Master Market Opportunity Identification: Unlock Growth

Spotting a market opportunity isn't about getting lucky. It's about a disciplined hunt for gaps where your business can add real value, turning sharp observations into profitable growth. It’s the process of discovering unmet customer needs or seeing whole markets that others are ignoring.

The Art of Seeing What Others Miss

Think of yourself as a detective piecing together clues to crack a case. That's what market opportunity identification feels like. You’re connecting seemingly unrelated dots—a new technology, a recent regulation, or a subtle shift in consumer habits—to uncover hidden paths to growth. These opportunities aren't just lying around waiting to be found; they’re uncovered through keen observation and smart analysis.

Success here really comes down to a specific mindset. You have to learn to look at the market not just for what it is, but for what it could be. This means you're constantly questioning assumptions, listening intently to what customers complain about, and looking for your competitors' blind spots. It's all about finding potential revenue streams before they become obvious to everyone else.

This proactive approach is more critical than ever. The broader market for identity verification and management, for example, is projected to see a substantial compound annual growth rate (CAGR) from 2025 through 2033, fueled by surging demand in sectors like finance and healthcare. This is a clear signal of fertile ground for new ideas and underscores why mastering this skill is so valuable.

Building Your Opportunity-Spotting Foundation

At its heart, finding market opportunities starts with asking the right questions, which requires a deep understanding of the current landscape. A huge piece of this is doing your homework with solid research. For those just starting, there are some great guides that simplify the process, like this one on Market Research for Small Business.

The goal is to move beyond just having "ideas" and find genuine gaps where your company’s unique strengths can deliver a solution customers are actually willing to pay for. It’s the difference between chasing a fleeting trend and building a sustainable business.

To build this foundation, you need to zero in on a few key areas:

- Unmet Customer Needs: What problems are people grappling with that current products just don't solve well? Keep an ear out for phrases like, "I just wish there was..." or "It's so frustrating when..."

- Underserved Markets: Are there specific demographics or niche groups that bigger players are ignoring? This is often where small businesses find their sweet spot and thrive.

- Industry Shifts: How are new technologies, economic changes, or cultural trends creating fresh demand or making old business models obsolete?

The Four Main Catalysts for Market Opportunities

New opportunities don't appear out of thin air. They're typically triggered by specific changes or forces in the market. Understanding these catalysts helps you know where to look and what signals to watch for.

This table breaks down the primary sources where new market opportunities typically originate, helping you quickly recognize the key drivers of change.

| Opportunity Catalyst | Description | Real-World Example |

|---|---|---|

| Technological Advances | New inventions or scientific breakthroughs that enable new products or make old ones obsolete. | The rise of AI creating a market for tools like ChatGPT and AI-powered analytics platforms. |

| Regulatory Changes | New laws or government policies that create new requirements, restrictions, or incentives. | The GDPR in Europe creating a demand for data privacy and compliance software. |

| Social & Cultural Shifts | Changes in consumer values, lifestyles, and preferences over time. | Growing consumer focus on sustainability leading to a boom in eco-friendly products and plant-based foods. |

| Economic Fluctuations | Changes in the broader economy, like recessions or booms, that alter spending habits. | A recession driving demand for budget-friendly subscription services and DIY solutions instead of premium alternatives. |

By keeping these four catalysts on your radar, you can systematically scan the horizon for the next big thing instead of just waiting for it to happen.

Where Opportunities Hide in Plain Sight

Great opportunities rarely wave a flag to announce their presence. They're usually tucked away inside the frustrations, complaints, and inefficiencies of the current market.

By developing a systematic way to scan for these signals, you can shift your business from being reactive to being proactive, always poised to catch the next wave of growth. And this skill isn't just for startups; established companies must constantly seek out new avenues to stay relevant and ahead of the curve.

Strategic Frameworks for Spotting Opportunities

Knowing what a market opportunity is gets you to the starting line. But to actually win the race, you need a repeatable game plan. This is where strategic frameworks come in.

Think of them less like rigid, academic rules and more like a set of professional-grade lenses. They help you systematically scan the business landscape for hidden value, turning the often chaotic process of market opportunity identification from a guessing game into a methodical exercise. By using these tools, you can analyze your environment and pinpoint high-potential ventures with much greater confidence.

Using SWOT Analysis to Find Your Edge

One of the most foundational yet powerful frameworks is the SWOT Analysis. It forces you to look at your business and its environment from four distinct angles: Strengths, Weaknesses, Opportunities, and Threats.

The real magic happens when you connect the dots between these quadrants. An opportunity is only truly valuable if you have the internal strengths to actually capitalize on it.

- Strengths (Internal): What does your company do exceptionally well? This could be a killer brand, unique tech, or a highly skilled team.

- Weaknesses (Internal): Where are you at a disadvantage? Maybe it's limited funding, gaps in your distribution, or a brand that nobody recognizes yet.

- Opportunities (External): What outside factors could you take advantage of? These are often trends, market gaps, or shifts in customer behavior.

- Threats (External): What external factors could sink your business? This includes new competitors, negative market trends, or disruptive new rules.

For example, a local coffee shop might list its loyal customer base as a strength but its small physical space as a weakness. After scanning the environment, they spot an opportunity in the growing demand for corporate catering. By connecting their strength (loyal customers who work at nearby offices) to this opportunity, they can launch a profitable new service that neatly sidesteps their weakness (the small shop).

A key insight from this process is that a market opportunity isn't just a trend; it's a trend that aligns perfectly with your company's unique ability to deliver value. Without that alignment, it’s just noise.

Mapping Growth Paths with the Ansoff Matrix

While SWOT gives you a solid general assessment, the Ansoff Matrix is your go-to tool for mapping out specific growth strategies. It lays out four clear paths for expansion, helping you decide how to chase an opportunity once you've found it.

Picture a simple 2x2 grid. One axis represents your products (existing vs. new), and the other represents your markets (existing vs. new). This setup gives you four strategic options:

- Market Penetration: Selling more existing products to your existing market. This is the safest bet, often involving aggressive marketing or new loyalty programs.

- Product Development: Creating new products for your existing market. This is about building on the customer relationships you already have by offering them new solutions.

- Market Development: Taking your existing products into new markets. This could mean expanding to a new city or targeting a completely different customer demographic.

- Diversification: Developing new products for new markets. This is the highest-risk, highest-reward path, as you're stepping into completely unfamiliar territory.

A tech startup could use this matrix to figure out its next move. Should they focus on adding more features to their current software (Product Development) or try to adapt it for a new industry (Market Development)? The Ansoff Matrix provides a clear framework for weighing the risks and rewards of each path. This kind of structured thinking is essential when you want to learn how to identify market trends that actually fit your company's ability to grow.

Expanding into new geographic markets is a classic Market Development play. For instance, in 2023, Latin America and the Caribbean attracted 48.9% of all foreign direct investment flowing into emerging economies. The value of announced projects in the region jumped by 16%, fueled by sectors like renewable energy and automotive. This signals a massive opportunity for companies with the right products looking to expand. You can discover more about these regional investment trends and see for yourself how global capital flows are pointing toward new frontiers.

Finding Actionable Data for Market Analysis

An opportunity without solid data is just a well-intentioned opinion. To turn a promising idea into something you can actually build a business on, you have to anchor it in real-world evidence. This means becoming a bit of a data detective, digging up the intelligence that validates your hunches and shows you what customers truly need.

The whole process of market opportunity identification hinges on blending two different but equally important types of information. It’s like building a 3D picture of the market; one type gives you the broad outline, while the other fills in all the crucial, textured details.

Combining Secondary and Primary Research

Think of secondary research as your library of established facts. This is information that others have already gone to the trouble of collecting, and it gives you that high-level, birds-eye view of the market. It’s always your starting point for getting a feel for the scale and scope of an opportunity.

You can find great secondary data from sources like:

- Industry Reports: Firms like Gartner or Euromonitor publish deep dives into market sizes, growth projections, and the competitive landscape.

- Government Statistics: Agencies like the U.S. Census Bureau offer a treasure trove of demographic, economic, and trade data that's both free and highly reliable.

- Academic Studies: Universities and research institutions are often on the front lines, publishing papers on emerging trends and shifts in consumer behavior.

Now, while this secondary data is great for telling you what is happening on a macro level, it rarely explains why. That’s where primary research comes into play. This is the data you collect yourself, straight from the source—your potential customers. It’s the only way to uncover the specific pain points, frustrations, and desires that actually drive people to buy something.

A crucial prerequisite for any market opportunity identification is understanding your ideal customer, and a comprehensive guide on how to identify your target audience can provide the data-driven framework needed for this essential step.

Tapping into Real-Time Consumer Signals

In today's fast-moving world, traditional research isn’t always enough. You need to supplement it with tools that can listen to the market as it breathes, in real time. This is where modern platforms give you a serious analytical edge.

Social listening tools, for example, let you monitor conversations happening right now across social media, forums, and review sites. By tracking keywords related to your industry or a specific problem, you can spot rising complaints, new desires, and competitor weaknesses straight from unfiltered, honest consumer discussions.

Another incredibly powerful tool is Google Trends. It offers a simple but profound look at search interest for specific topics over time. A rising trend line can be an early warning signal of a growing need or a new solution gaining traction, long before it ever shows up in a formal industry report. For traders and market analysts, tools like ChartsWatcher take this even further by integrating newsfeeds and alerts, helping you synthesize market sentiment with stock performance in real time.

Synthesizing Data into a Compelling Narrative

The final, and most critical, step is to pull all this information together. Raw data points are just noise until you weave them into a coherent story. You have to connect the "what" from your secondary research with the "why" you discovered in your primary research.

Here’s a practical way to approach it:

- Start Broad: Use industry reports to confirm the market is large enough and growing. Is there really a $2 billion market for your idea?

- Focus In: Layer in social listening and trend data. What specific problems are people actually talking about within that broader market? Are they complaining about "slow software" or "poor customer service"?

- Validate Directly: Use your own surveys and interviews to confirm these pain points with your target audience. Ask them straight up if they would pay for a better solution.

By following this process, you transform abstract ideas into a concrete, data-backed case. You can walk into any room and confidently show not only that an opportunity exists, but that you understand the specific customer needs you have to solve to capture it. This is what turns a speculative pitch into a credible business plan.

Your Step-by-Step Opportunity Identification Process

Alright, let's get down to business. Moving from theory to action is where the real magic happens. When you combine smart frameworks with solid data, you can build a structured, repeatable system for spotting market opportunities. This isn't about waiting for a single stroke of genius; it's about a methodical process that turns raw ideas into validated business cases.

Think of this as your roadmap, guiding you from broad exploration to a focused, actionable plan. Whether you're a startup founder sketching on a whiteboard or a corporate strategist hunting for the next growth engine, this process will bring much-needed clarity to your search.

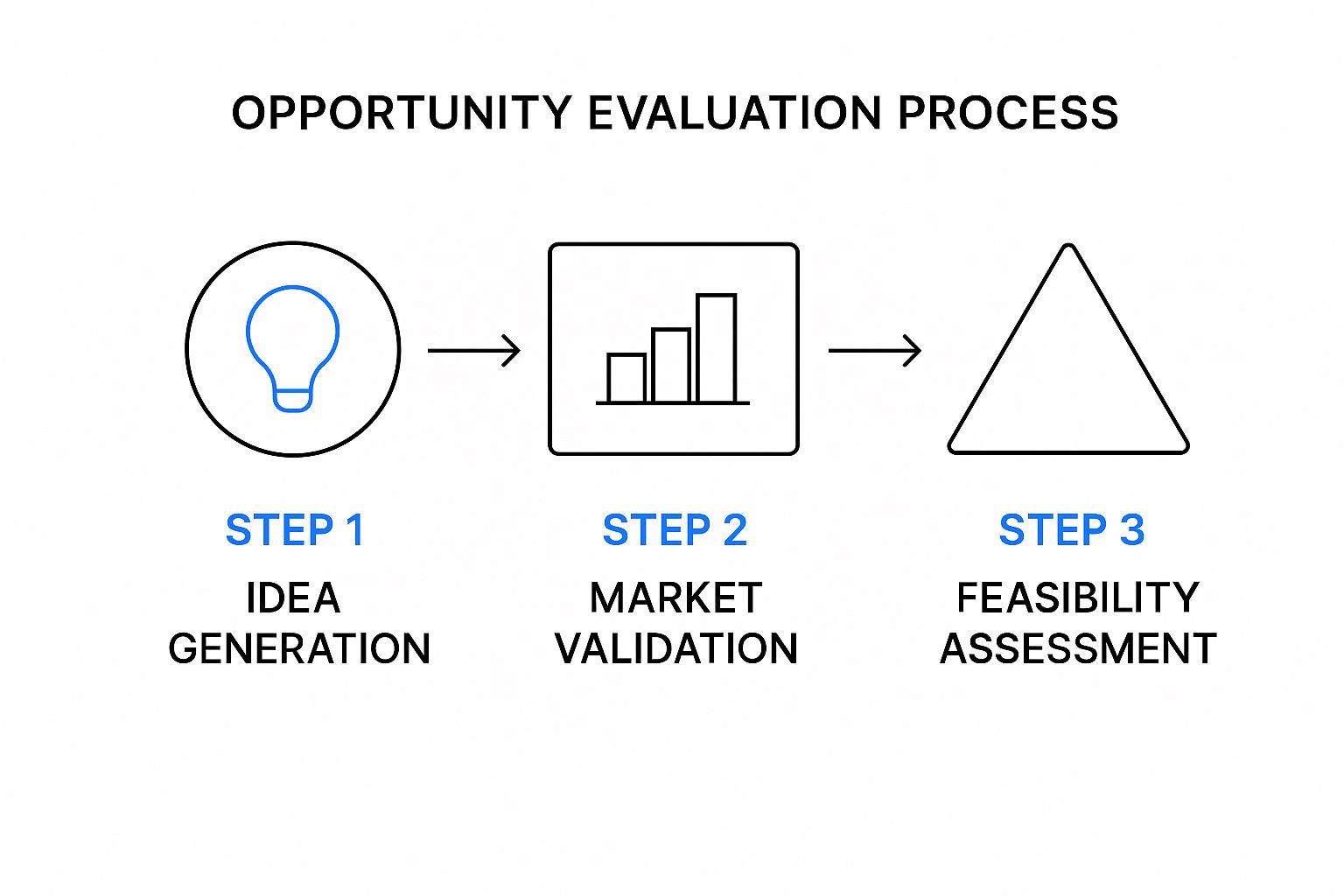

Here's a simple look at the core stages of this journey.

This flow shows how a successful search moves from creative brainstorming to tough, real-world testing. It's how you make sure you only pour resources into ideas with true potential.

Stage 1: Brainstorming and Initial Scanning

The first stage is all about casting a wide net. Your goal here is quantity, not quality. Don't filter your ideas just yet; the aim is to generate a long list of potential opportunities based on those catalysts we talked about—the big shifts in technology, regulations, society, or the economy.

Listen to your audience and dig into their feedback. Customer complaints are often just opportunities in disguise. What friction points do they bring up over and over? What clunky workarounds have they invented because existing solutions just don't cut it? This is where you'll find the raw material for real innovation.

A common mistake is to fall in love with the very first idea. The objective here is to generate a diverse portfolio of 10-15 potential opportunities. This forces you to think beyond the obvious and explore some unconventional paths.

To get the creative juices flowing, you can:

- Analyze Competitors: Look for what they aren't doing. Are there customer segments they completely ignore or service gaps they consistently fail to fill?

- Monitor Industry News: Keep a close watch on trends, M&A activity, and new product launches in adjacent fields. This can give you clues about where the market is headed next.

- Talk to Your Team: People on the front lines, like your sales and customer support staff, have priceless insights into what customers are actually asking for.

Stage 2: Prioritization and Initial Filtering

With your longlist in hand, it's time to start trimming the fat. The goal of this stage is to narrow down your 10-15 ideas into a much more manageable shortlist of 3-5 high-potential candidates. This is where you bring in your strategic frameworks and run some initial data checks.

A simple scoring matrix is a great place to start. Evaluate each idea against a consistent set of criteria that actually matter to your business. This brings some much-needed objectivity into what can otherwise be a very subjective, gut-feel process.

| Evaluation Criteria | Description | Why It Matters |

|---|---|---|

| Market Size | What's the total addressable market (TAM)? Is it big enough to even be worth it? | Ensures the potential reward justifies the risk and effort. |

| Strategic Fit | Does this opportunity align with our company's core strengths and long-term vision? | Prevents you from chasing shiny objects in markets where you have no right to win. |

| Competitive Heat | How crowded is this space? Is it dominated by a few giants or is it fragmented? | Helps you gauge how hard it will be to gain traction and grab market share. |

| Execution Feasibility | Do we have the technical, financial, and human resources to actually pull this off? | A brilliant idea you can't execute is worthless. This is a critical reality check. |

This screening process helps you quickly weed out ideas that are too small, too competitive, or just a plain bad fit for your organization. It lets you focus your deeper analytical efforts on the opportunities that truly matter.

Stage 3: Deep-Dive Analysis and Business Case

Finally, you take your shortlist of 3-5 ideas and put them under the microscope. This is the most resource-intensive stage, where you'll conduct deep primary and secondary research to build a full-blown business case for your top contender.

You’ll be running in-depth customer interviews, sending out surveys, and building financial models to project potential revenue and costs. The goal is to answer one critical question with confidence: Is this a viable, profitable business? This analysis should also factor in the broader investment climate.

The landscape for market opportunities is always changing, especially in private markets. For example, a 2025 global survey shows that while fewer limited partners see China as a compelling private market, the appetite for emerging Asia-Pacific has grown, with 38% of LPs expressing interest for 2025. This shows how global capital flows can signal where future growth might be. To get a better handle on these shifts, you can explore the full 2025 global investor survey.

By the end of this stage, you should have a single, prioritized opportunity backed by a robust, data-driven argument. This business case will become the foundation for securing investment and kicking off development.

How to Validate Your Opportunity Before Investing

An exciting idea is just the starting line. The real race begins when you have to pour time, money, and resources into making it a reality. Smart companies know that ideas are cheap, but execution is incredibly expensive. This is exactly why the crucial step of validation separates the winning ventures from the costly failures.

Validation is all about de-risking your opportunity. Think of it as gathering concrete evidence that people actually want what you’re planning to build before you build it. It’s about testing your core assumptions cheaply and quickly to make sure you’re on the right track.

Testing the Waters with Low-Cost Experiments

You don't need a finished product to start validating. In fact, building the whole thing first is often the worst way to go. Instead, you can run simple, low-cost experiments to gauge real-world interest.

One of the most effective methods is the "smoke test." This involves creating a simple landing page that describes your future product or service. The page lays out the value proposition and includes a clear call-to-action, like "Sign up for early access" or "Join our waitlist." You then drive a small amount of targeted traffic to this page and measure how many people sign up. If a good percentage of visitors convert, you have strong initial proof that the problem you're solving really resonates.

Another classic technique is what Dropbox famously did in its early days. Instead of building a complex file-syncing infrastructure, they created a simple explainer video showing how the product would work. The video went viral, and their sign-up list exploded overnight, giving them overwhelming validation that they were onto something huge.

Building Your Minimum Viable Product (MVP)

After your initial tests show promise, the next logical step is often to build a Minimum Viable Product (MVP). This isn't a buggy, half-finished version of your final product. It’s the simplest possible version that delivers the core value to your first set of users.

The purpose of an MVP is not to impress, but to learn. It’s a scientific instrument designed to test your most critical hypothesis: Will people use this solution to solve their problem?

For example, if your idea is a new project management tool, your MVP might only let users create a task and assign it to someone. No calendars, no reporting, no integrations. By releasing this bare-bones version to a small group of early adopters, you can gather priceless feedback on whether your core feature is actually useful. This feedback loop is essential for refining your product based on real user behavior, not just your own assumptions. The process is a lot like how traders test their ideas; for a deeper look into this methodical approach, you can explore this complete playbook on how to backtest a trading strategy.

Running the Numbers with Financial Validation

Even if customers love your idea, it won't be a viable business if the numbers don't work. Before committing serious capital, you need to do some "back-of-the-napkin" financial validation to see if it’s potentially profitable. This starts with sizing up your market.

- Total Addressable Market (TAM): This is the total market demand for a product or service. How big is the entire pie?

- Serviceable Available Market (SAM): This is the segment of the TAM you can actually reach with your product. How much of the pie can you realistically serve?

- Serviceable Obtainable Market (SOM): This is the portion of the SAM you can realistically capture. What’s your actual slice of the pie?

Estimating these figures helps you understand the scale of the opportunity. A $10 million SOM might be a fantastic opportunity for a small startup but a non-starter for a large corporation. By combining this market sizing with rough estimates of your pricing and costs, you can build a simple financial model to see if the opportunity is truly worth pursuing.

Common Questions About Spotting Market Opportunities

As you start putting these strategies into practice, you're going to have questions. It's only natural. The hunt for that next big thing isn't a straight line—it’s dynamic, and knowing how to handle the common uncertainties that pop up is half the battle.

This final section gets right to the point, answering those critical questions that almost always come up. Think of it as your field guide for refining your approach, dodging the usual traps, and keeping your momentum going.

How Often Should I Look for New Market Opportunities?

This is one of the first and most important questions people ask, but the truth is, there's no magic number that works for every business. The best approach? Stop thinking of it as a one-off project you tackle and then shelve. It needs to be a continuous process.

Think of it like having a radar system that’s always on, quietly scanning the horizon. This “always-on” mindset helps your team notice the tiny micro-shifts in customer chatter, competitor moves, or new tech as they happen. It builds a culture of curiosity where everyone feels empowered to point out a potential gap.

Of course, that constant, low-level scanning needs to be paired with more structured, deep-dive reviews.

For most businesses, the sweet spot is a mix of two cadences: continuous, informal observation combined with periodic, intensive analysis, maybe quarterly or annually. This dual approach gives you the perfect balance—you’re nimble enough to jump on immediate changes but still keep your long-term strategy in focus.

This structure keeps you from getting blindsided by a sudden market shift and makes sure innovation stays at the heart of what you do.

What Is the Difference Between a Trend and an Opportunity?

It’s incredibly easy to confuse a market trend with a real market opportunity, but getting this wrong can send you chasing popular ideas with no viable business model. It's a critical distinction.

A market trend is just the general direction things are moving. It’s the broad current. For instance, the growing interest in sustainable products or the big shift to remote work are both major trends. They tell you what is happening on a massive scale.

A market opportunity, on the other hand, is a specific, actionable gap that you can fill—a gap created by that trend. It’s the "how" and the "for whom" that turns a broad movement into a concrete business idea.

- Trend: More and more people are adopting plant-based diets.

- Opportunity: Creating a subscription box delivering chef-curated, plant-based meal kits for busy professionals who don't have time to cook.

An opportunity always solves a specific problem for a specific group of people. The trend is the wave; the opportunity is knowing exactly what kind of surfboard to build to ride it.

Can a Small Business Realistically Find and Win New Opportunities?

Absolutely. In fact, small businesses often have a huge advantage over their bigger, more established competitors. A large corporation might have deep pockets, but they're usually slow to turn and bogged down by endless layers of red tape. That sluggishness creates perfect openings for smaller, faster companies.

Your agility is your superpower. Here's how you can use it:

- Speed to Market: You can test ideas, build MVPs, and get new products out the door much, much faster than a corporate giant.

- Niche Focus: Small businesses can thrive by serving niche markets that are too small or specialized for the big players to even bother with.

- Customer Intimacy: With a smaller customer base, you can build real, authentic relationships, gathering priceless feedback and creating genuine loyalty.

The key is to stop trying to compete with large corporations on their terms, like scale or price. You win by changing the game entirely. Compete on speed, focus, customer connection, and creativity. Your strength is in your ability to see the gaps the giants are too big to notice or too slow to fill. For a small business, successful market opportunity identification is all about precision, not power.

Ready to turn market analysis into your competitive advantage? ChartsWatcher provides the powerful, real-time data and customizable dashboards you need to spot trends, analyze competitors, and uncover opportunities before anyone else. Stop guessing and start seeing the market with crystal clarity. Explore ChartsWatcher today.