Day Trading vs Swing Trading: Which Is Right for You?

Navigating the Trading Landscape: Day Trading vs. Swing Trading

This listicle provides a direct comparison of day trading vs. swing trading strategies, outlining their core differences and advantages. Understanding these approaches is crucial for stock market success, regardless of your experience level. We'll cover popular day trading strategies like scalping, momentum trading, range trading, and news-based trading. We'll then examine swing trading strategies, including position trading, technical pattern trading, and mean reversion trading. This information will empower you to choose the strategies best aligned with your financial goals and risk tolerance.

1. Scalping (Day Trading Strategy)

When comparing day trading vs swing trading, one of the most distinct day trading strategies is scalping. This ultra-short-term approach involves capturing minuscule price fluctuations for small, frequent profits. Unlike swing traders who hold positions for days or weeks, scalpers exploit fleeting market inefficiencies, holding positions for mere seconds to minutes. They execute dozens, sometimes hundreds, of trades per day, accumulating small gains that ideally compound into substantial returns. This rapid-fire approach demands intense focus, sophisticated tools, and a deep understanding of technical analysis.

Scalping thrives on high market liquidity and volatility. Think of the flurry of activity during the London-New York market overlap for EUR/USD, the frenetic opening bell for S&P 500 futures, or the intense price swings of Tesla stock on earnings announcement days. These volatile periods create numerous opportunities for scalpers to capitalize on rapid price movements. A successful scalper isn't looking for home runs; they're consistently hitting singles and doubles, relying on volume and precision to drive profitability.

Why choose scalping in the day trading vs swing trading debate? Scalping minimizes overnight risk, a significant advantage in unpredictable markets. Furthermore, the constant feedback loop of frequent trades allows for rapid adaptation and refinement of strategies. The impact of fundamental news is also reduced as positions are closed before these factors can significantly influence price.

However, scalping is not without its drawbacks. The high volume of trades leads to substantial transaction costs that can eat into profits. It's incredibly time-intensive, requiring constant monitoring of real-time market data, which can lead to high stress and mental fatigue. Meaningful profits also necessitate significant starting capital to offset transaction fees and maximize the impact of small price movements. Finally, absolute reliance on reliable trading platforms and internet connectivity is crucial; a single disconnection can be devastating.

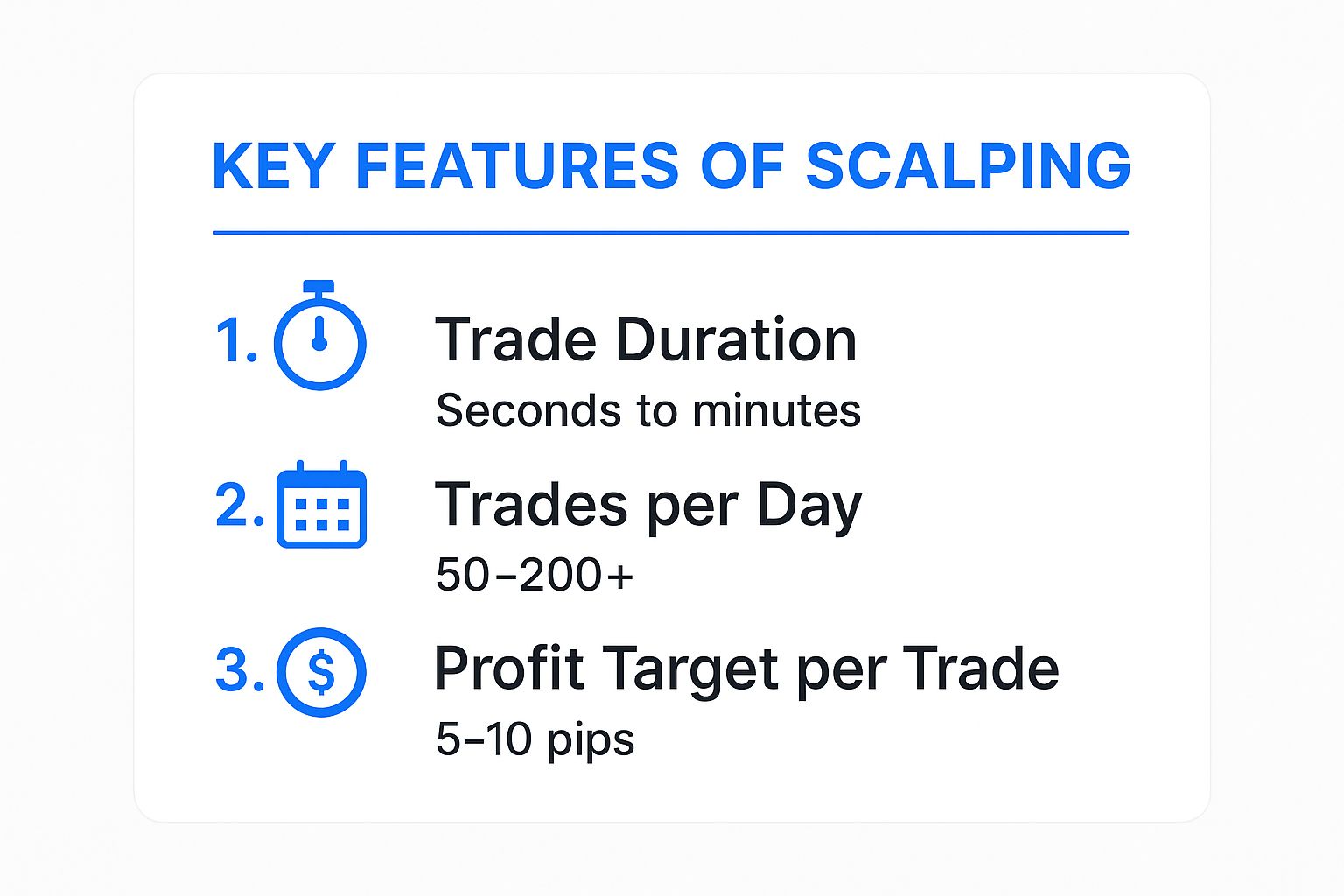

Here’s a quick reference summarizing the core elements of scalping:

As the infographic highlights, scalping relies on incredibly short trade durations, high trade frequency, and small profit targets per trade. These three components are the bedrock of a successful scalping strategy.

So, how can aspiring scalpers navigate this demanding trading style? Firstly, prioritize direct market access (DMA) brokers for faster execution speeds, essential for capturing fleeting price movements. Focus on highly liquid instruments like major currency pairs or highly traded stocks to ensure quick entry and exit. Strict risk management with tight stop-loss orders is paramount to protect capital during inevitable losing trades. Before risking real capital, extensive practice on demo accounts is crucial to develop the necessary speed and discipline. Finally, monitoring Level II order book data provides valuable insights into market depth and potential price movements. Legends like Paul Rotter (The Flipper), along with thriving scalping communities on platforms like Reddit and Discord, offer valuable resources and insights for those venturing into this high-octane trading strategy. Professional trading firms like Jane Street also utilize sophisticated algorithms for scalping, demonstrating its potential for significant returns.

This embedded video further elaborates on scalping techniques and provides a visual demonstration of its implementation. In conclusion, when considering day trading vs swing trading, scalping offers a unique approach for those seeking to capitalize on short-term market volatility. While it demands significant time, effort, and discipline, the potential for consistent profits and reduced overnight risk makes it an attractive strategy for certain traders within the broader context of day trading.

2. Momentum Trading (Day Trading Strategy)

In the fast-paced world of day trading vs. swing trading, momentum trading stands out as a dynamic strategy designed to capitalize on short-term price surges. This approach involves identifying stocks or other assets exhibiting strong directional movement, often accompanied by high trading volume, and riding this "momentum" for a period of minutes or hours. The core principle is to enter a trade when a stock is demonstrating clear upward or downward momentum and exit before the momentum wanes. This strategy prioritizes stocks making new highs or lows, typically driven by significant catalysts.

Momentum trading earns its place on the day trading vs. swing trading list due to its potential for rapid gains. Trades typically last from 30 minutes to a full trading day, with traders often executing 5-20 trades daily. This high-frequency approach distinguishes it from swing trading, which holds positions for longer durations. The strategy blends technical analysis, focusing on chart patterns and indicators, with fundamental analysis to understand the underlying catalysts driving the momentum. Proper risk management, primarily through careful position sizing, is crucial to mitigating potential losses.

Several factors contribute to a stock's momentum. These can include earnings surprises, positive news releases, FDA approvals, major product launches, or even influential social media trends. For example, the dramatic rise of GameStop in 2021, fueled by social media-driven buying frenzy, provides a vivid illustration of momentum trading in action. Similarly, Moderna's stock experienced significant upward momentum following positive news regarding its COVID-19 vaccine. Even broader market indices like the SPY can exhibit momentum driven by events such as Federal Reserve announcements. Tesla's stock often displays significant momentum swings around earnings releases, creating opportunities for momentum traders. These examples showcase how various catalysts can ignite powerful and often short-lived price movements exploitable through momentum trading.

To successfully implement momentum trading, several key tips should be considered. Utilizing stock scanners to identify pre-market movers can provide a valuable head start. However, waiting for confirmation through increased volume before entering a trade is crucial. Setting profit targets at key resistance levels helps ensure disciplined profit-taking, while trailing stops protect against sudden reversals. Avoiding trading during the volatile first 15 minutes of the trading day can also help minimize risk. You can Learn more about Momentum Trading (Day Trading Strategy) for an in-depth look at the evolving landscape of momentum trading strategies.

Momentum trading offers several advantages. The potential for substantial single-day gains is a primary draw. The strategy also benefits from relatively clear entry and exit signals, making it easier to systematize with automated scanners. Furthermore, momentum trading thrives in trending markets and is adaptable to both small and large accounts. Notable figures like Tim Sykes and Ross Cameron (Warrior Trading) have popularized this approach, and online chat rooms, such as Boiler Room Trading, often buzz with momentum trading discussions.

However, momentum trading also presents significant downsides. It demands rapid decision-making and carries the risk of considerable losses if momentum reverses unexpectedly. The strategy’s effectiveness relies heavily on market volatility, which can be unpredictable. The fear of missing out (FOMO) can lead to impulsive entries and poor trading decisions. Moreover, it requires constant market monitoring, demanding significant time and attention.

In the context of day trading vs. swing trading, momentum trading distinctly caters to traders seeking quick, potentially high-reward opportunities within the same trading session. While swing traders capitalize on multi-day price swings, momentum traders exploit intraday volatility, leveraging short-term price surges for rapid profits. By understanding the nuances of this strategy, its potential benefits, and inherent risks, traders can make informed decisions about whether momentum trading aligns with their trading style and risk tolerance within the broader landscape of day trading and swing trading strategies.

3. Range Trading (Day Trading Strategy)

When comparing day trading vs swing trading, range trading stands out as a powerful day trading strategy particularly suited to certain market conditions. It capitalizes on the predictable oscillations of asset prices within established support and resistance levels. Unlike swing trading, which aims to capture larger price swings over several days or weeks, range trading focuses on smaller, more frequent profits within a single trading day. This approach allows day traders to exploit short-term price fluctuations without needing to predict the overall market direction, making it an attractive option in consolidating or sideways markets.

Range trading involves identifying assets that are “range-bound,” meaning their price consistently bounces between a defined support level (the price floor) and a resistance level (the price ceiling). Traders buy near the support level, anticipating a price bounce, and sell near the resistance level, anticipating a price reversal. This strategy allows for multiple round trips—buying low and selling high—within the same trading day, potentially accumulating substantial profits. The typical trade duration ranges from one to eight hours, aligning perfectly with the timeframe of a day trader. This contrasts sharply with swing trading, where positions are held for longer periods, exposing the trader to overnight and weekend market risks. For traders who prefer to close out positions daily and manage their risk more tightly, range trading offers a distinct advantage in the day trading vs swing trading debate.

One of the key advantages of range trading is the clarity it offers in terms of entry and exit points. Unlike momentum trading, which relies on chasing breakouts that can be volatile and unpredictable, range trading provides well-defined levels for entering and exiting trades. This, combined with the use of defined risk-reward ratios (determined by the distance between entry points and stop-loss orders compared to the distance between entry points and profit targets), makes range trading a more controlled and less emotionally driven strategy. This is particularly appealing to newer traders navigating the complexities of day trading vs swing trading.

To illustrate range trading in practice, consider these examples:

- EURUSD: Imagine the EURUSD currency pair is trading within a range of 1.1000 (support) and 1.1100 (resistance). A range trader would buy near 1.1000, placing a stop-loss order slightly below this level, and aim to sell near 1.1100.

- Apple Stock: If Apple stock is range-bound between $150 and $155, a trader would buy near $150 and sell near $155, exploiting the $5 price swing multiple times during the day.

- Gold Futures: During consolidation phases, gold futures might trade between $1800 and $1850. Range traders could capitalize on this predictable price movement.

- Bitcoin: Bitcoin, known for its volatility, can also exhibit periods of consolidation. Range trading can be effective when Bitcoin trades between key psychological levels, like $20,000 and $25,000.

While range trading offers several advantages, it's crucial to be aware of its limitations. Profit potential per trade is limited by the range itself. While multiple trades can accumulate significant gains, each individual trade's profit is capped. Ranges can also break unexpectedly due to news events or shifts in market sentiment, leading to losses if stop-loss orders aren't in place. Furthermore, range trading requires patience to identify and confirm valid range setups and may be less effective in strongly trending markets where prices consistently move in one direction.

For those considering range trading in the context of day trading vs swing trading, here are some actionable tips:

- Confirm Range Validity: Ensure the range is valid by observing multiple touches of both support and resistance levels.

- Use Oscillators: Utilize technical indicators like the Relative Strength Index (RSI) to identify overbought or oversold conditions within the range for optimal entry timing.

- Place Stop-Loss Orders: Protect your capital by placing stop-loss orders just outside the range boundaries to limit potential losses if the range breaks.

- Target the Opposite Side: Set profit targets near the opposite end of the range to maximize potential gains.

- Reduce Position Size: Consider reducing position size when trading near the range boundaries as the probability of a breakout increases.

Range trading, popularized by trading experts like Mark Douglas (author of Trading in the Zone) and Steve Nison (known for his work on Japanese candlestick techniques), as well as professional market makers, is a valuable tool for day traders. By understanding the principles of support and resistance, utilizing appropriate technical indicators, and managing risk effectively, traders can leverage range trading to generate consistent profits in sideways markets, providing a compelling argument for this strategy within the day trading vs swing trading landscape.

4. News-Based Trading (Day Trading Strategy)

When comparing day trading vs swing trading, one key differentiator within day trading strategies is the exciting, albeit risky, world of news-based trading. This approach centers around capitalizing on the immediate price volatility that follows significant news events affecting financial markets. These events can range from earnings announcements and economic data releases to FDA approvals and geopolitical developments. The core principle is to react swiftly to breaking news, aiming to capture profits from the rapid price fluctuations that occur before the market fully digests the information. This makes it a distinctly day trading strategy, unsuitable for the longer holding periods typical of swing trading.

News-based trading is an event-driven approach, meaning traders actively monitor news feeds and set up alerts for specific catalysts they believe will significantly impact asset prices. The trade duration is typically very short, ranging from minutes to a few hours, aligning perfectly with the fast-paced nature of day trading. This strategy requires access to multiple reliable news sources, real-time alerts, and a platform capable of executing trades with minimal latency. Trades are generally high-impact but low-frequency, as traders patiently wait for the right news catalyst to emerge before entering the market. This contrasts sharply with swing trading, where traders capitalize on broader technical and fundamental trends over several days or weeks.

Several factors contribute to news-based trading earning its place in the day trading vs swing trading discussion. Its potential for explosive moves is a major draw for traders seeking quick profits. The clear catalysts for price movement provide a concrete basis for trading decisions, as opposed to relying solely on technical indicators, which can be more subjective. Moreover, news-based trading can be applied to accounts of any size, opening opportunities for both retail traders and large institutions. This versatility extends to various markets, including stocks, forex, commodities, and cryptocurrencies. Finally, its relative independence from traditional technical analysis provides a unique edge for those comfortable interpreting fundamental news.

Examples of News-Based Trading:

- Pharmaceutical Stocks: Trading on FDA drug approvals or rejections can lead to dramatic price swings. A positive announcement can send a stock soaring, while a rejection can trigger a steep decline.

- Currency Pairs: Central bank announcements on interest rates or monetary policy have a significant impact on forex markets. Traders closely watch these events to anticipate currency fluctuations.

- Tech Stocks: Earnings surprises, product launches, and major partnerships can drastically influence the share price of tech companies. News-based traders aim to capitalize on these events.

- Energy Stocks: Inventory reports, OPEC decisions, and geopolitical events related to oil-producing regions can create volatility in energy markets, providing opportunities for news-based traders.

- Crypto Trading: Regulatory news, exchange listings, and technological advancements can significantly impact cryptocurrency prices, making the crypto market ripe for news-based trading strategies.

Pros and Cons:

Pros:

- Potential for Explosive Moves: News events can create rapid and substantial price movements, offering significant profit potential.

- Clear Catalysts: Trades are based on concrete news events, providing a clear rationale for entering the market.

- Accessibility: Suitable for both small and large accounts.

- Market Diversity: Applicable across various asset classes.

- Less Reliance on Technical Analysis: Focuses on fundamental news rather than complex chart patterns.

Cons:

- High Risk: Adverse news reactions can lead to substantial losses.

- Fast Execution Crucial: Requires rapid decision-making and swift trade execution.

- News Unpredictability: News events can be unpredictable, making it challenging to anticipate market reactions.

- Algorithmic Competition: Competition from high-frequency algorithmic traders can be intense.

- Emotional Pressure: Trading under pressure can lead to emotional decision-making and mistakes.

Tips for Successful News-Based Trading:

- Comprehensive News Alerts: Set up real-time alerts from reputable financial news sources to stay informed about breaking news.

- Pre-Plan Position Sizes and Risk: Determine your position size and risk tolerance before the news event to avoid impulsive decisions.

- Use Limit Orders: Limit orders help avoid slippage and ensure you enter trades at your desired price.

- Focus on Liquid Instruments: Trade highly liquid instruments to ensure smooth entry and exit.

- Pre-Defined Exit Strategy: Have a clear exit strategy in place before the news hits to manage risk and lock in profits or limit losses.

Individuals like Timothy Sykes, known for his penny stock news plays, have popularized aspects of this strategy. Furthermore, financial news networks like CNBC and Bloomberg play a crucial role in disseminating market-moving information, while professional hedge funds and proprietary trading firms often utilize sophisticated news-based trading algorithms.

When considering day trading vs swing trading, remember that news-based trading is a high-risk, high-reward approach specifically suited for day trading. It requires discipline, speed, and a keen understanding of market dynamics. By carefully managing risk and adhering to a well-defined strategy, traders can potentially capitalize on the volatility created by news events and achieve significant profits within the fast-paced world of day trading.

5. Position Trading (Swing Trading Strategy)

When comparing day trading vs swing trading, it's important to consider a longer-term swing trading approach known as position trading. This strategy stands apart from the rapid-fire nature of day trading and even the shorter-term holds of typical swing trading. Position trading involves holding investments for weeks, months, or even years, capitalizing on major market trends and fundamental analysis rather than short-term price fluctuations. It's a strategy that prioritizes identifying and riding the wave of significant market cycles while intentionally ignoring the daily noise that often distracts shorter-term traders. This makes it a particularly interesting option for those seeking to participate in the market without the constant demands of active trading.

Position trading operates on the principle that fundamental factors, such as company earnings, industry growth, and macroeconomic conditions, ultimately drive long-term market movements. Traders using this strategy meticulously research and select assets they believe are poised for substantial growth over extended periods. Unlike day traders who seek to profit from minute price changes, position traders are content to let their investments mature, allowing the underlying value of the asset to appreciate over time. This approach necessitates patience and a strong understanding of fundamental analysis. It's less about timing the market perfectly and more about identifying solid investment opportunities and letting them flourish.

Several compelling examples illustrate the potential of position trading. Consider an investor who identifies a growth stock with strong fundamentals and holds it through multiple earnings cycles, capitalizing on the company's expanding market share and increasing profitability. Another example could be a currency carry trade, where a trader borrows a low-interest-rate currency and invests in a higher-yielding one, profiting from the interest rate differential over several months. Commodity traders might take positions based on anticipated seasonal patterns, such as increased demand for heating oil during winter months. These examples demonstrate the diverse range of opportunities available to position traders.

For those interested in exploring position trading, several actionable tips can enhance their success. Focusing on weekly and monthly charts provides a broader perspective on market trends, filtering out the distracting noise of daily price fluctuations. Thorough fundamental analysis is crucial for identifying companies with strong growth potential and sustainable competitive advantages. Implementing wide stop-losses is essential to protect against temporary market corrections and avoid being prematurely shaken out of a position due to short-term volatility, often referred to as whipsaws. Diversification across multiple positions helps mitigate risk and ensures that a single adverse event doesn't derail the entire portfolio. Finally, maintaining a detailed trading journal allows for long-term analysis of trading decisions, enabling continuous learning and refinement of the strategy.

Position trading offers a compelling alternative within the day trading vs swing trading landscape, especially for individuals who prefer a less time-intensive approach. Its benefits include lower transaction costs due to fewer trades, the ability to capture major trend movements, and relative immunity to short-term market noise. These advantages make it particularly suitable for working professionals or those with other commitments that prevent constant market monitoring. However, it’s crucial to be aware of the cons. Position trading often requires significant capital to withstand potential drawdowns and longer holding periods. It also entails overnight and weekend risk exposure and fewer trading opportunities compared to shorter-term strategies. Furthermore, it demands strong emotional discipline to ride out market fluctuations without succumbing to fear or greed.

The success of legendary investors like William O'Neil, known for his CAN SLIM methodology, Jesse Livermore, a pioneer in trend following, and Nicolas Darvas, famous for his box theory, underscores the potential of position trading. Even institutional asset managers frequently employ variations of this strategy, focusing on long-term value creation. Ultimately, deciding between day trading vs swing trading and even considering position trading within the swing trading realm depends on individual risk tolerance, time commitment, and investment goals. Position trading stands out as a viable option for those seeking to capture the significant gains offered by major market trends without the constant demands of short-term trading.

6. Technical Pattern Trading (Swing Trading Strategy)

When comparing day trading vs swing trading, one significant advantage of the latter lies in the ability to leverage technical pattern trading. This swing trading strategy focuses on identifying and exploiting predictable price patterns that appear on charts, offering traders a structured approach to market analysis. These patterns, formed by the collective behavior of buyers and sellers, can provide valuable insights into potential future price movements. This approach is especially relevant in the context of swing trading, as it requires holding positions for several days, allowing sufficient time for these patterns to fully develop and play out.

Technical pattern trading revolves around classical chart formations such as triangles (ascending, descending, symmetrical), flags (bullish, bearish), head and shoulders (regular, inverse), and double tops/bottoms. These patterns are believed to represent recurring market cycles, reflecting shifts in supply and demand. By correctly identifying these patterns and understanding their implications, swing traders aim to capitalize on the predictable price movements that often follow their completion. Typically, trades based on this strategy are held for a period of 3-10 days, aligning perfectly with the swing trading timeframe.

How Technical Pattern Trading Works:

The core of this strategy lies in identifying these patterns within the context of the broader market trend. Traders utilizing multiple timeframe analysis will often look for patterns forming on daily or weekly charts, confirming them with price action on shorter timeframes. For example, a trader might spot a bullish flag pattern forming on the daily chart of a particular stock. They would then zoom in to a 4-hour or 1-hour chart to pinpoint the optimal entry point based on smaller price fluctuations within the pattern.

Once a pattern is identified, traders use established methods to measure potential price targets and define their risk-reward ratios. For instance, the height of a flagpole in a flag pattern can be projected from the breakout point to estimate the potential price move. This measured move provides the trader with a clear profit target. Stop-loss orders are typically placed just below key support levels within the pattern, limiting potential losses if the pattern fails to develop as expected.

Examples of Successful Implementation:

- Cup and handle patterns forming in growth stocks often signal a continuation of the upward trend, presenting buying opportunities for swing traders.

- Triangle breakouts in forex pairs can indicate a significant price move in the direction of the breakout, offering swing trading opportunities in the currency market.

- Flag patterns observed in commodity futures can provide swing traders with entry points to capitalize on short-term price fluctuations within a larger trend.

- Head and shoulders patterns identified in major indices can foreshadow potential market reversals, alerting swing traders to possible short-selling opportunities.

- Double bottom reversals spotted in individual stocks can signal a shift from a downtrend to an uptrend, offering buying opportunities for swing traders.

Actionable Tips for Swing Traders:

- Confirm patterns with volume analysis: Increased volume during pattern breakouts lends credibility to the move and increases the probability of a successful trade.

- Wait for pattern completion before entering: Premature entries can lead to losses if the pattern fails to fully develop.

- Use pattern target measurements for profit goals: This provides a clear and objective profit-taking strategy.

- Place stops below pattern support levels: This limits potential losses and protects capital if the trade moves against you.

- Combine with broader market trend analysis: Trading patterns within the context of the overall market trend significantly increases the probability of success.

Pros and Cons:

Pros:

- Well-defined entry and exit rules provide a structured approach to trading.

- Measurable profit targets allow for objective risk management.

- Time-tested methodology based on recurring market behaviors.

- Works across all timeframes and markets, providing versatility.

- Can be systematized and backtested for optimal performance.

Cons:

- Patterns can fail or give false signals, leading to losses.

- Requires experience to identify valid patterns and distinguish them from random price fluctuations.

- Market gaps can invalidate setups, rendering pre-defined entry and exit points useless.

- Overreliance on historical patterns can lead to missed opportunities based on evolving market dynamics.

- Pattern completion is not guaranteed, and prices may reverse before reaching the projected target.

Technical pattern trading offers swing traders a powerful toolkit for identifying and capitalizing on predictable price movements. By mastering the art of pattern recognition and combining it with sound risk management principles, swing traders can gain a significant edge in the markets. Resources such as Technical Analysis of Stock Trends by Robert Edwards and John Magee and Encyclopedia of Chart Patterns by Thomas Bulkowski, alongside educational platforms like StockCharts.com, are valuable resources for traders looking to deepen their understanding of this strategy. When considering day trading vs swing trading, the disciplined approach of technical pattern trading makes a compelling case for the latter, offering the potential for consistent profits with a well-defined methodology.

7. Mean Reversion Trading (Swing Trading Strategy)

When comparing day trading vs swing trading, a key differentiator often lies in the chosen strategy. While day traders capitalize on intraday price fluctuations, swing traders often employ strategies like mean reversion, aiming to profit from the cyclical nature of price movements over several days. Mean reversion trading capitalizes on the statistical tendency of prices to return to their average (or mean) over time. This strategy is a core component of many swing trading approaches and offers a compelling alternative to the rapid-fire world of day trading. Instead of chasing fleeting price spikes, mean reversion traders patiently wait for overextended price movements, betting that the market will eventually correct itself. This typically involves buying oversold conditions and selling overbought conditions, holding positions for 2-7 days until prices revert to their mean. This makes it a classic swing trading strategy, clearly distinguishing it from the intraday focus of day trading.

The underlying principle of mean reversion is rooted in market dynamics. Prices rarely move in a straight line. Periods of rapid price increases (overbought conditions) are often followed by corrections, while sharp declines (oversold conditions) frequently precede bounces. Mean reversion traders identify these overextended moves and position themselves to profit from the anticipated return to the average price. This is a counter-trend approach, meaning you are essentially betting against the current momentum, making it a stark contrast to trend-following strategies often employed in both day trading and swing trading.

In practice, mean reversion trading relies heavily on technical indicators designed to measure price oscillations and deviations from the mean. Oscillators like the Relative Strength Index (RSI) and stochastic are commonly used to identify overbought and oversold conditions. Standard deviation, which measures price volatility, helps traders determine the extent of price deviation from the average and set appropriate entry and exit points. For instance, a stock trading significantly below its 20-day moving average, coupled with an RSI reading below 30 (oversold), could signal a potential buying opportunity for a mean reversion trader. Conversely, a stock trading significantly above its 20-day moving average with an RSI reading above 70 (overbought) might present a short-selling opportunity.

Several successful examples demonstrate the potential of mean reversion trading within a swing trading context. RSI oversold bounces in blue-chip stocks, Bollinger Band mean reversion plays, and currency pair reversion to moving averages are common scenarios. For example, after a sudden market correction, an index ETF might gap down significantly. A mean reversion trader might see this as an opportunity to buy the ETF, anticipating a bounce back towards its moving average within a few days. Similarly, a commodity experiencing a spike due to temporary supply disruptions might present a short-selling opportunity, expecting the price to revert to its mean as supply normalizes. These examples highlight the versatility of mean reversion across different asset classes within the swing trading framework.

While mean reversion offers distinct advantages in swing trading, it’s crucial to understand its limitations. One of the most significant drawbacks is its vulnerability to strong trends. In a sustained uptrend or downtrend, mean reversion trades can lead to substantial losses as the price continues to move further away from the historical average. This is a key consideration when evaluating day trading vs swing trading, as day traders might be quicker to adapt to sudden trend changes. Additionally, accurate timing is crucial for successful mean reversion trades. Entering a trade too early or too late can significantly impact profitability. False signals can also occur in highly volatile markets, leading to whipsaws and losses. Furthermore, the profit potential per trade is often limited, as the strategy aims to capture smaller price fluctuations around the mean. This contrasts with trend-following strategies, which can yield larger profits if the trend persists. Finally, mean reversion trading can be psychologically challenging, as it requires traders to go against the prevailing market momentum.

To improve the effectiveness of mean reversion trading within a swing trading plan, consider the following tips: Use multiple confirmation indicators to filter out false signals. Avoid mean reversion strategies in strong trending markets. Size positions smaller due to the potential for whipsaws and false breakouts. Set tight profit targets near moving averages to capture the anticipated price reversion. Combine mean reversion analysis with broader market regime analysis to identify periods when the strategy is most likely to succeed. By incorporating these tips, traders can enhance their chances of success with mean reversion trading.

Mean reversion trading, popularized by figures like Larry Connors, Cesar Alvarez, and academic researchers like Eugene Fama, is frequently employed by quantitative hedge funds. Its statistical foundation and potential for consistent returns in range-bound markets make it a valuable tool for swing traders. Understanding its strengths and limitations within the broader context of day trading vs swing trading is crucial for any trader seeking to diversify their approach and capitalize on market fluctuations. A typical mean reversion trader executes around 10-20 trades per month, holding positions for 2-7 days, a timeframe that aligns perfectly with the principles of swing trading. This distinguishes it from the high-frequency trading characteristic of day trading and positions mean reversion as a valuable strategy for those seeking to navigate market oscillations with a more patient, statistically-driven approach.

7 Trading Strategies Comparison Overview

| Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Scalping (Day Trading Strategy) | High – requires real-time monitoring and fast execution | High – capital ($25k+), reliable platform, intensive time (8-12 hrs/day) | Small, consistent profits from many trades; limited overnight risk | Highly volatile, liquid markets like forex and futures during active hours | Quick profits; capitalizes on tiny price moves; consistent gains |

| Momentum Trading (Day Trading) | Medium-High – quick decisions; combines tech & fundamental analysis | Medium – scanners, market data feeds; moderate time commitment | Potential for large single-day gains; clear entry/exit signals | Trending, high-volatility markets with strong catalysts | Large gains; clear setup; works for varied account sizes |

| Range Trading (Day Trading) | Medium – identifying reliable support/resistance; technical analysis focus | Low-Medium – mainly charting tools; less intensive monitoring | Predictable, moderate profits within established ranges | Sideways/consolidating markets with defined price boundaries | Clear entries/exits; lower risk; suitable for sideways markets |

| News-Based Trading (Day Trading) | High – fast reaction required; relies on fundamental catalysts | High – multiple news sources, fast execution platform | Potentially explosive moves; event-driven opportunities | Earnings, economic reports, FDA approvals, and other market-moving news events | Access to big moves; less reliant on technicals |

| Position Trading (Swing Trading) | Low-Medium – longer timeframe, fundamental analysis focused | Medium – capital $10k+, less daily time needed | Captures major trends over weeks/months; lower daily time commitment | Investors preferring long-term trades and less frequent monitoring | Lower costs; less stress; captures broad market moves |

| Technical Pattern Trading (Swing) | Medium – requires pattern recognition skills and multiple timeframe analysis | Low-Medium – charting software, education resources | Measurable profit targets with defined risk/reward; moderate trade frequency | Swing trading across various markets and timeframes using classical patterns | Well-defined rules; testable; applicable to all market types |

| Mean Reversion Trading (Swing) | Medium – statistical analysis and indicator use required | Low-Medium – oscillators, charting tools; systematic approach possible | High win rate in range-bound markets; limited profits | Low-volatility, range-bound markets where prices revert to mean | Statistically grounded; high success in sideways markets |

Elevate Your Trading with ChartsWatcher

Choosing between day trading and swing trading depends largely on your individual trading style, risk tolerance, and time commitment. We've explored various strategies within each approach, from the rapid-fire nature of scalping and momentum trading to the more patient approaches of position and mean reversion trading. Understanding the core differences between day trading vs swing trading—like the time horizon involved and the types of analysis used—is critical for consistent profitability. Mastering these concepts empowers you to make informed decisions, manage risk effectively, and capitalize on market opportunities aligned with your specific goals. This knowledge is fundamental whether you’re executing quick trades based on intraday fluctuations or holding positions for several days or weeks to capture larger swings.

For those involved in financial services, leveraging your expertise online is crucial for growth. A strong online presence can significantly expand your reach and influence within the financial community. To optimize your visibility and attract the right audience, consider exploring resources like the SEO for Financial Services: Your Complete UK Success Guide from Blackbird Digital.

Ultimately, success in either day trading or swing trading requires continuous learning, adaptation, and access to reliable market data. Ready to take your trading to the next level? Explore the power of ChartsWatcher. Whether you're analyzing minute-by-minute price action for a day trade or tracking broader market trends for a swing trade, ChartsWatcher provides the tools and insights you need to succeed in both fast-paced and longer-term strategies.