What Is Slippage In Trading? A Practical Guide

Ever placed a trade and ended up with a slightly different price than you expected? That’s slippage.

It's the small, sometimes frustrating, difference between the price you think you're going to get and the price you actually get. This happens in the blink of an eye—the tiny delay between you clicking the "buy" or "sell" button and your order actually being filled by the exchange.

Slippage can sometimes work against you (negative slippage) or, on rare occasions, in your favor (positive slippage).

So, What Is Slippage in Simple Terms?

Think about buying hot concert tickets the second they go on sale. You see a price, you frantically click "purchase," but by the time your order processes, the price has jumped. That’s a perfect real-world example of slippage.

In trading, it's the exact same principle. The price you see on your screen is just a momentary snapshot. In the milliseconds it takes for your order to travel from your computer to the exchange servers, the market can move. That tiny time gap is where slippage lives.

H3: The Two Sides of The Coin

It’s easy to think of slippage as a purely bad thing, but it’s not always a one-way street. It really comes down to which way the price moved in that split second.

- Negative Slippage: This is the one traders complain about. It’s when your buy order gets filled at a higher price than you wanted, or your sell order gets filled at a lower price. It directly chips away at your potential profit or adds to your loss.

- Positive Slippage: This is the happy accident. It happens when a buy order executes at a lower price, or a sell order executes at a higher price. You basically got a better deal than you bargained for. A pleasant surprise, but not something to count on.

Slippage isn't a broker's mistake or a sign of a faulty platform. It’s a natural, unavoidable feature of any market where prices are determined by real-time supply and demand.

H3: Why Does It Happen?

At its heart, slippage boils down to two main market forces: volatility and liquidity.

When prices are jumping around wildly (high volatility), the odds of the price changing before your order is filled go way up.

Similarly, if there aren't enough buyers or sellers at your exact price point (low liquidity), your order has to go find the next available price—which might be worse for you. Grasping these concepts is crucial for anyone learning how to read stock charts.

This is especially common in certain markets. Take cryptocurrency, for example. It's famous for its wild price swings and thinner liquidity compared to the stock market. It's not unheard of for slippage on a large crypto trade to exceed 2%.

To make this crystal clear, here’s a quick breakdown of the different slippage scenarios you might encounter.

Quick Guide To Slippage Types

| Type of Slippage | Description | Example Scenario |

|---|---|---|

| Negative Slippage | The executed price is worse than the expected price. | You place a buy order for XYZ stock at $100.00, but it gets filled at $100.05. |

| Positive Slippage | The executed price is better than the expected price. | You place a buy order for XYZ stock at $100.00, but it gets filled at $99.98. |

| Zero Slippage | The executed price is exactly the same as the expected price. | You place a buy order for XYZ stock at $100.00, and it gets filled at $100.00. |

Understanding these distinctions is the first step. Next, we’ll look at what you can actually do to manage and minimize the impact of negative slippage on your trading results.

The Real Reasons Slippage Happens

Slippage doesn't just happen out of the blue; it's a direct result of market physics. To really get what slippage is in trading, you have to look at the powerful forces that cause the price you click to be different from the price you actually get. More often than not, two key factors are at play: market volatility and market liquidity.

Think of these two forces as the weather conditions of the trading world. Some days are calm and predictable. Others, a storm hits without warning. How well you navigate these conditions will determine how much slippage you end up facing.

The Impact of High Volatility

High volatility is like a sudden, violent storm hitting the market. Prices don't just move—they swing wildly and unpredictably. This kind of chaos usually erupts around major economic news, company earnings reports, or unexpected global events.

When you place an order during one of these storms, the price can leap a significant distance in the milliseconds between your click and the order's final execution. This isn't a glitch in the system; it's the system reacting to a massive flood of new information and trading activity all at once. The market is simply repricing the asset in real-time, and your order gets caught in the turbulence.

Key Takeaway: Volatility creates a gap between your expectation and the market's reality. The faster prices are moving, the higher the chance that your execution price will be different from the one you saw when you hit the button.

The Challenge of Low Liquidity

If volatility is a storm, then liquidity is the depth of the water you're sailing in. In simple terms, liquidity is all about the availability of buyers and sellers at any given price level.

Picture a bustling marketplace with hundreds of vendors and shoppers. If you want to sell an apple for $1, you'll probably find a buyer instantly. That’s a high-liquidity environment.

Now, imagine a tiny, remote market with only a handful of people. If you try to sell that same apple for $1, you might not find a buyer right away. To make the sale, you may have to drop your price to $0.95 to attract the only person who's interested. That $0.05 difference? That’s slippage caused by low liquidity.

In trading, this exact scenario plays out when there aren't enough orders on the other side of your trade at your desired price. To get filled, your order has to "slip" to the next available price. This is a common headache when dealing with less-traded assets like penny stocks or obscure cryptocurrencies.

This problem gets even bigger in what experts call a 'thin market'. According to insights on futures trading, limited market depth and sudden spikes in participation are key drivers of slippage. When trading volumes are low, there are fewer buyers and sellers, which forces large orders to get filled across multiple, less favorable price levels. This can get especially hairy during major economic data releases that trigger rapid price moves and make slippage even worse. You can explore the full explanation of market slippage from StoneX for a more detailed analysis.

Other Contributing Factors

While volatility and liquidity are the main culprits, a few other things can pour fuel on the fire:

- Network Latency: Even something as simple as the physical distance and speed of your internet connection to your broker's servers can introduce costly delays.

- Broker Execution Quality: How quickly and efficiently your broker processes and routes your order to the exchange makes a huge difference. A slow or inefficient broker can be the weak link in the chain.

When you get right down to it, these factors combine to create the perfect storm for slippage. By understanding them, you can start to anticipate when slippage is most likely to rear its ugly head and take steps to protect your trades.

How Slippage Behaves In Different Markets

Slippage isn't a one-size-fits-all problem; it behaves completely differently depending on where you're trading. Getting a feel for these nuances is crucial for managing your expectations and, more importantly, protecting your capital.

The experience of trading in the vast, deep ocean of the Forex market is worlds away from navigating the Wild West of cryptocurrency. Each market has its own personality, defined by its unique levels of liquidity, volume, and volatility. These factors dictate how often slippage rears its head and how nasty its bite will be.

Slippage In The Forex Market

The foreign exchange (Forex) market is the undisputed king of liquidity, with trillions of dollars changing hands every single day. For the big-league currency pairs like EUR/USD or GBP/USD, the market is incredibly deep, especially when the London and New York trading sessions overlap.

In this kind of environment, slippage is usually a minor issue, often just a fraction of a pip. But don't get complacent—the market is never entirely immune.

- During major news events: A surprise economic announcement can send prices flying, creating temporary gaps and causing slippage.

- With exotic pairs: Step away from the majors and trade less common pairs, and you'll find much lower liquidity, which cranks up the risk.

- Outside peak hours: When trading volume thins out overnight, even major pairs can see their spreads widen, inviting more slippage into the picture.

Stocks: A Tale of Two Tickers

In the stock market, your risk of slippage boils down to what you're trading. It’s like the difference between buying shares in a global behemoth versus a speculative penny stock.

Trading a blue-chip name like Apple (AAPL) feels a lot like trading a major Forex pair. The market is liquid, with millions of shares traded daily. Significant slippage is rare unless you’re trying to move a massive block of shares or trading right around a volatile earnings release.

Penny stocks, on the other hand, are a minefield. Their thin trading volumes mean even a modest buy order can chew through all the available shares at the current asking price. Your order then starts filling at progressively higher, less favorable prices. This is especially damaging in high-frequency strategies like scalping trading, where quick, precise entries and exits are everything.

Cryptocurrency: Where Slippage Is Expected

If you're trading crypto, slippage isn't just a possibility; it's a core part of the experience. Wild volatility is the standard, and liquidity can vanish in an instant, particularly for newer or less-popular altcoins.

A key feature of decentralized exchanges (DEXs) is the "slippage tolerance" setting. This isn't just a helpful tool; it's a critical defense mechanism. It lets you tell the platform the absolute maximum percentage of negative slippage you're willing to stomach on any given trade.

Forget to set your tolerance, and a large market order for a low-liquidity token could get filled 5%, 10%, or even further away from the price you clicked. The fast, fragmented nature of crypto liquidity pools makes understanding and accounting for slippage a non-negotiable skill.

Seeing Slippage In The Real World

Theory is one thing, but watching slippage hit your account balance is something else entirely. Let's move past the definitions and walk through a few concrete examples of how this plays out in real trades.

These scenarios show exactly how a few cents or pips can make a real difference in your entry price and, ultimately, your bottom line. This is where the concept of slippage gets real.

Example 1: The Volatile Earnings Report

Imagine a company, let's call it TechCorp (TC), is about to drop its quarterly earnings report. You're bullish and ready to buy 100 shares the second the news hits.

The stock is trading at $50.00 a share, so you place a market order. But the report is a blockbuster—even better than expected. A massive wave of buy orders floods the market in the blink of an eye. In the milliseconds it takes for your order to get filled, the price has already jumped.

- Expected Entry Price: $50.00

- Actual Execution Price: $50.15

- Slippage Per Share: $0.15 (negative)

- Total Cost Increase: $15.00 ($0.15 x 100 shares)

Instead of your position costing $5,000, it ended up costing $5,015. That extra $15 is the direct cost of negative slippage, all thanks to that burst of volatility.

Example 2: A Fortunate Forex Trade

Now, let's flip the script and look at a time when slippage can work in your favor. You're in the Forex market, looking to short the EUR/USD pair because you think it's headed for a drop.

You place a market order to sell at the current bid price of 1.0750. Just as your order goes through, a surprise economic report comes out that weakens the Euro. Your broker, processing the order in that instant, manages to fill it at a better price than you even asked for.

- Expected Sell Price: 1.0750

- Actual Sell Price: 1.0752

- Slippage: +2 pips (positive)

It's a tiny movement, but it's a win. You entered your short position at a higher price, giving yourself an immediate 2-pip advantage. This proves that slippage isn't always the enemy.

Example 3: The Crypto DEX Swap

Finally, let's head over to a decentralized crypto exchange (DEX). You want to swap 1 ETH for a new, smaller altcoin called CosmicCoin (CC). At the moment, ETH is trading at $3,000, and the exchange rate shows you should get 10,000 CC for your 1 ETH.

The problem is, CosmicCoin has low liquidity. Your relatively large order is enough to move the price against you as it gets filled. To complete the swap, the DEX has to find sellers at progressively worse rates.

- Expected Amount: 10,000 CC

- Actual Amount Received: 9,800 CC

- Slippage: -200 CC (negative)

- Monetary Impact: Roughly $60 (assuming 200 CC at ~$0.30 each)

This is a classic case of low liquidity creating significant slippage. It's not uncommon in crypto, where slippage tolerance settings are often set to 2% or higher just to get a trade through. For comparison, an equity trader might buy 100 shares of a stock at $183.53, only for it to fill at $183.57 due to a quick move, resulting in a $4.00 total slippage. The impact in less liquid markets can be much, much bigger. Learn more about financial slippage and its significance on Tickeron.com.

Proven Strategies To Minimize Trading Slippage

Knowing what slippage is marks the halfway point of the battle. The other, more critical half? Learning how to control it. You can never completely eliminate slippage—that’s just the nature of the beast—but you can absolutely take decisive steps to keep it from eating into your profits. This is about shifting from being a passive price-taker to an active manager of your own trades.

Your most powerful weapon in this fight is the limit order. Unlike a market order, which basically screams, "Get me in at any price!", a limit order draws a firm line in the sand. When you place a buy limit order, you're telling the market, "I will not pay a single cent more than this price." A sell limit order does the opposite, declaring, "I won't accept a penny less than this."

This one simple move puts a hard cap on negative slippage. The trade-off, of course, is that your order isn’t guaranteed to execute. If the market zips past your limit price before your order gets filled, you might miss out on the trade entirely. It's a classic risk-reward decision every trader has to make.

Use Smarter Order Types and Tactics

Relying only on market orders, especially when the market is whipping around, is like leaving your front door wide open for slippage to walk right in. A much more disciplined approach involves a mix of smarter order types and a little bit of strategic timing.

-

Avoid Predictable Volatility: Don't trade directly into a hurricane. Slamming a market order moments before or after a major economic news release or a big earnings report is just asking for trouble. It's often better to let the initial chaos die down first.

-

Break Up Large Orders: If you're looking to move a large position, particularly in a less liquid asset, splitting it into several smaller orders can keep you from moving the price against yourself. This tactic, often automated, shrinks your footprint in the market.

-

Choose a Quality Broker: Your broker's execution speed is everything. A broker with sluggish or unreliable order routing can cause slippage even when the market is calm. Look for brokers who are known for lightning-fast execution and direct market access.

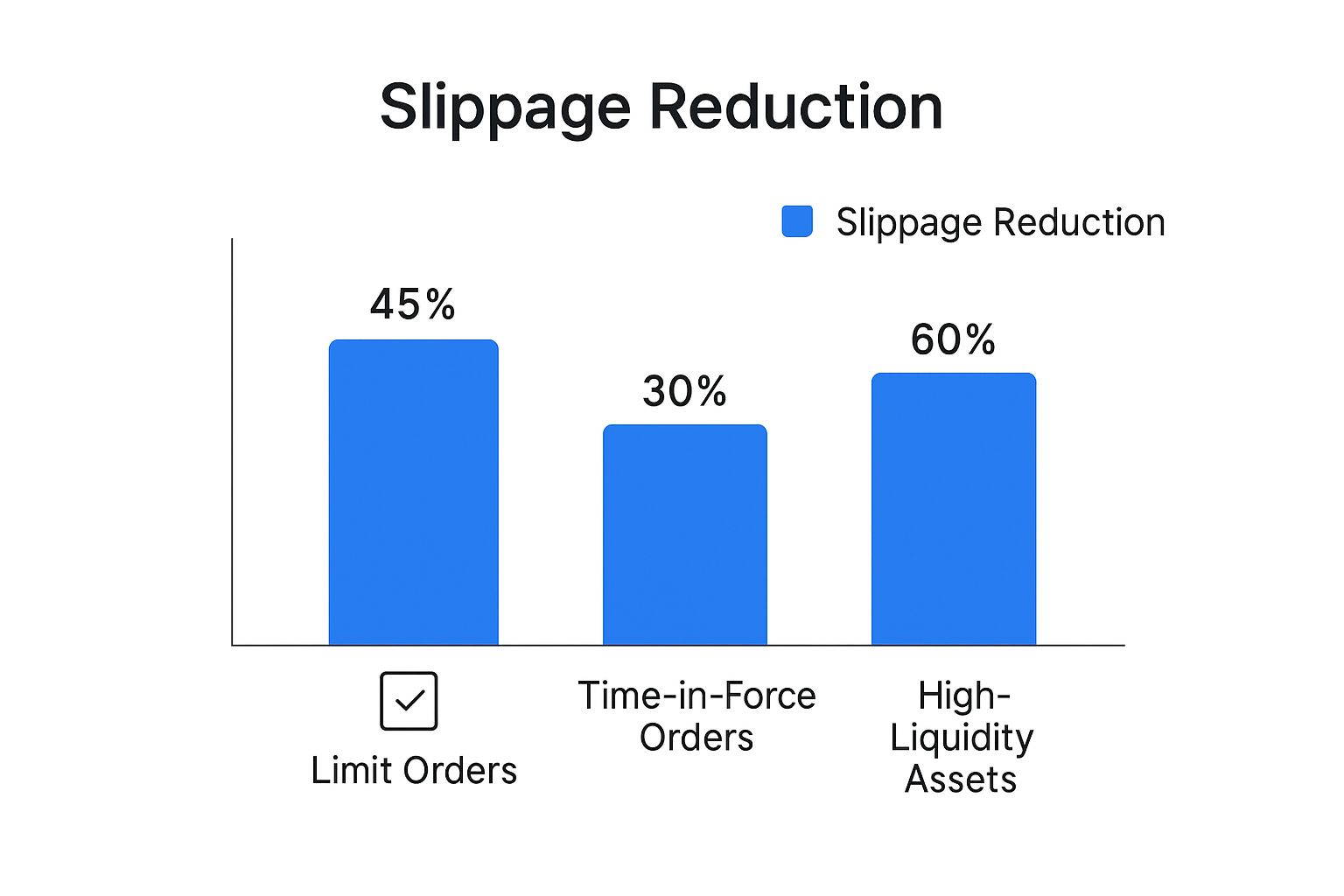

This helpful graphic breaks down how effective different strategies can be at taming slippage.

As you can see, sticking to high-liquidity assets offers the biggest advantage, while using limit orders gives you significant control over the final price you pay.

To really get a handle on this, it helps to see how different order types stack up.

Order Types To Control Slippage

| Order Type | How It Works | Pros for Slippage Control | Cons for Slippage Control |

|---|---|---|---|

| Market Order | Executes immediately at the best available current price. | Guaranteed execution. | Highest risk of slippage, especially in volatile or thin markets. No price control. |

| Limit Order | Executes only at your specified price or better. | Excellent. You define your maximum buy price or minimum sell price, eliminating negative slippage. | Your order may not get filled if the market moves away from your price. |

| Stop-Loss Order | Becomes a market order once a specific price (the "stop price") is hit. | Useful for exiting a losing trade automatically. | Once triggered, it's a market order, so you're fully exposed to slippage. |

| Stop-Limit Order | Combines a stop price with a limit price. Once the stop price is hit, it becomes a limit order. | More price control than a standard stop-loss. You set a price boundary. | The order might not execute if the price gaps past your limit after being triggered. |

Choosing the right order type is situational, but for actively managing slippage on your entries and exits, the limit order is your go-to tool.

Special Considerations for Crypto Traders

In the wild west of decentralized finance (DeFi), managing slippage isn't just a good idea—it's a mandatory skill. Most decentralized exchanges (DEXs) make you manually set your slippage tolerance before you can even confirm a trade.

Slippage tolerance is the maximum percentage of price movement you’re willing to stomach for a trade to go through. Set it too low in a fast-moving market, and your transaction might fail. Set it too high, and you’re giving the green light for significant negative slippage.

For most major crypto pairs like ETH/USDC, a tolerance between 0.5% and 1% is usually a safe bet. But if you’re trading a brand new, low-liquidity altcoin, you might have to crank that up to 3% or even higher just to get the transaction to go through. The best practice is to always start low and only nudge it up if your trade fails.

These tactics are a fundamental part of any solid trading plan. For a deeper look at protecting your capital, check out our guide on mastering day trading risk management. By actively managing how your orders are executed and staying aware of the market environment, you can dramatically cut down the hidden costs of slippage and keep more of your hard-earned profits.

Common Questions Traders Have About Slippage

Once you get the basic idea of slippage, the practical questions start popping up. Let's tackle some of the most common ones that traders ask when they're trying to figure out how this all works in the real world.

Think of this as your go-to cheat sheet for those "what-if" moments.

Can Slippage Be Avoided Completely?

In a word? No. Slippage is just a natural part of any market that’s actually moving. As long as prices are determined by supply and demand, and there's even a millisecond of delay between when you click "buy" and when your order is filled, the potential for slippage is always there.

But while you can't totally get rid of it, you can definitely manage it. The single best way to protect yourself from getting a worse-than-expected price on an entry is to use limit orders instead of market orders. Simple as that.

Is Slippage Always a Bad Thing?

Absolutely not. We tend to fixate on negative slippage—when the price moves against you—but the coin has two sides. Sometimes, you get positive slippage, which is when your order fills at a better price than you were aiming for.

Imagine you place a buy order for a stock at $25.00, but it executes at $24.98. That's positive slippage in your pocket. It’s a nice surprise when it happens, but since you can’t predict it, you can't really build a strategy around it.

Slippage itself isn't good or bad; it's a neutral market mechanic. It’s just the gap between your expected price and the real one, and that gap can work for you or against you.

Does My Broker Cause Slippage?

This is a great question. While your broker doesn't technically create slippage—market forces do that—their technology and efficiency can make it a whole lot better or worse. A broker with slow execution, high latency, or sloppy order routing can turn a small slip into a big one, especially when the market is flying.

To keep this risk in check, here’s what you should look for in a broker:

- Low Latency Execution: The faster your order hits the exchange, the less time the price has to move.

- High-Quality Order Routing: A good broker will intelligently route your order to find the best available price across multiple liquidity pools, not just the easiest one.

- Transparent Execution Policies: Reputable brokers will be upfront about how they handle orders and what their slippage policies are.

Choosing a broker known for fast, reliable execution is a huge part of managing the hidden costs of trading. The wrong one can pour gasoline on an already fiery market condition.

Ready to gain a clearer view of the market? ChartsWatcher provides the advanced scanning and charting tools that professional traders use to identify opportunities and manage risk with greater precision. Explore ChartsWatcher today and take control of your market analysis.