Risk Management Frameworks: Your Strategic Guide

The Evolving Landscape of Risk Management Frameworks

Risk management frameworks are no longer simply a checklist for compliance. They are transforming into vital strategic tools. Organizations now understand that a robust risk management framework can be crucial for not just surviving, but truly flourishing in today's uncertain market. This represents a major shift in how businesses view and handle risk. Instead of reacting to threats, they are proactively building resilience and adaptability into their core operations.

From Reactive to Proactive: A New Era of Risk Management

Traditional risk management often concentrated on avoiding negative outcomes. Modern frameworks, however, emphasize finding opportunities that emerge from effective risk management. This means organizations are increasingly using their risk management frameworks to inform strategic decisions.

For example, understanding market volatility can lead to innovative investment strategies. Anticipating supply chain disruptions can help develop more resilient sourcing models. Numerous risk management framework examples exist to help you build your own. You can find more information about risk management framework examples.

The Importance of Adaptability in Risk Management Frameworks

This shift is driven by the growing complexity and interconnectedness of global risks. Establishing effective risk management frameworks has become increasingly critical in recent years due to these rising risks. For instance, the World Economic Forum's Global Risks Report 2025 highlights increased concerns about environmental, geopolitical, and technological risks.

The report, compiled from over 900 experts worldwide, emphasizes the need for integrated risk management strategies. These strategies must address both immediate and long-term challenges. By 2025, organizations are expected to invest heavily in risk management tools and technologies. This investment will focus on adapting to climate change and societal polarization.

Key Components of a Modern Risk Management Framework

A truly effective risk management framework has several key components. It requires a clear governance structure defining roles, responsibilities, and accountabilities. Robust risk assessment methodologies are essential for identifying and analyzing potential threats and opportunities.

The framework must also outline clear risk response strategies. These strategies detail how the organization will mitigate, transfer, accept, or avoid identified risks. Finally, a system for monitoring and reporting on risk performance is crucial. This ensures continuous improvement and adaptability.

Building a Risk-Aware Culture

Beyond structural elements, a successful risk management framework requires a risk-aware culture. This means creating an environment where every employee understands the importance of risk management. They must actively participate in identifying and mitigating potential threats.

This cultural shift needs leadership commitment, ongoing training, and open communication about risk. By embedding risk awareness into the organizational DNA, companies create a more resilient and adaptable business model. This enables them to anticipate challenges, seize opportunities, and achieve greater success in a volatile global landscape.

Architecting Your Risk Framework: Essential Building Blocks

Building a successful risk management framework is a process, not an event. It involves thoughtfully integrating various interconnected components. These components serve as the foundation of a robust framework, allowing organizations to effectively identify, assess, and manage risks.

Defining the Scope and Objectives

The first step is defining the scope and objectives. Ask yourself what areas of the organization the framework will cover and what specific goals it should achieve. This initial step ensures the framework stays focused and aligns with the overall business strategy.

Identifying key stakeholders is also important. Determine who will participate in the risk management process and whose input is necessary. Engaging stakeholders early cultivates a sense of ownership and increases the chance of successful implementation.

Establishing a Governance Structure

A well-defined governance structure is vital for accountability and oversight. This structure defines roles, responsibilities, and reporting lines within the risk management framework, ensuring clarity on individual roles in the process.

For instance, a designated risk officer or committee could oversee the framework's implementation and effectiveness. This centralized authority provides leadership and ensures consistent risk management practices across the organization.

Choosing the Right Assessment Methodology

Identifying and analyzing potential risks requires an appropriate assessment methodology. Various methods exist, each with advantages and disadvantages. The right method depends on the organization's specific needs and risk profile.

Common methods include qualitative assessments, using expert judgment and scoring systems, and quantitative assessments, employing data and statistical modeling to estimate risk likelihood and impact. This variety lets organizations tailor their approach to the specific risks they face.

Implementing and Monitoring Controls

After identifying and assessing risks, organizations must implement appropriate controls to mitigate them. These controls can range from preventive measures, reducing the likelihood of occurrence, to detective measures, identifying risks that have already occurred.

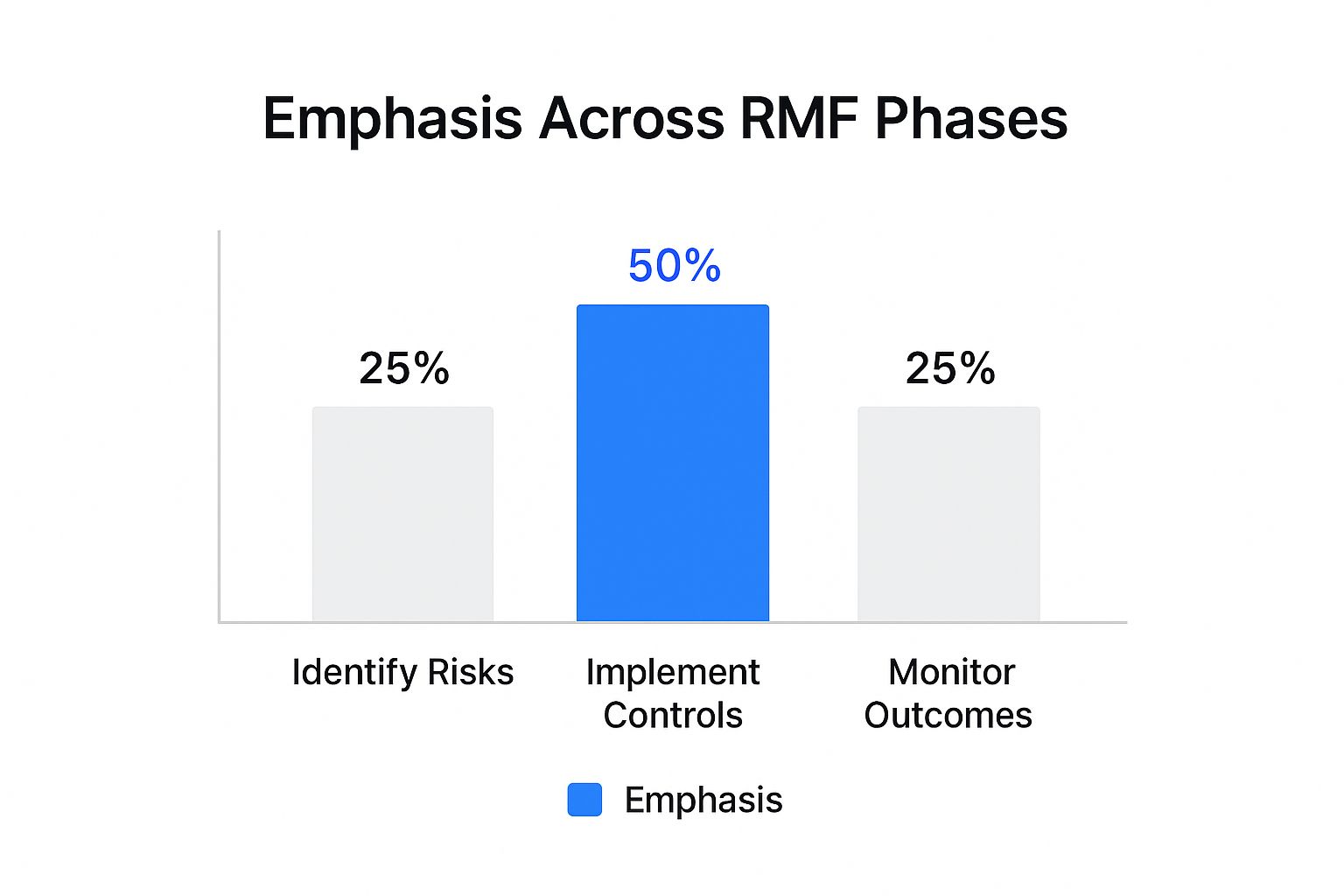

The following infographic illustrates effort distribution across key phases of a risk management framework:

Implementing controls is a central focus, at 50% of the overall effort. Identifying risks and monitoring outcomes are equally important, each taking 25%. This balanced approach emphasizes risk management's ongoing nature.

Communication and Reporting

Regular communication and reporting are vital for transparency and continuous improvement. Sharing risk information with stakeholders keeps them informed and allows for informed decision-making.

Communication can take various forms, including regular reports, dashboards, and presentations. These diverse channels ensure the right audience receives risk information in an accessible format. Feedback mechanisms should also be established to allow for continuous framework improvement, keeping it relevant and effective.

Different frameworks suit different organizations. COSO ERM provides a comprehensive approach to enterprise risk management. ISO 31000 offers a more general framework. NIST frameworks often cater to specific industries.

Understanding each framework's strengths and weaknesses allows organizations to choose the best fit for their needs and objectives. This alignment ensures the framework supports the organization's overall risk management strategy. By incorporating these building blocks, organizations can develop robust and adaptable risk management frameworks. These frameworks not only mitigate potential threats but also enable organizations to seize emerging opportunities, positioning them for long-term success.

To further illustrate the differences between these frameworks, consider the following table:

Comparison of Major Risk Management Frameworks

| Framework | Key Components | Strengths | Best For | Limitations |

|---|---|---|---|---|

| COSO ERM | Internal environment, objective setting, event identification, risk assessment, risk response, control activities, information and communication, monitoring | Comprehensive and widely adopted, strong focus on internal controls and governance | Large organizations, complex environments | Can be resource-intensive to implement |

| ISO 31000 | Principles, framework, process | Flexible and adaptable, applicable to diverse organizations | Organizations of all sizes, looking for a general framework | Less prescriptive than COSO, requires more tailoring |

| NIST | Cybersecurity Framework, Risk Management Framework | Specific guidance for cybersecurity and IT risk management | Organizations with significant cybersecurity concerns, government agencies | May not address all types of risk |

This table summarizes the key features of each framework, helping organizations select the most suitable one for their specific needs. Choosing the right framework, along with proper implementation and continuous improvement, can greatly enhance an organization's ability to manage risks effectively.

Creating a Risk-Intelligent Organization From the Inside Out

A strong risk management framework requires more than just a solid structure. It needs a supportive culture within the organization. This involves creating an environment where everyone considers risk in every decision, not just as a compliance exercise. Top-performing organizations develop this risk intelligence internally, changing risk management from an obligation into a strategic advantage.

Leadership Commitment: The Cornerstone of Risk Culture

Getting true leadership buy-in is critical. Leaders need to actively support and participate in the risk management process. This sets the standard for everyone and shows that risk management is a top priority.

Regular communication from leadership about risk management initiatives reinforces their importance. Including risk discussions in strategic planning sessions also demonstrates the vital link between risk and business goals. This integration helps establish risk management as essential for organizational success.

Engaging Employees at All Levels

Building a risk-intelligent culture means engaging employees at every level. This means providing training and resources so employees can identify and manage risks in their own roles. Empowered employees are more likely to proactively address potential problems.

Here are some effective strategies:

- Incorporate risk management principles into performance reviews. This connects risk awareness with individual goals and job responsibilities.

- Establish open communication channels so employees can report potential risks without fear. This encourages transparency and a proactive risk management environment.

Overcoming Psychological Barriers

Psychological barriers often get in the way of risk management. People may hesitate to acknowledge or discuss risks because they're afraid of being blamed or simply want to avoid bad news. Creating a psychologically safe environment where open and honest conversations about risk are welcomed is crucial.

How can this be achieved?

- Train employees on cognitive biases that can affect how we see risk.

- Foster a culture of learning from mistakes instead of assigning blame. This will lead to more transparency and better risk awareness.

Transforming Risk Management into a Competitive Advantage

Organizations that successfully embed risk management into their culture gain a real competitive edge. They can better anticipate and respond to market shifts, protect their reputation, and make well-informed strategic decisions.

This proactive approach allows them to seize opportunities and overcome challenges more effectively than competitors who are less risk-aware. Ultimately, a strong risk culture benefits the entire organization, contributing to sustainable growth and long-term success.

Leveraging Technology To Supercharge Your Risk Framework

Technology is changing the face of risk management. It's not just about automating what we already do. Forward-thinking organizations are building risk management frameworks that are proactive, insightful, and resilient. This enhanced approach enables them to anticipate and address threats more effectively.

AI-Powered Prediction and Automation

Artificial intelligence (AI) is becoming increasingly important in risk management. AI-powered predictive models analyze massive datasets to identify emerging risks before they become major problems. This gives organizations valuable time to develop mitigation strategies. Artificial Intelligence platforms also automate risk assessment and monitoring.

This automation frees up time and resources, allowing risk managers to focus on strategic decision-making. These tools can constantly monitor and adapt to the changing risk environment. For example, algorithms can scan news feeds and social media for early warnings of potential disruptions.

Advanced Analytics and Data Visualization

Advanced analytics uncover hidden patterns in risk data, providing insights into the factors driving risk and informing better decision-making. Data visualization plays a key role in making this complex information accessible.

Clear dashboards and interactive reports communicate risk information effectively. This leads to improved transparency and greater engagement with risk management initiatives. For more information on effective risk dashboards, check out this resource: Risk Management Dashboard Examples: Top Insights. Globally, risk management frameworks are being shaped by regulations and market pressures. For example, developments in risk management and REMS (Risk Evaluation and Mitigation Strategies) in 2024 will likely influence practices in 2025 and beyond. These developments often involve integrating technology and data analytics into risk management systems, enhancing prediction and response times. You can explore this topic further here. The need for adaptability and strategic decision-making underscores the increasing importance of these frameworks in navigating complex risks.

Integrating Technology Without Creating Silos

While technology offers significant potential, integrating these tools into existing frameworks requires careful consideration. The goal is to enhance human expertise, not replace it. It's important to avoid creating isolated technology silos. New technologies should integrate seamlessly with current processes and systems.

This integration requires planning and collaboration between IT, risk management, and other relevant departments. A phased implementation can help manage complexity and minimize disruptions, allowing organizations to test and refine their approach along the way.

Building a Future-Proof Risk Management Framework

Organizations can build powerful, resilient risk management frameworks by strategically using technology. This includes adopting AI-powered prediction, advanced analytics, and data visualization. These improvements lead to better risk identification, response capabilities, and decision-making across the organization.

Thoughtful integration of these tools is key to avoiding technology silos. This approach allows organizations to build robust, adaptable frameworks that can meet future challenges. This proactive approach positions organizations to thrive in a complex and uncertain world.

Elevating Risk Management to the Executive Agenda

A robust risk management framework needs buy-in from the top. Without executive support and engagement, even the best framework may not succeed. Securing commitment from the C-suite and board is essential.

The Importance of Executive Sponsorship

Executive sponsorship isn't simply budget approval. It requires active involvement in risk management. When leaders champion risk management, it sets the standard for the whole organization.

This active role demonstrates that risk management is a core business function, not just a box to check for compliance. It creates a culture of risk awareness. This top-down approach ensures risk is considered in strategic decisions. Executive sponsorship secures resources and clears obstacles for effective implementation.

Establishing Clear Accountability

Successful risk management frameworks require clear accountability. Who is responsible for identifying, assessing, and managing specific risks? Who decides how to respond to them? Clarity is vital.

Well-defined roles ensure ownership and follow-through, preventing confusion and oversight gaps. This involves assigning individuals or teams to specific risks and creating reporting procedures. This empowers employees to take responsibility and manage risks proactively.

Creating Compelling Risk Reporting

Effective risk reporting engages executives. Dry, technical reports often fail to connect. Reports should be concise, focused, and tailored for executives.

They should show the potential impact of risks on strategic goals. This involves translating technical risk assessments into business terms. For example, instead of just the probability of a data breach, highlight the potential financial and reputational damage. To enhance your risk framework with technology, consider AI and Predictive Analytics in Background Verification.

Demonstrating the Value of Risk Management

It’s crucial to prove risk management’s value to stakeholders. This involves showing how it helps achieve business objectives. It's not just about preventing losses.

It’s about making informed decisions and capitalizing on opportunities. Showing how risk assessments led to a successful product launch demonstrates a positive impact. Surveys reveal executives are increasingly focused on risk. The Executive Perspectives on Top Risks survey included 1,215 executives globally. The survey results indicate that technological risks are a significant concern over the next two years. This highlights the need for frameworks that address cybersecurity breaches and data privacy issues. For detailed survey statistics, click here. By turning risk discussions into strategic conversations, organizations make risk management a key driver of success.

To illustrate the varying concerns across industries, let's look at the following table:

Top Executive Risk Concerns by Industry

Statistical breakdown of the most significant risk concerns among executives across different industry sectors.

| Industry | Primary Risk Concern | Secondary Risk Concern | Year-Over-Year Change in Concern Level |

|---|---|---|---|

| Financial Services | Cybersecurity Breaches | Regulatory Changes | +15% |

| Healthcare | Data Privacy | Operational Resilience | +12% |

| Technology | Talent Acquisition & Retention | Supply Chain Disruptions | +8% |

| Manufacturing | Supply Chain Disruptions | Geopolitical Instability | +10% |

| Retail | Economic Downturn | Changing Consumer Behavior | +7% |

This table showcases how different industries prioritize their risk concerns. While cybersecurity remains a major concern for Financial Services, Healthcare focuses on Data Privacy. Supply chain disruptions heavily impact Manufacturing and Technology sectors. Retail executives are increasingly concerned about economic conditions and shifting consumer preferences.

From Theory to Practice: Implementing Your Risk Framework

Implementing a risk management framework isn't just about creating a document. It's about integrating a new mindset into your organization. This shift requires careful planning and execution, whether you're building a framework from the ground up or refining an existing one.

Phased Implementation For Success

A phased implementation is often the best approach. This allows you to begin with a pilot project within a specific business area. You can then gradually roll out the framework across the organization, gaining traction and learning as you go. This iterative process helps refine the framework and address any unexpected hurdles before full deployment. It also minimizes disruptions, giving teams time to adapt to the new processes.

Resource Allocation and Timeline Development

Successful implementation hinges on allocating adequate resources. This includes budgeting for technology, training, and personnel. Developing a realistic timeline is equally important. Be sure to allow enough time for each phase, from the initial assessment to ongoing monitoring. Clearly defined milestones help track progress and keep the project on schedule, allowing for proactive adjustments when necessary.

Stakeholder Management: A Key To Success

Engaging stakeholders throughout the process is essential. This involves clear communication about the framework's purpose, benefits, and anticipated impact. Regular updates and opportunities for feedback keep stakeholders informed and involved. Addressing their concerns and incorporating their feedback builds a sense of ownership and increases the chances of successful adoption.

Navigating Common Pitfalls

Several common issues can hinder the implementation of a risk framework. Lack of support from leadership can create the impression that risk management isn't a priority. Insufficient training can leave employees uncertain about their roles and responsibilities. Poor communication can lead to confusion and resistance. To prevent these problems, develop a detailed project plan that outlines these key components and their corresponding action steps. Regularly evaluate the plan's effectiveness and adjust as needed. Learn more in our article about how to master day trading risk management.

Learning From Successful Implementations

Organizations that have successfully integrated strong risk management frameworks often share similar traits. They secure strong leadership commitment, invest in training and communication, and focus on continuous improvement. They also emphasize measuring the framework's effectiveness using clear metrics. By learning from their successes, you can create a risk management framework that is both effective and sustainable, strengthening your organization's ability to navigate challenges and capitalize on opportunities. This proactive risk management approach enhances organizational resilience and positions the business for long-term success.

Measuring What Matters: Risk Framework Performance

A well-implemented risk management framework is a dynamic tool, constantly adapting to new challenges. But how can you determine its effectiveness? Simply ticking off compliance checklists falls short. Truly effective organizations evaluate their framework's performance by analyzing its tangible impact on the business.

Beyond Compliance: Measuring Real Business Impact

This involves going beyond simple compliance metrics and concentrating on outcomes. Risk-adjusted return analysis, for example, can showcase how the framework contributes to improved investment choices. Other key indicators, such as the number of prevented incidents or the speed of incident response, offer quantifiable performance measurements.

Resilience indicators reveal how effectively the framework helps the organization navigate unforeseen events. This might include assessing the effects of supply chain disruptions or the ability to bounce back from a cybersecurity incident. These metrics provide a more holistic view of the framework’s actual value.

Developing Metrics That Resonate With Stakeholders

Different stakeholders prioritize various aspects of risk management. Executives may focus on financial implications, while operational teams value efficiency and business continuity. Developing metrics that resonate with each stakeholder group is crucial for successful implementation.

Financial metrics like risk-adjusted return on capital are relevant to executives. Operational metrics, such as incident response time or the number of near misses, resonate with operational teams. This targeted method ensures that all stakeholders comprehend the framework's value and actively contribute to its success.

Communicating Risk Performance Effectively

Clear communication is paramount. Risk performance information should be presented in a readily understandable and actionable format. Data visualization tools like dashboards and charts can effectively communicate complex data sets.

Regular reporting, tailored to different audiences, keeps stakeholders informed and engaged. This consistent communication promotes transparency and strengthens accountability, ensuring everyone understands their role in maintaining a robust risk posture.

Continuous Improvement: Adapting to Change

The risk landscape is constantly shifting. A static risk management framework quickly becomes obsolete. A dedication to continuous improvement is essential. Regularly reviewing and updating the framework, based on performance data and emerging threats, ensures its ongoing relevance.

This iterative process allows organizations to adjust to evolving circumstances and maintain a strong risk profile. By prioritizing meaningful metrics, communicating effectively, and embracing continuous improvement, organizations can transform their risk management frameworks from static documents into dynamic tools for achieving success.

Ready to enhance your risk management strategy with effective market analysis? Explore ChartsWatcher today and discover how real-time insights can improve your trading strategies.