What Is a Short Squeeze in Stocks? A Complete Guide

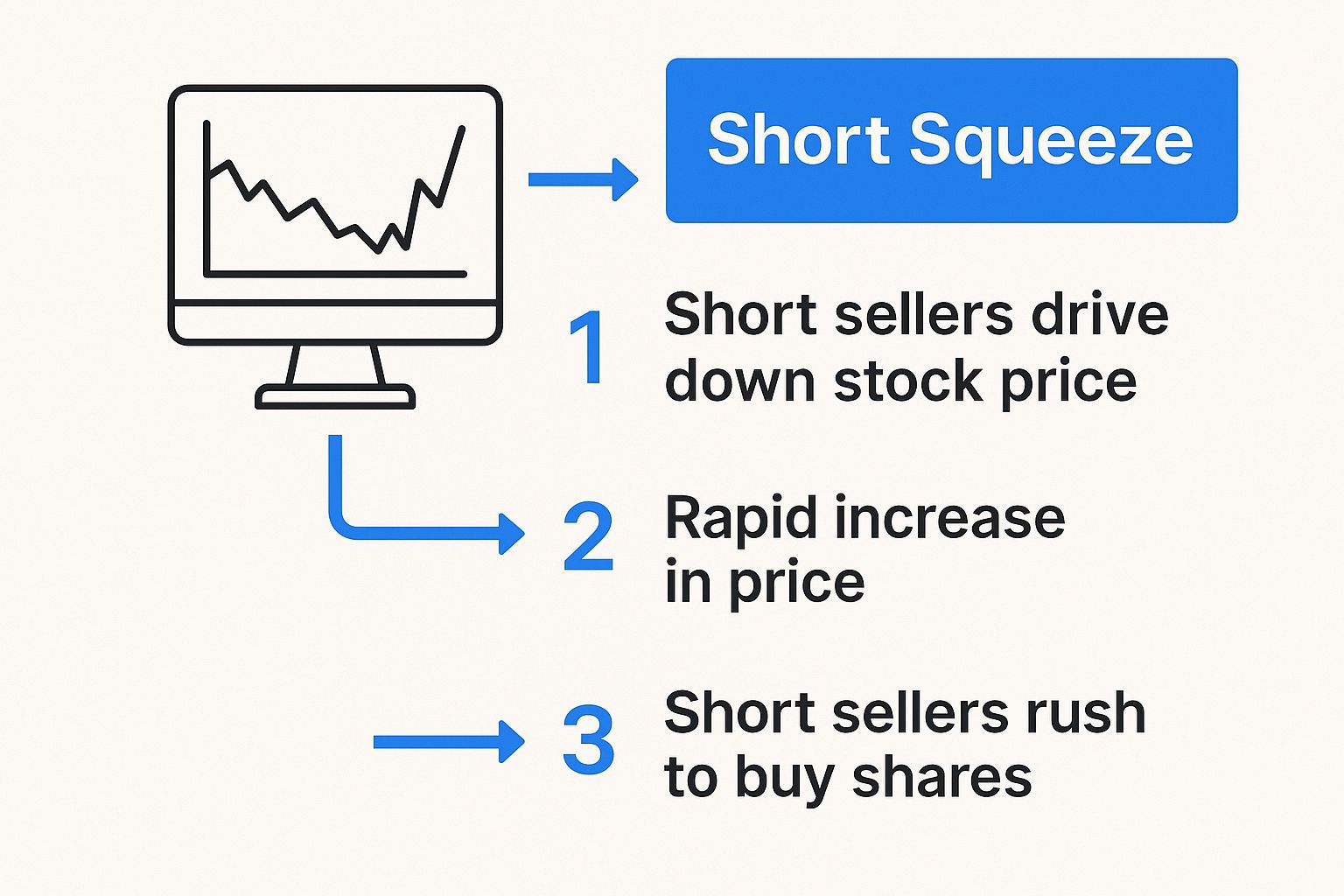

A short squeeze is what happens when a stock’s price explodes upwards, fueled by a stampede of traders who bet against it. These traders, known as short sellers, find themselves trapped as the price climbs, forcing them to buy back shares to cut their losses. This creates a powerful buying frenzy that sends the stock flying.

Think of it as a dramatic tug-of-war where the buyers completely overwhelm the sellers.

Unpacking the Short Squeeze Dynamic

To really get what a short squeeze is, you first have to understand its opposite: short selling. At its core, short selling is a bet that a stock's price is going down. A trader borrows shares, sells them immediately, and hopes to buy them back later at a much lower price. They then return the borrowed shares and pocket the difference.

We break this down in more detail in our guide to what is short selling.

The "squeeze" happens when this bet goes spectacularly wrong. Imagine a crowded movie theater with only one tiny exit. Suddenly, someone yells "fire!" Everyone—in this case, the short sellers—scrambles for that single exit all at once. Pure chaos.

This kind of panic is usually kicked off by some unexpected good news for the company, such as:

- Earnings reports that blow past expectations

- A major new product announcement

- Favorable regulatory news or a successful clinical trial

The Squeeze Mechanism

When that good news hits, the stock starts to climb instead of fall. This puts incredible pressure on short sellers, who are now watching their losses mount. As the price goes higher, they're forced to "cover" their positions by buying back the borrowed shares. Since there's no limit to how high a stock can go, their potential losses are infinite.

This forced buying creates a vicious feedback loop. More buying pushes the price higher, which in turn forces even more short sellers to cover their positions. The result is an explosive, almost vertical surge in the stock's price. A limited number of available shares just adds fuel to the fire.

A short squeeze is essentially a chain reaction of forced buying. The initial price jump acts as the fuse, and the rush of short sellers covering their positions is the explosion that sends the stock price soaring.

To see how all the pieces fit together, it helps to understand who’s involved and what they’re trying to accomplish.

Key Players in a Short Squeeze

This table breaks down the roles, goals, and actions of the main participants in a short squeeze.

| Participant | Primary Goal | Key Action |

|---|---|---|

| Short Seller | Profit from a stock's price decline | Borrows and sells shares, hoping to buy them back cheaper. |

| Long Investor (Buyer) | Profit from a stock's price increase | Buys and holds shares, believing in the company's future. |

Each player’s actions directly influence the others, creating the perfect storm for a squeeze.

How a Short Squeeze Unfolds Step by Step

A short squeeze doesn't just happen out of the blue; it's a chain reaction. Think of it like a line of dominoes—one little push can set off a spectacular, cascading collapse. In the stock market, this process builds through a few distinct stages, with each one cranking up the pressure on the short sellers.

If you can spot this sequence as it's developing, you're well on your way to understanding what a short squeeze really looks like in the wild.

Stage 1: The Setup

It all starts with a stock that has a ton of short interest. This simply means a big chunk of traders are betting against the company. They borrow shares and sell them, hoping to buy them back later at a lower price. When short interest climbs above 20% of a company's float (the shares available to the public), traders take notice. That's a lot of fuel for a potential fire.

So, what kind of company attracts this much negative attention? Usually, ones with obvious problems:

- They might have ugly financials or keep missing their earnings targets.

- Their business model could be stuck in the past, getting crushed by newer competitors.

- They could be struggling against powerful industry headwinds.

This pile-up of negative sentiment creates a massive pool of what I call "forced buyers in waiting." The more people betting against the stock, the more explosive the potential squeeze.

Stage 2: The Catalyst

With the stage set, all you need is a spark. This comes in the form of an unexpected positive catalyst—something that completely shatters the negative story everyone believed. This is the event that lights the fuse, turning market perception on a dime.

A catalyst can be almost anything. A biotech company gets a surprise FDA approval. A struggling retailer posts quarterly earnings that blow away every single forecast. Sometimes, it's just a viral tweet from an influential person or a coordinated buying spree organized by retail traders. Whatever it is, this news ignites the initial buying frenzy from investors who suddenly see a new opportunity.

Stage 3: The Squeeze Begins

As the good news hits the wires, buyers pile in, and the stock price starts to climb. This initial pop puts immediate pressure on the short sellers. Remember, their potential losses are unlimited, so every tick upward is painful.

Once the stock price sails past the point where short sellers opened their positions, their brokers start making margin calls. This is basically a demand for more cash to cover their growing losses. If they can't pony up the money, they have one choice: close the position by buying back the shares.

This is the real beginning of the squeeze. The buying from optimistic investors is now supercharged by forced buying from the first wave of short sellers running for the exits.

Stage 4: The Cascade

This is where things get crazy. The buying from covering short sellers adds even more fuel to the fire, pushing the stock price higher still. This kicks off a vicious feedback loop: a rising price forces more shorts to cover, which drives the price even higher, trapping anyone left.

This infographic captures the escalating pressure cooker that defines the final, chaotic moments of a squeeze.

As you can see, the buying pressure goes parabolic as panicked covering feeds on itself. This self-fueling cycle continues until nearly every short seller has been squeezed out of their position, often at eye-watering prices.

The Volkswagen Short Squeeze: A Historic Market Shock

To really grasp the raw, explosive power of a short squeeze, we don't have to look much further than the legendary market meltdown of 2008. The target was German automaker Volkswagen (VW), and the chaos that followed was so extreme it briefly made VW the most valuable company on the entire planet.

This story is the ultimate lesson in what happens when short-selling hedge funds get caught in a perfectly laid trap.

At the time, the world was deep in a global financial crisis. From the outside, it looked like a sure bet. Many hedge funds saw Volkswagen as overvalued and started building massive short positions, fully expecting the stock to crumble along with the rest of the economy. It seemed like a safe, logical play.

The Surprise Announcement That Ignited the Squeeze

But here's what they didn't know: another automaker, Porsche, had been quietly scooping up a massive stake in Volkswagen. Using a complex web of financial instruments, Porsche secretly gained control of over 74% of VW's voting shares while only disclosing a much smaller position. The market was flying blind, completely unaware of how few shares were actually left to trade.

Then, on a quiet Sunday in October 2008, Porsche dropped the bombshell. They revealed their true holdings and announced their plan to take over VW.

The news hit the market like a lightning strike. Short sellers, who had borrowed and sold roughly 12% of VW's stock, had a sudden, terrifying realization: the number of shares available to buy back—the "float"—was dangerously, impossibly small.

What followed was a panic of epic proportions. Between October 24th and October 28th, Volkswagen's stock shot up an unbelievable 376.65%. The price rocketed from €210.85 to over €1005 in just a matter of days. This violent surge trapped the short sellers, forcing them into a desperate buying frenzy to cover their positions, which only pushed the price even higher. You can read more about how this historic event unfolded on RoboMarkets.com.cy.

The Volkswagen event is a masterclass in short squeeze mechanics. It shows how a severe lack of available shares, sparked by an unexpected catalyst, can create a buying panic so intense it defies all market logic and fundamentals.

The chart below perfectly captures the sheer vertical explosion as the squeeze took hold.

Look at that chart. The stock price went nearly vertical—a crystal-clear sign of the frantic, forced buying that defines a classic squeeze. The aftermath was brutal. Hedge funds lost an estimated $30 billion, serving as a permanent, chilling reminder of the unlimited risk that comes with short selling.

How Tesla Became the Ultimate Short Seller Nightmare

While the Volkswagen squeeze was a violent, short-lived explosion, some of the most punishing short squeezes are slow burns that unfold over months or even years. No company illustrates this better than Tesla (TSLA).

For a long time, it was the most heavily shorted stock on the planet. It was a prime target for institutional investors who doubted everything from its production targets to its sky-high valuation.

This constant bearish pressure created an absolute battleground. On one side were seasoned hedge funds betting on failure; on the other, passionate retail investors and bullish institutions who believed in Elon Musk's disruptive vision. This prolonged standoff set the stage for one of the most significant wealth transfers in modern market history, fueled not by a single announcement but by a steady stream of undeniable achievements.

The Catalysts That Flipped the Script

The tide really began to turn as Tesla started consistently hitting its operational goals. Doubts about its ability to scale production faded with each successful quarter. This steady execution laid the groundwork for the squeeze, but a few key events pushed it into overdrive.

The squeeze between 2019 and 2021 is a masterclass in how high short interest, strong fundamentals, and retail enthusiasm can create a truly massive price surge. At the start of 2020, Tesla shares were trading around $28.68. By the end of the year, the stock had skyrocketed an incredible 735.32% to $239.57, forcing short sellers into billions of dollars in losses. You can find more insights about the biggest short squeezes ever on Capital.com.

Tesla's journey proves that the most powerful catalyst against short sellers isn't just a single event, but sustained business success that makes a bearish thesis fundamentally obsolete.

This multi-year squeeze wasn't an accident. It was driven by a powerful combination of factors that validated the bulls and dismantled the short sellers' arguments one by one.

A Perfect Storm for a Squeeze

Several key forces converged to create this historic run, turning the stock into a nightmare for anyone betting against the company.

- Sustained Profitability: When Tesla began posting consistent quarterly profits, it directly torpedoed the core short-seller argument that the company was just a cash-burning machine with no viable path to financial stability.

- S&P 500 Inclusion: The announcement that Tesla would join the S&P 500 index was a massive turning point. It forced index funds to buy billions of dollars worth of TSLA stock, creating immense, predictable buying pressure that shorts simply couldn't ignore.

- The Retail Investor Army: A dedicated and incredibly vocal community of retail investors provided relentless buying support. They absorbed shares and refused to sell, shrinking the available float for short sellers to cover their positions.

- The ESG Investing Trend: The growing movement toward Environmental, Social, and Governance (ESG) investing brought a whole new wave of institutional money into green companies like Tesla, adding another powerful layer of sustained demand for the stock.

How to Spot a Potential Short Squeeze

While a short squeeze can look like pure chaos from the outside, it doesn't just happen randomly. Certain conditions make one far more likely. Think of it like building a campfire: you need dry wood (the fuel), a confined space, and a spark to get it roaring. Spotting these ingredients in the stock market can give you a heads-up on where the next explosive move might happen.

Traders who successfully navigate these situations aren't just getting lucky; they're looking for a specific combination of data points and market sentiment. By keeping an eye on these key indicators, you can learn to recognize a stock that's primed for a squeeze before it really takes off.

Analyzing the Core Metrics

First things first, you have to look at the numbers that tell you just how heavily a stock is being bet against. These metrics are the raw data—they show you exactly how much "fuel" is piled up for a potential fire.

Two of the most critical numbers to watch are:

- High Short Interest Percentage: This tells you what percentage of a company's shares available for public trading (the "float") are currently sold short. A figure climbing above 20% is often considered a major warning sign. It signals that a massive number of traders are betting on the stock to fail, making it a prime candidate for a squeeze.

- High Short Interest Ratio (Days to Cover): This metric estimates how many days it would take for all the short sellers to buy back their shares and exit their positions, based on the stock's average daily trading volume. A ratio of 10 or more is a big deal. It means it could take over two weeks for shorts to get out, creating a potential traffic jam if they all rush for the exit at once.

When you see both of these numbers creeping up, it’s a huge red flag that a powerful squeeze could be on the horizon. The mix of a large crowd of short sellers and a very narrow exit door creates a highly combustible situation.

Watching for Warning Signs

Beyond the hard data, other signals can show you that the pressure on short sellers is building. These signs often pop up right before a stock begins its meteoric rise.

A crucial signal is a rising cost to borrow. When a ton of people want to short a stock, the fees that brokers charge to borrow those shares go up. If you see borrow fees spiking, it means it's getting more and more expensive for short sellers just to hold their positions. This financial pain can force them to give up and buy back their shares, which only adds more buying pressure.

A sudden, sharp jump in the cost to borrow shares is often one of the earliest and most reliable clues that the well of available shares is running dry. This puts immense, direct pressure on anyone still holding a short position.

Another key piece of the puzzle is a huge spike in trading volume that doesn't push the price down. Normally, a flood of selling would tank the stock. But if the volume is massive and the price is holding steady or even inching up, it can mean that buyers are soaking up every share the short sellers are dumping on the market. You can learn more about what this means by decoding unusual stock volume for smarter trades, as this activity often happens right before a major squeeze.

To help you get a feel for this, here’s a quick guide to what these indicators look like at different levels of risk.

Key Indicators of Short Squeeze Potential

This table breaks down the common metrics and what they might signal about a stock's potential for a squeeze. Keep in mind these are general guidelines, not guarantees.

| Indicator | Low Potential | Moderate Potential | High Potential |

|---|---|---|---|

| Short Interest % | Below 10% | 10% - 20% | Above 20% |

| Days to Cover | Below 5 | 5 - 10 | Above 10 |

| Cost to Borrow | Low & Stable | Noticeably Increasing | Spiking to Extreme Levels |

| Recent Price Action | Bearish, Trending Down | Sideways, Consolidating | Starting to Uptrend |

Looking for stocks that are shifting from the "Moderate" to "High" potential columns is a solid strategy for identifying brewing opportunities.

The Final Ingredient: The Catalyst

A stock can have sky-high short interest for months and do absolutely nothing. The final piece of the puzzle—the spark that lights the fuse—is the catalyst. This is an unexpected event that completely shatters the negative story the shorts were betting on and kicks off a buying frenzy.

Potential catalysts can be almost anything, including:

- An earnings report that absolutely crushes expectations.

- Positive news from a clinical trial or a surprisingly successful product launch.

- An announcement of a major partnership or a buyout offer.

- A surge of coordinated buying from a community of retail investors.

By combining the hard data with an awareness of what’s happening in the market, you can start building a framework for spotting what a short squeeze looks like before it fully unfolds.

The Extreme Risks of Chasing a Short Squeeze

While the idea of hitting a triple-digit home run is tempting, let's be real: chasing a short squeeze is one of the most dangerous games you can play in the stock market. The same rocket fuel that launches a stock into orbit can run out in a flash, sending it crashing back to Earth and wiping out anyone who showed up a little too late to the party.

This is not a strategy for the faint of heart. For every trader who nails the timing and cashes out a fortune, countless others are left holding a worthless bag.

The Peril of Perfect Timing

The biggest problem? It's almost impossible to time your entry and exit perfectly. A short squeeze isn't a logical event driven by a company's solid performance. It's pure chaos, fueled by the panic of trapped short sellers who are forced to buy back shares at any price.

Once those shorts have closed out their positions, the primary reason for the rally is gone. The artificial buying pressure disappears, and the stock price can collapse back to where it started—or even lower—in a matter of hours. This is how traders become “bag holders,” stuck with massive losses after buying at the top.

A short squeeze is like a high-stakes game of musical chairs. When the music stops—meaning the shorts are done buying—anyone left standing is in for a painful fall.

Managing the Unpredictable Fallout

Because these blow-ups are so unpredictable, your number one job is to protect your downside. The difference between a small gain and a devastating loss often comes down to disciplined risk management. Without a solid plan, the fear of missing out (FOMO) can trick you into buying at ridiculously high prices, right before the inevitable crash.

This is where simple tools become your lifeline. It is absolutely critical for traders to understand how to set stop losses to protect themselves from getting steamrolled. Think of it as your emergency exit. Truly understanding what a short squeeze is means accepting that the downside is just as dramatic as the upside, and that calls for extreme caution.

Common Questions About Short Squeezes

When you’re first digging into the world of short squeezes, a few questions always pop up. Let’s tackle some of the most common ones traders ask.

Is Short Selling Illegal?

No, standard short selling is a completely legal and regulated part of how the market works. It’s a strategy used every single day by institutional and retail traders alike.

Where you run into trouble is with manipulative practices like "naked" short selling. This is when someone shorts shares without actually borrowing them first, which is illegal in most markets because it can create phantom shares and mess with supply and demand. But regular, properly executed short selling is perfectly fine.

How Long Can a Short Squeeze Last?

There’s no set timeline, and the duration can vary wildly. Some squeezes are like a flash flood—over in just a few days. This usually happens when a single news event triggers a panic, the buying frenzy peaks, and then it's over as quickly as it began.

Others are more of a slow burn that can last for months or even over a year. Think about what happened with Tesla. That squeeze wasn't just a quick panic; it was fueled by a fundamental shift in the company's outlook and a die-hard investor base that refused to back down.

Can Any Stock Have a Short Squeeze?

Theoretically, yes, but in reality, it's pretty rare. You need a perfect storm of specific ingredients for a squeeze to even have a chance. The most likely candidates are stocks with a specific combination of factors:

- Extremely high short interest (a huge number of people betting against it).

- A low float, meaning a small number of shares are actually available for trading.

- An unexpected positive catalyst—like surprise positive earnings or a big partnership—that ignites a fire under buyers.

Without these key elements, it’s tough to get the intense, concentrated buying pressure needed to force short sellers out of their positions.

Ready to spot the next potential squeeze before it takes off? ChartsWatcher gives you the real-time data and advanced scanning tools you need to track short interest, volume spikes, and other unusual market activity.