A Trader's Guide to Bear Trap Trading

A bear trap is one of the most frustrating patterns in trading. It’s a fake-out, a classic "head fake" where the market tricks you into thinking a solid uptrend has finally rolled over, only to snap back and rip higher.

This pattern is designed to do one thing: trap bearish traders who jump the gun and short the asset. They get caught, and as the price recovers, they're forced to buy back their positions at a loss, which only throws more fuel on the fire.

Understanding the Bear Trap Phenomenon

Picture a trap door on a stage. A character confidently steps onto what looks like solid ground, but the floor gives way. They fall, and just as fast, the door snaps shut again, leaving the stage looking exactly as it did before. That’s a bear trap in the markets. It’s a sudden, sharp price drop that looks like the start of a new downtrend, luring sellers into short positions.

This drop will almost always break through a key support level—an area on the chart where the price has repeatedly bounced before. When that floor breaks, aggressive sellers see it as their green light. They pile in, expecting the price to keep sliding.

But it’s a setup. The breakdown is a feint. The price quickly reverses course, blasts back above that now-broken support, and often resumes its original uptrend with even more power.

A bear trap is essentially a test of market conviction. It’s a manufactured move designed to shake out weak hands and punish overly aggressive sellers before the real upward trend resumes.

This process is what makes the pattern so powerful. The sellers who got "trapped" are now underwater and scrambling to get out. Their frantic buying to cover their shorts adds a surge of buying pressure, turning what was once a support level into a launchpad for a powerful rally. Learning to spot this dynamic isn't just about avoiding a painful loss; it's about identifying a fantastic opportunity to go long.

The Psychology Behind the Trap

At its core, bear trap trading is a game of psychology, driven by two of the most powerful emotions in the market: fear and greed.

- Fear of Missing Out (FOMO): Eager sellers see the price cracking a major support level and can't stand the thought of missing a big move down. They rush to get short without waiting for any real confirmation.

- Panic and Capitulation: When the price whipsaws back against them, panic sets in. Their desperate buying to close out their losing short positions creates a "short squeeze," which is what causes the price to accelerate higher so quickly.

Getting a handle on the broader dynamics of short-selling is key to anticipating these traps. For a deeper dive, check out these Short-Selling Strategies and Market Insights. By learning to identify the classic signatures of a bear trap, you can flip a common trading pitfall into one of your most reliable setups.

The Anatomy of a Bear Trap

To spot a bear trap—and more importantly, not get caught in one—you have to understand how they’re built. A classic bear trap isn't just a random price drop; it’s a carefully orchestrated sequence of events designed to sucker in sellers at the worst possible moment. Think of it as a four-act play, where each scene builds on the last to create a dramatic, and often profitable, reversal.

It all starts with a prevailing uptrend. The stock or asset is looking healthy, making higher highs and higher lows. This established upward momentum is the foundation, setting the expectation that buyers are firmly in control.

The Consolidation Phase

After a strong run-up, the price action often cools off and enters a consolidation period. The stock trades sideways in a range, carving out a clear and obvious support level. This is the floor where buyers have repeatedly stepped in, creating a psychological line in the sand that every trader on the street is watching.

This sideways grind can look like the uptrend is losing steam, which is exactly what starts to get the bears interested. They see the momentum stalling and get ready to pounce, waiting for that support level to finally give way. Volume is usually pretty light here, suggesting a temporary truce between buyers and sellers before the real fireworks begin.

The Breakdown and the Snap-Back

The third act is where the trap springs. The price suddenly—and often violently—plunges below that well-defined support level. This move is usually juiced with a big spike in volume, making it look like a legitimate, high-conviction breakdown. This is the bait. Eager sellers, seeing the broken support and heavy volume, pile in and open short positions, convinced a major downtrend is underway.

But then, just as quickly as it fell apart, the selling dries up. The price whips back around and rallies right back above the old support level. This rapid recovery is the final piece of the puzzle, confirming the breakdown was nothing more than a fake-out. All those sellers who shorted the breakdown are now trapped, scrambling to cover their losing positions.

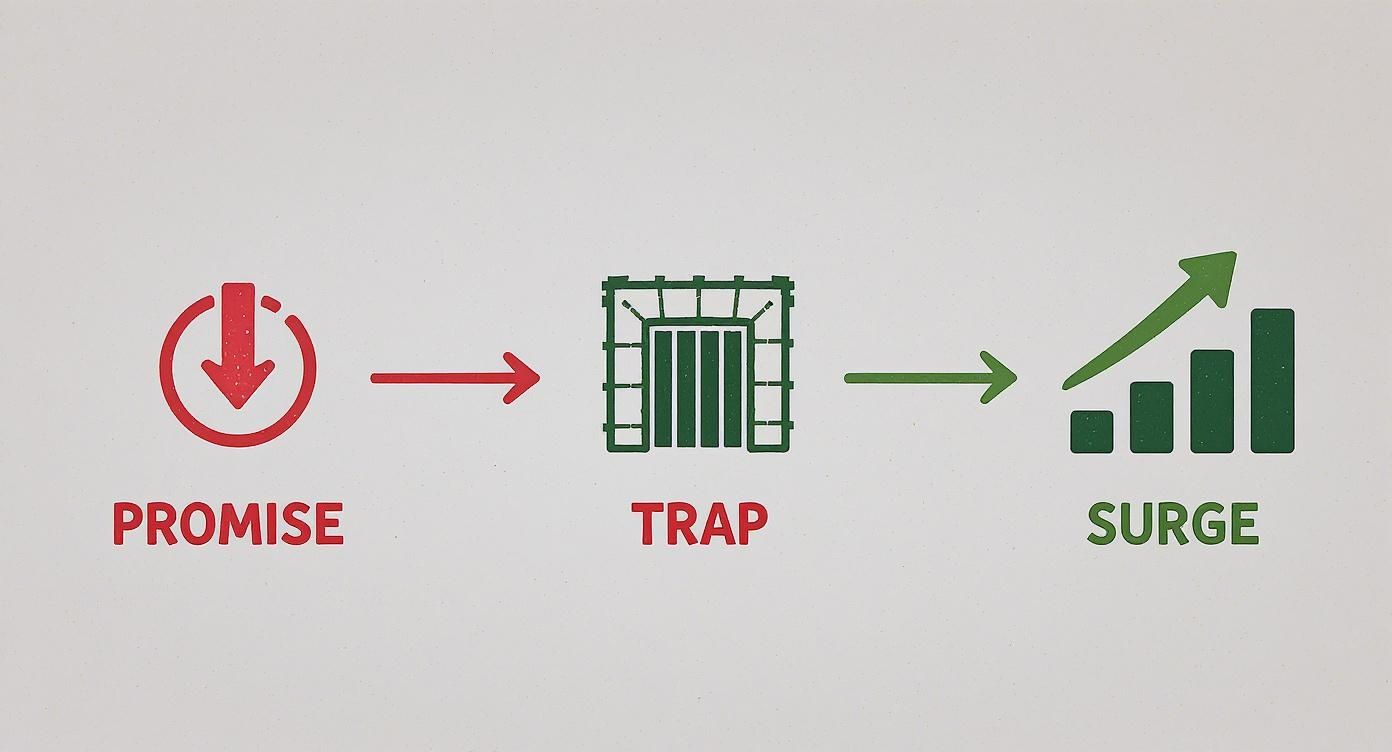

To really see it in action, look at the simple three-step flow of a bear trap setup.

This diagram perfectly captures the market's initial bearish promise, the moment sellers get trapped, and the powerful surge that follows as the shorts are forced to cover.

Interestingly, while we're focused on bear traps in bull markets, their evil twin—the bull trap—is even more common during bear markets. Research across eight major indexes found that bull traps happened more than 2 to 1 compared to bear traps. It’s a stark reminder of the risks of chasing breakouts and breakdowns without solid confirmation. You can read more about these findings on market traps and false breakouts to get the full statistical picture.

Key Takeaway: A bear trap isn't just about price breaking support. The defining feature is the failure of the price to stay below it. That rapid reclaim of the support level is what validates the pattern and signals a potential long entry.

Technical Indicators for Confirming a Bear Trap

Trading a bear trap on price action alone is like trying to navigate a storm with just a compass—you've got a general direction, but you're missing the critical details. To really know if you've spotted a true reversal or just a sucker's bounce, professional traders pull out a toolkit of technical indicators. Think of them as your multi-layered confirmation system.

A genuine bear trap isn't just a flick on the chart; it's a fundamental shift in market psychology. These tools help us look under the hood and see if buyers are truly wrestling control back from the sellers who just sprung the trap. Without this extra evidence, you're basically just guessing.

Reading the Story in Volume

If there's one confirmation tool you can't afford to ignore in bear trap trading, it's volume. Volume is the ultimate truth-teller; it measures the conviction behind any price move. A breakdown below a key support level on weak, pathetic-looking volume is an immediate red flag. It suggests there's no real firepower behind the sellers.

On the flip side, a classic bear trap often shows a massive, dramatic surge in volume right at the bottom of the move. This is what we call exhaustion volume or capitulation volume. It's the moment when all the panicked weak hands finally throw in the towel, and the big, strong-handed buyers step in to scoop up everything they're selling.

When you see a giant volume spike as the price snaps back upwards, that's a powerful signal that the trap has been set and the sellers are completely gassed out. To really get a handle on reading these market tells, check out our guide on trading with volume in our modern guide to market analysis.

Uncovering Hidden Strength with Divergence

Momentum oscillators like the Relative Strength Index (RSI) or MACD are fantastic for spotting a downtrend that's running out of steam. The specific signal you’re hunting for here is bullish divergence.

Bullish divergence happens when the price of an asset prints a new low, but your momentum indicator refuses to follow, instead carving out a higher low. This disconnect is a dead giveaway that the downward momentum is fading fast, even as the price takes one last dive.

This is a classic sign that sellers are losing their grip. The price is falling on fumes, making it incredibly vulnerable to a violent reversal. Spotting bullish divergence on your RSI or MACD as price breaks support is a huge clue that a bear trap is unfolding right before your eyes.

It’s like the price is screaming "down!", but the underlying momentum is whispering "up." In the world of bear trap trading, you need to listen to that whisper.

Candlestick Patterns as Reversal Signals

Candlestick patterns give you a high-definition snapshot of the battle between buyers and sellers at that make-or-break moment. Right at the low of a potential bear trap, specific bullish reversal patterns can act as your final confirmation and the trigger for your entry.

Here are a few of the most reliable patterns to watch for:

- Bullish Engulfing Candle: A huge green candle that completely swallows the body of the previous red candle. This is pure aggression, showing that buyers didn't just show up—they completely overwhelmed the sellers in a single period.

- Hammer or Dragonfly Doji: These candles have long tails sticking out the bottom and tiny bodies at the top. This tells you that sellers tried their best to push prices lower, but buyers came storming back, rejecting those low prices and closing the session right back near the open.

- Morning Star: This is a three-candle pattern. It starts with a big red candle, followed by a small, indecisive candle (or doji), and is finished off by a big green candle. It visually paints the picture of panic selling giving way to a powerful bullish takeover.

Now, let's put it all together in a quick reference table.

Key Indicators for Bear Trap Confirmation

This table breaks down the essential indicators we've discussed, showing what each one tells you and the specific signal to look for when confirming a bear trap.

| Indicator | What It Measures | Confirmation Signal for a Bear Trap |

|---|---|---|

| Volume | The amount of trading activity and conviction | A massive spike in exhaustion volume at the new low, followed by a sharp price reversal on high volume. |

| Momentum Oscillators | The speed and strength of price movements (e.g., RSI, MACD) | Bullish divergence: Price makes a new low, but the indicator makes a higher low, signaling weakening momentum. |

| Candlestick Patterns | The psychology of buyers vs. sellers in a period | A clear bullish reversal pattern like a Bullish Engulfing, Hammer, or Morning Star forming at the low. |

By combining these three elements—volume, divergence, and candlesticks—you create a robust trading checklist. When all three line up, the odds of a successful bear trap trade swing heavily in your favor, giving you the confidence you need to pull the trigger.

Putting Your Bear Trap Strategy into Action

Spotting a high-probability bear trap is only half the job. The real test of a trader's discipline comes down to execution. What separates the consistently profitable traders from those who get chewed up by market noise is a clear, mechanical, and repeatable plan for how to get in, manage risk, and take profits. This is where your analysis turns into action.

A solid strategy takes emotion out of the equation. When the price is whipping around and your capital is on the line, the last thing you want is to be making decisions based on a gut feeling. Instead, you need to fall back on a pre-planned framework that tells you exactly what to do at every stage of the trade.

Pinpointing Your Entry Trigger

Nailing your entry is probably the most critical part of bear trap trading. Jump in too early, and you risk getting caught in more downside if the trap hasn't fully snapped shut. But if you wait too long, you might miss the most explosive part of the reversal. The key is to wait for confirmation.

The most dependable entry signal is a strong move back above the broken support level. This is the moment the market screams that the breakdown was a fake-out.

A professional trader doesn't try to catch a falling knife. They wait for the knife to hit the floor, bounce, and land safely in their hand. Entering after the price reclaims the old support level is the trading equivalent of this.

Your entry trigger has to be objective and non-negotiable. For instance, you could decide to go long only after a full candle closes decisively back above that prior support line. This simple rule keeps you from getting faked out by a quick intraday spike that ultimately fails.

Setting a Disciplined Stop-Loss

Look, no trading strategy is foolproof, and bear trap setups can and do fail. That’s why your stop-loss is your single most important risk management tool. It defines your maximum acceptable loss before you even click the buy button, ensuring that one bad trade can't blow up your account.

The most logical spot for your stop-loss is just below the absolute low of the bear trap pattern. If the price goes there, your entire trade idea is proven wrong, period.

Here’s a simple process for placing your stop:

- Identify the Low: Find the lowest wick the price hit during the false breakdown.

- Add a Buffer: Place your stop-loss order a little bit below this low. This buffer helps you avoid getting knocked out by random market noise or a quick retest.

- Calculate Position Size: Once you know your entry price and your stop-loss level, you can calculate the perfect position size that fits your risk tolerance (e.g., risking no more than 1% of your account on any single trade).

This mechanical approach means your risk is controlled and pre-defined every single time. No guesswork.

Developing a Smart Profit-Taking Plan

Knowing when to cash out is just as important as knowing when to get in. A classic mistake is clinging to a winning trade for too long, only to watch it reverse and give back all those hard-won gains. A structured profit-taking plan helps you lock in profits systematically.

A multi-tiered approach usually works best:

- Initial Target (T1): Set your first profit target at the next significant resistance level. This is often a previous swing high from before the price started consolidating. Cashing out a piece of your position here (maybe 33-50%) lets you de-risk the trade and pocket some cash.

- Trailing Stop for the Rest: After T1 is hit, slide your stop-loss up to your entry price. Now you've got a risk-free trade on the rest of your position. From there, you can use a trailing stop (like a 20-period moving average) to let your winner run and capture as much of the new uptrend as possible.

This hybrid strategy gives you the best of both worlds: you get to secure profits while still giving yourself a shot at catching a massive home-run trade.

Quantitative analysis of similar strategies really drives this home. One backtest of a bear trap strategy from the early 1980s, covering 181 trades, showed an impressive 80% win rate and an average gain of 1.7% per trade. This systematic approach delivered a compound annual growth rate (CAGR) of 13% over the period. It just goes to show that with clear rules, exploiting these patterns can be a sustainable, long-term edge. You can explore the full data behind this bear trap trading strategy to see for yourself how data-driven rules can produce consistent results.

Automating Your Search for Bear Trap Setups

Staring at hundreds of charts, manually hunting for that perfect bear trap setup? That's an exhausting and inefficient way to trade. In today's markets, the pros use technology to get an edge, turning a grueling manual search into an automated discovery process. By building a custom scanner, you can let your platform do the heavy lifting, freeing you up to focus on what really matters: analysis and execution.

The idea is simple: translate the visual patterns and indicator signals we’ve covered into a set of logical rules a computer can follow. Using a platform like ChartsWatcher, you can build a filter that constantly sifts through the entire market, flagging only the stocks that meet your precise criteria for a potential bear trap. This flips your trading from reactive to proactive.

Building Your Custom Bear Trap Scanner

A truly powerful bear trap scan isn't about finding just one signal. It's about combining several conditions that, when they all fire at once, tell a compelling story. You're looking for a confluence of factors that stack the odds in your favor.

Here’s a foundational set of rules you can plug into your scanner to get started:

- Establish the Long-Term Uptrend: First things first, you only want to trade with the prevailing trend. A simple but effective rule is to scan only for stocks trading above their 200-day simple moving average (SMA). This immediately weeds out anything in a clear, long-term downtrend.

- Identify the False Breakdown: Next, you need to pinpoint the "trap" itself. Add a condition that looks for stocks that have just closed below a key shorter-term support level, like the 50-day SMA, for the first time in a while (say, the last 30 days). This isolates that critical break of support that sucks in the bears.

- Confirm with Bullish Divergence: This is the secret sauce that helps filter out legitimate breakdowns from the fakes. Add a rule to find bullish divergence on the Relative Strength Index (RSI). Specifically, the scanner should flag instances where the price just made a new low, but the 14-day RSI printed a higher low.

This screenshot shows what a typical scanner interface looks like. You can see how multiple rules—like moving averages and RSI conditions—are layered to create a highly specific search. The real power is in combining these conditions to find the exact market scenarios you’re looking for.

Pro Tip: Don't just run scans; set up real-time alerts based on your results. Instead of babysitting the scanner all day, you can get an instant notification the moment a stock meets all your criteria. This lets you react immediately to prime bear trap trading opportunities.

To get a much deeper look at setting up these kinds of dynamic filters, check out our complete trader's guide to real-time stock scanning. Automating your search doesn't just save a massive amount of time; it also builds discipline by forcing you to stick to your predefined rules.

And for those who want to take it a step further, machine learning offers some seriously powerful tools for identifying complex patterns that are invisible to the naked eye. You can explore some of the more prominent machine learning applications in market analysis to see how technology can help automate the search for setups. By systemizing your approach, you stop being a pattern hunter and become a trading strategist, letting the best opportunities come directly to you.

Bear Trap Case Studies from Recent Market History

Theory is one thing, but nothing beats seeing a pattern play out in the wild during a full-blown market panic. History is littered with textbook examples of bear traps that caught millions of traders leaning the wrong way.

These real-world case studies are where the rubber meets the road. We can move past the clean lines on a chart diagram and see how these setups unfold under immense pressure, connecting the technicals with the raw fear and greed that drive markets. By dissecting these moments, we can see the anatomy of a bear trap on a massive scale.

The 2020 COVID Crash Reversal

One of the most violent and recent examples of a bear trap trading scenario was the March 2020 COVID crash. It was pure chaos. As the pandemic brought the global economy to a screeching halt, markets went into a nosedive. The S&P 500 cratered over 30% in just a few weeks, blowing through every support level imaginable.

The panic was palpable. The consensus view was that we were staring down the barrel of a new Great Depression. Short sellers smelled blood and piled in, betting on a continued collapse. That was the setup. After bottoming out on March 23, the market staged a reversal so fast and furious it left everyone stunned.

Anyone who shorted near those lows was absolutely steamrolled. They were forced to buy back their positions at huge losses, which only threw more gasoline on the fire of the rally. Incredibly, the market clawed back everything it lost and went on to make new all-time highs just a few months later.

The 2020 reversal was a masterclass in market psychology. It showed that the point of maximum fear and universal bearishness is often the point of maximum opportunity.

This is a recurring theme. The 2008 financial crisis had a similar flavor, though it played out in slower motion. In both cases, indices like the S&P 500 saw rapid, panic-fueled declines that pulled in aggressive short-sellers. But these capitulation events were followed by massive rebounds that caught bears completely off guard.

The 2020 recovery was one of the fastest on record. After oil futures famously went negative in April 2020, they rocketed up nearly 90% the very next month. A quick look at the volume during these reversals tells the whole story: you see these huge spikes at the bottom as buyers rush back in, confirming the trap has been sprung. For a deeper dive, MarketBeat offers more insights into the volatility of bear traps.

Lessons from the 2008 Financial Crisis

The Great Financial Crisis of 2008-2009 was another brutal, but educational, case study. While the overall trend was clearly down, the road to the final bottom in March 2009 was a minefield of punishing bear traps.

Throughout that crisis, the market would repeatedly break to new lows, convincing everyone that the next leg down had started. But just when the bearish sentiment was at its peak, the market would stage a vicious multi-week rally.

These weren't the final bottom, but they acted as brutal short squeezes that punished anyone who got too aggressive at the wrong moment. Each rally was a painful reminder that even in the most severe bear market, prices never move in a straight line. It’s a timeless lesson in waiting for confirmation and never, ever forgetting about risk management. The market loves to reverse just when everyone has given up hope.

Common Questions About Bear Trap Trading

Even once you've got the mechanics down, some specific questions always pop up when you're trying to apply these ideas in the heat of the moment. Let's tackle some of the most common ones traders ask about bear traps to clear up any lingering confusion.

What Is the Difference Between a Bear Trap and a Pullback?

Getting this right is one of the most critical skills you can develop. Think of a pullback as the market taking a healthy breath. It's a temporary, shallow dip inside a bigger uptrend. The price just cools off for a bit before continuing its climb, and it never truly breaks a major support level. It’s all part of the natural rhythm of a trend.

A bear trap, on the other hand, is a different beast entirely—it’s aggressive and intentionally deceptive. Its signature move is the false breakdown below a major support level. The trap is designed to punch through that floor, suck in a flood of sellers who think the trend is reversing, and then viciously snap back. That violation of support is the key difference.

How Long Does a Bear Trap Last?

Bear traps are almost always fast and brutal. The whole sequence—from the breakdown below support to the powerful recovery—can play out over just a handful of candlesticks. The trap's goal is to create a quick, panicked flush of sellers, so the reversal has to be just as fast to catch them offside.

A bear trap thrives on speed. If a price breaks support and then just hangs out below that level for a long time, it's probably not a trap. It's more likely the beginning of a real downtrend. The "snap-back" is what makes it a trap.

Can Bear Traps Be Traded in Any Market?

Absolutely. The market psychology that fuels a bear trap is universal, which means you can find these patterns just about anywhere. They're effective in:

- Stocks: You'll see them all the time in individual stocks, especially after a big news event like an earnings report or during periods of consolidation.

- Forex: Major currency pairs are notorious for bear traps, as key support and resistance levels are watched by millions of traders.

- Cryptocurrencies: The crypto market is a playground for bear traps, thanks to its high volatility and sentiment-driven retail crowd.

That said, bear trap trading works best in highly liquid markets. You need enough traders in the game to create those sharp, sudden price moves that spring the trap and fuel the reversal. In thinly traded, illiquid assets, these patterns can be much less reliable.

Ready to stop hunting for setups manually? ChartsWatcher provides the advanced, real-time scanning and alerting tools you need to automatically find high-probability bear trap opportunities across the market. Build your custom scanner and start trading smarter today.