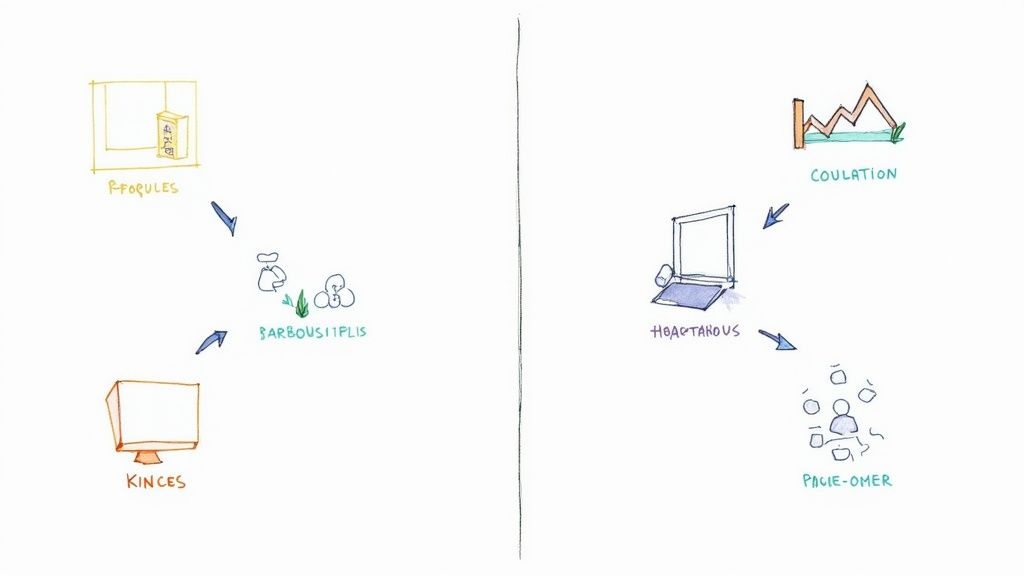

New investors often struggle to understand the difference between a stock screener and a stock scanner. Both tools help uncover potential investment opportunities, but they each cater to different needs and investment styles. Picking the right tool is crucial for achieving your financial goals.

Stock screeners focus on fundamental analysis and long-term investment strategies. They filter stocks based on financial criteria like price-to-earnings ratio, revenue growth, or dividend yield, using historical data. This helps investors build diversified portfolios aligned with their long-term goals.

Stock scanners, conversely, cater to short-term traders seeking real-time market opportunities. They emphasize technical indicators and intraday price movements, alerting traders to current market conditions. For example, a scanner might flag a sudden volume surge, signaling a potential short-term trade. This real-time data is essential for day traders who need to react quickly to market fluctuations. The difference between screeners and scanners reflects the distinct needs of long-term investors and short-term traders. Screeners utilize end-of-day data for long-term strategies, while scanners provide real-time insights for active trading. You can learn more about stock scanners here: Stock Scanner Definition.

Key Differences: Time Horizon and Data Type

The core distinction lies in the time horizon and data used. Stock screeners analyze historical data to find companies meeting specific fundamental criteria over extended periods. This helps investors identify companies with strong financials and growth potential.

Stock scanners, on the other hand, utilize real-time data to pinpoint short-term trading opportunities based on technical analysis. They focus on price action, volume, and momentum to detect potential breakouts, trend reversals, or other short-term patterns.

Choosing the Right Tool for Your Needs

The best tool for you depends on your investment approach. Long-term investors focused on fundamental analysis will find a robust stock screener beneficial. Active traders, however, should opt for a real-time stock scanner like ChartsWatcher, which offers instant alerts and real-time data feeds. ChartsWatcher empowers traders to identify and react to market movements as they happen. Choosing the right tool makes executing your investment strategy more effective.

To further illustrate the differences, let's examine a comparison table:

The following table highlights the key differences between stock screeners and stock scanners across several factors.

Stock Screeners vs. Stock Scanners Comparison

| Feature | Stock Screeners | Stock Scanners |

|---|---|---|

| Purpose | Long-term investing | Short-term trading |

| Data Timing | Historical (end-of-day) | Real-time (intraday) |

| Ideal Users | Long-term investors, fundamental analysts | Day traders, swing traders, technical analysts |

| Focus | Fundamental metrics (e.g., P/E ratio, revenue growth) | Technical indicators (e.g., moving averages, volume) |

| Output | List of companies meeting specific criteria | Real-time alerts and signals |

| Time Horizon | Months to years | Minutes to days |

In summary, stock screeners are designed for long-term investors who prioritize fundamental analysis, while stock scanners cater to short-term traders who rely on technical analysis and real-time data. Understanding these differences is essential for selecting the tool that best aligns with your investment style and goals.

Top Stock Screener Platforms: Finding Your Perfect Match

Now that we understand what a stock screener is and its core features, let's explore some of the top platforms available. Choosing the right platform is essential for investment success. The ideal stock screener depends on your specific needs, investment approach, and technical skills.

Free vs. Premium: Evaluating Your Choices

Many solid free stock screeners are excellent starting points for new investors. These platforms typically offer basic filtering options and market data. This allows beginners to learn how stock screeners work without a paid subscription.

However, premium platforms provide advanced features and datasets. These often include sophisticated charting tools, real-time data, and detailed fundamental analysis. For serious investors, these added capabilities are often worth the cost.

Key Features to Consider

When comparing stock screeners, consider these important factors:

-

Data Quality: Reliable, up-to-date data is vital for informed decisions. Choose platforms recognized for accurate data and frequent updates.

-

Filtering Capabilities: A wider range of filters allows more precise targeting of investments. Ensure the platform offers the specific criteria relevant to your strategy.

-

User Interface: A clean, intuitive interface significantly enhances user experience. The platform should be easy to navigate and personalize.

-

Complementary Features: Some platforms offer extras like portfolio tracking, news updates, and educational materials. These can provide valuable insights and improve your investment approach. For more on advanced tools, explore our guide on top stock market analysis tools for pro traders.

Platform Examples and Specializations

Different platforms excel in different areas. Some specialize in fundamental analysis, offering detailed financial data. Others focus on technical trading, with various charting tools and technical indicators. Some cater to specific markets, like international stocks or options.

For instance, TradingView is popular with active traders for its charting and real-time data. Finviz is known for its intuitive interface and extensive screening capabilities. Recognizing these specializations helps you pick a platform aligned with your investing style.

ChartsWatcher: A Robust Platform for Professional Traders

ChartsWatcher is a powerful stock market scanning platform designed for professional traders. It offers a dynamic environment to create custom windows and dashboards, displaying critical market data. Users can build tailored views of alerts, top lists, charts, news feeds, and watchlists, all synchronized with essential stock and currency analyses. With an array of alerts and filters, traders can refine their strategies. ChartsWatcher also offers backtesting and configuration import/export features. Its focus on real-time data and flexibility provides a notable advantage for traders wanting real-time insights.

Making Your Decision

Selecting a stock screener is a personal choice. There’s no universal solution. The best strategy is to research platforms, use free trials when available, and reflect on your individual goals. This careful approach will help you find a stock screener that becomes a valuable asset in your investment toolkit. You may also find this helpful: Top 8 Best Stock Screener Settings for Stock Success. The right platform enables you to efficiently filter the market and uncover promising investment opportunities matching your specific criteria.

Crafting Winning Stock Screens That Deliver Results

Building a winning stock screen blends art and science. It's about creating screens that highlight real investment opportunities, not just data noise. This involves defining your investment goals, choosing the right parameters, and constantly refining your approach.

Defining Your Investment Goals

Creating a winning stock screen starts with clearly defining your investment objectives. Are you a growth investor looking for companies with high earnings potential? Or are you a value investor seeking undervalued assets with solid fundamentals? Your goals will shape the criteria you use in your stock screener.

For example, a growth investor might focus on metrics like earnings-per-share growth and revenue growth. A value investor might prioritize low price-to-earnings ratios and high dividend yields.

Selecting and Calibrating Parameters

After defining your goals, select the relevant parameters for your screen. A stock screener offers hundreds of filters, from basics like market capitalization and share price to complex indicators like the Relative Strength Index (RSI). Relative Strength Index (RSI) is a valuable tool for technical analysis. Choose parameters aligning with your investment strategy.

This focused approach refines your search and pinpoints companies meeting your criteria. You might be interested in: Top 8 Best Stock Screener Settings for Stock Success.

Simply selecting parameters is not enough; you must also calibrate them. Overly restrictive filters can eliminate promising candidates. Overly broad criteria generate too many irrelevant results. Find a balance that yields a manageable list of potential investments without being too narrow.

Refining Your Screens and Systematic Implementation

Building a winning stock screen is an ongoing process. Refine it based on real-world performance. As market conditions and your investment goals change, adjust your criteria.

Monitor your screen's results and identify areas for improvement. Are you finding too many false positives or missing key opportunities? Analyze your screen’s performance to fine-tune your parameters and boost effectiveness.

Finally, incorporate your refined stock screens into a systematic investment routine. Regularly scan the market for new opportunities. This consistency helps you identify potential investments aligned with your philosophy, prevents impulsive decisions, and keeps your strategy on track.

Beyond The Screen: Maximizing Your Screener's Potential

A stock screener is a powerful tool for uncovering potential investment opportunities. However, understanding its limitations is just as crucial as recognizing its capabilities. Savvy investors use stock screeners as a starting point, not a final decision-maker. This means further analysis is essential, even after a screener narrows the field.

Integrating Qualitative Analysis

Stock screeners excel at quantitative filtering, providing data-driven insights. But qualitative analysis adds a crucial layer to the investment process. This involves researching company management, competitive landscapes, and industry trends. For example, a screener might highlight a company with impressive financials, but further research could reveal potential management issues or upcoming regulatory hurdles.

Data Accuracy and Time Lags

It's essential to verify the accuracy of the data from your stock screener. Different platforms use different data providers, and discrepancies can occur. Also, be mindful of potential time lags. Data might not reflect the most current market conditions, a significant factor in fast-moving markets.

Recognizing Limitations: Emerging Opportunities and Risks

Stock screeners operate based on pre-defined criteria. This can cause them to overlook emerging opportunities or risks that don't fit neatly into existing categories. For instance, a disruptive technology might not be captured by traditional financial metrics. Staying informed about broader market trends and conducting independent research is therefore vital. Services like ChartsWatcher offer daily screener results, offering insights into potential opportunities and risks. As shown in research from TradesViz, access to multiple daily screener results across various markets gives traders a pool of potential candidates for deeper analysis. Research also highlights the importance of focusing on readily understandable metrics like price and volume for initial screening, promoting broader usage and accessibility.

Practical Approaches for Integration

Successfully integrating a stock screener means combining its efficiency with human judgment.

- Start by defining clear investment goals. This informs your screening criteria.

- Regularly review and refine your screens based on market performance.

- Remember a stock screener is one tool within a broader investment strategy. It complements, but doesn't replace, thoughtful analysis and research.

Ready to explore real-time market analysis? Discover ChartsWatcher today! Discover ChartsWatcher