12 Best Stock Scanners for Day Trading in 2025 (Reviewed)

In the fast-paced world of day trading, seconds matter. The difference between profit and loss often comes down to how quickly you can identify opportunities, analyze momentum, and execute trades. This is where a high-performance stock scanner becomes an indispensable tool, not just a luxury. A generic, delayed scanner won't cut it; you need a platform that delivers real-time data, highly customizable filters, and actionable alerts tailored to your specific strategy. The goal isn't just to find stocks that are moving, but to find the right stocks moving in the right way, at the right time.

This guide moves beyond surface-level marketing claims to provide an in-depth, practical analysis of the market's leading tools. We will dissect the best stock scanners for day trading, focusing on real-world use cases, honest limitations, and the specific features that empower traders to filter out the noise and zero in on high-potential setups.

Inside, you will find detailed reviews for platforms like ChartsWatcher, Trade Ideas, and Benzinga Pro, complete with screenshots and direct links. We'll explore powerful broker-integrated scanners from thinkorswim and Interactive Brokers, alongside specialized analytical tools like TrendSpider and TC2000. Whether you're a momentum trader chasing breakouts, a news-driven trader capitalizing on catalysts, or a technical analyst seeking specific patterns, this comprehensive review will help you select the scanner that aligns with your workflow and trading style. Our goal is to provide a clear, actionable comparison to help you find the platform that gives you the critical edge needed to succeed.

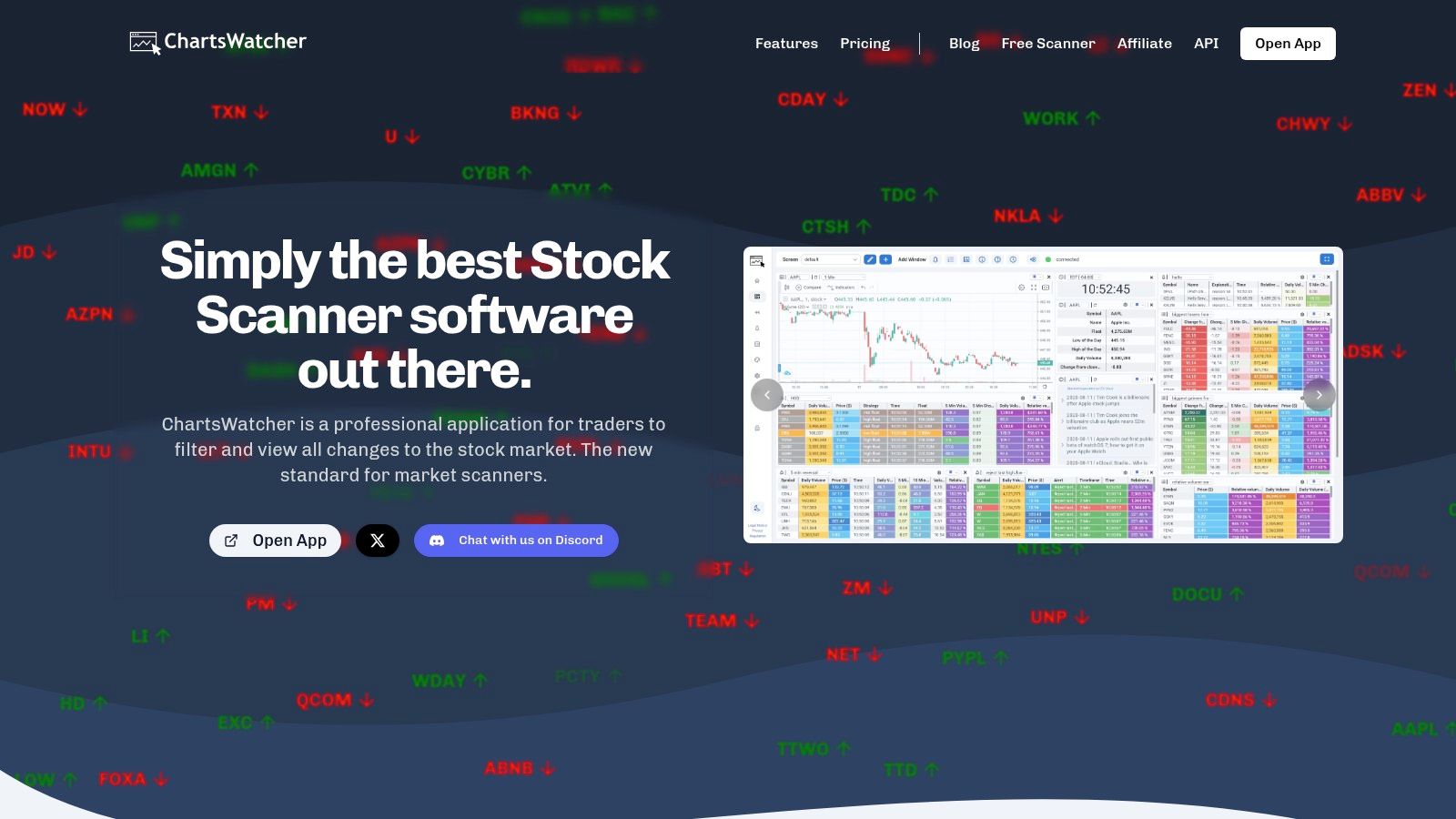

1. ChartsWatcher

Best For: All-in-One Real-Time Market Analysis & Strategy Backtesting

ChartsWatcher stands out as a powerful and exceptionally versatile platform, earning its top spot as one of the best stock scanners for day trading. Developed with the precision of German engineering, it delivers a comprehensive and highly customizable environment tailored for professional traders who require granular control over their market view. Its core strength lies in its modular dashboard, which allows users to build a command center of interconnected windows.

Unlike many scanners that offer rigid layouts, ChartsWatcher empowers you to arrange and synchronize alerts, toplists, charts, and newsfeeds. This unified view means clicking on an alert in one window can instantly update the chart and news in others, creating a seamless and efficient workflow for rapid decision-making.

Key Features & Analysis

- Multi-Window Customization: Users can configure up to eight distinct window types, including alerts, toplists, and live charts. This flexibility is ideal for traders who monitor multiple strategies or markets simultaneously.

- Advanced Alerting & Filtering: The platform goes beyond basic price alerts. It offers sophisticated filters for volume spikes, specific candlestick patterns (like Doji or Engulfing), and indicators such as VWAP support/resistance. This allows traders to build highly specific, actionable signals tailored to their unique strategies.

- Strategy Backtesting: A critical feature for serious traders, the backtesting tool lets you validate your scanning criteria against historical data. This helps refine strategies and build confidence before risking real capital, a function often missing in less comprehensive scanners.

- Integrated Workflow: The platform seamlessly combines scanning with watchlists, real-time newsfeeds, and charting. This integration eliminates the need to toggle between multiple applications, saving precious seconds during active trading sessions.

Practical Use Case

A momentum day trader could configure a dashboard with four key windows:

- A "Toplist" window filtering for stocks with the highest relative volume.

- An "Alerts" window set to trigger on 5-minute candlestick breakouts.

- A "Live Chart" window that automatically loads any stock selected from the other windows.

- A "News" window providing real-time updates for the selected ticker.

This setup provides a complete, synchronized view for identifying, analyzing, and acting on momentum plays without leaving the platform.

| Feature | Availability |

|---|---|

| Pricing | Free plan available; Pro plans offer full features |

| Backtesting | Available on paid subscription plans |

| Custom Dashboards | Yes, highly customizable and synchronized |

| Community & Support | Active Discord channel and extensive documentation |

Pros:

- Highly customizable multi-window dashboards offer a synchronized, unified view.

- Extensive alert options, including unique strategies like VWAP support/resistance.

- Robust backtesting capability to validate and refine trading strategies.

- Flexible pricing, including a free tier, makes it accessible to traders at all levels.

Cons:

- Full backtesting and configuration import/export require a paid subscription.

- The depth of customization may present a learning curve for new users.

Website: https://chartswatcher.com

2. Trade Ideas

Trade Ideas is a powerhouse among real-time stock scanners, specifically engineered for the high-speed demands of day trading. Its core strength lies in its server-side execution, which processes millions of data points to deliver alerts with minimal latency. This makes it one of the best stock scanners for day trading when speed is critical. Traders can leverage over 300 alerts and filters to build highly customized scans for strategies like momentum breakouts, gap plays, and reversal patterns.

The platform’s standout feature is its proprietary artificial intelligence, "Holly," which runs millions of simulations overnight to identify strategies with the highest probability of success for the upcoming session. This AI-driven insight provides actionable, statistically-backed trade ideas directly to the user.

Key Features and User Experience

While the interface has a significant learning curve and a Windows-first design, its configurability is unmatched. The platform’s backtesting tool, "The Money Machine," allows traders to validate their custom strategies against historical data without writing a single line of code.

- Pros: Among the fastest and most configurable real-time scanners available. Strong AI-driven idea generation for intraday momentum.

- Cons: Windows-first user experience. A steep learning curve for new users. Full AI and backtesting features are only available in premium plans.

- Pricing: A Standard plan is available, but the full feature set, including the AI Holly and backtesting, requires the Premium subscription.

Direct Link: Trade Ideas

3. Benzinga Pro

Benzinga Pro is a news-centric trading platform where information speed is the primary advantage. It combines a real-time stock scanner with an institutional-grade newsfeed, making it one of the best stock scanners for day trading based on catalysts. Traders use it to instantly react to market-moving headlines, earnings reports, and economic data, giving them an edge in momentum and event-driven strategies. Its core strength is translating news into actionable trade ideas before the information becomes widely known.

The platform’s standout feature is its live audio squawk, where a team of reporters announces breaking news and analysis in real time. This allows traders to receive critical updates without taking their eyes off their charts. Combined with a highly filterable newsfeed and signal alerts for price spikes or block trades, Benzinga Pro creates a comprehensive environment for information-driven trading.

Key Features and User Experience

The user interface is clean and modern, integrating multiple tools like scanners, newsfeeds, and watchlists into a single, customizable workspace. The scanner includes helpful presets for common strategies like session highs or unusual volume, which is great for traders who want to get started quickly. While the platform is powerful, its most valuable features, including the real-time scanner and audio squawk, are reserved for its premium subscription tiers.

- Pros: Unmatched speed for catalyst-driven news and alerts. Audio squawk provides hands-free market updates. Simple scanner presets are ideal for newer traders.

- Cons: The most critical day trading features are locked behind the highest-priced plan. Less focus on complex technical screening compared to dedicated scanners.

- Pricing: Several plans are available, but the Essential plan or higher is required for the full suite of real-time features, including the advanced scanner and audio squawk.

Direct Link: Benzinga Pro

4. Scanz

Scanz establishes itself as a powerful, dedicated scanning platform, particularly effective for day traders who specialize in momentum strategies and low-priced securities. Its all-in-one design integrates real-time scanning, news feeds, and Level 2 data into a single, cohesive interface. This makes it one of the best stock scanners for day trading highly volatile penny stocks and microcaps, which often demand rapid analysis of multiple data types simultaneously. Traders can access pre-built scans or create unlimited custom filters to pinpoint opportunities during pre-market, regular, and after-hours sessions.

The platform’s strength lies in its specialized tools like the Breakout Scanner, which continuously searches for stocks hitting new highs or lows and crossing key moving averages. This is complemented by a real-time news scanner that pulls from major wire services and SEC filings, providing crucial context for price movements.

Key Features and User Experience

Scanz offers a robust user experience within its Windows-based desktop application, presenting a vast amount of data in a well-organized layout. The inclusion of full Level 1 and Level 2 quote data, even for OTC markets, is a significant advantage for traders who need to analyze market depth and order flow to make informed decisions.

- Pros: Excellent for scanning penny stocks and OTC markets. Comprehensive all-in-one package with news, Level 2, and advanced scanning.

- Cons: The monthly price is higher than some entry-level alternatives. The platform is primarily a Windows desktop application.

- Pricing: Scanz offers a single, all-inclusive pricing plan that provides access to all its features, including real-time data for NASDAQ, NYSE, and OTC Markets.

Direct Link: Scanz

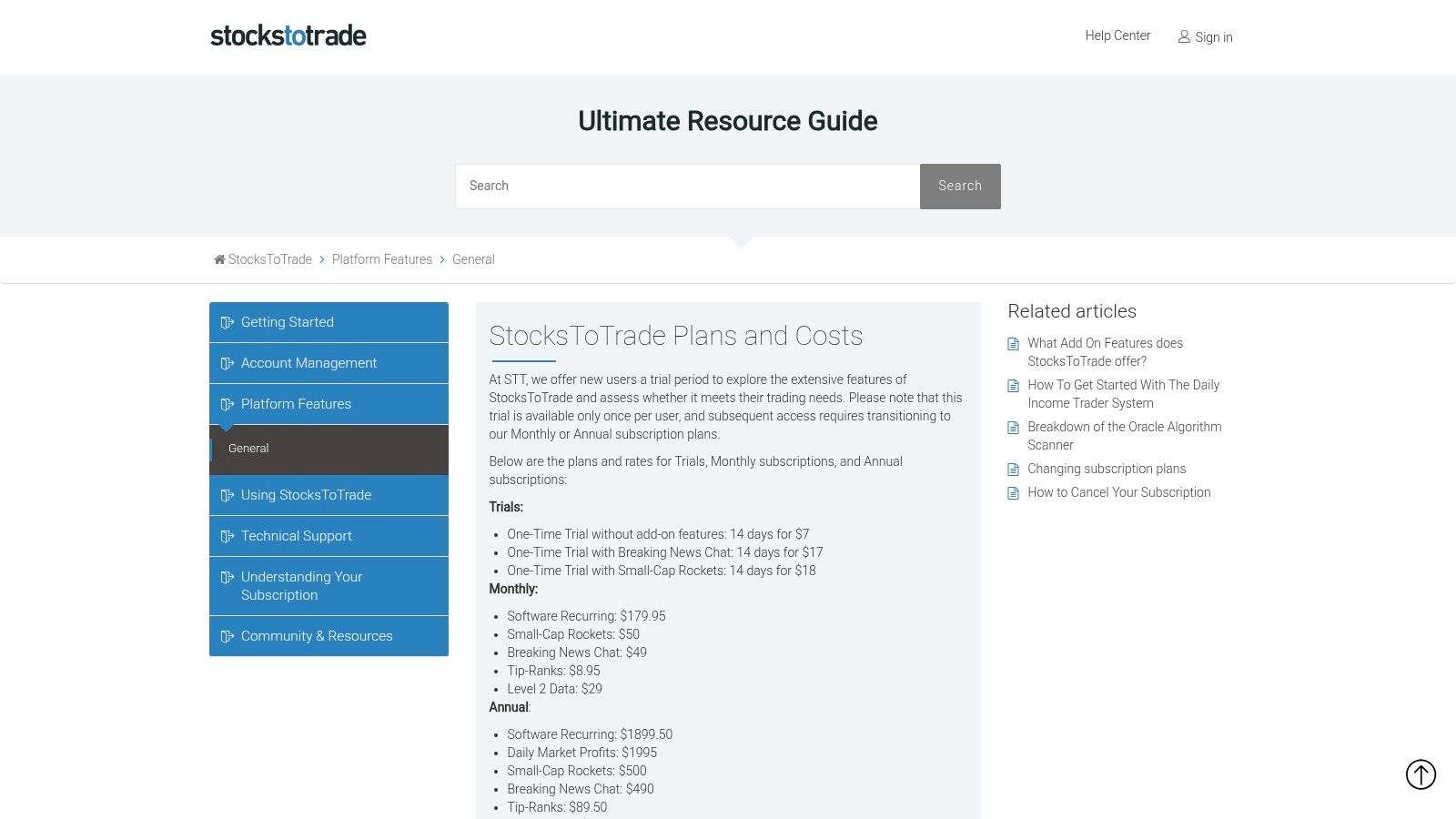

5. StocksToTrade

StocksToTrade is an all-in-one day trading platform that excels in the niche of small-cap momentum stocks. It combines powerful scanning capabilities with integrated news and charting, aiming to be a singular hub for traders. Its curated, pre-built scans are specifically designed to find volatile stocks, making it one of the best stock scanners for day trading for those who want to reduce research time and focus on execution. The platform is built with the small-cap day trader's workflow in mind, from discovery to analysis.

What sets StocksToTrade apart is its emphasis on actionable intelligence. The optional Breaking News Chat add-on, staffed by professional analysts, delivers alerts on market-moving catalysts in real-time. This feature, combined with integrated broker connections, allows traders to act on information without ever leaving the platform, streamlining the entire trading process. For new traders, this curated environment can significantly simplify the complexities of market analysis.

Key Features and User Experience

The interface is clean and user-friendly, integrating charts, scanners, and news into a single, cohesive layout. While the core platform is powerful, its real strength is unlocked through its add-ons like Level 2 data and the news chat service. For those interested in mastering the platform, learning about efficient scanning for stocks can enhance its effectiveness.

- Pros: Purpose-built for small-cap momentum traders. Integrated news and optional professional alerts save significant research time.

- Cons: Becomes expensive when adding essential features like the Breaking News Chat and Level 2 data. More focused on a specific trading style, which may not suit everyone.

- Pricing: A base StocksToTrade plan is available, with premium features offered as monthly add-ons, allowing for some customization based on budget and need.

Direct Link: StocksToTrade

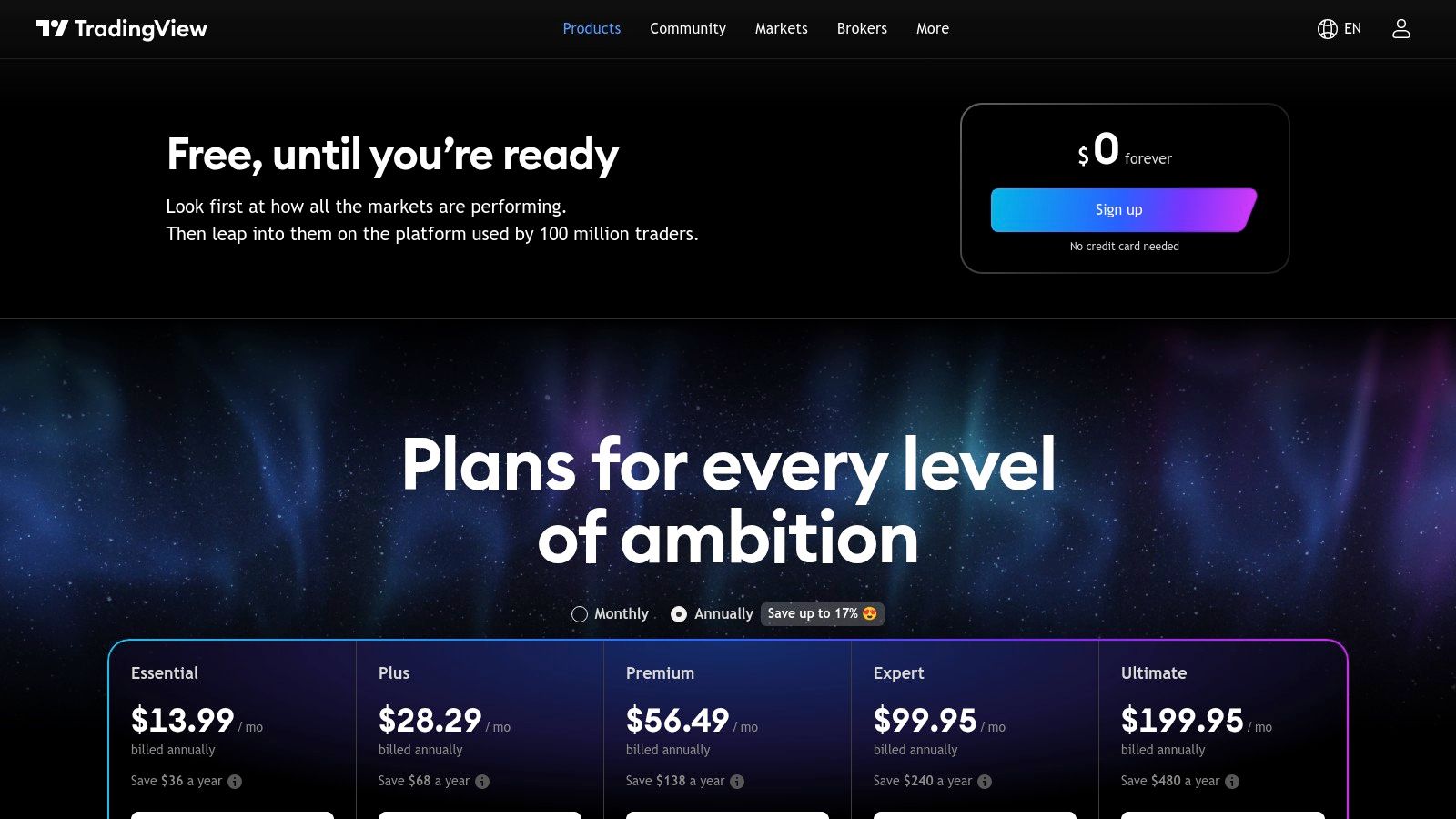

6. TradingView

TradingView has become a dominant force in the financial markets, not just for its world-class charting but also for its versatile and user-friendly screening tools. It's a cloud-based platform that offers real-time scanning for stocks, forex, and crypto, making it accessible across any device with a browser or its dedicated desktop app. For day traders who value a seamless cross-device experience and powerful visual analysis, TradingView is one of the best stock scanners for day trading available. Its strength lies in its intuitive interface and an enormous library of community-built indicators.

The platform’s screeners include over 100 descriptive and technical fields, allowing traders to filter for specific setups like unusual volume, new 52-week highs, or overbought/oversold conditions. What truly sets it apart is its Pine Script language, which empowers users to create, share, and use custom indicators and scanning criteria, fostering a vibrant community of innovation.

Key Features and User Experience

The user experience is exceptionally smooth, with powerful multi-chart layouts and customizable alerts that sync instantly across devices. While the base platform is robust, achieving true real-time U.S. stock data from NYSE or NASDAQ often requires small monthly data add-on fees. The desktop app enhances the experience with multi-monitor support, a key feature for serious traders.

- Pros: Excellent charts and a smooth, intuitive cross-device performance. A huge community for sharing indicators and strategies via Pine Script.

- Cons: Real-time U.S. exchange data often requires low-cost add-ons. The number of alerts and advanced features are limited in lower-tier plans.

- Pricing: A functional free version is available, with paid plans (Pro, Pro+, and Premium) unlocking more indicators per chart, additional alerts, and faster data.

Direct Link: TradingView

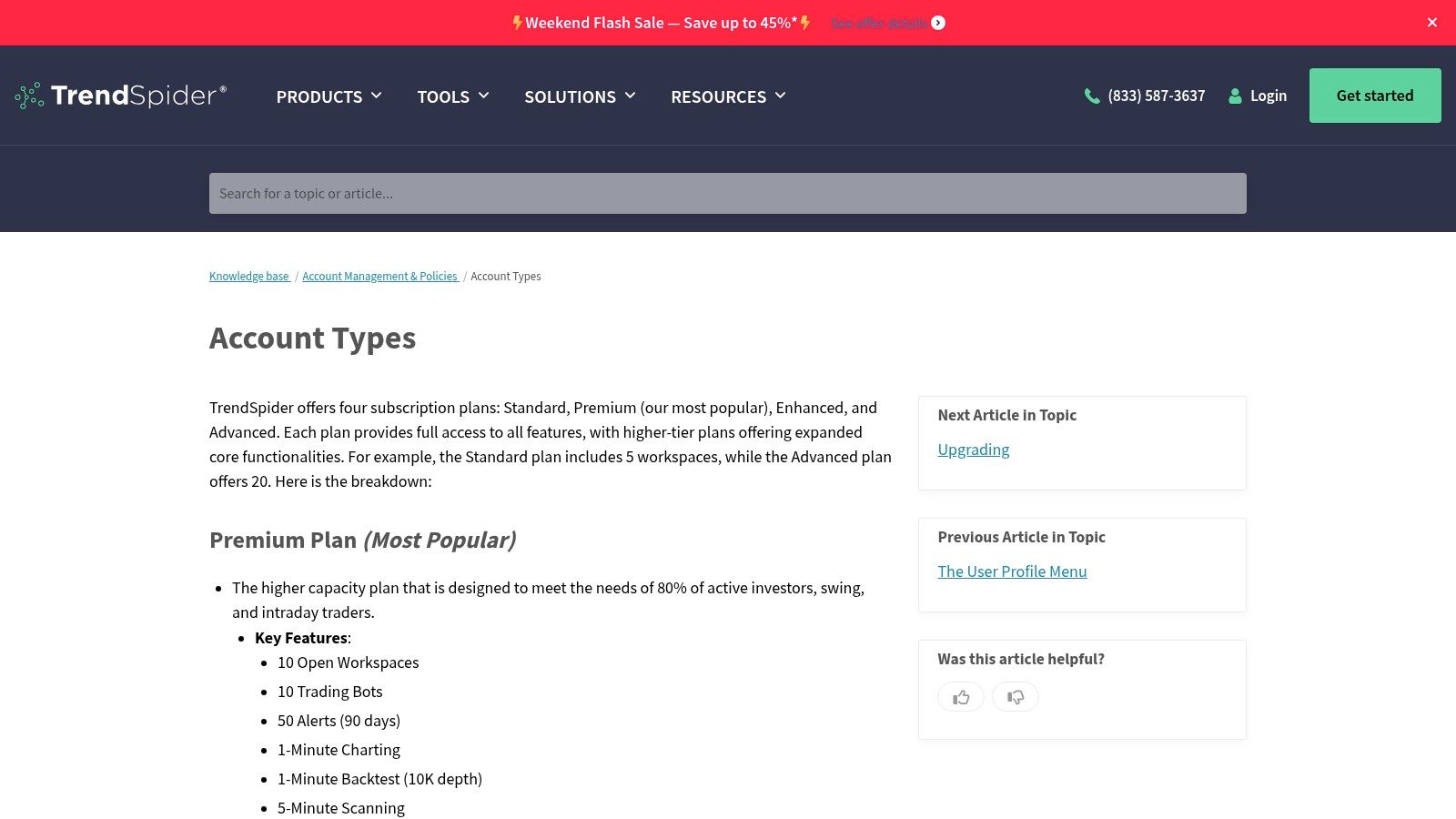

7. TrendSpider

TrendSpider is an AI-assisted technical analysis platform that automates much of the manual work involved in charting and scanning. It excels at identifying complex patterns and trendlines automatically, making it one of the best stock scanners for day trading for those who rely heavily on technical setups. The platform offers powerful scanning capabilities down to a 1-minute interval, allowing traders to find opportunities based on specific chart patterns, indicator conditions, and multi-timeframe analysis.

Its standout feature is the automation of sophisticated technical analysis tools, such as automated trendline detection and Anchored VWAP, which saves significant time. TrendSpider also integrates its scanner with a strategy tester and dynamic alerts, creating a cohesive ecosystem where traders can find, test, and execute on ideas without leaving the platform.

Key Features and User Experience

The user interface is modern and chart-centric, making it intuitive for traders familiar with technical analysis. The system's multi-factor alerts are highly customizable, allowing for notifications based on a combination of price action, indicators, and trendline touches. The built-in backtesting engine enables quick validation of scanning criteria against historical data.

- Pros: Automation significantly reduces the manual workload of technical analysis. It offers a great blend of scanning, backtesting, and alerting features in one package.

- Cons: Pricing tiers and included features vary; users need to check their plan for specific limits. Some advanced intraday scanning capabilities may require higher-tier plans.

- Pricing: TrendSpider offers several subscription tiers, with more advanced features like 1-minute scanning, backtesting, and automation reserved for premium plans.

Direct Link: TrendSpider

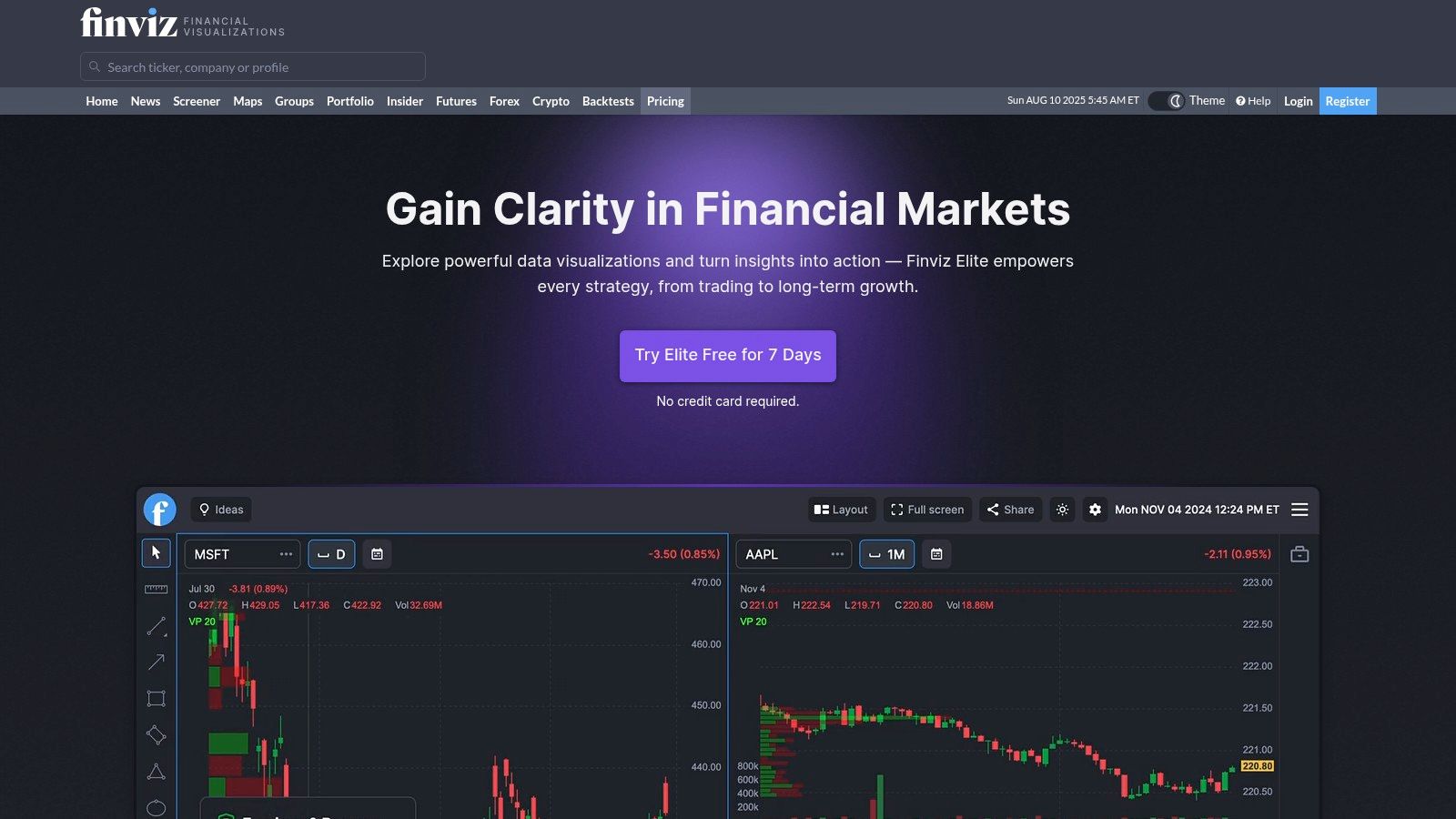

8. FINVIZ Elite

FINVIZ is widely known for its powerful, free, web-based stock screener, but its Elite subscription elevates it into a contender for the best stock scanners for day trading. The Elite plan unlocks crucial features like real-time data, intraday charts, and advanced alerts, transforming the platform from a research tool into an actionable trading instrument. Its primary strength is delivering a wealth of fundamental and technical data in a highly visual, easy-to-digest format without the need for complex software installation.

The platform excels at providing a top-down market overview through its iconic heat maps, which allow traders to instantly spot sector strength and weakness. With the Elite upgrade, these visuals update in real time, offering a dynamic view of market sentiment that is invaluable for identifying where the intraday action is happening.

Key Features and User Experience

FINVIZ Elite is celebrated for its incredibly intuitive and fast browser-based interface. Setting up complex scans using dozens of filters takes just a few clicks, and the results are displayed instantly. The Elite plan adds backtesting capabilities for technical strategies, as well as email and push alerts for price movements, news, and even insider trading activity. While it may lack the tick-by-tick depth of dedicated desktop applications, its efficiency and cost-effectiveness make it a superb choice.

- Pros: Extremely fast and user-friendly browser-based interface. Cost-effective access to real-time data, alerts, and intraday charts.

- Cons: Less tick-by-tick data depth compared to high-end desktop scanners. Backtesting tools are less sophisticated than specialized platforms.

- Pricing: Requires the FINVIZ Elite subscription to access real-time scanning, intraday charts, and advanced features.

Direct Link: FINVIZ Elite

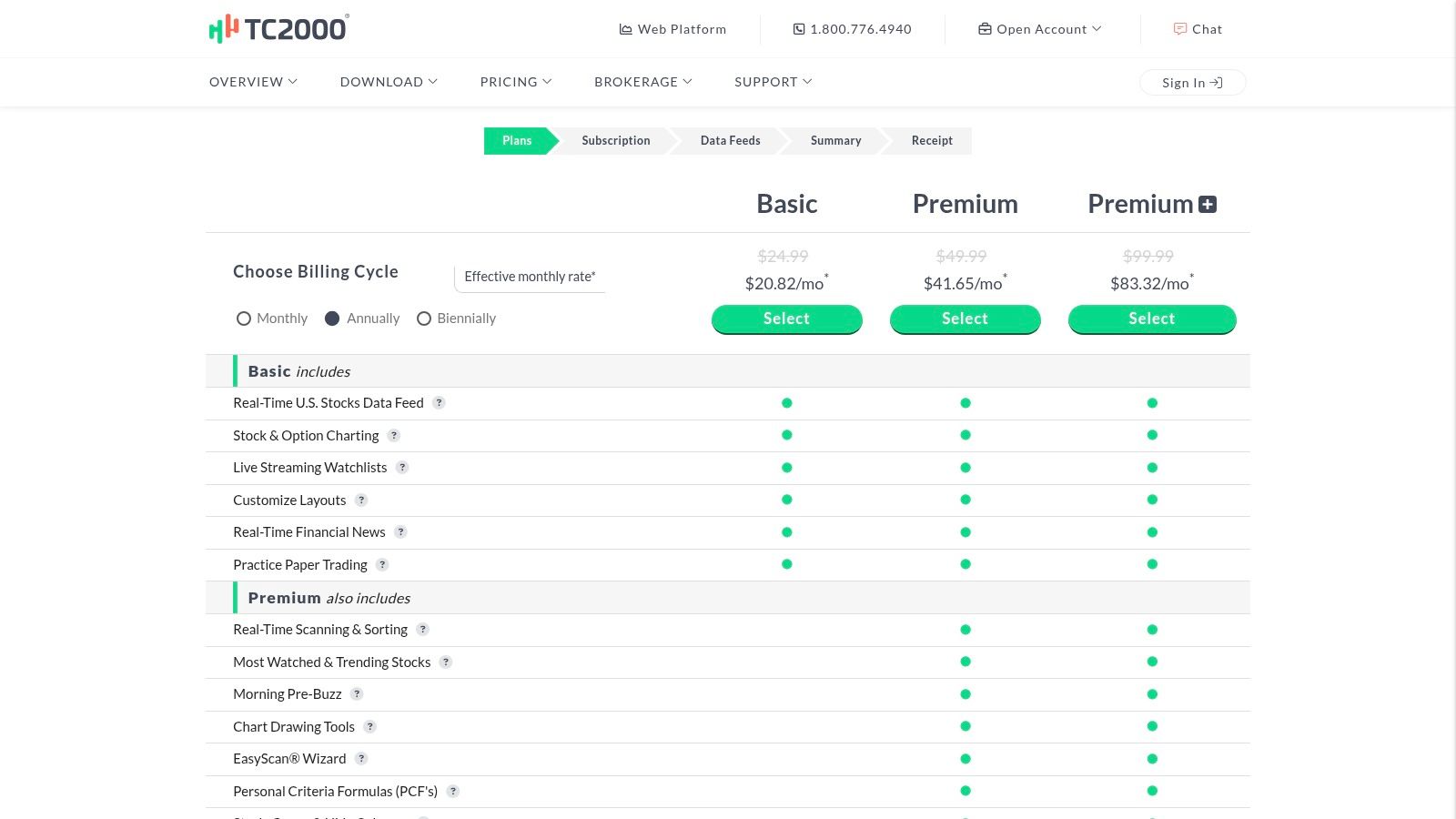

9. TC2000

TC2000 has long been a favorite among traders for its powerful combination of elite charting tools and integrated real-time scanning. Its EasyScan feature is particularly noteworthy, allowing users to sort through thousands of stocks in moments based on custom conditions and formulas. This seamless integration between charting and scanning makes it one of the best stock scanners for day trading, especially for traders who rely on visual analysis to find and confirm opportunities.

The platform excels at providing a smooth, fast workflow that is essential for active day trading. You can build complex scans using fundamental and technical data, apply them to watchlists, and immediately see the results plotted on a chart. Its formula language is powerful yet intuitive, giving traders precise control over their search criteria. For a deeper look into its capabilities, you can explore detailed guides on how to find winning trades with a stock screener.

Key Features and User Experience

The user interface is clean and highly responsive, whether you are using the desktop application or the web platform. Its speed is a major advantage, as scans and chart updates happen almost instantaneously. The platform also offers integrated paper trading and brokerage services, creating a complete ecosystem for analysis and execution.

- Pros: Exceptionally fast scanning with highly customizable formulas. Excellent, smooth charting workflow ideal for active traders.

- Cons: Real-time scanning and key features require a premium subscription. Full market coverage may require additional data add-ons.

- Pricing: TC2000 offers tiered pricing (Silver, Gold, Platinum). Real-time scanning is included starting with the Gold plan, with optional data feeds for news and additional markets.

Direct Link: TC2000

10. thinkorswim by Charles Schwab

Acquired by Charles Schwab, thinkorswim is a professional-grade trading platform that integrates a powerful, free scanner directly into its ecosystem. Its "Stock Hacker" tool allows traders to scan the entire market in real-time using a vast library of fundamental and technical filters. This makes it one of the best stock scanners for day trading for those seeking an all-in-one solution without a separate subscription fee, as it is included for Schwab clients.

The platform stands out by bundling its scanner with an institutional-level suite of tools, including advanced charting with proprietary indicators like the Sizzle Index and sophisticated options analytics. For those hesitant to commit, thinkorswim offers a 30-day Guest Pass, providing full access to its features, including the paperMoney simulated trading environment, without needing to open or fund an account first.

Key Features and User Experience

While thinkorswim's interface is complex and can be overwhelming for beginners, its depth is a significant asset for experienced traders. The paperMoney feature is a standout, offering a highly realistic environment to test scanning strategies and execution before risking real capital. The ability to build intricate, multi-conditional scans and save them for instant recall is a core benefit for systematic day traders.

- Pros: Powerful scanner included at no extra platform cost for Schwab clients. Comprehensive paper trading and extensive educational resources.

- Cons: Requires a Charles Schwab account for ongoing use beyond the Guest Pass. The platform's complexity may present a steep learning curve for new users.

- Pricing: The platform and its scanner are free for Charles Schwab account holders. A 30-day Guest Pass is available for a no-obligation trial.

Direct Link: thinkorswim by Charles Schwab

11. Interactive Brokers (IBKR) Market Scanner

For traders already embedded in the Interactive Brokers ecosystem, the built-in Market Scanner is a powerful and cost-effective tool. Integrated directly into the Trader Workstation (TWS) platform, it eliminates the need for a separate subscription by providing robust scanning capabilities across stocks, options, futures, and bonds. This direct integration makes it one of the best stock scanners for day trading if you prioritize seamless scan-to-trade execution without leaving your brokerage interface.

The scanner offers a wide array of predefined scans, such as "Top Percent Gainers" and "After-Hours Most Active," alongside extensive customization options. Traders can filter by fundamentals, technical indicators, and price-volume data, then immediately place trades based on the scan results, creating a highly efficient workflow.

Key Features and User Experience

While the TWS platform is known for its professional-grade tools, this also means it can be complex for beginners. However, for those willing to navigate the learning curve, the scanner's depth is a significant advantage. The ability to scan global markets and multiple asset classes from a single interface is a standout feature that few competitors can match.

- Pros: Included at no extra cost for IBKR clients. Extensive instrument coverage across global markets and asset classes. Direct scan-to-trade integration for maximum efficiency.

- Cons: Can be complex to set up due to the sheer number of options. While the scanner itself is free, market data fees and commissions still apply.

- Pricing: The scanner is free with an Interactive Brokers account. Costs are associated with market data subscriptions and standard trading commissions.

Direct Link: Interactive Brokers (IBKR) Market Scanner

12. TradeStation RadarScreen

TradeStation RadarScreen offers a professional-grade, real-time opportunity scanner deeply integrated within the acclaimed TradeStation Desktop platform. Rather than being a standalone tool, it functions as a dynamic watchlist on steroids, allowing traders to monitor and rank hundreds of symbols in real time based on over 180 technical indicators. This tight integration makes it one of the best stock scanners for day trading if you are already within the TradeStation ecosystem, as it links directly to charts and order entry tools for seamless execution.

The platform’s core strength is its unparalleled customization through TradeStation’s proprietary scripting language, EasyLanguage. Traders can move beyond built-in studies to design, test, and implement their own unique scanning criteria, a feature that sets it apart for those with specific, complex strategies.

Key Features and User Experience

RadarScreen is built for technical traders who value speed and customizability. The interface is data-dense and links dynamically with other platform windows; clicking a symbol in RadarScreen instantly updates your charts and order entry matrix. This creates an efficient workflow for quickly analyzing and acting on alerts.

- Pros: Powerful, flexible scanning driven by technical indicators. Unmatched customization with EasyLanguage scripting. Tight integration with TradeStation’s professional-grade charting and order execution tools.

- Cons: Primarily accessible within the desktop platform, which requires installation and setup. To unlock its full value without data fees, users typically need to maintain an active and funded TradeStation brokerage account.

- Pricing: RadarScreen is included with the TradeStation Desktop platform. Platform and data fees may be waived by meeting certain trading activity or account balance minimums through a TradeStation brokerage account.

Direct Link: TradeStation RadarScreen

Top 12 Day Trading Stock Scanners Comparison

| Software | Core Features / Customization ✨ | User Experience / Quality ★★★★★ | Value Proposition 💰 | Target Audience 👥 | Unique Selling Points 🏆✨ | Price Range 💰 |

|---|---|---|---|---|---|---|

| 🏆 ChartsWatcher | Multi-window dashboards, synced alerts, backtesting | Intuitive, light/dark themes ★★★★☆ | Free to Pro plans, flexible & scalable | Pro traders, analysts, educators | Highly customizable, German-engineered, backtesting | Free - Pro subscription |

| Trade Ideas | 300+ alerts, AI strategies, brokerage integration | Fast, configurable ★★★★☆ | Premium plans for full AI/backtests | Active/day traders | AI trade ideas (Holly), Money Machine backtester | Mid to high range |

| Benzinga Pro | Scanner + newsfeeds, squawk, preset filters | Easy presets, good for catalysts ★★★☆☆ | Higher-tier plans unlock best features | Momentum day traders | Audio squawk, catalyst signals | Mid range |

| Scanz | Unlimited scans, Level 2 quotes, pre/after-hours scanning | Comprehensive, strong for microcaps ★★★★☆ | Higher monthly price | Penny stock & momentum traders | OTC & Level 2 data, premarket scans | Mid to high range |

| StocksToTrade | Momentum scans, breaking news chat, broker & mobile app | Beginner-friendly scans ★★★☆☆ | Core + add-ons can be costly | Small-cap day traders | Breaking News Chat, integrated news | Mid to high range |

| TradingView | Multi-asset screeners, Pine Script, multi-chart layouts | Excellent charts, cross-device ★★★★☆ | Low-cost base; add-ons for real-time data | Retail traders, crypto & forex | Huge indicator community, Pine Script language | Low to mid range |

| TrendSpider | AI pattern detection, anchored VWAP, 1-min scanning | Automation reduces workload ★★★☆☆ | Varies by tier; higher costs for full access | Technical analysts & active traders | AI-driven automation, webhook bots | Mid to high range |

| FINVIZ Elite | Real-time filters, intraday charts, heat maps | Fast, easy browser use ★★★☆☆ | Cost-effective real-time data & alerts | Beginner to casual traders | Email/push alerts, API access | Low to mid range |

| TC2000 | EasyScan scanning, rich charting, paper trading | Very fast, smooth workflow ★★★★☆ | Add-ons may increase cost | Intraday & swing traders | Custom formulas, broker integration | Mid range |

| thinkorswim by Schwab | Stock Hacker scanner, advanced charts, paperMoney | Powerful but complex ★★★☆☆ | Free with Schwab account | Professional traders | 30-day Guest Pass, options analytics | Free with account |

| Interactive Brokers Scanner | Multi-asset scans, scan-to-trade, Excel export | Robust, but setup complex ★★★☆☆ | Included with IBKR platform | Professional traders & institutions | Extensive asset coverage, no extra fee | Included with IBKR platform |

| TradeStation RadarScreen | Indicator-based scanning, EasyLanguage scripting | Powerful but desktop focused ★★★★☆ | Full value with brokerage active | Technical & active traders | Deep indicator integration, order system link | Mid range |

Making Your Final Choice: Which Scanner Will Drive Your Trading Success?

Choosing from the vast landscape of the best stock scanners for day trading is a pivotal decision, one that can fundamentally shape your daily workflow and directly influence your profitability. As we've journeyed through this comprehensive list, from AI powerhouses to integrated broker platforms, one truth has become clear: the ultimate tool is not a one-size-fits-all solution. It's a deeply personal choice that must align with your specific trading strategy, experience level, and financial commitment.

The selection process is an exercise in self-assessment. Are you a momentum trader who thrives on pre-market gappers and high relative volume? Then a real-time, low-latency scanner like Scanz or the AI-driven Trade Ideas might be your most powerful ally. Or perhaps your edge comes from trading catalysts and breaking news? In that case, the indispensable audio squawk and real-time newsfeed of Benzinga Pro are non-negotiable.

Aligning the Tool with Your Trading Style

Your trading methodology is the primary filter for narrowing down your options. A tool that’s perfect for one trader could be entirely counterproductive for another.

- For the Technical Analyst: Traders who rely heavily on chart patterns, trendlines, and automated analysis will find immense value in platforms like TrendSpider, with its automated recognition features, or TradingView, with its unparalleled charting capabilities and community-driven scripts.

- For the Ecosystem-Loyal Trader: If you are already deeply integrated into a brokerage ecosystem, exploring their native tools first is a financially savvy move. The thinkorswim scanner by Charles Schwab and TradeStation's RadarScreen are incredibly robust and offer the significant advantage of seamless trade execution, eliminating precious seconds in order entry.

- For the Customization Expert: Advanced traders who require granular control to build and test highly specific, multi-conditional scans will gravitate towards TC2000 for its proprietary formula language or ChartsWatcher for its exceptional flexibility in creating and synchronizing multiple scanner windows into one cohesive dashboard.

Key Factors for Your Final Decision

Beyond pure features, several practical considerations should guide your final choice. Remember, the best stock scanner for day trading is the one that you can use efficiently and consistently under pressure.

- Data Speed and Accuracy: For day trading, real-time data is not a luxury; it's a necessity. Ensure the platform you choose provides true, tick-by-tick data and not delayed or batched quotes.

- Workflow Integration: How easily does the scanner fit into your existing setup? The ideal tool should feel like a natural extension of your analytical process, not a cumbersome extra step.

- The Learning Curve: Some platforms, while powerful, come with a steep learning curve. Be honest about the time you're willing to invest in mastering a new system. A slightly less complex tool that you can operate flawlessly is better than an advanced one you struggle to use.

- Budget vs. Value: Don't just look at the price tag; assess the value. A more expensive scanner that consistently provides you with high-probability setups can deliver a return on investment that far exceeds its monthly cost.

Your Actionable Next Steps

Theory will only take you so far. The final step is to put these tools to the test in a live market environment. We strongly recommend identifying your top two or three contenders from this list and taking full advantage of their free trials or demo accounts.

During your trial period, focus on building the exact scans that align with your strategy. Assess the speed, intuitiveness of the user interface, and the quality of the opportunities it uncovers. This hands-on experience is the only way to truly determine which scanner will become your trusted co-pilot in the fast-paced world of day trading. The right choice will not only save you time but will empower you to execute your strategy with greater precision and confidence, day in and day out.

Ready to build a truly customized and synchronized scanning dashboard? ChartsWatcher provides the ultimate flexibility for serious traders who need to monitor multiple, complex conditions simultaneously. Experience a new level of control and create the precise scanning environment your strategy demands by visiting ChartsWatcher to start your trial.