Backtest Trading Strategies That Actually Work

Understanding What Makes Strategy Backtesting Work

Backtesting trading strategies is often presented as the holy grail of market success. However, the reality is more complex. It isn't as simple as inputting a strategy into software and watching simulated profits accumulate. Effective backtesting relies on understanding the core principles that distinguish robust strategies from expensive errors. Let's explore what truly makes backtesting work and how to avoid common traps.

The Foundation of Effective Backtesting

A crucial aspect of backtesting is understanding its fundamental purpose: validation, not optimization. Many traders get caught in a cycle of endlessly adjusting parameters until their backtests display impressive returns. This practice, known as overfitting, creates strategies finely tuned to historical data, but prone to failure in live trading.

Instead, backtesting should confirm a strategy's logic and evaluate its potential across diverse market conditions. This means concentrating on realistic scenarios and acknowledging that losses are unavoidable, even with a successful backtest. You might be interested in: How to master...

Backtesting involves applying historical data to evaluate the performance of trading strategies. This process is essential for confirming a strategy’s potential profitability and assessing its risk exposure before live trading. For example, a mean reversion strategy can be tested using historical data to understand its past behavior. High-quality historical data is key to accurate results, allowing traders to evaluate their strategies in various market conditions. Explore this topic further: Learn more about backtesting trading strategies

The Mindset Shift

Successful backtesting demands a particular mindset. It involves approaching the process with skepticism and a focus on risk management. Traders must consistently challenge their assumptions and identify potential weaknesses in their strategies.

For instance, does the strategy depend on flawless execution? Does it overlook slippage and commissions? These seemingly minor details can significantly influence real-world outcomes.

The Importance of Data Quality

The quality of your data directly affects the reliability of your backtests. Using inaccurate or incomplete data is akin to constructing a building on a weak foundation. The results will be deceptive and ultimately result in poor trading choices. For current articles on trading, check out this Blog.

Important factors to consider include survivorship bias (excluding delisted stocks), corporate actions (splits and dividends), and data errors. Cleaning and validating your data is essential for dependable backtesting results.

From Backtesting to Trading Decisions

Transforming backtested results into actionable trading decisions requires careful analysis. While impressive returns are tempting, prioritize risk-adjusted performance metrics, such as the Sharpe Ratio and maximum drawdown. These metrics offer a more practical view of a strategy's potential profitability and risk.

Understanding backtesting's limitations is also crucial. No backtest can perfectly predict future market behavior. However, a properly executed backtest, coupled with robust risk management, can substantially improve the probability of trading success.

Choosing Tools That Match Your Trading Reality

Choosing the right backtesting tools for your trading strategies can be overwhelming. Numerous platforms, ranging from simple spreadsheets to complex software like Trade Ideas, promise incredible returns. However, the best tool isn't about flashy features. It's about aligning with your individual trading style, budget, and technical skills. Let's explore how to navigate the platform landscape and make informed choices.

From Python To Premium: Understanding the Options

Backtesting tools come in a wide variety. On one side, you have open-source programming languages like Python. Python provides flexibility and customization for experienced coders. Libraries such as Pandas and NumPy offer strong data manipulation abilities, while others are specifically designed for backtesting. This approach, however, requires significant programming knowledge and a substantial time commitment. Building a custom Python backtesting environment, for instance, requires understanding data structures, algorithms, and statistical analysis.

Traders also need to find and clean their own historical data, which adds another layer of complexity. This method offers granular control and avoids recurring subscription fees, making it suitable for highly technical traders with very specific needs.

On the other side are premium backtesting platforms. These platforms typically offer user-friendly interfaces, pre-built functions, and integrated data sources. They often cater to particular asset classes, like stocks or cryptocurrencies, providing specialized features like charting tools and simulated order execution. These conveniences come with a cost, frequently involving significant subscription fees. The platform's built-in limitations may also restrict customization, hindering some highly specialized trading strategies.

Evaluating Platforms Like a Pro

Successful traders look beyond marketing hype. Data quality is crucial. A platform with inaccurate data generates misleading results, which can lead to poor trading decisions. Carefully consider the data source, its coverage, and how it handles corporate actions and survivorship bias.

Next, examine the execution modeling. Does the platform realistically simulate real-world trading, including slippage, commissions, and order routing delays? Oversimplified execution creates unrealistic backtest results and inflates potential profits.

Finally, consider integration capabilities. Can the platform connect seamlessly with your brokerage account for automated trading? Does it support your preferred charting software or data feeds? A disjointed workflow reduces efficiency and increases the chance of errors.

The Hidden Costs: More Than Just Subscriptions

While subscription fees are an obvious expense, don't overlook other hidden costs. The learning curve of a new platform represents a significant time investment. Complex platforms may demand extensive training before you can use them efficiently. This downtime can delay your trading and impact your potential profits.

Also, consider the opportunity cost of a limited platform. If a platform restricts strategy customization, it might prevent you from discovering profitable strategies, hindering your innovation and ability to adapt to changing markets.

To help illustrate these points, let's look at a comparison of common backtesting platform types:

Backtesting Platform Reality Check: An Honest Comparison of Leading Platforms Including Real Costs, Learning Curves, and What You Actually Get

| Platform | Best For | Real Learning Curve | Hidden Costs | Key Limitations |

|---|---|---|---|---|

| Spreadsheet | Basic Strategies, Beginners | Low | Limited Features, Manual Data Entry | Data Capacity, Complex Calculations |

| Open Source (Python) | Advanced Strategies, Coders | High | Time Investment, Data Sourcing | Requires Programming Skills |

| Premium Platform | Specific Asset Classes, Ease of Use | Medium | Subscription Fees, Feature Limits | Customization Restrictions |

As the table shows, each platform type has its own strengths and weaknesses. Spreadsheets are easy to use but limited in their capabilities. Open-source solutions offer flexibility but demand coding skills. Premium platforms provide convenience but can be costly and restrictive.

By considering these factors, you can choose the best backtesting platform for your needs and maximize your trading potential. The best tool empowers you to backtest effectively and confidently implement your strategies in live markets.

Building Data Foundations That Don't Lie

Your backtesting results are only as reliable as the data they are built on. A flawed foundation can make a losing trading strategy appear profitable in backtests, potentially leading to significant losses when implemented live. This section explores critical data quality issues that can sabotage your efforts and offers practical solutions to avoid these pitfalls.

Sourcing Reliable Data: The First Line of Defense

Building a robust data foundation starts with sourcing reliable historical data. Free data sources might seem attractive, but they frequently lack the necessary quality and completeness for accurate backtesting. Think of it like building a house – using cheap materials might seem economical initially but will eventually lead to problems.

Free data might not accurately represent corporate actions such as stock splits and dividends. This can create distortions in price history, affecting backtest accuracy. Similarly, survivorship bias, where delisted or bankrupt companies are excluded, can paint an overly optimistic view of past market performance.

High-quality data, though potentially more expensive, offers a much stronger base for accurate backtesting. Reputable financial databases and market data providers offer comprehensive historical data, adjusted for corporate actions and survivorship bias, providing a truer reflection of market activity. Using reliable sources like financial databases is essential. This ensures your backtesting results reflect real-world conditions. For more on the vital role of high-quality data in backtesting, learn more about high-quality data and backtesting.

Structuring Data For Accurate Analysis

After sourcing reliable data, the next step is structuring it properly for analysis. This involves formatting the data so that your backtesting software can interpret and process it efficiently.

-

Consistent Timeframes: Make sure your data adheres to uniform timeframes (daily, hourly, or tick data). Mixing timeframes can introduce errors and skew results.

-

Data Cleaning: Thoroughly clean your data to eliminate errors, outliers, and missing values. Even minor errors can have a significant impact on your backtesting results over time.

-

Format Consistency: Maintain a consistent data format, whether CSV, JSON, or a database format. This guarantees compatibility with your software and streamlines data management.

Identifying and Addressing Data Issues: Real-World Examples

Several recurring data issues can create misleading backtest results. Survivorship bias, as discussed earlier, creates an artificially inflated view of past returns. Imagine backtesting a strategy using a dataset excluding companies that went bankrupt during the dot-com bubble. The backtest might show impressive returns that wouldn't hold up in real-world market conditions.

Adjustment errors, such as incorrect handling of stock splits or dividends, can also severely distort results. A minor miscalculation of the adjusted price after a stock split can dramatically impact the accuracy of trade simulations and performance metrics.

Look-ahead bias incorporates future information into your backtest. This can occur if your backtest utilizes data that wouldn't have been available at the time the trades would have been made. Using end-of-day data to simulate intraday trades is an example of this bias.

Validating Your Data: Building Trust in Your Results

Validating your data is a crucial step in ensuring the accuracy of your backtesting process. This includes comparing your data against alternative sources, identifying inconsistencies, and verifying the proper adjustments for corporate actions. This acts as a critical quality control check, confirming the accurate reflection of market reality.

By meticulously sourcing, structuring, and validating your data, you establish a solid foundation for effective backtesting. This process allows you to evaluate trading strategies with confidence, make more informed decisions, and avoid costly mistakes that stem from using faulty data.

Making Sense of Statistical Significance

Backtesting trading strategies can yield exciting results. However, understanding the statistical significance of these results is paramount. Impressive returns can be deceptive if they're merely due to random market fluctuations or overfitting to historical data. This section explores how to determine if your backtested profits represent genuine alpha or simply a lucky streak.

The Importance of Sample Size

Sample size, referring to the number of trades executed during a backtest, is fundamental to statistical significance. A small sample size increases vulnerability to random noise, potentially creating a false sense of confidence. For instance, strong returns from a strategy over just 20 trades might not indicate long-term success.

The number of trades needed for statistical significance varies depending on the strategy and market conditions. A general guideline is to aim for at least 100 to 200 trades. This provides a more reliable basis for evaluating long-term performance and robustness.

Backtesting a strategy for 5 years across varying market conditions (bull, bear, and ranging) could yield thousands of simulated trades, offering a thorough viability assessment. This helps prevent curve-fitting, where a strategy is overly optimized for historical data and might fail in live trading. Learn more about analyzing backtesting data. Accurate data collection is essential; check out these tips for bookmarking a website.

Confidence Intervals and Drawdowns

Confidence intervals offer a range within which your strategy's true performance likely falls. A narrow confidence interval indicates higher certainty. A 95% confidence interval of 10-12% annual return is more reliable than a 5-20% range.

Analyzing drawdowns, or periods of declining portfolio value, is equally important. All strategies experience drawdowns. Understanding their frequency, depth, and duration provides crucial risk insights. A strategy with excessive or prolonged drawdowns may need adjustments, even with high average returns.

Avoiding Premature Optimization

Premature optimization, tweaking strategy parameters based on small or statistically insignificant sample sizes, is a common pitfall. For example, maximizing returns during short, high-volatility periods might not be sustainable. Focus on validating your strategy's core logic with a statistically significant sample size before fine-tuning.

From Backtesting to Live Trading

A robust backtest is vital but not a future success guarantee. Market conditions shift, and no backtest perfectly predicts the future. Use backtesting to validate and refine your strategy, understand its statistical significance, and implement suitable risk management. You might also find this helpful: How to backtest like a pro.

By prioritizing statistical significance, you make informed decisions about capital allocation and improve your chances of successful trading. This includes avoiding premature optimization, designing adaptable strategies, and critically evaluating results.

Avoiding the Traps That Destroy Results

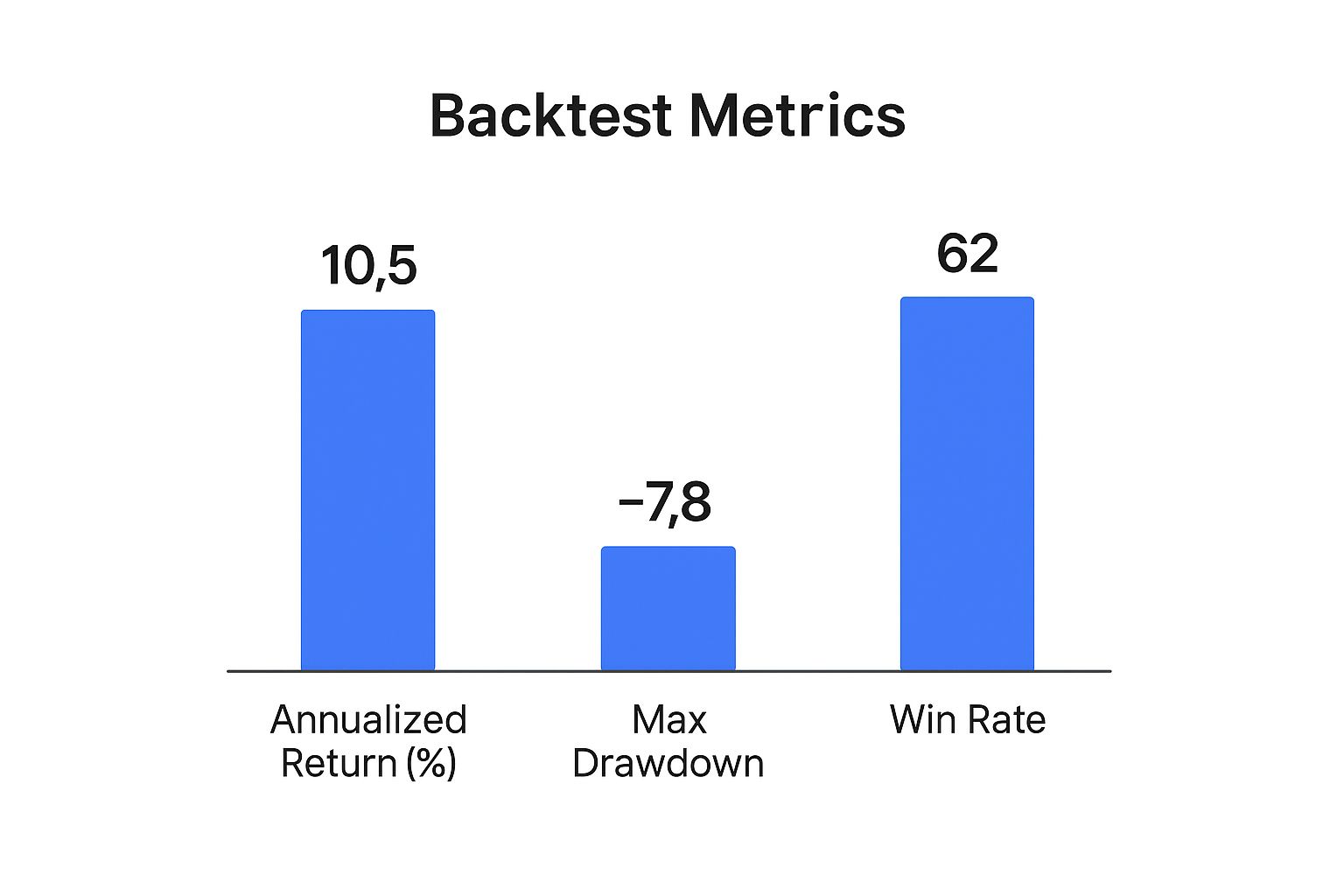

The infographic above illustrates three vital backtest metrics: annualized return, maximum drawdown, and win rate. A high annualized return may seem enticing, but the corresponding maximum drawdown highlights the potential for significant losses. When backtesting trading strategies, finding the balance between potential profits and acceptable risk is paramount.

Even when results appear statistically significant, backtesting can be deceptive if certain traps aren't avoided. These pitfalls can make losing strategies appear incredibly profitable, tempting traders into costly errors. This section explores the most common and detrimental traps, demonstrating how they appear in practice and offering practical solutions to protect your analysis.

Overfitting: The Illusion of Perfection

Overfitting happens when a trading strategy becomes too closely tailored to historical data. It's like a student memorizing answers for a test instead of understanding the underlying concepts. An overfitted strategy performs brilliantly on past data but falters in live trading.

This occurs because the strategy has captured the noise and random fluctuations within the historical data, not the true market dynamics. For instance, a strategy optimized for a specific low-volatility period might fail dramatically during a sudden market crash.

Look-Ahead Bias: Trading With Future Knowledge

Look-ahead bias introduces future information into your backtest, creating unrealistic outcomes. It happens when your strategy uses data that would not have been available at the time a trade would have been executed.

One example is using end-of-day closing prices to backtest intraday strategies. This gives the simulated trader an unfair advantage, as they make decisions based on information unavailable intraday. This creates a misleading impression of profitability that disappears in live trading.

Survivorship Bias: Ignoring the Fallen

Survivorship bias results from excluding failed companies from the historical data. Imagine backtesting a strategy on a stock index that only includes currently listed companies. This overlooks companies that went bankrupt or were delisted, leading to an artificially inflated view of past performance.

Your strategy might appear successful because it avoids the losses from these failed companies, resulting in inaccurate expectations about future performance.

Recognizing The Warning Signs and Implementing Solutions

Several warning signs can indicate potential issues with your backtesting results:

- Excessively High Returns: Returns substantially higher than market averages should be treated with skepticism, particularly when coupled with low drawdowns.

- Complex Rules and Numerous Parameters: Strategies with many adjustable parameters are more vulnerable to overfitting. Simplicity is often the better approach.

- Lack of Robustness: Test your strategy under different market conditions. A robust strategy performs reasonably well across various scenarios, not just during a specific historical period.

To mitigate these biases, consider these strategies:

- Out-of-Sample Testing: Set aside a portion of your historical data specifically for out-of-sample testing. This tests the strategy on data it hasn't been exposed to, providing a more realistic performance assessment.

- Walk-Forward Analysis: Divide your data into multiple periods and progressively test your strategy on each one, refining it as you go. This approach simulates real-world adaptation.

- Simulate Real-World Conditions: Incorporate factors like slippage, commissions, and realistic order execution into your backtests. This helps avoid inflated profit expectations.

To help illustrate these concepts further, the following table summarizes the backtesting traps, their manifestations, warning signs, and prevention methods.

Backtesting Traps and How to Spot Them

| Trap | How It Manifests | Warning Signs | Prevention Method | Quick Check |

|---|---|---|---|---|

| Overfitting | Strategy tailored too tightly to historical data; captures noise rather than true market dynamics | Excessively high returns; complex rules; poor out-of-sample performance | Out-of-sample testing; simplify strategy rules | How does performance compare on unseen data? |

| Look-Ahead Bias | Using future information (not available at the time of the trade) in the backtest | Unrealistically high win rates; strategies exploiting information not available at the time | Ensure all data used is available at the simulated trade execution time | Is all data used historically accurate for the backtest period? |

| Survivorship Bias | Excluding failed companies or assets from historical data | Artificially inflated performance; ignoring potential downsides | Use complete datasets, including failed companies or delisted assets | Does the dataset accurately represent the entire market for the backtested period? |

By understanding these common backtesting traps and employing preventative measures, you can build a robust and reliable backtesting process that generates results translatable into live trading. This rigorous approach separates genuine edge from statistical illusion, transforming backtesting from a source of expensive lessons into a powerful tool for profitable trading.

Turning Results Into Trading Decisions

Transforming backtesting output into confident trading decisions requires a shift in perspective. It’s not enough to simply see high returns. Successful traders dig deeper, analyzing the metrics that tell the real story. This section explores how to translate backtest results into actionable strategies for live trading.

Beyond Simple Returns: Analyzing Performance Metrics

High returns are enticing, but they don't guarantee future success. Consider risk-adjusted performance metrics. For example, the Sharpe Ratio measures return relative to volatility. This provides a clearer picture of profitability adjusted for risk.

A strategy with a Sharpe Ratio of 1.5 is generally considered better than one with a Sharpe Ratio of 1.0, even if the latter has higher returns.

Analyzing drawdowns – periods of declining portfolio value – is also critical. All strategies experience drawdowns. The key is understanding their frequency, depth, and how long they last. A strategy with frequent, deep drawdowns might be too risky, despite a high average return.

Comparing Strategies: Finding the Real Alpha

When backtesting multiple strategies, choosing the one with the highest historical return is tempting. However, this overlooks the possibility of lucky streaks and overfitting.

You need a framework for objective comparison. Consider factors like:

- Consistency: Does the strategy consistently perform well in different market conditions, or is its success limited to a specific period?

- Risk-Adjusted Returns: Metrics like the Sharpe Ratio provide a better comparison when considering risk.

- Transaction Costs: Factor in realistic transaction costs, such as commissions and slippage. High transaction costs can significantly reduce profits.

Considering these factors allows you to identify strategies with true alpha – consistent, risk-adjusted outperformance. You can learn more about the process here: How to backtest like a pro.

Setting Realistic Expectations: Bridging the Gap Between Backtests and Reality

Backtesting relies on historical data. While it offers insights, it cannot predict future market behavior. Avoid unrealistic expectations based solely on backtested results.

Understand the inherent limitations. Markets change, new information appears, and unexpected events occur. Your actual trading performance might differ from your backtest results, even with a strong strategy.

From Backtests to Forward Testing: The Next Step

Before risking capital based on backtested results, consider forward testing. This involves simulating trades in a live market with a small amount of capital.

Forward testing bridges the gap between simulated past performance and the unpredictable future. It allows you to refine strategy parameters and prepare for real-world conditions.

For example, you might forward test your strategy for three months. Good performance increases confidence. Poor performance highlights areas for adjustment before significant capital is at risk.

The Power of Informed Decisions

Backtesting isn't about predicting the future perfectly. It's about making informed decisions. Analyzing performance metrics, comparing strategies objectively, and understanding the relationship between backtested and live results improves your chances of profitable trading. This knowledge helps you choose strategies worthy of your capital and attention.

Ready to improve your trading? ChartsWatcher offers the tools and resources to backtest, analyze, and execute your strategies effectively. Visit today to explore our platform and discover how we can help you reach your trading goals.