12 Portfolio analysis tools You Should Know

Navigating the complexities of investment management requires more than just intuition; it demands powerful, data-driven insights. Spreadsheets have their place, and truly understanding your investments can start with mastering essential Excel financial formulas, but dedicated portfolio analysis tools offer a far more robust and efficient solution. These platforms automate the tracking, analysis, and optimization of your holdings, providing a clear, consolidated view that simple spreadsheets cannot match. They help you identify hidden risks, uncover performance drivers, and ensure your asset allocation aligns with your strategic goals.

This guide moves beyond generic feature lists to provide a comprehensive evaluation of the top portfolio analysis tools available today. We dive deep into each platform, offering practical use-case scenarios, honest assessments of their limitations, and specific implementation considerations for professional traders and serious investors. You will find detailed breakdowns of tools like Empower, Stock Rover, and Portfolio Visualizer, among others. Each review includes screenshots and direct links, helping you quickly identify the best platform to manage your specific investment strategy. Our goal is to equip you with the information needed to select a tool that not only tracks your assets but actively enhances your decision-making process and portfolio performance.

1. Empower (formerly Personal Capital)

Empower, widely known by its former name Personal Capital, offers one of the most robust free suites of portfolio analysis tools available today. It excels at providing a holistic financial picture by allowing users to aggregate various accounts, including brokerage, 401(k), IRA, and even credit cards and mortgages, into a single, intuitive dashboard. This aggregation is its key differentiator, moving beyond simple stock tracking to deliver a comprehensive net worth and cash flow analysis.

The platform is particularly useful for identifying hidden investment fees and assessing your overall asset allocation against your risk tolerance. For traders looking to consolidate their view across multiple platforms, this tool is invaluable. While the powerful analysis dashboard is free, be aware that accessing their paid advisory services requires a $100,000 minimum investment, and users of the free tools may receive marketing calls from Empower's financial advisors. For more strategies, you can learn how to track an investment portfolio like a pro.

- Best For: Investors seeking a consolidated view of their entire net worth and investment fees.

- Key Features: Fee Analyzer, Retirement Planner, Asset Allocation Target tool.

- Pricing: Free financial dashboard; advisory services require a minimum investment.

- Website: https://www.empower.com/

2. Stock Rover

Stock Rover is a powerful investment research and analysis platform designed for investors who need to go deep into the data. It stands out for its exceptionally detailed stock screener and comprehensive portfolio analysis tools, which allow for sophisticated performance tracking and comparisons. Users can link multiple brokerage accounts to get a consolidated view, making it a strong choice for those managing diverse portfolios and seeking to benchmark their performance against major indices like the S&P 500. The platform is particularly strong in fundamental analysis, offering over a decade of historical financial data.

The platform provides a wealth of metrics, from standard performance and risk calculations to more advanced analytics like dividend income projections and correlation analysis. While it offers a capable free version, the most powerful features are reserved for its premium tiers, which may be a consideration for casual investors. The user interface is data-rich and resembles a spreadsheet, which is highly efficient for data-focused traders but might have a steeper learning curve for beginners. The lack of a dedicated mobile app is also a notable limitation for on-the-go analysis.

- Best For: Data-driven investors who prioritize fundamental analysis and advanced stock screening.

- Key Features: Customizable stock screener, portfolio correlation analysis, dividend income projection, detailed research reports.

- Pricing: Free basic plan; premium plans offer more advanced features and data.

- Website: https://www.stockrover.com/

3. Portfolio Visualizer

Portfolio Visualizer is a web-based platform that offers a powerful suite of sophisticated portfolio analysis tools geared toward technically-minded investors and analysts. Unlike platforms focused on account aggregation, its core strength lies in its deep analytical capabilities, particularly in strategy modeling and historical performance simulation. It allows users to conduct in-depth backtesting, run Monte Carlo simulations to forecast potential outcomes, and perform complex factor analysis to understand what drives returns.

The platform excels at helping users fine-tune their asset allocation and test investment theses against decades of historical data. Its tools are especially valuable for traders who want to validate a strategy before deploying capital. While the interface is more utilitarian than flashy, it is highly functional for its intended purpose. Most of its powerful features are free to use, although this requires manual input of your portfolio holdings or tickers. The steep learning curve for its advanced models may be a hurdle for novices, but for those willing to dive in, the insights are unparalleled. To learn more about how it compares, you can check out some of the best backtesting software for stocks.

- Best For: Data-driven investors wanting to backtest strategies and perform advanced performance analysis.

- Key Features: Portfolio Backtesting, Monte Carlo Simulations, Factor Analysis, Asset Correlation Analysis.

- Pricing: Core features are free; premium tiers offer more advanced capabilities and higher usage limits.

- Website: https://www.portfoliovisualizer.com/

4. Morningstar Portfolio Manager

Morningstar is a highly respected name in the investment research world, and its Portfolio Manager tool leverages that authority to provide some of the best portfolio analysis tools for investors focused on mutual funds and ETFs. The platform’s strength lies in its deep, proprietary research and ratings, allowing users to benchmark their holdings against established industry standards. It moves beyond basic performance tracking by offering a detailed breakdown of your portfolio's underlying holdings, sector weightings, and investment style.

The standout feature is the Portfolio X-Ray tool, which dissects your entire portfolio to reveal potential overlaps and concentration risks you might otherwise miss. While the basic portfolio tracker is free, gaining full access to Morningstar’s premium research, in-depth analyst reports, and advanced screening capabilities requires a subscription. A significant drawback is the need for manual data entry, as it does not automatically sync with brokerage accounts like some competitors. This makes it better suited for periodic, in-depth analysis rather than real-time daily tracking.

- Best For: Investors who prioritize deep fund analysis and access to professional-grade research.

- Key Features: Portfolio X-Ray tool, Fund and stock analysis, Investment research reports.

- Pricing: Free basic portfolio tracking; Morningstar Investor subscription required for premium features.

- Website: https://www.morningstar.com/

5. Ziggma

Ziggma positions itself as a powerful, data-driven platform for modern investors, offering a suite of portfolio analysis tools designed for optimization and deep-dive research. It stands out by connecting with numerous brokerage accounts to provide a consolidated view, then applying its proprietary scoring system to evaluate portfolio quality, risk, and dividend yield. This quantitative approach helps traders quickly identify the strengths and weaknesses within their holdings without getting lost in raw data.

The platform’s portfolio simulator is a key feature, allowing users to test potential trades and see their impact on overall portfolio metrics before committing capital. While the core portfolio tracking is free and robust, accessing the advanced stock screener, smart alerts, and more comprehensive analytics requires a premium subscription. The user interface is generally clean and intuitive, though its mobile app functionality is more limited compared to its web-based counterpart, making it better suited for desktop analysis.

- Best For: Data-focused investors who want quantitative scores and portfolio simulation capabilities.

- Key Features: Portfolio dashboard with performance metrics, Stock screener with quantitative scores, Portfolio simulator, Smart alerts.

- Pricing: Free basic plan; Premium subscription required for advanced features.

- Website: https://www.ziggma.com/

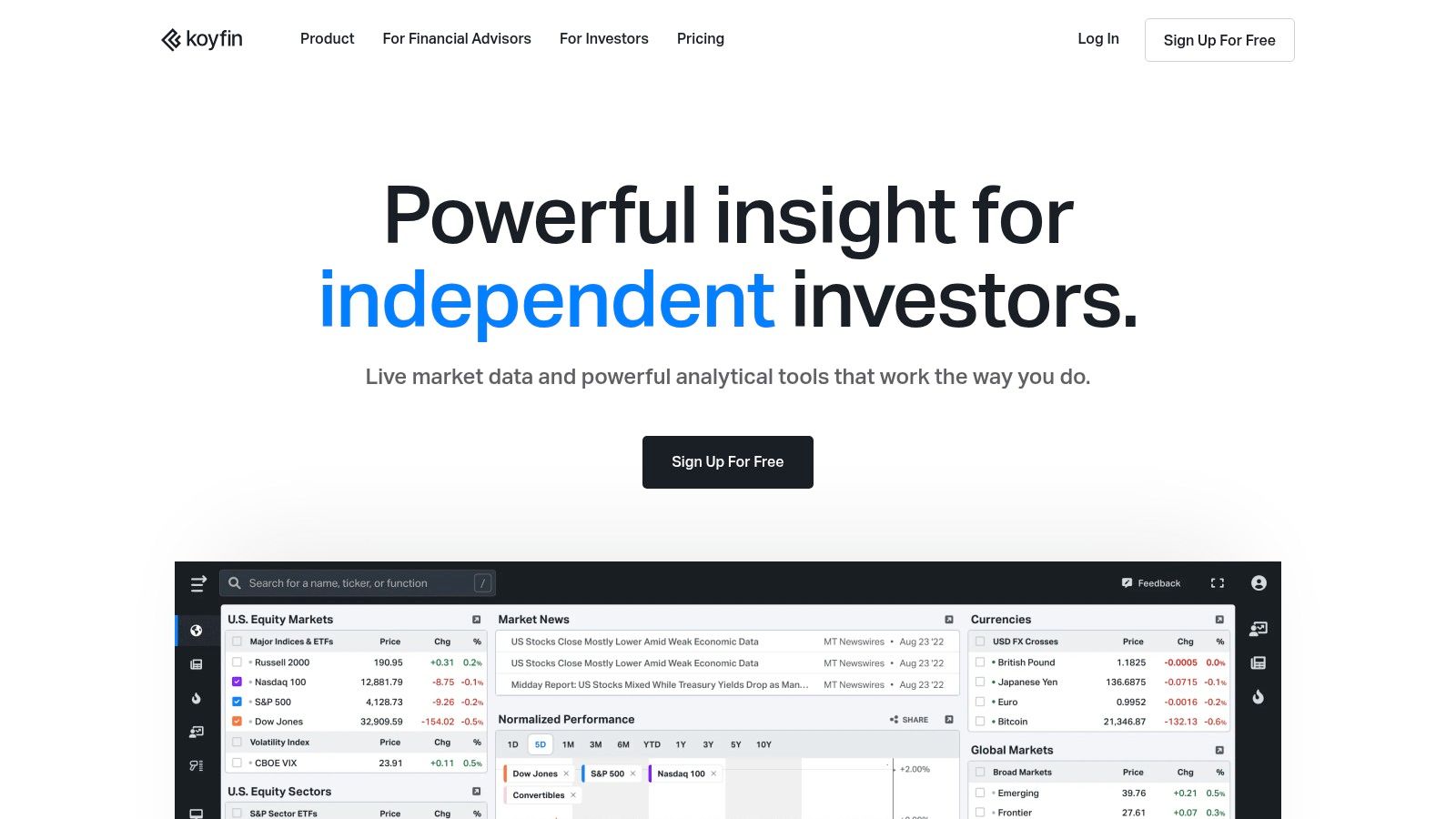

6. Koyfin

Koyfin positions itself as a powerful, more accessible alternative to expensive institutional terminals, offering a sophisticated suite of portfolio analysis tools for serious investors. It delivers institutional-grade financial data and analytics through a clean, customizable dashboard interface. Users can link brokerage accounts to track their holdings or manually create multiple portfolios to monitor performance, analyze asset allocation, and dive deep into the fundamental data of individual securities. Its strength lies in its extensive global data coverage and advanced charting capabilities, making it feel like a professional-grade platform.

The platform is designed for traders who need more than just basic portfolio tracking, offering features like stock screeners, financial statement analysis, and macroeconomic data visualization. While Koyfin provides a very generous free tier that covers the needs of many investors, accessing its most advanced features, like premium data and expanded model portfolios, requires a paid subscription. It's a web-based tool and currently lacks a dedicated mobile app, making it best suited for desktop analysis.

- Best For: Traders and investors who want institutional-level data and analytics without the high cost.

- Key Features: Customizable dashboards, Advanced charting tools, Brokerage account integration, Global financial data.

- Pricing: A robust free version is available; paid plans unlock advanced features.

- Website: https://www.koyfin.com/

7. SigFig

SigFig offers a streamlined and highly accessible suite of portfolio analysis tools, positioning itself as a strong contender for investors who value simplicity and clarity. By linking your existing brokerage accounts, SigFig’s free Portfolio Tracker provides a consolidated dashboard that analyzes your holdings for performance, risk, and diversification. Its key strength lies in its user-friendly interface, which clearly visualizes how your investments are performing and where potential imbalances or excessive fees exist.

The platform shines at providing actionable insights without overwhelming the user with overly complex data, making it ideal for checking portfolio health at a glance. It helps you understand your exposure and identifies areas for improvement based on a personalized risk profile. While the free tracking and analysis are excellent, traders should note that its more advanced features are part of its paid automated investment management service, which requires a minimum investment. This makes SigFig a hybrid tool, useful for both DIY analysis and optional hands-off management.

- Best For: Investors who want a simple, free tool to check portfolio health and analyze fees across multiple brokers.

- Key Features: Portfolio Tracker, Risk Assessment, Fee Analyzer, External Account Sync.

- Pricing: Free portfolio tracking and analysis; managed portfolios require a minimum investment ($2,000) and have an advisory fee.

- Website: https://www.sigfig.com/

8. Quicken Premier

Quicken Premier has a long-standing reputation as a comprehensive personal finance management tool, but it also packs powerful portfolio analysis tools for dedicated investors. Unlike purely web-based platforms, Quicken is desktop software that syncs a wide array of financial accounts, offering detailed tracking of investments, capital gains, and performance. Its strength lies in its all-in-one approach, allowing users to manage their budget, bills, and investments within a single ecosystem.

The platform provides robust features for active traders, including buy and sell decision support tools that help evaluate the tax implications of potential trades. While some tools are tailored for specific investment analysis, other comprehensive platforms like Quicken Premier can also cover broader financial needs, including capabilities often found in budget software for small business. A key drawback is its subscription model and the fact that its core functionality is desktop-based, with more limited features on its mobile companion app.

- Best For: Investors who want to integrate detailed portfolio tracking with their overall personal financial management and budgeting.

- Key Features: Real-time investment tracking, Buy and sell decision support, Tax optimization tools, Year-end tax reports.

- Pricing: Requires an annual subscription; various tiers are available.

- Website: https://www.quicken.com/

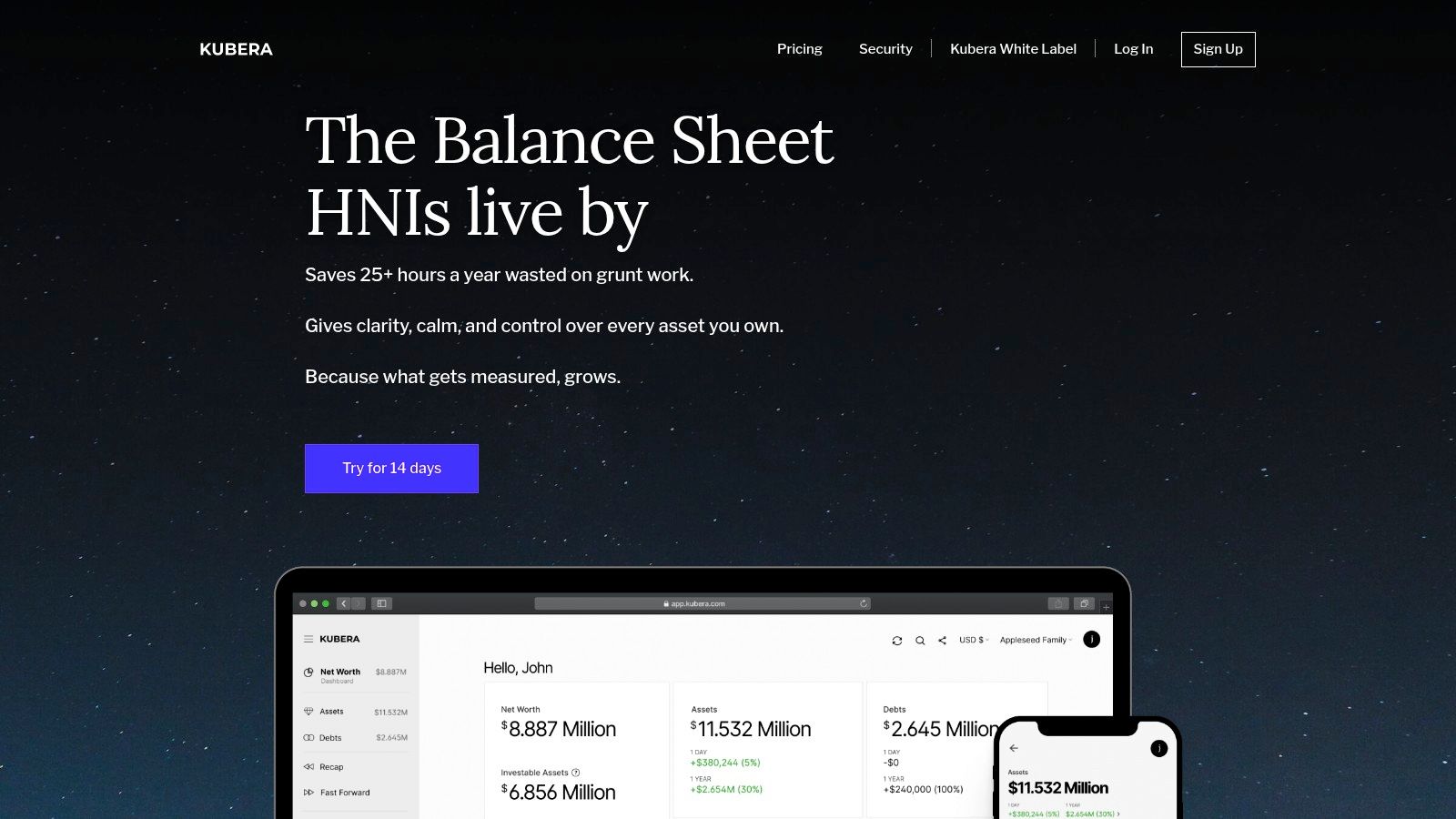

9. Kubera

Kubera positions itself as a modern, clean, and private alternative in the world of net worth tracking. Unlike many free portfolio analysis tools that may monetize user data or push advisory services, Kubera operates on a simple subscription model, ensuring user privacy is a top priority. Its core strength lies in tracking a vast and diverse range of assets, from traditional stocks and ETFs to cryptocurrencies, DeFi assets, real estate, and even the value of domain names or classic cars. This makes it ideal for investors with unconventional or widely distributed portfolios.

The platform automatically syncs with thousands of banks and brokerage accounts globally, presenting all your financial data in a sleek, spreadsheet-like interface that is both intuitive and highly customizable. While it excels at aggregation and net worth visualization, its analytical capabilities are less deep than dedicated investment platforms. It lacks advanced charting, fee analysis, or retirement planning calculators, focusing instead on providing an accurate, real-time snapshot of your total wealth.

- Best For: Privacy-conscious investors with diverse asset classes, including crypto and real estate.

- Key Features: Comprehensive asset tracking, Automatic account syncing, Future net worth projection, Secure document storage.

- Pricing: Subscription-based service with no free tier, offering a 14-day trial.

- Website: https://www.kubera.com/

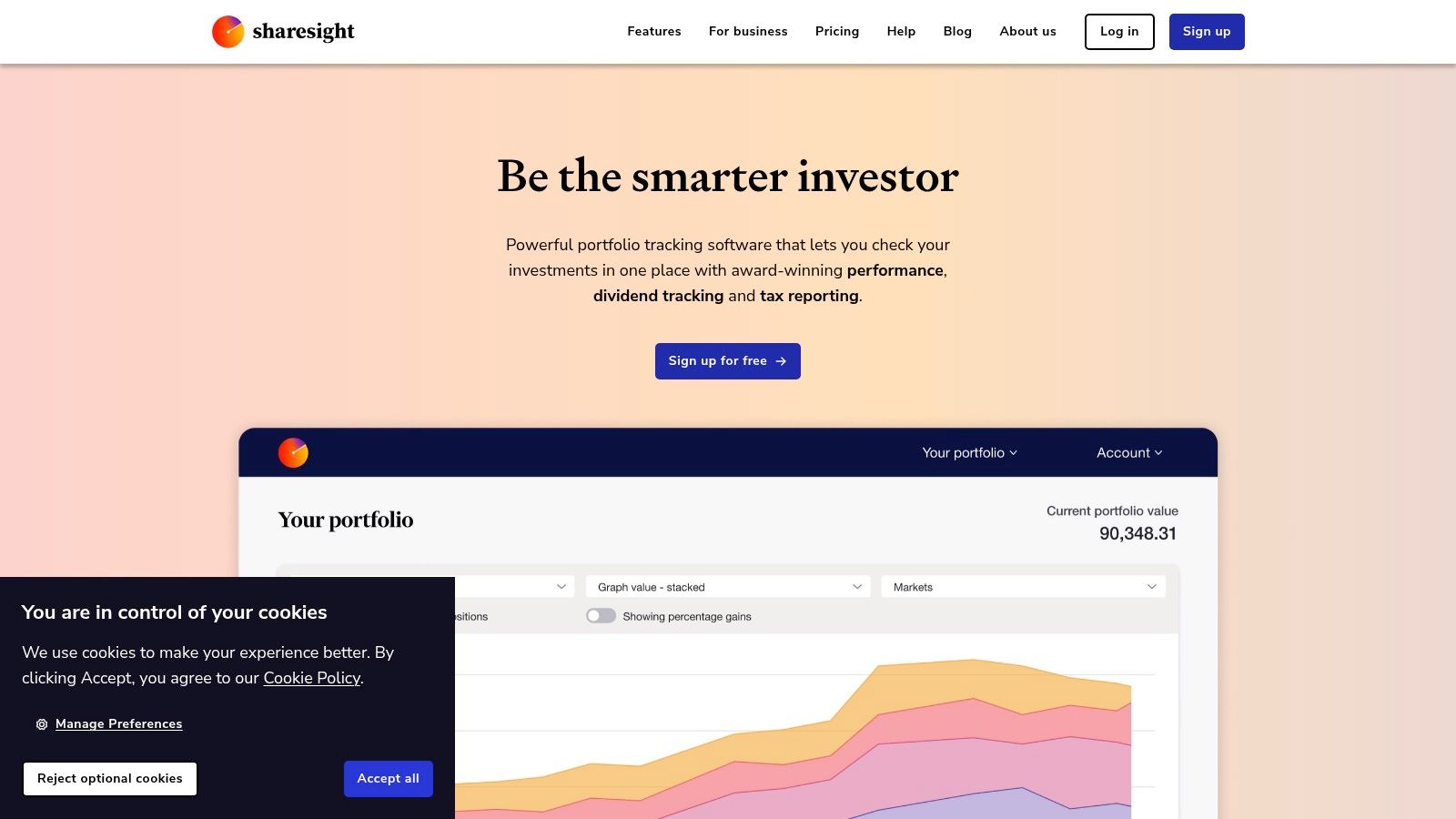

10. Sharesight

Sharesight is a powerful portfolio tracker that excels in providing detailed performance, dividend, and tax reporting. Its key strength lies in its global reach, offering support for over 40 stock exchanges worldwide and automatic dividend tracking with multi-currency capabilities. This makes it one of the essential portfolio analysis tools for investors with international holdings, as it automatically converts performance and dividends back to your local currency, simplifying complex calculations.

The platform’s tax reporting features are particularly robust, allowing users to generate reports like Capital Gains Tax and Taxable Income, which can be shared directly with an accountant. While its free plan is a great entry point, it is limited to 10 holdings. For investors with more diverse or larger portfolios, upgrading to a paid plan unlocks advanced features and unlimited holdings. The user interface is clean and intuitive, making it easy to see true performance after accounting for brokerage fees, currency fluctuations, and dividends.

- Best For: Global investors needing comprehensive tax reporting and true performance tracking.

- Key Features: Automatic dividend tracking, Performance and tax reporting, Broker integration, Multi-currency support.

- Pricing: Free plan for up to 10 holdings; paid plans for advanced features and more holdings.

- Website: https://www.sharesight.com/

11. Investment Account Manager

Investment Account Manager (IAM) offers a distinct approach in the modern landscape of web-based portfolio analysis tools by providing robust, comprehensive desktop software. Designed for serious individual investors who prefer local data control, it moves beyond basic tracking to deliver in-depth management and analytical capabilities. IAM stands out with its one-time purchase model, appealing to users who are wary of recurring subscription fees and prefer a long-term, self-managed solution for their investment data.

The platform’s strength lies in its detailed reporting features, including asset allocation analysis and tools specifically for tax-lot accounting and reporting. This makes it particularly useful for investors managing complex portfolios who need precise control and documentation for tax purposes. While the software is Windows-only and lacks a mobile app, its detailed functionality serves a specific niche of traders who prioritize depth of analysis and data ownership over cloud-based accessibility and cross-platform convenience. An optional annual update subscription provides ongoing feature enhancements and support.

- Best For: Detail-oriented investors who want a one-time purchase desktop solution with deep reporting features.

- Key Features: Real-time performance tracking, Asset allocation analysis, Customizable investment reports, Tax reporting tools.

- Pricing: One-time purchase ($99 for a new user license) with an optional annual maintenance plan.

- Website: https://www.investmentaccountmanager.com/

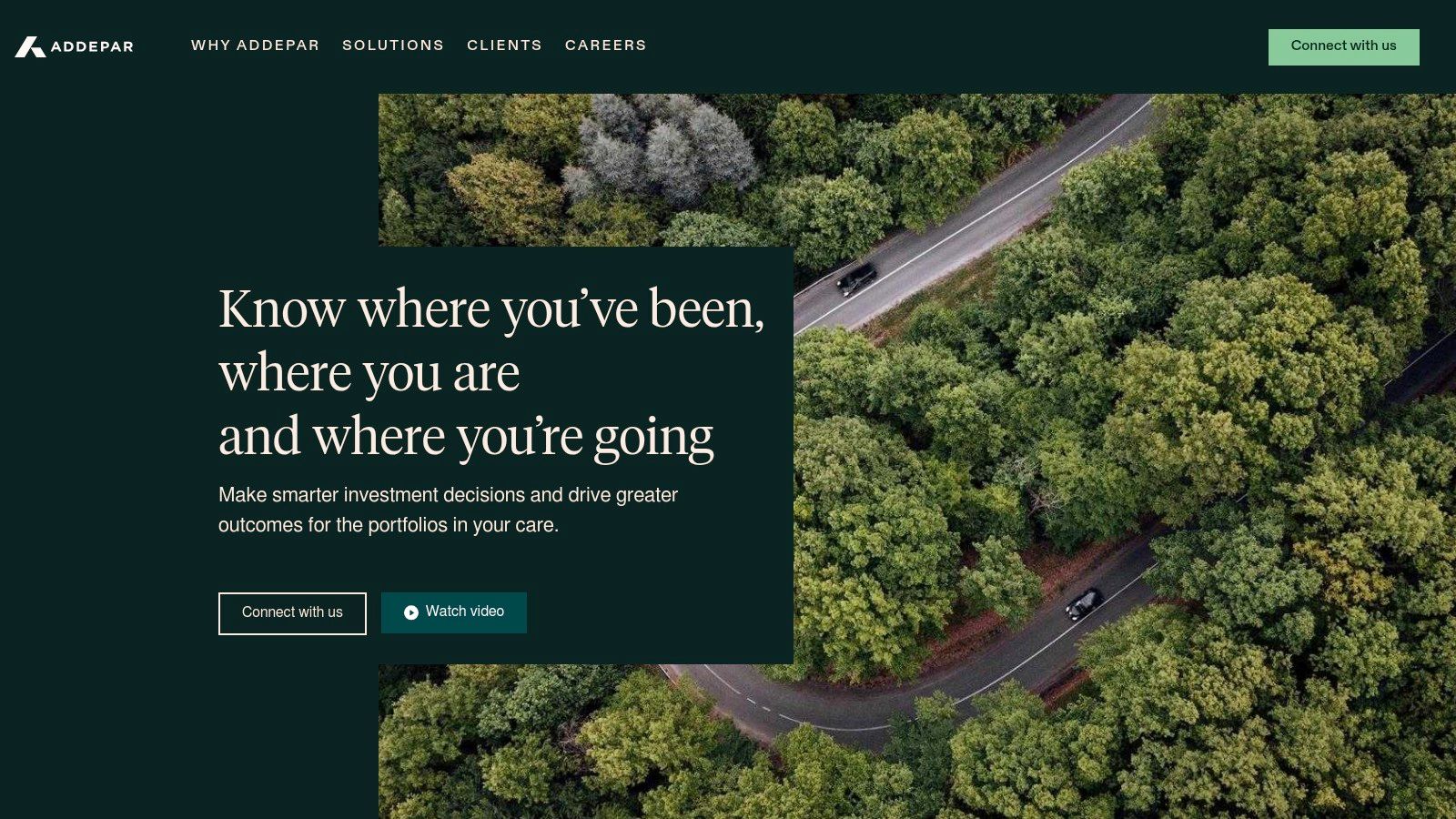

12. Addepar

Addepar delivers an institutional-grade wealth management platform designed for the complex needs of financial advisors, family offices, and high-net-worth individuals. Its strength lies in its ability to aggregate and analyze data from a vast array of sources, including traditional assets like stocks and bonds alongside alternative investments such as private equity and real estate. This makes it one of the most powerful portfolio analysis tools for managing intricate, multi-generational wealth.

The platform's highly customizable dashboards and reporting capabilities allow users to drill down into performance, exposure, and risk across their entire portfolio with exceptional detail. While it offers unparalleled depth, Addepar is not intended for the average retail investor; it is an enterprise-level solution. Pricing is not publicly listed and is tailored to the specific needs of the advisory firm or institution, reflecting its focus on the professional market. Traders managing significant or exceptionally diverse portfolios will find its analytical power to be unmatched.

- Best For: Financial advisors and institutions managing complex, multi-asset class portfolios.

- Key Features: Comprehensive data aggregation, Advanced analytics and reporting, Customizable dashboards, Support for alternative investments.

- Pricing: Not publicly available; enterprise-level pricing.

- Website: https://addepar.com/

Portfolio Analysis Tools Feature Comparison

| Product | Core Features / Tools | User Experience ★ | Value Proposition 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| Empower (formerly PC) | Asset allocation, retirement tools | ★★★★☆ User-friendly | 💰 Free tools; advisory $100k+ | 👥 Individuals seeking holistic finance | ✨ Comprehensive financial health overview |

| Stock Rover | Stock screener, charting, dividend proj | ★★★★☆ Data-rich interface | 💰 Paid plans for advanced use | 👥 Investors & professionals | ✨ Brokerage integration, extensive metrics |

| Portfolio Visualizer | Backtesting, Monte Carlo, factor analysis | ★★★★☆ Analytical depth | 💰 Free core tools | 👥 Advanced portfolio analysts | ✨ Robust simulation & asset correlation |

| Morningstar Portfolio Mgr | Fund & stock analysis, performance | ★★★★☆ Trusted, research-rich | 💰 Subscription for premium | 👥 Investors needing research | 🏆 Extensive Morningstar ratings & reports |

| Ziggma | Dashboard, screener, portfolio sim | ★★★★☆ User-friendly | 💰 Free & premium options | 👥 Portfolio optimizers | ✨ Smart alerts, quantitative scoring |

| Koyfin | Dashboards, charting, global financial | ★★★★☆ Intuitive interface | 💰 Free core, subscription adv | 👥 Institutional & retail users | ✨ Wide data coverage, customizable dashboards |

| SigFig | Performance, risk, automated mgmt | ★★★☆☆ Easy to use | 💰 Free tracking; auto invest min | 👥 Brokerage account users | ✨ Automated investment management |

| Quicken Premier | Investment tracking, tax tools | ★★★☆☆ Integrated suite | 💰 Annual subscription | 👥 Comprehensive personal finance | ✨ Buy/sell support & tax optimization |

| Kubera | Asset tracking, net worth projection | ★★★★☆ Privacy-focused | 💰 Paid only | 👥 Diverse asset investors | ✨ Multi-asset class & document storage |

| Sharesight | Dividend tracking, tax & performance | ★★★★☆ User-friendly | 💰 Free limited holdings, paid | 👥 Global & multi-currency inv. | ✨ Multi-currency & automatic dividend tracking |

| Investment Account Mgr | Performance, reports, tax tools | ★★★☆☆ Detailed desktop | 💰 One-time purchase | 👥 DIY investors (Windows only) | ✨ Custom reports, tax tools |

| Addepar | Data aggregation, advanced analytics | ★★★★☆ Institutional grade | 💰 Custom pricing | 👥 High-net-worth & advisors | 🏆 Complex portfolio & dashboard customization |

Final Thoughts

Navigating the complex landscape of the financial markets without the right equipment is like sailing a ship without a compass. The comprehensive portfolio analysis tools we've explored serve as that essential navigational aid, transforming raw data into actionable intelligence and strategic clarity. From the holistic wealth management of Empower to the deep-dive institutional-grade analytics of Koyfin and the robust research capabilities of Stock Rover, the modern trader has an unprecedented arsenal at their disposal.

Our journey through these platforms reveals a crucial truth: there is no single "best" tool for everyone. The ideal choice is deeply personal, tethered to your specific trading style, investment philosophy, and technical requirements. A day trader’s needs for real-time data and performance attribution are vastly different from a long-term, buy-and-hold investor who might prioritize retirement planning and asset allocation modeling.

Choosing Your Analytical Co-Pilot

Making the right selection requires a clear-eyed assessment of your own process. Before committing to a subscription, consider the following factors:

- Investment Style: Are you an active trader, a passive investor, or a hybrid of both? Your answer will guide you toward tools with robust real-time data (Koyfin) or those excelling in long-term forecasting and allocation (Portfolio Visualizer).

- Technical Integration: How easily does the tool connect with your existing brokerage accounts? Seamless API integration, offered by platforms like Sharesight and Kubera, is critical for accurate, automated tracking and analysis. Manual data entry is not a sustainable solution for an active professional.

- Core Analytical Needs: Pinpoint your primary goal. Is it tax-loss harvesting, risk modeling, dividend tracking, or performance benchmarking? Ziggma excels in company-specific fundamental analysis, while Morningstar offers unparalleled fund and ETF-level insights.

- Scalability and Cost: Consider both your current portfolio size and your future growth. A free tool might suffice now, but will it support you as your strategies and capital grow more complex? Evaluate the tiered pricing structures to ensure the tool can scale with your success.

Implementation and Beyond

Once you've selected one of the portfolio analysis tools, the work has just begun. The true value is unlocked through consistent, disciplined use. Dedicate time to master its features, set up your dashboards, and integrate its reports into your daily or weekly review process. Use the data not just to see where you've been, but to stress-test your theses and model potential future outcomes. For a wider perspective or to compare additional options, explore this comprehensive guide to: other top portfolio analysis tools for 2025.

Ultimately, the goal of using these powerful platforms is to move beyond emotional, gut-feel decisions and toward a data-driven, systematic approach. By quantifying risk, identifying performance drivers, and uncovering hidden correlations, you elevate your trading from a speculative venture to a professional enterprise. Choose wisely, implement diligently, and let your chosen tool be the catalyst for more informed and profitable decision-making.

Ready to pair your powerful portfolio analysis with elite-level charting and real-time market scanning? ChartsWatcher provides the advanced visualization tools you need to spot opportunities as they happen. Complement your strategic analysis with our cutting-edge charting platform by visiting ChartsWatcher today.