The Ultimate Guide to Multiple Monitor Trading Setup: Strategies and Best Practices

The Evolution of Multiple Monitor Trading Setups

Fast-paced financial markets require traders to process and act on information quickly. Multiple monitor trading setups have become essential tools for staying on top of market movements. What was once limited to professional trading floors is now accessible to individual traders, fundamentally changing how they interact with markets.

From Single Screens to Advanced Setups

Early traders struggled with single screens, constantly switching between windows to track different data streams. The development of better graphics cards and lower monitor costs has made multi-screen setups both practical and affordable for many traders. This shift enables faster analysis and more effective strategy execution.

Traders can now organize complex data in clear, useful ways. For example, one screen might show live stock charts, another displays news and economic calendars, while a third handles order entry and portfolio tracking. This organized approach reduces errors and helps traders stay focused on their strategies.

The growth in multi-monitor trading has accelerated as equipment costs dropped while technology improved. Current data shows that many traders use three or four screens to track multiple indicators at once - from real-time charts to longer-term trends. This setup allows viewing up to four different charts per monitor, helping traders make quick, informed decisions. Learn more about optimal trading screen setups here: Investopedia

The Benefits of Modern Multi-Monitor Trading

Beyond just more screen space, a well-planned multiple monitor setup provides key advantages. It improves situational awareness by giving traders a complete market view, helping them spot trends and react quickly to changes. It also boosts efficiency by eliminating constant window switching.

Multiple monitors also strengthen risk management. Having a dedicated screen for position monitoring and risk tracking helps traders maintain better portfolio control. This often leads to smarter decisions and improved results. The ability to customize each screen's information for specific trading strategies gives traders precise control over their market analysis. This level of detailed market visibility has become central to modern trading success.

Strategic Monitor Layout and Workspace Design

A powerful multiple monitor trading setup needs careful planning and thoughtful workspace design to maximize its potential. This means strategically placing monitors, organizing your desk space, and managing cables to create an environment where you can trade efficiently and stay focused.

Optimizing Your Monitor Placement

The way you position your monitors directly impacts your comfort and efficiency. Place your primary monitor straight ahead at eye level to avoid neck and eye strain. This screen should show your most-used charts and trading platforms. Angle your secondary monitors slightly inward in a curved layout to minimize head movement. This setup gives you quick access to key information in your peripheral vision, helping you spot and react to market changes faster.

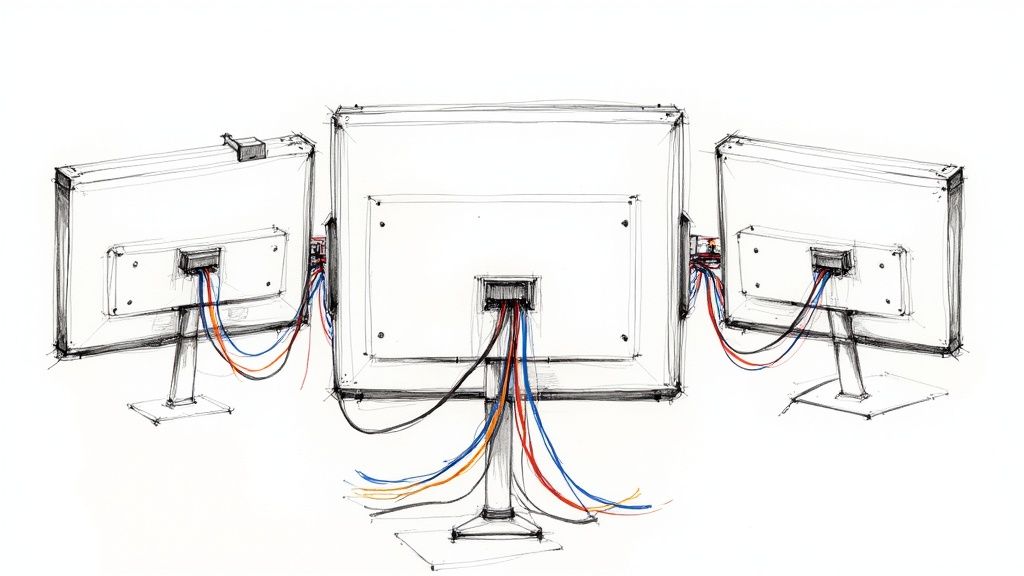

Desk Organization and Cable Management

A messy desk can make it harder to focus on trading. Keep your workspace clean and organized - it makes a real difference during long trading sessions. Get a desk that's big enough to fit all your monitors and equipment comfortably. Use cable management solutions like ties or trays to keep wires tidy and prevent them from tangling up. These small details help create a more productive environment.

Good ergonomics are essential too. Quality adjustable chairs and keyboard trays help prevent physical strain during long trading sessions. When setting up multiple monitors, think carefully about what each screen will be used for. Many traders dedicate specific monitors to different tasks - one for active trading charts, another for longer-term analysis, and others for tracking closed positions or managing other tasks. This organized approach helps you work efficiently without wasting time searching for information. Learn more about monitor setups: Autonomous.

Creating a Flexible and Adaptable Setup

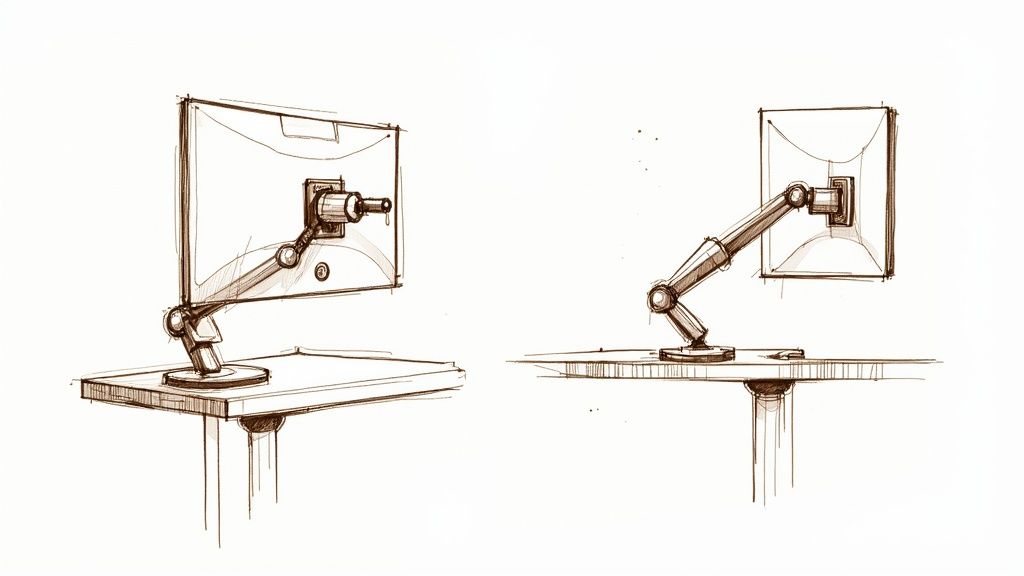

Your monitor setup should adapt to your changing needs. Use adjustable monitor arms so you can easily change screen positions throughout the day. This flexibility lets you switch between different layouts - like vertical views for price ladders or horizontal arrangements for technical analysis.

Building an effective trading workspace takes careful planning based on how you actually trade. When done right, a well-designed setup can significantly improve your trading by keeping you comfortable, focused and efficient.

Customizing Your Setup for Different Trading Styles

Every trader has unique needs for their monitor setup. How you arrange your screens should align with your individual trading approach and goals. Let's look at how to optimize your workspace based on your specific trading style.

Tailoring Your Setup to Your Trading Style

-

Day Trading: When tracking short-term price moves, you need quick access to real-time data. A popular setup uses one screen for placing trades, another for watching market depth, and a third for following news and charts. This lets you spot and act on market changes instantly.

-

Swing Trading: For traders holding positions over days or weeks, the focus shifts to broader analysis. Consider dedicating screens to longer timeframe charts, company research, and market news tracking. This helps build a fuller picture of market trends and potential moves.

-

Scalping: Speed is everything for scalpers taking quick trades on tiny price changes. Two well-organized screens often work best - one for market depth data and another for rapid trade execution. Keeping it simple helps maintain focus during fast-paced trading.

Adapting to Evolving Strategies and Circumstances

Your setup needs to grow with you as your trading evolves. A day trader branching into swing trading might add a screen for longer-term analysis. You might want to check out: How to master day trading risk management.

Life changes can also impact how you trade and what setup works best. One trader went from using three screens to mainly mobile trading after having a child. This shows that success depends more on smart strategy than screen count. Even scalping can work well on just one or two screens when used efficiently. Learn more: Trading and Adaptability.

Practical Approaches to Screen Organization

Good screen layout helps you make faster, better decisions. Try using virtual desktops to group related windows, color-code charts by asset type, and use window-snapping to maximize screen space. These simple tricks cut visual clutter and help you find key info quickly. The goal is creating a workspace that fits your unique trading style and helps you perform at your best.

Future-Proofing Your Trading Environment

Setting up multiple monitors isn't just about adding more screens - it's about building a workspace that can grow and adapt as your trading needs change. Smart planning now will help your setup stay effective for years to come.

Emerging Display Technologies and Their Impact on Trading

Display technology keeps getting better. Ultra-wide monitors now offer enough screen space to potentially replace multiple standard monitors. The curved versions help reduce eye strain during long trading sessions, which can lead to sharper focus and better decisions. New 4K and 8K resolutions show incredibly detailed charts and data.

But not every new feature matters for trading. While gamers need high refresh rates, traders working with mostly static data won't see much benefit. It's important to focus on upgrades that actually improve your trading, rather than just adding complexity. Some traders are moving to large 4K Smart OLED TVs with G-Sync and FreeSync, like LG's 65", 77", and 83" C1 Class models. These big, high-res screens can replace multiple smaller monitors while providing smooth performance. Read more about this trend: Raging Bull.

Building a Scalable and Adaptable Setup

To keep your setup current, focus on flexibility. Choose monitors with DisplayPort and HDMI 2.1 connections that support high resolutions. Pick VESA mount-compatible monitors and adjustable monitor arms so you can easily change your layout as needed. Being able to modify your setup helps you stay competitive as trading technology evolves.

Preparing for the Future of Trading Technology

Trading is becoming more dependent on AI-powered tools and automation. Make sure your setup has enough processing power and network speed to run demanding applications smoothly. Don't forget about comfort - proper desk height, chair support, and clean cable management become crucial when you spend long hours trading. Planning for these needs helps create a workspace that will support your success over time.

Essential Software Tools for Multi-Monitor Success

A successful multi-monitor trading setup requires both reliable hardware and thoughtfully chosen software. The right combination of tools for managing screens, analyzing charts, and optimizing your trading platform across displays can make a major difference in your trading performance.

Mastering Screen Management

Proper control of multiple displays is crucial for trading efficiently. Window management software like DisplayFusion or UltraMon helps you take command of window placement, create custom layouts for different trading activities, and extend your taskbar across monitors. This gives you the control needed to keep your workspace clean and organized. You can save preferred window positions for your charting platform, news feeds, and order entry software so everything snaps into place when you start trading.

Consider using virtual desktop tools like VirtuaWin or the built-in virtual desktop features in Windows and macOS. These let you group related windows on separate virtual desktops, reducing clutter across your physical screens. You can quickly switch between desktops focused on specific tasks like technical analysis or market research.

Chart Analysis Software for Multi-Monitor Setups

Your charting platform serves as your window into market activity. Popular platforms like TradingView and NinjaTrader support multiple monitors, allowing you to spread charts across screens to compare timeframes and track multiple assets. This broader view helps spot patterns that may be missed on a single display. For instance, viewing daily, weekly and monthly charts side-by-side provides deeper insight into price action. You might be interested in: 10 Best Day Trading Indicators: A Complete Guide to Profitable Trading.

Look for features like custom layouts, drawing tools, and indicator libraries to adapt the software to your strategy. Being able to save and load different chart configurations adds flexibility. Also consider specialized charting platforms designed for specific markets or trading approaches.

Optimizing Your Trading Platform

Your trading platform is central to your setup. Choose one built for multi-monitor use with features like detachable windows for orders, watchlists, and portfolio tracking. Having dedicated screen space for key trading information keeps your workflow smooth without cluttering your main chart view.

Explore tools that expand your platform's capabilities. Order management systems can integrate with your platform for advanced order handling. Alert systems can be configured to notify you across screens when market conditions match your criteria, helping you act quickly on opportunities and manage risk.

By carefully selecting and setting up your software tools, you can transform multiple monitors into a unified trading command center. This integration between hardware and software equips you to make faster, more informed decisions in fast-moving markets.

Maintaining Peak Performance: Troubleshooting and Best Practices

A multiple monitor trading setup can give traders major advantages, but it also comes with technical complexities. Keeping your setup running smoothly is essential, especially during key market hours. Regular maintenance and quick problem-solving help prevent disruptions that could impact your trades.

Troubleshooting Common Technical Issues

Multi-monitor setups sometimes face issues like screen flickering, resolution problems, or lost signals. These can happen due to bad cables, old graphics drivers, or hardware that doesn't work well together. Using different types of connections (like DisplayPort and HDMI) without proper setup can also cause display issues.

Here are key steps to fix common problems:

- Check Your Cables: Make sure cables are firmly connected to both monitors and computer. A loose cable is often the culprit. Try swapping cables to check if one is faulty.

- Update Graphics Drivers: Old or corrupted drivers often cause display problems. Keep drivers current for best compatibility.

- Check Display Settings: Review your system's monitor settings. Make sure each screen has the right resolution and refresh rate. Testing different settings may fix display issues.

Best Practices for System Optimization

Good maintenance keeps your multi-monitor setup running well. Focus on system performance, regular backups, and preventive care.

Here's how to keep your system running smoothly:

- Clear Unused Programs: Background apps can slow down your trading platform. Close programs you aren't using to free up resources.

- Restart Regularly: Rebooting your computer clears temp files and resets processes. This helps prevent slowdowns over time.

- Watch System Stats: Use tools to check CPU, memory, and disk usage. This helps catch problems before they affect your trading.

Backup and Disaster Recovery

Losing trading data can be costly. Set up solid backup plans to protect your data and settings. Back up key files to external drives or cloud storage regularly. Also consider making system images so you can quickly restore everything if needed.

Preventive Maintenance for Long-Term Reliability

Like maintaining a car, regular care keeps your trading setup performing its best.

- Clean Often: Dust can cause overheating and hardware problems. Regular cleaning prevents these issues.

- Organize Cables: Keep cables tidy to prevent damage. Good cable management also helps air flow, reducing heat buildup.

- Update Software: Keep your OS, trading platform, and other programs current. This improves security and prevents software conflicts.

Follow these tips to keep your multi-monitor trading setup reliable and efficient, with minimal downtime. Check out ChartsWatcher for a professional-grade platform built for multi-screen trading setups.