Top Stock Market Analysis Techniques for Savvy Traders

Unlocking Market Insights

Understanding the stock market in 2025 requires more than intuition. It demands a deep understanding of market forces. Whether you're a seasoned trader at a major financial institution, a day trader using stock scanners and screeners, or an individual investor, analyzing stocks effectively is key to success. From predicting price fluctuations to assessing intrinsic value, insightful analysis is paramount.

Modern finance is built on evolving analytical frameworks. These range from traditional valuation methods inspired by Benjamin Graham to advanced algorithmic trading strategies. These approaches, refined over decades and constantly adapting to new technologies and market conditions, provide a powerful lens for interpreting market signals and making informed investment decisions.

What makes a stock market analysis technique truly effective? It's the combination of solid theoretical foundations, proven historical success, and the ability to adapt to the dynamic nature of the market.

Exploring Effective Techniques

In this listicle, we'll delve into ten powerful stock market analysis techniques. We'll cover everything from established methodologies to cutting-edge, data-driven approaches.

- Fundamental Analysis

- Technical Analysis

- Quantitative Analysis

- Sentiment Analysis

- Event-Driven Analysis

- Cycle Analysis

- Industry Analysis

- Comparative Company Analysis

- Regression Analysis

- Statistical Arbitrage

By understanding the core principles, strengths, and weaknesses of each technique, you'll gain valuable insights. You'll learn how to better evaluate market trends, spot potential opportunities, and manage risk more effectively.

Building Your Analytical Arsenal

Get ready to equip yourself with the analytical tools needed to navigate the complexities of the stock market. Investing can be both exciting and challenging, and a strong understanding of these techniques can significantly improve your investment outcomes.

1. Technical Analysis

Technical analysis is a powerful tool for evaluating investments and identifying opportune times to enter and exit trades. It works by analyzing statistical trends, like price movements and trading volume, derived directly from market activity. Unlike fundamental analysis, which focuses on a company’s intrinsic value, technical analysis concentrates solely on price and volume data.

The core belief behind technical analysis is that all known information is already reflected in the market price. This makes it a valuable technique for a wide range of market participants, from seasoned professionals at financial institutions to independent investors and day traders.

Tools and Techniques

Technical analysts use a variety of tools and techniques to interpret market trends and forecast future price action.

- Chart Pattern Analysis: This involves identifying recurring patterns, such as head and shoulders, double tops/bottoms, triangles, and flags. These patterns can indicate potential trend reversals or continuations.

- Trend Indicators: Tools like moving averages (MA), the Moving Average Convergence Divergence (MACD), and trendlines help determine the direction and strength of current trends.

- Momentum Indicators: Oscillators, like the Relative Strength Index (RSI) and stochastic oscillator, measure the speed and magnitude of price changes. They can help identify overbought or oversold conditions.

- Volume Indicators: Analyzing trading volume alongside price movements helps confirm the strength of trends and identify potential breakouts.

- Support and Resistance Level Identification: This involves pinpointing price levels where significant historical buying or selling pressure occurred. These levels can indicate areas where price might stall or reverse.

History and Development

The foundations of technical analysis can be traced back to Charles Dow and his Dow Theory, which established many modern technical concepts. Later, figures like J. Welles Wilder, creator of the RSI, and John Murphy, author of Technical Analysis of the Financial Markets, further developed the field. Thomas Bulkowski’s research on chart patterns also provided key insights into their potential predictive power.

Pros and Cons

Like any analytical method, technical analysis has its advantages and disadvantages.

Pros:

- Versatility: It’s applicable to nearly any tradable instrument, from stocks and bonds to commodities and currencies.

- Multi-Timeframe Analysis: It’s effective across various timeframes, from short-term intraday charts to long-term multi-year charts.

- Clear Signals: It offers relatively objective entry and exit signals based on established rules and patterns.

- Market Psychology Insight: It helps assess market sentiment and identify potential shifts in investor behavior.

Cons:

- Subjectivity: Interpreting chart patterns can be subjective, leading to varied conclusions.

- Past Performance: Past performance doesn't guarantee future results, and patterns may not always unfold as expected.

- False Signals: It can produce false signals in volatile or sideways markets.

- Continuous Learning: It requires ongoing learning and adaptation to changing market dynamics.

Real-World Application and Tips

Examples of technical analysis in action include:

- The head and shoulders pattern appearing in major stock indices before the 2008 financial crisis.

- The use of trend-following strategies with moving averages during the 2020-2021 bull market.

- The RSI's effectiveness in identifying overbought conditions before market corrections.

For successful implementation:

- Combine multiple indicators to confirm signals.

- Analyze price action across different timeframes.

- Avoid relying on just one pattern or indicator.

- Practice with historical data before live trading.

For a deeper dive, check out Unlocking Market Trends with Technical Analysis Indicators. Technical analysis is valuable for its practicality, versatility, and potential to provide insights into market trends. However, remember it’s not foolproof and should be used with sound risk management.

2. Fundamental Analysis

Fundamental analysis is a cornerstone of long-term investing. It's a powerful technique for uncovering true value in the stock market. Unlike technical analysis, which focuses on price patterns and market trends, fundamental analysis digs deeper. It looks at the underlying factors driving a company's performance.

The goal of fundamental analysis is to determine a security's intrinsic value. This is what the security is actually worth based on its financial health and prospects. Investors then compare this intrinsic value to the security's current market price. This comparison helps investors identify stocks that might be undervalued or overvalued.

Understanding The Core Concepts

At its core, fundamental analysis involves examining a company's financial statements. These statements—the income statement, balance sheet, and cash flow statement—reveal a company's profitability, assets, liabilities, and cash flow. Key metrics, like earnings per share (EPS), return on equity (ROE), and debt-to-equity ratio, provide a quantitative snapshot of the company's financial health.

Fundamental analysis also goes beyond just the numbers. It looks at qualitative factors, too. These can include the quality of the management team, brand strength, competitive advantages (sometimes called an "economic moat"), and the overall industry landscape. This broader perspective helps investors develop a comprehensive understanding of a company's current position and future potential.

Features and Benefits of Fundamental Analysis

- Financial statement analysis: Offers insights into revenue growth, profitability, and financial stability.

- Ratio analysis (P/E, P/B, ROE, debt-to-equity): Provides standardized metrics for comparing companies within the same industry.

- Economic indicators assessment: Helps evaluate the impact of broad economic factors on a company's performance.

- Industry and competitive analysis: Determines a company's position within its industry and its ability to compete effectively.

- Company management evaluation: Assesses the leadership's experience, strategy, and execution capabilities.

Pros and Cons of Fundamental Analysis

Let's summarize the advantages and disadvantages of fundamental analysis.

Pros:

- Deeper understanding: Provides investors with the knowledge to make more informed decisions.

- Long-term focus: Better suited for long-term investing, as it emphasizes intrinsic value over short-term price swings.

- Identifying value: Can help identify undervalued stocks, allowing investors to potentially "buy low and sell high."

- Avoiding overvaluation: Offers a framework for recognizing companies trading at inflated prices.

Cons:

- Time-consuming: Requires significant time and effort to analyze financial statements and other data.

- Delayed market recognition: Intrinsic value and market price can differ for extended periods.

- Requires expertise: A solid understanding of accounting and business principles is essential.

- Data limitations: Company disclosures might be incomplete or misleading.

Evolution and Popularity

Investing legends like Benjamin Graham, author of "The Intelligent Investor," and his student, Warren Buffett, CEO of Berkshire Hathaway, popularized fundamental analysis. Buffett’s success using this approach solidified its status as a core investment strategy. Other influential figures like Peter Lynch, known for his management of the Magellan Fund at Fidelity, and Aswath Damodaran, a respected valuation expert, further developed and promoted fundamental analysis.

Examples in Action

- Warren Buffett's investment in Apple, based on its brand strength, loyal customer base, and strong cash flow, is a prime example of fundamental analysis in action.

- Value investors who saw Amazon's long-term potential, despite years of low profits, demonstrate the importance of looking beyond short-term results.

- Joel Greenblatt's "Magic Formula" investing, which seeks out undervalued companies with high returns on capital, is a systematic approach to fundamental analysis.

Practical Tips for Implementation

- Focus on familiar industries: Leverage existing knowledge to identify key industry factors and risks.

- Compare within industries: Use relative valuation, comparing companies to their peers rather than the broader market, for more accurate assessments.

- Read annual reports: Pay close attention to the management discussion and analysis (MD&A) section for insights into management's perspective and strategic direction.

- Balanced approach: Consider both qualitative and quantitative factors for a comprehensive view.

For professionals and individual investors alike, fundamental analysis offers a valuable framework for understanding a company's true worth. While it demands time and effort, the ability to identify undervalued opportunities and avoid overvalued pitfalls makes it an essential tool for long-term success in the stock market.

3. Quantitative Analysis

Quantitative analysis, or "quant," is a sophisticated approach to stock market analysis using mathematics and statistical modeling. Rather than relying on intuition or qualitative factors, quant analysis uses data to understand financial behavior and make investment decisions. This means applying mathematical models to large sets of historical market data to find patterns, predict future price movements, and build algorithmic trading strategies.

Quant's prominence grew with increased computing power and the availability of large datasets. Pioneers like Jim Simons of Renaissance Technologies showed its potential by using statistical arbitrage to generate exceptional returns. Others like Emanuel Derman, Cliff Asness, and David Shaw further developed and popularized it within finance. Today, firms like Two Sigma and BlackRock use machine learning and platforms like Aladdin for market prediction, risk analysis, and portfolio construction.

Key Features of Quant Analysis

Quant analysis has several key features that set it apart from other analytical methods:

-

Mathematical modeling of market behavior: Quant analysts build complex mathematical models to simulate market dynamics and predict future price movements.

-

Statistical analysis of historical data: They use extensive statistical techniques to analyze historical market data, identify trends, and test the validity of trading strategies.

-

Algorithm development for trading signals: Algorithms are designed to automatically generate buy and sell signals based on pre-defined criteria and current market conditions.

-

Risk measurement through statistical methods: Sophisticated statistical models quantify and manage risk within investment portfolios.

-

Backtesting of strategies using historical data: Trading strategies are rigorously tested using historical data to evaluate their performance and identify potential weaknesses. For a deeper dive into this topic, see How to Backtest a Trading Strategy: The Complete Playbook for Modern Traders.

Pros and Cons of Quantitative Analysis

Here's a quick look at the advantages and disadvantages of using quant:

Pros:

-

Removes emotional bias: Decisions are data-driven, eliminating emotional influences.

-

Processes vast amounts of data quickly: Quant can efficiently analyze huge datasets, revealing insights that would be impossible to find manually.

-

Provides rigorous statistical validation: Strategies undergo rigorous testing and validation using statistical methods.

-

Identifies complex patterns: Quant models can uncover complex market patterns often missed by traditional analysis.

Cons:

-

Requires technical expertise: Using quant strategies requires advanced knowledge of mathematics, statistics, and programming.

-

Over-reliance on historical data: Models based only on past data may not predict future events accurately, especially during market volatility.

-

Model risk: Incorrect assumptions or design flaws can lead to significant losses.

-

Expensive implementation: Building and maintaining quant models requires substantial investment in data, software, and skilled professionals.

Tips for Implementing Quantitative Analysis

If you are considering incorporating quantitative analysis into your investment strategy, keep these tips in mind:

-

Ensure data quality: Accurate and reliable data is essential for building robust models.

-

Test strategies across different market conditions: Evaluate your strategies' performance in various market scenarios, including bull and bear markets.

-

Incorporate risk management: Implement strong risk management measures to mitigate potential losses.

-

Regularly validate models: Continuously monitor and validate your models against new market data to ensure effectiveness.

Quantitative analysis earns its place on this list because of its potential for significant returns and its rigorous, data-driven approach. However, it's important to understand its complexities and potential drawbacks. It’s a powerful tool, but it demands expertise and careful consideration.

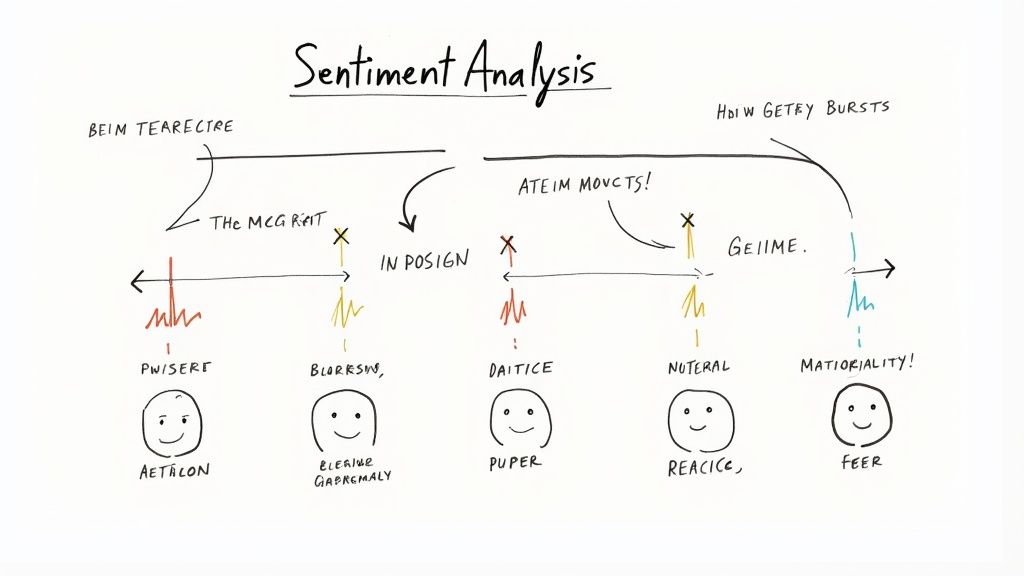

4. Sentiment Analysis

Sentiment analysis has become a key technique in stock market analysis. It provides a unique lens into market psychology, a world often driven by emotion rather than pure logic. By examining text from sources like news articles, social media, and online forums, sentiment analysis aims to understand the market's feelings about specific stocks, sectors, or the overall market. When interpreted correctly, this information can offer valuable predictions about potential market movements, adding another layer of insight to traditional price-based analysis.

Sentiment analysis uses Natural Language Processing (NLP) and machine learning algorithms to interpret human language. These algorithms assign sentiment scores, typically categorizing text as positive, negative, or neutral. This process allows traders to quantify qualitative data, transforming subjective opinions into actionable insights. Real-time sentiment indicators, drawn from continuous monitoring of social media platforms like Twitter, Reddit (particularly subreddits like r/WallStreetBets), and StockTwits, combined with news sentiment scoring and web scraping of financial websites, give traders a sense of the market’s evolving opinions. These features help traders spot shifts in sentiment that might predict price changes.

The growing use of social media and the increasing availability of textual data have made sentiment analysis in finance increasingly popular and sophisticated. Companies like FinBrain Technologies, StockTwits, MarketPsych Data, and Social Market Analytics (SMA) are developing advanced sentiment analysis tools and indicators. The GameStop (GME) short squeeze of 2021 offers a compelling example of its potential. The overwhelmingly positive sentiment on Reddit’s r/WallStreetBets foreshadowed GME’s unprecedented price surge. Even established platforms like the Bloomberg Terminal now incorporate Twitter sentiment data for generating trading signals, showcasing the growing acceptance of sentiment analysis in mainstream finance.

Pros of Using Sentiment Analysis

- Early Warning System: Sentiment analysis can identify changes in market sentiment before they show up in price movements, potentially giving traders an advantage.

- Psychological Insight: It provides a glimpse into market psychology and crowd behavior that traditional technical or fundamental analysis often misses.

- Quantification of Qualitative Data: It turns subjective opinions into measurable data that can be used in trading strategies.

- Effective for Highly Publicized Stocks: Sentiment analysis works especially well for stocks with a lot of social media discussion and news coverage.

Cons and Challenges

- Manipulation: Market sentiment can be manipulated through fake news, coordinated online campaigns, and bot activity.

- Signal-to-Noise Ratio: Filtering out irrelevant information and finding genuine sentiment can be difficult.

- Herd Mentality: Relying only on sentiment analysis can lead to following the crowd and missing contrarian opportunities.

- Technological Limitations: NLP algorithms still struggle with understanding context, sarcasm, and complex language.

Tips for Effective Implementation

- Focus on Changes: Pay attention to significant shifts in sentiment rather than absolute levels. A sudden increase in positive sentiment can be as informative as a sharp drop in negativity.

- Confirmation is Key: Always combine sentiment analysis with other types of technical and fundamental analysis. This helps confirm signals and avoid relying solely on sentiment.

- Source Credibility: Evaluate the source and credibility of the sentiment data. Information from respected financial news outlets is usually more reliable than anonymous social media posts.

- Contrarian Indicators: Extreme sentiment levels (excessive euphoria or extreme fear) can sometimes act as contrarian indicators, hinting at a possible market reversal.

By understanding the strengths and weaknesses of sentiment analysis and using these tips, traders can use the power of collective market psychology to gain valuable insights and make better trading decisions.

5. Algorithmic Trading

Algorithmic trading, also known as algo trading, has reshaped how financial markets function. It uses computer programs to execute trades based on pre-defined instructions (algorithms), achieving speeds and frequencies impossible for human traders. This technique has become essential in modern finance, impacting everything from high-frequency trading to long-term investments. Its importance in stock market analysis stems from its effects on market efficiency, trading volume, and market access.

Algo trading systems analyze market data, identify opportunities, and execute trades automatically, often within milliseconds. These algorithms consider various trade aspects, including timing, price, quantity, and other factors. The main goals typically involve optimizing order execution, minimizing market impact, enabling systematic trading strategies, and profiting from even minor price differences.

Features and Benefits

Algorithmic trading platforms offer various features to give traders a competitive advantage:

- Automated Execution: Trades are executed automatically based on predefined rules, eliminating emotional biases and enhancing speed.

- High-Frequency Trading (HFT) Capabilities: Algorithms can execute numerous orders rapidly, enabling strategies like market making and arbitrage.

- Statistical Arbitrage Strategies: These strategies use statistical models to identify and exploit temporary mispricing in related securities.

- Market Making Functionality: Algo trading allows for automated market making, providing liquidity by continuously quoting bid and ask prices.

- Customizable Parameters: Traders can adjust parameters to suit specific market conditions, risk tolerance, and trading goals.

Pros

- Eliminates Emotional Decision-Making: Removes human biases from trading decisions.

- Optimal Price Execution & Minimal Slippage: Achieves better execution prices by minimizing slippage through efficient order routing and timing.

- 24/7 Operation Across Multiple Markets: Operates continuously across global markets, maximizing trading opportunities.

- Backtesting Capabilities: Strategies can be thoroughly backtested on historical data to validate their effectiveness.

Cons

- Technical Failures: System malfunctions or connectivity problems can lead to substantial and rapid losses.

- Ongoing Maintenance and Monitoring: Algorithms require continuous maintenance, updates, and monitoring to adapt to changing market conditions.

- High Initial Development and Infrastructure Costs: Developing and implementing these systems can be expensive, requiring specialized expertise and powerful infrastructure.

- Regulatory Scrutiny and Changing Rules: The regulatory environment for algo trading is constantly evolving, demanding ongoing compliance.

Real-World Examples and Evolution

Algorithmic trading has advanced considerably. Firms like Citadel Securities, led by Ken Griffin, have used it for market making, providing liquidity for many financial instruments. Virtu Financial utilizes high-frequency trading strategies globally, demonstrating the speed and scale possible with algorithmic systems. Platforms like Interactive Brokers' Algo Wheel offer algorithmic trading to retail investors. The rise of community platforms like Quantopian (now defunct) also helped popularize algorithmic trading. Two Sigma Investments is another prominent firm successfully using advanced algorithmic strategies.

Practical Tips for Implementation

- Start Simple: Begin with basic algorithms before moving to complex strategies.

- Risk Management: Integrate robust risk management rules and circuit breakers to limit potential losses.

- Extensive Testing: Thoroughly backtest and test algorithms in simulated environments before live trading.

- Continuous Monitoring: Continuously monitor algorithm performance and adjust to changing market dynamics.

Algorithmic trading is now a core part of modern finance. While it has risks and challenges, its potential for improved efficiency, speed, and returns makes it a vital tool for professionals, institutions, and increasingly, individual investors.

6. Intermarket Analysis: Uncovering Hidden Connections

Intermarket analysis offers a powerful way to see the financial markets. Instead of looking at stocks, bonds, commodities, and currencies separately, it examines the relationships between them. This helps identify potential turning points and understand market direction. It acknowledges that global finance is interconnected, and movements in one market can often predict activity in others. For professional traders, analysts, and even long-term investors, understanding these connections is crucial for superior portfolio management and risk mitigation.

Intermarket analysis is based on the idea that different asset classes react predictably to changing economic conditions. For example, rising bond yields might suggest higher inflation, potentially impacting stock valuations. A stronger dollar can put downward pressure on commodity prices, affecting related industries. Understanding these dynamics helps investors anticipate shifts and adjust their portfolios.

Features and Benefits

Intermarket analysis involves several key components:

- Correlation analysis: Studying the statistical link between different assets' price movements.

- Cross-asset relationships: Examining how stocks, bonds, commodities, and currencies interact.

- Business cycle analysis: Understanding how economic cycles influence different asset classes.

- Global market interdependencies: Analyzing how events in one area affect markets worldwide.

- Sector rotation: Moving investments between sectors based on expected performance in different economic conditions.

Incorporating intermarket analysis into your investment strategy offers several advantages:

- Broader market context: Get a more comprehensive understanding of market dynamics.

- Early warning signs: Identify potential shifts before they're obvious in individual assets.

- Improved timing: Enhance the timing of entries and exits by predicting turning points.

- Reduced portfolio risk: Diversify risk by understanding the relationships between assets.

Real-World Examples

- Bond Yields and Stocks: Rising bond yields often come before stock market corrections as investors shift to fixed income for higher returns.

- Dollar Strength and Commodities: A strong U.S. dollar usually pushes down commodity prices because they're typically priced in dollars. This can affect companies involved in commodity production or use.

- Crude Oil and Transportation Stocks: Higher crude oil prices can hurt the profits of transportation companies, impacting their stock prices.

Evolution and Popularization

Intermarket analysis became more well-known through the work of people like John Murphy, whose book "Intermarket Analysis" is highly regarded. Martin Pring's "Technical Analysis Explained" further explored these relationships. Louis Mendelsohn's VantagePoint Trading Software helped make using intermarket data for trading more common. Sam Stovall's work on sector rotation also emphasizes understanding market cycles and their sector-specific impacts.

Practical Tips for Implementation

- Regular Monitoring: Consistently track key intermarket relationships, like the correlation between bond yields and stock prices.

- Correlation Breakdowns: Watch for times when usual correlations change, as this can indicate a significant shift.

- Relative Performance Charts: Use these charts to find leading and lagging markets, offering insights into potential rotation opportunities.

- Timeframe Considerations: Analyze intermarket relationships across different timeframes (short-term to long-term) for a better understanding of market dynamics.

Pros and Cons

| Pros | Cons |

|---|---|

| Broader market context | Relationships between markets can change over time |

| Early warning signs of market shifts | Complex analysis requiring understanding of multiple markets |

| Improved timing of entries and exits | Data synchronization issues across global markets |

| Reduced portfolio risk through diversification | Difficult to isolate causal relationships from correlations |

Intermarket analysis has challenges. Market relationships aren't fixed and can shift. The analysis itself can be complex, needing a strong understanding of various asset classes and global economics. However, the potential to better grasp market dynamics makes it a valuable tool. By using this approach, traders and investors can gain a significant advantage in navigating the financial markets.

7. Elliott Wave Theory

Elliott Wave Theory, a form of technical analysis, proposes that market prices move in predictable, recurring wave patterns. These patterns are driven by investor psychology and sentiment. Developed by Ralph Nelson Elliott in the 1930s, this theory identifies five waves moving with the primary trend (impulsive waves) followed by three corrective waves.

These wave patterns are fractal. This means they repeat on different timeframes, from minutes to decades, allowing analysts to potentially forecast future price movements. By identifying the current wave within the larger pattern, traders can gain insights into market direction.

Elliott Wave Theory is valuable for its potential to provide a framework for understanding market cycles. Accurately identifying these wave patterns can help traders anticipate turning points. This allows them to capitalize on both upward and downward price swings. The theory isn't limited to stocks; it applies to any freely traded market, including commodities, Forex, and cryptocurrencies.

Key Features and Benefits

- Five-Wave Impulsive Sequence & Three-Wave Correction: This core principle forms the foundation of market movements according to the theory.

- Fibonacci Relationships: The theory suggests that relationships between different wave lengths often correspond to Fibonacci ratios (like 0.618, 1.618, etc.), offering potential price targets.

- Fractal Nature: The repetition of patterns across multiple timeframes helps both short-term and long-term traders.

- Specific Rules and Guidelines: While complex, the rules provide structure for wave identification.

Pros and Cons

Here's a quick look at the advantages and disadvantages of using Elliott Wave Theory:

| Pros | Cons |

|---|---|

| Framework for understanding market cycles | Subjective wave counting and interpretation |

| Potential identification of reversal points | Steep learning curve and complex methodology |

| Applicability to various markets | Multiple valid wave counts, leading to ambiguity |

| Potential price targets | Retrospective clarity, prospective uncertainty |

Real-World Examples and Case Studies

- Robert Prechter, a prominent Elliott Wave analyst, famously predicted the 1987 stock market crash using the theory.

- Commodity traders use Elliott Wave analysis to spot major tops and bottoms in commodity cycles.

- Bitcoin’s price movements, particularly its boom-bust cycles, have also been analyzed using this theory.

Practical Tips for Implementation

- Start Simple: Practice wave counting on clear textbook examples before analyzing real-world charts.

- Confirmation is Key: Use additional technical indicators, such as volume, momentum oscillators, or moving averages, to validate your counts.

- Consider Alternatives: Be open to multiple wave count possibilities and adjust your analysis with new market data.

- Rules vs. Guidelines: Strictly follow Elliott's rules, but be flexible with the guidelines, as interpretations can differ.

Prominent Figures in Elliott Wave Theory

- Ralph Nelson Elliott: The originator of the theory.

- Robert Prechter: President of Elliott Wave International.

- Glenn Neely: Developer of NEoWave.

- A.J. Frost: Co-author of Elliott Wave Principle.

Elliott Wave Theory provides a powerful framework for understanding market behavior. Its subjective nature, however, means diligent study and practice are necessary. By mastering its principles and using supplementary tools, traders can gain a potential edge in the financial markets.

8. Dow Theory

Dow Theory, a cornerstone of technical analysis, provides a framework for understanding market trends. Developed by Charles Dow, founder of the Wall Street Journal and Dow Jones & Company, this theory remains surprisingly relevant. Its focus on confirming signals and identifying primary trends offers valuable insights for the long-term investor.

Dow Theory identifies three types of market trends:

-

Primary Trends: These long-term market movements, lasting for years, are either bullish (upward) or bearish (downward). Think of them as the tides.

-

Secondary Trends: These are intermediate-term corrections or rallies, lasting weeks or months, acting like waves against the tide.

-

Minor Trends: These short-term fluctuations, lasting days or weeks, are often just noise within the larger trends.

A core principle of Dow Theory is confirmation. Originally, movements in the Dow Jones Industrial Average (DJIA) had to be confirmed by the Dow Jones Transportation Average (DJTA) to validate a change in the primary trend. The logic: industrial production (DJIA) and transportation of goods (DJTA) should move together. Today, this principle is applied to other related market indices.

Volume is another key element. Dow Theory suggests volume should increase in the direction of the primary trend. A rising market should see increasing volume on up days, and decreasing volume on down days. The opposite is true in a falling market.

Why Dow Theory Matters

Despite its age, Dow Theory emphasizes the big picture. It helps investors filter out short-term distractions and focus on significant, long-term market moves.

Features and Benefits:

- Time-tested Methodology: Over 100 years of market history support Dow Theory's principles.

- Focus on Primary Trends: Capitalize on major market moves.

- Confirmation Principle: Reduces false signals.

- Simplicity: Easy to understand and apply.

Pros and Cons of Dow Theory

Here's a quick look at the advantages and disadvantages:

| Pros | Cons |

|---|---|

| Long-term perspective | Slow to identify trend changes |

| Reduced false signals | Original confirmation principle less relevant today |

| Simple and applicable | Doesn't provide specific entry/exit points |

| Subjective interpretation |

Examples of Dow Theory in Action

- The bull market from 1949 to 1966 was clearly identified.

- The theory signaled the end of the dot-com bubble.

- Confirmation between the S&P 500 and the DJTA often precedes market advances.

Tips for Using Dow Theory

- Focus on the primary trend: Ignore short-term fluctuations.

- Look for confirmation between related market sectors.

- Be patient: Dow Theory is for major moves, not short-term trading.

- Use volume analysis to confirm trend strength.

Key figures like William Hamilton, Robert Rhea (author of The Dow Theory), and Richard Russell (publisher of Dow Theory Letters) built on Charles Dow's work.

While Dow Theory may not pinpoint exact entry and exit points, its principles offer valuable insights for long-term investors. By focusing on the big picture and confirming signals, investors can use Dow Theory to make more informed decisions.

9. Cycle Analysis

Cycle analysis is a fascinating, albeit complex, method for predicting market turning points. It focuses on identifying recurring patterns in market behavior, suggesting that price movements aren't random but follow predictable cycles. These cycles can range from short-term intraday fluctuations to long-term, multi-decade waves. Unlike methods that focus solely on price, cycle analysis adds a crucial time-based dimension to forecasting.

Cycle analysis involves several key components:

- Identifying recurring market cycles: This is the foundation of the analysis, involving recognizing repeating patterns in historical data.

- Measuring cycle characteristics: Analysts measure the length (duration), amplitude (magnitude of price swings), and phase (position within the overall cyclical pattern) of each identified cycle.

- Applying advanced mathematical tools: Techniques like Fourier analysis and spectral analysis help decompose complex price movements into their underlying cyclical components.

- Analyzing multiple overlapping cycles: Market behavior is influenced by multiple cycles operating simultaneously, and understanding their interactions is crucial.

- Studying seasonal patterns: This specific application of cycle analysis focuses on recurring patterns linked to particular times of the year.

Evolution and Popularity

The concept of market cycles has a long history, dating back to observations of seasonal agricultural patterns. Modern cycle analysis was significantly influenced by individuals like J.M. Hurst, author of “The Profit Magic of Stock Transaction Timing”, who developed methods for identifying and trading cycles. Walter Bressert also played a key role as a pioneer in cycle trading. The Foundation for the Study of Cycles has furthered research and understanding of cycles across various fields, including financial markets. Larry Williams contributed significantly to the popularization of cycle analysis, especially through his work on seasonal trading strategies.

Real-World Examples

- The 4-Year Presidential Cycle: This cycle suggests a tendency for increased market volatility and potential declines during the second year of a US presidential term, followed by stronger performance in the third and fourth years.

- Seasonal Patterns in Agricultural Commodities: The prices of agricultural products often fluctuate predictably based on planting and harvesting seasons.

- Kondratieff Long Wave Cycle: This long-term cycle (50-60 years), proposed by Nikolai Kondratieff, describes periods of economic growth and decline linked to technological innovations and major societal shifts.

- Decennial Pattern in the Stock Market: This pattern points to a tendency for stronger stock market performance in years ending in '5' and weaker performance in years ending in '0'.

Pros and Cons of Cycle Analysis

A simple table summarizes the advantages and disadvantages:

| Pros | Cons |

|---|---|

| Can anticipate turning points | Cycles can shift, stretch, or contract unpredictably |

| Works in both trending and ranging markets | Requires extensive historical data |

| Provides time-based forecasting | Often necessitates complex mathematical techniques |

| Helps understand market rhythm | Multiple interacting cycles can complicate analysis |

Practical Tips for Implementation

- Start with Simplicity: Begin with well-established cycles, such as seasonal patterns, before exploring more complex analyses.

- Validate Your Findings: Employ statistical methods to confirm the existence and significance of identified cycles.

- Focus on Probability: Use cycle analysis as a tool for assessing probabilities, not as a guaranteed predictor.

- Combine with Other Techniques: Integrate cycle analysis with other technical indicators, like trend analysis, for a more robust strategy.

By understanding cycle analysis principles, acknowledging its limitations, and using it wisely, traders, analysts, and investors can gain valuable insights into market timing and enhance their decision-making. While complex, this technique offers a unique perspective on market dynamics and can significantly contribute to achieving trading goals when applied effectively.

10. Market Profile Analysis

Market Profile analysis provides a unique lens through which to view the stock market, moving beyond traditional price charts to uncover the dynamics of trading activity. Instead of simply plotting price over time, Market Profile organizes price information by time spent at each price level, visually representing market activity as a distribution curve. This allows traders to identify value areas, potential support and resistance zones, and gain a deeper understanding of market sentiment.

Developed by J. Peter Steidlmayer at the Chicago Board of Trade (CBOT), this technique initially gained traction in futures markets. Steidlmayer recognized that markets function like auctions, and the Market Profile visually represents this process. Its popularity grew through influential books like "Mind Over Markets" and "Markets in Profile," becoming a mainstay for many professional traders.

How It Works

Market Profile uses Time-Price Opportunity (TPO) charts. Each letter on the chart represents a specific time period (e.g., 30 minutes) at a particular price level. The distribution of these letters forms a profile, often resembling a bell curve in a balanced market. Key features and concepts include:

-

Value Area: This typically encompasses 70% of the TPOs, representing the price range where the market spent the most time trading. It's often considered the fair value area for that period.

-

Point of Control (POC): The price level with the highest volume or greatest number of TPOs. This highlights the price accepted by the most market participants.

-

Initial Balance: The price range established during the initial trading period, often offering clues to the day's potential range.

-

Range Extension: Movement outside the initial balance, suggesting increased volatility and stronger directional conviction.

-

Profile Shape: Analyzing the shape of the profile (normal, trending, neutral) can provide information about market sentiment and potential future price action.

Real-World Examples

-

CME Group: The CME Group, the birthplace of Market Profile, continues to provide Market Profile data and tools for various futures markets.

-

Identifying Reversals: Traders use Market Profile to find "poor highs/lows," areas where price extends beyond the value area with low TPO counts. This can indicate potential weakness and possible reversals.

-

Mean Reversion Strategies: The value area acts as a reference point for mean reversion strategies. Traders might look for opportunities when the price deviates significantly from the value area, anticipating a return to the perceived fair value.

-

Volume Profile: While not strictly Market Profile, Volume Profile, available on many trading platforms, adds volume data to the price distribution, giving further insight into trading activity.

Pros and Cons

Pros:

- Provides valuable context to price action, explaining the "why" behind market movements.

- Helps identify fair value and potential support/resistance levels.

- Offers insight into market sentiment and auction dynamics.

Cons:

- Requires specialized software and a learning curve.

- Its terminology and concepts can be challenging at first.

- Less effective in highly volatile or illiquid markets.

- More suited for short-term active traders than long-term investors.

Practical Tips for Implementation

- Focus on Market Structure: Before seeking trading signals, understand the overall market structure shown by the Market Profile.

- Compare Profiles: Analyze current profiles against previous days or sessions to identify developing trends and sentiment shifts.

- Observe Shape Changes: Note changes in profile shape, as these can indicate evolving market conditions and potential turning points.

- Multiple Timeframes: Use Market Profile across various timeframes (e.g., daily, hourly) for a comprehensive analysis and to confirm trading decisions.

Market Profile analysis is a powerful tool for understanding market dynamics. While its complexity can be a hurdle, the insights it provides into value, sentiment, and the auction process can significantly improve a trader's ability to interpret price action and make informed decisions. Its evolution from the CBOT trading floor to broad adoption across various markets speaks to its enduring value in technical analysis.

Top 10 Stock Market Analysis Techniques Comparison

| Technique | 🔄 Complexity | ⚡ Resources | 📊 Outcomes | 💡 Use Cases | ⭐ Advantages |

|---|---|---|---|---|---|

| Technical Analysis | Moderate – requires continuous learning | Low to moderate – charting and historical data | Clear entry/exit signals and trend identification | Versatile for any tradable instrument | Multiple timeframe insights; intuitive pattern recognition |

| Fundamental Analysis | High – involves extensive research and analysis | High – in-depth financial data and analytical skills | Long-term valuation and identification of undervalued stocks | Ideal for long-term investing and value discovery | Deep company insights; intrinsic value evaluation |

| Quantitative Analysis | Very High – advanced math and programming required | Very high – robust computing, data, and expertise | Statistically validated, data-driven trading signals | Suitable for algorithmic strategies and big data analysis | Removes emotional bias; uncovers complex market patterns |

| Sentiment Analysis | Moderate – NLP and tech moderate complexity | Moderate – specialized tools for social and news data | Early detection of sentiment shifts before price moves | Effective for stocks with active public discussion | Captures market mood; quantifies qualitative sentiment |

| Algorithmic Trading | Very High – complex coding and continuous monitoring | Very high – expensive infrastructure and software | Optimized execution with minimal slippage | Best for high-frequency and automated trading | Eliminates emotional bias; improves trade execution speed |

| Intermarket Analysis | High – requires cross-market correlation analysis | Moderate-high – diverse market data integration | Broader market context and early warning signals | Useful for portfolio risk reduction and trend timing | Connects multiple asset classes for comprehensive insights |

| Elliott Wave Theory | Very High – steep learning curve and subjectivity | Low to moderate – primarily theoretical training | Identification of market cycles and potential reversals | Best for timing reversals across various markets | Provides a structured framework for market cycles |

| Dow Theory | Low to moderate – simple principles but slower signals | Low – basic chart analysis tools | Identification of major primary trends | Ideal for long-term trend identification and broad market views | Time-tested methodology; reliable for overall trend confirmation |

| Cycle Analysis | High – advanced mathematical and historical analysis | High – extensive historical data and computational tools | Forecasts periodic market turning points | Well-suited for timing market entries and exits | Uncovers underlying market rhythms; predictive cycle insights |

| Market Profile Analysis | High – specialized software and unique terminology | Moderate-high – detailed volume and price data | Reveals auction process and fair value areas | Effective for active trading and precise support/resistance identification | Highlights value areas through market distribution analysis |

Mastering Your Market Approach

Mastering stock market analysis requires continuous learning, adaptation, and refinement. From basic technical analysis and fundamental analysis to complex quantitative models, sentiment analysis, and algorithmic trading, each technique offers unique market insights. Understanding the strengths and limitations of different approaches, such as Intermarket Analysis, Elliott Wave Theory, Dow Theory, Cycle Analysis, and Market Profile Analysis, helps build a comprehensive analytical framework. The key is to find the right combination of techniques that best suits your individual investment style, risk tolerance, and financial goals. Whether you're a day trader looking for quick profits or a long-term investor focused on value, a personalized approach is essential for navigating market complexities.

Putting these concepts into practice requires discipline and adaptability. Start by thoroughly researching and practicing each technique. Backtesting your strategies and analyzing historical data offers valuable insights into their potential effectiveness. Don't hesitate to experiment and adjust your approach as market conditions change. Continuous learning is key to staying ahead.

The stock market analysis landscape is constantly changing. Trends like the growing use of artificial intelligence, machine learning, and big data analytics are shaping the future of investment strategies. Staying informed about these developments and integrating them into your analytical toolkit can provide a significant advantage.

Key Takeaways

-

Diversify Your Analytical Toolkit: Don't depend on just one technique. Combine different approaches for a more complete market view.

-

Adapt and Evolve: Market conditions are always changing. Be ready to adjust your strategies.

-

Continuous Learning is Crucial: Stay up-to-date on the latest market analysis trends and technologies.

-

Practice and Backtest: Refine your strategies through thorough testing and analysis.

-

Tailor Your Approach: Select techniques that align with your investment style and objectives.

In today’s fast-moving market, having the right tools is essential. ChartsWatcher provides a platform for professional traders to navigate the stock market. From customizable dashboards and real-time data to advanced charting tools and backtesting capabilities, ChartsWatcher helps you make informed decisions and optimize your trading strategies. Whether you're tracking alerts, managing watchlists, or performing in-depth analysis, ChartsWatcher offers the flexibility and power you need. Take control of your market analysis.