12 Best Backtesting Software for Stocks in 2025 (Reviewed)

Every great trading idea feels like a winner in your head, but the live market is the ultimate, unforgiving judge. Without rigorous testing, even the most promising strategy is just a hypothesis. This is where backtesting software for stocks becomes an indispensable part of a trader's toolkit, transforming theoretical concepts into data-driven, actionable plans. By simulating how your strategy would have performed against historical market data, you can identify its strengths, weaknesses, and potential profitability before risking a single dollar. This process isn't just about validating good ideas; it's about systematically eliminating flawed ones, saving you from costly real-world mistakes.

This guide provides a comprehensive breakdown of the best backtesting platforms available today, from automated, no-code solutions to powerful, developer-focused environments. We cut through the marketing noise to deliver an honest assessment of each tool's capabilities, limitations, and ideal use cases. You will find in-depth analysis of key features, pricing structures, and implementation considerations to help you select the right software for your specific trading style, whether you're a day trader, swing trader, or long-term investor. To gain a comprehensive understanding of what truly makes a trading strategy effective, it's beneficial to also explore the principles behind data analytics and broader trading tools.

Our goal is to help you move from strategy conception to confident execution. Each review includes direct links and screenshots, providing a clear picture of what to expect. We will explore platforms like TrendSpider, QuantConnect, TradingView, and TradeStation, among others, to ensure you find the perfect fit for your analytical needs and technical skill level. Let's find the reality check your strategy needs.

1. ChartsWatcher

Best For: All-in-One Market Scanning and Strategy Validation

ChartsWatcher distinguishes itself as a premier choice by integrating powerful real-time market scanning with a highly accessible backtesting tool. Developed in Germany for professional traders and analysts, its core strength lies in its profound customizability. Users can construct intricate trading dashboards from scratch, utilizing eight distinct window types like toplists, charts, alerts, and newsfeeds, all synchronized to provide a comprehensive market overview. This setup is ideal for traders who need to monitor multiple conditions simultaneously before executing a strategy.

The platform’s integrated backtesting feature is a standout, allowing users to validate their custom-built scanning configurations and alert criteria against historical data. This capability is crucial for any serious trader looking to deploy a new strategy with confidence. By testing a hypothesis on past market behavior, you can gain valuable insights into its potential effectiveness, a key step in refining your approach.

Key Features and Use Cases

ChartsWatcher excels in providing a unified environment where strategy creation, testing, and live monitoring converge. This makes it one of the most versatile platforms for data-driven trading.

- Integrated Backtesting: Validate your custom scanner filters against up to 20 days of historical data. This is particularly useful for day traders wanting to test the efficacy of their intraday setups before risking capital.

- Highly Customizable Interface: Combine eight different window types to build a workspace that perfectly matches your workflow. For example, a momentum trader could create a layout featuring a toplist of high-volume movers, a 5-minute chart, a real-time newsfeed filtered for specific keywords, and an alert window for price breakouts.

- Advanced Alerts and Filters: The platform supports complex, multi-conditional alerts across various timeframes. This allows you to move beyond simple price alerts and create nuanced triggers based on a combination of technical indicators, volume, and other market data points.

Practical Considerations

While the free plan offers an excellent introduction to the platform's capabilities, serious traders will find the Pro plan essential for unlocking its full potential. The Pro plan extends the backtesting period and enables the import/export of configurations, which is invaluable for teams or traders using multiple machines.

| Feature | Free Plan | Pro Plan ($74.99/mo, billed annually) |

|---|---|---|

| Backtesting Data | Limited historical period | Extended historical period (up to 20 days) |

| Custom Configurations | Full customization | Full customization + Import/Export feature |

| Real-Time Data | Included | Included |

| Alerts & Filters | Comprehensive | Comprehensive |

Website: https://chartswatcher.com

2. TrendSpider

TrendSpider is a sophisticated technical analysis platform that leverages artificial intelligence to automate much of the tedious work involved in charting. It’s particularly powerful for traders who rely on visual patterns, trendlines, and candlestick formations, as its AI can detect these automatically across multiple timeframes. This makes it an exceptional tool for momentum and growth stock traders who need to act quickly on emerging patterns. The platform’s core strength lies in its ability to translate visual chart analysis into a testable strategy without requiring any code.

The user experience is clean and intuitive, especially given the platform's advanced capabilities. You can simply click on indicators and patterns on a chart to build the conditions for your strategy. This approach significantly lowers the barrier to entry for robust backtesting. For those searching for backtesting software for stocks that bridges the gap between manual charting and automated system testing, TrendSpider is a standout choice.

Key Features & Use Case

- AI-Powered Analysis: Automatically detects trendlines, support/resistance levels, and over 200 candlestick patterns.

- Strategy Tester: A no-code backtesting engine that uses a simple point-and-click interface to define entry and exit rules.

- Multi-Timeframe Analysis (MTFA): Allows you to overlay indicators or patterns from one timeframe onto another (e.g., a 50-day moving average on a 15-minute chart), which is crucial for contextual analysis.

- Dynamic Alerts: Set complex, multi-conditional alerts that can notify you when a specific set of criteria is met across different timeframes.

Pricing & Platform Access

TrendSpider operates on a subscription model with several tiers, typically starting around $30-$40 per month for the Premium plan when billed annually. Higher-priced Elite and Advanced plans offer more backtests, more alerts, and access to more specialized data. A 7-day free trial is available, allowing you to explore its full feature set before committing.

- Pros: User-friendly for non-coders, excellent automation features, strong educational support.

- Cons: Primarily focused on technical analysis for stocks and crypto; limited options backtesting capabilities and a higher price point than some basic tools.

Website: https://www.trendspider.com/

3. TradingView

TradingView is arguably one of the most popular cloud-based charting and social networking platforms for traders and investors worldwide. Its core strength is its beautiful, intuitive interface combined with a powerful proprietary scripting language, Pine Script. While known primarily for its exceptional charting tools and massive community, it also offers robust backtesting capabilities, making it a go-to for traders who want to build, test, and share their ideas all in one place.

The platform’s backtesting is handled through its Strategy Tester panel, which runs strategies coded in Pine Script. This makes it ideal for users who are comfortable with some level of coding and desire deep customization. For those seeking backtesting software for stocks that integrates seamlessly with world-class charting and a vibrant community, TradingView provides an unparalleled ecosystem. The ability to see thousands of public scripts and strategies from other users provides a unique learning and idea-generation environment.

Key Features & Use Case

- Pine Script: A lightweight, powerful programming language designed for creating custom technical indicators and strategies.

- Strategy Tester: An integrated feature that allows you to run Pine Script strategies on historical data and view detailed performance reports, including net profit, max drawdown, and win rate.

- Vast Asset & Data Coverage: Access to a huge range of global stocks, ETFs, forex, and crypto data, often in real-time.

- Social Networking: A massive library of community-built scripts and a social feed where traders share analysis and strategies, offering a rich source of inspiration and feedback.

Pricing & Platform Access

TradingView offers a freemium model. The free Basic plan is quite functional for charting but has limitations on indicators, layouts, and ads. Paid plans (Pro, Pro+, and Premium) start around $15-$60 per month and remove ads, increase the number of indicators per chart, provide more server-side alerts, and offer more historical data for backtesting.

- Pros: Excellent charting interface, massive active community, supports multiple asset classes globally.

- Cons: Backtesting requires coding in Pine Script; advanced backtesting features are limited compared to dedicated platforms.

Website: https://www.tradingview.com/

4. Trade Ideas

Trade Ideas is a powerful market intelligence platform best known for its AI-driven scanning and trade alert capabilities. While primarily a tool for discovering real-time opportunities, its integrated backtesting engine, OddsMaker, allows traders to validate their strategies against historical data. The platform is designed for active day traders and momentum investors who need to quickly identify and test ideas based on a massive array of real-time market data points. Its core strength is connecting AI-generated trade ideas directly to a validation process without requiring any coding.

The user experience centers on its customizable scan windows and AI channels, which stream potential trade setups throughout the day. With the OddsMaker tool, you can take any scan or alert configuration and instantly see how it would have performed historically. This makes it an excellent choice for those looking for backtesting software for stocks that excels at idea generation first and validation second, creating a seamless workflow from discovery to execution.

Key Features & Use Case

- AI-Powered Trade Signals: Features several AI algorithms (Holly) that generate statistically tested trade ideas with specific entry and exit points.

- OddsMaker Backtesting Tool: A visual, event-based backtesting engine that lets you test any custom scan or strategy over years of historical data with just a few clicks.

- Customizable Scanners: Build highly specific real-time scanners using hundreds of filters and alerts to find stocks matching your exact criteria.

- Simulated Trading: Test strategies in a live, simulated environment to practice execution without risking real capital.

- Brokerage Integration: Connect directly to select brokerage accounts to automate trading based on your tested strategies.

Pricing & Platform Access

Trade Ideas is a premium platform with a subscription-based model. The backtesting feature (OddsMaker) is only available in its highest-tier plan, the Trade Ideas Premium, which costs around $2,268 annually. A Standard plan with scanners but no backtesting or AI is available for a lower price. The company occasionally offers promotions or trial periods.

- Pros: Exceptional AI-driven idea generation, no coding required for backtesting, powerful real-time scanning capabilities.

- Cons: High subscription cost, backtesting is restricted to the most expensive plan, can have a steep learning curve due to the sheer number of features.

Website: https://www.trade-ideas.com/

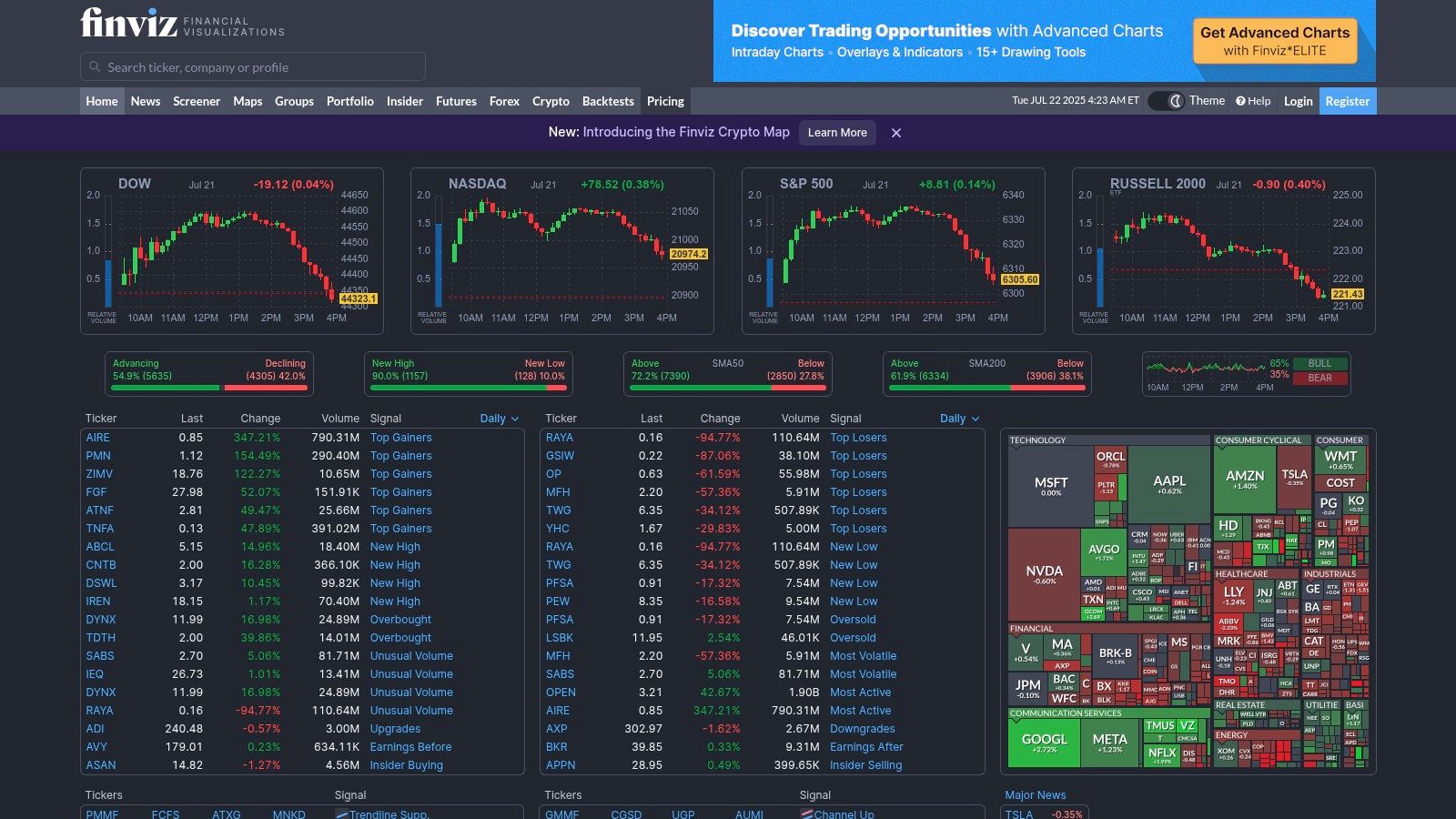

5. FinViz

FinViz is a household name for many traders, primarily known for its powerful and free stock screener. While not a dedicated backtesting platform in the same vein as others on this list, it offers fundamental and technical screening capabilities that form the preliminary stage of any robust strategy. It excels at helping traders filter the entire U.S. stock market down to a manageable list of candidates based on hundreds of criteria, from P/E ratios to specific candlestick patterns. This makes it an invaluable starting point for developing and validating trading ideas before moving them to more advanced testing environments.

The user experience is incredibly fast and data-dense, presenting vast amounts of information in an easily digestible format through its signature heatmaps and screener tables. While its direct backtesting features are limited, its "Elite" version allows users to access historical screener data and chart custom indicators, enabling a form of manual or semi-automated backtesting. For traders looking for backtesting software for stocks that integrates world-class screening with basic performance visualization, FinViz serves as an essential research and discovery tool.

Key Features & Use Case

- Advanced Stock Screener: Filter stocks using over 100 descriptive, fundamental, and technical metrics.

- Financial Visualizations: Includes market heatmaps, sector performance charts, and futures quotes to provide a broad market overview.

- Interactive Charts: Elite subscribers can access intraday charts, advanced charting tools, and overlay technical indicators.

- News Aggregation: Provides a real-time news feed from various sources, categorized by ticker symbol.

Pricing & Platform Access

FinViz offers a powerful free version that includes most of its screening and charting features with delayed data. The FinViz Elite subscription, which unlocks real-time data, advanced charting, backtesting capabilities, and removes ads, is competitively priced at around $25 per month when billed annually. There is no free trial, but the extensive functionality of the free version allows users to thoroughly evaluate the platform.

- Pros: Best-in-class stock screener, very affordable, user-friendly and fast interface.

- Cons: Limited and basic backtesting functionality, primarily focused on U.S. markets, lacks automated strategy testing.

Website: https://finviz.com/

6. Backtest Zone

Backtest Zone is a streamlined, web-based platform designed for traders who want to test strategies without getting bogged down by code or complex configurations. Its core value proposition is simplicity and accessibility, making it an ideal starting point for beginners or those who need to run quick, straightforward tests on technical indicator-based ideas. The platform supports a wide range of asset classes including stocks, forex, and cryptocurrencies, which is a significant advantage for a free tool.

The user interface is minimalist and focused entirely on the backtesting function. You select an asset, define your entry and exit conditions using a dropdown menu of common technical indicators, set your parameters, and run the test. For traders looking for backtesting software for stocks that removes nearly all barriers to entry, Backtest Zone offers a no-cost, no-code solution that gets straight to the point. It's perfect for validating simple "if-then" trading concepts quickly.

Key Features & Use Case

- No-Code Strategy Builder: Create strategies by selecting from a comprehensive library of technical indicators and setting their parameters through a simple form.

- Multi-Asset Support: Test strategies on stocks from over 70 global exchanges, as well as on forex and cryptocurrency pairs.

- User-Friendly Interface: The entire process is contained on a single page, making it incredibly easy to learn and use within minutes.

- Historical Data Access: Provides the necessary historical data to run meaningful tests without requiring users to source or pay for their own data feeds.

Pricing & Platform Access

Backtest Zone is completely free to use. There are no subscription tiers, hidden fees, or premium features locked behind a paywall. This makes it a truly accessible tool for anyone interested in exploring systematic trading, regardless of their budget. Access is provided directly through the website without any need for software installation.

- Pros: Completely free, incredibly easy for beginners to use, supports a wide variety of asset classes and exchanges.

- Cons: Limited advanced features, not suitable for complex multi-conditional strategies or portfolio-level backtesting.

Website: https://backtest.zone/

7. QuantConnect

QuantConnect is an open-source, cloud-based algorithmic trading platform designed for quants and developers who want to build, test, and deploy sophisticated trading strategies. It supports multiple asset classes including stocks, options, forex, and crypto, making it highly versatile. The platform is built around its powerful LEAN engine and requires users to code their algorithms in Python or C#, offering immense flexibility and control over strategy logic. This makes it an ideal environment for traders who need institutional-grade tools and are comfortable with programming.

The platform stands out by providing a collaborative, cloud-based environment where you don't need to manage your own servers or data feeds. Its strength is in offering granular control and access to vast historical datasets, which is essential for robust quantitative analysis. For those serious about algorithmic trading, QuantConnect provides one of the most comprehensive platforms for backtesting software for stocks. Its community-driven approach also means you can learn from and collaborate with thousands of other quants. A comprehensive understanding of its capabilities is essential, and you can learn more about how to backtest a trading strategy to maximize its potential.

Key Features & Use Case

- Multi-Language Support: Build complex algorithms using either Python or C#, two of the most popular languages in quantitative finance.

- LEAN Algorithmic Trading Engine: An open-source, high-performance engine that powers all backtests and live trading operations.

- Cloud-Based Infrastructure: Eliminates the need for local hardware, providing access to massive computational power and extensive historical data for equities, options, and more.

- Brokerage Integration: Seamlessly deploy tested strategies to live trading accounts with numerous integrated brokers.

Pricing & Platform Access

QuantConnect offers a free tier that is perfect for learning and development, providing access to backtesting and research environments. For more intensive needs like live trading, faster backtesting, and access to premium datasets, it offers paid subscription plans starting from around $8 per month for the "Quant Researcher" tier. Higher-level plans offer more resources and co-location for reduced latency.

- Pros: Extremely powerful and flexible for coders, supports multi-asset strategies, strong community, and open-source engine.

- Cons: Has a steep learning curve for non-programmers and requires a subscription for live trading and advanced features.

Website: https://www.quantconnect.com/

8. TradeStation

TradeStation is a powerhouse platform designed for serious, active traders who demand professional-grade tools and integrated brokerage services. It stands out by combining comprehensive charting, automated trading, and incredibly detailed backtesting capabilities into a single, robust ecosystem. Its core strength is its proprietary scripting language, EasyLanguage, which allows traders to build, test, and automate virtually any trading idea from scratch, offering near-limitless customization.

The platform is geared toward experienced users who are comfortable with complex software and potentially coding. While there is a learning curve, the payoff is access to one of the most powerful retail-focused systems available. For those looking for backtesting software for stocks that doubles as a complete trading and brokerage solution, TradeStation is a long-standing industry leader. As a leading choice for algorithmic trading, you can learn more about TradeStation's capabilities and how it compares to other automated platforms.

Key Features & Use Case

- EasyLanguage: A beginner-friendly programming language designed specifically for creating custom indicators and trading strategies.

- Portfolio Maestro: An advanced portfolio-level backtesting tool that analyzes the performance of a basket of strategies across multiple symbols.

- Extensive Historical Data: Provides access to decades of historical intraday and daily data, essential for rigorous strategy validation.

- Integrated Brokerage: Seamlessly move from backtesting a strategy to deploying it for live or simulated automated trading within the same platform.

Pricing & Platform Access

TradeStation's pricing can be complex. The TS GO plan offers commission-free stock and ETF trades with access to the web and mobile platforms. To use the powerful desktop platform (required for EasyLanguage and advanced backtesting), you need the TS SELECT plan, which has different commission structures and may have minimum funding or trading volume requirements to waive platform fees.

- Pros: All-in-one platform with brokerage, powerful and highly customizable backtesting, strong community and support for EasyLanguage.

- Cons: Can be overwhelming for new traders, the best features are tied to the desktop platform which may have associated fees or requirements.

Website: https://www.tradestation.com/

9. MultiCharts

MultiCharts is a professional-grade electronic trading platform renowned for its advanced charting, high-definition backtesting, and robust automated trading capabilities. It is designed for serious traders who require deep customization and institutional-level analytics. What sets MultiCharts apart is its PowerLanguage scripting, which is based on EasyLanguage, making it familiar to many seasoned traders and allowing for the creation of highly complex custom indicators and strategies from scratch. This flexibility makes it an excellent choice for quantitative traders and system developers.

The platform’s user interface is dense with features, reflecting its professional focus. While this presents a steeper learning curve for beginners, it empowers advanced users with precise control over their analysis and execution. For those needing comprehensive backtesting software for stocks that can handle portfolio-level analysis and connect to numerous data feeds and brokers, MultiCharts provides a powerful, all-in-one desktop solution that can grow with a trader’s sophistication.

Key Features & Use Case

- PowerLanguage Scripting: Build and customize indicators and trading strategies using a flexible, C#-like scripting language.

- Portfolio-Level Backtesting: Test a single strategy across a basket of symbols or multiple strategies on a single instrument, providing a more holistic view of performance.

- Multiple Data Feeds & Brokers: Connect to a wide array of data providers and brokerage accounts for seamless analysis and trade execution.

- Advanced Charting Tools: Offers extensive charting options, including tick, volume, and range bars, with deep customization for visual analysis.

- Automated Trading Support: Fully supports automated execution of strategies once they have been backtested and optimized.

Pricing & Platform Access

MultiCharts is available through a one-time license fee, which distinguishes it from the common subscription model. The standard MultiCharts license costs approximately $1,497, while the .NET version is priced higher. There is a 30-day free trial available, giving prospective users ample time to evaluate its extensive capabilities before purchasing.

- Pros: Highly customizable and flexible, robust portfolio backtesting engine, supports a wide range of asset classes and brokers.

- Cons: Steeper learning curve for beginners, requires a significant upfront license cost, and is a desktop-based application.

Website: https://www.multicharts.com/

10. MetaTrader 5 (MT5)

While primarily known as a powerhouse in the forex and CFD trading worlds, MetaTrader 5 (MT5) is also a capable and surprisingly powerful platform for stock backtesting, especially for those interested in algorithmic strategies. It stands out because it is completely free to use, supported by a vast ecosystem of brokers. Its core strength lies in its proprietary MQL5 programming language, which allows for the creation of highly customized "Expert Advisors" (EAs), or automated trading robots, and complex technical indicators.

The user experience can be intimidating for beginners due to the platform's professional-grade interface and the steep learning curve of MQL5. However, for traders willing to invest time in learning the language, MT5 offers unparalleled flexibility. It provides a robust Strategy Tester that allows for deep analysis and optimization of automated strategies. This makes it an excellent choice for quantitative traders searching for free backtesting software for stocks who are comfortable with coding their own systems from the ground up.

Key Features & Use Case

- MQL5 Programming Language: Build sophisticated trading robots (EAs) and custom indicators for full strategy automation.

- Advanced Strategy Tester: Provides comprehensive backtesting reports, including multi-threaded optimization to find the best input parameters for a strategy.

- Multi-Asset Support: While famous for forex, it supports stocks, futures, and options, depending on the connected broker.

- Large Community & Marketplace: Access a massive library of free and paid EAs, indicators, and scripts developed by other users.

Pricing & Platform Access

MetaTrader 5 is a free platform. Its business model relies on brokers licensing the software to offer it to their clients. You can download the platform directly from the official website or through a supporting stockbroker. There are no subscription fees for the software itself, although broker-specific commissions and data fees may apply.

- Pros: Completely free software, highly customizable via MQL5, powerful strategy optimization tools.

- Cons: Primarily geared towards forex and CFDs (stock availability varies by broker), MQL5 presents a steep learning curve for non-programmers.

Website: https://www.metatrader5.com/

11. Amibroker

Amibroker is a comprehensive technical analysis program renowned for its speed, power, and deep customization capabilities. It is favored by quantitative analysts and experienced traders who need to test complex trading ideas across vast historical datasets with maximum efficiency. The platform’s core is its proprietary Amibroker Formula Language (AFL), a flexible scripting language that allows users to build anything from simple indicators to sophisticated, multi-asset portfolio-level trading systems from the ground up.

While its interface is more functional than flashy, Amibroker’s strength lies in its raw processing power. The backtesting engine is one of the fastest available, capable of running tests on decades of tick data in mere seconds. For traders who prioritize performance and limitless flexibility over a plug-and-play experience, Amibroker is a top-tier choice. It stands out as powerful backtesting software for stocks for those willing to invest time in learning its language to unlock its full potential.

Key Features & Use Case

- Amibroker Formula Language (AFL): A powerful, C-style scripting language for creating custom indicators, scanning rules, and complete trading systems.

- High-Speed Backtesting Engine: Optimized for rapid execution, allowing for quick iteration and testing of complex strategies on large datasets.

- Advanced Portfolio Backtesting: Enables testing strategies across a basket of securities, with features for managing rotational trading and shared position sizing.

- Optimization and Walk-Forward Testing: Includes tools for finding optimal parameters and validating strategy robustness against overfitting.

Pricing & Platform Access

Amibroker is offered as a desktop application with a one-time license fee, which is a departure from the common subscription model. The Standard Edition costs around $339, while the Professional Edition, which includes advanced portfolio backtesting, is priced at approximately $499. There is also a free trial version with some limitations, allowing users to evaluate the software before purchase.

- Pros: Extremely fast and powerful backtesting, highly customizable with AFL, supports multiple asset classes with a one-time purchase fee.

- Cons: Has a steep learning curve, especially for non-programmers; the user interface feels dated compared to modern cloud-based platforms.

Website: https://www.amibroker.com/

12. Portfolio123

Portfolio123 is a comprehensive platform designed for investors who want to build and backtest quantitative, rule-based strategies using a vast library of fundamental and technical data. Its primary strength is in portfolio-level backtesting, allowing users to simulate how a complete portfolio of stocks, not just a single security, would have performed over time based on specific screening and ranking rules. This makes it an ideal choice for long-term investors, asset managers, and anyone focused on systematic equity and ETF strategy development.

The platform successfully bridges the gap between simple screeners and complex coding environments. You can create sophisticated multi-factor models without writing a single line of code, using a clear, logical interface to define your investment universe, ranking systems, and rebalancing rules. For those looking for backtesting software for stocks that excels at fundamental analysis and portfolio construction, Portfolio123 offers an exceptionally powerful and accessible toolset.

Key Features & Use Case

- Rule-Based Screening & Ranking: Build complex strategies using over 470 fundamental factors and technical indicators to screen, rank, and select stocks.

- Portfolio-Level Backtesting: Test entire portfolio strategies, including rebalancing frequency, position sizing, and hedging, to get a realistic view of historical performance.

- Extensive Datasets: Access to decades of high-quality historical data, including point-in-time financial statements, estimates, and economic data.

- Strategy Optimization: Tools to refine your models and test for robustness, helping to avoid overfitting your strategy to historical data.

Pricing & Platform Access

Portfolio123 offers a tiered subscription model. A free plan is available with limited backtesting capabilities, making it great for initial exploration. Paid plans start at around $25 per month and scale up significantly for advanced features, more backtests, and access to premium data sets required by serious quants and professional investors.

- Pros: Excellent for fundamental and quantitative equity backtesting, user-friendly for rule-based systems, offers extensive and high-quality datasets.

- Cons: Primarily limited to stocks and ETFs; the most powerful features are locked behind higher-priced subscription tiers.

Website: https://www.portfolio123.com/

Backtesting Software Feature Comparison

| Platform | Core Features & Tools | User Experience & Quality ★★★★☆ | Value & Pricing 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| 🏆 ChartsWatcher | Customizable dashboards, real-time alerts, backtesting | Intuitive, highly customizable | Free plan + Pro $74.99/mo annual | Pro traders, analysts, active investors | 8 window types, import/export, light/dark theme |

| TrendSpider | AI pattern recognition, multi-timeframe analysis | Beginner-friendly, updated features | Higher cost subscription | Momentum/growth stock traders | AI-driven automation, no coding required |

| TradingView | Pine Script coding, social community, global data | Intuitive, large community | Freemium with paid premium | Coder traders, all levels | Large active user base, social trading ideas |

| Trade Ideas | AI trade recommendations, simulated trading | Intuitive, no coding needed | Higher subscription cost | Traders seeking AI insights | AI-powered insights, broker integration |

| FinViz | Stock screener, heat maps, portfolio tracking | User-friendly, affordable | Low-cost plans | U.S. market stock screeners | Extensive screener criteria, heat maps |

| Backtest Zone | Multi-asset backtesting, no coding required | Simple, easy for beginners | Completely free | Beginners, multi-asset traders | Free platform, no coding needed |

| QuantConnect | Python/C# coding, multi-asset, cloud-based | Dev-focused, collaborative | Paid tiers for advanced features | Algo/quants, coders | Open-source LEAN engine, brokerage integration |

| TradeStation | EasyLanguage scripting, integrated broker | Robust but complex for beginners | Subscription may be high | Active traders, pros | Automated trading, strong brokerage support |

| MultiCharts | PowerLanguage, portfolio backtesting, automation | Highly customizable, flexible | Licensed software | Advanced technical traders | Portfolio-level backtesting, multi-feed support |

| MetaTrader 5 | MQL5 scripting, multi-asset, charting tools | Free but coding steep learning | Free | Forex/CFD traders, algo traders | Free platform, expert advisors (EAs) |

| Amibroker | AFL scripting, fast backtesting, optimization | Powerful but steep learning | Licensed | Quantitative/technical traders | Extremely customizable, efficient engine |

| Portfolio123 | Rule-based screening, portfolio testing | User-friendly | Subscription required | ETF/stock rule-based investors | Fundamental + technical data integration |

Turning Backtests into Actionable Trading Strategies

Throughout this comprehensive guide, we have explored a diverse landscape of the best backtesting software for stocks, each offering a unique set of capabilities tailored to different types of traders. From the visual, no-code automation of TrendSpider to the institutional-grade power of QuantConnect and the custom scripting flexibility of Amibroker, it is clear that there is no single "best" platform for everyone. The right tool is a deeply personal choice, intrinsically linked to your trading style, technical expertise, and strategic goals.

We've seen that platforms like TradingView and FinViz offer accessible entry points with robust charting and screening, while their backtesting features serve as a great introduction. On the other hand, power users and quantitative analysts will gravitate towards the programmatic environments of TradeStation, MultiCharts, or MetaTrader 5, where granular control and complex algorithmic design are paramount. Portfolio123 carves out its niche with a strong focus on fundamental data and portfolio-level backtesting, appealing to long-term investors.

Key Takeaways for Selecting Your Software

Choosing the right platform requires a clear-eyed assessment of your needs. Before committing, reflect on these critical takeaways from our analysis:

-

Coding vs. No-Code: Your technical proficiency is the most significant fork in the road. If you are not a programmer, platforms like TrendSpider or Trade Ideas, with their visual strategy builders and alert-based systems, are your most direct path to implementation. If you are comfortable with code (or willing to learn), Python-based platforms like QuantConnect or proprietary languages like EasyLanguage (TradeStation) unlock nearly limitless potential.

-

Data Quality and Depth: The adage "garbage in, garbage out" has never been more true. Ensure the platform provides high-quality, clean historical data that covers the markets and timeframes you trade. Consider if you need only end-of-day data, or if your high-frequency strategies demand tick-level data.

-

Strategy Complexity: Are you testing simple moving average crossovers, or are you building multi-factor models incorporating fundamental data, sentiment analysis, and machine learning? Your answer will quickly narrow the field from generalist platforms to specialized quantitative tools like QuantConnect or Portfolio123.

-

Ecosystem and Integration: A backtester doesn't exist in a vacuum. Consider how it integrates with your broker for live execution. Does it have a strong community for support and strategy sharing? Platforms like TradingView and QuantConnect excel here, offering vibrant ecosystems that can accelerate your learning and development.

From Theory to Practice: Implementing Your Chosen Tool

Once you have selected a tool, the real work begins. Successful implementation is not just about running a backtest; it is about building a rigorous and repeatable process.

First, start with a clear, testable hypothesis. For example, "I believe that stocks in the technology sector that cross above their 50-day moving average on above-average volume will outperform the S&P 500 over the next 20 trading days." This specificity is crucial for designing a meaningful test.

Second, be vigilant against biases. Overfitting is your greatest enemy. This occurs when you tailor a strategy so perfectly to historical data that it fails in live market conditions. To combat this, use out-of-sample data, walk-forward analysis, and Monte Carlo simulations, features available in more advanced platforms.

Finally, treat backtesting as an iterative discovery process, not a one-time validation. Your initial tests will likely reveal flaws. Use these "failures" as learning opportunities to refine your parameters, adjust your assumptions, and strengthen your underlying logic. The goal isn't to find a perfect backtest but to build a robust strategy that understands and accounts for risk. The best backtesting software for stocks facilitates this iterative refinement, empowering you to move from a rough idea to a statistically sound, actionable trading plan.

Ready to bridge the gap between insightful charting and automated, data-driven strategy validation? ChartsWatcher provides a powerful, no-code environment designed for modern traders who demand both sophisticated analysis and ease of use. You can visually build, backtest, and deploy your trading ideas without writing a single line of code, making it the perfect next step after identifying patterns on the charts. Explore how to turn your observations into automated strategies by visiting ChartsWatcher today.