Trading the News Strategy: Master Market Psychology

Why Most Traders Get News Trading Completely Backwards

Most traders treat news trading like a sprint. Glued to their screens, fingers hovering over the buy/sell buttons, they’re ready to pounce the second a headline hits. This is a recipe for disaster. Trust me, I’ve seen it firsthand – chasing headlines usually leads to slippage, bad fills, and emotional trading that eats away at your account.

Successful news trading isn’t about reacting; it’s about anticipating. It’s like a chess game, not a race. You need to position yourself strategically before the news breaks, anticipating the market’s next move. You're not trying to be the fastest; you’re aiming to be the smartest.

This means analyzing market sentiment, reading between the lines of pre-news price action, and understanding how institutional money positions itself before big events. Sometimes "bad" news can be bullish, and "good" news can trigger a sell-off. Why? The market often anticipates the news, pricing it in before the headlines even drop.

That initial reaction? Often just noise. A knee-jerk response that quickly reverses. The real opportunities appear later, when the dust settles and the smart money starts moving.

News and Volatility

The effect of news on trading is obvious when you look at how it impacts market volatility. News trading strategies flourish in environments where economic data releases or unexpected events create big price swings. Think about scheduled news events like interest rate announcements from the Federal Reserve or quarterly earnings reports from major companies. These can cause some serious price action. For a deeper dive into news trading, check out this resource: How To Trade The News.

Building a sustainable trading system takes work. You need efficiency. These tips on improving supply chain efficiency offer some interesting ideas applicable to any system you’re building, even a trading one.

This screenshot from Investopedia illustrates how news impacts volatility. The key takeaway? News creates price swings, which present both risks and opportunities.

Building Your Information Edge Without Breaking The Bank

Having the right information setup is absolutely key for successful news trading. Forget shelling out a fortune for a Bloomberg Terminal – you can build a professional-grade operation using mostly free resources and a few smart paid subscriptions. Let's talk about sourcing market-moving news, setting up alerts, and organizing your trading environment.

Finding the Right News Sources

Believe it or not, it's not always the mainstream financial media outlets that move markets. I've found that specialized sources often deliver faster and more targeted information. Personally, I combine free economic calendars like those from ForexLive and Investing.com with a paid subscription to a real-time news service. I target the service to the specific asset classes I’m trading. Trust me, focusing on a few highly relevant sources is way more effective than trying to drink from a firehose of information.

Setting Up Actionable Alerts

Alerts can be a double-edged sword. Too many, and you'll be constantly bombarded with noise. Too few, and you’ll miss crucial opportunities. The key is finding the right balance. ChartsWatcher's alerting feature gives you granular control. I configure alerts for specific keywords, key economic indicators, and unusual options activity. Here's a pro tip: setting alerts in ChartsWatcher for unusual volume spikes before news releases can often give you a glimpse into how institutions are positioning themselves early.

Organizing Your Trading Setup

Your physical trading setup – whether you're on a desktop or mobile – can significantly impact how well you perform during fast-moving news events. A cluttered desktop invites missed opportunities and expensive mistakes. I use multiple monitors with ChartsWatcher open to track different markets, news feeds, and charts all at the same time. If you’re trading on mobile, having a dedicated device with pre-configured alerts and trading apps can be a real game-changer.

My Personal Configuration

I’ve chatted with tons of traders about their setups, and one theme consistently comes up: organization is paramount. I have one trader friend who swears by color-coding his news feeds to quickly distinguish between asset classes. Another uses a dedicated chat room with fellow traders for real-time analysis and bouncing ideas around. These kinds of personalized systems prove just how powerful the right information flow can be. Tailor it to your specific needs to dramatically improve your trading edge. Remember, it's not about having the most tools – it’s about having the right information at the right time, presented in a way that allows you to react decisively. This is the foundation of any successful news trading strategy.

Let's talk tools. Having the right tools can also make a significant difference. I’ve put together a comparison table of some popular choices. It highlights key features, costs, what they're best suited for, and some pros and cons to give you a better idea of what’s out there.

Essential News Trading Tools Comparison Comparison of key tools and platforms for news trading, including features, costs, and effectiveness

| Tool/Platform | Key Features | Cost | Best For | Pros/Cons |

|---|---|---|---|---|

| ChartsWatcher | Real-time alerts, unusual volume detection, scanning | Varies based on subscription | News traders focused on technical analysis | Pros: Granular control over alerts, integrates well with charting. Cons: Specific focus may not suit all trading styles. |

| ForexLive | Economic calendar, market commentary | Free | Traders looking for forex news and analysis | Pros: Accessible and free. Cons: Limited to forex. |

| Investing.com | Economic calendar, news, charts | Free | General market overview | Pros: Broad range of assets, free. Cons: Information can be overwhelming. |

| Paid Real-Time News Service (Generic Example) | Real-time news feeds, customizable alerts | Varies | Traders needing fast news for specific assets | Pros: Speed and targeted information. Cons: Cost can be a factor. |

| Dedicated Trading Chat Room (Generic Example) | Real-time discussion and analysis with other traders | Varies | Traders who value collaborative learning | Pros: Shared insights and diverse perspectives. Cons: Requires finding a reputable community. |

This table highlights the variety available. From free resources like economic calendars to powerful platforms like ChartsWatcher and the potential value of community insights from a trading chat room, there’s something for everyone. The key is to find what works best for your trading style and budget. Remember, the goal is to create a setup that gives you a clear advantage, delivering the essential information you need precisely when you need it.

Reading The Market's Mood Before News Even Breaks

The real key to a news-trading strategy isn't predicting the news. It's about grasping how the market anticipates reacting. Instead of guessing the contents of a sealed envelope, you're reading the room beforehand. This means analyzing the subtle cues that reveal institutional positions and general market sentiment.

Let's say there's an upcoming earnings report. Everyone expects great numbers, the stock has been rallying, and there's a lot of optimism. But what if, just before the announcement, you see unusual options activity—a spike in put buying? That's a potential warning sign. It suggests some big players are betting against the general feeling. A solid information edge comes from using effective AI Search.

That's where tools like ChartsWatcher become so valuable. Set up alerts for unusual volume and price action. It's like getting a sneak peek into the market's mood before the news breaks, allowing you to anticipate possible moves and position yourself strategically. For more on market sentiment, check out this article: Top Market Sentiment Indicators for Smarter Trading in 2025.

Identifying "Loaded" Markets

Sometimes the market is so primed for a specific reaction that the actual news almost doesn't matter. I recall a company releasing surprisingly good earnings, but the stock plummeted. Why? The market had already priced in a fantastic quarter. The good news simply wasn’t good enough.

I've also seen "bad" news cause prices to rise. This happens when the market has already braced for the worst. Anything less than a complete disaster triggers a relief rally. A classic example of news trading involves earnings surprises. Buying stocks with large positive earnings surprises lets you ride the upward drift after the announcement. You can learn more about this here.

Reading the Subtle Signals

Mastering news trading means learning to read these subtle signals. This isn't about having a crystal ball. It’s about understanding market psychology. It’s about recognizing when the crowd is leaning too far in one direction. The best opportunities often appear when everyone is betting the same way. That's when a contrarian approach, guided by pre-news market analysis, can be incredibly profitable.

This involves analyzing options flow, examining positioning data, and using basic technical analysis to assess market expectations. It's not luck; it's about truly understanding how markets process information.

Protecting Your Capital When Markets Go Wild

News trading can be exhilarating, offering the potential for quick profits. However, I've seen firsthand how quickly things can go south without a solid risk management plan. Even seasoned traders can get wiped out by a single news event they misjudged. So, let's talk about how to protect your capital in these volatile markets. We'll cover practical strategies for position sizing, stop-loss orders, and – perhaps the most important aspect – managing your emotions under pressure.

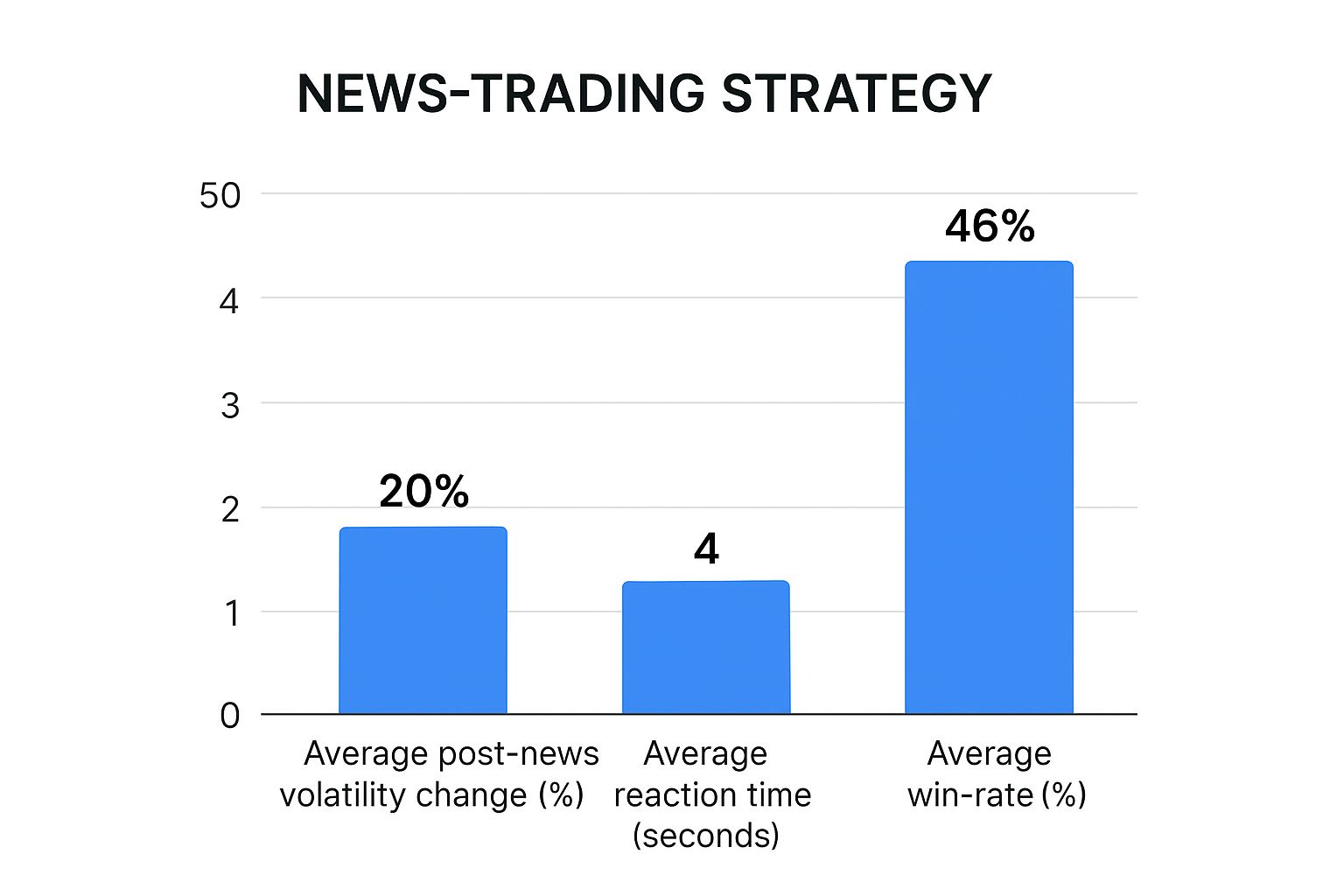

This infographic illustrates the relationship between average post-news volatility, reaction time, and win-rate. Notice how even a high win-rate doesn't eliminate risk when volatility spikes and reaction times are short. This underscores the need for a tight risk management strategy when trading the news.

Position Sizing and Stop-Loss Placement for News Trading

Typical risk management rules often need tweaking for the fast-paced world of news trading. Position sizing, for example, needs to account for unexpected gaps. Imagine bracing for a 5% move, only to see the stock gap 10% against your position. Ouch. Proper position sizing prevents this kind of scenario from decimating your account.

Stop-loss orders are your lifeline, but placement is key. Too tight, and you'll get stopped out by normal price fluctuations (those pesky whipsaws). Too wide, and you risk significant losses. Finding the sweet spot requires looking at the asset’s historical volatility around similar news events.

For instance, when trading earnings announcements, check the historical volatility around past announcements for that particular stock. This gives you a realistic range for expected price swings, preventing premature exits from potentially winning trades. News trading requires making quick decisions even when facing uncertainty. Understanding frameworks for decision making under uncertainty can be invaluable. Don’t forget about correlation risk, either. Even seemingly unrelated assets can plummet together when panic sets in. Diversification isn't a magic bullet in those situations.

Before we move on, let's look at some practical risk management guidelines based on different news event types. This table summarizes recommended position sizing, stop-loss ranges, and time horizons.

Risk Management Guidelines by News Event Type

| Event Type | Volatility Level | Max Position Size | Stop Loss Range | Time Horizon |

|---|---|---|---|---|

| Earnings Announcement | High | 2% of Account | 3-5% | 1-2 Days |

| FDA Approval | Very High | 1% of Account | 5-7% | 1 Week |

| Fed Announcement | Medium | 3% of Account | 2-3% | 1 Day |

| Product Launch | Medium | 2.5% of Account | 4-6% | 1-2 Weeks |

This table provides a starting point. Remember, adapting these parameters to your specific risk tolerance and trading style is crucial. Don't be afraid to adjust these guidelines as you gain more experience.

Managing Multiple Positions and Emotional Control

Juggling multiple positions during a flurry of news releases can feel overwhelming. One helpful strategy is utilizing options to define your maximum risk upfront. Pre-defining your exit points before the news hits is also essential for maintaining discipline and avoiding impulsive trades driven by fear or greed. Check out our guide on mastering day trading risk management for more in-depth strategies.

Finally, let's talk about the elephant in the room: emotional control. The rapid-fire nature of news trading can be a rollercoaster. Avoiding the temptation of revenge trading after a loss and sticking to your pre-defined plan are crucial for long-term success. These aren't just theoretical tips; they're battle-tested strategies used by traders who have weathered countless market storms.

Spotting Real Moves From Market Head Fakes

The hardest part of news trading isn't getting in, it's knowing if that initial pop is the real McCoy or a total head fake. I've seen it countless times – traders jumping into what looks like a breakout, only to watch it fizzle out in a matter of hours. So, how do we tell the difference? Let's explore how to separate genuine moves from the market's whims, looking at volume, price action, and overall market behavior.

Deciphering Volume Clues

Volume is your first big hint. A true breakout typically comes with a surge in volume. This confirms real buying or selling pressure. Think of it like this: a big wave needs a lot of water behind it, right? A small ripple? Not so much. If the price jumps on low volume, be careful. It might be a trap. But high volume with a big price move often signals conviction. It suggests the move has legs.

Recognizing Price Action Patterns

The way the price moves tells its own story. Does it stall after the initial spike? Is there indecision or even a quick reversal? Those are red flags. Real breakouts usually continue, even with normal pullbacks. Look for continuation patterns – things like higher lows and higher highs in an uptrend, or lower highs and lower lows in a downtrend. These patterns, along with confirming volume, are your best friends when trading news.

Understanding Market Behavior

Sometimes the initial move is so fast it’s almost impossible to react. That's when understanding the bigger picture becomes critical. Is the overall market panicking? Or is it relatively calm? If the broader market is shaky, even good news can trigger selling as traders try to get liquid. This is why good news can sometimes be bad for individual stocks, and vice versa.

Institutional Money vs. Algorithmic Noise

It's key to learn the difference between institutional money flow and algorithmic noise. A sustained move driven by institutional investors is generally smoother, with higher volume and clear price action patterns. Algorithmic trading, though, can create rapid price swings that disappear just as fast. These are the head fakes that often trap traders. There's actually data supporting the potential of news trading. Studies show that combining news sentiment with momentum can produce impressive results. Check out this research for a deeper dive: Discover insights into sentiment-based trading.

Look at market internals – things like sector rotation and breadth indicators – to confirm or challenge the initial reaction. Sometimes the best move is patience. Waiting for that second wave, after the initial flurry dies down, can be the most profitable approach. This helps you filter out the noise and trade with more clarity.

Learning From Expensive Mistakes (So You Don't Have To)

Every trader has a few trades they’d love to have back. Trust me, I've got my share. One particularly painful memory involves over-leveraging on an earnings announcement I was certain was a slam dunk. Spoiler alert: it wasn't. But these expensive lessons are valuable. Let's talk about some common news-trading pitfalls and how you can sidestep them.

The Temptation of "Obvious" Trades

The "obvious" trade is a siren song. When everyone expects a stock to move a certain way, it's easy to get caught up in the hype. You might feel like you're grabbing a guaranteed winner. But that's often when things go south. Remember market psychology? The crowd can be dead wrong, especially when big news is expected.

I once saw a stock tank after what seemed like positive news. The catch? The market had already priced in even better results. The actual news, while good, just wasn't good enough. It was a pricey lesson in over-optimism for many of us.

The Emotional Rollercoaster and Revenge Trading

News trading can be an emotional whirlwind. Fast price swings can trigger fear and greed, even in experienced traders. One minute you’re riding high, the next you're staring at a loss. This can lead to revenge trading, where you chase those losses with impulsive trades. And that's a disaster waiting to happen.

Early in my trading career, I doubled down on a loser after some bad news. Convinced the market was wrong, I poured more money into a sinking ship. It was a harsh reminder that emotional trading rarely works. Detaching from the outcome of individual trades and sticking to your plan, even when it's tough, is essential. Sticking to your news trading strategy is your best defense.

Staying Disciplined Under Pressure

Staying disciplined during volatile news events is a real challenge. It means setting your entry and exit points before the news hits. And sticking to them, even when you're tempted to chase bigger profits or cut losses short. It also means knowing when your emotions are taking over. Sometimes, the best move is to close your positions and walk away.

I remember one crazy day with a flood of conflicting news. I felt overwhelmed, questioning every decision. I realized I was running on adrenaline, not logic. Closing everything and taking a break was the smartest thing I did that day. That taught me the importance of self-awareness and stepping back when the pressure is too much. Sometimes, protecting your capital is more valuable than chasing a win.

Building Sustainable Success In News Trading

Trading the news successfully isn't about chasing every headline. It's about building a robust strategy, understanding market psychology, and constantly learning. It's more of a marathon than a sprint, requiring discipline and a systematic approach. Let's dive into how to create a framework for long-term success in news trading.

The Trading Journal: Your Personal Feedback Loop

Many traders use a journal just to log wins and losses. That's a good first step, but it's not enough. Think of your journal as a powerful tool for analyzing your decisions – the good, the bad, and the ugly. Before entering a trade, what were your assumptions? Did the market react as you expected? What could you have done differently? Documenting these details helps you spot recurring patterns and refine your news trading strategy.

I've even found it useful to jot down my emotional state during each trade. Were you feeling anxious, greedy, or perhaps a little too confident? Recognizing these emotional influences is key to avoiding repeating the same mistakes.

Reviewing Trades: Learning From Wins and Losses

It’s natural to celebrate wins and shrug off losses. But real improvement comes from analyzing both with the same level of scrutiny. Surprisingly, losing trades often offer the most valuable lessons. They can highlight weaknesses in your strategy or expose those sneaky psychological blind spots.

My post-trading routine is simple: I review every trade, starting with the losers. I ask myself, "Was this loss due to faulty analysis, poor execution, or emotions getting the better of me?" Then, I move on to the winning trades, looking for ways to maximize profits. Could I have improved my position sizing or exit strategy? These little tweaks can make a big difference over time.

This TradingView chart shows a typical setup for technical analysis. Notice the various indicators and tools available for assessing price action. Understanding how these tools can inform your news trading strategy is essential for sustainable success.

Realistic Timelines and Scaling Up

News trading isn't a path to overnight riches. Developing the skills and experience for consistent profitability takes time, dedication, and consistent effort. Begin with smaller positions, prioritizing learning and refining your approach. Gradually increase your position size as you build confidence and a solid track record.

Don’t fixate solely on profit and loss. Keep an eye on other crucial metrics, like your win rate and the average size of your wins compared to your losses. These metrics offer a more granular view of your performance, revealing areas you can improve.

Building a sustainable news trading strategy is a marathon, not a sprint. It requires continuous learning, adapting to market changes, and consistently improving your decision-making. Remember: managing your emotions and staying disciplined is just as important as technical analysis and market knowledge.

Ready to step up your news trading game? ChartsWatcher offers the tools you need to stay on top of market-moving events, analyze price action, and execute trades precisely. Sign up today and discover the power of a truly customizable trading platform.