Day Trading Strategies for Beginners: Trade Smarter

Kickstart Your Day Trading Journey

Ready to dive into the exciting world of day trading? Intraday markets move fast, demanding a sharp understanding of proven strategies and a disciplined approach. From the yelling and hand signals of the open outcry trading pits to today's algorithmic trading platforms, the core principles of successful day trading have constantly evolved, adapting to new technologies and deeper market insights.

What truly makes a day trading approach effective? It’s the combination of spotting predictable patterns, managing risk, and adjusting to the ever-changing market conditions. This guide provides you with 8 powerful day trading strategies designed for success in 2025 and beyond.

These techniques are built upon time-tested principles. Think recognizing momentum shifts, capitalizing on volatility breakouts, and using key indicators for precise entries and exits. Whether you're a beginner just starting or a seasoned trader honing your skills, understanding the mechanics behind these strategies is crucial. We’ll cover everything from classic trend following to advanced volume-weighted analysis.

Understanding Core Principles

This article builds a solid foundation for understanding the core principles and how to put these strategies into action, putting you on the path to becoming a more informed and confident day trader. You'll learn to:

- Identify opportune moments

- Manage risk

- Potentially maximize returns

in the dynamic world of intraday trading.

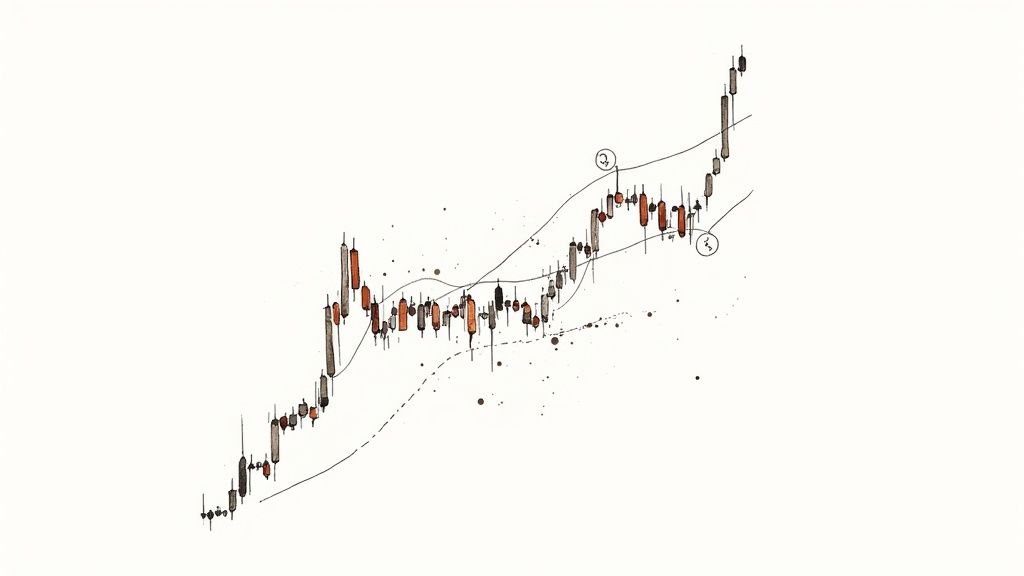

1. Trend Trading

Trend trading is a fundamental strategy, especially for those new to day trading. It's all about capitalizing on the market's momentum, riding the waves of established upward or downward trends. Rather than trying to predict market reversals, which is notoriously difficult, trend traders simply identify and follow existing directional movements. This simplifies the process and provides a more manageable entry into day trading's complexities. It's a core strategy for building a solid day trading foundation because of its simplicity and reliance on established patterns.

How Trend Trading Works

Trend trading operates on the principle that "the trend is your friend." Traders use technical indicators to identify and confirm these trends. Common tools include moving averages, like the 20-day, 50-day, and 200-day, which smooth out price fluctuations and reveal the underlying trend direction. Momentum indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) help confirm trend strength and potential overbought or oversold conditions.

Features of Trend Trading

- Reliance on Technical Indicators: Moving averages, RSI, and MACD are key tools.

- Longer Holding Periods (Relative to Other Day Trading Styles): Positions may be held longer than in strategies like scalping.

- Emphasis on Momentum: Following established momentum is the core principle.

- Multi-Timeframe Applicability: Works on charts ranging from 5-minute to daily intervals.

Pros

- Beginner-Friendly: Identifying existing trends is generally easier than predicting changes.

- Reduced Stress: Following trends can be less stressful than constantly fighting market movements.

- Less Screen Time: Doesn't require constant monitoring like scalping.

- Versatile Timeframes: Applicable across different chart timeframes offers flexibility.

Cons

- Late Entries: Joining late can mean buying high or selling low.

- Reversal Risk: Sudden reversals can cause significant losses.

- Missed Early Profits: May miss the largest gains at a trend's start.

- Stop-Loss Difficulty: Setting optimal stop-loss levels can be tricky.

Real-World Examples

- Breakout Trading: Buying when a stock's price exceeds its 20-day moving average with increased volume.

- Support/Resistance Breaks: Shorting when a stock falls below a key support level on high volume.

- Higher Highs and Higher Lows: Consistently higher highs and higher lows indicate an uptrend, while lower highs and lower lows signify a downtrend.

Practical Tips for Implementation

- Focus on a Few Stocks: Track 2-3 strong trending stocks to avoid being overwhelmed.

- Look for Pullbacks: Buy during temporary dips within an uptrend.

- Use Stop-Loss Orders: Protect your capital by limiting potential losses.

- Multi-Timeframe Confirmation: Verify the trend on different timeframes for greater confidence.

Evolution and Popularization

Trend following has been a central trading philosophy for decades. Figures like Richard Dennis (Turtle Trading), William O'Neil (CANSLIM method), and Mark Minervini (trend following with risk management) have popularized these strategies, showcasing their effectiveness in various market conditions. Their disciplined approach, combining entry and exit rules with strong risk management, has made trend trading a timeless technique.

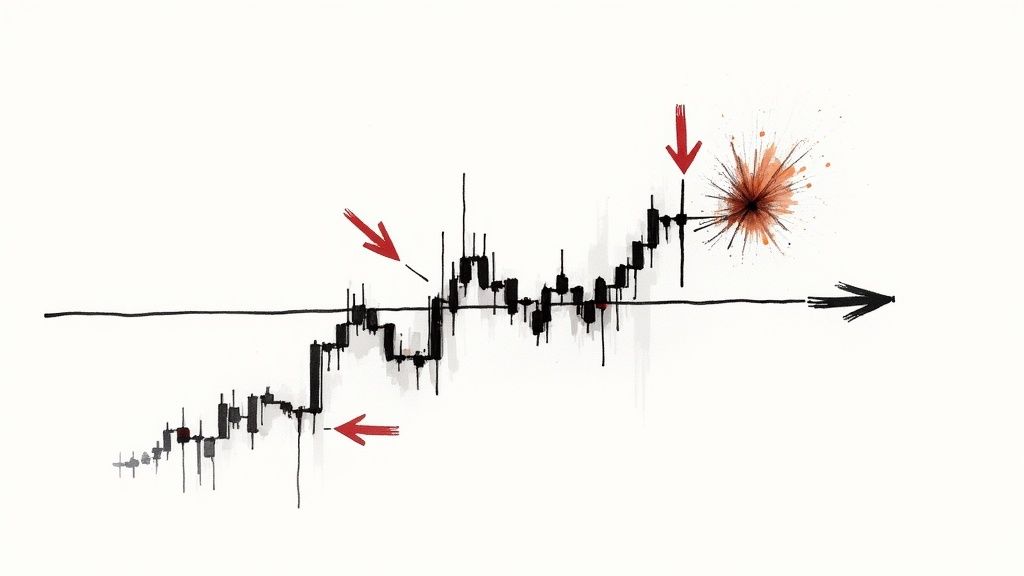

2. Breakout Trading

Breakout trading is a popular strategy used by day traders. It focuses on identifying key price levels like support, resistance, or consolidation patterns. Traders enter trades when the price moves decisively beyond these levels. This strategy takes advantage of the increased volatility and momentum that typically happens after an asset breaks through established barriers.

It's straightforward, and offers the potential for quick profits, making it appealing to beginners. Experienced traders also appreciate the nuances of breakout trading, which allow them to refine their approach. It's a crucial strategy for any aspiring day trader to learn.

How Breakout Trading Works

Breakout trading is based on the idea that when a stock's price breaks through a significant support or resistance level with increased volume, it signals a potential shift in supply and demand. This shift can lead to a sustained price move in the direction of the breakout.

Features and Benefits

Breakout trading offers several advantages:

- Clear Entry and Exit Points: Support and resistance levels define entry and exit points, making trading decisions easier.

- High-Profit Potential: Successful breakouts can be very profitable, especially with effective risk management.

- Volatility Advantage: This strategy works well in volatile markets, providing many trading opportunities.

- Beginner-Friendly: The core concept is simple to understand, making it accessible for new traders.

Pros and Cons

Here's a quick look at the pros and cons:

Pros:

- Clear entry and exit points

- Potential for explosive profit opportunities

- Works well in volatile markets

- Relatively simple to learn

Cons:

- Risk of false breakouts (fakeouts)

- Requires quick decision-making

- Can be emotionally challenging

- Stop-losses can be triggered frequently

Real-World Examples and Case Studies

- Example 1: A stock trades between $20 and $25 for several weeks. It breaks out when the price closes above $25 with high volume. A breakout trader would buy the stock, expecting further upward movement.

- Example 2: A stock gaps up above the previous day's high after positive earnings, breaking through resistance. This gap-up could trigger a breakout trade.

- Case Study (Hypothetical): A trader sees a symmetrical triangle pattern on a stock chart. They place a buy order just above the upper trendline. The price breaks out with increased volume, triggering the order and entering a long position.

Evolution and Popularity

Breakout trading's roots go back to the early 20th century with traders like Jesse Livermore, who focused on identifying and exploiting large price movements. Traders like Nicolas Darvas further developed the concept with his "Box Theory." It remains a popular strategy used by professionals like Linda Bradford Raschke.

Practical Tips for Implementation

Here are some helpful tips for breakout trading:

- Confirmation is Key: Wait for confirmation with increased volume or price closing beyond the breakout level before entering.

- Manage Risk: Use smaller position sizes until the breakout is confirmed to limit potential losses from false breakouts.

- Limit Orders: Use limit orders placed just above resistance or below support to enter trades automatically at the breakout point.

- Quick Exits: Be ready to exit quickly if the breakout fails and the price reverses.

- Backtesting: Test your strategy on historical data to improve your entry and exit rules.

By understanding breakout trading principles, managing risk effectively, and practicing disciplined execution, traders can potentially generate significant profits in the fast-paced world of day trading.

3. Scalping

Scalping is a high-frequency day trading strategy. It's designed to profit from small price changes over very short periods—often seconds or minutes. This involves executing numerous trades daily, taking advantage of fleeting price inefficiencies and minor market fluctuations.

The core principle of scalping is accumulating small profits. These small gains, when combined across many trades, can lead to substantial returns. Imagine capturing just a few cents on hundreds of trades each day. Scalpers often focus on highly liquid assets, such as major forex pairs or large-cap stocks, to ensure rapid order execution and minimize slippage.

Several characteristics define this trading style. These include extremely short-lived trades, high trading frequency, small profit targets per trade, and a reliance on quick decision-making. It requires intense focus, discipline, and a strong understanding of how the market works.

Features of Scalping

- Extremely Short-Term Trades: Positions are typically held from mere seconds to a few minutes.

- High Trade Frequency: Scalpers execute dozens, even hundreds, of trades daily.

- Small Profit Targets: The objective is to consistently capture small gains from minimal price movements.

- Requires Extreme Focus and Quick Decision-Making: Swift reactions to market changes are crucial.

Pros of Scalping

- Limited Market Exposure: Short holding periods reduce the risk associated with unexpected market swings.

- Profit Potential in Ranging Markets: Scalping can be profitable even in non-trending or sideways markets.

- Quick Feedback on Strategy Effectiveness: Frequent trades allow for rapid strategy evaluation and adjustment.

- Small Profits Add Up: Consistent small gains can accumulate into substantial profits over time.

Cons of Scalping

- Impact of Transaction Costs: Commissions, fees, and spreads can significantly impact profits.

- Requires Intense Concentration and Constant Monitoring: Scalping demands unwavering attention and can be mentally taxing.

- Potential for Stress and Fatigue: The fast-paced nature of this strategy can lead to stress and burnout.

- Need for Fast, Reliable Technology: A high-speed internet connection, a powerful computer, and a reliable trading platform are essential.

Real-World Examples

- Spread Scalping: Buying at the bid price and immediately selling at the ask price to profit from the spread.

- Reversal Scalping: Identifying and trading small price reversals at key support and resistance levels.

- Order Book Imbalance Scalping: Using Level II market data to spot order book imbalances and anticipate short-term price moves.

Scalping’s Rise to Prominence

Scalping gained traction with the advent of electronic trading and the rise of high-frequency trading (HFT) firms. Traders like Paul Rotter (known as “The Flipper” in bond futures) and even controversial figures like Navinder Singh Sarao (involved in the 2010 flash crash) brought attention to this strategy. HFT firms like Virtu Financial further demonstrated how technology could be used for scalping-like strategies on a massive scale.

Tips for Implementing Scalping

- Minimize Latency and Commissions: Choose a brokerage platform offering low commissions and minimal latency.

- Practice with Simulators: Before using real capital, practice scalping strategies in a simulated environment.

- Focus on Liquid Assets: Trade highly liquid stocks or forex pairs for smooth entries and exits.

- Strict Risk Management: Implement strong risk management rules, aiming for a favorable risk-reward ratio (e.g., 1:1 or better). You might be interested in: Mastering Day Trading Risk Management.

- Time Stops: Use time stops to automatically exit trades that don't perform as expected within a set timeframe.

Scalping is a challenging but potentially profitable approach. It's best suited to experienced traders with the necessary discipline, focus, and technological resources. It shows how even small price fluctuations can generate profits in the dynamic world of day trading.

4. Reversal Trading

Reversal trading is a counter-trend strategy focused on identifying potential trend exhaustion points and capitalizing on subsequent price reversals. Instead of riding the current trend, reversal traders anticipate when the movement is losing steam and poised to shift. This allows them to enter early in a new potential trend, making it a potentially lucrative, but risky, strategy. Its focus on anticipating market shifts, rather than following established trends, makes it a valuable tool for day traders.

How It Works

Reversal trading hinges on identifying potential exhaustion points. Traders use a combination of technical indicators and price action analysis to spot these crucial turning points.

- Oscillators: Tools like the Relative Strength Index (RSI), Stochastic Oscillator, and Commodity Channel Index (CCI) are frequently used to identify overbought or oversold conditions, suggesting a potential reversal.

- Candlestick Patterns: Patterns such as bullish engulfing, evening stars, or hammer patterns can further confirm these potential shifts in momentum.

- Support and Resistance Levels: These are crucial areas of focus, as price reversals frequently occur at these levels.

Real-World Examples and Case Studies

-

Bullish Engulfing at Support: Imagine a stock in a downtrend. It hits a key support level, and a bullish engulfing candlestick pattern forms. This suggests buying pressure is overwhelming selling pressure, potentially signaling a reversal. A trader might enter a long position, anticipating an upward price movement.

-

Bearish Divergence and Resistance: A stock rallies to a historical resistance level. But, the RSI shows bearish divergence – the price makes higher highs while the RSI makes lower highs. This suggests weakening momentum and a potential reversal. A trader might initiate a short position, anticipating a downward correction.

-

Double Top/Bottom: A stock forms a double top pattern, where the price reaches a certain level twice but fails to break through. This often signals a reversal, and a trader might enter a short position. Conversely, a double bottom pattern can signal a bullish reversal, prompting a long entry.

Evolution and Popularity

The use of candlestick patterns for reversal trading gained significant traction through the work of Steve Nison. Tom DeMark's DeMark Indicators and John Bollinger's Bollinger Bands further refined the identification of potential reversal points. Modern charting software and real-time data have also made reversal trading more accessible.

Pros and Cons

Pros:

- High Risk-Reward Ratios: Entering near the turning point allows for potentially significant gains with relatively smaller initial investments.

- Advantageous Entry Prices: Reversal trading often provides entry points at more favorable prices than trend-following strategies.

- Opportunities in Both Bull and Bear Markets: This strategy works in both upward and downward trending markets.

Cons:

- High Risk: Going against the prevailing market sentiment is inherently risky. Incorrect predictions can lead to losses.

- False Signals: Distinguishing true reversal signals from false ones requires experience and analysis.

- "Catching Falling Knives": Entering a long position during a downtrend reversal (trying to "catch a falling knife") can be particularly risky.

Practical Tips for Implementation

- Confirmation Is Key: Wait for multiple confirming signals – price action, volume, indicator divergence – before entering a trade.

- Smaller Position Sizes: Use smaller position sizes than trend-following strategies to manage risk.

- Tight Stop Losses: Place tight stop-loss orders above/below key reversal candlestick patterns to limit losses.

- Look for Confluence: Identify confluence of multiple reversal signals at key price levels for higher probability trades.

By understanding the principles of reversal trading, using appropriate technical tools, and implementing risk management strategies, traders can potentially capitalize on market shifts and achieve attractive returns. However, it's important to acknowledge the risks and dedicate time to mastering this challenging approach.

5. Moving Average Crossover Strategy

The moving average crossover strategy is a popular tool used in technical analysis, favored by day traders of all skill levels. It identifies trends by using two or more moving averages to pinpoint buy and sell signals. This strategy's simplicity and effectiveness in trending markets make it a fundamental strategy for beginners. By understanding how moving averages work together, traders can potentially profit from substantial price swings.

This strategy is based on the idea that when a shorter-term moving average crosses above a longer-term moving average, it suggests rising momentum and a potential price increase (a bullish signal). On the other hand, a shorter-term moving average crossing below a longer-term moving average indicates weakening momentum and a potential price drop (a bearish signal). The periods used for these moving averages can differ. Popular combinations include 9/20 Exponential Moving Averages (EMAs), 5/20 EMAs, and 50/200 Simple Moving Averages (SMAs). For example, if the 9-day EMA crosses above the 20-day EMA, it creates a buy signal.

The strength of this strategy is its straightforward, objective signals. Traders don't need to speculate; the crossover provides a clear signal to enter or exit a trade. This objective approach minimizes emotional decision-making, which can negatively impact trading success. Plus, moving average crossovers are available on nearly all trading platforms, making them easily accessible.

Real-World Examples

-

The "Golden Cross" and "Death Cross": For longer-term trading, the 50-day SMA crossing above the 200-day SMA is a well-known bullish signal called the "Golden Cross." The opposite, the 50-day SMA crossing below the 200-day SMA, is a bearish signal called the "Death Cross."

-

Day Trading with EMAs: Day traders might use the 9/20 EMA crossover on a 5-minute chart to find short-term opportunities in stocks like Apple or Tesla. A crossover above could signal a quick entry for a scalp trade, while a crossover below would signal a quick exit.

Historical Context and Popularity

The use of moving averages goes back to the beginnings of technical analysis. Early pioneers like Charles Dow recognized the value of following trends. John Murphy, a respected technical analysis author, further popularized moving averages and crossover strategies in his book Technical Analysis of the Financial Markets. Gerald Appel's creation of the Moving Average Convergence Divergence (MACD) indicator, which is based on moving averages, solidified the concept's importance in trading.

Pros and Cons

Pros:

- Easy to understand and use

- Clear entry and exit signals

- Works well in trending markets

- Widely used and historically significant

Cons:

- Lagging indicator; signals can be late

- Performs poorly in choppy or sideways markets, generating false signals

- Can miss substantial price moves

- Needs additional filters (like volume or support/resistance) in volatile markets

Practical Tips for Implementation

-

Confirm with Volume: Higher volume with a crossover makes the signal more reliable.

-

Favor EMAs for Day Trading: EMAs respond faster to price changes.

-

Use Support/Resistance: Combine crossovers with support and resistance levels for more accurate entries and exits.

-

Adapt to Market Conditions: Try different MA combinations for various market situations and timeframes.

-

Simulate First: Test your strategy in a simulated trading environment before risking real money.

By understanding the nuances of the moving average crossover strategy, using it with other technical indicators, and practicing careful risk management, both new and experienced day traders can potentially improve their trading results.

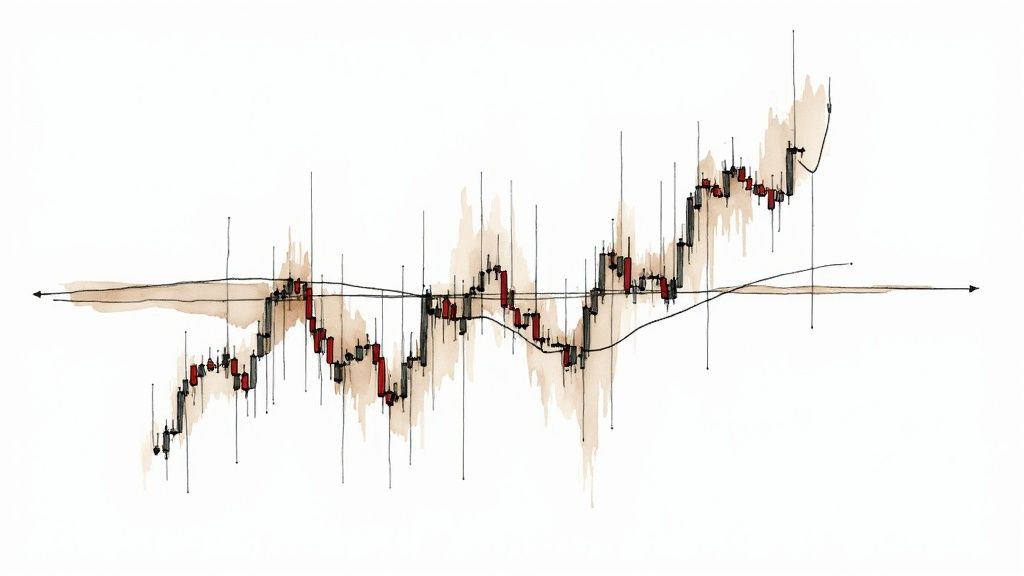

6. Range Trading

Range trading is a versatile strategy perfectly suited for sideways or choppy markets. It's a valuable tool for any day trader looking for an edge. This strategy capitalizes on the predictable price swings of an asset between established support and resistance levels. Instead of trying to predict breakouts or chasing momentum, range traders profit from the back-and-forth movement within these defined boundaries. This offers a structured, and potentially less stressful, way to navigate the markets, especially during periods of low volatility.

How It Works

Range trading starts with identifying clear support and resistance levels, which form a price channel or range. Traders buy near the support level, anticipating a price bounce, and sell near the resistance level, anticipating a pullback. This buy-low/sell-high process repeats as long as the asset's price stays within the established range. Using oscillators, such as the Relative Strength Index (RSI) and Stochastic, can help confirm overbought conditions near resistance and oversold conditions near support, further refining entry and exit points.

Real-World Examples

-

Lunch Hour Consolidation: Trading volume often decreases during lunch breaks, leading to price consolidation in many stocks. This creates ideal conditions for range trading within these narrower midday ranges.

-

Currency Trading: Consider the EUR/USD currency pair trading between 1.0900 (support) and 1.1000 (resistance). A range trader would buy near 1.0900 and sell near 1.1000, repeatedly profiting from this price oscillation.

-

Pre-Market Futures Trading: Index futures frequently establish clear ranges during pre-market hours. Traders can identify these ranges and implement range trading strategies before the regular market opens.

Evolution and Popularity

Range trading has gained significant traction thanks to the contributions of prominent figures like John Bollinger. His Bollinger Bands are widely used to visually identify and trade ranges. J. Welles Wilder's RSI, a popular oscillator, is another tool frequently employed by range traders to confirm overbought/oversold conditions within a range. The research of Toby Crabel on range-based patterns has also advanced the understanding and application of this valuable strategy.

Pros

-

Consistent Profits in Non-Trending Markets: Range trading excels when other strategies falter, presenting unique opportunities in sideways markets.

-

Clear Entry and Exit Points: The well-defined support and resistance levels provide readily identifiable trading signals.

-

Favorable Risk-Reward Ratios: Tight stop losses, placed just outside the range, can create opportunities for favorable risk-reward setups.

-

Reduced Stress: Compared to the fast-paced world of momentum trading, range trading can be less emotionally demanding due to the more predictable price action.

Cons

-

Vulnerability to Breakouts: Unexpected breakouts from the established range can result in losses if not managed properly.

-

Limited Profit Potential Per Trade: Profits are inherently limited by the width of the trading range.

-

Requires Patience: Traders must exercise patience, waiting for the price to reach the defined range extremes.

-

Identifying True Ranges: Distinguishing between true, established ranges and temporary periods of consolidation can be challenging.

Tips for Implementation

-

Confirm the Range: Look for multiple tests of support and resistance before considering the range valid.

-

Conservative Entry: Placing entry orders slightly inside the range can help avoid being caught in false breakouts.

-

Protective Stop Losses: Setting stop losses just beyond the range boundaries is a crucial risk management technique.

-

Use Oscillators: Employ oscillators, such as RSI or Stochastic, to identify overbought/oversold conditions within the range and refine entry and exit timing.

-

Be Prepared for Breakouts: Always have an exit strategy in place in case a legitimate breakout occurs.

Range trading is a valuable addition to any day trader's arsenal. It provides a structured and relatively low-stress approach, particularly effective in non-trending markets. By concentrating on the predictable price fluctuations within established support and resistance levels, and using appropriate risk management, range traders can aim for consistent profits while mitigating the risks associated with volatile market swings. It's a powerful strategy that complements other approaches, broadening a trader's toolkit.

7. VWAP Trading Strategy

The Volume Weighted Average Price (VWAP) strategy is a powerful tool for day traders. It helps pinpoint potential entry and exit points by using the average price of an asset, weighted by its trading volume throughout the day. Its popularity comes from its use by institutional traders as a benchmark. This gives day traders valuable insights into how these large players, often referred to as "smart money," are moving in the market.

VWAP is displayed as a line on a price chart, acting as a dynamic support and resistance level. It answers the question, "At what average price have institutions been trading this asset today?" The daily reset makes VWAP particularly useful for day trading, providing a fresh perspective each session.

Features and Benefits

-

Dynamic Support/Resistance: In uptrends, the VWAP line often acts as a support level, while in downtrends, it can become resistance. Prices tend to gravitate towards the VWAP, offering potential entry points.

-

Volume Analysis Integration: VWAP inherently considers volume, giving a more complete picture of price action. Strong volume near the VWAP confirms the level's importance.

-

Daily Reset: The daily reset is ideal for day traders, offering a clean slate for each trading session.

-

Standard Deviation Bands: Like Bollinger Bands, VWAP can include standard deviation bands (typically ±1 and ±2 standard deviations). These bands offer additional potential entry and profit target levels.

Real-World Examples

-

Long Entry: A stock is trending upwards. The price retraces to the VWAP on lower volume. This might be a buying opportunity, suggesting institutional accumulation at a perceived "fair value."

-

Short Entry: A stock is in a downtrend. The price bounces off the VWAP from below on higher volume. This could signal a shorting opportunity due to institutional selling pressure.

-

Using Standard Deviations: A trader might buy near the -1 standard deviation band during an uptrend, with a profit target at the VWAP line, or even the +1 standard deviation band.

Influence and Origins

The VWAP indicator's popularity among day traders has grown, partly due to influential figures like Brian Shannon (author of 'Technical Analysis Using Multiple Timeframes') and Peter Reznicek (Shadowtrader). Its real strength, however, lies in its institutional roots. Large institutions use VWAP as an execution benchmark, making it a valuable tool for understanding large order placement. For more advanced VWAP scanning techniques, check out Our guide on VWAP Reject Scanner.

Practical Tips for Implementation

-

Multiple Touches: Look for the price to interact with the VWAP multiple times as support or resistance, strengthening its significance.

-

VWAP Crosses: Consider VWAP crosses as potential trend change signals, especially with increased volume.

-

Volume Confirmation: Always validate VWAP signals with volume analysis. Rising volume on VWAP breaks reinforces the signal.

-

Market Context: VWAP is most useful during regular trading hours. Its relevance decreases pre/post market due to lower volume.

-

Multiple Timeframes: Using VWAP on multiple timeframes (e.g., 5-min, 15-min) can confirm and filter signals.

Pros and Cons

Pros:

- Offers insight into institutional activity.

- Provides objective entry and exit points.

- Integrates price and volume analysis.

- Works well for stocks with high institutional participation.

Cons:

- Less effective with low-volume stocks or outside regular trading hours.

- Can produce false signals during news or high volatility.

- Limited use for multi-day strategies due to the daily reset.

- Requires market microstructure understanding for best results.

8. Gap Trading Strategy

Gap trading is a popular strategy among day traders. It focuses on exploiting the price differences between a stock's closing price one day and its opening price the next. These "gaps" represent significant price jumps or drops, often caused by overnight news, earnings announcements, or major market events. This creates volatility, giving traders a chance to profit as the market reacts to new information. This strategy's straightforward setup, high reward potential, and established track record make it a valuable tool for beginners learning short-term market mechanics.

Gaps are broadly classified into four types:

- Common Gaps: These are small, quickly filled gaps that don't usually indicate a significant price move.

- Breakaway Gaps: These occur at the end of a period of consolidation (price moving sideways) and signal the beginning of a new trend. They often mark a significant change in market sentiment and can result in large price swings.

- Continuation Gaps (Runaway Gaps): These gaps happen mid-trend and represent an acceleration of the current price movement. They signify strong momentum and often lead to further price gains or losses in the direction of the trend.

- Exhaustion Gaps: These emerge at the end of a trend and signal a potential reversal. High volume but limited price follow-through often characterizes these gaps, suggesting the trend is weakening.

Features and Benefits

Gap trading centers around the opening price action relative to the previous day’s close. It involves pre-market analysis to pinpoint potential trading candidates. Traders often aim to profit from either the "gap fill" (price returning to the previous day's close) or the continuation of the gap. Accurately categorizing gaps is essential for optimizing the risk-reward ratio. A key advantage is that gap trading strategies work in both bullish (rising) and bearish (falling) markets. Furthermore, certain gap types, like partially filled earnings gaps, have shown statistical edges, offering traders a deeper analytical approach.

Pros and Cons of Gap Trading

Let's look at a quick breakdown of the advantages and disadvantages:

| Pros | Cons |

|---|---|

| Clear trading opportunities at market open | Requires early morning trading during volatile periods |

| Potential for high risk-reward ratios | Gap direction isn't always predictive of the day |

| Works in both bull and bear markets | Can be affected by low-liquidity pre-market trading |

| Statistical edges for some gap types | Requires rapid decision-making |

Gap Trading Examples

Here are a few examples of how gap trading can be applied:

- Fading an Exhaustion Gap: A large gap up during an extended uptrend might signal an exhaustion gap. A trader could short sell the stock, anticipating a reversal and a price drop.

- Trading a Breakaway Gap: A gap up after a period of consolidation could be a breakout. A trader might buy the stock, expecting further upward momentum.

- Trading the Gap Fill: If a stock gaps down, a trader could buy near the previous day’s close, anticipating a gap fill.

Practical Tips for Gap Trading

Here are some practical tips for using gap trading strategies:

- Observe Early Price Action: Wait for the first 15-30 minutes of trading to confirm price direction before entering. This allows initial volatility to settle.

- Analyze Pre-Market Volume: High pre-market volume can indicate strong conviction behind the price movement.

- Consider Broader Market Context: Assess overall market and sector performance. A strong market might support gap continuations, while a weak market could favor gap fills.

- Use Level II Data (If Available): Level II data provides detailed order book information, helping to identify support and resistance levels.

- Set Clear Profit Targets: Determine profit targets based on technical analysis or recent price levels. This helps manage risk and encourages consistent profit-taking.

Popularity and Key Figures

Notable figures like Scott Andrews (the "Gap Guy"), Toby Crabel, and Jon and Pete Najarian have popularized gap trading. Their work has significantly advanced understanding and application of gap trading. Many online resources and brokerage platforms offer educational materials on this strategy.

By understanding gap types, analyzing pre-market data, and implementing risk management, traders can use gap trading to capitalize on short-term price fluctuations and potentially achieve substantial returns. However, remember that all trading strategies involve inherent risks. Thorough research, practice, and disciplined execution are essential for consistent success.

8-Point Day Trading Strategies Comparison

| Strategy | Implementation Complexity (🔄) | Resource Requirements (⚡) | Expected Outcomes (📊) | Ideal Use Cases & Key Advantages (💡) |

|---|---|---|---|---|

| Trend Trading | Moderate | Basic charting tools (moving averages, RSI, MACD) | Consistent gains in trending markets; lower emotional stress | Beginner-friendly; works across multiple timeframes |

| Breakout Trading | Moderate | Real-time price/volume data and clear support/resistance | Potential for explosive profits; risk of false breakouts | Suited for volatile markets and clear price barriers |

| Scalping | High | Advanced platforms, low-latency execution, Level II quotes | Frequent small gains; requires tight risk control | Ideal in highly liquid markets with rapid price movements |

| Reversal Trading | High | Sophisticated oscillators and candlestick pattern tools | Possible high reward if reversal is timed correctly; higher risk | Best for experienced traders spotting trend exhaustion |

| Moving Average Crossover Strategy | Low to Moderate | Standard moving averages available on most platforms | Clear buy/sell signals though may lag amid choppy prices | Great for beginners and automated systems in trending scenarios |

| Range Trading | Moderate | Tools for support/resistance and oscillators | Steady returns within sideways markets; defined entry/exit points | Effective in low-volatility, well-defined price channels |

| VWAP Trading Strategy | Moderate | VWAP indicator combined with volume data | Objective intraday entries reflecting institutional activity | Best for high-volume stocks/ETFs during active trading hours |

| Gap Trading Strategy | Moderate to High | Pre-market data and gap analysis tools | Profits from gap fills and rapid post-open moves; dependent on market catalysts | Optimal for stocks with news catalysts and earnings events |

Level Up Your Trading

Throughout this listicle, we’ve explored eight foundational day trading strategies: Trend Trading, Breakout Trading, Scalping, Reversal Trading, Moving Average Crossover Strategy, Range Trading, VWAP Trading Strategy, and Gap Trading Strategy. These strategies offer distinct approaches to capitalizing on intraday market fluctuations. Remember, success in day trading isn’t about mastering every single strategy, but about finding the ones that best suit your individual trading style, risk tolerance, and market understanding.

Applying these concepts requires a disciplined approach. Start by backtesting potential strategies on historical data. This helps you understand their strengths and weaknesses. Paper trading can also be a valuable tool for practicing execution and risk management without risking real capital.

As you gain experience, adapt these strategies to prevailing market conditions and refine your entry and exit points. Don't be afraid to experiment and adjust your approach as you learn more. The market is dynamic, so your strategies should be too.

Staying Ahead of the Curve

The financial markets are constantly evolving. Staying informed about ongoing trends and future developments is crucial for long-term success. This includes keeping up with advancements in algorithmic trading and the integration of artificial intelligence (AI) in trading platforms. Understanding the evolving regulatory landscape is also essential.

Continuous learning through books, courses, and mentorship can help you stay ahead of the curve. Consider joining online communities or attending industry events to network with other traders and share insights.

Key Takeaways

- Risk Management is Paramount: Always prioritize protecting your capital. Define your risk tolerance and stick to it.

- Consistency is Key: Develop a disciplined approach and stick to your trading plan. Avoid emotional decisions.

- Adaptation is Essential: Refine your strategies as market conditions change. Flexibility is crucial in the dynamic world of trading.

- Continuous Learning is Crucial: Stay updated on market trends and new technologies. The market never stops evolving, and neither should you.

Ready to elevate your day trading game and navigate the markets with precision and efficiency? ChartsWatcher offers a comprehensive suite of tools designed to empower professional traders like you. From customizable dashboards and real-time alerts to advanced charting and backtesting capabilities, ChartsWatcher provides the insights you need to make informed decisions and stay ahead of the curve. Explore our flexible pricing plans and discover how ChartsWatcher can enhance your trading strategy. Visit ChartsWatcher today and unlock your full trading potential.