The Ultimate Day Trading Course Guide

So, what exactly is a day trading course? Think of it less like a stuffy college lecture and more like flight school for an aspiring pilot. You wouldn't just hop into a jet and hope for the best. You need rigorous training, hours in a simulator, and a deep, practical understanding of every control, gauge, and potential danger.

Day trading is no different. Jumping in with just a brokerage account and a bit of cash is a recipe for disaster. A proper course is designed to take your raw ambition and mold it into a methodical, rules-based approach that can weather the market's storms.

What Is a Day Trading Course, Really?

At its heart, a day trading course demystifies the chaotic world of financial markets. Its real purpose isn't to spoon-feed you "hot tips" or promise you'll get rich overnight. Instead, it’s about building a foundation of repeatable skills that you can apply day in and day out, no matter what the market is doing.

This is where you move beyond blog posts and YouTube videos into a structured learning environment.

The Core Building Blocks of a Good Course

A legitimate course cuts through the noise and focuses on the absolute pillars of trading. It's a curriculum built to give you both competence and the confidence to actually click the "buy" and "sell" buttons. Here's a quick look at what you can expect to master:

To give you a clearer picture, here’s a breakdown of what a standard day trading course typically covers, the skills you'll walk away with, and the tools you'll become familiar with.

Quick Overview of a Day Trading Course

| Core Component | Skills You Develop | Tools You Will Use |

|---|---|---|

| Market Fundamentals | Understanding order flow, liquidity, and what makes prices move. | Brokerage platforms, market news feeds |

| Technical Analysis | Reading price charts, identifying key patterns, and using indicators. | Charting software like TradingView, technical indicators (RSI, MACD) |

| Strategy & Execution | Building a trading plan with clear entry, exit, and stop-loss rules. | Backtesting software, trading journals |

| Risk Management | Protecting capital, calculating position size, and managing drawdowns. | Position sizing calculators, risk/reward tools |

These components work together to form a complete trading framework, turning you from a passive observer into an active, strategic participant.

One of the biggest hurdles for new traders is realizing it’s not about being right all the time. Professional trading is about cutting your losses quickly and letting your winners run. A good course hammers this mindset home from the very beginning.

The great news is that access to quality trading education has exploded. You can find excellent online programs covering everything from chart analysis to advanced options strategies, often at very reasonable prices. These courses are constantly updated to reflect what's happening in the markets right now. You can learn more about these educational options on day trading to find a good starting point.

Ultimately, a day trading course is an investment in your process, not a specific outcome. It teaches you to focus on executing your strategy flawlessly, trade after trade, rather than obsessing over the profit or loss of any single position. That shift in perspective is what separates the pros from the gamblers—and it's the true value you get from a formal education.

The Blueprint of a High-Quality Trading Education

Let's be clear: not all trading courses are created equal. A legitimate program gives you a clear, structured roadmap—not just a folder of random videos. Think of it like an architect's blueprint. Every element is there for a reason, building on the last to create a solid, functional structure. Without that plan, you're just stacking bricks and hoping for the best.

The journey has to start with the absolute basics and work its way up to complex, split-second decisions. A quality course doesn't assume you know a thing. It starts with the very mechanics of how markets move and breathe, building your competence from the ground up.

Mastering the Language of the Market

Before you can trade, you have to learn to read the charts. In our world, this means getting a firm grip on technical analysis. It's both an art and a science, allowing you to interpret price charts to get a sense of where the market might be heading next. It’s like learning the grammar and vocabulary of the market’s language.

Any solid curriculum will dedicate significant time to this, covering essentials like:

- Candlestick Charts: Learning what each candle—its body, wicks, and color—is telling you about the battle between buyers and sellers in a given moment.

- Support and Resistance: Pinpointing the key price levels where buyers or sellers have historically stepped in. These are the floors and ceilings that can contain price action.

- Chart Patterns: Recognizing recurring shapes like head and shoulders, triangles, and the classic cup and handle. These patterns can offer powerful clues about where the trend is going.

- Technical Indicators: Using tools like the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) to confirm your ideas and gauge market momentum.

This isn't about rote memorization. It’s about building a deep, almost intuitive feel for price action.

Developing and Testing Your Trading Strategies

Once you can read the charts, it's time to start forming sentences—or in our case, trading strategies. A top-tier day trading course won't just hand you a "magic" strategy. It teaches you how to build, test, and fine-tune your own.

This means creating a concrete, rule-based plan that tells you exactly when to get in, where to place your protective stop-loss, and where to take profits. The course should walk you through backtesting, a process where you apply your strategy to past data to see how it would have performed. This is your flight simulator, letting you test your approach without risking a single dollar of real money.

A trading strategy is your personal business plan for every trade. Trading without one is like running a business without a budget or a product—it's pure gambling.

The Two Pillars of Long-Term Success

This is where the best courses really earn their keep. While chart patterns and strategies are the flashy parts of trading, they're useless without the two pillars that support every single profitable trader: risk management and trading psychology.

These are often the least glamorous topics, but they are, without a doubt, the most important. In fact, when you look at why most traders fail, poor risk management is almost always at the top of the list. A great course will hammer these points home.

1. Ironclad Risk Management

- This is all about one thing: protecting your capital.

- You'll learn the 1% rule, a guideline that says you should never risk more than 1% of your account on any single trade.

- You’ll master position sizing, making sure your trade size is always appropriate for your account and where your stop-loss is.

2. Disciplined Trading Psychology

- This is where you confront the emotional enemies of every trader: fear, greed, and hope.

- You’ll learn techniques to stay objective when the market gets chaotic and to stick to your plan no matter what.

- The goal is to trade like a machine, executing your rules without letting your emotions get in the way.

When designing a day trading course, integrating modern learning tools can make a huge difference. There are good reasons to use interactive video for training and educational content, especially for making these complex topics more engaging. A course that skimps on these two pillars is setting its students up for a painful lesson, no matter how great its charting section is.

How Education Builds the Discipline to Succeed

Ask any seasoned trader why most newcomers wash out, and you'll likely hear the same word over and over: discipline. You can have the sharpest strategy in the world, but it's completely useless if you can't stick to it. This is where a structured day trading course becomes your single best tool—not just for learning charts, but for forging the mental toughness you need to survive.

A good course is what helps you transition from an emotional, impulsive gambler into a calm, rule-based professional. It’s what keeps you from slamming your keyboard in a panic when a trade moves against you, and instead prompts you to follow the exit plan you already made. This transformation doesn’t happen by magic. It's built through rigorous, deliberate practice.

From Emotional Reactions to Rule-Based Actions

Think of a pilot hitting severe turbulence. The amateur panics, yanking the controls based on pure fear. The trained professional trusts their instruments and follows procedure, knowing that a knee-jerk overreaction is far more dangerous than the turbulence itself. A day trading course is your flight school.

It forces you to build and commit to a trading plan before you ever risk a single dollar. This plan is your flight manual, and it needs to be ruthlessly specific.

- Entry Triggers: What exact market conditions must line up before you even think about placing a trade?

- Stop-Loss Placement: Where is your non-negotiable exit point if the market proves you wrong? This is your safety parachute.

- Profit Targets: At what price will you take your money off the table and lock in a win?

By drilling these rules relentlessly—first in a simulator, then with small amounts of real capital—a course helps rewire your brain. The goal is to make following your plan a boring, automatic habit, effectively sidelining your emotions when the pressure is on.

The market is a master at provoking our deepest instincts—fear and greed. A proper trading education acts as your shield, training you to trust your system, not your gut, when chaos erupts.

Forging the Mindset of a Professional Trader

A solid day trading course will spend just as much time on psychology as it does on candlestick patterns. It's about building the mental armor needed to handle the losses and drawdowns that are a completely normal—and unavoidable—part of this business. You learn to stop seeing trading as a series of individual bets and start treating it like a game of probabilities.

This is why a core benefit of structured education is its intense focus on emotional control. It’s where you learn how to improve self-discipline for lasting success, a skill that is absolutely essential for any serious trader.

Ultimately, enrolling in a day trading course is an investment in discipline. It provides the structured, high-pressure environment needed to build the habits that separate the handful of successful traders from the massive crowd that fails. It reframes trading from a get-rich-quick gamble into a professional enterprise—one that demands preparation, consistency, and an unwavering commitment to your plan.

Choosing the Right Day Trading Course for You

The world of trading education is a wild place. On one hand, you have social media gurus flashing rented Lambos and promising instant wealth. On the other, you have structured, almost academic programs that feel like a college course. With so many options out there, finding the right day trading course can feel like trying to find a specific stock ticker in a sea of market noise.

So, how do you cut through the hype? The trick is to approach this decision like you would a trade: with a clear, analytical mindset. You need a solid checklist to filter out the noise and zero in on a program that actually fits your goals, learning style, and budget. Let's break down what really matters.

Evaluate the Instructor, Not Just the Hype

The single most important factor in any course is the person teaching it. A great teacher can make complex ideas feel simple, but a slick marketer can make an empty course seem like the holy grail. Your job is to look past the sales pitch and find proof of their real-world trading chops.

- Verifiable Trading Experience: Does the instructor have a documented trading history? Look for transparency. If they only ever show their winning trades and never talk about their losses or their day-to-day process, be skeptical. Real trading involves both.

- Teaching Style and Clarity: Before you even think about paying, consume all their free content. Watch their YouTube videos, join a free webinar, or read their blog posts. Does their communication style click with you? A trading genius who can't explain their methods clearly is useless to a new student.

- Focus on Process over Profits: A legitimate educator will hammer home the importance of risk management, discipline, and a consistent strategy. If the main message is about a lavish lifestyle, it's a massive red flag.

It can also be helpful to understand the business side of things. Knowing how to sell online courses provides insight into what separates a genuinely valuable program from a simple money-making scheme.

Scrutinize the Curriculum for Depth

A charismatic instructor doesn't mean much if the course content is shallow. The curriculum should be a complete blueprint for a trading career, not just a random collection of tips and tricks. The most crucial element, by far, is an obsessive focus on risk management.

A course that dedicates only one module to risk management is doing you a disservice. It should be a theme woven into every single lesson, from chart analysis to trade execution.

Beyond that critical foundation, the curriculum needs to provide a deep dive into practical skills. To get a feel for what a well-rounded approach includes, check out our guide on day trading strategies for beginners. A quality course will equip you with the tools to not only understand these strategies but to build and test your own.

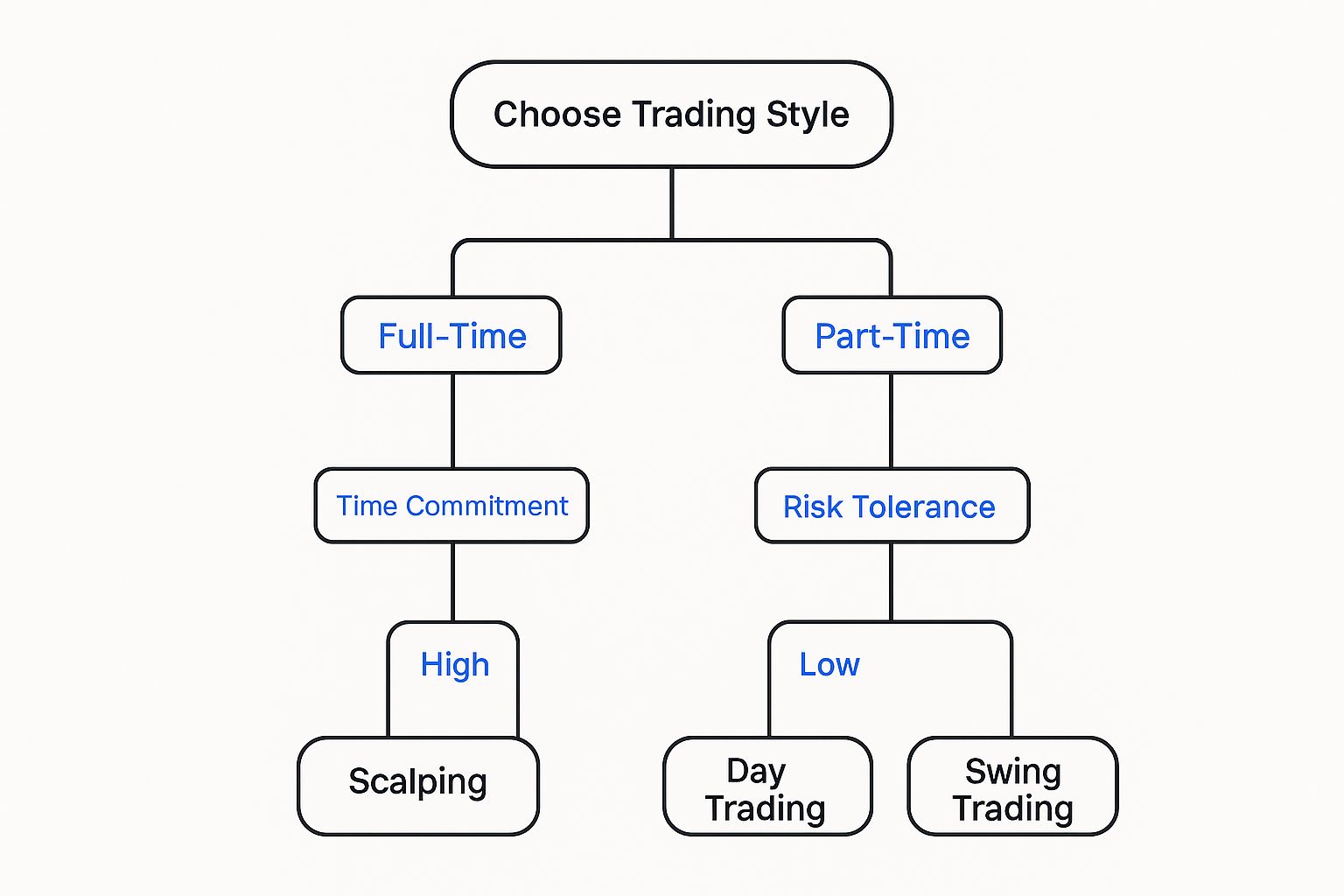

This decision tree can help you start thinking about what kind of trading style might suit you, which will in turn guide what you look for in a course.

As the infographic shows, factors like your available time and comfort with risk can point you toward a specific trading style. Your chosen course should absolutely support and teach that style.

Compare Course Formats and Support Systems

Finally, you need a format that actually fits into your life. There’s no single “best” way to learn; what works for a college student with free afternoons won't work for a working parent. The right choice hinges on your schedule, budget, and how you personally absorb information.

To help you decide, this table breaks down the most common course formats.

Comparing Day Trading Course Formats

This table helps you compare common course styles to find the best fit for your budget, schedule, and learning preferences.

| Course Type | Best For | Typical Cost | Key Advantage |

|---|---|---|---|

| Self-Paced Video | Self-starters with busy schedules who need flexibility. | $100 - $1,000 | Learn at your own pace, on your own time. Highly affordable. |

| Live Online Bootcamp | Learners who need structure and immediate instructor feedback. | $1,000 - $5,000 | Interactive Q&A, real-time market examples, strong accountability. |

| 1-on-1 Mentorship | Traders seeking highly personalized guidance and plan development. | $5,000+ | Direct access to an expert focused solely on your progress and challenges. |

After weighing the formats, look at the support system. Does the course include access to a trading community, like a private Discord server or forum? This is more important than most people realize. Learning alongside your peers provides incredible support and can dramatically speed up your progress. Having a place to ask questions, bounce trade ideas off others, and get honest feedback is almost as valuable as the course content itself.

Who Is the Modern Day Trader?

When you hear "day trader," what comes to mind? For many, it’s a high-strung guy in a suit, shouting into a phone on a chaotic Wall Street floor. That stereotype is officially a relic. Today’s trading floor is digital, global, and more accessible than ever, ushering in a completely new kind of market participant.

The modern trader is younger, more comfortable with technology, and often sees trading as a legitimate path to financial freedom—not just a job, but a flexible business. They aren't looking for a lottery ticket; they're looking to build a real skill. This new wave gets that success in the markets is built on strategy and education, not just a lucky guess.

The New Demographics of Trading

This isn't just a feeling; the data tells a clear story. The profile of the average trader is skewing younger and becoming far more diverse. Recent analysis from the UK shows a staggering 65% of online traders are between 18 and 34. In the U.S., the gender gap is closing fast, with the number of women who identify as active traders jumping from 27% to 41%. You can explore the full picture of this shift by checking out the latest day trading demographic data.

So, what does this all mean? It means trading is no longer some exclusive "boys' club." People from all walks of life—stay-at-home parents, recent grads, and professionals changing careers—are stepping into the arena. This diversity brings fresh perspectives, but it also shines a light on one universal need: solid, structured education.

The modern trader treats their education like a professional certification. They recognize that taking a high-quality day trading course is the standard, intelligent first step—not a remedial action.

This fundamental shift in who is trading also changes why they trade. For many, it’s not about the adrenaline rush. It’s about building a sustainable, location-independent business. They approach it with the same seriousness as someone launching any other small enterprise.

This mindset is crucial. It normalizes the idea of investing in a day trading course as a basic cost of entry. The new generation of traders doesn't see education as an optional add-on but as a core business expense—the cost of arming yourself with the knowledge to navigate the markets methodically instead of gambling on impulse.

Your First Steps After Graduation

Finishing a day trading course is a huge milestone, but it's important to see it for what it really is: the starting line, not the finish line. The knowledge you've picked up is your foundation, but the real work of building a trading career starts right now. This is where you shift from being a student to a practitioner, a journey that demands patience, discipline, and a very deliberate approach.

The first step is completely non-negotiable and it's what separates serious traders from hopeful gamblers: paper trading. Think of it as your flight simulator. It’s a risk-free space where you can apply the strategies you learned in your course to live market data, all without putting a single dollar on the line.

The Critical Paper Trading Phase

The goal here isn't to rack up fake profits; it's to prove that your process actually works. Your real mission is to achieve consistent results over a decent stretch of time—weeks, or even months. You have to prove to yourself that you can follow your trading plan with rock-solid discipline when there's no money to cloud your judgment.

Here’s what to zero in on during this phase:

- Flawless Execution: Can you consistently get into trades, set your stop-losses, and take profits according to your rules? No hesitation, no second-guessing.

- Data Collection: This is crucial. Log every single trade in a trading journal. Note the setup, why you entered, the outcome, and just as importantly, how you felt.

- Performance Review: Go over your journal every week. Which setups are making you money? What common mistakes keep popping up? This data is pure gold.

You shouldn't even think about trading with real money until you've demonstrated consistent profitability in the simulator. This disciplined practice is the bridge that connects what you learned in theory to what you can do in the real world.

Moving to Live Trading

Once your paper trading results look solid, it's time to go live—but you have to do it with extreme caution. Start with an amount of capital so small that losing every penny of it wouldn't impact your financial life in any meaningful way. Your first goal with real money isn't to get rich; it's simply to survive and manage your emotions.

The psychological pressure of having even $1 at risk is profoundly different from paper trading. The emotional discipline you thought you had will be tested immediately. This is why starting small is essential.

Your position sizes should be tiny. The focus is still on executing your plan perfectly, not on the profit and loss. You are still in a training phase, just with the added element of real-world emotional pressure. A huge part of this is locking in bulletproof risk management. For a deeper dive on this topic, it’s worth reviewing how to approach mastering day trading risk management proven strategies to protect your capital.

Embrace Continuous Growth

The market is a living, breathing thing. It's always changing. The strategies that crush it today might need a tune-up tomorrow. Your education never really stops.

- Stay a Student: Keep reading books, follow reputable market analysts, and go back over the core concepts from your day trading course. The best traders are the ones who never stop learning.

- Join a Community: Surround yourself with other serious traders. A good community gives you support, holds you accountable, and provides a space to share ideas and get feedback. It helps you stay sharp and reminds you that you aren't alone in your struggles or successes.

- Review, Refine, Repeat: Your trading journal is your most powerful tool for getting better. Constantly review your performance to figure out your strengths and weaknesses. Use this feedback loop to refine your strategy, plug your leaks, and steadily improve your edge.

This period after graduation is where you forge your identity as a trader. By respecting the process, starting small, and committing to being a lifelong learner, you give yourself the best possible shot at turning your education into a lasting, successful career.

Of course. Here is the rewritten section, designed to sound like it was written by an experienced human expert.

Your Top Questions About Day Trading Courses, Answered

If you're exploring day trading, you've probably wondered if a formal course is really necessary or just an expensive shortcut. It's a fair question, and one that every aspiring trader grapples with.

Let's cut through the noise and tackle the three biggest questions I hear all the time. Getting these answered upfront will give you the clarity you need before you invest a single dollar in your education.

Can I Just Teach Myself and Skip the Course?

The short answer is yes, you can try. The longer, more honest answer is that it's incredibly difficult, and the odds are stacked against you. Many traders attempt the self-taught route, hoping to save money, but often end up paying a much higher price in the form of blown-up accounts.

Think of it this way: a good course provides a map. Without it, you're wandering through a dense forest full of traps. A structured program gives you:

- Proven frameworks that help you avoid costly, soul-crushing trial and error.

- A solid risk management plan from day one to protect your hard-earned capital.

- Strategy practice in a controlled environment, which drastically speeds up your learning curve.

How Much Should I Expect to Pay for a Good Course?

This is where you'll see a huge range, and it really comes down to the depth of the training and the level of personal access you get to the instructor.

- Self-paced video courses are the most accessible, often running from $50 to $500.

- Live, interactive bootcamps and workshops usually fall between $1,000 and $5,000.

- Personalized one-on-one mentorship is the most premium option and can easily exceed $5,000.

Tip: Don't let price be your only guide. A cheap course with outdated strategies is worthless. Always compare the curriculum and instructor's reputation to make sure you're getting real value.

When Will I Actually Start Seeing Results?

This is the million-dollar question, and the answer depends entirely on your discipline, practice time, and the market's behavior. There's no magic button for instant profits.

Here’s a realistic timeline to set your expectations:

- First, commit to at least 3 to 6 months of daily paper trading. This is your simulator, your practice field. No exceptions.

- Next, review your performance every single week. What worked? What didn't? Tweak your strategy based on the data, not your emotions.

- Only after you've achieved consistent profitability in the simulator should you even think about trading with real money.

Patience is the name of the game. If you stick with the process, the results will follow.

A Quick Real-World Comparison

Imagine a trader named Sarah. She started on her own, lost money in her demo account, and felt completely lost. Then, she invested in a structured course, learned disciplined risk rules, and kept a detailed trade journal. Within six months, she was seeing steady progress and eventually hit a 15% annual return.

Her story isn't unique. A structured path simply gets you there faster and with fewer scars.

| Learning Method | Time to Proficiency | Typical Success Rate |

|---|---|---|

| Self-Study | 12+ months | ~10% |

| Structured Course | 3–6 months | ~25% |

The data is pretty clear: a quality day trading course dramatically shortens the path to proficiency.

Insight: Consistency beats intensity every time. Slow, steady progress is what wins in trading.

How to Choose the Right Course for You

Before you pull out your credit card, do your homework. A little due diligence goes a long way.

- Verify the instructor. Do they have a verifiable trading history, or are they just good at marketing?

- Look for a community. Is there an active chatroom or mentorship group where you can ask questions?

- Check the curriculum. A good course balances theory with live practice and, crucially, trading psychology.

- Ensure it's up-to-date. The market is always changing. Make sure the content reflects what's working now.

You're Enrolled. Now What?

Once you've signed up, the real work begins. Set a clear study schedule and stick to it.

The key is to immediately apply what you learn. Combine the video lessons with daily market observation and hands-on practice in a trading simulator.

Get in the habit of reviewing every trade. Use a platform like ChartsWatcher to monitor your alert criteria, backtest ideas, and analyze real-time data all in one place. This constant feedback loop is what separates break-even traders from profitable ones.

Ready to scan the markets with precision? Start your free trial at ChartsWatcher.