Top Stock Backtesting Software for 2025 | Test Your Strategies

In the high-stakes world of stock trading, a winning strategy is your most valuable asset. But how can you be certain that your brilliant idea will actually perform in the unpredictable live market without risking real capital? The answer is rigorous historical analysis, a process made possible by powerful stock backtesting software. Simulating your trading concepts against historical data allows you to validate their effectiveness, uncover hidden flaws, and systematically refine your approach for optimal, repeatable performance. This process transforms trading from a game of guesswork into a data-driven discipline.

This guide is your comprehensive resource for navigating the diverse landscape of backtesting tools. We will dive deep into the 12 best platforms available today, from user-friendly, no-code solutions like TrendSpider and Trade Ideas to sophisticated, code-based frameworks such as QuantConnect and Backtrader. Each review is designed to give you a clear, practical understanding of the software's capabilities.

We cut through the marketing noise to deliver what truly matters:

- Honest analysis of core features, pricing, and limitations.

- Practical use cases to match the right tool to your trading style.

- Direct comparisons to help you make an informed decision.

Every entry includes detailed screenshots and direct links to get you started quickly. Whether you are a discretionary day trader, a quantitative analyst, or a long-term investor, this list will provide the insights needed to select the best stock backtesting software to build, test, and deploy your strategies with confidence. You'll find the perfect tool to stop guessing and start making data-backed decisions.

1. ChartsWatcher

ChartsWatcher stands as a premier choice for traders demanding a powerful, all-in-one market analysis and strategy validation platform. Developed with German engineering precision, it excels by integrating robust stock scanning capabilities with accessible backtesting functionalities, making it a uniquely versatile tool for active traders and analysts. Its core strength lies in its profound customizability, allowing users to build a trading desktop tailored precisely to their workflow.

Unlike many platforms that specialize in only one area, ChartsWatcher provides a holistic trading environment. You can arrange up to eight distinct window types, including real-time toplists, advanced charts, and integrated newsfeeds, creating a comprehensive command center for market surveillance.

Key Feature Analysis: Backtesting & Strategy Building

What truly distinguishes ChartsWatcher as a top-tier stock backtesting software is how seamlessly it merges screening with strategy validation. Users can construct intricate alert conditions and filters based on a vast library of technical indicators and price action criteria. Once a promising setup is defined, you can immediately run a backtest to see how it would have performed.

Practical Application: Imagine you've developed a "gap and go" strategy for pre-market movers. With ChartsWatcher, you can build a screener to identify stocks gapping up on high volume, then instantly backtest the entry and exit rules against the previous 20 trading days of data to validate its historical profitability before risking capital.

The platform's backtesting engine provides clear performance metrics, enabling rapid iteration and refinement of your trading ideas. This tight feedback loop between idea generation, screening, and historical testing is a significant advantage for systematic traders looking to gain an edge.

User Experience and Customization

The user interface is exceptionally clean and supports both light and dark modes, reducing eye strain during long trading sessions. The ability to save, export, and import entire screen configurations is a standout feature for professionals managing multiple strategies or teams wanting to share standardized analytical layouts.

Pros:

- Deep Customization: Build a truly personal trading view with multiple screens and window configurations.

- Integrated Backtesting: Validate complex filter and alert strategies directly within the platform.

- Robust Alert System: Create sophisticated, multi-conditional alerts for real-time notifications.

- Flexible Pricing: A powerful free plan makes it accessible, with scalable paid tiers for advanced needs.

Cons:

- Paid Plan Limitations: Extended backtesting history and advanced features like configuration sharing require a Pro subscription.

- Potential Cost Increase: Monthly subscriptions and country-specific VAT can increase the overall price.

Website: https://chartswatcher.com

2. TrendSpider

TrendSpider is an AI-driven technical analysis platform designed for traders who want to leverage sophisticated tools without writing a single line of code. Its primary strength lies in automating the time-consuming aspects of charting, such as trendline and pattern recognition, allowing you to build and validate strategies visually. This makes it an exceptional piece of stock backtesting software for traders who prioritize speed and efficiency.

Unlike platforms that require programming skills, TrendSpider’s Strategy Tester uses a simple "if this, then that" logic builder. You can combine dozens of technical indicators, candlestick patterns, and price actions to define your entry and exit rules. The system then backtests your strategy against up to 50 years of historical data in seconds, providing a detailed performance report.

Key Features and Pricing

The platform stands out with its multi-timeframe analysis, which lets you view chart data from different timeframes simultaneously on a single chart, providing deeper context for your trades. Its automated backtesting is robust, though it's crucial to remember it assumes perfect execution, which can inflate performance metrics compared to real-world trading.

| Plan | Price (Billed Annually) | Key Backtesting Features |

|---|---|---|

| Premium | $27.40/month | 1-minute backtesting, 100 backtests per day, 50 alerts |

| Elite | $54.20/month | Second-by-second backtesting, unlimited backtests, 250 alerts |

Pros and Cons

- Pros:

- No-code strategy builder is highly accessible for non-programmers.

- AI-powered chart analysis automates trendline and pattern detection.

- Extensive educational content and a highly responsive development team.

- Cons:

- Backtests assume ideal execution without slippage or commissions.

- Limited support for backtesting complex options strategies or broad market indices.

Website: https://www.trendspider.com/

3. TradingView

TradingView has become a dominant force in the financial charting world, combining social networking with powerful analysis tools. While known for its exceptional charts, it also serves as a robust stock backtesting software for traders who are comfortable with scripting. Its primary backtesting engine is powered by Pine Script, a proprietary programming language designed to be relatively easy to learn for creating custom indicators and strategies.

Unlike no-code platforms, TradingView gives you complete control to build complex, nuanced trading strategies from the ground up. Once a strategy is coded in the Pine Editor, its Strategy Tester runs it against historical data, providing a detailed performance summary with metrics like net profit, drawdown, and win rate. For those who prefer a manual approach, the Bar Replay feature allows you to visually test your decision-making skills tick-by-tick on historical charts.

Key Features and Pricing

The platform's greatest strength is its massive, active community. You can access a public library containing thousands of community-built scripts and strategies, which you can use directly or modify for your own backtesting. This collaborative environment is invaluable for learning and idea generation. However, access to deeper historical data and more simultaneous chart layouts requires a paid subscription.

| Plan | Price (Billed Annually) | Key Backtesting Features |

|---|---|---|

| Essential | $12.95/month | 2 charts per layout, 20 active alerts, limited historical data |

| Plus | $24.95/month | 4 charts per layout, 100 active alerts, intraday bar replay |

| Premium | $49.95/month | 8 charts per layout, 400 active alerts, second-based intervals |

Pros and Cons

- Pros:

- Huge and active community with a vast library of public scripts.

- Pine Script offers deep customization for complex strategy development.

- Excellent charting interface and multi-asset support (stocks, crypto, forex).

- Cons:

- Requires coding knowledge in Pine Script for custom strategies.

- The free plan has significant limitations on historical data and backtesting capabilities.

Website: https://www.tradingview.com/

4. Trade Ideas

Trade Ideas is an AI-powered market intelligence platform renowned for its real-time trade signals and sophisticated scanning capabilities. While primarily known as a scanner, it also offers a powerful backtesting module called the "OddsMaker," which allows users to test strategies without writing any code. This makes it a unique piece of stock backtesting software that bridges the gap between idea generation and performance validation.

The platform's strength is its event-based backtesting engine. Instead of just testing indicator crossovers, you can build strategies around specific market events, alerts, and filters from its real-time scanner. Once you define your entry and exit rules using a simple point-and-click interface, the OddsMaker crunches historical data to provide a detailed report on the strategy's viability, including its win rate, profit factor, and expected drawdown.

Key Features and Pricing

Trade Ideas stands out with its AI, "Holly," which presents statistically-backed trading ideas each day. A key feature is the ability to directly automate successful backtested strategies through its Brokerage Plus module, which connects to accounts like Interactive Brokers. This seamless integration from testing to live execution is a major advantage for serious traders.

| Plan | Price (Billed Annually) | Key Backtesting Features |

|---|---|---|

| Standard | $84/month | No backtesting tools, real-time streaming scanner |

| Premium | $167/month | OddsMaker backtesting, AI trade signals, automated trading |

Pros and Cons

- Pros:

- No coding required for building and testing complex strategies.

- Direct integration with brokerage accounts for automated trading.

- Extensive educational resources, including daily live support sessions.

- Cons:

- Backtesting tools are only available on the highest subscription tier.

- The subscription cost is significantly higher than many competitors.

Website: https://www.trade-ideas.com/

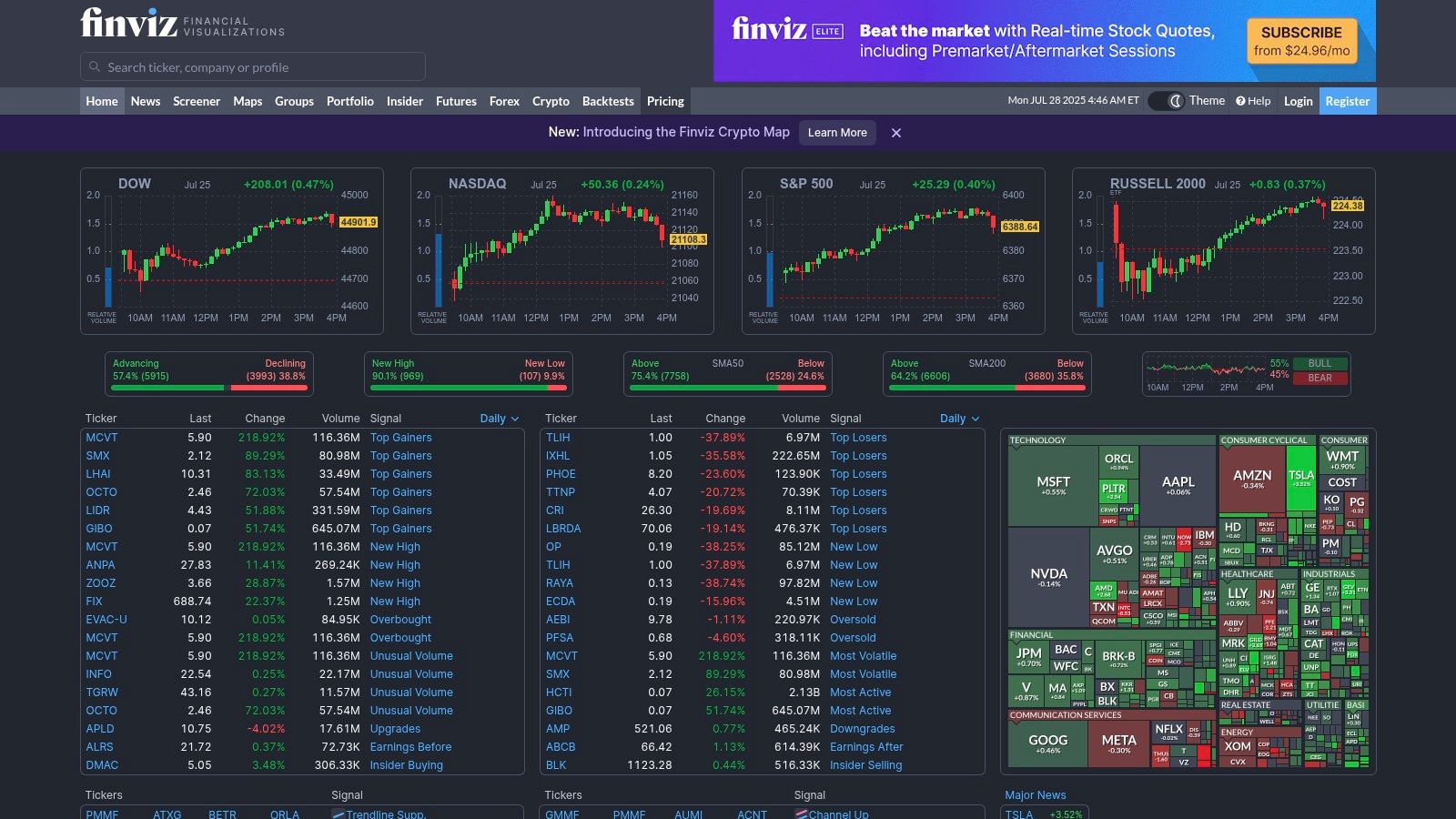

5. FinViz

FinViz is a powerful financial visualization platform renowned for its exceptional stock screener. While not a dedicated backtesting powerhouse, it offers a unique entry point for traders who want to combine robust screening with fundamental strategy validation. It excels at helping you identify potential trading opportunities from thousands of stocks using descriptive, technical, and fundamental criteria, making it a valuable precursor to more intensive stock backtesting software.

The platform’s backtesting feature allows users to test strategies based on a selection of technical indicators against historical data. You can define your entry and exit signals, specify your holding period, and run the test across the entire market or a pre-filtered list from its screener. This approach is ideal for quickly validating simple, indicator-driven ideas before committing them to a more advanced testing environment.

Key Features and Pricing

FinViz's primary strength is its screener, which includes over 70 filters. Its backtester is a supplementary tool, best used for high-level validation of technical signals. The Elite plan unlocks real-time data, advanced charting, and removes ads, providing a much smoother and more powerful user experience.

| Plan | Price | Key Backtesting Features |

|---|---|---|

| Free | $0/month | Delayed quotes, limited screener functionality, backtesting with ads. |

| Elite | $24.96/month (Billed Annually) | Real-time data, advanced charts, full screener access, ad-free backtesting. |

Pros and Cons

- Pros:

- One of the most powerful and intuitive stock screeners available.

- Extremely affordable for the amount of data and screening tools provided.

- Great for quickly validating simple technical indicator strategies across the market.

- Cons:

- Backtesting functionality is basic compared to dedicated platforms.

- Does not account for transaction costs, slippage, or other real-world factors.

Website: https://finviz.com/

6. Backtest Zone

Backtest Zone offers a refreshingly accessible and completely free approach to strategy testing, making it a standout choice for beginners or traders on a budget. The platform is entirely web-based and requires no coding, allowing users to build and test strategies using a straightforward, form-based interface. Its core strength lies in its simplicity and broad market access, supporting stocks, ETFs, and other assets across more than 70 global exchanges.

To create a strategy, you simply select your desired asset and define entry and exit conditions using its comprehensive library of technical indicators. Backtest Zone then runs the simulation and provides a clear performance report, including metrics like total return and win rate. This makes it an excellent piece of stock backtesting software for validating simple, indicator-driven ideas without any financial commitment or software installation.

Key Features and Pricing

The platform's main draw is its zero-cost model. All features, from the indicator library to the strategy tester, are available for free. While it lacks the sophisticated, multi-leg options analysis or deep quantitative tools of premium platforms, it provides more than enough functionality for new traders to learn the principles of backtesting and for experienced traders to run quick, preliminary checks on basic concepts.

| Plan | Price | Key Backtesting Features |

|---|---|---|

| Free | $0/month | No-code strategy builder, access to 70+ exchanges, full indicator library |

Pros and Cons

- Pros:

- Completely free to use, making it highly accessible.

- Simple, intuitive interface is ideal for beginners.

- Supports a wide range of global exchanges and multiple asset classes.

- Cons:

- Lacks advanced features like portfolio-level backtesting or detailed risk analysis.

- The platform may not be suitable for developing highly complex or nuanced trading strategies.

Website: https://backtest.zone/

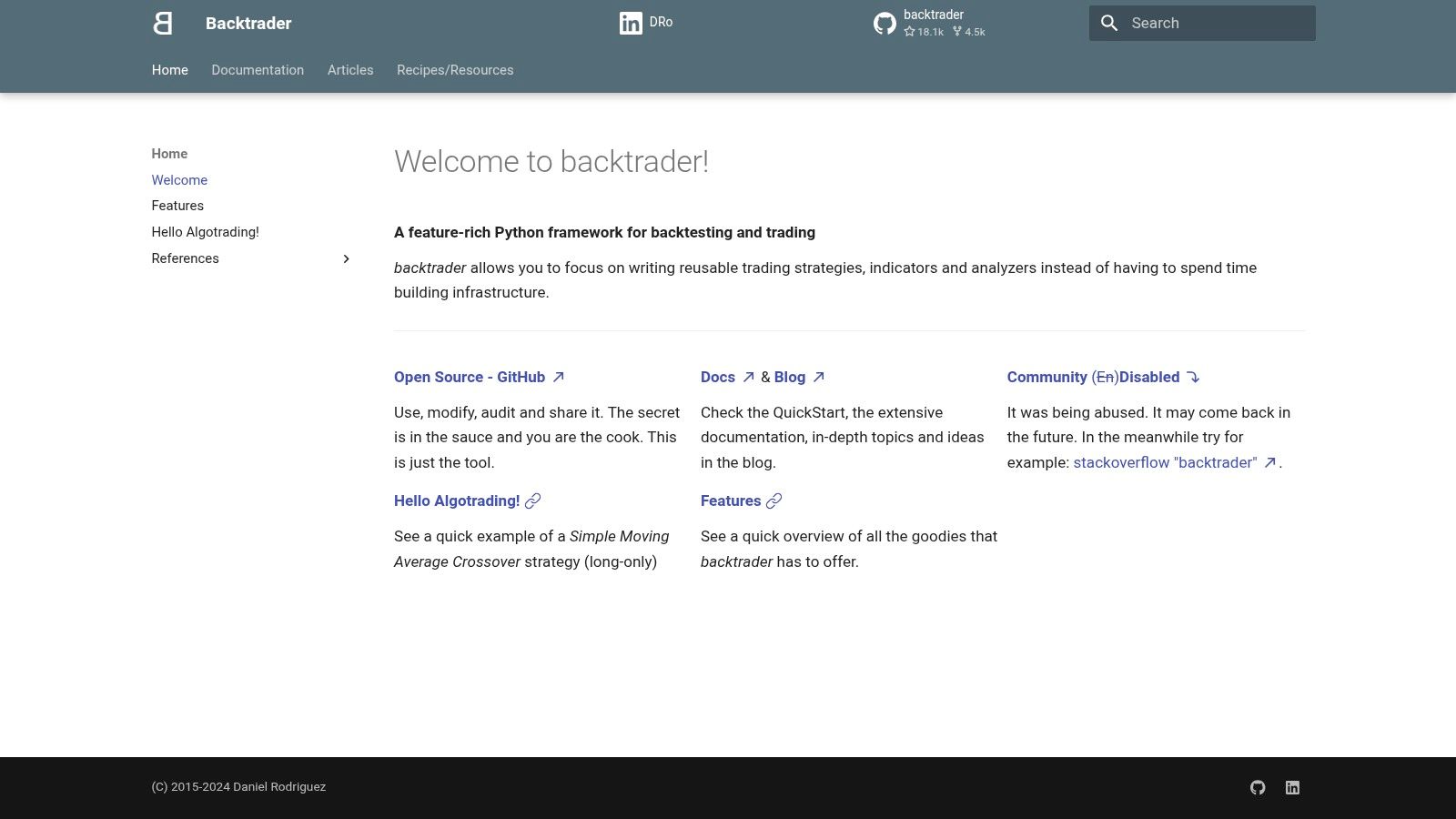

7. Backtrader

Backtrader is a free, open-source Python framework celebrated by quantitative traders and developers for its flexibility and power. It is designed for those comfortable with programming who need to build, test, and deploy complex trading strategies from the ground up. As a highly customizable piece of stock backtesting software, it puts you in complete control, allowing integration with a vast ecosystem of Python libraries for data analysis and machine learning.

Unlike turnkey platforms, Backtrader is a library, not a standalone application. This means you can integrate it directly into your own trading scripts and analytical workflows. It supports multiple data feeds, connects to live brokers for automated trading, and includes a plotting feature to visualize your results. The framework is renowned for its thorough documentation and active community, which provide crucial support for navigating its steep learning curve. If you want to dive deep into algorithmic strategy development, you can explore more resources to learn about Backtrader.

Key Features and Pricing

The core strength of Backtrader is its extensibility. You can write your own indicators, data feeds, and analyzers, giving you unparalleled control over every aspect of the backtest. It is completely free to use, making it an accessible option for developers, students, and traders on a budget who are willing to invest time in learning Python.

| Plan | Price | Key Backtesting Features |

|---|---|---|

| Open Source | Free | Unlimited backtests, live trading integration, custom indicator support |

Pros and Cons

- Pros:

- Completely free and open-source, offering great value.

- Highly customizable for developing sophisticated, unique strategies.

- Strong community support and extensive documentation.

- Cons:

- Requires strong Python programming skills, creating a steep learning curve.

- Lacks a graphical user interface, relying entirely on code.

Website: https://www.backtrader.com/

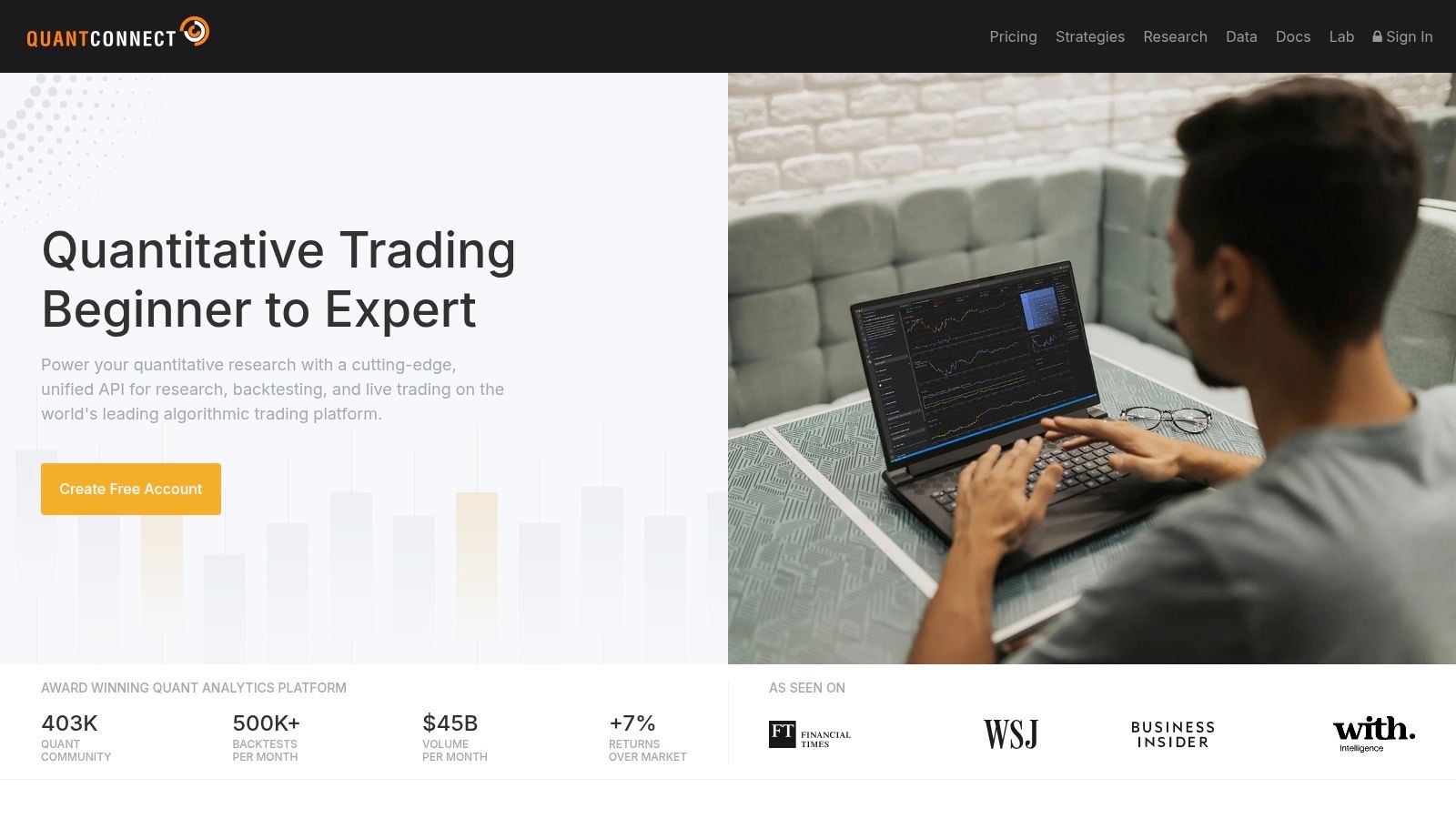

8. QuantConnect

QuantConnect is an open-source, cloud-based algorithmic trading platform built for quants and developers who require deep customization and institutional-grade tools. Its core strength is the powerful, open-source LEAN engine, which allows for intricate strategy development in Python or C#. This makes it a formidable piece of stock backtesting software for those who prefer coding their logic from scratch and require access to a vast array of asset classes.

Unlike no-code visual builders, QuantConnect provides a complete development environment in the cloud. You can code, backtest, and deploy algorithms that trade equities, futures, options, forex, and crypto. The platform's access to extensive historical data, combined with the flexibility of Python's scientific libraries like Pandas and NumPy, enables highly sophisticated quantitative research and strategy validation. This makes it a top choice for serious algorithmic traders; you can learn more about its place among the best algorithmic trading software picks for 2025.

Key Features and Pricing

The platform's community-driven approach is a significant advantage, offering a forum where thousands of quants share strategies, code, and insights. Its cloud infrastructure handles the complexities of data management and computation, freeing you to focus solely on algorithm design. While the free tier is remarkably generous, paid plans provide more processing power for complex backtests.

| Plan | Price (Billed Annually) | Key Backtesting Features |

|---|---|---|

| Free | $0/month | 1 backtesting node, 5 projects, community support |

| Quant Researcher | $8/month | 2 backtesting nodes, unlimited projects, 10GB object store |

| Team | $20/month/seat | 5 backtesting nodes, collaboration features, 100GB object store |

Pros and Cons

- Pros:

- Extremely powerful and customizable with Python and C# support.

- Multi-asset support including equities, options, futures, and crypto.

- Generous free plan and a collaborative open-source community.

- Cons:

- Requires strong programming skills in Python or C#.

- The learning curve can be steep for beginners without a coding background.

Website: https://www.quantconnect.com/

9. TradeStation

TradeStation is a powerful, professional-grade electronic trading platform that combines brokerage services with sophisticated analysis and backtesting tools. It is particularly renowned for its proprietary scripting language, EasyLanguage, which allows traders to build, test, and automate their own custom strategies with a high degree of precision. This integration of brokerage and analytics makes it a top-tier piece of stock backtesting software for serious traders and developers.

Unlike many platforms that separate backtesting from execution, TradeStation offers a seamless workflow. You can develop a strategy in EasyLanguage, backtest it against decades of historical data, optimize its parameters, and then deploy it for automated trading directly within the same environment. This all-in-one approach is ideal for systematic traders who need a robust and unified ecosystem for their entire trading process.

Key Features and Pricing

TradeStation’s strength is its customizability through EasyLanguage, which is more intuitive than traditional programming languages like Python but offers immense flexibility. The platform provides extensive historical data for equities, options, and futures, which is crucial for conducting meaningful backtests. Its software is generally free for brokerage clients who meet certain activity or balance minimums.

| Plan | Price | Key Backtesting Features |

|---|---|---|

| TS SELECT | $0 commissions on stocks & ETFs | Access to the full desktop platform, EasyLanguage, Strategy Backtesting & Optimization |

| TS GO | $0 commissions on stocks & ETFs | Web and mobile platform access; desktop platform available for a fee |

Pros and Cons

- Pros:

- EasyLanguage allows for deep customization without requiring advanced programming skills.

- Integrated brokerage services streamline the process from testing to live trading.

- Powerful and professional-grade charting and analysis tools.

- Cons:

- EasyLanguage has a steeper learning curve compared to no-code builders.

- Per-trade commissions may apply depending on the asset and account type.

Website: https://www.tradestation.com/

10. MultiCharts

MultiCharts is a professional trading platform renowned for its high-definition charting, robust analytics, and automated trading capabilities. It is built for serious traders who require precision and flexibility, offering an environment where you can develop, test, and deploy complex strategies. Its key differentiator is the PowerLanguage scripting engine, which is nearly identical to TradeStation's EasyLanguage, making it a powerful piece of stock backtesting software for quantitative traders.

The platform allows for incredibly detailed strategy optimization, including 3D optimization graphs that help visualize how parameter changes affect performance. Unlike many cloud-based solutions, MultiCharts is a downloadable software that connects to a wide array of data feeds and brokers, giving you complete control over your trading environment and data integrity. This setup is ideal for traders who want to avoid the limitations of web-based interfaces and require direct market access.

Key Features and Pricing

MultiCharts stands out with its portfolio backtesting feature, allowing you to test a single strategy across multiple instruments simultaneously. This provides a more realistic assessment of a strategy's performance in a diversified portfolio. The platform is sold as a licensed software product, which means a one-time purchase rather than a recurring subscription.

| Plan | Price (One-Time Fee) | Key Backtesting Features |

|---|---|---|

| MultiCharts | $1,497 | PowerLanguage scripting, Portfolio backtesting, 3D optimization charts, Market data replay |

| MultiCharts .NET | $1,497 | C# and VB.NET support, Full integration with Visual Studio, Advanced strategy development |

Pros and Cons

- Pros:

- Highly customizable with the powerful PowerLanguage scripting.

- Portfolio backtesting provides a comprehensive performance overview.

- Extensive compatibility with numerous data feeds and brokerage accounts.

- Cons:

- The one-time license fee represents a significant upfront investment.

- Has a considerable learning curve, especially for those new to scripting or advanced TA.

Website: https://www.multicharts.com/

11. MetaTrader 5

MetaTrader 5 (MT5) is an internationally recognized trading platform primarily associated with forex and CFD trading, but its powerful, built-in tools also make it a viable piece of stock backtesting software. It is particularly favored by algorithmic traders who want to build, test, and deploy automated trading strategies, known as Expert Advisors (EAs). The platform’s advanced charting tools and multi-asset support provide a comprehensive environment for detailed technical analysis.

MT5's core strength lies in its MQL5 programming language, a high-level language similar to C++ that allows for the creation of highly complex trading robots and custom indicators. Its Strategy Tester is a sophisticated module that can backtest EAs against historical data with tick-level precision, offering detailed performance reports and optimization modes to fine-tune strategy parameters. While the platform itself is free, access to stock data depends on the brokerage you connect it to.

Key Features and Pricing

The platform stands out for its extensive ecosystem. The MQL5 community provides a massive marketplace for ready-made EAs, freelance developers, and a vast library of free code. This makes it a great starting point for those new to algorithmic trading. However, creating a truly custom strategy from scratch requires a significant learning curve with the MQL5 language.

| Plan | Price | Key Backtesting Features |

|---|---|---|

| Standard | Free* | Tick-by-tick backtesting, MQL5 programming language, Strategy Tester with optimization, Large library of indicators and EAs. |

*Note: The MetaTrader 5 platform is free to download and use, but data feeds and trading access are provided by third-party brokerages, which may have their own costs and commissions.

Pros and Cons

- Pros:

- Completely free to use, making it highly accessible.

- Powerful and flexible MQL5 language for custom algorithmic strategies.

- Extensive community support and a large marketplace for EAs and indicators.

- Cons:

- Requires strong programming skills in MQL5 for custom strategy development.

- Primarily focused on forex and CFDs; stock data availability varies by broker.

- Options backtesting is generally not supported.

Website: https://www.metatrader5.com/

12. Wealth-Lab

Wealth-Lab is a comprehensive desktop platform designed for serious traders and quants who require deep customization and robust analytical power. It operates on its proprietary C#-based language, WealthScript, giving users granular control over strategy logic, from indicator creation to portfolio-level position sizing. This focus on programmability and institutional-grade features makes it a powerful piece of stock backtesting software for developing sophisticated, multi-asset trading systems.

Unlike many browser-based tools, Wealth-Lab excels at portfolio backtesting, allowing you to test a single strategy across a basket of securities simultaneously. This is crucial for validating diversification and risk management rules. The platform integrates with numerous data providers and brokers, enabling a seamless workflow from historical analysis to automated, live execution of your strategies.

Key Features and Pricing

Wealth-Lab is a licensed software product with a one-time purchase fee, which is a different model from the common monthly subscriptions. Its strength lies in its extensive library of built-in indicators and the ability to build, share, and test complex strategies within its active user community.

| Plan | Price (One-Time Fee) | Key Backtesting Features |

|---|---|---|

| Wealth-Lab 8 | $1499 | WealthScript C# API, Portfolio-level backtesting, Monte Carlo simulation, Walk-forward optimization, Broker and data provider integration |

Pros and Cons

- Pros:

- Highly customizable with the WealthScript programming language.

- Excellent for portfolio-level backtesting and system development.

- Active community forum and extensive documentation for support.

- Cons:

- Steep learning curve; requires C# programming knowledge for full potential.

- One-time licensing fee is a significant upfront investment.

Website: https://www.wealth-lab.com/

Stock Backtesting Software Features Comparison

| Platform | Core Features & Customization ✨ | User Experience & Quality ★★★★☆ | Value & Pricing 💰 | Target Audience 👥 | Unique Selling Points 🏆 |

|---|---|---|---|---|---|

| ChartsWatcher 🏆 | Multi-window dashboards, real-time alerts, backtesting (20 days) | Intuitive UI with light/dark modes, frequent updates | Free to Pro Plans, flexible subscriptions | Professional traders, analysts, educators | Highly customizable, import/export features |

| TrendSpider | AI pattern recognition, no-code strategy, multi-timeframe analysis | User-friendly, strong education, updated regularly | Mid-tier subscription | Beginner to intermediate traders | AI-driven automation, automated backtesting |

| TradingView | Pine Script, bar replay, multi-asset support | Large community, cross-device, extensive data | Free plan + paid tiers | All trader levels | Vast script library, cloud-based |

| Trade Ideas | AI trade recommendations, simulated trading, brokerage integration | No coding needed, educational webinars | Higher subscription cost | Non-coders, active traders | Real-time trade recommendations |

| FinViz | Stock screener, basic backtesting, fundamental data | Easy to use, comprehensive market data | Affordable plans, limited free | Beginner to intermediate investors | Advanced screener, pre/post-market data |

| Backtest Zone | No-code backtesting, 70+ exchanges supported | Simple UI, free to use | Completely free | Beginners, casual traders | Free access, broad exchange support |

| Backtrader | Python-based, multiple feeds/brokers, automated trading | Powerful but steep learning curve | Free, open-source | Programmers, advanced traders | Highly customizable, vast Python ecosystem |

| QuantConnect | Multi-asset cloud platform, Python & C# support | Cloud-based IDE, collaborative community | Free tier + paid options | Quant developers, algorithmic traders | Open-source LEAN engine, extensive data |

| TradeStation | EasyLanguage scripting, brokerage integration | Powerful charts, free for brokerage clients | Commission fees apply | Professional traders, algo developers | Brokerage + backtesting integration |

| MultiCharts | Portfolio backtesting, PowerLanguage scripting | Customizable, strong community | Licensed software (paid) | Advanced technical traders | Multi-feed support, automated order management |

| MetaTrader 5 | MQL5 scripting, automated trading, multi-asset | Free, popular with forex traders | Free to use | Forex & CFD traders | Extensive indicators, large community |

| Wealth-Lab | WealthScript language, portfolio backtesting, broker support | Advanced, active support community | Paid licensed software | Advanced quants, professional traders | Extensive indicator library, portfolio focus |

Transforming Data into Decisions: Your Next Step

Navigating the landscape of stock backtesting software can feel overwhelming, but it's a crucial journey for any trader committed to long-term success. We've explored a diverse array of platforms, each with its unique strengths and ideal user. From the extensive, institutional-grade capabilities of QuantConnect and TradeStation to the visually intuitive, chart-centric approach of TradingView and TrendSpider, the common thread is clear: historical data is your most valuable asset for refining future strategies.

The journey from a trading idea to a robust, validated strategy is not a single leap but a series of deliberate, tested steps. Relying on gut feelings or market hype is a recipe for inconsistency and potential disaster. The tools we've detailed provide the framework to move beyond guesswork, enabling you to systematically dismantle your assumptions, challenge your biases, and build a trading methodology grounded in statistical evidence.

Synthesizing Your Options: Key Takeaways

Your choice of software should be a direct reflection of your personal trading style, technical proficiency, and ultimate goals. Let's distill our findings into actionable insights:

- For the No-Code Visual Strategist: If your strength lies in identifying patterns on a chart and you prefer a point-and-click interface, platforms like TrendSpider, TradingView, and ChartsWatcher are your ideal starting points. They translate visual ideas into testable strategies without requiring you to write a single line of code.

- For the Aspiring Quant and Python Developer: For those who are comfortable with programming and desire limitless customization, open-source frameworks like Backtrader and cloud-based platforms like QuantConnect are unparalleled. They offer the ultimate flexibility to build complex, multi-asset strategies from the ground up.

- For the High-Frequency Scanner and Day Trader: Traders who rely on identifying real-time opportunities need a tool that combines powerful scanning with backtesting. Trade Ideas excels in this domain with its AI-driven alerts and event-based backtesting, while FinViz offers robust screening capabilities that can serve as the foundation for your research.

- For the All-in-One Brokerage Power User: If you value the convenience of an integrated trading and analysis environment, broker-dealers like TradeStation (with its powerful EasyLanguage) and platforms like MultiCharts and MetaTrader 5 provide comprehensive ecosystems where you can research, test, and execute all in one place.

A Practical Framework for Selection

Choosing the right stock backtesting software is less about finding the "best" tool and more about finding the right tool for you. Before committing, ask yourself these critical questions:

- What is my current skill level? Be honest about your coding abilities. Choosing a complex, code-heavy platform when you're a beginner will only lead to frustration. Conversely, if you're a skilled developer, a simple click-based tool might feel restrictive.

- What is my budget? Solutions range from free, open-source libraries to premium subscriptions costing hundreds of dollars per month. Define your budget, but also consider the potential return on investment that a powerful tool can provide.

- What markets and asset classes do I trade? Ensure the software provides clean, reliable historical data for the assets you're interested in, whether they are US equities, forex, futures, or cryptocurrencies. Data quality is non-negotiable.

- How much time can I commit? Some platforms have a steep learning curve. Consider how much time you are willing to dedicate to mastering a new system. An intuitive platform you use consistently is far more valuable than a powerful one that gathers digital dust.

The ultimate goal is to find a platform that empowers you to build a rigorous, repeatable testing process. This process is your edge. It's what transforms you from a reactive market participant into a proactive strategist. Don't just chase winning trades; build a winning system. The confidence that comes from knowing your strategy has weathered thousands of historical scenarios is the true foundation of disciplined and profitable trading.

Ready to turn your chart observations into data-backed strategies? ChartsWatcher provides a powerful yet intuitive platform that integrates advanced scanning, custom alerts, and streamlined backtesting, making it an ideal solution for traders who want to validate their ideas without a steep learning curve. Explore how you can systematically test your strategies and trade with greater confidence by visiting ChartsWatcher today.