7 Proven Intraday Trading Strategies for 2025

Intraday trading presents a thrilling opportunity to capitalize on short-term market fluctuations, but success hinges on having a well-defined plan. Navigating the fast-paced world of day trading without a solid framework is like sailing without a compass; you're likely to get lost in the volatility. That's why mastering specific intraday trading strategies is non-negotiable for anyone serious about profiting from the market's daily rhythm. This guide moves beyond generic advice to provide a detailed breakdown of seven distinct and powerful strategies, each complete with actionable steps and real-world examples.

Whether you aim for quick, small profits through scalping or prefer to ride powerful market waves with momentum trading, understanding these diverse approaches is your first step toward consistent performance. We will explore a range of proven methods, including range trading, breakout strategies, and news-based trading, ensuring you have a comprehensive toolkit to tackle various market conditions. Each section is designed to be a practical blueprint, not just a theoretical overview.

Furthermore, we'll demonstrate how a sophisticated tool like ChartsWatcher can give you the analytical edge needed to implement these strategies effectively. By leveraging its customizable dashboards, real-time alerts, and advanced scanning capabilities, you can learn to spot high-potential opportunities as they happen. This article is your resource for turning theory into action. Let’s dive into the methodologies that can transform your trading day and help you navigate the markets with confidence and precision.

1. Scalping

Scalping is one of the most fast-paced intraday trading strategies, appealing to traders who thrive on high-frequency action and immediate results. The core principle of scalping is to capture very small profits from dozens, or even hundreds, of trades executed throughout a single day. Instead of waiting for a significant price move, a scalper holds a position for a few seconds to a few minutes, aiming to profit from minor price fluctuations.

This strategy relies on the law of large numbers. A single trade might only yield a tiny profit, such as 5 to 15 pips in forex, but a high volume of these small, successful trades can accumulate into substantial gains by the end of the trading session. Scalpers often focus on highly liquid assets like major currency pairs (e.g., EUR/USD), large-cap stocks (e.g., Apple), or popular futures contracts, where tight bid-ask spreads and constant order flow provide ample opportunities.

How Scalping Works in Practice

A scalper's success hinges on precision, speed, and discipline. They typically use one-minute or five-minute charts to identify entry and exit points with surgical accuracy. The strategy often involves leveraging technical indicators like Moving Averages, RSI, or Bollinger Bands to spot micro-trends and moments of momentum. For example, a scalper might enter a long position on Bitcoin futures when the price breaks just above a short-term moving average during a high-volatility period, aiming to exit as soon as a small, predefined profit target is hit.

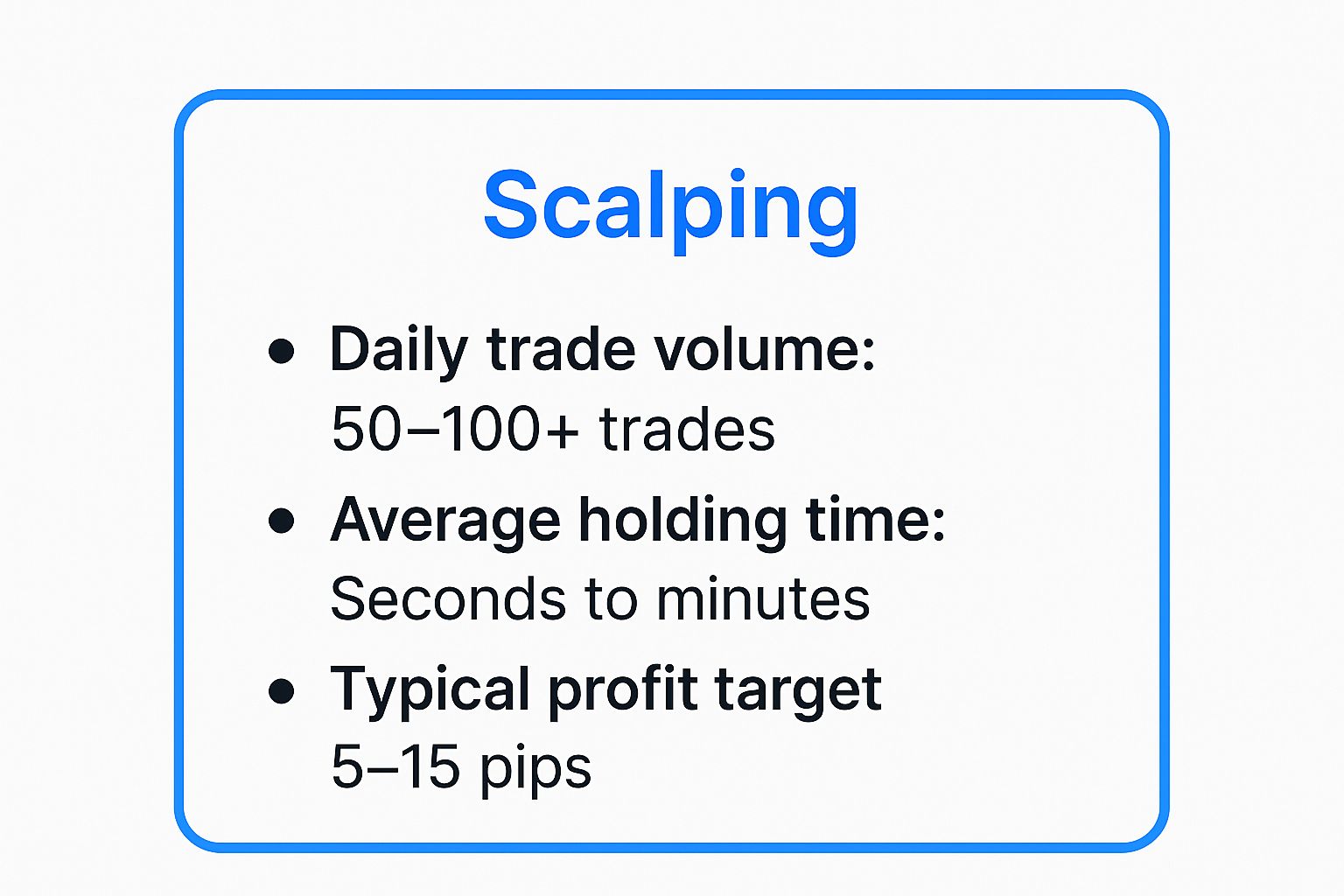

The following infographic highlights the defining characteristics of this high-frequency approach.

This data underscores the strategy's demand for rapid decision-making and a robust trading platform, as the window for profit is exceptionally narrow.

When and Why to Use Scalping

Scalping is most effective during periods of high market liquidity and volatility, typically when major market sessions overlap, such as the London-New York overlap for forex traders. This is when the volume is highest, ensuring that a trader can enter and exit positions almost instantly without significant slippage. It's a strategy best suited for traders who can maintain intense focus, make quick decisions under pressure, and adhere strictly to their risk management rules.

Key Insight: The primary advantage of scalping is its potential for frequent, small wins, which can reduce exposure to larger market risks associated with holding positions for longer durations. However, it demands low-latency execution and competitive brokerage fees to be profitable.

For a deeper dive into scalping techniques, the video below offers valuable insights and practical examples:

Actionable Tips for Scalpers

To successfully implement scalping as one of your intraday trading strategies, consider these essential tips:

- Choose the Right Broker: Opt for a broker offering Direct Market Access (DMA) for the fastest possible trade execution and the tightest spreads.

- Focus on Liquidity: Stick to major currency pairs or stocks with high daily trading volumes to ensure you can enter and exit trades without delay.

- Implement Strict Risk Management: Use a tight stop-loss and a clear profit target for every trade. A risk-reward ratio of 1:1 or even 1:1.5 is common.

- Trade at Peak Times: Execute your trades during the busiest market hours to capitalize on the best liquidity and volatility.

- Maintain Detailed Records: Keep a trading journal to track every trade. Analyzing your performance will help you identify patterns and refine your strategy over time.

2. Momentum Trading

Momentum trading is an intraday trading strategy that focuses on capitalizing on the velocity of price changes in the market. The core idea is to identify assets that are moving significantly in one direction on high volume and ride that "momentum" until signs of reversal appear. Rather than focusing on an asset's fundamental value, momentum traders are concerned with the strength and durability of its current trend.

This strategy is built on the principle that a strong price move, often driven by news, earnings reports, or a shift in market sentiment, will likely continue for a short period. Momentum traders aim to join an established trend as it accelerates and exit before it loses steam. This approach is common with volatile assets, including high-growth tech stocks like Tesla after a positive earnings announcement or biotech stocks following FDA approval news.

How Momentum Trading Works in Practice

A momentum trader's toolkit revolves around identifying and confirming the strength of a trend. They often use technical indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and volume indicators to gauge the force behind a price move. For instance, a trader might identify a stock gapping up in the pre-market on high volume. They would then watch the opening price action, waiting for a breakout above a key resistance level on the one-minute or five-minute chart, confirming the bullish momentum before entering a long position.

Success in momentum trading relies heavily on timing and effective risk management. Traders must be quick to enter a promising trade but equally quick to exit when the momentum starts to fade. Using a trailing stop-loss is a common technique to lock in profits while giving the trade room to run.

When and Why to Use Momentum Trading

Momentum trading is most effective in markets characterized by clear trends and high volatility, particularly during major news events or corporate announcements that act as catalysts. It is an ideal strategy for traders who can stay attuned to market news and are skilled at reading chart patterns to identify assets on the verge of a breakout. It suits individuals who are decisive and can manage the psychological pressure of trading fast-moving, volatile stocks.

Key Insight: The primary advantage of momentum trading is its potential for significant gains in a short period. By aligning with powerful market forces, traders can achieve substantial returns, but this comes with heightened risk due to the inherent volatility of the assets being traded.

Actionable Tips for Momentum Traders

To successfully implement momentum trading as one of your core intraday trading strategies, consider these essential tips:

- Wait for Volume Confirmation: A price move without significant volume is often a false signal. High volume confirms that there is strong conviction behind the trend.

- Use Trailing Stops: Protect your profits by using a trailing stop-loss. This allows you to stay in a winning trade longer while automatically exiting if the price reverses.

- Scan for Catalysts: Use a real-time news feed and pre-market scanner to identify stocks with potential catalysts, such as earnings beats, new contracts, or clinical trial results.

- Focus on Liquid Stocks: Trade stocks with a high average daily volume (typically over 1 million shares) to ensure you can enter and exit positions easily without significant slippage.

- Practice Smart Position Sizing: Adjust your position size based on the stock's volatility. More volatile stocks should warrant smaller position sizes to manage risk effectively.

3. Range Trading

Range trading is an intraday trading strategy that capitalizes on markets moving sideways within a predictable channel. It involves identifying clear support and resistance levels where an asset’s price consistently bounces between, allowing traders to buy at the low end (support) and sell at the high end (resistance). This approach is particularly effective in markets lacking a strong, clear trend.

Unlike momentum strategies that chase breakouts, range trading thrives on stability and price oscillation. The core idea is to profit from the market's tendency to revert to its mean within an established "range" or channel. This makes it a go-to strategy for assets in a consolidation phase, such as gold futures trading within established daily boundaries or major currency pairs like EUR/USD during periods of low macroeconomic news flow.

How Range Trading Works in Practice

A range trader's primary skill is accurately identifying the upper (resistance) and lower (support) boundaries of a trading channel. They use technical analysis tools like trendlines, Bollinger Bands, or the Relative Strength Index (RSI) to confirm these levels. For instance, a trader might identify that the SPY ETF is consistently trading between $450 and $452 during a low-volatility session and use this information to plan their trades.

Once the range is confirmed, often after at least two or three touches of both support and resistance, the trader will place buy orders near the support level and sell orders near the resistance level. The key is precise execution and disciplined risk management, as the profit window is defined by the width of the range itself.

When and Why to Use Range Trading

Range trading is most effective in markets that are consolidating or lacking a clear directional bias. This often occurs during mid-day trading sessions after the initial morning volatility has subsided or in specific currency pairs outside of their most active trading hours. It is an ideal strategy for traders who prefer a more methodical, less frantic approach compared to scalping.

This strategy appeals to traders who are skilled at pattern recognition and can remain patient while waiting for the price to reach the desired entry points. It offers a clear framework for defining risk and reward on every trade.

Key Insight: The main advantage of range trading is its clearly defined entry, exit, and stop-loss levels. It removes much of the guesswork, providing a systematic way to trade non-trending markets. However, the greatest risk is a "breakout," where the price forcefully moves beyond the established range.

Actionable Tips for Range Traders

To successfully implement range trading as one of your intraday trading strategies, consider these essential tips:

- Confirm the Range: Wait for at least two or three touches of both the support and resistance levels to validate the range before placing any trades.

- Use Limit Orders: Place buy-limit orders just above the support line and sell-limit orders just below the resistance line to improve your entry prices and automate execution.

- Set Protective Stops: Always place your stop-loss just outside the established range. For a long position, set it slightly below support; for a short position, place it just above resistance.

- Monitor Volume: Pay close attention to trading volume. A significant increase in volume near a support or resistance level can signal an impending breakout, which is a cue to exit your position.

- Trade Smaller Positions: Using smaller position sizes allows you to potentially scale into a position or withstand minor fluctuations without being stopped out prematurely.

4. Breakout Trading

Breakout trading is one of the most popular intraday trading strategies, centered on capitalizing on sudden, powerful price movements. The core principle involves identifying key support and resistance levels and entering a trade just as the price breaks through one of these established boundaries. Traders using this strategy aim to ride the initial wave of momentum that often follows such a break.

This approach is based on the idea that a break beyond a significant price level signals a potential shift in market sentiment and the start of a new trend. A breakout trader looks for confirmation, often in the form of increased trading volume, to validate the move and enter a position. This strategy is applicable across various markets, including stocks, forex, and commodities, where clear price structures form.

How Breakout Trading Works in Practice

A breakout trader's workflow begins with identifying strong, well-tested support or resistance levels on a chart. They might use trendlines, chart patterns like triangles and rectangles, or psychological levels such as round numbers. Once a level is identified, the trader sets an alert or watches the price action closely. For example, if Apple stock has been consolidating between $180 and $185 for several days, a breakout trader might place a buy-stop order just above $185.

When the price moves decisively through the resistance at $185, accompanied by a surge in volume, the trade is triggered. The goal is to capture the subsequent upward thrust as other market participants recognize the breakout and join the move. A common variation is the open range breakout, which specifically targets breaks of the high or low established in the first few minutes of the trading day. For a detailed guide, you can learn more about this specific technique in our article about the Open Range Breakout strategy on chartswatcher.com.

When and Why to Use Breakout Trading

Breakout trading is most effective in markets that are transitioning from a period of consolidation to a trending phase. It is particularly powerful during times of high volatility or following major news releases, such as an earnings report or a central bank announcement, which can act as a catalyst for a significant price move.

This strategy is well-suited for traders who prefer clear entry signals and can act decisively when an opportunity arises. It offers a defined risk, as a stop-loss can be placed just below the broken resistance (for a long trade) or above the broken support (for a short trade).

Key Insight: The main advantage of breakout trading is its potential to catch the beginning of a major trend, leading to significant profits. However, the biggest risk is the "fakeout," where the price briefly breaks a level only to reverse, highlighting the importance of volume confirmation and proper risk management.

Actionable Tips for Breakout Traders

To successfully implement breakout trading as one of your intraday trading strategies, consider these essential tips:

- Wait for Volume Confirmation: A true breakout should be supported by a significant increase in trading volume. A break on low volume is more likely to be a fakeout.

- Use Retest Entries: For a more conservative approach, wait for the price to break the level and then pull back to "retest" it as new support (or resistance). This often provides a better risk-reward entry.

- Set Stops Strategically: Place your stop-loss just on the other side of the broken level. This gives the trade room to breathe while defining your maximum risk.

- Focus on Psychological Levels: Pay close attention to round numbers (e.g., $100) and all-time highs or lows, as these are often powerful catalysts for breakouts.

- Avoid Low-Volume Conditions: Breakout strategies tend to perform poorly during quiet, sideways markets. Focus on highly liquid assets during active trading hours.

5. News Trading

News trading is an intraday trading strategy that focuses on capitalizing on the volatility generated by significant economic announcements, corporate earnings reports, or geopolitical events. Traders who use this approach seek to profit from the rapid and often substantial price movements that occur as the market digests new, impactful information. Instead of relying solely on technical chart patterns, news traders are fundamentally driven, timing their entries and exits around specific scheduled events.

This strategy is built on the principle that new information can dramatically shift market sentiment and asset valuations in a very short period. For instance, a central bank's interest rate decision can cause immediate, widespread fluctuations across currency pairs, indices, and bonds. News traders aim to anticipate the market's reaction or react swiftly once the news breaks to capture the resulting price swing. The assets involved are typically those most sensitive to the specific news, such as trading USD/JPY during a U.S. Non-Farm Payrolls release.

How News Trading Works in Practice

A news trader’s success depends on preparation, speed, and the ability to interpret market sentiment. They meticulously follow economic calendars to know exactly when key data points like GDP figures, inflation rates (CPI), or unemployment numbers are released. For example, if a company like Netflix is set to release its quarterly earnings, a trader might anticipate a significant stock price move. If the earnings beat expectations, they could enter a long position the moment the news is public to ride the upward momentum.

Conversely, if the Federal Reserve signals a more aggressive stance on interest rates than expected, a trader might quickly short the S&P 500 index futures. The goal is to get in and out of the position before the initial volatility subsides and the market finds a new, temporary equilibrium. This requires a fast news feed, low-latency execution, and a clear plan for both entry and exit.

When and Why to Use News Trading

News trading is most effective during high-impact, scheduled events where a clear deviation from market consensus can trigger a strong directional move. It is a powerful intraday trading strategy for those who can remain calm under pressure and make split-second decisions. The primary allure is the potential for large profits in a matter of minutes, as news-driven volatility can be far greater than typical daily price fluctuations.

This approach is ideal for traders who have a strong understanding of macroeconomic principles and can quickly analyze how new data will affect asset prices. It's a method that bypasses the noise of minor market movements and focuses directly on the catalysts that drive significant trends. To get a better grasp of the psychological and strategic elements, you can learn more about news trading strategies and market psychology in our detailed guide.

Key Insight: The main advantage of news trading is its potential to generate significant returns in a very short timeframe. However, it also carries high risk due to extreme volatility, potential for slippage, and the widening of bid-ask spreads during news events.

Actionable Tips for News Traders

To effectively implement news trading as one of your intraday trading strategies, consider these essential tips:

- Use an Economic Calendar: Always be aware of upcoming high-impact news releases. Services like Forex Factory or the calendar in your trading platform are indispensable.

- Understand Market Expectations: The market's reaction is often based on how the actual data compares to the consensus forecast. A surprise is what typically creates the largest price move.

- Define Your Plan in Advance: Decide your entry, stop-loss, and take-profit levels before the news is released. The market will move too fast for you to think clearly in the moment.

- Be Wary of Slippage: During major news, liquidity can dry up, causing your orders to be filled at a much worse price than intended. Account for this in your risk management.

- Practice with a Demo Account: Before risking real capital, practice trading news events on a demo account to get a feel for the speed and volatility without financial risk.

6. Gap Trading

Gap trading is an intraday trading strategy that focuses on exploiting price "gaps" between the previous day's close and the current day's open. These gaps, which appear as empty spaces on a price chart, are typically caused by significant news or events that occur after market hours, such as earnings reports, mergers, or macroeconomic data releases. Traders capitalize on the statistical tendency for these gaps to either "fill" (return to the previous day's closing price) or continue in the direction of the gap.

The strategy is rooted in understanding market sentiment. A gap up suggests strong positive sentiment, while a gap down indicates a wave of negativity. The trader's job is to analyze the context of the gap and determine whether the initial overnight reaction is an overextension that will reverse (a "gap fade") or the beginning of a powerful new trend for the day (a "gap continuation"). This makes gap trading a popular method among experienced day traders looking for high-probability setups right at the market open.

How Gap Trading Works in Practice

Gap traders use pre-market data to identify stocks gapping up or down. A key factor is the pre-market volume; high volume suggests strong conviction behind the move and increases the odds of a continuation. For example, if Apple (AAPL) announces better-than-expected earnings and gaps up 4% on high pre-market volume, a trader might buy at the open, anticipating further upward momentum as more market participants react to the news.

Conversely, if a stock gaps down 3% on negative news but with very low pre-market volume, a trader might look for a "gap fade." This involves entering a long position shortly after the open, betting that the initial panic will subside and the price will rebound to "fill the gap" by rising back to the previous day's closing price. The first 15-30 minutes of the trading session are crucial for confirming the direction of the trade.

When and Why to Use Gap Trading

Gap trading is most effective during periods of high news flow, such as earnings season, or following major economic announcements. It is particularly well-suited for traders who are prepared to act decisively at the market open, a time of peak volatility and opportunity. This strategy is ideal for identifying clear, event-driven moves with defined entry and exit points.

The primary advantage is that gaps often initiate the most significant price moves of the day. By correctly identifying whether a gap will continue or fade, a trader can position themselves early in a powerful trend, potentially capturing a substantial portion of the day's total range. It's a strategy that rewards careful pre-market research and quick execution.

Key Insight: The success of gap trading hinges on properly classifying the gap. Factors like the catalyst (news), pre-market volume, and the overall market trend are critical for determining whether to trade for a gap fill or a continuation.

Actionable Tips for Gap Traders

To effectively incorporate gap trading into your arsenal of intraday trading strategies, consider these specific tips:

- Classify Gaps Correctly: Differentiate between common gaps, breakaway gaps, and exhaustion gaps. Breakaway gaps on high volume are strong continuation signals.

- Analyze Pre-Market Volume: Use pre-market volume as a primary indicator of the gap's strength. High volume suggests institutional participation and a higher likelihood of continuation.

- Set Clear Profit Targets: For gap fade trades, the primary profit target is typically the previous day's closing price where the gap is filled. For continuation trades, use key technical levels or a risk-reward ratio.

- Focus on High-Liquidity Stocks: Trade gaps in stocks with high average daily volume. These stocks provide smoother price action and reduce the risk of slippage on entry and exit.

- Use the First 5-15 Minutes for Confirmation: Don't jump in immediately at the open. Wait for the first few price bars to form to confirm the directional bias before committing to a trade.

7. Reversal Trading

Reversal trading is a contrarian intraday trading strategy that involves identifying potential turning points in a prevailing trend and entering positions against the current market direction. Instead of following the trend, reversal traders aim to capture the very beginning of a new trend by anticipating when the current momentum will exhaust itself. They look for specific signals that suggest a trend is losing steam and is ripe for a change in direction.

This approach is fundamentally about identifying moments of market exhaustion. Traders using this strategy bet against the herd, entering long positions when a downtrend shows signs of weakness or shorting an asset when an uptrend appears overextended. The goal is to profit from the subsequent price correction or complete trend reversal. Success with this strategy requires a deep understanding of market psychology, technical patterns, and key indicators that signal overbought or oversold conditions.

How Reversal Trading Works in Practice

A reversal trader's toolkit is filled with indicators and patterns that measure momentum and identify extremes. They often use oscillators like the Relative Strength Index (RSI) to spot divergences, where the price makes a new high or low, but the indicator fails to follow suit. For instance, a trader might identify a stock making a new intraday high while the RSI simultaneously forms a lower high (a bearish divergence). This signals waning upward momentum and presents a potential short-selling opportunity.

Another common tactic is to watch for specific candlestick patterns at key support or resistance levels. Patterns like the Engulfing Candle, Hammer, or Doji can signal a potential reversal, especially when they appear after a prolonged price move and are accompanied by a spike in volume. A reversal trader would wait for such a pattern to form at a pre-identified resistance zone before initiating a short position, anticipating that the upward push is over.

When and Why to Use Reversal Trading

Reversal trading is most effective when an asset's price has made a sharp, extended move in one direction without significant pullbacks. These parabolic moves often lead to trader exhaustion and profit-taking, creating the ideal environment for a reversal. This strategy is particularly useful in markets that are range-bound or at major psychological price levels (e.g., $100 for a stock), where trends are more likely to stall and reverse.

Key Insight: Reversal trading offers the potential for highly favorable risk-reward ratios, as traders can enter a position very close to the turning point with a tight stop-loss. This allows for capturing a large portion of the subsequent move if the reversal materializes.

Actionable Tips for Reversal Traders

To effectively implement reversal trading as one of your intraday trading strategies, consider these essential tips:

- Wait for Confirmation: Never enter a trade based on a single reversal signal. Look for multiple confirmations, such as a divergence on the RSI combined with a bearish candlestick pattern at a key resistance level.

- Use Tighter Stop-Losses: Since you are trading against the prevailing trend, the risk is inherently higher. Place a tight stop-loss just above the recent high (for a short) or below the recent low (for a long) to limit potential losses if the trend continues.

- Focus on Key Levels: The highest probability reversal trades occur at significant, historically proven support and resistance levels. Use tools to map these zones on your chart before the trading day begins.

- Manage Position Size: Due to the lower probability of success compared to trend-following, it's wise to use smaller position sizes when trading reversals. This helps manage risk while you wait for the high-reward setups.

- Monitor Volume: A decrease in volume during an uptrend or downtrend can signal exhaustion and add conviction to a potential reversal setup. A sudden spike in volume at the turning point can confirm the new direction.

Intraday Trading Strategies Comparison

| Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Scalping | High - requires advanced tech and real-time execution | High - fast internet, DMA brokers, low latency | Small, consistent gains per trade with quick profit realization | Liquid markets with tight spreads; full-time traders | Quick profits, minimal overnight risk, consistent daily income |

| Momentum Trading | Medium - uses technical indicators and volume confirmation | Moderate - good data feeds and quick decision-making | Significant intraday moves with good risk-reward | Trending markets with strong volume and volatility | Clear signals, works in various conditions, captures large moves |

| Range Trading | Low to Medium - requires identification of support/resistance | Low - suitable for part-time traders | Predictable trades within range, smaller but frequent gains | Sideways/consolidating markets; patience-driven traders | Lower risk, multiple daily opportunities, suitable for part-time use |

| Breakout Trading | Medium to High - quick reaction and volume confirmation | Moderate - requires fast execution | Potential for large moves with objective entries | Trending markets, all timeframes | Large movement capture, clear entry/exit, good risk-reward |

| News Trading | High - needs extensive fundamental analysis and fast execution | High - access to economic calendars, news feeds | Profits from volatility around news events, high potential gains | Scheduled economic/earnings events with strong catalysts | Predictable timing, can profit both directions, clear catalysts |

| Gap Trading | Medium - classification and statistical analysis needed | Moderate - pre-market access and monitoring | High probability setups with measurable edge | Market open periods, stocks with consistent gap patterns | Statistically backed, clear entry/exit, good for part-time traders |

| Reversal Trading | High - advanced skill to identify reversal signals | Moderate - requires multiple indicator confirmations | Captures counter-trend moves with good risk-reward | Market extremes and key support/resistance zones | Excellent risk-reward, less crowded strategy, valuable at extremes |

Integrating Your Strategy for Peak Performance

We've navigated through a comprehensive roundup of seven powerful intraday trading strategies, from the rapid-fire precision of scalping to the calculated patience of reversal trading. Each method offers a unique lens through which to view and act upon the market's daily fluctuations. The journey from a novice trader to a consistently profitable one, however, isn't about memorizing every strategy. It's about deep, focused mastery.

The core takeaway is this: success in day trading is not about knowing everything, but about mastering something. Trying to be a scalper one day and a breakout trader the next often leads to confusion and inconsistent results. Your first critical task is to align your choice of strategy with your personal trading psychology, risk tolerance, and daily availability. A trader with limited screen time may find news-based or gap trading more suitable, while someone who thrives on high-frequency action might naturally gravitate toward scalping.

From Knowledge to Actionable Systems

Merely choosing a strategy is the first step on a much longer path. The real progress begins when you transform that strategy from a concept into a repeatable, rule-based system. This involves defining your exact entry and exit criteria, establishing firm risk management rules (like stop-loss and take-profit levels), and determining your ideal position sizing.

This is where the theoretical meets the practical. For example, a momentum trader's system should not just be "buy strong stocks." It needs to be specific:

- Entry Signal: A stock breaking above its 20-period moving average on the 5-minute chart with volume at least 150% above its average.

- Exit Signal (Profit): Sell when the price hits the R2 pivot point or when RSI (14) crosses above 80.

- Stop-Loss: Place a stop 1% below the entry price or just below the 20-period moving average, whichever is wider.

Building such a system requires objective data and the ability to test your hypotheses without risking capital. This disciplined approach separates professional traders from hobbyists.

The Technological Edge in Intraday Trading

In today's hyper-competitive markets, a robust strategy is only as good as the tools you use to execute it. The speed and complexity of intraday movements mean that manual analysis is often too slow and prone to emotional error. Leveraging a sophisticated platform like ChartsWatcher is no longer a luxury; it's a fundamental component of a professional trading operation.

Think of it as the control panel for your trading business. Instead of manually searching for potential breakout candidates, you can build a custom scanner that alerts you in real-time when a stock meets your exact criteria. Instead of guessing if your gap trading idea has historical merit, you can backtest it against years of data to see its statistical probability of success. The true power lies in automating the discovery process so you can focus your mental energy on execution and management. A well-configured dashboard that syncs your news feed, scanners, and charts empowers you to act decisively when opportunities arise, turning your well-defined intraday trading strategies into tangible results.

Ultimately, the path to peak performance is a synthesis of three key elements: selecting the right strategy for you, developing it into a rigorous system, and leveraging technology to execute it with precision and efficiency. Start with one strategy, paper trade it until you understand its nuances, and continuously refine your approach based on performance data. This methodical process is your best route to navigating the challenging yet rewarding world of day trading.

Ready to transform your theoretical knowledge into a powerful, executable trading system? ChartsWatcher provides the advanced scanning, backtesting, and real-time data tools you need to build, test, and master the intraday trading strategies discussed in this guide. Stop guessing and start trading with a data-driven edge by visiting ChartsWatcher to see how our platform can elevate your performance.