Powerful Market Maker Signals for Smart Trading

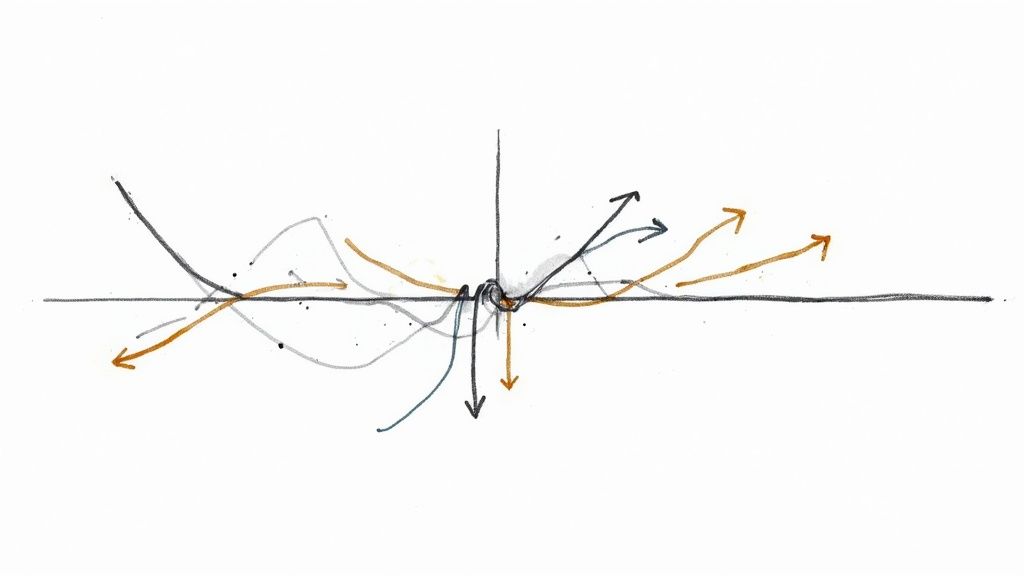

The Hidden Language of Market Maker Signals

Let's explore the world of market maker signals. These signals can provide valuable clues about potential market movements, much like subtle cues in a conversation. Experienced traders often rely on these signals to gain an advantage. But what makes them tick, and why are they so significant?

Market makers are essential for maintaining market liquidity and facilitating trades. Their actions, driven by profit, often create predictable patterns, leaving behind "footprints" of their intentions. For instance, a substantial buy order from a market maker might suggest an expected price increase. However, it's important to remember that market makers don't always reveal their true intentions.

This lack of transparency can cause many retail traders to completely miss these vital signals. Market makers can also influence prices through strategic order placement. They might place orders larger or smaller than their actual needs, impacting the bid and ask prices. This lets them profit from the spread, especially in penny stocks and micro-cap markets. While sometimes viewed as speculation, market maker signals can significantly affect trading dynamics. Learn more about these signals here.

Decoding the Signals: Types and Implications

Understanding the different types of market maker signals is crucial for using them effectively. Several key signals have proven particularly useful:

-

Order Flow Patterns: Examining the flow of buy and sell orders can uncover accumulation or distribution phases, hinting at future price direction.

-

Trading Volume: Sudden changes in trading volume can highlight other market maker signals, strengthening predictions about price action.

-

Specific Order Types: Some order types, like iceberg orders (large orders partially revealed), suggest significant institutional activity, offering clues about future price movements.

These signals appear differently depending on the market and the asset being traded. Signals in the stock market might vary from those in futures or cryptocurrency markets. Recognizing these differences is essential for accurate signal interpretation.

Putting Signals to Work: Real-World Examples

Many examples show how recognizing market maker signals can lead to profitable trades. Imagine a trader spots consistent spoofing (placing and canceling large orders to create a false impression) along with unusually high volume. This might indicate an upcoming price reversal, allowing the trader to profit from the change.

Another example involves identifying tape painting, where market makers execute trades to artificially manipulate prices. Spotting this before others can provide a significant edge.

By learning to identify and interpret these signals, traders can anticipate market movements and position themselves strategically. Tools like ChartsWatcher can help visualize market data and identify potential signal patterns. This empowers traders to anticipate and profit from market changes rather than simply reacting to them.

From Trading Floors to Algorithms: Signal Evolution

The world of market maker signals has changed dramatically. The boisterous trading pits, once filled with intricate hand signals, have been replaced by the quiet, rapid-fire world of algorithms. While the methods of communication have been transformed, the underlying motivations remain remarkably consistent.

Historically, market makers communicated their intentions through physical gestures and verbal cues. This created an exclusive environment where only those physically present on the trading floor understood the market's hidden language. For instance, a trader might signal their desire to buy a large block of shares by raising a specific number of fingers. While quick and effective at the time, these signals were limited by their physical nature and susceptible to misinterpretation.

The Digital Revolution: A New Era of Signals

The advent of electronic trading platforms revolutionized the generation and interpretation of market maker signals. The transition from physical to digital meant increased speed, accuracy, and accessibility. The introduction of Level 2 software, providing real-time insights into market maker activity, has also empowered traders. Since the early 2000s, the use of such software has become commonplace, enabling traders to better understand market maker actions. You can learn more about Level 2 software and market maker signals here. This shift to digital hasn't removed the human element; it has simply changed how it's expressed.

Adapting and Evolving: Signals in the Modern Market

This digital shift has led to the extinction of some traditional signals, while others have adapted. Iceberg orders, large orders that are only partially revealed, are a perfect example of a signal that has transitioned smoothly into the digital age. The core purpose—to conceal large-scale buying or selling—remains unchanged. However, instead of physical gestures, iceberg orders are now executed through electronic order entry.

The modern market has also given rise to entirely new signals. High-frequency trading (HFT) algorithms, for example, generate incredibly subtle and complex signals that are virtually undetectable without specialized tools. Identifying these patterns requires sophisticated analytical tools and a deep understanding of market microstructure. This evolution highlights the constant back-and-forth between market makers and those trying to decipher their signals.

Understanding the Past to Navigate the Future

For traders aiming to profit from market maker signals, understanding this historical context is essential. Whether conveyed through hand signals or sophisticated algorithms, the motivations of market makers remain rooted in profit. By studying this evolution, traders can better understand why some signals retain their predictive power, while others fade away. Using tools like ChartsWatcher can help in this process, providing valuable insights into market maker behavior and giving traders an advantage.

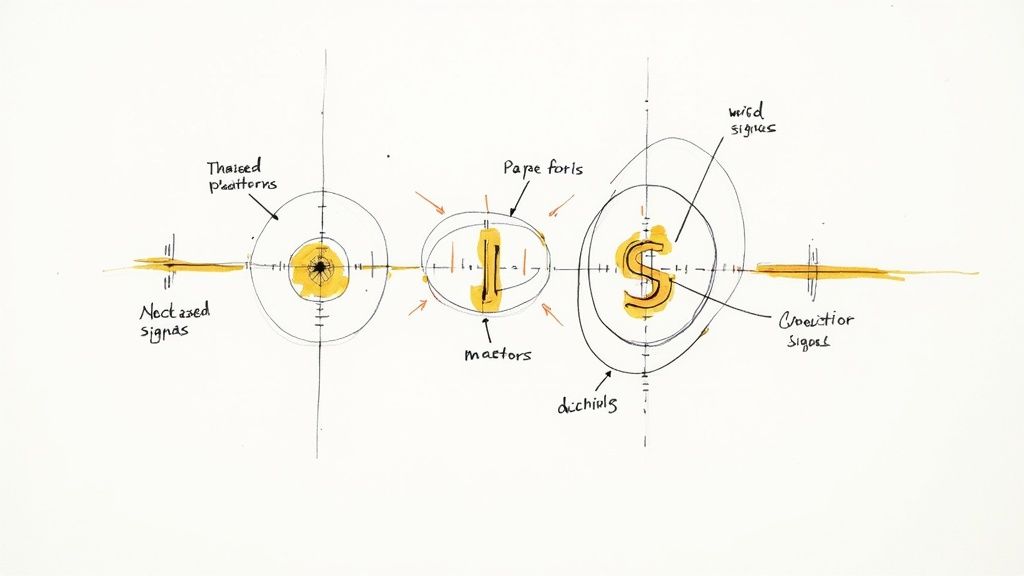

High-Impact Market Maker Signals Worth Watching

Beyond theoretical discussions, let's explore specific market maker signals that often precede significant price movements. By analyzing order flow patterns, we can uncover signs of institutional accumulation, distribution, and even market manipulation. This section will help you recognize crucial signals like iceberg orders, spoofing patterns, and tape painting. We'll delve into why these signals occur and what they suggest about future price action.

Understanding Key Market Maker Signals

Several key market maker signals offer valuable insights for traders:

-

Iceberg Orders: These large orders are intentionally partially hidden, revealing only a small portion of their total size. Like an iceberg, only the tip is visible, concealing the vast majority of its mass below the surface. This tactic allows institutions to accumulate or distribute large positions without drastically affecting market price.

-

Spoofing: This manipulative tactic involves placing large buy or sell orders with no intention of executing them. These "phantom" orders create a false impression of market depth, luring other traders to enter the market. Once the spoofer achieves their objective, they cancel their orders, trapping other traders.

-

Tape Painting: This involves a series of coordinated trades designed to artificially move an asset's price. It creates a visual representation on the ticker tape to influence other market participants, often used to push a stock's price to a specific level, triggering stop-loss orders or options expirations.

To better understand the implications of these signals, let's look at the table below:

To help visualize and analyze these signals, consider using tools like ChartsWatcher. Its customizable dashboards and real-time data feeds can clarify significant patterns and inform trading decisions.

Common Market Maker Signals and Their Implications

| Signal Type | How to Identify | Typical Meaning | Reliability Score |

|---|---|---|---|

| Iceberg Orders | Repeated small orders at the same price level, followed by a sudden price move. | Large institutional accumulation or distribution. | Medium - Requires confirmation from other indicators. |

| Spoofing | Large orders appearing and disappearing rapidly, especially near key support or resistance levels. | Attempt to manipulate price and trap other traders. | Low - Difficult to confirm intent. |

| Tape Painting | A series of rapid trades pushing the price in a specific direction, often near the end of a trading session. | Effort to influence price and trigger stop-loss orders or options expirations. | Medium - Look for unusual volume and price movement. |

This table summarizes key market maker signals, how to identify them, and their typical meaning. Remember, the reliability of these signals varies, and combining them with other indicators is always recommended.

Real-World Examples Across Different Markets

These signals appear differently across various markets. For instance, in the stock market, iceberg orders might accumulate shares before a major announcement. In futures markets, spoofing can create false momentum, leading to a cascade of trades. How to Identify Market Trends - A Complete Guide to Finding Hidden Opportunities might be helpful for your analysis. Even in the fast-paced cryptocurrency market, these tactics are common. Tape painting, for example, can manipulate the price of a thinly traded altcoin.

Distinguishing Between Noise and Significant Signals

Not every unusual order flow pattern signifies a major market maker signal. It's essential to differentiate between minor noise and genuine signals.

-

Look for Convergence: Several simultaneous signals, like a large iceberg order and increased trading volume, often suggest a higher probability of a price move.

-

Consider the Context: Analyze the broader market environment. A spoofing pattern during low volatility might be more significant than during high volatility.

By understanding these signals and differentiating between noise and genuine opportunities, traders can gain a significant edge. This knowledge empowers you to anticipate market movements, leading to more informed and profitable trading decisions.

Essential Tools for Catching Market Maker Moves

Identifying market maker signals requires having the right tools at your disposal. These tools can help transform seemingly invisible actions into concrete trading opportunities. With a plethora of options available, selecting the right platform for your needs can be challenging.

Level 2 Data: Peering Behind the Curtain

Level 2 market data is crucial for understanding market maker intentions. It provides a real-time look at the order book, showing the current bid and ask prices at different levels, along with the size of the orders. This detailed information allows traders to identify patterns and potential market maker activity.

For effective signal detection, certain Level 2 features are essential:

-

Order Book Depth: This shows the number of buy and sell orders at each price level, giving you insights into the overall market interest.

-

Time & Sales: This feature provides a real-time feed of every executed trade. It offers valuable information about order flow and market momentum. Customizing the Time & Sales window to highlight unusual volume or order sizes can be particularly useful.

-

Market Maker IDs: Some platforms identify the market makers involved in each trade. This offers a more direct look at their actions.

Charting Platforms and Indicators: Visualizing the Signals

Charting platforms are essential for visualizing market maker signals in the context of price action. Look for platforms with these features:

-

Customizable Charts: The ability to overlay multiple indicators, use drawing tools, and switch between different chart types is crucial for comprehensive market analysis.

-

Real-Time Data Feeds: Access to accurate and up-to-the-minute data is essential for timely signal recognition.

-

Integrated Level 2 Data: Seamless integration of Level 2 data with your charting platform enables a combined analysis of order flow and price action.

Using specific custom indicators can also improve your ability to spot signals. For instance, the Volume Weighted Average Price (VWAP) indicator can help identify deviations from typical trading volume, which may indicate market maker activity.

Scanning Software: Finding Opportunities Quickly

Scanning software, such as ChartsWatcher, automatically scans thousands of stocks based on specific criteria. This allows traders to quickly identify potential market maker signal setups. Setting up custom scans for unusual volume, rapid price changes, or large order sizes can significantly improve efficiency. This automation frees up valuable time, allowing for deeper analysis and faster responses to market opportunities. You might be interested in this article about: Top Stock Market Analysis Tools for Pro Traders.

Choosing the Right Tool for Your Trading Style

The best tools for you will depend on your individual trading style. Scalpers, who focus on short-term price movements, may prioritize fast and responsive Level 2 platforms. Swing traders, who hold positions for longer durations, may benefit from robust charting platforms that include historical data and backtesting capabilities.

Separating the Essential From the Distractions

Not all trading tools are created equal. Some platforms offer limited features at high prices. Others have steep learning curves, requiring significant time investment to master. It's crucial to choose tools that offer a good return on both your financial investment and your time. The key is to find tools that meet your specific requirements and enhance your trading strategy. Discussions with professional traders often reveal that the most effective tools emphasize core functionality, providing actionable insights without overwhelming the user with unnecessary features. These tools allow traders to clearly identify market maker signals, ultimately enabling faster and more informed trading decisions.

Market Maker Signal Myths That Cost Traders Money

Market maker signals are often seen as a secret weapon for traders looking for an advantage. But many misunderstandings about these signals can lead to expensive errors. Let's break down some common market maker signal myths that can deplete your trading account.

Myth 1: All Large Orders Indicate Market Maker Activity

One common myth is that every large order automatically means market maker activity. This isn't true. While market makers do place large orders, other big players like institutional investors, hedge funds, and even retail traders can also place substantial orders. Thinking every large order comes from market makers leads to misinterpreting order flow and incorrectly predicting price movements.

For example, a large buy order might be a mutual fund rebalancing, not a market maker building a position. This mistake can lead traders into a trade too early, only to watch the price move against them.

Myth 2: Market Makers Always Want to Trap Retail Traders

Another harmful myth paints market makers as always trying to trick retail traders. While market makers do want to be profitable, their main job is providing liquidity. They profit from the spread, not necessarily from trapping retail traders.

Overemphasizing this "us vs. them" idea can lead to confirmation bias, where traders see manipulation in every price change. This skewed perspective prevents objective analysis of true market maker signals and can cause traders to miss real opportunities out of fear.

Myth 3: Signal-Based Strategies Guarantee Profits

Perhaps the most risky myth is believing that relying only on market maker signals guarantees profits. No single strategy, including those using market maker signals, offers guaranteed success. Market conditions are always changing, and using only one type of signal ignores other critical factors like overall market sentiment, economic news, and company events.

Imagine a trader relying on a market maker's apparent accumulation signal. Then, surprise bad news about the company comes out, causing the stock to crash despite the perceived accumulation. Diversification and a broad understanding of market dynamics are essential for long-term success.

Evaluating Signal Validity: A Critical Framework

To avoid these myths, use a critical framework for evaluating market maker signals:

-

Context is Key: Consider the overall market situation. A large order during high volatility might be less important than during low volatility. ChartsWatcher's real-time data feeds can provide valuable context.

-

Confirmation is Crucial: Look for multiple signals agreeing. A large iceberg order with unusual trading volume is more reliable than a single signal. ChartsWatcher lets traders create custom dashboards to see multiple data points at once, helping confirm signals.

-

Continuous Learning: Stay up-to-date on market maker tactics and changing signal patterns. Trading is a continuous learning process. ChartsWatcher's blog offers helpful articles and market trend updates.

By separating fact from fiction, you can use market maker signals effectively as one part of a complete trading strategy. ChartsWatcher can give you a clearer market view, helping you see the difference between noise and real signals for smarter trading decisions. A solid grasp of market dynamics and powerful tools provide a strong foundation for profitable trading.

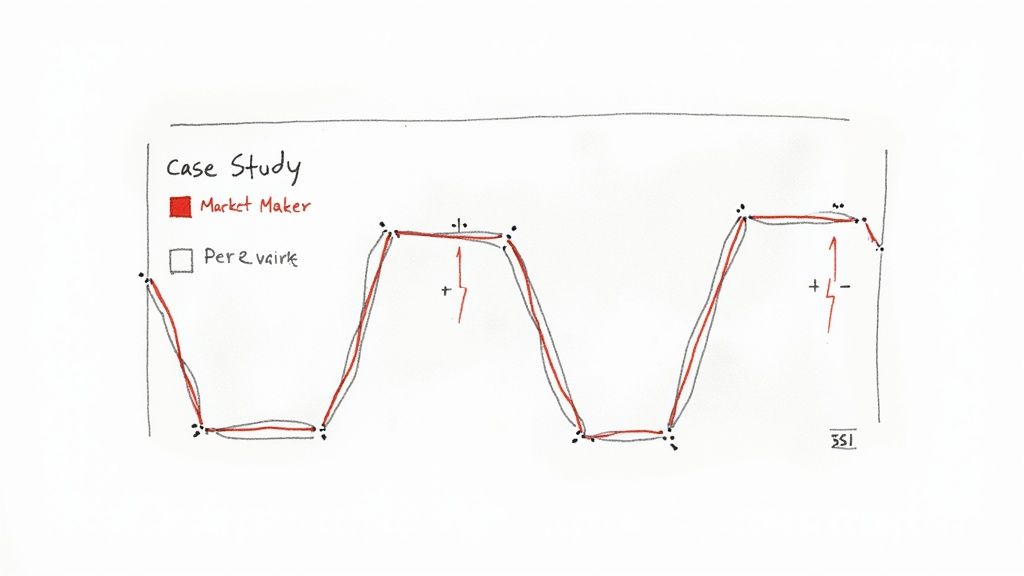

Building Your Market Maker Signal Trading Edge

Identifying market maker signals is just the first step. Let's explore how to turn that knowledge into a real trading advantage. Successful traders don't just look at market maker signals in isolation; they use them as part of a bigger picture. This broader market analysis significantly improves the chances of profitable trades.

Validating Signals Across Multiple Timeframes

Building a solid strategy means checking market maker signals across different timeframes. A signal on a 5-minute chart might not be as important as one on a daily or weekly chart.

For example, a large "iceberg" order on a short-term chart could just be a temporary blip. But if you see similar activity on longer timeframes, it might mean institutional investors are showing sustained interest. Checking across multiple timeframes helps filter out the noise and highlight the strongest signals.

Position Sizing Based on Signal Strength

Managing risk and maximizing profits hinges on effective position sizing. The strength of the market maker signal should guide how much you invest in a trade.

A strong signal, especially one seen across multiple timeframes, might justify a larger position. A weaker, unconfirmed signal suggests a smaller position. This approach helps you make the most of high-conviction trades while limiting potential losses on less certain ones.

Exit Strategies Tied to Specific Signal Patterns

Exit strategies are as important as entry strategies. Link your exits to specific signal patterns or price levels.

If you enter a trade based on signs of accumulation, think about exiting when you start to see distribution patterns. Predefined profit targets and stop-loss levels based on the initial signal strength can also help manage risk and lock in consistent profits.

Maintaining Objectivity During Live Trading

Staying objective is key when interpreting market maker signals in live trading. Emotions can lead to bad decisions.

Create a trading plan with clear rules for entering and exiting trades, based on predetermined signal patterns. Sticking to this plan, even when the market gets volatile, keeps you objective.

Tracking Signal Effectiveness: Continuous Refinement

Tracking your strategy's performance is essential for ongoing improvement. Keep a detailed trading journal of every trade. Note your entry and exit points, position size, and the signals that prompted your decisions.

Regularly reviewing this data helps you figure out what's working and what's not, allowing you to adapt your strategy as needed.

Adapting to Different Market Conditions and Asset Classes

Market maker signals show up differently in different markets and asset classes. A strategy that works in a bull market might not work in a bear market. Signals in the stock market can be different from those in futures or cryptocurrencies.

Continuously adjust and refine your approach based on the specific market you're trading. For example, in volatile markets, prioritize signals validated across longer timeframes to avoid getting caught out by short-term price swings.

Real-World Examples of Combining Signals With Other Setups

Many traders use market maker signals with other high-conviction setups for a higher probability of success. They might spot a potential breakout using technical analysis and then look for confirming market maker signals, like increased buying pressure or iceberg orders, before entering the trade. This combined approach provides a more comprehensive view.

To improve your market maker signal analysis and streamline trading, consider ChartsWatcher. Its customizable dashboards, real-time data, and advanced charting could give you the edge you need in today's markets.

Let's look at how these components can be combined into a practical trading framework:

Market Maker Signal Strategy Framework

A structured approach to building a trading strategy incorporating market maker signals across different market scenarios and asset classes.

| Strategy Component | For Bullish Signals | For Bearish Signals | Risk Management |

|---|---|---|---|

| Entry Signals | High volume accumulation, iceberg orders on the bid side, strong price increases on large volume | High volume distribution, iceberg orders on the ask side, strong price decreases on large volume | Define clear entry criteria based on validated signals. |

| Multiple Timeframe Confirmation | Look for confirming signals on higher timeframes (daily, weekly) to validate bullish signals observed on shorter timeframes (5-minute, 15-minute) | Look for confirming signals on higher timeframes (daily, weekly) to validate bearish signals observed on shorter timeframes (5-minute, 15-minute) | Avoid over-reliance on short-term signals. |

| Position Sizing | Larger positions for stronger, confirmed signals; smaller positions for weaker or unconfirmed signals | Larger positions for stronger, confirmed signals; smaller positions for weaker or unconfirmed signals | Adjust position size based on signal strength and conviction level. |

| Exit Strategies | Exit when distribution patterns emerge, or based on predefined profit targets | Exit when accumulation patterns emerge, or based on predefined profit targets | Set stop-loss orders to limit potential losses. |

| Market Adaptation | Adjust strategy based on market conditions; focus on longer-term signals during high volatility | Adjust strategy based on market conditions; focus on longer-term signals during high volatility | Adapt risk management approach based on market volatility. |

This table outlines a structured approach to using market maker signals, highlighting the importance of adapting your approach to different market conditions and effectively managing risk. By combining strong signal identification with robust risk management and continuous analysis, you can develop a more consistent trading edge.