Ultimate Guide to Your Multi Monitor Trading Setup

Why Serious Traders Need Multiple Monitors

The modern financial market is a constant stream of data. Traders need to be attentive and make quick decisions. Managing this information overload on a single monitor can feel overwhelming and inefficient, much like navigating a complex city with only a single map. This is why multiple monitors have become essential for serious traders.

A multi-monitor setup offers the necessary screen space to display various data streams simultaneously. Think real-time charts, news feeds, order books, and more. This eliminates the need to switch between windows or tabs, saving precious seconds that could be the difference between seizing an opportunity and missing out. Imagine: price charts on one monitor, order flow and depth on another, and breaking news on a third. This compartmentalization promotes faster analysis and more informed trading decisions.

Distributing information across multiple screens also significantly improves cognitive efficiency. Our brains process visual data much faster than text. By dedicating specific screens to distinct data types, traders can capitalize on this, reacting to market fluctuations with increased speed and accuracy. This enhanced situational awareness can lead to faster execution and, ultimately, higher profitability.

The Evolution of Multi-Monitor Trading

The growth of multi-monitor setups reflects the increasing complexity of financial markets. As trading platforms become more sophisticated and data volumes expand, efficient information processing is paramount. The need to effectively manage and analyze the flood of data in today's markets has driven this evolution. Active traders, especially those building proprietary trading stations, frequently employ multiple monitors to separate various data streams, such as live charts, order books, news feeds, and watchlists. While monitor prices and graphics card limitations once restricted traders, current technology supports multiple displays at an affordable cost. To delve deeper into setting up trading screens, explore this Investopedia article. A well-designed multi-monitor setup empowers traders to leverage the available information, turning data overload into a strategic advantage.

Benefits of a Multi-Monitor Setup for Trading

-

Improved Productivity: See everything at once, eliminating constant window switching. This allows for more focus on analysis and execution.

-

Enhanced Data Visibility: Increased screen real estate allows traders to monitor more markets, asset classes, and technical indicators concurrently, broadening their perspective and uncovering hidden opportunities.

-

Reduced Missed Opportunities: Faster reaction times to market events mean fewer missed trades and potentially higher profits, especially in fast-paced markets.

-

Better Risk Management: Simultaneously monitoring positions and market conditions across multiple screens allows for faster risk identification and mitigation.

-

Increased Comfort and Reduced Eye Strain: Spreading visual information across several screens reduces eye fatigue during long trading sessions, leading to improved concentration and better decision-making.

These advantages demonstrate why multiple monitors are no longer a luxury but a necessity for serious traders aiming to succeed in today's dynamic markets. This raises the next important question: how many monitors are sufficient?

Finding Your Perfect Monitor Count For Trading Success

While a multi-monitor trading setup offers clear advantages, the ideal number of screens for optimal performance remains a key question. More isn't always better. Just like having too many cooks in the kitchen, an excessive number of screens can lead to information overload and diminishing returns. This section explores finding the right number of monitors for your trading needs.

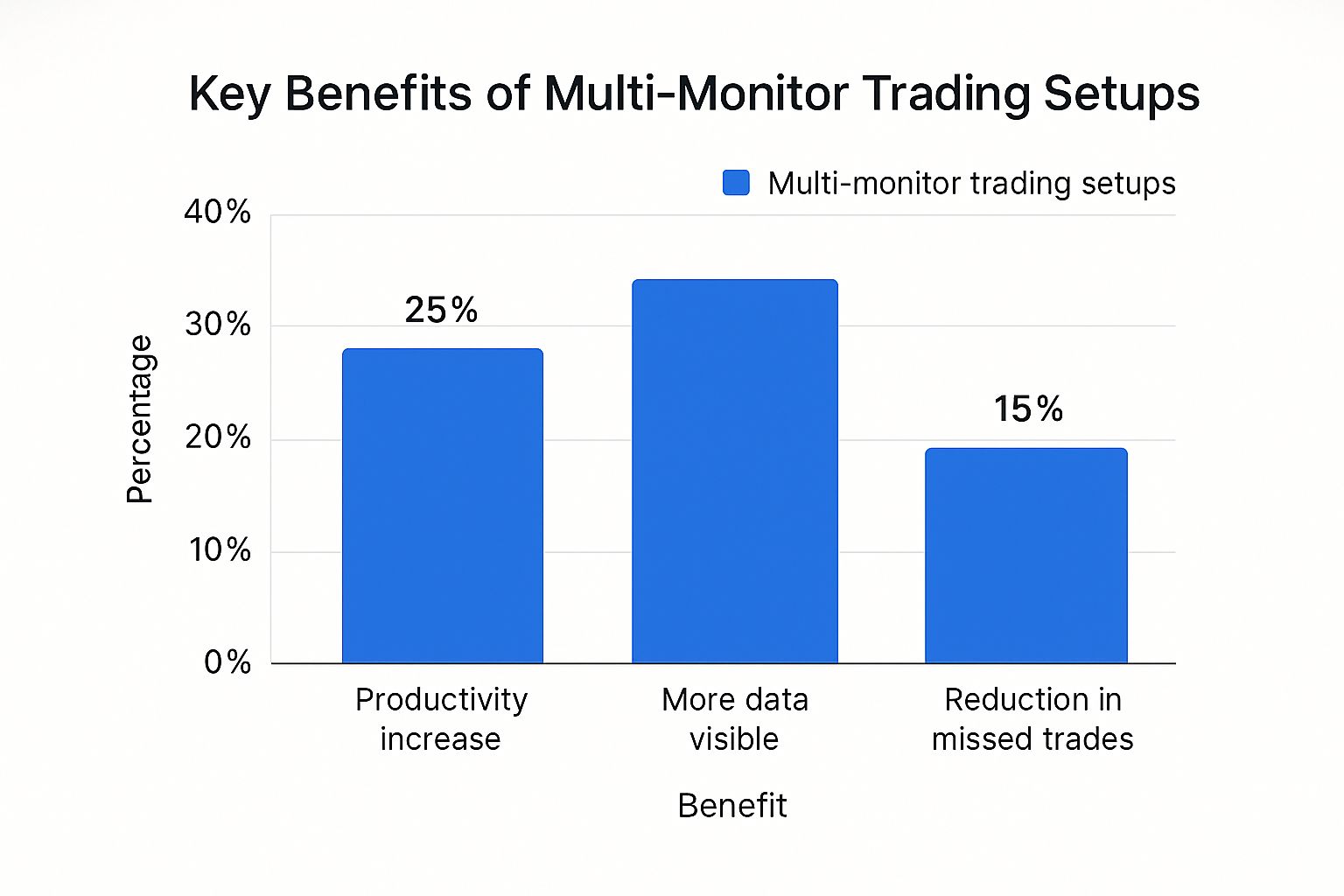

The infographic below illustrates the key advantages of a multi-monitor trading setup, highlighting percentage improvements in productivity, visible data, and a reduction in missed trades.

As the infographic shows, upgrading to multiple monitors can significantly enhance a trader's capabilities. The substantial gains in productivity, data visibility, and trade execution underscore the importance of carefully considering the number of monitors in a trading setup.

How Many Monitors is Too Many?

Research reveals a strong preference for multi-monitor setups among professional traders. Data from ViewSonic indicates that over 70% of active traders in major financial hubs use at least three monitors. Approximately 40% utilize four or more, particularly those involved in high-frequency trading or complex multi-asset strategies. However, this doesn't mean more is always better. Beyond a certain point, additional monitors can overload your cognitive capacity, hindering effective information processing and potentially leading to suboptimal trading decisions. It's like trying to drink from a firehose—too much information at once becomes unmanageable.

Matching Monitor Count to Trading Style

The optimal monitor count depends heavily on individual trading styles and strategies. Let's examine a few examples.

-

Scalpers: These traders often benefit from a two-to-three monitor setup. One monitor typically displays real-time price charts, another tracks order flow and market depth, and a third (if used) can be dedicated to news feeds or a watchlist. The focus here is on speed and rapid decision-making.

-

Day Traders: Three-to-four monitors are usually optimal for day traders. This configuration allows for dedicated screens for charting, market news and analysis, order entry and portfolio management, and potentially a fourth for monitoring specific sectors or asset classes.

-

Swing Traders/Long-Term Investors: These traders can effectively manage with two-to-three monitors. One monitor can be dedicated to long-term charts and fundamental analysis, another for news and economic data, and a third, if necessary, for portfolio tracking and research.

To illustrate these recommendations further, consider the following table:

Monitor Count Comparison for Different Trading Styles

This table compares the recommended number of monitors for different trading approaches and strategies.

| Trading Style | Recommended Monitor Count | Typical Information Displayed | Benefits |

|---|---|---|---|

| Scalpers | 2-3 | Real-time charts, order flow, news | Speed and quick decision-making |

| Day Traders | 3-4 | Charts, market news, order entry, sector monitoring | Comprehensive market overview and efficient order management |

| Swing/Long-Term Investors | 2-3 | Long-term charts, fundamental data, news, portfolio tracking | In-depth analysis and portfolio oversight |

This table demonstrates how the information needs of different trading styles influence the recommended monitor count. Scalpers prioritize speed, while day traders require more comprehensive market data. Swing and long-term investors benefit from in-depth analysis and portfolio tracking capabilities.

Finding Your Sweet Spot

Ultimately, determining the perfect monitor count is a personal process. Start with a smaller setup and gradually add monitors as needed. Evaluate your workflow after each addition. Consider factors such as information overload, decision-making speed, and overall trading performance. Some traders find that reducing their monitor count, after experimenting with larger setups, improves focus and profitability. The key is finding the right balance between information access and cognitive processing ability.

The 4-Monitor Sweet Spot: Designing Your Command Center

After exploring the benefits and drawbacks of different monitor setups, let's focus on the popular 4-monitor configuration. Many see this as the perfect balance between maximizing information and keeping a manageable workspace. It offers a broad market overview while minimizing information overload.

This setup isn't about simply adding more screens. It's about strategically arranging your workspace to improve trading decisions. A 4-monitor setup allows traders to build a personalized command center, giving them a real advantage in fast-moving markets. This leads to a more efficient and informed trading process.

You might be interested in: The Ultimate Guide to Multiple Monitor Trading Setup Strategies and Best Practices

Optimizing Screen Real Estate: What Goes Where?

With four monitors, assigning a specific role to each is key. This organized approach reduces clutter and helps you process data quickly. A common setup uses one monitor for charting, another for order execution platforms like ChartsWatcher, a third for watchlists, and the last for news and social media.

This separation creates a clean, organized workspace, similar to departments in a company. Each monitor performs a specific job, boosting the overall efficiency of your trading. This division of labor prevents important data from being missed.

For example, a trader might display real-time charts on their main monitor, while their order execution platform sits on a secondary screen for quick order entry. This setup promotes a smooth flow between analysis and execution. This separation helps maintain focus and react to market shifts.

Layout Strategies: Symmetry vs. Asymmetry

How you physically arrange your monitors also matters. Two main approaches exist: symmetrical and asymmetrical layouts. A symmetrical 2x2 grid with equally sized monitors offers a balanced visual setup. However, an asymmetrical setup, with a larger main monitor and smaller surrounding screens, might be better if you prioritize certain data.

The best layout depends on your preferences and trading style. Some traders prefer the balance of a symmetrical grid for focus, while others like the hierarchy of an asymmetrical setup. The right layout should make your workspace both comfortable and efficient.

The 4-monitor setup has become a popular, practical choice. It balances information intake with ergonomic comfort and cognitive efficiency. Recent 2024 guides and expert analyses show that a four-screen configuration lets traders see four key trading elements at once: real-time charts, watchlists, news feeds, and portfolio management tools. This arrangement provides a comprehensive view, letting traders spot opportunities and risks quickly across different assets. Explore this topic further: Build a 4-Monitor Setup for Trading This strategic organization improves how quickly and accurately you make decisions, leading to better trading outcomes.

Building The Hardware Foundation For Trading Success

A powerful multi-monitor trading setup requires more than just adding extra screens. It needs a solid hardware foundation to ensure everything runs smoothly and prevents costly interruptions when you need it most – during critical market moments. This section dives into the core hardware components that form the backbone of a professional-grade trading system.

Essential Hardware Components: Beyond the Screens

Creating a dependable multi-monitor setup involves carefully choosing components that work in harmony. This means thinking about the monitors themselves, as well as the computer that powers them.

-

Graphics Card (GPU): The GPU is the heart of any multi-monitor system. It's the component responsible for generating the images you see on your screens. For a smooth, lag-free experience, especially with demanding charting platforms like ChartsWatcher, a dedicated graphics card is non-negotiable. The more monitors you use, the more powerful your GPU needs to be. Driving four high-resolution monitors demands considerably more processing power than a single screen. The right GPU prevents lag and ensures charts update in real-time, even during volatile market conditions.

-

Central Processing Unit (CPU): The CPU manages all the calculations and processes happening within your system. A fast, multi-core processor keeps your system responsive when running multiple trading applications simultaneously. This is essential for avoiding delays in order execution and maintaining system stability.

-

Random Access Memory (RAM): RAM acts like short-term memory for your computer. It provides quick access to data your CPU needs. Adequate RAM is crucial for smooth multitasking, especially in a multi-monitor setup, preventing slowdowns when you need to act fast. 16GB of RAM is a good starting point for a solid trading setup, while 32GB is recommended for more demanding software.

-

Storage: A fast Solid State Drive (SSD) significantly improves boot times and application loading speeds. This speed is vital for quickly accessing large datasets and launching your trading platform.

Choosing The Right Monitor: Key Specifications

The monitors themselves are, of course, vital components. Certain specifications significantly affect your trading performance.

-

Response Time: A low response time (measured in milliseconds) minimizes motion blur, which is crucial for clearly seeing fast price movements and ensuring you don’t miss opportunities.

-

Panel Type: IPS (In-Plane Switching) panels provide accurate colors and wide viewing angles. This allows for comfortable viewing across multiple screens, reducing eye strain during long trading sessions.

-

Resolution: Higher resolution gives you more screen real estate, displaying more information without sacrificing clarity. This allows for more charts, tools, and data on each screen.

-

Refresh Rate: A higher refresh rate produces smoother motion, making the visual experience more comfortable and less tiring on your eyes.

Maintaining System Stability: Mounting, Cables, and Power

Beyond the core components, other important factors contribute to a reliable setup:

-

Mounting Solutions: Sturdy monitor mounts or arms free up valuable desk space and allow for ergonomic positioning for optimal viewing.

-

Cable Management: Proper cable management helps keep your workspace organized and prevents accidental disconnections that could interrupt your trading.

-

Backup Power Supply (UPS): A UPS protects your equipment from power outages, ensuring your system stays online during critical market moves, preventing lost trades due to unexpected power failures.

By carefully selecting these hardware components, you'll create a multi-monitor setup that provides the screen space, reliability, and performance you need to thrive in today's markets. This solid foundation supports your trading software and leads to a more efficient and informed trading process.

Software That Maximizes Your Multi-Screen Advantage

A powerful hardware setup is only the beginning. To truly unleash the potential of multiple monitors for trading, you need software designed to take advantage of that expanded screen real estate. Experienced traders know this, using specific software and tools to build a smooth and efficient trading environment. This involves selecting trading platforms built for multi-screen use and incorporating tools that improve workflows and enhance decision-making. For long-term performance and reliability, consider a comprehensive approach to your trading infrastructure. It’s similar to having a solid website maintenance plan for your trading setup.

Trading Platforms Optimized for Multiple Screens

Many leading trading platforms are specifically designed with multi-monitor setups in mind. For example, platforms like ChartsWatcher let traders seamlessly spread out charts, watchlists, order books, and news feeds across multiple screens. This creates a personalized command center for monitoring diverse market data simultaneously. This focused approach improves market awareness and speeds up reaction time. These platforms often provide features such as customizable window layouts, drag-and-drop functionality, and synchronized data across all screens to get the most out of your workspace.

Window Management and Hotkey Customization

Beyond your core trading platform, window management software can significantly boost efficiency. These tools let you pre-set window positions and sizes across your monitors, allowing you to switch between configurations with a single click or hotkey. Imagine instantly switching from a pre-market analysis layout to a live trading setup with all your essential tools exactly where you need them. Custom hotkeys can also shave valuable seconds off order entry and execution, a critical advantage in fast-moving markets. This is especially helpful for scalpers, who depend on extremely fast execution.

Building Context-Specific Layouts

Successful traders understand the value of organizing information by function and timeframe. For instance, you might dedicate one monitor to short-term charts and technical analysis while another focuses on long-term trends and fundamental data. This separation prevents information overload and allows for more focused analysis. You can further refine this by creating context-specific layouts for various market conditions or trading strategies. One example might be a distinct layout for high-volatility periods that prioritizes order flow and Level 2 data, while another focuses on news and economic calendars for pre-market analysis.

Before we discuss creating dashboards, let's look at some of the popular trading software options available for multi-monitor setups. The following table compares key features, customization options, and pricing.

Top Trading Software for Multi-Monitor Setups Comparison of popular trading platforms and their multi-monitor capabilities

| Software | Multi-Monitor Features | Customization Options | Performance Rating | Price Range |

|---|---|---|---|---|

| ChartsWatcher | Seamless distribution of charts, watchlists, and news feeds | Customizable window layouts, drag-and-drop functionality | High | Varies based on package |

| TradingView | Multiple charts, watchlists, and analysis tools on different screens | Customizable layouts, indicators, and drawing tools | High | Free to $49.95/month |

| TC2000 | Advanced charting and scanning across multiple monitors | Customizable layouts, indicators, and formulas | High | $8.32 to $49.99/month |

| NinjaTrader | Multiple charts, order entry windows, and market data feeds | Customizable layouts and indicators | High | Varies based on license |

| Sierra Chart | Highly customizable charting and market data on multiple screens | Extensive customization options for indicators and layouts | High | $26 to $33/month |

This table highlights the strengths of different platforms regarding multi-monitor support. While all offer robust features, the best choice for you will depend on your specific needs and trading style.

Creating Powerful Trading Dashboards

Finally, think about creating dynamic dashboards that highlight the most important information at a glance. These dashboards can combine data from different sources into a single, easy-to-understand view. Imagine a dashboard displaying real-time price alerts, important economic indicators, and your current portfolio performance, all updated live. This centralized information hub helps you make informed decisions quickly. Many platforms offer customizable dashboards tailored to your specific needs and trading style, so you always have the right information readily available.

Trader Health: Optimizing Your Body and Environment

The thrill of a multi-monitor trading setup can quickly diminish if you're constantly fighting neck pain, eye strain, or headaches. While creating your ideal trading command center, remember that prioritizing your physical well-being is essential for long-term success. A comfortable and ergonomic trading environment has a direct impact on your focus and decision-making abilities – crucial factors for navigating the complexities of the market. Just like an athlete needs to be in peak physical condition, a trader needs an optimized setup to perform at their best.

This image shows a trader enjoying a thoughtfully designed workspace. The ergonomic chair, proper monitor placement, and organized desk all contribute to a healthier and more productive trading experience.

Monitor Placement and Viewing Distance

Correct monitor placement is paramount. Position your primary monitor directly in front of you, about arm's length away, with the top of the screen at or slightly below eye level. This helps minimize neck strain. Secondary monitors should be angled inwards, creating a semi-circle around your seating position. They should be easily viewable without needing to turn your head excessively. Maintain a viewing distance of 20-40 inches from your screens to reduce eye fatigue.

Imagine yourself at the center of a semi-circle, with your monitors arranged along the curve. This setup promotes comfortable viewing of all screens without straining your neck or eyes.

Lighting and Eye Strain Prevention

The right lighting significantly impacts eye strain. Avoid glare on your screens by positioning them away from direct sunlight or bright overhead lights. Adjust your monitor's brightness and contrast to comfortable levels, and consider using blue light filtering glasses for additional eye strain reduction.

Take regular breaks, following the 20-20-20 rule: every 20 minutes, look at something 20 feet away for 20 seconds. This exercise helps your eyes refocus and prevents fatigue. This means that even during periods of intense market activity, short breaks are important for maintaining focus and protecting your long-term eye health.

Ergonomic Seating and Desk Setup

Invest in an ergonomic chair that offers good lumbar support and adjustability. Your chair should allow you to sit with your feet flat on the floor, knees at a 90-degree angle, and elbows resting comfortably on your desk. Make sure your desk height is suitable for your chair and monitor setup, allowing for a relaxed posture. For more tips, check out this resource: Trading Desk Setup - Craft Your Perfect Workspace.

Optimizing your workspace goes beyond furniture, however.

Hydration, Nutrition, and Physical Activity

Stay hydrated throughout the trading day. Dehydration can lead to fatigue and negatively impact cognitive function. Keep a water bottle handy and sip on it regularly. Maintain a balanced diet and avoid sugary snacks and processed foods which can cause energy crashes.

Incorporate short bursts of physical activity into your day, even during busy trading sessions. Simple stretches, short walks, or even standing up every 30 minutes can improve circulation and reduce stiffness. For increased productivity, consider using software that supports features like split screen multitasking for more efficient use of your monitors.

By prioritizing these elements, you'll improve your physical health and boost your trading performance. A healthy body and a well-designed environment are essential for a successful trading career.

The Evolving Trading Desk: Future-Proofing Your Setup

The world of trading is constantly changing, driven by advancements in technology. Your current multi-monitor setup, while effective today, needs to be adaptable to remain powerful in the future. Let's explore emerging technologies and strategies to help you build a flexible trading system that can evolve alongside the markets.

Beyond the Flat Screen: Exploring New Display Technologies

Ultra-wide curved monitors are gaining popularity with traders. These monitors offer an immersive viewing experience, displaying more information with less head movement. This is particularly useful for those using a three- or four-monitor setup, potentially consolidating down to fewer screens without sacrificing screen real estate.

Eye-tracking systems are another exciting development. These systems can anticipate where your eyes are focused and proactively load relevant information, streamlining your workflow. Imagine your system automatically displaying a detailed chart for a specific stock simply by you glancing at it on your watchlist. This emerging technology holds tremendous potential for improving trading efficiency.

AI and the Future of Trading Analysis

AI-assisted analytics is revolutionizing how traders analyze market data. AI algorithms can identify patterns and trends often missed by human observation, offering new insights and potential trading opportunities. These tools process vast amounts of data, delivering real-time alerts and predictive models that can enhance your trading strategies. Think of it as a dedicated research assistant constantly monitoring the markets, highlighting potential risks and rewards.

Building a Flexible and Adaptable System

A future-proof trading desk needs to incorporate new technologies easily without requiring a complete overhaul. Choose modular components that are easy to upgrade. For example, make sure your computer has enough expansion slots for future graphics cards and increased storage.

Consider a modular desk design that accommodates different monitor configurations as your needs change. This flexibility lets you adapt to new technologies and trading styles without constantly rebuilding your entire setup. Just as a successful trader adapts to market fluctuations, your trading desk needs to adapt to technological advancements.

Mobile Trading and Cloud Synchronization

Mobile trading extensions and cloud-synchronized platforms give traders access to their tools and data from anywhere. These technologies allow you to stay connected to the markets, react to important events, and manage your portfolio on the go. This ensures you're always informed and able to respond to critical market movements.

Maximizing Your Investment: A Technology Upgrade Path

Instead of constantly purchasing the newest gadgets, create a strategic technology upgrade path. Determine which components will provide the biggest performance boosts for your specific trading style and prioritize those upgrades. This focused approach optimizes your investment and ensures you're using the best tools for your needs.

Ready to take your trading to the next level with a customizable platform? Explore ChartsWatcher, dynamic market scanning software built for serious traders. With customizable windows, real-time data, and advanced features like backtesting, ChartsWatcher empowers you to create the ultimate trading command center. Discover the power of ChartsWatcher today!