How to Backtest Trading Strategy: The Complete Playbook for Modern Traders

Understanding the True Power of Strategy Backtesting

Backtesting gives traders proof that their strategies work before putting real money at risk. By testing strategies against historical market data, traders can verify if their ideas actually make money and manage risk effectively. This data-driven approach helps successful traders avoid common mistakes and build reliable strategies based on real evidence instead of hunches.

Why Backtest? Removing Bias and Testing Strategies

Testing strategies on past data helps eliminate emotional trading decisions that often lead to mistakes. With backtesting, traders can calmly analyze a strategy's performance across different market conditions without the pressure of live trading. The results show whether a strategy has consistent long-term potential or if it just got lucky during a brief period. This objective view helps traders stick to proven approaches rather than chasing the latest market moves.

From Theory to Practice: Creating a Reliable Testing Process

A proper backtest simulates trading a strategy on historical price data to measure its actual results. For example, running a test over 10 years of market history reveals key performance stats like profits, drawdowns, win rates, and total trades. These numbers tell traders if a strategy is likely to work with real money. Get more backtest guidance here: Build Alpha. For help reading stock charts, check out our guide: How to Read Stock Charts: The Complete Guide for Beginner Investors.

Real-World Examples: Finding What Works

Backtesting helps spot potential problems before they cost real money. A test might show that a strategy performs poorly in volatile markets, allowing traders to adjust their approach. Tests can also reveal hidden opportunities - like strategies that consistently profit in specific conditions. This ability to learn from market history helps traders build reliable strategies that stand up to real-world challenges.

Mastering Essential Performance Metrics

Every successful trader knows that looking beyond basic profit and loss numbers is essential. Understanding key performance metrics helps reveal insights that raw P&L figures miss. The traders who consistently make money are the ones who know exactly what data points matter when analyzing their strategies.

Key Metrics for Evaluating Trading Strategies

The metrics that matter fall into two main categories - basic and advanced measurements that show different aspects of performance.

-

Basic Metrics: These provide the foundation for understanding how a strategy performs:

- Net Profit/Loss: Total money made or lost

- Win Rate: Percentage of profitable trades

- Average Win/Loss: Typical profit on winners vs loss on losers

- Maximum Drawdown: Biggest peak-to-valley decline

- Reward-to-Risk Ratio: Average win compared to average loss

-

Advanced Metrics: These examine risk-adjusted returns and consistency:

- Sharpe Ratio: Returns relative to risk - higher is better

- Sortino Ratio: Similar to Sharpe but focused on downside risk

- Standard Deviation: How much returns vary - lower means more consistency

These metrics work together to show the full picture. For example, maximum drawdown reveals the worst loss you might face, while reward-to-risk helps assess if the potential gains justify the risks. Learn more about backtesting metrics.

Interpreting Interrelated Metrics for a Holistic View

No single metric tells the whole story. A high win rate means little if your average loss is much bigger than your average win. Similarly, strong returns may not be worth it if they come with wild swings in account value. Smart traders look at how all the numbers work together.

Applying Metrics to Strategy Optimization and Risk Management

These metrics point the way to making your strategy better. If your Sharpe ratio is low, you may need to adjust to improve your risk-adjusted returns. A big maximum drawdown could mean tightening stops or reducing position sizes. The key is using the data to make specific improvements. Regular analysis helps you adapt as markets change - you can see how different conditions affect your metrics and adjust accordingly.

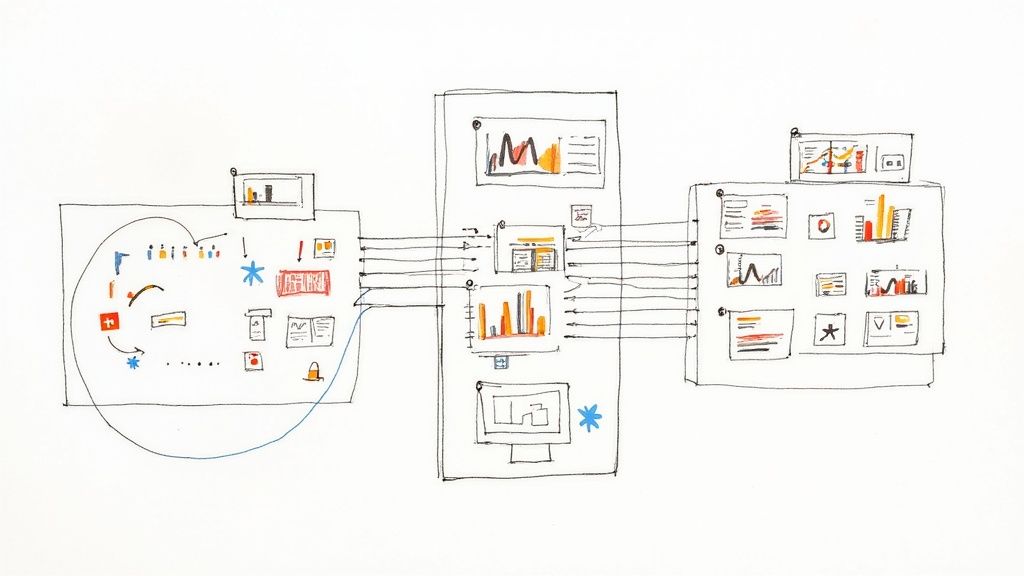

Creating Your Professional Backtesting Environment

A well-designed backtesting environment makes a real difference in how accurately you can evaluate trading strategies. The key is choosing the right mix of tools and platforms that closely match actual market behavior.

Selecting Reliable Data Sources

Good data is the foundation of effective backtesting. You'll need accurate historical market data that covers the assets and time periods you want to test. Many traders rely on established data providers that offer comprehensive price history across different markets and trading conditions.

Setting Up Proper Testing Parameters

Your backtesting needs to reflect real trading conditions. Make sure to include:

- Slippage costs: Account for the difference between expected and actual trade prices

- Trading fees: Factor in broker commissions and other transaction costs

- Market impact: Consider how large trades might affect market prices

Building the Testing Environment

Key components of a solid backtesting setup:

- Testing software: Tools like Backtrader give you the flexibility to build and test custom strategies

- Trading platforms: Use ChartsWatcher's customizable screens to analyze historical data alongside real-time market information

Step-By-Step to Efficiency

Here's how to put together your backtesting system:

- Pick your tools: Choose software that matches your needs - Python and ChartsWatcher are good starting points

- Get quality data: Find reliable historical data sources and verify the data is clean

- Set test conditions: Define realistic parameters for slippage, fees and market impact

- Test thoroughly: Run your strategy through different market environments to check its reliability

A careful approach to backtesting helps ensure your test results will translate well to live trading conditions. This gives you confidence that strategies that work in testing should perform similarly in the real market.

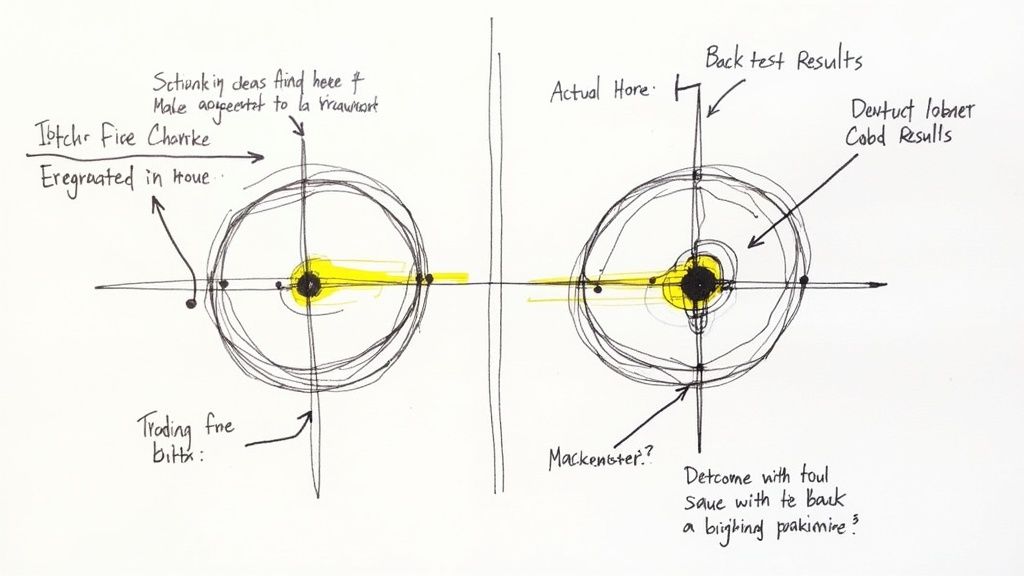

Navigating Common Backtesting Challenges

Backtesting helps validate trading strategies, but brings several key challenges that can affect results. Understanding these common issues - particularly survivorship bias, look-ahead bias, and curve fitting - is essential for building trading systems that work in real market conditions.

Identifying Biases in Backtesting

Testing results often appear better than reality due to hidden biases. Survivorship bias happens when historical data only includes companies that still exist today, leaving out those that failed or were delisted. This creates overly positive results. Look-ahead bias occurs when tests accidentally use future information that wouldn't have been available at the time of trading.

To minimize these issues:

- Use complete historical datasets that include delisted securities

- Check that all data matches the exact time period being tested

- Verify information availability dates match trading decision points

Avoiding Curve Fitting

Making a strategy fit past data too perfectly often leads to poor real-world performance. The risk comes from optimizing settings specifically for historical conditions without considering future changes. To prevent this:

- Test on separate data sets: Split your data into testing and validation segments

- Use walk-forward analysis: Test the strategy across different time periods

- Keep strategy rules simple and logical rather than highly complex

Implementing Proper Validation Techniques

Good validation helps confirm if results show real market patterns or just random luck. Key validation methods include:

- Monte Carlo simulations and permutation tests to check if returns are statistically meaningful

- Cross-validation across different market conditions and time periods

- Regular testing with new data as it becomes available

Practical Safeguards Against Unreliable Results

Watch for these warning signs that may indicate issues with your backtesting:

- Highly variable returns between different test periods

- Results that seem too good to be true compared to typical market returns

- Poor performance when market conditions change slightly

Building reliable backtesting processes takes time and constant refinement. Keep testing and adjusting your approach as markets evolve. For more detailed guidance, check out systematic trading resources and best practices.

Fine-Tuning Your Strategy for Maximum Performance

Once you've built a solid backtesting setup and worked through common challenges, it's time to optimize your trading strategy's performance. This critical step goes beyond accepting initial test results and focuses on proven techniques used by successful traders to generate consistent profits while managing risk.

Parameter Optimization: Finding the Sweet Spot

Adjusting your strategy's key variables - like entry/exit points, stop-loss levels, and indicator settings - can meaningfully improve results. The key is avoiding curve fitting, where parameters are over-optimized to match past data perfectly. This often leads to poor real-world performance since the strategy becomes too specialized. Instead, focus on finding parameters that deliver good historical results while remaining adaptable to different market conditions.

Consider a moving average crossover strategy as an example. Testing different combinations like 10-day/50-day versus 20-day/100-day moving averages helps identify which settings provide the best balance of returns and risk management.

Advanced Validation Techniques: Ensuring Reliability

Professional traders rely on several methods to verify their strategies work consistently. Walk-forward analysis tests performance across multiple time periods to spot potential weaknesses. Out-of-sample testing using fresh data not used in optimization confirms the strategy works on new market conditions.

You can also use multi-market validation by testing your strategy on different assets. For instance, a strategy developed for the S&P 500 should also be tested on other major indices. This extra validation builds confidence in your strategy's long-term viability.

Practical Frameworks for Strategy Refinement

Following a systematic optimization process leads to better results. Here are key steps to include:

- Set clear goals: Decide which metrics matter most (Sharpe ratio, max drawdown, etc.)

- Test systematically: Record each change and its impact on performance

- Validate thoroughly: Apply walk-forward analysis and out-of-sample testing

- Keep improving: Make ongoing adjustments based on results

By taking a structured approach to optimization and using proven validation methods, you can fine-tune your strategy for reliable real-world performance. This methodical process helps ensure a smooth transition from backtesting to live trading with a strategy ready for actual market conditions.

Making the Leap to Live Trading Success

Moving from backtesting to live trading takes careful preparation and steady focus. You'll need to adapt your strategy to real market conditions while keeping emotions in check. Here's how to make that transition successfully.

Start With Paper Trading

Before using real money, practice with a demo account. Paper trading lets you test your strategy in live markets without financial risk. You'll learn about execution challenges like slippage and build mental resilience.

Key Paper Trading Steps

- Match real conditions: Use the same parameters and markets as your backtests

- Track key metrics: Compare actual results to backtest data

- Record everything: Write down your thoughts, decisions, and any deviations

Adjust to Live Markets

When trading with real money, you'll need solid position sizing and risk management. Markets can move in unexpected ways with sudden changes in volatility or liquidity.

- Size positions wisely: Use tools like the Kelly Formula to determine optimal trade size based on your track record and risk tolerance

- Protect your capital: Set and monitor stop losses, adjusting them as market conditions shift

Keep Your Cool

Trading real money brings emotional challenges. Sticking to your strategy requires discipline and helps maintain consistent results over time.

- Stay on track: Review performance regularly and follow your trading rules

- Control emotions: Build routines to manage stress and avoid impulsive decisions

Use detailed checklists to spot potential issues early in your transition. Catching small problems quickly prevents them from becoming expensive mistakes.

For more guidance on risk management, check out our guide on mastering risk management strategies with tools like ChartsWatcher. The platform offers real-time alerts and backtesting features to help optimize your trading approach.

Want to get the most from your live trading? Visit ChartsWatcher to learn how their custom alerts and analysis tools can improve your trading results.