Top Stock Screener with Alerts for Smarter Trading

Elevate Your Trading with Smart Alerts

Stop wasting time manually tracking market fluctuations. This list of the top 7 stock screeners with alerts will help you seize opportunities and mitigate risks more effectively. Whether you're a day trader or long-term investor, finding the right stock screener with alerts is crucial for success. We've compiled the best tools for 2025, including ChartsWatcher, Finviz, TradingView, Stock Rover, Zacks Investment Research, Thinkorswim, and Yahoo Finance, to help you pinpoint winning stocks. Discover the perfect platform to refine your investment strategies and maximize returns.

1. ChartsWatcher: A Powerful Stock Screener with Alerts for the Discerning Trader

ChartsWatcher stands out as a premium stock screener with alerts, designed to empower professional traders, market analysts, and financial institutions with a distinct advantage in today's dynamic markets. Developed in Germany, this sophisticated platform goes beyond basic stock screening, offering a comprehensive suite of tools to analyze real-time market data, implement complex trading strategies, and make informed decisions with precision. Unlike simpler stock screeners that focus solely on identifying stocks meeting specific criteria, ChartsWatcher provides a customizable, multi-faceted approach to market analysis. It's ideal for those who need a robust solution for day trading, in-depth market analysis, and staying ahead of rapid market fluctuations.

One of ChartsWatcher's most compelling features is its highly customizable dashboard system. Traders can create multiple screens, each incorporating up to eight different window types: alerts, top lists, charts, news feeds, watchlists, clocks, and detailed stock or currency data. These windows can be arranged and resized to suit individual preferences, creating a truly personalized trading environment. Critically, these screen configurations synchronize across all elements. This means that adjusting a filter in one window instantly updates the data displayed across all other linked windows, providing a cohesive and dynamic view of the market. This synchronization is particularly useful for complex trading strategies involving multiple indicators and data points.

ChartsWatcher’s extensive library of alerts and filters sets it apart from many stock screeners with alerts. Users can define highly specific criteria based on technical indicators, price movements, volume changes, and more. These alerts can be customized to trigger notifications via pop-ups, sounds, or emails, ensuring traders never miss a critical market event. This granular control over alerts allows for the precise monitoring of stocks and currencies across various timeframes, from short-term intraday movements to long-term trends. For instance, a day trader could set up alerts for specific price breakouts on a five-minute chart, while a long-term investor might configure alerts based on moving averages on a daily or weekly chart.

Furthermore, ChartsWatcher integrates backtesting capabilities, enabling traders to test their strategies against historical market data. This feature significantly enhances risk management by allowing users to evaluate the potential performance of their strategies before deploying them in live trading scenarios. By simulating past market conditions, traders can refine their approach, optimize parameters, and gain confidence in their decision-making. This level of backtesting functionality is often absent in simpler stock screeners, making ChartsWatcher a valuable tool for serious traders.

The platform offers flexible subscription tiers to accommodate different needs and budgets. A robust free plan provides access to core features, making advanced scanning tools accessible to a wider audience. The Pro Plan, priced at $74.99/month when billed annually, unlocks unlimited config exports, extensive backtesting capabilities, and other premium features. While the pricing might seem steep compared to some basic stock screeners, the comprehensive functionality and depth of analysis offered justify the investment for professional traders. However, potential users should be aware of potential additional VAT charges depending on their country, which could impact the overall cost.

In terms of implementation, ChartsWatcher is designed for ease of use. The import/export functionality allows seamless sharing of configurations between users or across different devices. The availability of both light and dark themes enhances user comfort during extended trading sessions. While no specific technical requirements are published on the site, a modern computer with a stable internet connection is recommended to leverage the real-time capabilities of the platform.

Compared to free or more basic stock screeners, ChartsWatcher provides a significantly more powerful and customizable experience. While platforms like TradingView offer some similar charting and alert features, ChartsWatcher's focus on synchronized dashboards, advanced filtering, and in-depth backtesting caters specifically to professional traders requiring a higher level of control and analysis.

In summary, ChartsWatcher justifies its position in this list as a top-tier stock screener with alerts by offering a unique combination of customizable dashboards, powerful filtering, and robust backtesting. Its flexible pricing plans, user-friendly interface, and focus on real-time analysis make it a valuable tool for anyone serious about succeeding in today's complex and fast-paced financial markets. Visit https://chartswatcher.com to explore the platform and discover how it can elevate your trading strategy.

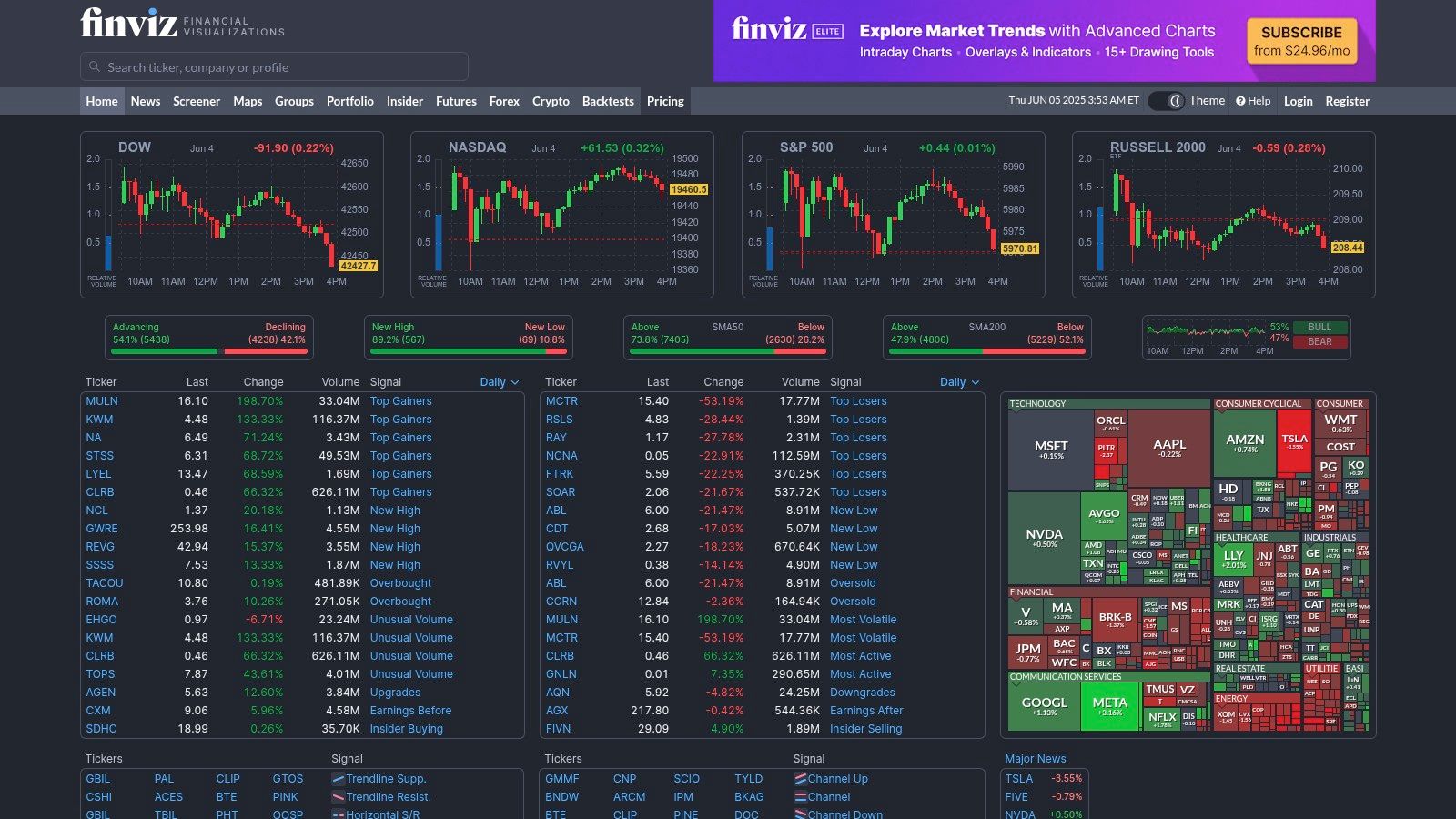

2. Finviz

Finviz stands out as one of the most popular stock screeners available, offering a compelling blend of comprehensive screening capabilities and real-time alerts. This robust platform caters to both novice and seasoned investors, providing an intuitive interface packed with powerful filtering options, visual heat maps, and customizable alerts to help pinpoint trading opportunities. Whether you're a day trader seeking quick market insights or a long-term investor building a portfolio, Finviz offers a suite of tools designed to streamline your investment research. Its ability to combine fundamental and technical analysis with real-time data makes it a valuable asset for anyone navigating the complexities of the stock market. The availability of a free version, alongside a more advanced Elite subscription, further enhances its accessibility and appeal to a wide range of users. This positions Finviz as a must-have tool for identifying potential investments that align with individual trading strategies and risk tolerances.

One of the key strengths of Finviz lies in its comprehensive stock screening capabilities. With over 70 fundamental and technical filters, users can fine-tune their searches based on a wide array of criteria, including market capitalization, price-to-earnings ratio, dividend yield, trading volume, technical indicators, and much more. This granular control allows for highly specific screening, enabling investors to identify stocks that precisely match their investment strategies. For example, a day trader might use Finviz to screen for stocks with high relative volume and unusual price movements, while a long-term investor might focus on companies with strong fundamentals and consistent dividend growth. The platform's interactive stock charts, complete with technical indicators, further empower users to perform in-depth technical analysis directly within the platform, saving time and streamlining the research process. Furthermore, Finviz’s visual heat maps provide a quick and intuitive overview of market sector performance, allowing traders to identify trending sectors and potential investment opportunities at a glance. Learn more about Finviz and how it can be integrated into your investment strategy.

The real-time alert functionality is a standout feature for active traders. By setting up custom alerts based on specific screening criteria, users can receive instant notifications via email when a stock meets their predefined conditions. This allows for timely entries and exits, maximizing profit potential and minimizing risk. For example, a trader could set an alert to be notified when a stock’s price breaks through a key resistance level, signaling a potential buying opportunity. The free version offers email alerts based on custom screener criteria, though with 15-minute delayed data. The Elite version, however, unlocks real-time data and more advanced alert features, offering a significant advantage for traders who require up-to-the-second information.

Finviz also offers portfolio tracking and watchlist management tools, enabling users to monitor their investments and keep track of potential trading opportunities. This consolidated view of holdings and watchlists helps investors stay organized and make informed decisions based on real-time data and market trends. The platform's user-friendly interface makes it easy to navigate these features, even for those new to stock screening.

While the free version of Finviz offers a remarkable range of features, it's important to note the limitations. The 15-minute delayed data in the free version may not be suitable for all traders, particularly those engaged in day trading or other short-term strategies. The customization options for alerts are also limited in the free version. For access to real-time data and advanced alert functionalities, a subscription to Finviz Elite is required, priced at $24.96/month.

Compared to other similar tools, Finviz stands out for its intuitive interface, comprehensive screening capabilities, and robust charting tools, all packaged in a user-friendly platform. While some competitors may offer specific features not found in Finviz, the overall balance of functionality, usability, and affordability makes Finviz a compelling choice for a wide range of investors. If you are seeking a powerful and versatile stock screener with alerts, Finviz is undoubtedly a platform worth exploring. You can visit their website at https://finviz.com.

3. TradingView

TradingView stands out as a premier platform for traders seeking a robust stock screener with alerts, seamlessly blending powerful charting, screening, and social trading features. Its advanced alert system, coupled with customizable technical indicators and Pine Script integration, caters to both seasoned professionals and aspiring traders. This comprehensive platform allows users to scan for specific stock criteria, set real-time alerts based on those criteria, and analyze potential investment opportunities. Whether you're a day trader looking for quick price movements or a long-term investor monitoring fundamental indicators, TradingView’s sophisticated tools make it a worthy contender in the realm of stock screeners with alerts.

For those searching for a stock screener with alerts, TradingView's capabilities are truly impressive. The platform provides a highly customizable alert system that can be triggered by a multitude of conditions. Users can set alerts based on simple price movements, like a stock crossing a specific price threshold, or delve into complex technical indicators such as moving averages, Relative Strength Index (RSI), and Bollinger Bands. This flexibility allows for a tailored approach to monitoring the market and seizing opportune moments. Furthermore, the ability to create alerts using Pine Script, TradingView’s proprietary scripting language, opens up a world of possibilities for experienced traders who want to implement highly specific and complex alert criteria based on their unique trading strategies.

One of the most significant advantages of TradingView for stock screening and alerts is the seamless integration with its charting tools. The platform offers professional-grade charting with over 100 built-in technical indicators. This tight integration means traders can visually analyze price action, apply indicators, and set alerts all within the same interface. For instance, you could be analyzing a stock chart, identify a potential breakout pattern forming, and instantly set an alert to notify you when the breakout occurs, streamlining your workflow and minimizing missed opportunities.

Beyond the technical aspects, TradingView thrives as a social trading platform. This presents a unique advantage for users looking for stock screeners with alerts. The vibrant community allows for sharing trading ideas, discussing market trends, and learning from other traders' experiences. Access to published scripts and ideas provides valuable insight and can save users time and effort in developing their own strategies. This collaborative environment is particularly beneficial for beginners navigating the complexities of stock screening and alert setup.

TradingView supports multi-asset screening, catering to traders interested in stocks, forex, and cryptocurrency. This versatility makes it a one-stop shop for traders managing diverse portfolios. Whether you’re tracking the S&P 500, monitoring currency pairs, or following Bitcoin's volatility, TradingView provides the tools to screen and set alerts across various asset classes.

However, TradingView is not without its drawbacks. One of the primary challenges is the learning curve associated with its advanced features, especially for those new to technical analysis or Pine Script. While basic alert setup is relatively straightforward, mastering the intricacies of custom scripting and advanced charting tools requires time and dedication. Furthermore, the free plan limits users to only one active alert, making it restrictive for serious traders. The premium plans, ranging from $14.95 to $59.95 per month, unlock more alerts, indicators, and features. While these features enhance the platform's functionality, the cost can be a barrier for some.

For professional traders, stock market analysts, and financial institutions, TradingView's comprehensive features and sophisticated tools often justify the premium subscription cost. The platform’s depth makes it suitable for advanced charting, complex screening, and automated alert strategies. Independent investors and stock trading educators will also find value in the platform’s educational resources and community insights. However, for those just starting with stock screening and alerts, the platform's complexity can feel overwhelming. It's essential to weigh the pros and cons and consider your specific needs and experience level before committing to a paid subscription.

To get started with TradingView, simply visit their website (https://tradingview.com) and create an account. The platform is accessible via web browser, mobile app, and desktop application, providing flexibility for users to access their alerts and charts on the go. While the free plan offers a limited taste of TradingView's capabilities, exploring the platform's extensive documentation and community resources can significantly enhance your understanding and utilization of its features, maximizing its potential as a powerful stock screener with alerts.

4. Stock Rover

Stock Rover is a powerful, comprehensive investment research platform that goes beyond a basic stock screener with alerts. It combines robust screening capabilities with in-depth portfolio analysis and fundamental research tools, making it an attractive option for serious investors. While it caters to a range of experience levels, its extensive feature set and analytical depth are particularly well-suited for professional traders, stock market analysts, financial institutions, and independent investors seeking a competitive edge. If you’re looking for a stock screener with alerts that can also help you manage and analyze your entire investment portfolio, Stock Rover is a compelling contender.

Stock Rover’s stock screener with alerts functionality is built on a foundation of over 650+ metrics, covering both fundamental and technical analysis. This breadth allows users to create highly specific screens tailored to their individual investment strategies. Want to find undervalued small-cap companies with high growth potential? Stock Rover allows you to screen based on factors like price-to-earnings ratio, earnings growth rate, market capitalization, and hundreds of other data points. Real-time price alerts and condition-based alerts, such as changes in analyst ratings or earnings revisions, ensure you're immediately notified of market-moving events. This empowers you to react swiftly to opportunities and manage risk effectively.

Beyond simply screening for stocks, Stock Rover excels in portfolio analysis and performance tracking. You can easily import your portfolio and track its performance against various benchmarks. The platform provides in-depth analysis of your holdings, including asset allocation, sector exposure, and dividend income. This comprehensive overview can help you identify strengths and weaknesses in your portfolio and make more informed investment decisions. Combined with the stock screener with alerts, this creates a powerful synergy, allowing you to identify new investment opportunities that align with your portfolio strategy and receive timely notifications of potential buy or sell signals.

Stock Rover truly differentiates itself through its extensive fundamental analysis capabilities. The platform provides access to detailed financial statements, key ratios, and analyst estimates, giving you the tools to perform a thorough due diligence process. This is invaluable for investors who prioritize fundamental analysis and want to understand the underlying financial health and prospects of a company. For example, you can use Stock Rover to analyze a company’s cash flow statement, assess its debt levels, and compare its profitability metrics to industry peers. This depth of information goes far beyond what you’ll find in many other stock screeners with alerts.

While Stock Rover's comprehensive features are a significant advantage, the interface can feel overwhelming for beginners. Navigating the multitude of data points and research tools requires a learning curve. However, Stock Rover provides extensive documentation and tutorials to help new users get up to speed. Additionally, the platform offers a good free version with useful screening tools, allowing users to explore the platform’s capabilities before committing to a paid subscription.

Stock Rover’s pricing ranges from $7.99 to $27.99 per month, depending on the chosen plan. The free version offers a limited set of features, including basic screening and portfolio tracking, but restricts access to real-time data and some advanced analytical tools. The premium plans unlock the full power of the platform, including real-time data, advanced charting, and more comprehensive fundamental data. While the premium features come at a cost, the depth of research and analysis available justifies the price for serious investors. It's worth noting that Stock Rover is primarily focused on US markets, which might be a limitation for investors interested in international stocks.

For those seeking a powerful stock screener with alerts integrated into a robust investment research platform, Stock Rover is a compelling choice. Its extensive features, particularly its focus on fundamental analysis and portfolio management, make it stand out from the crowd. While the interface can be initially challenging and the premium features require a subscription, the depth of insights and analytical power Stock Rover provides makes it a valuable tool for both professional and individual investors. You can explore its features and capabilities further by visiting their website at https://stockrover.com.

5. Zacks Investment Research

Zacks Investment Research stands out as a powerful stock screener with alerts, particularly for investors who prioritize fundamental analysis and earnings-driven strategies. Its proprietary Zacks Rank system, coupled with its focus on earnings estimate revisions, provides a unique approach to stock selection. This makes it a valuable tool for professional traders, stock market analysts, financial institutions, and independent investors seeking an edge in the market. Zacks' strength lies in identifying potential investment opportunities based on the projected earnings growth of companies, offering a distinct perspective compared to screeners that primarily focus on technical indicators. For those interested in a stock screener with alerts specifically geared towards fundamental analysis, Zacks deserves serious consideration.

A key feature of Zacks is its robust stock screener with alerts that allows users to filter stocks based on a wide range of fundamental criteria, including earnings growth, valuation metrics, and the Zacks Rank. The platform's alert functionality ensures users are immediately notified of important changes, such as earnings estimate revisions and Zacks Rank changes. This real-time information empowers investors to react quickly to market-moving events and adjust their portfolios accordingly. For example, a trader looking for momentum stocks could set up alerts for positive earnings revisions, potentially signaling an upcoming price surge. Similarly, a long-term investor might use the screener to find undervalued companies with a strong Zacks Rank, indicating potential for future growth.

The Zacks Rank itself is a cornerstone of the platform. Ranging from #1 (Strong Buy) to #5 (Strong Sell), it reflects the consensus of analyst earnings estimate revisions for a particular stock. A higher Zacks Rank suggests a greater likelihood of positive earnings surprises and potential price appreciation. Zacks boasts a strong track record in earnings prediction, adding further weight to its ranking system. This makes the Zacks Rank a valuable input for both short-term trading strategies and long-term investment decisions. Stock trading educators can also leverage the Zacks platform and its educational resources to demonstrate the practical application of fundamental analysis and earnings-based investing to their students.

While Zacks excels in fundamental analysis, it offers limited technical analysis capabilities. This might be a drawback for traders who rely heavily on technical indicators and charting tools. Platforms like TradingView or Finviz, while not as strong on the fundamental analysis side, offer a wider array of technical analysis tools and might be a better fit for technically-inclined traders. However, for fundamentally-focused investors, Zacks’ research reports and industry/sector analysis tools offer valuable insights that complement its screening and alert features. These reports provide in-depth analysis of companies, industries, and market trends, helping investors make more informed investment decisions.

The cost of accessing Zacks premium features is a significant factor to consider. Subscription prices range from $249 to $2995 per year, depending on the chosen plan. While the basic screener functionality might be sufficient for some users, the more advanced features, including real-time alerts and detailed research reports, require a premium subscription. Compared to free or lower-cost stock screeners with alerts, Zacks represents a significant investment. However, for serious investors who value its unique earnings-focused approach and proven methodology, the cost might be justified.

In terms of technical requirements, Zacks is a web-based platform accessible from any device with an internet connection. There are no specific software downloads or installations required. While the platform’s interface has been criticized for appearing dated compared to some competitors, it remains functional and provides access to the platform's powerful features.

Setting up alerts within Zacks is straightforward. Users can define their desired criteria within the stock screener and then set up email or platform notifications for changes related to those criteria. For instance, a user could set up an alert to be notified when a stock's Zacks Rank improves from #3 (Hold) to #2 (Buy), signaling a potential buying opportunity. This proactive approach to monitoring investments helps users stay informed and react quickly to changes in the market.

In conclusion, Zacks Investment Research is a specialized stock screener with alerts that caters to investors who prioritize fundamental analysis and earnings-driven strategies. Its unique Zacks Rank system, combined with its comprehensive earnings data and research reports, offers a valuable resource for identifying potential investment opportunities. While the platform's limited technical analysis tools and premium pricing might be drawbacks for some, its strengths in fundamental analysis and proven track record in earnings prediction make it a worthy consideration for serious investors and a powerful addition to any investor's toolkit. The platform is easily accessible through its website, https://zacks.com.

6. Thinkorswim by TD Ameritrade

Thinkorswim, now under the Charles Schwab umbrella, stands out as a powerful stock screener with alerts designed for serious traders and investors. It offers a robust suite of features that go beyond basic screening, providing a comprehensive platform for analyzing, identifying, and acting on market opportunities. This makes it a top contender for anyone looking for a professional-grade stock screener with integrated alerting capabilities. If you're actively involved in the market and need a platform that can keep pace with your demands, Thinkorswim is a strong contender. Its tight integration with the TD Ameritrade/Schwab trading platform makes it particularly appealing for those seeking a seamless transition from analysis to execution.

Thinkorswim distinguishes itself through its advanced filtering system. While many stock screeners with alerts offer basic fundamental and technical filters, Thinkorswim provides a granular level of control. You can screen based on a vast array of criteria, including traditional metrics like price-to-earnings ratios, moving averages, and volume, as well as more specialized indicators like implied volatility and options-related data. This level of customization is invaluable for experienced traders seeking specific market conditions. For instance, you could create a scan that identifies stocks with a relative strength index (RSI) above 70, a MACD crossover, and a minimum average daily volume, helping you pinpoint potential momentum plays.

A key advantage of Thinkorswim lies in its real-time scanning and alert system. You receive instant notifications when stocks meet your predefined criteria, ensuring you don’t miss critical trading opportunities. Unlike some platforms that offer delayed data for alerts, Thinkorswim leverages real-time information, crucial for fast-moving markets. This real-time functionality extends to the platform's charting capabilities, which are seamlessly integrated with the stock screener. You can quickly switch between screening, charting, and order entry, streamlining your entire trading workflow. The platform also allows backtesting of your screening strategies, providing a valuable tool for refining your approach.

One of the most powerful features of Thinkorswim is its thinkScript capability. This proprietary scripting language allows users to create custom studies and alerts tailored to their specific trading strategies. For example, you can create an alert that triggers when a stock’s price breaks through a specific moving average or when a custom indicator reaches a defined threshold. This level of customization is rarely found in other stock screeners with alerts and provides a significant edge for sophisticated traders. While learning thinkScript requires some initial investment, the potential payoff in terms of customized alerts and analysis is significant. This feature elevates Thinkorswim from a simple stock screener to a powerful trading platform that can be adapted to individual needs.

Thinkorswim is available free of charge to TD Ameritrade/Schwab account holders. There are no separate subscription fees for the platform itself, though real-time data feeds for certain exchanges may incur additional costs. Technical requirements are relatively modest; the platform runs on Windows, macOS, and Linux, and there are also mobile apps available for iOS and Android.

While Thinkorswim offers exceptional functionality, it's important to acknowledge its drawbacks. The platform's sheer depth of features can be overwhelming for beginners, and there's a steep learning curve involved in mastering its advanced tools. The interface, while powerful, can feel cluttered and complex, particularly for those accustomed to simpler platforms. Additionally, the software is resource-intensive and may require a reasonably powerful computer for optimal performance. Compared to more user-friendly platforms like TradingView or Finviz, which cater to a broader audience, Thinkorswim is clearly geared toward experienced traders willing to invest time in learning its intricacies.

For those seeking a professional-grade stock screener with alerts, Thinkorswim is a powerful solution. Its advanced features, real-time capabilities, and seamless integration with the TD Ameritrade/Schwab trading platform make it a valuable tool for active traders. However, its complexity and steep learning curve may be a deterrent for beginners. If you are looking for a powerful and customizable stock screener with alerts and are willing to invest the time to master it, then Thinkorswim (https://thinkorswim.com) is well worth exploring.

7. Yahoo Finance

Yahoo Finance holds a prominent position as a widely-used platform offering a free stock screener with integrated alert capabilities. This makes it a particularly attractive option for investors of all levels, from beginners just dipping their toes into stock screening to casual investors looking for a straightforward tool. While it might not boast the advanced features found in premium, subscription-based platforms, Yahoo Finance provides a robust suite of essential screening tools and price alerts, more than sufficient for many investors. Its accessibility and integration with other financial news and data on the platform make it a one-stop shop for many market participants.

One of Yahoo Finance's most significant advantages is its completely free access. No subscription is required to utilize the stock screener or set up alerts, making it an ideal starting point for those exploring stock screening strategies. The platform's user-friendly interface contributes to its accessibility, allowing even novice investors to navigate the tools with relative ease. You can screen based on fundamental metrics like market capitalization, P/E ratio, dividend yield, and more. This allows you to quickly filter down the vast universe of stocks to a manageable list that meets your specific investment criteria.

Once you've identified potential investments through the screener, Yahoo Finance’s alert functionality becomes invaluable. You can set up basic price alerts to be notified when a stock reaches a specific price target, helping you capitalize on buying or selling opportunities. Percentage change alerts provide notifications when a stock’s price fluctuates by a predefined percentage, enabling you to react swiftly to market movements. You can also set alerts for specific news events and upcoming earnings announcements related to your portfolio holdings. This feature helps you stay informed and make timely investment decisions based on the latest developments. Learn more about Yahoo Finance to understand its broader applications.

For investors managing portfolios, Yahoo Finance offers tracking tools with integrated alert notifications. This feature allows you to monitor your investments closely and receive alerts on significant price changes or news events related to the stocks you own. This real-time information helps you manage your portfolio proactively and make informed decisions about buying, selling, or holding.

Compared to more specialized stock screeners with alerts, Yahoo Finance’s alert options are relatively basic. It lacks advanced features like technical analysis alerts based on indicators like moving averages, RSI, or MACD, which are often crucial for active traders and technical analysts. For instance, a trader looking for alerts based on candlestick patterns or Fibonacci retracements will need to consider a more advanced platform. Similarly, the lack of real-time data for some international markets might be a drawback for investors focused on global equities. Delays in data can hinder split-second trading decisions, making it less suitable for day traders focused on rapidly changing markets.

However, the simplicity of Yahoo Finance's system is also its strength. For many investors, particularly those focused on long-term strategies and fundamental analysis, the basic alert options are perfectly adequate. The integration with Yahoo's extensive financial news platform offers a significant advantage. Users have access to a wealth of market information, news, and analysis, all within the same platform. This provides valuable context and insights that can inform investment decisions, all without the need to switch between different applications or websites. The availability of a mobile app with push notifications further enhances its usability, enabling investors to stay connected to the markets and receive timely alerts even when they are on the go.

In conclusion, Yahoo Finance's free stock screener with alerts occupies a valuable niche in the market. Its simplicity, accessibility, and integration with broader financial news make it an excellent tool for beginners and casual investors. While it might not have the advanced features of paid alternatives, it offers reliable basic functionality that meets the needs of many. For professionals requiring real-time data, technical analysis alerts, or backtesting capabilities, more specialized platforms might be a better fit. However, for those looking for a user-friendly and free tool for basic stock screening and alerts, Yahoo Finance stands out as a compelling option.

Stock Screener Alerts Feature Comparison

| Platform | Core Features & Customization | User Experience & Quality | Value & Pricing | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| 🏆 ChartsWatcher | 8 window types, multi-screen sync, backtesting | Highly customizable ★★★★☆ | Free to Pro $74.99/mo 💰 | Pro traders, analysts, institutions 👥 | Advanced filters, import/export, light/dark themes ✨ |

| Finviz | 70+ filters, heat maps, alerts | User-friendly ★★★☆☆ | Free; Elite $24.96/mo 💰 | Beginners to pros 👥 | Visual heat maps, fast alerts ✨ |

| TradingView | Pine Script alerts, social trading, multi-asset | Excellent charts ★★★★☆ | Free-$59.95/mo 💰 | Retail & professional traders 👥 | Custom script alerts, strong community ✨ |

| Stock Rover | 650+ metrics, portfolio analysis | Professional tools ★★★★☆ | Free; $7.99-$27.99/mo 💰 | Fundamental analysts & investors 👥 | Deep fundamental data & ratios ✨ |

| Zacks Investment Research | Earnings alerts, Zacks Rank system | Focused research ★★★☆☆ | $249-$2995/yr 💰 | Earnings-driven investors 👥 | Proprietary earnings models ✨ |

| Thinkorswim by TD Ameritrade | Real-time scanning, thinkScript alerts | Professional-grade ★★★★☆ | Included with brokerage 👥 | Active traders & investors 👥 | Full trading integration, paper trading ✨ |

| Yahoo Finance | Basic alerts, portfolio tracking | Simple & reliable ★★★☆☆ | Free 💰 | Casual & beginner investors 👥 | No subscription, solid news integration ✨ |

Maximize Your Returns with the Right Stock Screener

Finding the perfect stock screener with alerts can significantly impact your trading performance. We've explored several leading platforms, from established names like Yahoo Finance and TradingView to robust tools like Stock Rover and Zacks Investment Research, and specialized options like Thinkorswim and Finviz. Each offers unique features, catering to different trading styles and experience levels. Remember the key takeaways: consider your individual needs – whether you're a day trader, long-term investor, or somewhere in between – and prioritize features that align with your strategy. Think about factors such as real-time data feeds, customizable alert parameters, backtesting capabilities, and of course, your budget.

Effective communication is also crucial for success in the financial world. As you analyze market trends and share your insights, creating engaging video content can be invaluable. Consider leveraging tools like text to video AI to streamline your workflow and boost your reach. Transforming your strategy with text to video, as suggested by revid.ai, can make a significant difference in how your message resonates with your audience.

Choosing the right stock screener with alerts empowers you to identify opportunities, manage risk, and ultimately, achieve your financial goals. In the fast-paced world of finance, staying informed is paramount. A powerful stock screener paired with timely alerts keeps you ahead of market movements. To further refine your screening and alerting process, consider exploring ChartsWatcher, a platform specifically designed for real-time market monitoring. Want to experience the power of advanced stock screening and alerts firsthand? Visit ChartsWatcher today and elevate your trading strategy to the next level.