market order vs limit order: which to use for smarter trades

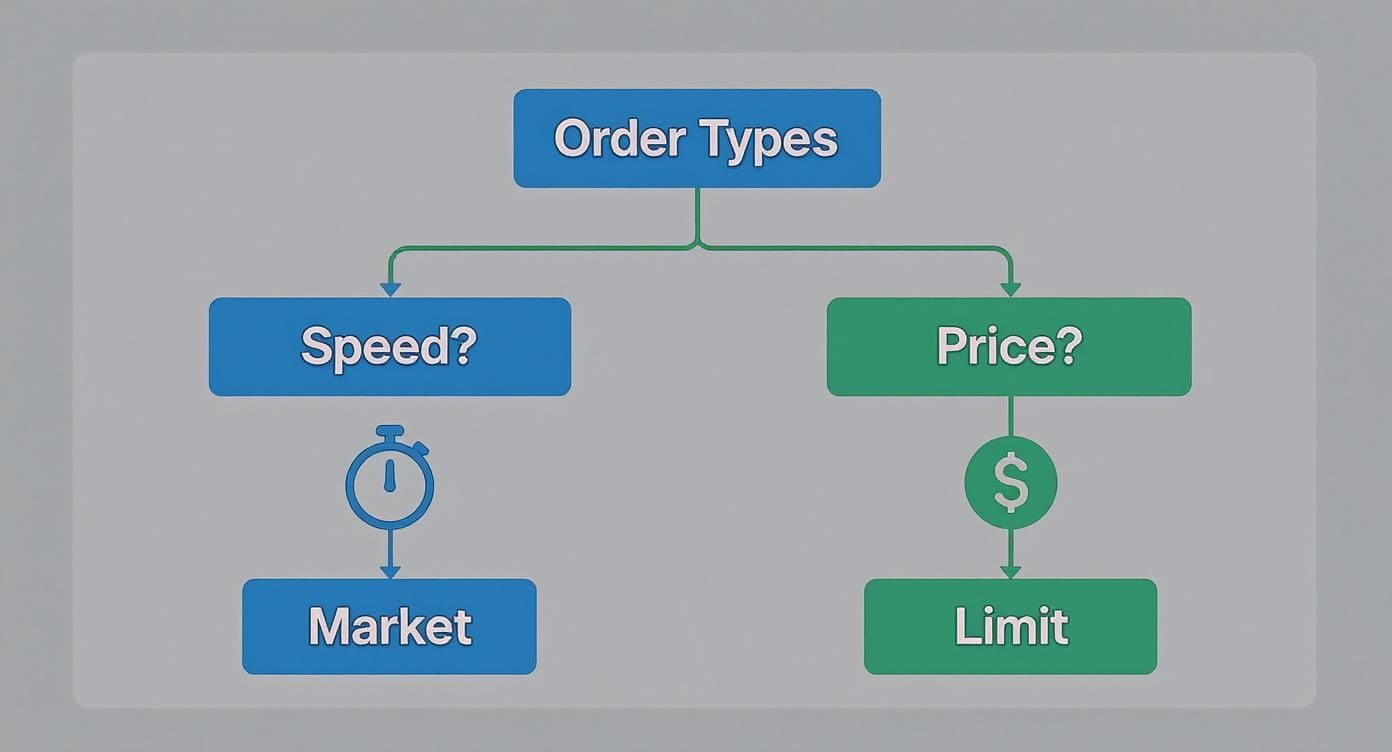

At the heart of every single trade lies a choice that shapes its outcome before you even commit a dollar. It’s not about what you trade, but how you trade it. The market order vs limit order debate boils down to a classic trading dilemma: speed versus control.

A market order is all about speed—it prioritizes getting your trade filled right now at the best price available on the market. Think of it as the "get me in, no matter what" button. On the flip side, a limit order is your tool for precision. It lets you name your price, but there's no guarantee your trade will ever execute.

Choosing Your Order Execution Strategy

Your choice here isn't just a technicality; it's a strategic decision that needs to sync up perfectly with your trading goal and what the market is doing at that exact moment.

Are you trying to jump on a fast-moving stock after some breaking news? Or have you done your homework and are patiently waiting for an asset to dip to that perfect entry point you've identified? Each scenario demands a completely different approach.

Market Order vs Limit Order At a Glance

To make the right call, you have to be crystal clear on what each order type brings to the table. One gives you instant execution, the other gives you price precision. They are fundamentally different tools for different jobs.

This table cuts through the noise and gives you a side-by-side look at the core differences.

| Feature | Market Order | Limit Order |

|---|---|---|

| Execution | Guaranteed (if liquidity exists) | Not guaranteed |

| Price | Filled at the best current price | Filled only at your specified price or better |

| Speed | Instantaneous | Can take time or never execute |

| Control | You control when (now) | You control what price |

| Primary Use | Speed and certainty are critical | Price precision is critical |

Once your trade is executed, the job isn't done. The next step is understanding your broker statements to see exactly what price you got filled at. This is how you'll be able to review your trade's performance and see if your chosen strategy is actually working out in the real world.

The Mechanics of a Market Order

When you hit the button on a market order, you’re telling your broker one thing: “Get me in or out of this trade right now at whatever the best price is.” There’s no waiting around. Your order immediately jumps into the market’s order book—the real-time ledger of all the buy and sell limit orders waiting for a match.

A buy market order instantly seeks out the lowest available sell price (the “ask”). A sell market order does the opposite, grabbing the highest available buy price (the “bid”). Because they immediately consume orders sitting on the book, market orders are often called “liquidity takers.”

This process gets your trade executed instantly, but it comes with a major catch: slippage.

Understanding the Impact of Slippage

Slippage is the tiny—or sometimes not-so-tiny—difference between the price you thought you were getting and the actual price your order filled at. In a busy, liquid market, it's usually just pennies. But under the wrong conditions, it can really sting.

Let’s say you want to buy 100 shares of a stock you see trading at $50.00. You look at the order book and see:

- 50 shares are for sale at $50.00

- 75 shares are for sale at $50.01

Your market order for 100 shares first snaps up all 50 shares at $50.00. To fill the rest of your order, it has to move to the next price level, buying the remaining 50 shares at $50.01. Your average price ends up being $50.005—a little higher than you expected. That’s slippage in a nutshell.

Placing a market order signals an urgent intent to trade immediately, accepting minor price variances for the certainty of execution. It is the ultimate trade-off of precision for speed.

When Slippage Becomes a Major Factor

The risk of getting a bad price ramps up in a few key situations, which makes the market vs. limit order decision so important.

- High Volatility: Think news events, earnings reports, or Fed announcements. Prices can whip around in milliseconds. The price you see on your screen can be ancient history by the time your order actually hits the exchange.

- Low Liquidity: This is a big one. For stocks that don’t trade much, there just aren’t many buyers and sellers lined up. A large market order can chew through the best prices in an instant, forcing the rest of your order to fill at much, much worse prices further down the order book.

For example, trying to dump 1,000 shares of a thinly-traded penny stock with a market order could crater the price. Your order would eat up every available bid at progressively lower prices, potentially costing you a huge chunk of your position's value. This is exactly why you have to know a stock's trading volume before you even think about using a market order.

The Power of a Limit Order

While a market order is all about speed, a limit order is the trader's tool for precision. It’s how you take back control from the market, telling it the only price you're willing to accept for your trade. You aren't just taking what's available; you're setting the terms.

Think of it like this: for a buy order, you're setting a price ceiling—the absolute highest you’ll pay. For a sell order, you're setting a price floor—the rock-bottom price you'll accept. Your order will only get filled if the market hits your price or, even better, gives you a more favorable one.

But this control comes with a catch: there's no guarantee your order will ever execute. It just sits patiently on the exchange's order book, waiting for someone to meet your price.

The Journey to Execution

Once you place a limit order, it joins the queue on the order book. In market terms, you've just become a "liquidity provider." You're adding to the pool of buy or sell interest, whereas a market order takes that liquidity away. This is why market orders almost always fill first—they're designed to instantly match with the waiting limit orders. On major exchanges like the NYSE or NASDAQ, your limit order contributes to the market's depth until a market order comes along to clear it out.

This patient waiting game is where the biggest risk of a limit order comes into play.

A limit order is an instruction based on price, not time. It communicates that securing a specific price is more important than the certainty of immediate execution.

The Risk of Non-Execution and Partial Fills

The single biggest downside of a limit order is the very real possibility of missing a trade entirely. Imagine you set a buy limit for a stock at $95. If the price dips to $95.01 and then rallies hard, your order is left in the dust. You successfully avoided overpaying, but you also missed the entire move up.

This is the core trade-off when comparing a market order vs limit order; one guarantees you get in, the other guarantees your price if you do.

Another thing to watch for is a partial fill. Let's say you place a limit order to buy 200 shares at $50, but only 75 shares become available from sellers at that price. Your order will be partially filled, leaving you with 75 shares and an open order for the remaining 125.

To manage this, traders use different time-in-force settings:

- Good 'til Canceled (GTC): The order stays active for days, weeks, or even months until it fills or you manually cancel it.

- Day Order: If the order doesn't execute by the end of the trading day, it's automatically canceled.

These settings give you control over how long you’re willing to wait for your price, making the limit order an indispensable tool for disciplined, strategic trading.

Comparing Order Execution Dynamics

When you’re weighing a market order against a limit order, you're looking at more than just speed versus price. It’s a deeper decision about how you want to interact with the market itself. The choice you make casts you in a specific role: are you going to be a liquidity taker or a liquidity provider?

Think of a market order as the aggressive player. It’s a liquidity taker because it instantly consumes the best available orders sitting on the order book. This guarantees you get into or out of a position right away, but that convenience has a price—you’ll always pay the bid-ask spread. You’re essentially paying a small premium for the luxury of immediate execution.

A limit order, on the other hand, is a liquidity maker. It patiently adds your order to the book, waiting for the market to come to your specified price. This disciplined approach gives you total control over your entry or exit point and can even let you capture the spread if your order becomes the best bid or ask.

The Role of the Bid-Ask Spread

The bid-ask spread is that tiny gap between the highest price a buyer is willing to pay (the bid) and the lowest price a seller will accept (the ask). It's a fundamental cost of doing business in the markets, and each order type navigates it very differently. For a deeper dive, check out our guide on what the bid-ask spread is and why it's so important.

- Market Orders: A buy market order will fill at the current lowest ask price, while a sell market order executes at the highest bid. Either way, you’re crossing the spread and absorbing that cost for the sake of speed.

- Limit Orders: When you place a buy limit order below the current ask or a sell limit order above the current bid, you avoid paying the spread upfront. Your order will only trigger if the market moves to your price, giving you much tighter cost control.

The decision between a market and limit order is a strategic choice between being a price taker, who accepts the market's terms for speed, and a price maker, who sets their own terms at the risk of non-execution.

Execution Speed vs. Price Certainty

The push and pull between these two order types boils down to a classic trading trade-off. Interestingly, research shows that while limit orders offer price control, most don’t sit on the books for very long. Only about 4.6% of limit orders stay open for more than a single trading day, suggesting traders either get their price filled quickly or they cancel and move on.

The data also reveals that the average order size waiting at the best bid or ask is roughly nine times larger than the average market order. This confirms what many experienced traders already know: smaller, impatient market orders are often filled by larger, patient limit orders waiting in the wings.

To make the strategic differences crystal clear, let's break them down in a table.

Strategic Differences in Order Execution

This table gets to the heart of how market and limit orders perform under different conditions, helping you decide which one aligns with your immediate trading goal.

| Criterion | Market Order Analysis | Limit Order Analysis |

|---|---|---|

| Market Impact | High. Immediately removes liquidity, which can cause significant slippage on large orders in thin markets. | Low. Adds liquidity to the order book, contributing to market depth and stability until executed. |

| Cost Control | Low. The final execution price is uncertain and subject to slippage, especially during volatile periods. | High. Guarantees your execution price or better, providing complete control over your entry or exit cost. |

| Risk Profile | Faces price risk—the danger of getting a worse price than anticipated due to slippage. | Faces execution risk—the danger of the market moving away from your price, resulting in a missed opportunity. |

Ultimately, choosing the right order type depends entirely on your objective for a specific trade. Are you trying to get in right now, no matter the cost, or is hitting your price target the most important thing? Answering that question will tell you exactly which tool to use.

Matching Your Order Type to Market Conditions

Knowing the textbook difference between a market and limit order is one thing. Applying that knowledge in a fast-moving, live market? That’s what separates the pros from the rest. The right order type is always situational—it depends on your goal, the asset’s personality, and what the market is doing right now.

To make the right call, you have to know how to analyze market trends. That's the foundation for deciding whether you need speed or price control for any given trade.

High-Volume, Liquid Stocks

Let's talk about the big names, like Apple (AAPL) or Microsoft (MSFT). These stocks are incredibly liquid, with a bid-ask spread that's often just a penny wide. Millions of shares change hands every day, so the order book is deep.

In this environment, a market order is usually fine for smaller trades. The risk of getting a bad price (slippage) is tiny because your order is just a drop in an ocean of volume. If you just need to get in or out now with near-certainty, a market order on a liquid stock is a dependable move.

Reacting to Breaking News

Picture this: a company drops a bombshell positive earnings report after the market closes. You know the stock is going to gap up big at the opening bell. Here, speed is everything. Fumbling around with a specific price could mean you miss the boat entirely.

This is a textbook scenario for a market order. Your objective is simple: get filled the second the market opens so you can ride that initial wave of momentum. Sure, you’ll probably get some slippage because of the morning chaos, but that’s a small price to pay compared to potentially missing a 10% pop while you wait.

The decision really boils down to this: Is the risk of paying a slightly different price (slippage) worse than the risk of the market running away from you completely (missed opportunity)?

Volatile or Thinly-Traded Assets

Now, flip the script. Imagine you’re looking at a small-cap stock or an obscure crypto with very little trading volume. The order book is thin, and the gap between the bid and ask prices is huge. Hitting the "market buy" button here would be a disaster.

For these assets, a limit order isn’t just a good idea—it’s non-negotiable. It acts as your safety net, preventing you from accidentally wiping out the entire order book and filling at progressively terrible prices. You can learn more about these hidden costs by understanding what slippage in trading is and how limit orders are the solution.

This decision tree helps visualize the simple logic: prioritize speed for immediate execution or price for controlled entry and exit.

As the chart shows, your primary goal—getting in now versus getting in at the right price—is what should guide your choice.

Strategic Entry and Exit Points

For swing traders and long-term investors, patience and precision are king. You’ve done your homework and identified a critical support level where you want to buy, or a tough resistance level where you plan to sell.

The limit order is the perfect tool for the job. It lets you "set it and forget it." You place your order on the books and simply wait for the price to come to you. This disciplined approach keeps emotions out of the trade and makes sure your plan is executed exactly as you designed it, without chasing the market.

Putting Your Orders into Action on ChartsWatcher

Knowing the difference between market and limit orders is half the battle; putting that knowledge into practice is what really counts. The ChartsWatcher platform gives you a direct interface to execute your trading decisions with the speed and precision you need.

Placing an order is designed to be straightforward, minimizing mistakes by giving you a chance to confirm everything before it goes through.

First things first, you'll head over to the order entry panel, which you'll usually find right next to your charting tools. This is where you pick the asset you want to trade, punch in the quantity, and choose your order type from a dropdown menu. It’s the critical decision point: select "Market" for an immediate fill or "Limit" to set your exact price.

Here's a look at the order entry interface on ChartsWatcher where all the magic happens.

This screenshot highlights the fields for order type, quantity, and price. You'll notice that when "Limit" is selected, the price field is active, letting you type in your specific entry or exit target. Switch to a market order, and that field gets disabled—the trade will simply execute at the best price available right now.

Confirming and Monitoring Your Order

Once you've plugged in the details, a confirmation window pops up to summarize your trade. This final check is a lifesaver, helping you avoid costly typos by showing your order type, quantity, and the estimated cost or proceeds.

After you confirm, a market order executes almost instantly. If you placed a limit order, it will show up in your "Open Orders" tab. From there, you can keep an eye on its status or cancel it if your strategy changes or the market moves in an unexpected direction.

Still Have Questions? Let's Clear Things Up.

Even when you feel you’ve got a handle on market vs. limit orders, a few specific questions always pop up once you start trading for real. Let's tackle some of the most common ones I hear from traders.

Can a Market Order Actually Fail to Execute?

Yes, but it's incredibly rare. A market order might fail if an asset has zero liquidity—literally no one is willing to buy or sell at any price. This usually only happens during a trading halt or with extremely obscure, thinly-traded securities you probably shouldn't be touching anyway.

For most active stocks, you can be confident your market order will go through. It's practically guaranteed.

What Happens if My Limit Order Price Is Never Reached?

If the market never trades at your limit price, your order just sits there, open and unfulfilled. It won't execute.

Depending on the duration you chose, it will either expire at the end of the day (Day Order) or stay active until you decide to cancel it yourself (Good 'til Canceled). This is the main trade-off with a limit order: you might completely miss out on a move if the price runs away from your target.

A classic rookie mistake is setting a limit price too far from the current market price. It feels safe, but it drastically lowers the odds of your order ever getting filled.

Are Limit Orders Free to Place?

No, placing a limit order isn't free. You'll still pay the same commission or trading fee your broker charges for any executed trade.

The real advantage of a limit order isn't about saving on commissions. It's about controlling your execution price and protecting yourself from hidden costs like slippage.

Which Order Type Is Better for New Traders?

For someone just starting out, the limit order is often the smarter, safer choice. It acts as a safety net, preventing nasty surprises from slippage, especially when markets get choppy or you're trading a less-liquid stock.

By forcing you to name your absolute maximum buy price or minimum sell price, a limit order instills a crucial sense of discipline. It protects your capital while you're still getting a feel for how the market behaves.

Ready to put these strategies into practice? ChartsWatcher gives you the professional-grade charting and analysis tools you need to pinpoint your entry and exit points with confidence. Stop guessing and start making smarter decisions on every trade. Explore our features and take control at https://chartswatcher.com.