Technical Analysis Indicators Explained: Unlock Market Trends

Decoding the Charts: Your Guide to Technical Indicators

Market analysis requires more than instinct - it demands a methodical approach to interpreting data. Technical analysis, which studies past market movements to forecast future price action, has been a cornerstone of trading since the Japanese rice merchants of the 1600s. From those early chart patterns to modern stock scanning tools, technical analysis helps transform raw market data into practical trading insights.

What makes technical analysis effective in practice? The key lies in understanding and properly using technical indicators - the essential tools for analyzing market conditions. These indicators, calculated from historical price and volume data, help identify potential trend changes, momentum shifts, and market extremes. They provide traders with a systematic framework for reading market sentiment and making more informed decisions.

In this detailed guide, we'll break down 10 fundamental technical indicators, explaining how they work and how to apply them effectively in real trading. Whether you're an experienced professional trader, institutional analyst, individual investor managing your own portfolio, trading educator, or someone who uses stock screening tools to find opportunities, this guide will help you better interpret charts and spot meaningful trading signals. Let's explore how technical analysis can improve your market decision-making process.

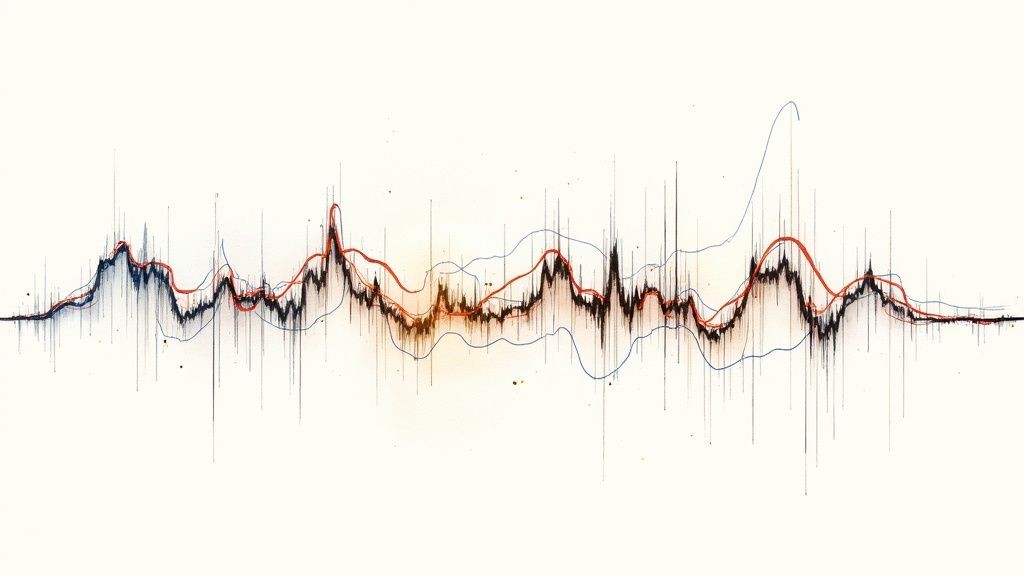

1. Moving Average Convergence Divergence (MACD)

The Moving Average Convergence Divergence (MACD) is a key technical analysis tool used by traders and investors worldwide. This powerful indicator analyzes both trend and momentum by comparing the relationship between two price moving averages.

The MACD calculation is straightforward - subtract the 26-period Exponential Moving Average (EMA) from the 12-period EMA to form the MACD line. A 9-period EMA of the MACD line creates the signal line. The histogram shows the difference between these two lines, helping spot momentum changes.

Key Benefits:

- Two-in-One Analysis: Combines trend direction and momentum strength in a single view

- Clear Trading Signals: Buy and sell signals appear when the MACD line crosses above or below the signal line

- Early Warning System: Divergence between price and MACD can signal potential trend reversals

Real Trading Example: Picture a stock trending upward with rising highs. If the MACD line also makes higher highs, it confirms the uptrend. But if the MACD starts making lower highs while prices still climb, this bearish divergence warns of possible trend reversal - a signal to tighten stops or exit long positions.

History: Gerald Appel created the MACD in the late 1970s. Its simple yet effective approach to showing both trend and momentum quickly made it popular among traders.

Advantages:

- Clearly shows trend direction and strength

- Provides specific entry and exit signals

- Helps spot momentum shifts early

Limitations:

- Can give false signals in choppy markets

- Lags price action due to moving average calculations

- May struggle in highly volatile conditions

Usage Tips:

- Watch for Divergence: Pay attention when price and MACD move in opposite directions - it often signals important changes

- Use Multiple Tools: Combine MACD with other indicators like support/resistance levels and volume for better confirmation

- Monitor Histogram: Changes in the histogram can warn of upcoming crossovers between MACD and signal lines

For deeper understanding of chart analysis, check out: How to Read Stock Charts: The Complete Guide for Beginner Investors.

The MACD remains essential for traders, analysts, and investors who need reliable tools for market analysis. Its proven ability to identify trends, spot momentum changes, and generate clear signals makes it valuable for anyone trading financial markets.

2. Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a powerful momentum indicator created by J. Welles Wilder Jr. in 1978. This tool helps traders spot potential overbought and oversold conditions in markets by measuring recent price changes. It works across many markets - from stocks and forex to commodities and crypto.

The RSI calculation compares average gains to average losses over a set period (usually 14 days) and plots the results on a 0-100 scale.

Key Features and Interpretation:

- 0-100 Scale: This clear range makes it easy to spot extreme price moves

- Overbought/Oversold Signals: Readings above 70 typically signal overbought conditions and potential pullbacks. Below 30 suggests oversold conditions and possible bounces.

- Price Divergences: One of the RSI's best features is spotting divergences. When price makes lower lows but RSI shows higher lows, that's a bullish signal. The opposite pattern (price higher but RSI lower) suggests weakness.

Real Trading Example:

Picture a stock in a strong uptrend making new highs while the RSI starts showing lower highs. This bearish divergence hints that momentum is fading and prices may reverse soon. Smart traders might tighten stops or take profits when they see this pattern.

Pros:

- Clear Buy/Sell Signals: Easy-to-spot levels that often mark price reversals

- Works Well in Ranges: Excellent at finding turning points in sideways markets

- Simple to Use: The 0-100 scale makes readings straightforward for any trader

Cons:

- Extended Overbought/Oversold: Strong trends can keep RSI at extreme levels longer than expected

- False Signals: Major market shifts can trigger incorrect signals

- Needs Backup: Works best combined with other indicators and price analysis

Tips for Better RSI Trading:

- Check Multiple Timeframes: Looking at daily and weekly RSI gives a fuller picture

- Watch for Divergences: These often signal high-probability reversals

- Adjust Your Levels: Use wider ranges (80/20) in volatile markets and tighter ones (60/40) in calmer conditions

The RSI remains popular because it gives clear signals that are easy to act on. While it offers valuable insights into market momentum, remember that it works best as part of a complete trading approach - not in isolation.

3. Bollinger Bands®

The Bollinger Bands® indicator was created by John Bollinger in the 1980s to help traders measure market volatility and spot potential entry and exit points. This popular tool has proven effective across different market conditions and timeframes, making it a key resource for analyzing price movements.

The indicator consists of three key components:

- Middle Band: A 20-period simple moving average (SMA) of price

- Upper Band: The middle band plus two standard deviations

- Lower Band: The middle band minus two standard deviations

Key Capabilities:

- Volatility Measurement: The bands expand during high volatility and contract when markets are calm, giving traders a clear visual of market conditions

- Market Adaptation: The indicator automatically adjusts to changing price action and works across different assets

- Statistical Foundation: Uses standard deviation to identify significant price moves and potential reversals

Real Trading Applications:

- Breakout Trading: When price moves decisively above the upper band or below the lower band, it often signals trend continuation. For example, a stock breaking above the upper band with strong volume could present a buying opportunity.

- Price Reversals: When price touches an outer band and shows weakness (like declining volume), it may indicate an upcoming reversal.

- Trend Following: During strong trends, price often "rides" along an outer band - staying near the upper band in uptrends or lower band in downtrends.

Advantages:

- Self-adjusting to market conditions

- Clear overbought/oversold signals

- Effective across multiple timeframes

Limitations:

- Delayed signals due to moving average calculations

- Less reliable in choppy, sideways markets

- Requires basic statistics knowledge for best results

Implementation Tips:

- Monitor price interactions with the bands for potential signals

- Use band width to gauge current volatility levels

- Look for price consistently touching outer bands in trends

- Combine with other indicators like RSI or MACD for confirmation

The Bollinger Bands® indicator gives traders a proven framework for analyzing volatility and price action. While it works best as part of a complete trading strategy rather than in isolation, its ability to adapt to different market conditions makes it a valuable analytical tool. For additional details, visit Bollinger Bands® (Note: This link is for reference only).

4. Stochastic Oscillator

The Stochastic Oscillator is a momentum indicator created by George Lane back in the 1950s that helps traders spot potential market reversals. It does this by comparing a security's closing price to its high/low range over a set period. This makes it especially useful for finding turning points in choppy or rangebound markets.

Key Components:

The indicator uses two main lines:

- %K Line: The "fast" stochastic that shows where price closed relative to its recent high-low range. Calculated as:

%K = ( (Current Close - Lowest Low) / (Highest High - Lowest Low) ) * 100

- %D Line: A smoothed version of %K, typically using a 3-period moving average to reduce volatility and create clearer signals.

Reading the Scale:

The oscillator moves between 0 and 100. When readings go above 80, it suggests the price is closing near recent highs and may be overbought. Below 20 indicates possible oversold conditions near recent lows. While these levels can help spot reversals, they don't guarantee one is coming.

Finding Reversals:

The main purpose is catching trend changes early. Some key signals include:

- Bearish divergence - Price makes new highs but the oscillator doesn't follow

- Bullish divergence - Price makes new lows while oscillator shows higher lows

- Line crossovers - %K crossing above/below %D can signal entry points

Real Example:

Take a stock trading between $50-60 for several weeks. When the oscillator hits 80+ as price nears $60, it warns of a potential drop. Similarly, readings under 20 near $50 could signal an upcoming bounce.

Benefits:

- Spots momentum shifts before price confirms

- Works well in sideways markets

- Gives early reversal warnings through divergences

Drawbacks:

- Can give false signals, especially in strong trends

- Less reliable during powerful up/down moves

- Takes time to learn proper interpretation

Usage Tips:

- Watch both %K and %D lines together

- Combine with trend indicators like moving averages

- Pay attention to divergences between price and oscillator readings

While the Stochastic Oscillator can help catch market turns, it works best as part of a complete trading approach that includes other technical tools and solid risk management rules. Understanding its strengths and limits helps traders use it more effectively.

5. Fibonacci Retracement

Fibonacci Retracement is one of the most popular tools in technical analysis. It helps traders identify potential support and resistance levels based on a fascinating mathematical sequence where each number equals the sum of the previous two (0, 1, 1, 2, 3, 5, 8, 13...).

This tool highlights key price levels at 23.6%, 38.2%, 50%, 61.8%, and 78.6% - ratios derived from this sequence that often mark where prices may reverse direction. Many traders rely on these levels to make decisions about entering and exiting positions.

The basic idea is simple: after a significant price move up or down, the price often pulls back part way before continuing in the original direction. These Fibonacci levels help predict where those pullbacks might stop.

Key Features:

- Natural mathematical foundation provides objectivity

- Multiple levels for identifying support/resistance

- Works on any timeframe from 1-minute to monthly charts

Example in Action: Let's say a stock moves from $10 to $20. Using Fibonacci Retracement, we can calculate potential support levels - a 38.2% pullback would target $16.18, while a 50% pullback would reach $15. Traders watch these levels for signs of price stabilization before entering trades.

Historical Background: While Leonardo Fibonacci documented this sequence in the 13th century, its application to markets gained prominence in the late 1900s as technical analysis became more widely accepted. Today it's used by traders across all markets - from stocks and forex to cryptocurrencies.

Advantages:

- Helps spot potential reversal points

- Widely recognized tool

- Applicable across different markets

Limitations:

- Drawing points can be subjective

- Multiple valid interpretations possible

- Requires practice to use well

Tips for Using Fibonacci Retracement:

- Draw from major swing highs and lows

- Use alongside trend analysis

- Combine with other indicators like price action and volume. Read more: Price Action Trading Strategies: A Comprehensive Guide for Market Success

Remember that Fibonacci works best as part of a complete trading approach. By combining it with other technical tools, you can develop a more robust trading strategy with higher probability setups.

6. Average Directional Index (ADX)

The Average Directional Index (ADX) helps traders measure how strong a market trend is, making it a key tool for technical analysis. Created by J. Welles Wilder Jr., ADX stands out from other indicators because it focuses specifically on trend strength rather than price direction. This makes it incredibly useful for identifying strong trends and avoiding choppy, range-bound markets.

ADX readings range from 0 to 100. Generally, readings above 25 indicate a strong trend, while readings below 20 suggest a weak or non-existent trend. The higher the ADX value gets, the stronger the trend becomes. Remember that ADX only tells you about trend strength, not whether the trend is up or down.

Understanding ADX Components

Two key parts make up the ADX: the Plus Directional Indicator (+DI) and Minus Directional Indicator (-DI). These measure upward and downward price momentum. Here's what their relationship tells us:

- When +DI is higher than -DI: Points to bullish trend strength

- When -DI is higher than +DI: Points to bearish trend strength

- When +DI and -DI cross: May signal trend changes, though you'll want more confirmation

Real Market Example

Picture a stock making steady higher highs and higher lows - a clear uptrend. In this case, the ADX would likely climb above 25, confirming strong trend momentum. If +DI stays above -DI during this time, it further validates the bullish trend.

Now imagine a stock bouncing between support and resistance levels without breaking out. Here, the ADX would likely stay under 20, warning traders that trend-following strategies probably won't work well in these conditions.

Using ADX Effectively

For best results with ADX:

- Look for readings above 25 to confirm strong trends

- Watch for +DI and -DI crossovers as early warning signs

- Skip trend trades when ADX is below 20 (choppy markets)

- Pair ADX with other tools like moving averages or RSI

- Test different ADX periods (standard is 14) - shorter periods like 7 are more reactive, longer periods like 21 smooth things out

Key Benefits

- Clearly measures trend strength

- Helps avoid sideways markets

- Confirms existing trends

Limitations

- Doesn't show trend direction

- Can lag behind price moves

- Complex calculations make manual tracking difficult

Why ADX Matters

ADX gives traders a reliable way to measure trend strength, helping them focus on strongly trending markets and skip weak ones. This makes it a vital tool for building more effective trading strategies.

7. Volume Weighted Average Price (VWAP)

The Volume Weighted Average Price helps traders understand the true average trading price of a security during the day, factored by trading volume. Think of it as answering: "What price level has seen the most trading activity?" This makes it essential for both big institutions and individual traders who want deeper insights into market behavior.

VWAP calculates the total dollar value traded (price x shares) divided by total shares traded. Unlike basic averages, it emphasizes where real trading happens. It starts fresh each morning, giving traders a clean view of that day's action.

Key Benefits:

- Price + Volume Integration: Combines both metrics for a complete view of trading activity

- Daily Reset: Starts new each morning for a fresh perspective

- Fair Price Guide: Acts as a dynamic support/resistance level showing perceived fair value

Real Trading Examples:

When a stock gaps up at the open, it may look tempting to short. But if it stays above VWAP consistently, that signals strong buying pressure and a likely continued uptrend. Or if a stock drops sharply but holds above VWAP, some traders see this as a buy signal, expecting a move back toward the average price.

Large funds often use VWAP for big orders. A manager building a position might try to buy below VWAP to get better prices. When selling, they aim to execute above VWAP for higher returns.

Growth in Usage:

VWAP became more popular as computer trading grew. Trading algorithms use it to improve order execution and reduce costs. As better charting tools became available to everyday traders, VWAP spread to retail trading.

Trading Tips:

- Entries/Exits: Look for buys near VWAP in uptrends, sells near VWAP in downtrends

- Price Relationships: Watch how price acts around VWAP - above suggests strength, below suggests weakness

- Multiple Views: Check VWAP across different timeframes for broader context

Advantages:

- Day Trading Focus: Gives clear insights for intraday decisions

- Shows Big Money: Price moves away from VWAP can indicate institutional activity

- Smooths Volatility: Reduces impact of short-term price spikes

Drawbacks:

- Daily Only: Resets each day, less useful for longer timeframes

- Pre/Post Hours Impact: Early trading can affect regular hours VWAP

- Delayed Response: As a lagging indicator, may be slow to reflect sudden changes

Using VWAP helps traders make smarter choices based on where real trading activity happens.

8. On-Balance Volume (OBV)

On-Balance Volume (OBV) helps traders analyze market momentum by tracking trading volume alongside price changes. While most indicators only look at price action, OBV examines volume patterns to spot potential buying and selling trends. This makes it a useful tool for finding emerging market moves early on.

How OBV Works:

OBV tracks volume in a clever way. On days when the closing price rises above the previous close, the full day's trading volume gets added to the running OBV total. When the close is lower, that day's volume gets subtracted. If prices stay flat, the OBV stays the same. This creates a running tally that shows volume pressure building up or fading over time.

Real-World Example:

Let's walk through a simple OBV calculation. Stock XYZ closes at $20 on Day 1 with 1 million shares traded. The OBV starts at 0. On Day 2, it closes up at $22 on 1.5 million shares - so OBV becomes 1.5 million. Day 3 sees a drop to $21 on 500,000 shares, bringing OBV down to 1 million (1.5M - 500K).

Key Benefits:

- Early Warning System: Volume shifts often happen before price moves, so OBV can flag potential trend changes early

- Trend Validation: Rising OBV confirms an uptrend's strength, while falling OBV validates a downtrend

- Easy to Follow: The math and interpretation are straightforward for traders at any level

Pros:

- Spots trend changes early

- Simple to understand and use

- Good for confirming trends

Cons:

- Gives mixed signals in choppy markets

- Treats all price changes equally regardless of size

- Can produce false signals when markets are volatile

Tips for Using OBV:

- Watch for Divergences: If prices hit new highs but OBV doesn't, buying pressure may be weakening

- Combine with Other Tools: Use OBV alongside moving averages and trendlines for better insight

- Monitor Trendline Breaks: When OBV breaks through trend lines, big momentum shifts may follow

Historical Background:

Joe Granville created OBV in 1963, introducing it in his book "Granville's New Key to Stock Market Profits." His key insight was that volume movements tend to precede price changes.

Why OBV Matters:

OBV stands out by focusing on volume patterns that other indicators miss. While it shouldn't be used alone, it helps reveal buying and selling pressure that can point to where prices may head next. Its straightforward nature makes it valuable for both new and seasoned traders looking to spot market trends early.

9. Ichimoku Cloud

The Ichimoku Cloud, or "one glance equilibrium chart," is an essential technical indicator that gives traders a complete view of market conditions at a glance. Created by Japanese journalist Goichi Hosoda in the 1960s for daily newspaper trading, it has proven its worth across decades of market analysis.

The indicator uses five key lines:

- Tenkan-sen (Conversion Line): (9-period high + 9-period low)/2 - Shows short-term momentum

- Kijun-sen (Base Line): (26-period high + 26-period low)/2 - Shows medium-term momentum

- Senkou Span A (Leading Span A): (Tenkan-sen + Kijun-sen)/2 - Forms one cloud boundary, plotted 26 periods ahead

- Senkou Span B (Leading Span B): (52-period high + 52-period low)/2 - Forms other cloud boundary, plotted 26 periods ahead

- Chikou Span (Lagging Span): Current close plotted 26 periods back - Provides historical context

The space between Spans A and B creates the "cloud" that shows future support and resistance zones.

Key Benefits:

The Ichimoku Cloud offers traders several advantages:

- All-in-One Analysis: Combines trend, momentum, and support/resistance in one view

- Forward-Looking: Projects support/resistance levels 26 periods ahead

- Flexible Timeframes: Works on any chart interval from minutes to months

Trading Example:

Consider this setup: Price moves above the cloud, the cloud turns green (Span A above Span B), and Tenkan-sen crosses above Kijun-sen. These aligned signals point to a strong uptrend. The opposite scenario - price below a red cloud with bearish line crosses - suggests a downtrend.

Strengths:

- Complete Market View: Shows multiple aspects of price action

- Future Price Levels: Projects upcoming support/resistance

- Efficient Analysis: Reduces need for extra indicators

Limitations:

- Learning Curve: Takes time to understand all components

- Visual Complexity: Multiple lines can be confusing at first

- Component Knowledge: Must understand each element for proper use

Usage Tips:

- Start Simple: Focus first on cloud direction and color

- Watch Line Crosses: Use Tenkan/Kijun crossovers for trade signals

- Mind Time Shifts: Remember the displaced nature of cloud and Chikou Span

The Ichimoku Cloud shines as a powerful analysis tool. While it may seem complex initially, its ability to show current conditions, future levels, and trend strength makes it worth mastering for serious traders.

10. Money Flow Index (MFI)

The Money Flow Index (MFI) adds an important dimension to momentum analysis by combining price action with volume data. This makes it especially useful for spotting buying and selling pressure in the markets. While similar to the familiar Relative Strength Index (RSI), the MFI's inclusion of volume data provides deeper market insights.

How MFI Works:

The MFI ranges from 0 to 100 and is calculated through these steps:

- Typical Price: Calculate (High + Low + Close) / 3

- Raw Money Flow: Multiply typical price by volume

- Positive/Negative Flow: Compare today's typical price to yesterday's

- Money Flow Ratio: Calculate over 14 days: Positive Flow / Negative Flow

- Final MFI: 100 - (100 / (1 + Money Flow Ratio))

Reading the Signals:

The MFI uses 80 and 20 as key levels - above 80 suggests overbought conditions while below 20 indicates oversold conditions. But these shouldn't be your only signals.

The real power comes from spotting divergences. When price makes a lower low but MFI shows a higher low, that's a bullish sign pointing to growing buying pressure. The opposite setup - price making higher highs while MFI makes lower highs - warns of weakening momentum.

Real Example:

Picture a stock hitting new price highs while its MFI readings decline. This bearish divergence suggests buying pressure is falling even as prices climb higher. Smart traders might tighten stops or consider short positions here.

Background:

Gene Quong and Avrum Soudack developed the MFI to give traders deeper insight than price-only indicators could provide. Its incorporation of volume data made it especially useful for understanding market dynamics.

Tips for Using MFI:

- Watch for divergences between price and MFI - they often signal reversals

- Check multiple timeframes to build a fuller picture

- Pair with trend indicators like moving averages

- Don't trade solely on overbought/oversold readings

Key Benefits:

- Includes both price and volume data

- Strong at spotting divergences

- Shows underlying pressure

Limitations:

- Can give false signals

- More complex calculations

- May be delayed in fast markets

The MFI shines at revealing the force behind price moves through its unique blend of price and volume analysis. While not perfect on its own, it serves as a valuable tool for understanding market dynamics when used as part of a complete trading approach.

Technical Analysis Indicators: 10-Point Comparison

| Indicator | Implementation (🔄) | Resource Needs (⚡) | Expected Outcomes (📊) | Ideal Use Cases (💡) | Key Advantages (⭐) |

|---|---|---|---|---|---|

| Moving Average Convergence Divergence (MACD) | Moderate | Low (price data and EMAs) | Identifies trend direction, momentum shifts, entry/exit points | Trending markets | Combines trend and momentum analysis |

| Relative Strength Index (RSI) | Simple | Low (price-based calculation) | Clear overbought/oversold signals, divergence detection | Ranging markets and reversal identification | Easy to interpret and widely used |

| Bollinger Bands® | Moderate | Moderate (requires statistical data) | Measures volatility and indicates relative price levels | Volatile markets and multi-timeframe analysis | Adapts automatically to market volatility |

| Stochastic Oscillator | Moderate | Low-Moderate | Early identification of momentum changes and reversals | Ranging markets and cyclical turning points | Provides early momentum detection |

| Fibonacci Retracement | Simple (subjective) | Very Low | Identifies potential support/resistance levels | Trend reversal identification across markets | Based on trusted mathematical ratios |

| Average Directional Index (ADX) | Complex | Low-Moderate | Confirms the strength of a current trend | Trend strength confirmation | Provides clear and direction-neutral trend measurement |

| Volume Weighted Average Price (VWAP) | Moderate | Moderate (requires intraday volume) | Highlights intraday fair value and support/resistance zones | Intraday trading and institutional benchmarks | Reflects volume-weighted pricing for more precise levels |

| On-Balance Volume (OBV) | Simple | Low | Analyzes volume trends and detects divergences | Volume confirmation and trend analysis | Simple to compute with leading indicator potential |

| Ichimoku Cloud | Complex | High (multiple data lines) | Offers comprehensive trend, support/resistance, and momentum analysis | Full market analysis and multi-timeframe insights | All-in-one tool delivering multiple signals simultaneously |

| Money Flow Index (MFI) | Moderate | Moderate (integrates volume & price) | Measures buying/selling pressure with divergence detection | Volume-price relationship analysis | Combines price and volume for a more complete picture |

Level Up Your Trading with Technical Analysis

Understanding market analysis tools can make a real difference in your trading decisions. We've explored ten essential indicators including MACD, RSI, Bollinger Bands®, Stochastic Oscillator, Fibonacci Retracement, ADX, VWAP, OBV, Ichimoku Cloud, and MFI. Each provides unique views into market movements, energy, and potential turning points. The most effective approach combines multiple indicators to build a complete picture of market conditions.

Getting the most from these tools starts with knowing your trading approach and risk comfort level. Consider whether you're focused on day trading, swing trading, or long-term investing. Day traders often rely heavily on momentum indicators like MACD and RSI, while long-term investors may prefer trend indicators such as moving averages and ADX. Try different indicator combinations to find what matches your style. Testing strategies with historical data helps identify what works before trading real money.

Success requires ongoing education as markets constantly change. Keep learning about new indicators and approaches while practicing consistently. Review your trades regularly to improve your methods based on real results. The financial world keeps evolving, making continuous learning crucial for traders. As artificial intelligence grows more advanced, it will likely provide traders with more sophisticated analysis capabilities.

Key Takeaways:

- No single indicator guarantees success: Combine multiple indicators for a more comprehensive view.

- Practice and experimentation are key: Backtest your strategies to optimize performance.

- Continuous learning is essential: Stay updated on market trends and new developments.

- Adapt your strategy: The market is dynamic, requiring flexibility and ongoing refinement.

Ready to advance your technical analysis skills? ChartsWatcher helps professional traders track and analyze markets efficiently. Create custom windows and dashboards that match your trading style, set up real-time alerts, test strategies, and access features like customizable screens and data import/export tools. With both free basic access and full Pro Plans available, ChartsWatcher gives you the analysis edge you need. Visit ChartsWatcher today to explore the tools.