What Is Market Volatility A Complete Guide

Let's be direct: market volatility is just a fancy term for how much and how fast an asset's price bounces around. Think of it like the market's heartbeat. A rapid, jumpy pulse means high volatility. A slow, steady beat? That's low volatility. Getting a handle on this rhythm is your first step toward making smarter trades.

What Is Market Volatility In Simple Terms

Let's use an analogy. Picture the stock market as the ocean. Some days, it's glass-calm, with gentle, predictable waves. Other days, a storm hits, and you've got massive, chaotic swells crashing everywhere. Market volatility is simply a way to measure the size and frequency of those waves—the price swings.

High volatility is that stormy sea. It means prices are making huge moves, up or down, in a short amount of time. This kind of environment is packed with uncertainty and risk, but for traders who know how to ride the waves, it's also filled with opportunity. You might see a stock leap 5% one day only to plunge 4% the next.

On the flip side, low volatility is that calm ocean. Prices drift along within a narrow, predictable range, which usually signals stability and solid investor confidence. In this kind of market, a stock might barely budge, moving just 0.5% over an entire week.

High Volatility vs Low Volatility at a Glance

To really nail this down, it helps to see the two market states side-by-side. This quick comparison breaks down the core differences you'll experience in high and low volatility environments.

| Characteristic | High Volatility Environment | Low Volatility Environment |

|---|---|---|

| Price Swings | Large, rapid, and unpredictable price changes. | Small, gradual, and more predictable price changes. |

| Investor Sentiment | Dominated by fear, uncertainty, and speculation. | Characterized by confidence, stability, and optimism. |

| Risk Level | Higher potential for both gains and losses. | Lower immediate risk, with more stable asset values. |

| Trading Opportunity | Abundant for short-term traders; challenging for long-term investors. | Favorable for long-term investors; fewer opportunities for quick profits. |

Seeing them compared like this makes it clear just how different the trading landscape can be.

Ultimately, volatility isn't inherently "good" or "bad." It is simply a measure of market movement. For a day trader, volatility is the source of opportunity; for a long-term investor, it can be a source of anxiety.

Knowing what market volatility is gives you the groundwork for reading the market's mood. It’s not some abstract financial concept—it's a real-world gauge of risk, sentiment, and your potential for profit. Once you learn to spot the signs of a volatile market, you're in a much better position to adjust your strategy accordingly.

The Real Forces Behind Market Swings

Market volatility rarely just happens. It's almost always a reaction, a direct consequence of specific triggers that can flip investor sentiment from calm to chaotic in a heartbeat. If you can get a handle on these triggers, you're in a much better position to anticipate market swings instead of just being caught off guard by them.

Think of the market as an incredibly sensitive seismograph, one that registers every tremor from the global economic and political landscape. These tremors are the real forces that drive prices up and down. Sometimes, a single piece of news is all it takes to cause a massive shift, creating the very volatility traders are constantly watching.

While these drivers can be grouped into categories, they often bleed into one another, creating complex and powerful chain reactions. The most significant ones, however, usually fall into a few key areas that every savvy investor keeps a close eye on.

Economic Data and Central Bank Actions

Economic reports and the decisions of central banks are probably the most consistent drivers of market volatility. These announcements act like a regular health check on the economy, and any unexpected results can force the market to re-price assets almost instantly.

Some of the biggest market-movers include:

- Inflation Reports: Numbers from the Consumer Price Index (CPI) have a direct line to interest rate expectations. If inflation comes in hotter than expected, it can signal that rate hikes are coming, which often sends the stock market lower.

- Employment Data: Jobs reports, like the monthly Non-Farm Payrolls in the U.S., are a great barometer for economic strength. Strong job growth can supercharge investor confidence, whereas weak numbers can spark fears of a recession.

- Interest Rate Decisions: When a central bank like the Federal Reserve moves interest rates, it changes the cost of borrowing for everyone. This sends ripples across every single asset class. A surprise rate hike can easily trigger a sharp sell-off.

A perfect example of this was back in 2022. The Fed announced an aggressive string of rate hikes to fight off runaway inflation, and the markets responded with a long period of high volatility. Every announcement from the Fed was met with huge price swings as traders scrambled to adjust their outlook for the economy.

The market is a forward-looking machine. It doesn't just react to what's happening now; it reacts to what it thinks will happen next based on the latest data.

Geopolitical and Corporate Events

Beyond the scheduled economic reports, unexpected events can inject a sudden and severe dose of volatility into the markets. These are the black swans—the events that are often impossible to predict, which makes them especially disruptive.

Geopolitical instability, like a war breaking out or a major trade dispute, creates enormous uncertainty. That uncertainty sends investors running from riskier assets like stocks and into so-called safe havens. The shock of the Russian invasion of Ukraine in February 2022 is a stark example; global markets plunged while energy prices went through the roof almost overnight.

On a smaller scale, company-specific news can create isolated pockets of extreme volatility. A big-name tech company that misses its earnings forecast can see its stock plummet 20% or more in a single session. This doesn't just hurt that one company; it can drag down the entire sector, showing just how one event can have a cascading effect across the market.

How Do Traders Actually Measure Volatility?

Think of a pilot flying through a storm. They wouldn't just guess their altitude; they'd rely on precise instruments. For traders, navigating market turbulence is no different. We need reliable tools to measure the "bumpiness" of the market, helping us quantify risk and spot potential opportunities.

When it comes to measuring volatility, we essentially have two approaches. We can either look in the rearview mirror to see how wild the ride has been, or we can look ahead through the windshield to gauge what the market thinks is coming.

Looking Back: Historical Volatility

The most direct way to measure volatility is simply to look at what's already happened. This is called Historical Volatility (HV).

At its core, HV calculates how much an asset's price has deviated from its average over a set period. It’s a purely backward-looking metric. A high HV tells you the asset has been all over the place, experiencing big price swings. A low HV, on the other hand, points to a period of calm and stability. Traders use this to get a feel for an asset’s personality and set realistic expectations.

If you want to get into the nitty-gritty of the formulas, our guide on how to calculate volatility breaks it all down.

Looking Forward: Implied Volatility

While the past is a great teacher, markets are always trying to price in the future. That’s where Implied Volatility (IV) comes into play. Instead of looking at past price data, IV is derived from the current prices of options contracts.

In essence, Implied Volatility reflects the market's consensus guess on how volatile an asset is expected to be. It’s often called the "fear gauge" because it tends to shoot up when investors are nervous and rushing to buy options as insurance.

A rising IV is a clear signal that traders are bracing for bigger price moves on the horizon.

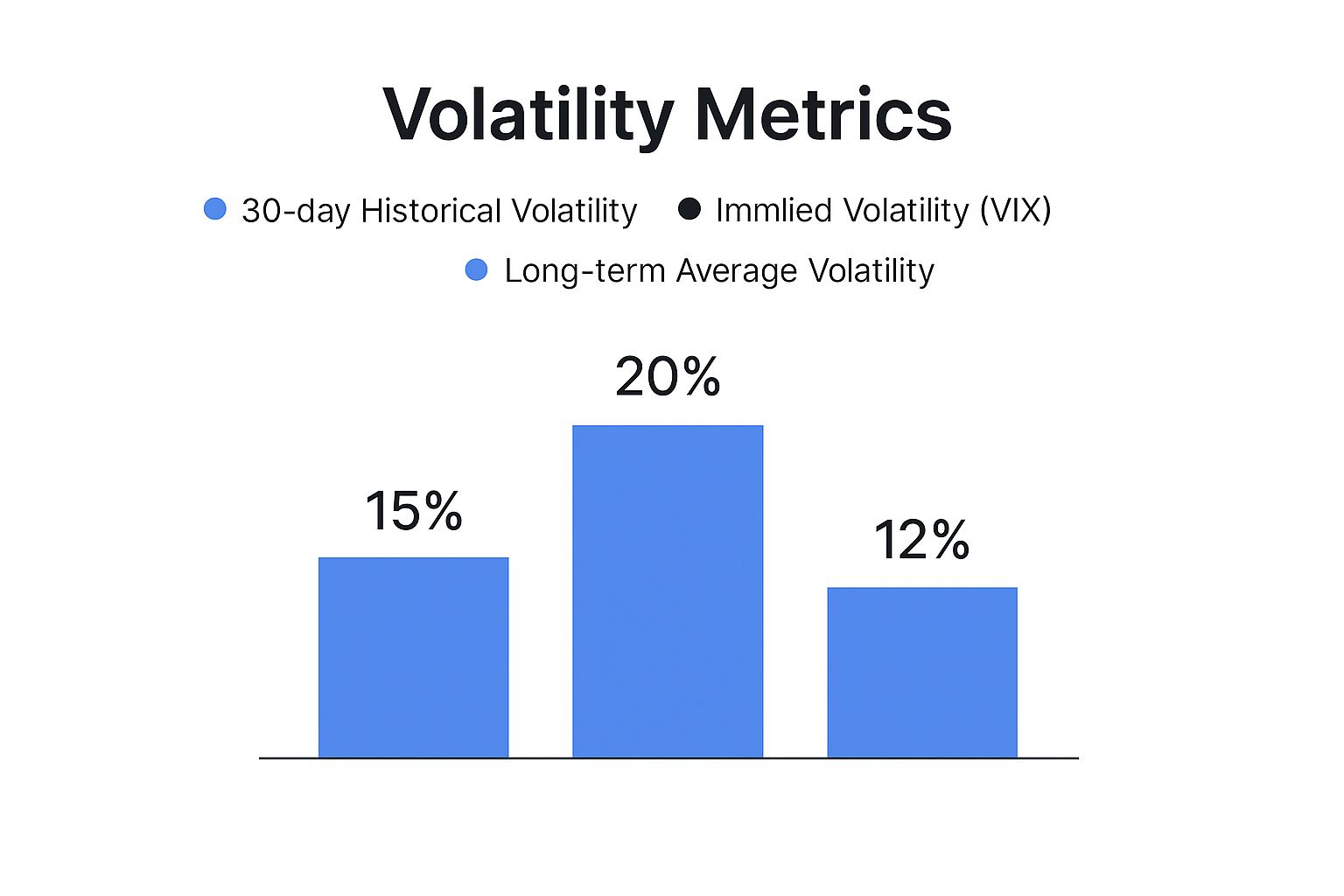

This handy chart gives you a visual on how these different volatility readings can stack up against each other.

As you can see, implied volatility often runs higher than recent historical volatility. That gap is basically the market pricing in a premium for future unknowns.

To get a clearer picture of these two key metrics, here's a simple breakdown of what they tell us.

Historical Volatility vs Implied Volatility

| Metric Type | What It Measures | Data Source | Primary Use Case |

|---|---|---|---|

| Historical Volatility | The actual price movement that has already occurred. | Past price data of an asset. | Understanding an asset's past behavior and risk profile. |

| Implied Volatility | The expected future price movement. | Current prices of options contracts. | Gauging future risk and market sentiment. |

So, while Historical Volatility gives you a report card on past performance, Implied Volatility offers a forecast based on the market's current mood.

The most famous example of implied volatility in action is the Cboe Volatility Index (VIX). Since 2003, the VIX has served as the go-to benchmark for the market's expectation of 30-day volatility in the S&P 500. During periods of extreme market stress, like the 2008 financial crisis, the VIX has been known to spike above 40. In contrast, during eerily calm periods, it can dip below 10, showing just how sensitive it is to investor sentiment.

Understanding The VIX: The Market's "Fear Gauge"

While historical volatility is great for looking in the rearview mirror, the real edge for a trader comes from understanding what the market expects to happen next. This is precisely where the Cboe Volatility Index, famously known as the VIX, comes into play. It's often called Wall Street's "fear gauge" for a good reason—it gives you a real-time pulse on expected market turbulence.

Unlike historical data, which looks back at past price swings, the VIX is a forward-looking forecast. It calculates the expected volatility of the S&P 500 Index over the next 30 days. How? It derives this from the real-time prices of S&P 500 options. This makes it an incredibly powerful and direct indicator of current investor sentiment.

Interpreting VIX Levels

So, what does the VIX number actually mean for you? Think of it as a simple barometer for market mood. While the underlying math is complex, interpreting the signals is pretty straightforward.

Here’s a general guide to what its value is telling you:

- VIX below 20: This usually points to a calm, low-anxiety market. Investors are feeling confident, and stocks tend to be stable or trending upwards.

- VIX between 20 and 30: Things are getting a bit tense. This range suggests a growing level of uncertainty and the potential for bigger price swings. Traders are starting to get cautious.

- VIX above 30: This is where you see real fear and uncertainty taking hold. These levels are common during sharp market sell-offs, financial crises, or major global events.

The VIX has a famously inverse relationship with the stock market. When the S&P 500 falls, the VIX almost always rises. This is why a spiking VIX is a classic sign of market panic.

History is filled with powerful examples. During the peak of the 2008 financial crisis, the VIX exploded to levels never seen before, closing above 80. We saw a similar, dramatic spike in March 2020 with the onset of the COVID-19 pandemic. These extreme readings captured the intense fear in the air as investors rushed to shield their portfolios from catastrophic losses.

The VIX in Action

While these moments of extreme volatility don't happen every day, they have a massive impact when they do. High-volatility periods have historically occurred about 10% of the time.

Consider the flash crash in early February 2018. In just one week, U.S. stock prices plummeted by roughly 6.5%. As the market reeled, the VIX shot up to 32, perfectly capturing the sudden panic and reinforcing its role as an indispensable measure of market stress. You can dig into more data on how volatility metrics react during these kinds of major market events.

Strategies for Navigating Volatile Markets

Knowing what makes markets swing is one thing. Knowing how to react is what really separates the pros from the crowd. When the market feels like a stormy sea, you can’t just hope for the best; you need a solid game plan. This isn't about predicting the future with perfect accuracy, but about preparing for whatever comes your way with a smart mix of defense and offense.

A turbulent market is a classic double-edged sword. If you’re caught off guard, it can lead to some painful losses. But for a trader who’s prepared, that same chaos can open up some incredible opportunities. The goal is to stop reacting to the market's whims and start proactively managing them.

Defensive Plays to Protect Your Capital

Before you even think about making a profit from volatility, your number one job is to manage risk. When uncertainty is high, protecting what you already have is everything.

Here are a few essential defensive moves every trader should have in their back pocket:

- Diversification: It's the oldest rule in the book for a reason: don't put all your eggs in one basket. Spreading your capital across different asset classes—like stocks, bonds, and commodities—can soften the impact if one sector suddenly takes a dive.

- Stop-Loss Orders: Think of a stop-loss as your automated safety net. It’s an order to sell a security once it hits a price you’ve already decided on, which keeps a small, manageable loss from spiraling into a devastating one.

- Holding Cash: Keeping some of your portfolio in cash is a power move. First, it acts as a stable buffer when markets are falling. Second, it gives you the “dry powder” to jump on great buying opportunities when everyone else is selling.

A volatile market is a test of discipline, not a test of courage. The traders who survive and thrive are those who stick to their risk management rules without letting emotion take over.

Offensive Moves to Seize Opportunities

Once your defenses are solid, you can start looking for ways to turn that market choppiness into an advantage. After all, sharp downturns often create situations where fantastic assets are put on the discount rack.

Consider these offensive tactics for your playbook:

- Buying the Dips: Big sell-offs can drag down the prices of fundamentally strong companies to really attractive levels. For anyone with a long-term mindset, these moments are often the perfect time to pick up quality assets for cheap.

- Using Options for Hedging: Options can be a fantastic form of portfolio insurance. For example, buying put options can help offset losses you might see in your stock holdings during a broad market decline. It's a way to protect your downside.

- Trading Volatility Directly: You can also trade volatility itself. Instruments like VIX-related ETFs are designed to track market fear and uncertainty, allowing you to profit directly when volatility spikes.

These are just a handful of ideas to get you started. For traders who want to dive deeper, you can explore more advanced volatility trading strategies to build out a more sophisticated toolkit.

By combining rock-solid defensive measures with calculated offensive moves, you can reframe market turbulence from something to be feared into a strategic opportunity.

Why Volatility Is a Big Deal, Even for Long-Term Investors

Think you can just "set it and forget it" and ignore the market's wild swings? Think again. Even if you're playing the long game, you can't afford to overlook what market volatility is doing to your portfolio. While day traders thrive on the chaos, seeing it as a money-making opportunity, for those of us building wealth over years, volatility introduces a subtle but powerful enemy.

This hidden force is called volatility drag. It's the punishing math that makes bouncing back from a big loss way harder than you'd expect. Grasping this concept shows you why protecting your cash during a downturn is every bit as important as racking up gains when the market is hot.

The Unfair Math of Gains and Losses

At the heart of volatility drag is a simple, lopsided reality. When your portfolio loses a certain percentage, you need an even bigger percentage gain just to get back to where you started. This isn't just a theory; it's a mathematical fact.

Let's break it down with a clear example:

- Your portfolio drops by 20%. Getting back to your original value requires a 25% gain.

- It falls by 33%? You'll need a 50% gain to recover.

- And a catastrophic 50% loss? You have to double your money—a 100% gain—just to break even.

The deeper the hole you dig, the steeper the climb out. That’s volatility drag in a nutshell. It’s a relentless headwind that makes large losses so destructive to your long-term compounding journey.

Once you truly understand this, your whole perspective on risk shifts. It becomes crystal clear that sidestepping a 30% loss can be far more powerful than chasing a 30% gain.

Stock price volatility is our best gauge of market risk, and history is filled with dramatic swings. Back in 2021, for example, the average 360-day stock market volatility in the U.S. hit 24.99, a number that captures just how much prices were jumping around due to economic shifts and world events. If you want to dig into the numbers, you can see how global events impact market stability on TradingEconomics.com. This data just reinforces a core lesson: learning to navigate the storms is fundamental to reaching your financial destination.

Common Questions About Market Volatility

If you've spent any time in the markets, you know that volatility is a constant topic of conversation. Let's tackle some of the most frequent questions traders have about it.

Is Market Volatility Good or Bad?

This is a classic "it depends" scenario, and it really comes down to your trading style. For a day trader who thrives on quick in-and-out moves, high volatility is the engine of opportunity. It creates the price swings they need to generate profits.

But for a long-term investor building a retirement portfolio, that same volatility can feel like a storm, creating stress and the potential for significant paper losses.

Volatility isn't inherently good or bad—it’s just a characteristic of the market. Whether it's a friend or a foe depends entirely on your strategy and time horizon.

Low volatility can be just as polarizing. A day trader might see it as a boring, frustrating market with no clear setups. That same quiet market, however, is often a welcome sight for someone focused on steady, long-term compounding.

What Is the Difference Between Volatility and Risk?

It's easy to use these two words interchangeably, but they mean very different things. Think of it this way: Volatility is a statistical measurement of price movement. It just tells you how much a stock’s price is bouncing around.

Risk, on the other hand, is about the potential for you to permanently lose your money.

A highly volatile stock isn't automatically a "risky" investment if its fundamental trend is strong and upward over the long run. The journey might be bumpy, but the destination could be fine. Conversely, a stock with very low volatility can be incredibly risky if the underlying company is slowly heading toward bankruptcy. The price might not swing wildly, but the potential for total loss is very real.

How Can I Easily Track Volatility?

Keeping an eye on volatility is crucial for making smart decisions, and thankfully, you don't have to do it manually. While indexes like the VIX give you a great bird's-eye view of the overall market mood, most traders need to zoom in on specific stocks.

This is where a good market scanning tool comes in. It’s the most practical way to monitor what's happening in real time.

Modern platforms are built to help you with this. They let you:

- Scan the entire market for high-volatility stocks right now, pinpointing where the action is.

- Set up custom alerts that notify you the moment a stock's volatility hits a level you care about.

- Overlay historical volatility on your charts, giving you instant context on whether the current movement is normal or an outlier.

Ready to stop guessing and start measuring market volatility with precision? ChartsWatcher provides the powerful, real-time scanning and charting tools you need to turn volatility into your strategic advantage. Start your free trial.