What is Pre Market Trading? A Complete Guide to Early Market Moves

Ever wonder how a stock can jump or tank the moment the market opens? The action often starts hours before the opening bell. This early session is called pre-market trading, and it's where the tone for the entire trading day is set.

Think of it as the market's early-morning warm-up. It's an exclusive window where traders get a chance to react to overnight news—like a blockbuster earnings report or a major global event—before the floodgates open to the general public.

What Is Pre Market Trading?

Pre-market trading is simply a special session that happens before the stock market's official opening at 9:30 AM ET. It doesn't happen on the main exchanges like the NYSE or Nasdaq. Instead, it runs on electronic networks that match buyers and sellers directly.

This early access is crucial because company news and world events don't stick to a 9-to-5 schedule. If a big tech company announces a game-changing partnership at 6 AM ET, traders in the pre-market can act on that information immediately rather than waiting three and a half hours for the market to open. This initial flurry of activity provides a sneak peek into investor sentiment and can signal where the market might be heading for the day.

Why Does Pre Market Trading Even Exist?

At its core, the pre-market exists so the market can start digesting news that breaks outside of normal business hours. The activity here is almost always driven by fresh, market-moving information.

A few key catalysts get things moving:

- Earnings Reports: Many companies strategically release their quarterly results after the market closes or well before it opens. This is a huge driver of pre-market volatility.

- Global News: Economic data coming out of Europe or Asia can have a massive ripple effect on U.S. markets. Geopolitical shifts and overseas central bank decisions also play a big role.

- Company Announcements: Big news like mergers, acquisitions, new product reveals, or FDA approvals often drop outside the standard 9:30 AM to 4:00 PM ET window.

To give you a better idea of how these two sessions stack up, here’s a quick side-by-side comparison.

Pre Market Trading vs. Regular Market Trading At A Glance

This table breaks down the fundamental differences between trading before the opening bell and during the main session.

| Feature | Pre Market Trading | Regular Market Trading |

|---|---|---|

| Hours | Typically 4:00 AM to 9:30 AM ET, but varies by broker. | 9:30 AM to 4:00 PM ET. |

| Liquidity | Lower. Fewer buyers and sellers mean it can be harder to get your order filled. | High. Millions of participants ensure deep liquidity for most stocks. |

| Volatility | Higher. With less trading volume, even small orders can cause big price swings. | Lower (relatively). Prices are more stable due to the high volume of trades. |

| Price Spreads | Wider. The gap between the bid (buy price) and ask (sell price) is often larger. | Tighter. High competition keeps the bid-ask spread narrow. |

| Order Types | Generally limited to limit orders. Market orders are usually not allowed. | All order types are available (market, limit, stop, etc.). |

| Primary Drivers | Overnight news, earnings reports, and global events. | A broad range of factors, including economic data, sector trends, and intraday news. |

| Participants | A mix of institutional investors and active retail traders. | Everyone, from large institutions to casual retail investors. |

While the table gives a great overview, the key takeaway is that the pre-market is a completely different beast—it's faster, riskier, and driven by immediate reactions.

Who Is Trading in the Pre Market?

Not too long ago, this early session was the exclusive playground of big-shot institutional investors and Wall Street pros. But thanks to online brokerages, the doors have swung open for just about everyone. Today, any retail trader with an account that offers extended-hours trading can jump into the action.

But be warned: pre-market trading is known for its low liquidity and high volatility. Fewer traders mean wider spreads and the potential for wild price swings. A small buy or sell order that would barely make a ripple during regular hours can cause a huge splash in the pre-market.

To really get a feel for what’s happening, you need to look beyond the price and see the order book. Getting familiar with Market Data Level 2 is a game-changer here. It shows you the full list of buy and sell orders at different prices, giving you a crucial look at supply and demand when volume is thin.

The Pre Market Trading Timeline

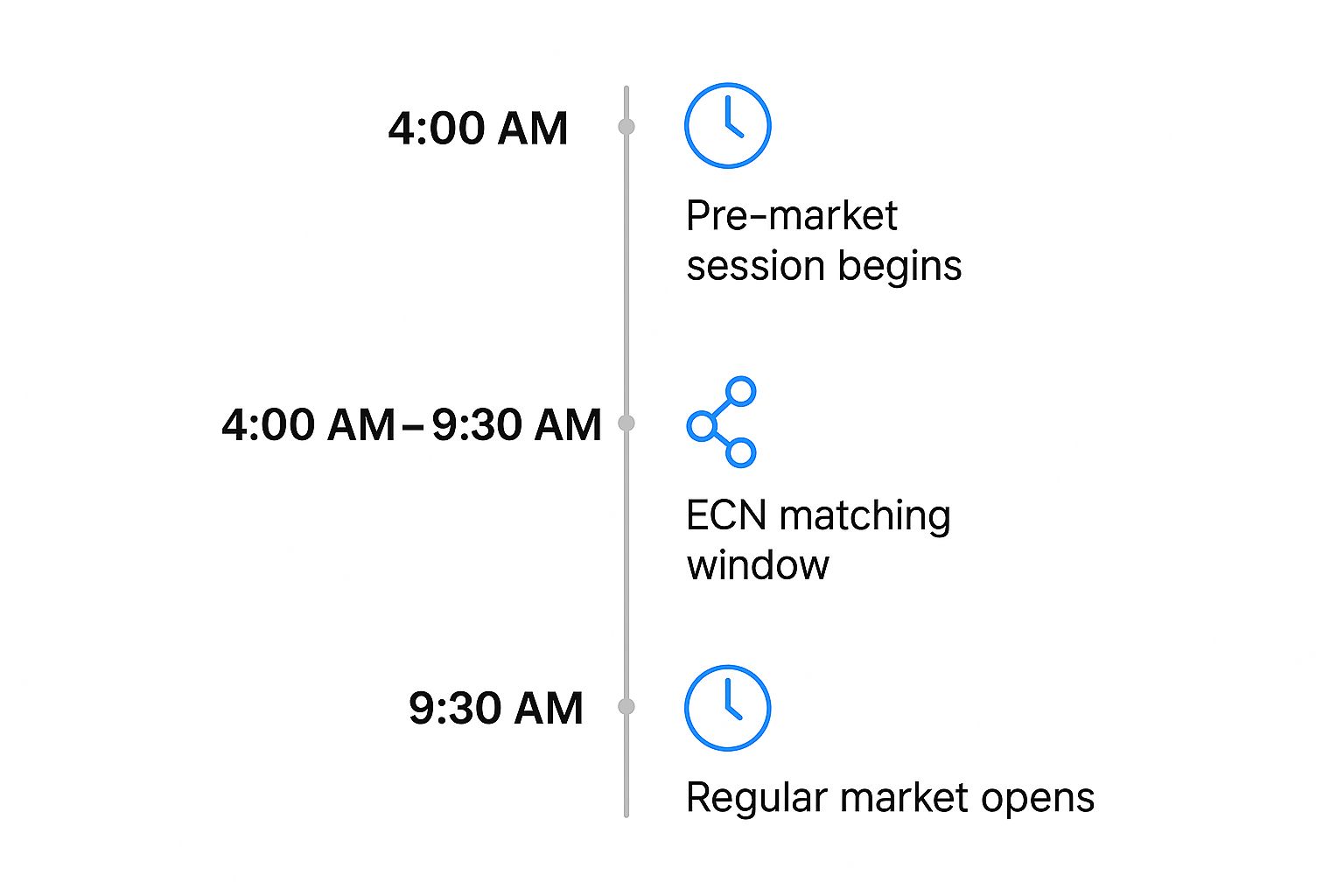

To really get what pre-market trading is all about, you have to understand its unique schedule. It’s not like the rigid 9:30 a.m. to 4:00 p.m. Eastern Time bell-to-bell session. The pre-market is a more fluid, exclusive window where the early action happens.

Officially, the pre-market session in the U.S. runs from 4:00 a.m. to 9:30 a.m. ET. This five-and-a-half-hour block gives investors a chance to react to overnight news, earnings reports dropped after the previous day's close, or major global events.

But here’s a key detail: not everyone gets to play at 4 a.m. Brokerage access varies, with many only opening the gates for their clients at 7:00 a.m. or even 8:00 a.m. ET. Always check with your platform to see what their specific hours are.

Because this all happens before the major exchanges like the NYSE or Nasdaq officially open, the mechanics are different. Orders aren't routed through the usual channels. Instead, they are matched up through Electronic Communication Networks (ECNs). Just think of ECNs as digital matchmaking services that connect buyers and sellers directly, no middleman required.

As you can see, this whole pre-9:30 a.m. world relies on these networks to get trades done before the opening bell rings and the main event begins.

Navigating Lower Liquidity

The single most important thing to understand about these early hours is liquidity—or rather, the lack of it.

Think of the difference between a quiet country road at 5 a.m. and a major highway at rush hour. The pre-market is that country road. With far fewer cars (traders), the flow is completely different, and one big truck (a large order) can have a massive impact. This is what traders call "thin" trading.

Because participation from market makers and ECNs is voluntary, liquidity in the pre-market is generally lower. This can lead to more volatile price movements and wider bid-ask spreads, potentially resulting in less favorable prices compared to regular market hours.

This lower volume means finding a buyer for your shares, or a seller for the stock you want to grab, can be tougher. It also means a relatively small order can make a stock's price spike or tank in a way you'd rarely see during the main session. For a deeper dive into pre-market dynamics, Nasdaq's official site offers some great insights.

Strategic Opportunities In Early Trading

So, why would anyone willingly jump into the volatile, thinly-traded pre-market session? It really boils down to one thing: getting a head start. The pre-market is a chance to act on game-changing information before the rest of the herd rushes in at the opening bell.

Imagine a biotech firm drops a press release at 6 AM ET announcing a major drug approval. A pre-market trader could potentially scoop up shares right then and there. They get in before the 9:30 AM bell signals a flood of buy orders that could send the stock into the stratosphere.

This early access is all about capitalizing on overnight news that creates significant price gaps between yesterday's close and today's open.

Finding An Edge Before The Bell

But it's not just about reacting to bombshell news. The pre-market also works as a fantastic sentiment gauge, offering clues about which way the wind might be blowing for the rest of the day.

Here are a few of the key opportunities that draw traders into the early hours:

- Reacting to Earnings: A company reports blowout earnings after the bell. That stock is almost certainly going to see a flurry of activity in the pre-market. Traders can jump in early to ride that wave of positive momentum.

- Capitalizing on Global Events: Major economic data out of Europe or a market swing in Asia doesn't happen in a vacuum. These events can create powerful ripple effects in U.S. markets, and the pre-market is the first chance to react.

- Securing Better Entry or Exit Points: If you're convinced a stock is going to gap up big on good news, buying in the pre-market might get you a much better price. On the flip side, if bad news breaks, you can get out before the panic selling starts in the regular session.

Pre-market activity is a fantastic snapshot of investor sentiment. A stock gapping up on high volume is a powerful signal that bullish momentum could easily carry over into the main session.

Think about the immediate, powerful price moves that happen after a huge merger is announced or a company gets an unexpected FDA approval. Being able to place a trade in those early hours is a massive strategic advantage.

Learning how to trade pre-market like a pro means getting good at spotting these catalysts and understanding the risks that come with them. The real goal is to act on information that the broader market hasn't had a chance to fully digest and price in yet.

Navigating The Hidden Risks Of Pre Market Trading

While the pre-market offers a tantalizing head start, it’s a totally different ballgame than regular trading. The allure of acting on early news is strong, but you have to balance that excitement with a clear-eyed understanding of the pitfalls that can easily trap unprepared traders.

The biggest challenge by far is low liquidity. With fewer buyers and sellers active, it can be a real struggle to get your trades filled at a decent price. This thin trading environment leads directly to another major risk: much wider bid-ask spreads.

Think of the spread as a hidden fee you pay on every trade. During pre-market hours, the gap between what buyers are willing to pay (the bid) and what sellers are asking for (the ask) can be massive. This means you’re already at a disadvantage the moment you enter a position. If you want to dive deeper into this, it's worth understanding what market liquidity is and why it matters.

Volatility and The Big Players

Beyond liquidity issues, the low volume in these early sessions can trigger extreme price volatility. A single large order can send a stock’s price shooting up or crashing down in minutes. These moves often don't reflect the stock’s true value and can completely reverse once the opening bell rings.

You’re also not trading in a vacuum. You're up against institutional investors who have access to far more sophisticated data and tools. They can analyze information and execute trades faster, putting retail traders at a clear disadvantage in this less-regulated arena.

Because of the wild price swings and wide spreads, using a limit order isn’t just a good idea—it’s an essential rule for survival in the pre-market. A limit order ensures your trade only executes at your specified price or better, protecting you from getting a terrible fill.

This next image shows a list of pre-market movers, giving you a sense of which stocks are seeing the most action before the market opens.

Look at those huge percentage changes on relatively little volume. It perfectly highlights the high-risk, high-reward nature of this session. While these early moves can offer clues, they are far from a guarantee of how a stock will trade during regular hours.

How Global Markets Set The Stage For US Pre Market Action

The U.S. stock market doesn't exist in a vacuum. Long before the opening bell rings in New York, a whole trading day has already unfolded across the globe, creating powerful ripple effects that set the tone for the U.S. pre-market session.

Think of it as a global relay race. The baton is passed from Asia to Europe, and finally to the U.S. Each market reacts to its own local news—economic reports, central bank decisions, or major corporate earnings. The resulting sentiment, whether bullish or bearish, quickly spills over into U.S. index futures like the S&P 500 E-minis, which trade nearly 24/7.

This makes global market performance a crucial early indicator for anyone trying to get a read on the U.S. open.

Asia Kicks Things Off

The trading day really begins in Asia. Major indices in Japan (the Nikkei) and Hong Kong (the Hang Seng) set the initial mood for global investors.

For instance, on one recent day, Japan's Nikkei 225 jumped over 3.3% while Hong Kong's Hang Seng index climbed 2.42%. These moves weren't random; they were reactions to local economic data and overnight developments. Traders worldwide watch these numbers closely, and you can discover more insights on Business Insider about how these early moves shape sentiment.

Europe Carries The Baton

As Asian markets wind down, European exchanges in London, Frankfurt, and Paris are in full swing. Big news, like Germany’s latest manufacturing numbers or an inflation report from the Eurozone, can send shockwaves that move both European stocks and U.S. futures.

By the time most U.S. traders are just waking up and grabbing their first cup of coffee, the global market has already been digesting news for hours. This continuous flow of information creates a narrative that professional traders use to anticipate the market's opening direction.

An unexpected interest rate decision from the European Central Bank (ECB) can send U.S. index futures soaring or tumbling well before 4:00 AM ET, directly impacting what is pre market trading for American stocks.

Essentially, by monitoring these international dominoes, savvy investors gain a valuable edge. They can see the story developing and position themselves to react long before their own trading day officially begins.

Got Questions About Pre-Market Trading?

Even after you get the hang of the basics, some practical questions always pop up about trading in the early hours. Let's clear up some of the most common ones so you can trade with more confidence.

Can I Actually Trade In The Pre-Market As A Retail Investor?

You bet. Gone are the days when this was a playground reserved for the pros. Most major online brokers now give retail clients access to extended-hours trading.

You'll usually have to enable it in your account settings and click through a disclosure form acknowledging the extra risks. Once that's done, you're clear to react to overnight news and place trades right alongside the big firms. Just make sure you understand the unique challenges before jumping in.

What's The Best Order Type To Use?

This one isn't up for debate: the limit order is your best and only friend in the pre-market. This order type lets you set the exact maximum price you're willing to pay for a stock or the minimum price you're willing to sell it for.

Think of a limit order as your safety net. The pre-market is notoriously volatile with wide gaps between the bid and ask prices. A limit order protects you from getting a terrible fill price, which is almost guaranteed to happen if you use a market order.

Seriously, avoid market orders at all costs during these sessions. They are a recipe for disaster.

Does Pre-Market Action Really Predict The Rest Of The Day?

It can offer some valuable clues, but it's far from a crystal ball. Think of it as an early poll, not the final election result. A big price jump on unusually high pre-market volume is a decent signal that the momentum might just carry over into the regular session.

But here’s the catch: the volume is so thin that a few large trades can easily shove a stock price around. It's not at all uncommon to see a stock soar pre-market only to completely reverse course when the opening bell rings and the institutional floodgates open. Always treat these early moves with a healthy dose of skepticism.

Stop guessing and start seeing. ChartsWatcher gives you the professional-grade scanning and charting tools needed to find real pre-market movers and manage your risk before everyone else piles in. Start analyzing the market like a pro today.