Market Insights: what are extended hours trading

Extended hours trading refers to buying and selling securities outside regular market hours, in the pre-market and after-hours windows. Think of it as a café that opens at sunrise and stays open past sunset, giving you extra time to react to breaking news.

Understanding Extended Hours Trading

• Venues such as ECNs and ATSs route orders once the NYSE and Nasdaq lights go off

• Liquidity thins at odd hours, stretching bid-ask spreads and amplifying volatility

• Traders adjust with limit orders, strict position sizing, and thorough pre-trade reviews

Off-hours sessions give both retail and institutional players a chance to react to earnings surprises and news announcements outside the standard 9:30 AM–4:00 PM ET window.

For instance, a merger unveiled at 4:05 PM ET can spark a sharp price move before the next regular session opens.

Overview of Extended Hours Sessions

Here’s a quick look at the main off-hours sessions and who tends to show up:

| Session | Time Window (ET) | Typical Volume Share | Key Participants |

|---|---|---|---|

| Pre-market | 4:00 AM–9:30 AM | 3%–5% | Institutions, early traders |

| After-hours | 4:00 PM–8:00 PM | 4%–6% | News-driven traders, algos |

This snapshot helps you see when the market thins out and who’s driving the action.

Why Extended Hours Matter

Off-hours markets are quieter, so even a handful of orders can send prices swinging.

“Think of pre-market as an early bird window and after-hours as a night owl session—each has unique opportunities and traps.”

The thinner the book, the wider the swings. That makes timing and risk controls critical.

What You’ll Explore

- How ECNs and ATSs match orders in pre-market and after-hours

- Advantages like front-running news balanced against the challenges of low liquidity

- Risk controls, including limit orders, position sizing, and spread checks

Each section builds on the last, guiding you from basic concepts to advanced off-hours tactics.

Next Steps

Read on to uncover the venues and order types powering pre-market trading and see how after-hours execution and reporting differ.

- Preview ChartsWatcher dashboards for real-time off-hours scanning today

Stay tuned.

Understanding Extended Hours Trading Concepts

Pre-market trading kicks off before the 9:30 AM ET bell, and after-hours action begins once U.S. exchanges close at 4:00 PM ET. This extra window lets you respond to late-breaking news—earnings releases, economic data or sudden headlines—outside the crowded regular session.

Picture a busy midday street that turns into a nearly empty alley at dawn and dusk.

In thin markets every order carries more weight and pushes prices further.

With fewer participants, liquidity shrinks and bid-ask spreads widen, making fills less reliable and price swings more pronounced.

Key Participants In Off Hours

- Retail Traders hunting early entry or exit points on overnight news

- Institutional Desks rebalancing large holdings away from daytime noise

- ECNs and Dark Pools matching orders when main exchanges are closed

Market makers may widen quotes or even step back when volatility surges.

Session Characteristics

| Feature | Regular Hours | Extended Hours |

|---|---|---|

| Time Window | 9:30 AM–4:00 PM ET | 4:00 AM–9:30 AM and 4:00 PM–8:00 PM ET |

| Liquidity | High | Low to Medium |

| Spread Width | Narrow | Wide |

Extended-hours trading now makes up over 11% of daily share volume—about 1.7 billion shares each session, roughly double the 5% seen in Q1 2019. Read more on the NYSE research page.

Key Takeaways

- Note the exact time windows to spot session triggers.

- Anticipate wider spreads and thinner liquidity.

- ECNs, ATSs and dark pools take over when exchanges close.

Treat off-hours as an extension of your strategy, not a separate gamble.

Armed with these fundamentals, you’re ready to explore order types and venue mechanics in depth.

Venue Routing Basics

When exchanges close their open-outcry pits, ECNs and ATSs step in to match orders electronically. Dark pools offer hidden liquidity, letting large trades fill without alerting the wider market.

Many brokers tag pre-market orders with specific flags so they flow directly to targeted ECNs. Behind the scenes, strict protocols keep matching timely and fair.

Why Off Hours Move Faster

Fewer traders mean each bid or ask can tip the price significantly. Wider spreads cushion low liquidity but also drive up transaction costs.

News-driven events—like surprising earnings or Fed updates—often trigger sharper moves after hours. Volatility can easily double or triple once the closing bell rings.

Use tight limit orders and scale position sizes to manage these swings. Tracking volume profiles and quote depth will highlight potential gaps.

Building A Mental Model

Off-hours trading is like paddling upstream on a calm river: smooth on the surface but with a powerful current beneath. Low volume hides intense flows driven by news and large blocks.

Small, precise strokes (your orders) can change your direction dramatically. Keep this image in mind when using ChartsWatcher’s off-hours volume alerts and depth scans.

Now that you’ve got the vocabulary down, let’s move on to practical execution steps. Armed with these insights, you’re ready to master order types, venue tactics and risk controls. Dive in.

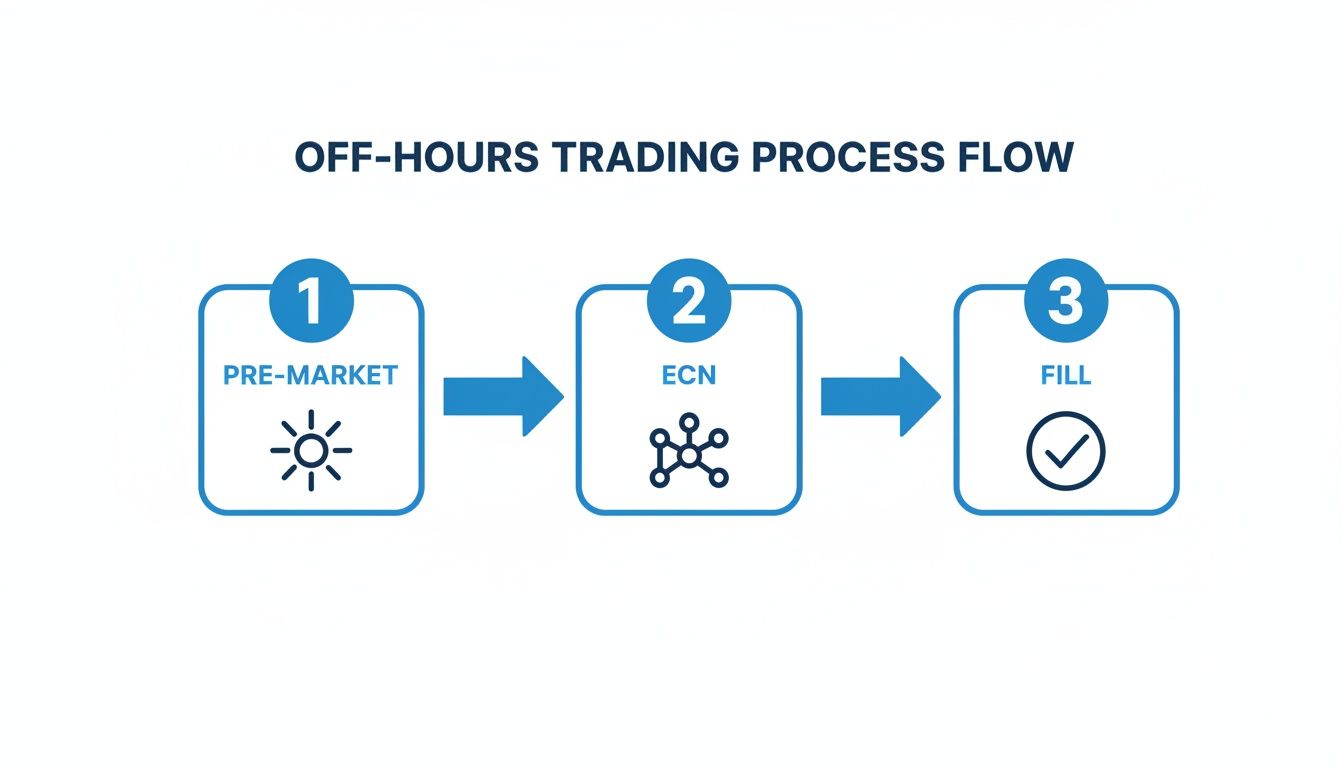

How Off Hours Trading Works

When the NYSE and NASDAQ lights dim, a different network hums behind your screen. Alternative Trading Systems and Electronic Communication Networks (ECNs) pick up the baton, and market makers step in to post bids and asks in thinner waters.

- Alternative Trading Systems route orders when the primary exchanges are closed.

- Electronic Communication Networks (ECNs) match buy and sell orders directly between participants.

- Market Makers widen their quotes to balance risk during low-liquidity windows.

Each player fills a unique role in keeping trades moving. Yet, in these quieter sessions, you’ll often see odd price prints and uneven execution speeds.

Supported Order Types

Extended-hours venues usually accept the same orders you use during regular sessions, but with wilder behavior:

| Order Type | How It Works |

|---|---|

| Limit Order | You set the exact price you’ll buy or sell. It only executes if that price (or better) appears. |

| Market Order | Seeks an immediate fill at the best available quote. Risky when spreads blow out. |

| Stop Order | Rests dormant until its trigger price hits, then converts into a market or limit order. |

These order types become your guardrails when spreads expand and volatility kicks in.

Step By Step Pre-Market Example

Picture this: It’s 8:15 AM ET and you enter a limit order on your brokerage platform. A special flag marks it for the pre-market, so your broker sends it to an ECN handling early trades. That ECN broadcasts your bid, then a matching ask pops up from another trader. Once matched, the ECN confirms the fill back to your broker—and you see the execution update on your dashboard.

Fast-forward to 8:30 AM ET: an unexpected earnings report drops. Quotes leap, spreads widen, and a limit order can be your best defense against surprise fills. For a deeper dive into these early hours, check our guide on early market moves.

Why Spreads And Volatility Matter

When volume dries up, bid-ask spreads act like a toll booth with fewer lanes—costs go up.

Wider spreads are the price of operating in quieter hours.

Meanwhile, overnight news or earnings surprises can send prices rocketing hundreds of ticks in seconds. Placing limit orders helps you avoid getting swept away by those sharp swings.

Broker Routing Differences

Off-hours orders carry special tags that steer them to designated ECNs or ATS pools. Some brokers offer:

- Direct ECN Access across multiple venues.

- Aggregated ATS Routing focusing on a handful of pools.

- Venue Prioritization based on the best displayed price.

Off hours routing depends on your broker’s access and cost structure.

Always review your execution reports to see exactly where—and how—your trades were filled.

Next Steps

Now that you’ve unpacked the mechanics, you’re ready to craft strategies that exploit off-hours flows. Up next, we’ll explore news-driven setups and show you how to configure risk controls in low-liquidity environments using live ChartsWatcher screen layouts.

Benefits And Risks Of Extended Hours Trading

Extended-hours trading opens a window to early price swings and breaking news outside the 9:30 AM–4:00 PM ET session. It lets you jump into moves before the crowd—but it also comes with its own pitfalls when liquidity vanishes.

Picture yourself navigating a narrow mountain pass at dusk. The view is stunning, yet one wrong turn on a lonely road can be costly. Off-hours sessions work the same way: you can lock in big gains or suffer sudden losses in an instant.

Here’s why traders venture beyond the bell:

- Reacting to announcements can pay off handsomely. For example, Tesla shares leapt +8% after-hours on an unexpected earnings beat.

- Capturing favorable prices sometimes means buying at $49.50 pre-market before the regular session opens at $50.00.

- Riding global news flows helps pros tap moves driven by Asian or European markets when U.S. exchanges are dark.

Yet lower participation can widen spreads and spark wild swings around earnings or economic reports. When the order book thins, even a modest order may slip through at an unfavorable price or fail to fill.

Comparison Of Benefits And Risks

Below is a side-by-side look at what makes extended-hours trading attractive—and what to watch out for.

| Aspect | Benefits | Risks |

|---|---|---|

| Liquidity | Access when regular markets are closed | Thin order books leading to wide spreads |

| Price Discovery | Early signals on news and earnings | Sharp price swings with limited depth |

| Execution Cost | Potentially better pre-news pricing | Higher transaction costs as spreads expand |

| Market Access | Engage global events across timezones | Limited counterparties may cause unfilled orders |

Armed with this snapshot, you can measure whether the extra window suits your style. Balancing opportunity against volatility is the first step to trading off-hours with confidence.

Practical Risk Controls

Taming off-hours risk starts with the right orders and sizing:

- Use limit orders to lock in maximum buy or minimum sell prices.

- Practice strict position sizing so a single move won’t derail your portfolio.

Before you hit “send,” run through this quick pre-trade checklist:

- Review scheduled earnings, Fed releases or corporate announcements at least 30 minutes ahead.

- Scan recent volume profiles and liquidity levels on your trading platform.

- Set stop limits or bracket orders to cap potential losses.

“In off-hours, every order moves the market more. Treat each trade as a calculated step on a narrow ridge.”

Real World Examples

Headlines unleashed after the bell often translate into dramatic price action. For instance, Zoom shares jumped +12% after announcing a major partnership at 4:02 PM ET. In contrast, Peloton plunged –9% in post-market trade following mixed guidance.

ChartsWatcher users overlay off-hours candlesticks and volume profiles to catch these swings live. Annotated alerts flag price gaps and spotlight session-specific liquidity shifts.

Key best practices include:

- Monitor company news feeds before both pre-market and after-hours windows open.

- Adjust order sizes in line with displayed depth data to avoid being “run through” thin markets.

- Use bracket orders or one-cancels-other setups to automate exits at predefined levels.

You might be interested in how slippage can widen costs in quiet windows. Check out our practical guide on slippage in trading to see detailed examples.

Next, we’ll explore regulatory rules and margin requirements that shape your extended-hours play. Maintaining tight logs of off-hours fills and reviewing performance over time will sharpen your edge. Master these controls, and those narrow trading roads become far more manageable.

Regulatory Rules And Margin Requirements

Off-hours trading comes with its own playbook once the regular session ends. Liquidity dries up, and brokers raise margin requirements to cushion against sudden swings.

Pattern day trader rules don’t take a coffee break after 4:00 PM ET. If you’re tagged as a PDT, you still need $25,000 in your account. Over the years, firms have added extra layers of approval—think of them as permits—to let you trade overnight or in extended windows.

Key Off-Hours Margin And Approval Highlights:

- Pattern day trader equity floor $25,000

- Pre-market margin multiplier up to 3x

- Overnight window requires broker agreement

- After-hours margin rules mirror pre-market

Market data gets bumpy too. SIP feeds pause from 8:00 PM to 4:00 AM ET, leaving a gap in the consolidated tape. Meanwhile, patchwork rules across exchanges, ATSs and ECNs can muddy best-execution standards.

Proposed Near 24 Hour Trading Models

Since late 2023, regulators and venue operators have been testing near-round-the-clock trading. In November 2024, the SEC gave one exchange the green light for overnight sessions. Other exchanges are in talks about multi-hour or full 24-hour windows.

Learn more about this shift on the World Economic Forum site World Economic Forum: 24/7 Trading Impact.

“Extended hours rules ensure fair access but demand extra diligence,” said a senior exchange official.

Broker fees often climb after hours. You may pay more per share or per order, and limit-only matching could replace other execution types. Always double-check your broker’s commission and routing disclosures—some waive fees at certain venues but tack on data-access charges.

Execution paths can shift based on clearing arrangements. Understand principal versus agency routing before sending off-hours orders.

Compliance Checklist And Safeguards

Treat off-hours trading like a pre-flight checklist. Run through each item before takeoff:

- Check $25,000 equity balance for pattern day trader status

- Verify session-specific margin multipliers for pre-market and after-hours

- Obtain broker consent for overnight or 24-hour extensions

- Record SIP feed windows and any data gaps

- Set stop-limit guardrails and per-trade loss caps

Use stop-limit orders and size caps to protect your capital. Review extended-hours P&L and drawdowns in a separate report.

ChartsWatcher users can add custom alerts for margin thresholds, trade approvals and session boundaries. Visual flags pop up on your layout, making sure each order ticks the compliance boxes before execution.

With clear rules, sign-off steps and margin safeguards in place, you can treat pre-market and after-hours sessions as a controlled trading arena rather than a risk minefield.

Next up, we’ll dive into practical strategies and show how ChartsWatcher can monitor off-hours activity with live screenshots and real examples.

Ensure compliance to keep the windows open.

Practical Strategies For Off Hours Trading

Trading outside the bell can feel like stepping into uncharted waters. But with a clear checklist and tested tactics, you can turn those off-hour swings into real chances to profit. This guide walks you through every stage—from your pre-trade review to scanning with ChartWatcher—so you trade with confidence when volumes thin out.

Pre Trade Checklist

To kick things off, make sure your broker actually lets you place pre-market and after-hours orders. Next, switch to limit orders so your fills stay within the price ranges you choose. Finally, tune into any upcoming news events that could rock the market and size your positions for the thinner volume.

- Pick a limit order price based on the recent bid-ask spreads and your own risk tolerance.

- Scan news feeds for earnings releases, economic data drops or geopolitical headlines.

- Review volume profiles from the past few sessions to see where liquidity is thick or thin.

- Cap your position sizes so one trade can’t blow out your margins.

The table below highlights core steps in your pre-trade review and why they matter.

| Checklist Item | Purpose | Benefit |

|---|---|---|

| Limit Orders | Control price | Avoid bad fills |

| News Scan | Spot catalysts | Timing advantage |

| Position Size | Manage risk | Prevent overexposure |

This table highlights core steps in your pre-trade review and why they matter for off hours.

Using ChartWatcher Tools

ChartWatcher’s dashboards are built for when the market slows down. You can zoom into custom time ranges to isolate pre-market or post-market candles in seconds. Layer in session VWAPs to see if price is trading near key averages. And take a peek at the order book depth to spot hidden bid or ask clusters.

Here is a screenshot that shows the extended-hours volume profile overlay in ChartWatcher.

That view quickly reveals zones where price tends to stall when liquidity dries up.

Blending Off Hours Signals

Once you spot a signal—say, a pre-market breakout through VWAP—don’t rush in blindly. Watch for the first regular session candle after 9:30 AM ET. If price holds above that level, you’ve got a green light to add to your position.

- Identify an off-hours trigger like a sudden volume spike or breakout.

- Wait for the first 15-minute candle in regular hours to close above or below the key level.

- Test the move by entering a portion of your planned size.

- Only scale up if the price sustains through the 30-minute mark.

Best Practices And Risk Controls

Risk management ramps up in the off hours. Always plan your exits and keep your sizes conservative.

Off hours trading without strict controls is like driving a narrow mountain road at dusk—exhilarating but dangerous.

- Use stop-limit or bracket orders to lock in your exit before you even enter.

- Cap your intraday exposure so no single swing can trigger a margin call.

- Log your fill prices, venues and spread widths for later review.

By combining a pre-trade checklist, ChartWatcher insights and structured setups, you’ll trade off hours with a system, not just hope.

After running through your checklist, tweak your ChartWatcher workspace. Build a dedicated off-hours layout with alerts, VWAP overlays and time filters.

Configuring Off Hours Alerts

In ChartWatcher, you can set alerts that fire when volume spikes exceed your threshold in pre-market or after-hours. You can also catch the early signs of a liquidity squeeze by watching the bid-ask gap.

- Set a volume spike alert at 150% of average off hours volume.

- Trigger a spread expansion alert when the bid-ask widens beyond your tick count.

- Filter symbols by sector to watch the most active names during thin sessions.

These alerts keep you one step ahead, flagging sudden shifts before the regular session even starts.

Tagging News Catalysts

Nothing beats seeing headline events plotted right on your chart. Tag earnings announcements, economic reports and guidance drops to connect the dots between news and price action.

- Use event tags to mark earnings release times.

- Add economic calendar markers for FOMC meetings or CPI prints.

- Highlight company news like M&A announcements or product launches.

These visual cues help you dissect how price reacts when the news hits, so you can refine your entry rules.

Combining Off Hours And Regular Session Data

Real precision comes from marrying off-hours clues with regular session confirmation. Picture a stock that tests pre-market support and then bounces as the bell rings. Aligning your off-hours VWAP with the first few candles in regular hours gives you high-confidence entries.

- Use off hours VWAP to map out key price zones.

- Watch the first regular session candle closes against those levels.

- Enter or add to your position if price respects the zone.

- Adjust stops based on combined session ATR to reflect overall volatility.

This two-session approach throttles back false breakouts and lets you scale in with conviction.

Reviewing Session Metrics

Keep an eye on session-specific stats like trade count, average spread and VWAP divergence. ChartWatcher shows these numbers live, so you can sense when liquidity conditions shift.

- Trade Count shows how many orders traded in your session filter.

- Average Spread highlights your true cost of execution.

- VWAP Divergence measures the gap between pre-market and regular hours VWAP.

Monitoring these metrics keeps you grounded. When spreads blow out or trade count falls off, it’s a signal to pull back or dial in your tactics.

Frequently Asked Questions

Extended-hours trading can feel like a different arena compared to the regular session. Traders often ask the same four questions: What order types work best? How deep is the liquidity? Which venues can I reach? And how do margin rules shift once the bell rings? Below, you’ll find down-to-earth answers and practical tips for your next off-hours play.

Best Pre-Market Order Types

In the pre-market, you’re often trading in a half-empty stadium. With fewer buyers and sellers, limit orders and stop orders let you set your own guardrails.

- Limit Orders lock in the exact price you want, so you won’t get swept up by wild swings.

- Stop Orders only kick in when a trigger price is hit, giving you a safety net against sudden moves.

- Market Orders execute instantly—but beware of wide spreads that can balloon your costs.

“When volume is low, anchoring your trade with a limit or stop order prevents nasty surprises.”

How Liquidity Differs After Market Close

Once the closing bell rings, you’ll often see volume dip to 50% (or less) of the regular session. That means thinner order books, slower fills, and sharper price hops.

- Check recent trade counts to find pockets of activity.

- Watch the bid-ask gap so you don’t send an order that never gets filled.

- Scale your order size to match the displayed depth.

Off-Hours Venue Access

Not every broker taps into all the off-hours Electronic Communication Networks (ECNs) or Alternative Trading Systems (ATSs). Retail platforms can limit your pool of potential matches.

- Review your broker’s extended-hours venue list.

- Confirm your platform flags orders as pre-market or after-hours.

- Tweak your settings to cover as many ECNs/ATSs as possible.

Off-Hours Margin Requirements

When the market closes, many brokers tighten margin calls. If you’re tagged as a pattern day trader, you still need $25,000 equity. And during off-hours, margin multipliers can jump to 2x–3x.

- Always check your broker’s off-hours margin rates before you place a trade.

- Build a cash cushion to absorb potential margin calls.

- Consider reducing position sizes if your available buying power shrinks.

Ready to turn these answers into action? Keep this checklist handy for your next pre-market or after-hours session—and trade with confidence.

Ready to master off-hours trading? Explore real-time scanning and custom dashboards at ChartsWatcher.