What Is Intraday Trading A Beginner's Guide

Think of the stock market like a massive, sprawling ocean. Most people are on large cargo ships or cruise liners, setting a course and holding it for weeks, months, or even years. They’re investors, playing the long game.

Then you have the day traders. They’re zipping around in high-speed powerboats, darting between the waves. Their goal isn’t to cross the ocean; it’s to win a series of short, intense sprints before the sun goes down. That, in a nutshell, is intraday trading.

Decoding Intraday Trading: What It Actually Means

Intraday trading is the simple, yet demanding, practice of buying and selling financial assets within the same trading day. All positions are opened and closed before the final market bell rings. No exceptions.

The entire game is about capitalizing on small, fleeting price movements. An intraday trader might buy a stock at 10:00 AM and sell it by 10:15 AM, just to capture a profit of a few cents per share. While that sounds tiny, when you multiply it by hundreds or thousands of shares over dozens of trades, those small wins can stack up into a significant daily profit.

This style of trading thrives on two key ingredients: volatility (how much a price swings) and liquidity (how easily you can get in and out of a trade). Volatility creates the profit opportunities, and liquidity ensures you can execute your trades instantly without getting stuck.

To quickly break down the fundamentals, here’s a simple look at what defines this approach.

Intraday Trading at a Glance

| Characteristic | Description |

|---|---|

| Time Horizon | All trades are opened and closed within a single trading day. |

| Primary Goal | Profit from short-term price fluctuations, not long-term growth. |

| Key Rule | Absolutely no overnight positions are held. |

| Relies On | High market volatility and asset liquidity. |

| Mindset | Tactical and disciplined; focused on technical analysis and speed. |

This table captures the essence of the intraday philosophy—it’s a disciplined, high-tempo engagement with the market, focused entirely on the here and now.

The Golden Rule: No Overnight Positions

The single, non-negotiable rule of intraday trading is closing out every position before the market shuts down for the day. This isn't just a preference; it's a core risk management principle.

By being "flat" (holding no positions) overnight, traders completely sidestep the risks of after-hours news, surprise earnings announcements, or global events that could cause a stock's price to "gap" dramatically up or down at the next morning's open. It’s a crucial layer of protection.

At its heart, intraday trading is a game of probability and speed. Success hinges on executing a well-defined strategy dozens or even hundreds of times, aiming for small, consistent gains that accumulate over time.

A Global Phenomenon

This high-speed approach isn't a niche strategy. Intraday trading is a massive part of the world’s biggest financial markets, from the New York Stock Exchange (NYSE) and Nasdaq in the U.S. to the London Stock Exchange (LSE) and the National Stock Exchange of India (NSE).

The explosion in its popularity comes down to technology. Powerful trading platforms and instant access to real-time market data have put the tools of the pros into the hands of retail traders everywhere. For a deeper dive into market data sources, resources like FirstRateData.com offer valuable insights.

Ultimately, getting into intraday trading means committing to a specialized discipline that demands:

- A Solid Strategy: A clear, repeatable plan for entering and exiting trades.

- Strict Risk Management: Hard rules to protect your capital from big losses.

- Emotional Discipline: The mental toughness to stick to your plan, win or lose.

Without this foundation, the fast-paced world of day trading can be unforgiving. But with it, you have a framework for navigating the market's daily ebb and flow.

How Intraday Trading Compares to Other Styles

To really get a handle on intraday trading, you have to see where it fits in the bigger picture. The market isn’t a one-size-fits-all arena; there are countless ways to play the game, each with its own speed, risk level, and required commitment. Putting intraday trading side-by-side with other popular styles makes its unique, high-octane nature crystal clear.

Think of trading styles like different kinds of races. Long-term investing is a multi-day endurance rally, slow and steady. Intraday trading is a series of intense, single-lap sprints. The strategy, the tools, and the mindset for each are worlds apart.

The Spectrum of Trading Timeframes

The biggest difference between trading styles comes down to one thing: the holding period. How long you hold an asset changes everything, from the strategies you use to the mental toughness you need.

An intraday trader lives in a world of minutes and hours, trying to catch profits from the market's daily chatter and noise. Other traders, by contrast, are trying to ignore that same noise. They’re focused on bigger, more meaningful moves that take days, weeks, or even months to play out.

The shorter your trading timeframe, the more critical speed, discipline, and technical precision become. Intraday trading operates at the fastest end of this spectrum, where decisions must be made in seconds, not days.

Let’s look at a quick breakdown of how intraday stacks up against the others.

Comparison of Trading Styles

The table below gives you a bird's-eye view of the main trading approaches. Notice how the time commitment and goals shift dramatically as the holding period gets longer.

| Trading Style | Holding Period | Typical Goal | Time Commitment |

|---|---|---|---|

| Intraday Trading | Seconds to Hours | Small, frequent profits from daily volatility | High daily focus required during market hours |

| Scalping | Seconds to Minutes | Tiny, rapid profits on dozens or hundreds of trades | Extremely high; requires constant monitoring |

| Swing Trading | Days to Weeks | Capture a single "swing" or price move within a larger trend | Moderate; daily or weekly check-ins |

| Position Trading | Weeks to Months | Capitalize on major market trends and long-term asset direction | Low; periodic monitoring of long-term charts |

As you can see, these approaches are completely different animals. A position trader might only place a few trades a year, while a scalper could easily hit that number before their first coffee break.

Intraday Trading Versus Swing Trading

Swing trading is the next step up the ladder in terms of time. A swing trader wants to capture a solid price move—a "swing"—that usually lasts anywhere from a few days to several weeks. They aren't sweating the small stuff.

- Intraday Trader's Focus: "How will this stock behave over the next 30 minutes based on this news catalyst?"

- Swing Trader's Focus: "How will this stock perform over the next 10 days as it approaches its earnings report?"

The swing trader holds positions overnight, which means they accept the risks that come with it, all for a potentially bigger reward. This style requires less screen time than day trading but still demands that you keep up with the market regularly.

Intraday Trading Versus Position Trading

Position trading is at the complete opposite end of the spectrum. These traders are playing the long game, holding assets for weeks, months, or even longer to ride out major market trends.

Their decisions are driven by big-picture fundamentals and economic shifts, not the tick-by-tick data an intraday trader obsesses over. It’s much closer to traditional investing and is perfect for people who can't—or don't want to—watch a screen all day.

A Special Note on Scalping

Scalping is like intraday trading on steroids. It’s an even more extreme, hyper-fast version where every second counts. While all scalping is technically intraday trading, not all intraday traders are scalpers.

- Scalpers go after razor-thin profits on huge volumes of shares, often jumping in and out of a trade in just a few seconds. A classic scalp might be capturing a tiny $0.01 price move on 10,000 shares.

- Other Intraday Traders might hold a position for a few hours, looking for a more significant price change to unfold during the day.

Ultimately, picking the right style comes down to you—your personality, your stomach for risk, how much capital you have, and how much time you can realistically commit each day. Understanding these key differences is the first step to finding a trading style that actually works for you.

The Essential Toolkit for Every Day Trader

Trying to day trade without the right setup is like showing up to a Formula 1 race in a family sedan. You're just not going to compete. Your success doesn't just hinge on a clever strategy; it's deeply tied to the quality and speed of the tools at your disposal. These aren't just nice-to-haves; they're your command center.

The baseline for any serious trader starts with a rock-solid tech foundation. A slow internet connection or a platform that lags can turn a winning trade into a loser in the blink of an eye. Split-second decisions demand split-second execution, making your tech stack a non-negotiable part of your trading plan.

Core Technology Requirements

At the bare minimum, every day trader needs a setup built for speed and reliability. Think of these as the engine, chassis, and navigation system of your trading operation.

- A Lightning-Fast Trading Platform: This is your cockpit. You need a platform known for rapid order execution and minimal downtime. Direct market access (DMA) is a huge plus, as it can shave critical milliseconds off your trade entries and exits.

- Reliable, High-Speed Internet: A wired, low-latency internet connection is non-negotiable. Wi-Fi can be unstable, and a dropped connection during a volatile market move is a recipe for disaster.

- Powerful Charting Software: Forget the basic charts your broker provides. You need advanced software with a full suite of technical indicators and drawing tools to do real analysis. If you're wondering which ones matter most, check out our practical guide to technical indicators for intraday trading.

The Critical Role of Real-Time Data

In day trading, information is everything, and its value decays in seconds. That's why having access to real-time, high-quality market data is arguably the most vital tool in your arsenal. This is where tick data enters the picture.

A "tick" is any single price change in a stock, up or down. Tick data is the most granular information you can get, recording every single trade and quote. For a day trader, this isn't just data; it's the market's heartbeat, revealing the true supply and demand dynamics as they happen.

Day trading is powered by a massive global infrastructure. Institutional-grade data sets contain trillions of ticks compiled from over 500 venues, representing petabytes of historical market information.

This firehose of data is what the pros use to find their edge. They invest heavily in sophisticated software and direct data feeds just to process and analyze it all.

Finding Opportunities with Market Scanners

With thousands of stocks moving every second, how do you find the handful with real potential? You can't do it manually. That's a job for a market scanner.

A market scanner is a powerful filter that sifts through the entire market based on criteria you define. For example, you can tell your scanner to alert you the instant a stock:

- Hits a new daily high.

- Shows an unusual surge in trading volume.

- Breaks above a key technical level like the 50-day moving average.

Scanners automate the search, letting you focus your energy only on the stocks that fit your specific strategy. They're your eyes on the market, ensuring you never miss an opportunity. Without one, you're flying blind.

Core Strategies for Intraday Trading Success

Having the best tools on the planet won't make you a dime if you don't know what you're looking for. In intraday trading, your strategy is your blueprint—a clear, repeatable set of rules telling you when to buy, when to sell, and most importantly, why.

A solid strategy is what separates methodical trading from just gambling. While there are endless variations, most intraday approaches boil down to a few core playbooks. Let's break down the big ones.

Momentum Trading: Riding the Wave

Momentum trading is probably the most intuitive strategy out there, which is why so many traders start with it. The idea is simple: find a stock making a powerful move and jump on for the ride.

Think of it like surfing. You’re not trying to create the wave; you’re just trying to catch it as it’s building and ride its energy until it starts to fizzle out. You get on, you ride, and you get off before it crashes back to the shore. These moves are often fueled by a clear catalyst, like a blockbuster earnings report or major company news.

To pull this off, momentum traders need to confirm the move has real power behind it. They look for a few key signs:

- Moving Averages: Is the price blasting off a key short-term moving average, like the 9 or 20 EMA? A decisive move above these levels often confirms bullish momentum is in control.

- Volume Indicators: A huge spike in trading volume is the classic signature of conviction. If a stock is soaring on low volume, it's a trap waiting to spring. Big volume means big money is behind the move.

- Relative Strength Index (RSI): This tells you how fast and hard the price is moving. An RSI climbing above 50 and pushing higher is a great signal that the momentum is building, not fading.

Range Trading: Finding Predictable Boundaries

Not every stock is a rocket ship. In fact, most spend their days bouncing between predictable price levels—a ceiling (resistance) and a floor (support). When a stock gets stuck in one of these channels, it's said to be "in a range."

Range trading is the art of profiting from this predictable behavior. You buy when the price hits the floor (support) and sell when it hits the ceiling (resistance). It’s a contrarian style that shines when the market is choppy and lacks a clear direction. You're betting that the established boundaries will hold, causing the price to reverse.

The core principle of range trading is "buy low, sell high" within a well-defined channel. The key is accurately identifying the support and resistance levels that the market is respecting.

Executing a range trade is all about precision. You need indicators that help spot "overbought" and "oversold" conditions at the edges of the range:

- Bollinger Bands: These bands create a dynamic channel around the price, expanding and contracting with volatility. A common tactic is to sell when the price hits the upper band and buy when it tags the lower band.

- Stochastic Oscillator: This indicator compares a stock's current price to its recent price range. A reading above 80 suggests the stock is "overbought" and might be due for a pullback (a sell signal), while a reading below 20 flags it as "oversold" and potentially ready to bounce (a buy signal).

Scalping: The Art of Quick Strikes

Welcome to the fast lane. Scalping is the most intense, high-frequency form of intraday trading imaginable. Scalpers aren't looking for big wins; they're trying to snag dozens, or even hundreds, of tiny, flea-sized profits throughout the day. A trade might last only a few seconds.

The goal is to capture minuscule price movements, often just the difference between the bid and ask price (the "spread"). This isn't for the faint of heart. It demands laser focus, lightning-fast execution, and the discipline of a soldier to cut a losing trade without a second thought.

Because the profit on each trade is so small, scalpers rely on trading large share sizes to make the wins add up. Their eyes are glued to the Level 2 order book, watching the real-time flow of buy and sell orders to make split-second decisions. It's a game of speed where every single millisecond counts.

Mastering Risk Management to Protect Your Capital

You can have the world's greatest strategy and perfect market timing, but none of it matters if you don't protect your trading capital. This isn't just a friendly tip; it's the absolute bedrock of intraday trading. Most new traders don't fail because their strategies are flawed—they fail because a handful of big losses wipe them out before they ever get a chance to find their groove.

Think of risk management like a trapeze artist's safety net. It doesn't guarantee you'll never fall, but it makes sure you live to perform again. Without these hard-and-fast rules, you’re flying blind, and one bad move could be the end of your trading career.

The Non-Negotiable Stop-Loss

Your most powerful tool is the stop-loss order. A stop-loss is simply a pre-set instruction for your broker to sell a stock once it hits a certain price. It’s your automated emergency brake, and it’s non-negotiable.

You need to set a stop-loss on every single trade before you even click the buy button. This isn't optional. It rips emotion out of the equation, stopping you from clinging to a losing position and "hoping" it turns around—a rookie mistake that has blown up countless trading accounts.

Your first job as a trader isn't to make money; it's to protect what you already have. Capital preservation always comes before profit.

By deciding your maximum acceptable loss upfront, you transform a potential disaster into a manageable, calculated business expense. It's a huge mental shift from gambling to professional trading. For a deeper look, check out our full guide on mastering day trading risk management strategies.

The 1% Rule of Capital Preservation

So, how much should you actually risk on any given trade? The gold standard in intraday trading is the 1% rule. This simple principle states that you should never risk more than 1% of your total trading capital on a single idea.

- Got a $30,000 account? Your maximum loss on any one trade is $300.

- Working with a $50,000 account? You never lose more than $500 on a trade.

This rule is your shield against the inevitable losing streak. Every trader hits a rough patch. The 1% rule ensures that even a string of bad trades won't cripple your account, keeping you in the game long enough for your winning edge to play out.

Avoiding Destructive Habits

At the end of the day, successful trading is just as much about psychological discipline as it is about charts and patterns. Two of the most destructive habits are overleveraging and revenge trading.

Overleveraging means using too much borrowed money (margin), which magnifies both your winners and your losers. A key part of avoiding this is understanding margin calls and the catastrophic damage they can do to your account.

Then there's revenge trading—the emotional impulse to jump right back into the market to "win back" money after a loss. This is a recipe for absolute disaster. Pros treat losses as a cost of doing business, stick to their plan, and live to fight another day.

Of course. Here is the rewritten section, crafted to sound like an experienced human expert.

Anatomy of an Intraday Trade Step by Step

Theory is great, but seeing a trade play out in real-time is where the lightbulb really goes on. Let’s walk through a complete, hypothetical intraday trade from the first scan to the final click. This turns abstract ideas into a concrete workflow you can actually see.

We'll follow a trader named Alex as she stalks a potential breakout trade. Her entire process, from finding the setup to banking the profit, all happens in a single trading session.

Step 1: Identifying the Opportunity

For Alex, the trading day starts well before the opening bell. She’s firing up her market scanner, filtering for stocks with unusually high pre-market volume and a clear upward trajectory. She’s hunting for a stock that looks coiled and ready to rip through a key resistance level right after the market opens.

One ticker, we'll call it XYZ Corp, catches her eye. It's already up 5% in the pre-market session on the back of a new partnership announcement, and it's bumping right up against yesterday's high of $50.00. This is a classic breakout setup, a bread-and-butter play for many day traders.

Step 2: Analyzing the Chart and Forming a Plan

Alex pulls up the 5-minute chart for XYZ Corp. First thing she checks: is the pre-market volume legit? Yes, it's significantly higher than average, telling her there’s real conviction behind this move. She adds a couple of go-to indicators to her chart—the 9-period Exponential Moving Average (EMA) and a volume profile.

With the chart in front of her, she builds a simple, rules-based plan:

- Entry Trigger: If XYZ Corp breaks and holds above the $50.00 resistance level with a big surge in volume, she’s going long.

- Confirmation: After the breakout, she wants to see the price stay above the 9 EMA. This is her confirmation that the momentum is for real.

A well-defined plan is the line between trading and gambling. Before a single dollar is at risk, Alex knows her exact entry trigger, where she's wrong (her stop), and where she'll take profits.

This pre-trade prep work is everything. It takes emotion out of the equation and forces her to stick to the strategy, not get spooked by the chaos of live trading.

Step 3: Executing the Trade and Managing Risk

The opening bell rings, and XYZ Corp makes a beeline for the $50.00 level. Volume explodes as buyers pile in. The price punches through, hitting $50.10. That's her signal. Alex buys 200 shares, getting filled at an average price of $50.15.

The moment her order is filled, she puts in her protective orders. No hesitation.

- Stop-Loss Order: She places a stop-loss at $49.85. This is just under the breakout point and gives the trade a little room to breathe. It defines her risk at $0.30 per share. If the trade immediately fails, her max loss is locked in at $60 (200 shares x $0.30).

- Profit Target: Based on the stock's recent price swings, she sets a profit target at $50.75. She's aiming for a $0.60 gain per share.

This setup gives her a clean 2:1 risk/reward ratio. She's risking $1 for the chance to make $2—a positive expectancy that professional traders insist on.

Step 4: Closing the Position

The stock catches a wave of momentum and keeps climbing. It pushes past $50.50 and briefly spikes to $50.80. Her pre-set sell order at $50.75 is hit automatically, taking her out of the trade.

The entire trade, from entry to exit, took just 18 minutes.

Alex is now "flat" with a profit of $120 (200 shares x $0.60), less commissions. No emotional attachment, no second-guessing. She banked the win and is already back to scanning for the next high-probability setup, sticking to the discipline that defines intraday trading.

Common Questions About Intraday Trading

Jumping into the world of intraday trading always kicks up a lot of questions. It's an area filled with misconceptions, and getting straight answers is the only way to build a solid foundation. Let's tackle the most common ones head-on.

A lot of new traders wonder how they could possibly manage this fast-paced style of trading while holding down a job. The good news? While it demands serious focus, it doesn’t always mean you're chained to your desk for eight hours a day.

Can I Day Trade with a Full-Time Job?

It’s definitely a challenge, but it's not impossible if you have rock-solid discipline. Many traders with jobs zero in on the most active parts of the day—usually the first and last hours of the market session. That’s when you’ll find the biggest price moves.

Others lean on technology, setting up alerts for specific price levels or using automated strategies to place trades for them. What you absolutely can't do is try to trade while you're distracted by your day job. That's a surefire way to make expensive mistakes.

Is Intraday Trading Just Gambling?

This is a big one, and it's a fair question. Let's be blunt: intraday trading without a strategy, risk management, or any education is absolutely gambling. You’re just betting on luck, and luck eventually runs out in the markets.

But professional intraday trading is the polar opposite. Think of it as a performance-based business, built on statistics and sharp analysis. Real traders aren't playing the lottery; they're operating a business. They find a repeatable strategy with a positive statistical outcome—an "edge"—and they execute it over and over with discipline.

The real difference comes down to control. Gambling is giving in to random chance. Methodical trading is about managing probabilities and controlling your risk on every single trade. It's a calculated business decision, not a hopeful punt.

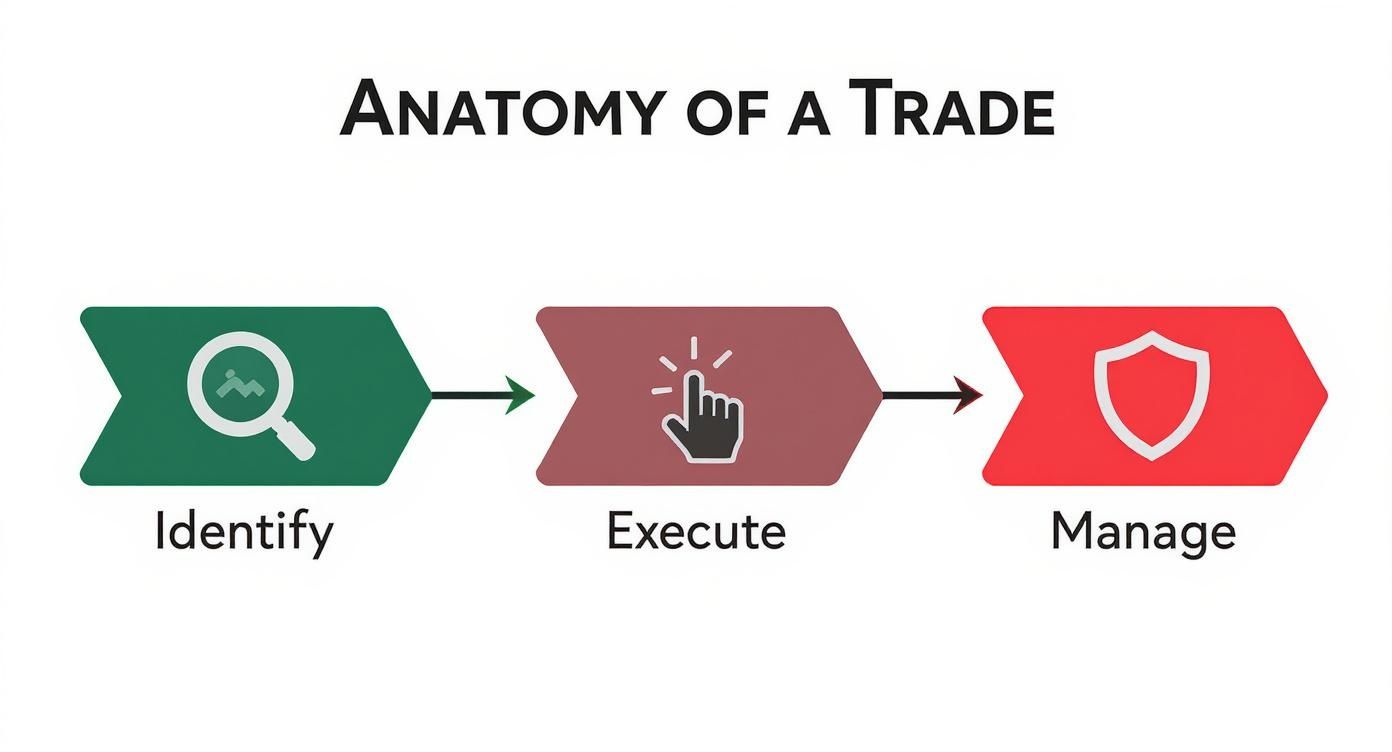

The process that separates structured trading from a random guess is actually quite simple. It's a repeatable, three-step loop.

This Identify, Execute, and Manage flow is the backbone of every professional trade. It ensures every action you take is part of a deliberate plan, not just a reaction.

How Much Capital Do I Need to Start?

This really depends on where you live and which broker you use. In the United States, for instance, regulators have a "pattern day trader" rule that requires you to keep a $25,000 minimum balance in your account. In other parts of the world, you can get started with less.

But the most important rule is universal: only trade with money you can afford to lose.

A better way to think about starting capital is through the lens of risk management. You need enough money to make the 1% rule work for you. If you're risking 1% of a tiny account, your potential profits might get completely wiped out by commissions and fees, making the trade pointless from the start.

Ready to stop guessing and start analyzing? ChartsWatcher provides the powerful, real-time scanning and charting tools you need to identify high-probability setups and execute your strategy with precision. Build your custom dashboards and find your edge in the market by visiting https://chartswatcher.com today.