MACD Trading Strategy: Proven Techniques for Success

Demystifying the MACD Indicator: Beyond the Basics

The MACD indicator is a cornerstone of technical analysis. Traders use it to identify potential buy and sell signals based on market momentum. It's a powerful tool that can provide valuable insights when used correctly. This means understanding not just what the MACD is, but also how it reflects underlying market psychology.

One of the core principles behind the MACD is its ability to reveal momentum shifts before they're obvious in price action. This early warning system is what attracts many traders to the indicator. For example, imagine a stock price trending upwards. Even while the price continues to rise, the MACD might show a decrease in momentum, hinting at a potential reversal.

Understanding the MACD Components

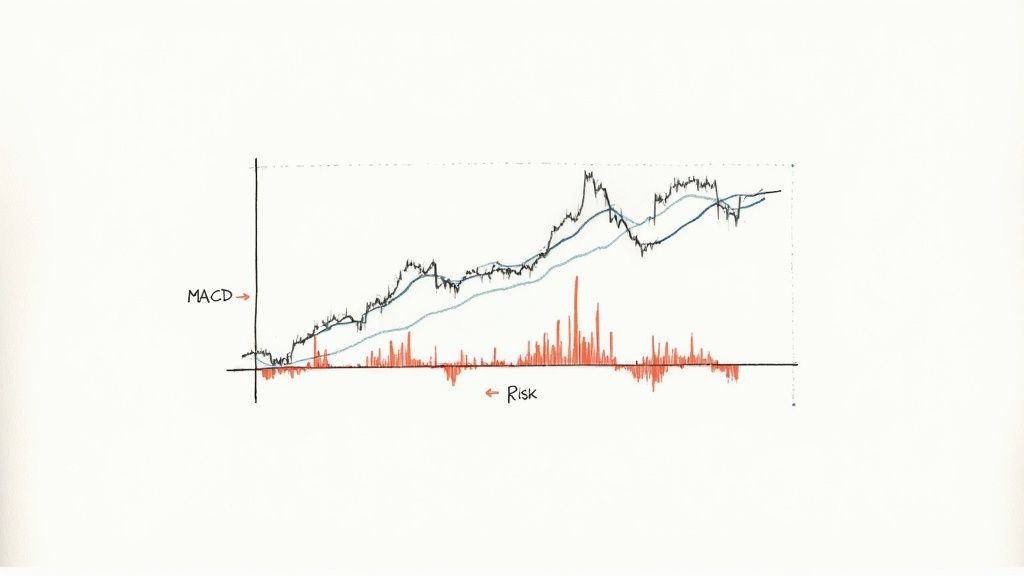

The MACD indicator has three key components: the MACD line, the signal line, and the histogram. The MACD line is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. This provides a short-term view of momentum.

The signal line, a 9-period EMA of the MACD line itself, acts as a smoother, slower momentum indicator. Finally, the histogram visually represents the difference between these two lines. The MACD indicator, developed by Gerald Appel in the late 1970s, is widely used in technical analysis to identify price trends and momentum shifts. It consists of three main components: the MACD line, the signal line, and the histogram.

The MACD line is calculated by subtracting the 26-period EMA from the 12-period EMA, while the signal line is a 9-period EMA of the MACD line. The histogram represents the difference between the MACD line and the signal line. This provides insights into the strength of the trend. Explore this topic further here.

Interpreting MACD Signals

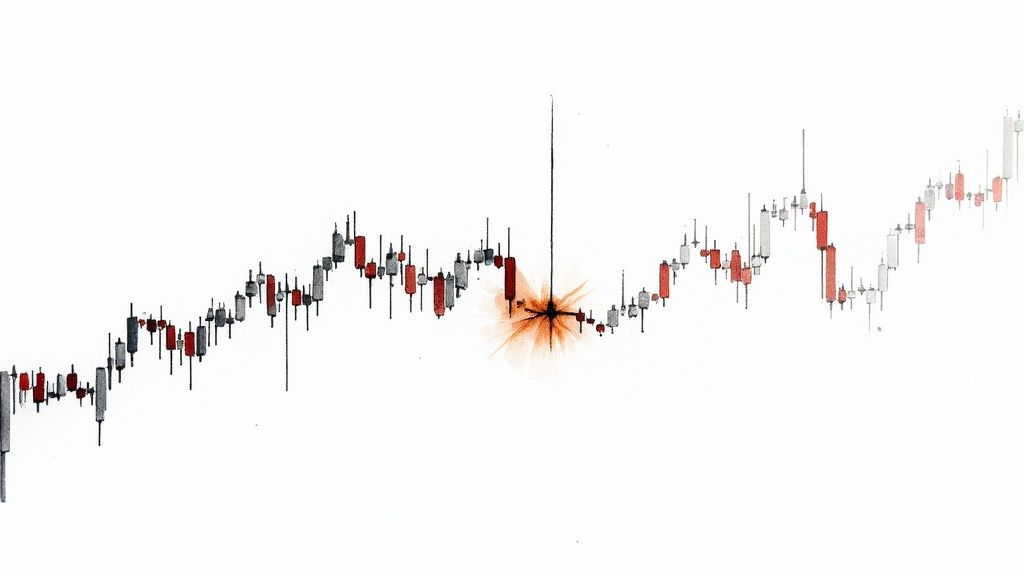

Traders often focus on crossovers between the MACD line and the signal line. A bullish crossover, where the MACD line crosses above the signal line, is often seen as a buy signal. Conversely, a bearish crossover (MACD line crossing below the signal line) can be interpreted as a sell signal. However, relying only on these crossovers can be misleading.

The histogram also provides crucial context. A widening histogram suggests increasing momentum, while a narrowing histogram indicates weakening momentum. This helps traders assess the trend's strength and filter out potential false signals. You might be interested in: Top Stock Market Analysis Techniques for Savvy Traders.

Understanding the MACD indicator's components is essential for developing effective MACD trading strategies. By combining these insights with other technical analysis tools and a solid grasp of market context, traders can significantly improve their decision-making process.

High-Probability MACD Setups That Consistently Deliver

Beyond the basics, let's explore how seasoned traders utilize the MACD indicator to identify high-probability setups. This involves understanding not only the individual components – the MACD line, signal line, and histogram – but also the nuances of their interactions within specific market conditions. Mastering these setups can significantly improve your trading strategy. The MACD trading strategy has shown historical effectiveness across various markets, boasting a success rate of approximately 81.41% and a profit factor of 1.51. However, real-world trading often yields lower win rates. This highlights the importance of thorough strategy analysis and effective risk management. The strategy is particularly well-suited for stock indices, stocks, commodities, currencies, and cryptocurrencies. The MACD indicator relies on the relationship between two exponential moving averages (EMAs) of an asset's price, making it a valuable tool for identifying trend momentum and potential entry points. For a deeper dive into MACD trading strategy statistics, check out this resource: MACD Accuracy.

Signal Line Crossover Strategy

The signal line crossover is a core MACD trading strategy. However, simply buying when the MACD line crosses above the signal line (bullish crossover) and selling when it crosses below (bearish crossover) can be risky. Experienced traders use filters to refine these signals.

One such filter is trading in confluence with the prevailing trend. This means only taking bullish crossovers in an uptrend and bearish crossovers in a downtrend. This helps avoid whipsaws and false signals.

Traders also consider the slope of both the MACD line and the signal line. A steep slope indicates strong momentum, while a shallow slope suggests weaker momentum and a higher chance of a false signal. Analyzing the slope in conjunction with the overall market context provides a more reliable signal.

MACD Divergence Patterns

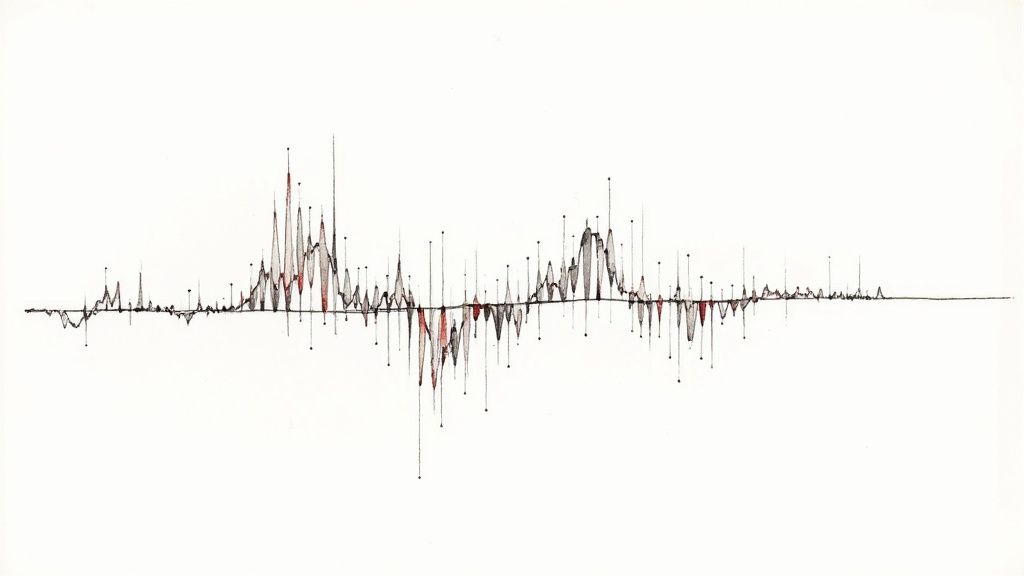

MACD divergence is a powerful indicator that often precedes significant market reversals. It occurs when the price action of an asset diverges from the movement of the MACD indicator. This divergence can be either bullish or bearish.

A bullish divergence occurs when the price makes lower lows, but the MACD forms higher lows. This often suggests underlying buying pressure and a potential upward reversal. Conversely, a bearish divergence appears when the price makes higher highs, but the MACD makes lower highs. This indicates weakening momentum and a potential downward turn. For instance, if a stock price hits new highs, but the MACD doesn't, it signals waning buying pressure.

Analyzing Histogram Dynamics

Many traders focus on whether the histogram is above or below the zero line, but the real value lies in analyzing changes in the histogram’s height and width.

A widening histogram, whether positive or negative, indicates increasing momentum. Conversely, a narrowing histogram suggests weakening momentum. This information helps traders anticipate potential trend reversals or continuations. The histogram acts as a visual representation of momentum strength.

Practical Entry and Exit Guidelines

Each MACD setup requires specific entry and exit criteria. For example, with the signal line crossover strategy, the entry might be when the MACD line decisively crosses the signal line, while the exit could be the next opposing crossover or a predetermined profit target. Having a clear plan is essential.

Professional traders also prioritize proper position sizing based on their risk tolerance and market conditions. They understand that even the best strategies experience drawdowns. Careful position sizing helps preserve capital during these inevitable periods and contributes to long-term success.

Let's take a closer look at how these signals can be interpreted in different market environments. The following table summarizes common MACD trading signals, their reliability, and the optimal market conditions for each:

Common MACD Trading Signals Comparison

| Signal Type | Reliability Rating | Best Market Conditions | Typical Stop Loss Range |

|---|---|---|---|

| Signal Line Crossover | Medium | Trending Markets | Below recent swing low (bullish) / Above recent swing high (bearish) |

| Bullish Divergence | High | Ranging or Downtrending Markets | Below the lowest low of the divergence pattern |

| Bearish Divergence | High | Ranging or Uptrending Markets | Above the highest high of the divergence pattern |

| Widening Histogram | Medium | Trending Markets | Below recent swing low (bullish) / Above recent swing high (bearish) |

| Narrowing Histogram | Low | Ranging Markets | Below recent swing low (bullish) / Above recent swing high (bearish) |

This table provides a general guideline for interpreting MACD signals. It's important to remember that no indicator is perfect, and combining MACD with other technical indicators and fundamental analysis is always recommended. By understanding the nuances of each signal and applying appropriate risk management techniques, you can significantly improve your trading performance using the MACD indicator.

Customizing MACD Parameters For Your Trading DNA

The standard MACD settings (12, 26, 9) are a good place to start, but they're not universally ideal. Every trader has a unique style, and your MACD parameters should reflect that. Understanding how these numbers impact your trading signals is key to maximizing this versatile indicator. It's about balancing the interplay between the fast and slow moving averages (the first two parameters) and the signal line (the third parameter).

Fine-Tuning the Fast and Slow Moving Averages

The fast and slow moving averages are at the core of the MACD. They determine how sensitive the indicator is to price changes. A shorter fast-moving average (like 5 instead of 12) makes the MACD highly responsive to recent price movements. This generates more frequent crossover signals.

However, a flood of signals isn't always a good thing. This heightened sensitivity can lead to false signals, triggering trades based on fleeting price fluctuations.

On the flip side, using longer moving averages (like 21 and 50) makes the MACD less sensitive. This helps reduce false signals, but it can also mean missing profitable opportunities as the indicator lags behind market changes.

Finding the right balance is essential. A day trader, for instance, might favor shorter-term averages, while a swing trader could benefit from longer periods.

Optimizing the Signal Line for Smoother Signals

Derived from the MACD line, the signal line acts as a smoother, slower indicator. It helps filter out some of the "noise" from the faster MACD line. Adjusting the signal line period can further refine your strategy.

A shorter signal line (like 5 instead of 9) provides faster crossovers. But, as with the moving averages, a shorter period can also increase false signals. A longer signal line (like 13) further smooths the indicator, providing more reliable but less frequent signals, which may suit swing or position traders.

MACD is often used in mean reversion trading strategies. These strategies assume prices will revert to their average. By identifying overbought and oversold conditions through MACD crossovers, traders can anticipate reversals. This approach requires careful backtesting and parameter optimization. Analyzing historical data is crucial for evaluating the strategy's effectiveness. Find more detailed statistics here.

Finding Your Optimal MACD Parameters

There's no universally "best" MACD setting. The ideal parameters depend on your individual trading style, time frame, and risk tolerance.

Systematically testing different combinations is vital. Backtest various settings on historical data to see their past performance. Documenting your findings, including win rates, average profit/loss, and maximum drawdown, is essential. Through testing and meticulous record-keeping, you'll find the parameters best suited to your needs. This helps capture profitable moves while minimizing the impact of false signals. Remember, the goal isn't to eliminate all false signals (an impossible feat), but to find the balance that maximizes your overall performance.

Power Combinations: MACD Plus Complementary Indicators

While the MACD indicator is powerful on its own, combining it with other technical indicators can significantly improve its effectiveness. This is a core principle professional traders use to build robust MACD trading strategy systems. Let's explore some power combinations that elevate MACD trading.

MACD and RSI: A Momentum Powerhouse

Pairing the MACD with the Relative Strength Index (RSI) creates a strong momentum verification system. The RSI measures the speed and change of price movements, helping identify overbought and oversold conditions.

For example, a bullish MACD crossover combined with an RSI below 30 (oversold) provides a stronger buy signal. This combination helps confirm momentum shifts and reduces false signals. It can also offer earlier warnings of potential trend reversals.

Combining MACD with Support and Resistance

Using the MACD alongside support and resistance levels creates a comprehensive trading framework. Support levels act as price floors, while resistance levels act as ceilings.

A bullish MACD crossover near a key support level increases the likelihood of a successful long trade. Conversely, a bearish crossover near resistance strengthens a short signal. This approach combines momentum and price action analysis for a more complete market view.

Volume-Based Confirmation with MACD

Volume confirms price movement strength. High volume during a MACD crossover validates the signal, suggesting increased market participation and conviction. This is especially important for trading breakouts.

A bullish MACD crossover with high volume breaking through resistance is a powerful buy signal. Filtering for volume spikes can help differentiate high-probability setups from potential traps. A low-volume MACD crossover, for instance, might indicate a false breakout.

Handling Conflicting Signals

Sometimes, indicators provide conflicting signals. The MACD might show a bullish crossover while the RSI indicates overbought conditions. In these situations, understanding market context is critical.

During strong uptrends, the RSI can remain overbought for extended periods. Prioritizing the MACD signal might be appropriate here. However, in choppy markets, caution is advised when indicators diverge. Traders might wait for confirmation from both indicators or avoid the trade entirely. These scenarios require experience and understanding of how each indicator behaves.

Practical Guidelines for Indicator Precedence

Which indicator takes precedence depends on various factors: market conditions, timeframe, and individual trading styles. In trending markets, momentum indicators like the MACD often lead. In ranging markets, oscillators like the RSI can be more reliable.

For long-term trading, focusing on the MACD and longer-term moving averages might be beneficial. Short-term traders may prioritize faster indicator combinations. The key is developing a MACD trading strategy that suits your specific needs and adapting it as market conditions change. These combinations are the core of many successful MACD trading strategies. By combining the strengths of multiple indicators and understanding their interplay, you can significantly improve your MACD analysis.

Advanced MACD Tactics From Professional Trading Desks

Professional traders often employ advanced MACD tactics that go beyond the basics. These techniques, developed over years of market experience, can give you a real edge. Let's explore some of these powerful strategies to boost your MACD trading.

Multiple Timeframe MACD Analysis

Analyzing the MACD across multiple timeframes helps pinpoint high-probability trades. This involves looking for points where momentum aligns across different periods. For example, a bullish crossover on the daily chart, coupled with a bullish crossover on the 4-hour chart, offers much stronger confirmation than a signal from just one timeframe. This approach helps ensure both short-term and long-term momentum are working in your favor. It’s like getting multiple confirmations before making an important decision.

The Power of MACD Histogram Double Bottoms and Tops

The MACD histogram can reveal subtle patterns that often precede significant price moves. Double bottoms and double tops in the histogram, particularly when they diverge from price action, are strong signals. A double bottom in the histogram during a downtrend, while the price continues to fall, can signal a potential reversal. On the other hand, a double top in the histogram during an uptrend, while the price continues to rise, may indicate an upcoming downturn. These patterns offer early warnings of potential trend shifts.

Integrating Price Action Confirmation

Price action analysis, the study of price movements on a chart, becomes extremely valuable when used with the MACD. For instance, a bullish MACD crossover combined with a breakout from a key resistance level greatly increases the likelihood of a successful long trade. Confirming MACD signals with price action patterns creates a more robust trading strategy, combining the strengths of momentum and price action analysis.

Adaptive MACD Approaches

Market volatility is always changing. Adaptive MACD approaches automatically adjust to these shifting conditions. This ensures your system remains relevant, regardless of market behavior. These systems frequently use volatility indicators like the Average True Range (ATR) to dynamically adjust MACD parameters. During periods of high volatility, MACD settings might be lengthened to filter out noise. Conversely, shorter settings can be used in calmer markets to capture smaller price movements. This adaptability helps ensure your MACD strategy remains effective across different market conditions. Learn more in our article about 8 Proven Market Scanning Techniques for 2025.

Implementing Advanced MACD Tactics

Each advanced technique has specific implementation guidelines. Understanding how to interpret multiple timeframe signals, spot double bottoms and tops, confirm with price action, and adapt to volatility changes is crucial for success. These skills, honed through trading experience, can greatly enhance your MACD strategies. Before putting these tactics into practice, let's examine how MACD performance varies across different market types.

The following table provides a summary of how different MACD strategies perform across various market conditions and asset classes based on historical backtesting.

MACD Performance Across Market Types

| Market Type | Win Rate | Average Profit/Loss | Typical Holding Period | Best Signal Type |

|---|---|---|---|---|

| Trending Bull Market | 65% | 12% | 2 Weeks | MACD Crossover with Price Action Confirmation |

| Ranging Market | 50% | 5% | 1 Week | MACD Histogram Divergence |

| Volatile Market | 55% | 8% | 3 Days | Adaptive MACD with ATR |

| Bear Market | 40% | -7% | 1 Week | MACD Crossover on Multiple Timeframes |

This table highlights the importance of adapting your MACD approach to the prevailing market conditions. Trending bull markets favor confirmation with price action, while ranging markets benefit from focusing on histogram divergence. Volatile markets require adaptive methods, and bear markets often see better performance using multiple timeframe analysis. By combining these insights, traders can develop a comprehensive trading approach that incorporates both momentum and price action analysis. This creates a more nuanced and adaptive approach to MACD trading.

Avoiding the MACD Mistakes That Destroy Trading Accounts

Even with a firm grasp of MACD setups, many traders make common mistakes that can severely damage their accounts. This section explores these pitfalls and offers practical advice from seasoned traders to help you navigate the complexities of MACD trading. These tips can mean the difference between consistent gains and substantial losses.

Misinterpreting Signals During Consolidation

One of the most common errors is misreading MACD signals during consolidation. When the market trades within a range, the MACD often produces false crossovers, leading to whipsaw trades and subsequent losses. For instance, in a sideways market, the MACD lines might fluctuate around each other, triggering numerous buy and sell signals that reverse shortly after.

So, what's the solution? Don't rely solely on MACD crossovers during these periods. Look for confirmation from other indicators, like the Relative Strength Index (RSI) or identifiable price action patterns, before entering a trade. This helps filter out unreliable signals and pinpoint more dependable ones.

Ignoring Broader Market Context

Another significant mistake is disregarding the overall market context. The MACD, like any technical indicator, shouldn't be used in isolation. A bullish MACD crossover might appear promising, but if the overall market trend is bearish, the trade is likely to fail.

Always consider the bigger picture. Analyze the market trend on higher timeframes, examine related markets, and consider news and economic events that could influence your trades. This broader perspective enhances your MACD trading strategy with another layer of analysis.

Position Sizing Errors and Volatility Adjustments

Incorrect position sizing often leads to depleted accounts. Traders frequently risk too much capital on a single MACD trade, making them susceptible to unexpected market movements.

A good rule of thumb is to risk no more than 1-2% of your total capital on any single trade. Also, adjust your position size based on market volatility. In volatile markets, reduce your position size to safeguard your capital. During quieter periods, you may consider slightly increasing it. This adaptable approach protects your account while still allowing you to profit from favorable conditions.

Over-Optimizing MACD Parameters

Many traders get caught up in over-optimizing MACD parameters. They continually adjust the settings, searching for the perfect combination that predicts every market move. This often leads to curve fitting and ultimately poor real-time trading performance.

Instead of seeking perfection, focus on finding MACD settings that perform consistently across various market conditions. Backtest your strategies thoroughly and maintain a consistent approach. This establishes a more robust and realistic foundation for your MACD trading.

By understanding and avoiding these common errors, you can significantly improve your MACD trading success. Remember, consistent profits stem from disciplined risk management, a comprehensive market view, and ongoing learning, not from perfect indicator settings.

Ready to elevate your trading? ChartsWatcher, a sophisticated stock market scanning software, offers professional traders real-time data, customizable dashboards, and advanced charting tools. Explore its powerful features and flexible pricing plans today and transform your trading experience. Visit ChartsWatcher now!