MACD in Stocks: Strategy for Profitable Trading

Decoding MACD in Stocks: Beyond the Basic Indicator

Many traders see the Moving Average Convergence Divergence (MACD) as a simple crossover indicator. But a deeper understanding of its nuances can significantly improve your trading strategy. This section explores what separates successful MACD traders from the rest, focusing on how the indicator transforms raw price data into actionable market insights. You might be interested in: How to master technical indicators.

Understanding the Mechanics of MACD

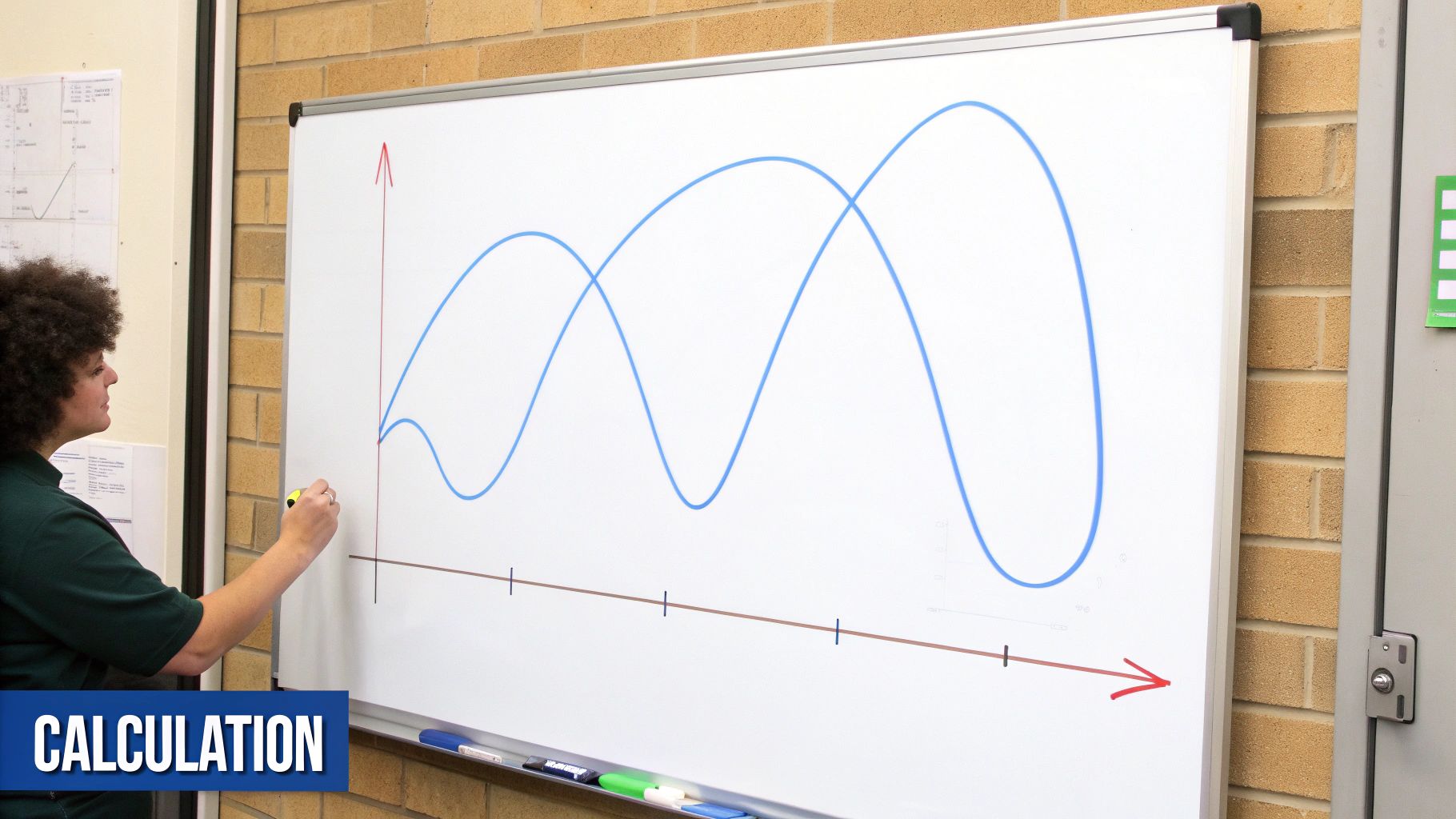

Developed by Gerald Appel in the late 1970s, the MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. This calculation reveals shifts in trend momentum and direction. MACD is a widely used technical indicator in stock analysis. This difference between the two EMAs forms the MACD line.

A 9-period EMA of the MACD line, known as the signal line, is also plotted. The relationship between these two lines generates trading signals. For instance, in 2009, the S&P 500 ETF (SPY) experienced several bearish divergences between August and November, yet the ETF continued its upward trajectory. This illustrates that MACD divergences require careful interpretation.

Why Being a Lagging Indicator Is MACD's Strength

The MACD is often labeled a lagging indicator because it confirms existing trends. But this isn't a weakness. Rather, it’s a strength. Experienced traders recognize that this lag offers valuable confirmation of momentum shifts, preventing premature entries or exits, especially in trending markets. A bullish crossover during an uptrend, for example, could signal a strong entry point for a long position.

Using MACD in Different Market Environments

MACD is adaptable to both trending and choppy markets. In trending markets, traders often watch for crossovers of the MACD and signal lines, indicating potential entry and exit points.

In choppy markets, divergences between the MACD and price action become more critical. These divergences can signal weakening momentum and possible trend reversals. Knowing how to apply the MACD in different market conditions is key to maximizing its effectiveness. Combining it with other indicators and tools can further refine your trading decisions.

MACD Crossovers: Timing Your Market Entries and Exits

Many traders misinterpret MACD crossover signals. This section clarifies how experienced traders distinguish high-probability crossovers from false signals that can trap less-experienced traders. We'll explore identifying the subtle differences between strong and weak crossovers using real-world examples. You might be interested in: How to master the MACD trading strategy.

Understanding MACD Crossovers in Stocks

A MACD crossover happens when the MACD line crosses above or below its signal line. This seemingly simple event forms the foundation of many trading strategies. A bullish crossover, where the MACD line crosses above the signal line, suggests a potential uptrend. Conversely, a bearish crossover, with the MACD line crossing below, hints at a possible downtrend.

The MACD is particularly useful for identifying these crossovers and divergences. For example, a crossover above the signal line is considered bullish, while a crossover below is bearish.

The reliability of these signals improves when aligned with the overall market trend. In strong uptrends, bearish divergences can occur without reversing the trend, illustrating the importance of the broader market context. This approach is commonly used in major markets like the NASDAQ and the DJIA. Learn more about MACD calculations and interpretations.

Context is King: Analyzing Crossover Strength

A crossover signal’s strength depends heavily on the surrounding market context. A bullish crossover within an established uptrend carries more weight than one appearing at a major resistance level. Likewise, a bearish crossover during a downtrend is more reliable than one near strong support.

Traders must analyze crossovers in relation to price action, support and resistance levels, and overall market trends.

Refining Your Entries and Exits With Filtering Techniques

Professional traders use filtering techniques to minimize false signals and improve the accuracy of MACD crossovers. Some common techniques include:

-

Volume Confirmation: Increased trading volume during a crossover strengthens the signal. This suggests stronger conviction behind the price move.

-

Timeframe Alignment: Confirming crossovers across multiple timeframes, such as seeing a bullish crossover on both daily and weekly charts, increases signal reliability.

-

Price Action Confirmation: Look for confirming price patterns, like breakouts or pullbacks, that validate MACD crossover signals.

By using these strategies, traders can significantly improve their entry and exit timing. This leads to more effective risk management in various market conditions.

Spotting Power Shifts: Mastering MACD Divergences

MACD divergences are some of the most useful tools in a trader's arsenal. However, they are often misunderstood. This section explores how institutional traders use these divergences to find early warning signs of change in the stock market. We'll look at the important difference between regular and hidden divergences, and how to tell them apart for more profitable trades.

Regular vs. Hidden Divergences: Two Sides of the Same Coin

A regular divergence happens when the price of a stock makes a higher high, but the MACD indicator makes a lower high. This is a bearish divergence. The opposite, where the price makes a lower low and the MACD forms a higher low, is a bullish divergence. These patterns often signal a weakening trend and the possibility of a reversal.

For example, a bearish divergence might come before a price drop, suggesting a good time to sell short.

On the other hand, hidden divergences suggest the opposite. A bullish hidden divergence happens when the price makes a lower high, but the MACD makes a higher high. A bearish hidden divergence occurs when the price makes a higher low, but the MACD makes a lower low. Hidden divergences often indicate that a current trend will continue.

For instance, a bullish hidden divergence during an uptrend could signal that the uptrend is likely to keep going.

A great example of the MACD's predictive power happened with Google (GOOG). In October and November 2008, a bullish divergence appeared. Google's stock price hit a lower low, while the MACD formed a higher low. This was followed by a signal line crossover, accurately predicting a reversal and a breakout above resistance, which kicked off a substantial rally. This highlights the power of MACD divergences to signal weakening trends and upcoming reversals. Learn more about MACD.

Real-World Examples: Spotting Divergences in Market Leaders

MACD divergences have successfully predicted shifts in well-known stocks like Apple, Amazon, and Tesla. Often, these divergences reflect what's happening with investor psychology. For example, during a stock's rapid rise, a bearish divergence could mean that investors are becoming less excited, even as the price keeps climbing.

Studying these real-world examples can give traders a better understanding of how to anticipate and respond to similar market situations.

Validating Divergences for Higher Accuracy

Professional traders often use other tools to confirm their MACD divergence signals and increase accuracy:

-

Volume Analysis: Checking trading volume is important. Look for decreasing volume during a bearish divergence, and increasing volume during a bullish divergence. This helps to verify the change in momentum.

-

Price Action Confirmation: Using candlestick patterns or trendline breaks with divergences can add an extra layer of confirmation. This helps filter out false signals and improve trading decisions.

By understanding and using these techniques, traders can identify high-probability trading setups using MACD divergences, and navigate the markets more effectively. This knowledge can be paired with tools like those offered by ChartsWatcher to improve market analysis.

The MACD Histogram: Your Early Warning System

While many traders focus on MACD crossovers, the histogram often provides more predictive power. This section explores how seasoned traders use histogram patterns to anticipate momentum shifts before they impact price, giving them a crucial timing edge.

Deciphering the MACD Histogram

The MACD histogram isn't a separate indicator. It visually represents the difference between the MACD line and the signal line. This difference helps visualize trend momentum. When the MACD line is above the signal line, the histogram is positive. When the MACD line is below the signal line, the histogram is negative. The size of these values indicates the strength of the momentum.

Recognizing Early Warning Signs in Histogram Structure

Small changes in the histogram's structure often precede shifts in momentum. Experienced traders use two key techniques to analyze these changes:

-

Peak-to-Peak Analysis: Comparing consecutive peaks or troughs reveals momentum strength or weakness. Lower peaks in an uptrend might indicate weakening buying pressure. Higher lows in a downtrend might signal weakening selling pressure. This analysis offers potential early warnings of trend changes.

-

Slope Evaluation: The slope of the histogram bars provides additional insights. A steepening slope suggests increasing momentum, while a flattening or declining slope suggests weakening momentum. A bullish crossover with a flattening histogram might indicate weaker bullish momentum than one with a steepening histogram.

Histogram Contractions and Expansions: Insights Into Market Psychology

The histogram's contractions and expansions often reflect the underlying market psychology:

-

Contractions: Narrowing histogram bars (decreasing distance between the MACD and signal lines) suggest indecision or decreasing momentum. This frequently happens during consolidation periods before a large price move.

-

Expansions: Widening histogram bars (increasing distance between the MACD and signal lines) often signal increasing momentum and conviction behind a trend. This can occur during breakouts or strong trending moves.

Let's explore some common MACD histogram patterns and their implications:

To help visualize these patterns, here's a handy table:

MACD Histogram Patterns and Their Implications This table outlines common MACD histogram patterns and what they typically signify for future price movements

| Histogram Pattern | What It Indicates | Typical Market Response | Reliability Factor |

|---|---|---|---|

| Increasing Peaks (Uptrend) | Strengthening Bullish Momentum | Continued Price Rise | High |

| Decreasing Peaks (Uptrend) | Weakening Bullish Momentum | Potential Trend Reversal or Consolidation | Medium-High |

| Increasing Troughs (Downtrend) | Strengthening Bearish Momentum | Continued Price Decline | High |

| Decreasing Troughs (Downtrend) | Weakening Bearish Momentum | Potential Trend Reversal or Consolidation | Medium-High |

| Divergence (Histogram moves opposite to price) | Warning of Potential Trend Reversal | Trend Change or Extended Pullback | Medium |

| Convergence (Histogram moves in line with price) | Confirmation of Current Trend | Continuation of Trend | Medium |

| Narrowing Bars (Contraction) | Decreasing Momentum/Indecision | Consolidation or Breakout | Low-Medium (Depends on Context) |

| Widening Bars (Expansion) | Increasing Momentum/Conviction | Strong Trend Move or Breakout | Medium-High |

As you can see, different histogram patterns can provide valuable clues about future price movements. Remember that no indicator is perfect, and it's always best to combine MACD histogram analysis with other technical indicators and price action analysis.

Practical Strategies for Using Histogram Patterns

Histogram patterns offer insights for market timing, entries, exits, and risk management:

-

Refined Entry Timing: Instead of waiting for crossovers, traders might use histogram divergences or patterns like bullish histogram expansions to anticipate better entry points.

-

Precise Exits: Declining histogram peaks or divergence patterns can signal weakening momentum, suggesting possible exit points before a full reversal.

-

Effective Risk Management: Recognizing weakening momentum through histogram analysis improves risk management. Traders can adjust position sizes or set tighter stop-loss orders based on the histogram's behavior.

Creating Your MACD Power Stack: Strategic Combinations

Smart traders know that using the Moving Average Convergence Divergence (MACD) indicator effectively involves more than just looking at it alone. Combining it with other indicators creates a powerful system that improves the quality of trading signals and, ultimately, leads to better trading decisions. This section explores some of the most effective indicator pairings that complement the MACD's strengths and mitigate its weaknesses.

Combining MACD With Trend-Defining Indicators

The MACD excels at identifying momentum shifts, but it doesn't always tell you about the overall trend. Pairing MACD with trend-defining indicators like moving averages provides this critical context.

For example, imagine a bullish MACD crossover happening during an uptrend. If the price is also above its 200-day moving average, the signal is much stronger. It’s like getting a second opinion that confirms your initial assessment.

Adding Momentum Oscillators for Confirmation

The MACD is a momentum oscillator, but combining it with others, like the Relative Strength Index (RSI), creates a robust confirmation system. If both the MACD and the RSI show bullish momentum, the probability of a continued uptrend increases. This convergence adds more weight to your analysis.

Integrating Volume-Based Indicators

Volume shows the conviction behind price movements. Integrating volume-based indicators with MACD offers a more accurate view of market sentiment. A bullish MACD crossover with increasing volume indicates stronger buying pressure, making the signal more reliable.

Conversely, if the price is rising but volume is declining, it could be a warning sign, even if the MACD looks bullish. This is known as divergence and often precedes a price reversal.

Pairing Strategies for Different Market Conditions

Different market environments require different indicator combinations. During trending markets, combining MACD with moving averages and trendlines helps identify high-probability entries and exits. In choppy or consolidating markets, oscillators like the RSI and volume indicators become more important for spotting breakouts or reversals.

To help illustrate effective MACD combinations, let's look at the following table:

To make informed trading decisions, understanding how the MACD interacts with other indicators is essential. The following table summarizes some effective combinations.

Effective MACD Indicator Combinations: Comparison of how MACD works with other technical indicators to enhance trading decisions

| Indicator Combination | What It Reveals | Best Market Conditions | Trading Strategy |

|---|---|---|---|

| MACD + Moving Averages | Trend Confirmation and Entry/Exit Points | Trending Markets | Enter long/short positions on MACD crossovers confirmed by price action relative to moving averages. |

| MACD + RSI | Momentum Confirmation and Overbought/Oversold Conditions | Trending and Ranging Markets | Look for converging signals in both indicators to confirm momentum. Use RSI to identify potential overbought/oversold conditions. |

| MACD + Volume | Strength of Trend and Conviction Behind Price Moves | All Market Conditions | Confirm MACD signals with corresponding volume changes. High volume strengthens signals; low volume weakens them. |

| MACD + Bollinger Bands® | Volatility Breakouts and Trend Reversals | All Market Conditions | Combine MACD with Bollinger Bands to anticipate breakouts from consolidation or identify potential trend reversals. |

This table highlights how combining the MACD with different indicators can provide a more comprehensive market analysis. Using these combinations can help traders identify stronger signals and make more informed trading decisions.

Interpreting Conflicting Signals

Sometimes, indicators give conflicting information. For instance, the MACD might show bullish momentum while the RSI indicates overbought conditions. This can be confusing, especially for less experienced traders.

In these situations, look for more information using price action analysis, support/resistance levels, or higher timeframe charts to better understand the market dynamics.

By mastering the combination of MACD with other indicators, traders can develop robust trading strategies suited for various market conditions. This approach, along with tools like those available on ChartsWatcher, can significantly improve the accuracy of your MACD analysis and boost your overall trading performance. Using these tools together increases the likelihood of correctly assessing the market and making informed decisions.

Customizing MACD For Your Trading Personality

The standard 12-26-9 MACD settings provide a solid foundation for many traders, but they aren't universally applicable. Savvy traders often tweak these parameters to better suit their individual trading styles, preferred timeframes, and financial goals. This section explores how various parameter combinations perform under different market conditions and examines advanced customization techniques employed by quantitative traders.

Fine-Tuning MACD Parameters For Different Trading Styles

The standard 12, 26, and 9 periods used in MACD calculations represent the number of time periods (usually days) used for the exponential moving averages (EMAs). These values significantly impact how the MACD behaves and the signals it generates.

-

Day Traders: For day traders working with shorter timeframes, using shorter periods like 8-17-9 or 5-35-5 can generate earlier signals. This allows them to react quickly to short-term price swings. Shorter periods increase the MACD's sensitivity to recent price changes.

-

Position Traders: Position traders, who focus on longer-term trends, benefit from longer periods such as 21-55-13 or 34-144-9. These settings smooth out short-term market noise and highlight significant trend changes, enabling strategic entries and exits. This long-term perspective helps avoid being whipsawed by short-term price fluctuations.

Backtesting Frameworks For Objective Evaluation

It's essential to backtest any custom MACD settings before implementing them. Backtesting involves applying your strategy to historical price data to evaluate its potential performance. This process helps assess the effectiveness of various parameter combinations. Consider integrating information from comprehensive risk assessment frameworks when building your MACD strategy. Explore practical financial risk assessment tools.

Here’s a straightforward backtesting framework:

-

Define Your Trading Rules: Clearly define your entry and exit criteria based on your chosen MACD settings.

-

Select a Historical Data Period: Choose a representative historical data period that encompasses diverse market conditions.

-

Apply Your Strategy: Run your trading rules against the historical data, tracking trades and calculating performance metrics. Key metrics include win rate, average profit/loss, and maximum drawdown.

-

Analyze the Results: Evaluate the performance of your strategy and adjust your parameters until you achieve your desired results.

Advanced Customization Techniques: Adaptive MACD

Quantitative traders often use advanced customization techniques, such as the adaptive MACD. With this approach, the parameters automatically adjust based on market volatility or other relevant factors. For instance, during periods of high volatility, the periods might shorten to react more quickly to price changes. Conversely, in calmer markets, longer periods might be used to reduce false signals. This dynamic approach creates a more responsive indicator that adapts to changing market conditions.

Recommended Starting Points For Various Trading Approaches

The table below summarizes some recommended starting points for various trading approaches:

| Trading Style | Timeframe | Recommended MACD Settings |

|---|---|---|

| Scalping | 1-5 minutes | 5-35-5 or 8-17-9 |

| Day Trading | 15-60 minutes | 8-17-9 or 12-26-9 |

| Swing Trading | Daily | 12-26-9 or 21-55-13 |

| Position Trading | Weekly/Monthly | 21-55-13 or 34-144-9 |

Keep in mind these are just starting points. Backtesting and fine-tuning these settings based on your individual preferences and market analysis is crucial. Fine-tuning your MACD parameters and combining them with other technical analysis tools allows for a truly personalized trading strategy. ChartsWatcher offers powerful charting and scanning tools to help you apply and optimize your MACD strategies. Visit ChartsWatcher today to learn more and start your free trial.