Risk Management and Trading Your Definitive Guide

Risk and trading go hand-in-hand. Let’s get that straight. Effective risk control isn’t about trying to sidestep every loss—that’s impossible. It’s about making absolutely sure that no single loss, or even a string of them, can knock you out of the game for good.

This is the bedrock of any sustainable trading career. It’s a complete shift in focus from chasing home-run wins to intelligently protecting your downside. Think of it as the braking system on a high-performance race car. Without it, all that speed is just a massive liability waiting to happen.

Reframing Risk as Your Greatest Advantage

Most new traders are obsessed with one thing: finding the perfect entry. They spend countless hours hunting for that holy-grail indicator or flawless setup, convinced that profits come from simply being "right." But the pros know a much deeper truth. Long-term success has very little to do with predicting the future and everything to do with managing uncertainty.

This guide is about flipping the entire concept of risk on its head. It’s not some barrier you have to overcome; it’s the very tool that makes success possible. A trader without a solid risk plan is like a tightrope walker with no safety net—one gust of wind, and the show is over. But a trader with disciplined controls can absorb the inevitable mistakes and market shocks, staying in the game long enough for their edge to actually pay off.

The Professional Mindset Shift

The biggest difference between amateurs and pros? It’s where they put their focus. The amateur is constantly asking, "How much can I make on this trade?" The professional, on the other hand, is laser-focused on one question: "How much can I afford to lose?" This isn't about being negative; it's about strategic capital preservation.

"The essence of risk management lies in maximizing the areas where we have some control over the outcome while minimizing the areas where we have absolutely no control... and accepting the reality that uncertainty is a constant." - Peter L. Bernstein

Internalizing this shift is everything. When you prioritize defense, you ensure that your trading capital—your single most important tool—lives to fight another day. We’re going to dig into these core ideas:

- Capital Preservation is Job #1: Your first goal isn't to make money. It's to protect the money you already have.

- Profits are a Byproduct: Consistent profits are what happens after you’ve built a fortress around your capital.

- Control is an Illusion: You can’t control the market. Ever. But you can always control your exposure to it.

Once you embrace these principles, you stop gambling and start running a proper trading business.

Understanding the Core Principles of Trading Risk

Let's get one thing straight: successful trading isn't about finding a crystal ball to predict the market's next move. It's built on a bedrock of timeless principles for managing risk.

These pillars don't just help you dodge losses—they create the foundation you need to survive and, eventually, thrive. Mastering them is the first real step you take from being a market gambler to becoming a strategic trader. Think of these principles as the operating system for your entire trading business. Without them, even the most brilliant strategy is doomed to fail. But with them, you can navigate the choppy waters of the market with a steady hand.

Capital Preservation Your Prime Directive

Before you even dream about profits, your first and only priority is capital preservation. Your trading capital is your lifeblood. It's the only tool you have to play the game. Once it's gone, you're out. Period.

Picture your trading account as the hull of a ship on a long voyage. You know you're going to hit storms. Your primary mission isn't to get to the destination as fast as possible; it's to make sure the hull doesn't spring a catastrophic leak. A small ding is manageable, but one giant hole will sink the whole vessel. In trading, this means you must avoid any single loss that could cripple your account.

Your number one job as a trader is not to make money. It is to protect the capital you already have. Profits are simply the byproduct of excellent defense.

Protecting your capital means you live to trade another day. It guarantees you have enough ammo to withstand a string of losses—and trust me, they will happen—and still be ready to fire when the next big opportunity comes along.

Insist on Positive Risk-to-Reward Ratios

Once you've committed to keeping your capital safe, the next rule is simple: only take trades that are mathematically worth it. This is where the risk-to-reward ratio comes in. It’s a back-of-the-napkin calculation comparing how much you're willing to lose on a trade versus how much you realistically stand to gain.

Would you risk $100 for a shot at winning $10? Of course not. The logic is completely broken. Yet, countless traders do the financial equivalent every single day by jumping into trades with terrible risk profiles. A sustainable strategy demands that your potential rewards consistently dwarf your potential risks.

- 1:2 Risk-to-Reward: For every $1 you risk, you're aiming to make at least $2.

- 1:3 Risk-to-Reward: For every $1 you risk, you're aiming to make at least $3.

Sticking to positive ratios gives you a massive mathematical edge. With a 1:2 risk-to-reward setup, you only need to be right 34% of the time just to break even. Anything better than that is pure profit. This is how you can be wrong more often than you're right and still grow your account.

Master Your Position Sizing

Position sizing is all about deciding how much capital to bet on a single trade. It's arguably the most powerful risk management tool you have. It directly controls your exposure and makes sure no single trade can blow up your account. Think of it as balancing the cargo on your ship.

If you stack all the heavy containers on one side, the ship becomes unstable and can easily capsize in rough seas. But by distributing the weight properly, you stay balanced and afloat. In the same way, proper position sizing stops you from going "all-in" on one idea that could sink your portfolio if it turns against you. Consistent, calculated sizing is what keeps you in the game during the inevitable losing streaks.

Cultivate Emotional Discipline

Finally, the glue that holds all these principles together is emotional discipline. The market is an arena specifically designed to trigger your deepest instincts of fear and greed. Without a steady mind, those emotions will hijack your well-thought-out plans, causing you to make impulsive mistakes like cutting your winners too early or, even worse, letting your losers run.

Emotional discipline is the captain's calm during the storm. The crew might be panicking, but the captain sticks to the navigational chart and trusts the process. For a trader, that means:

- Trusting your trading plan, especially when your stomach is in knots.

- Hitting your stop-loss without a second of hesitation.

- Taking profits at your target instead of getting greedy for more.

This final principle is the psychological armor that protects you from your greatest enemy in trading: yourself. By mastering these four core concepts, you build the resilient, strategic mindset that separates the pros from the amateurs.

Essential Metrics and Tools for Quantifying Risk

Moving from broad principles to daily practice means you need tangible tools to measure and control your exposure. Make no mistake, effective risk management and trading isn't just a mindset; it's a system built on concrete numbers and pre-planned actions. These tools are what turn abstract ideas into a practical dashboard for navigating the markets with precision.

Think of these metrics as the gauges in a pilot's cockpit. They give you critical, real-time feedback, letting you make calculated decisions instead of flying blind. By building them into your routine, you swap out guesswork and emotion for a systematic, professional approach to protecting your capital.

The 1% Rule as Your Portfolio's Circuit Breaker

The 1% Rule is one of the simplest yet most powerful rules in the game. It dictates that you should never risk more than 1% of your total trading capital on any single trade. Simple as that. If you have a $20,000 account, your maximum acceptable loss on one position is $200.

This rule acts as a non-negotiable circuit breaker for your portfolio. It ensures that a single bad decision—or even a string of five or six consecutive losses—cannot inflict devastating damage. A 5% drawdown is a manageable setback; a 50% drawdown is a catastrophic event that can take years to recover from.

By capping your risk on every single trade, you mathematically guarantee your survival. This forces you to stay disciplined and prevents the kind of emotional, oversized bets that wipe out novice traders. It's your ultimate defense against blowing up your account.

Stop-Loss Orders The Ultimate Business Decision

A stop-loss order is a pre-set instruction to automatically close your position once the price hits a specific level. Far too many traders see a stop-loss getting hit as a personal failure. This is a destructive mindset. You have to reframe it: a stop-loss is a pre-committed business decision, executed flawlessly.

Before you even click "buy," you should know exactly where your trade idea is proven wrong. That point is your stop-loss. Placing it immediately after entering a position rips emotion out of the equation. You don't have to sit there debating whether to hold on "just a little longer" as the loss gets bigger; the decision was already made by your rational, pre-trade self.

A stop-loss is not an admission of failure. It is the cost of doing business—a planned expense that protects you from the un-plannable, catastrophic losses that end trading careers.

This single tool is a cornerstone of professional risk management, turning a reactive, emotional process into a proactive, strategic one.

Understanding Your Maximum Drawdown

Maximum Drawdown (MDD) is the largest peak-to-trough decline your portfolio has ever experienced. Imagine you're a mountain climber. Your journey to the summit (your equity high) won't be a straight line up; there will be dips and descents along the way. Your MDD is the single biggest, gut-wrenching descent you had to endure.

Knowing this number is crucial for psychological preparedness. If backtesting shows your strategy has a historical MDD of 15%, you won't freak out when you find yourself down 10%. You'll recognize it as a normal, expected part of the system's performance.

This metric helps you answer a critical question: "Can I emotionally handle the worst-case scenario this strategy might deliver?" If the answer is no, you need to dial down your risk until the potential drawdown falls within your personal tolerance.

The Sharpe Ratio Are Your Returns Worth the Risk

Finally, the Sharpe Ratio helps you evaluate your performance by answering one simple question: am I being compensated fairly for the risks I'm taking? It measures your risk-adjusted return, showing how much profit you've generated for each unit of risk (volatility).

A higher Sharpe Ratio is always better. For example:

- Strategy A: Returns 15% with low volatility (Sharpe Ratio of 1.5).

- Strategy B: Returns 20% but with extreme volatility (Sharpe Ratio of 0.8).

While Strategy B made more money in absolute terms, Strategy A was far more efficient. The Sharpe Ratio helps you compare different strategies and ensures you aren't just chasing high returns while ignoring the wild ride required to get them.

The growing importance of these metrics is mirrored by industry trends. The global market for trading risk management software was valued at $2.36 billion in 2021 and is expected to reach $3.47 billion by 2025, with North America leading the charge. This investment highlights the industry-wide recognition that sophisticated tools are essential for managing modern market risks. You can discover more insights about this growing market on cognitivemarketresearch.com.

How to Build Your Personal Risk Management Plan

Okay, let's move from theory to action. Knowing all the metrics is one thing, but that knowledge is useless until you forge it into a personal, non-negotiable set of rules. This is where you create your own constitution for trading—a formal plan that dictates every move and saves you from making emotional decisions in the heat of the moment.

Building this plan isn’t about restricting yourself. It’s about creating the very structure that allows you to succeed in the long run. Think of it as the foundation that gives your trading edge the time it needs to actually work. Let's build it, step by step.

Start With The Sleep-at-Night Test

Before you write a single rule, you need to get brutally honest about your personal risk tolerance. The best way I know to do this is with the "Sleep-at-Night Test." It’s a simple question you ask yourself: "How much of my portfolio could I lose in a single day without it wrecking my sleep, my mood, or my life outside the charts?"

Your answer is your emotional breaking point. If a 5% drop in your account would have you staring at the ceiling all night, then your risk parameters need to be set far below that. This number is deeply personal; there’s no right or wrong answer. But being honest here is everything, because it’s the bedrock for all the other rules you’re about to set.

Set Your Maximum Risk Per Trade

With your tolerance level clear, it’s time to set your first hard-and-fast rule: the absolute maximum percentage of your capital you’re willing to lose on any single trade. For nearly every trader, this number should fall somewhere between 0.5% and 2% of your total account equity. This is your primary defense mechanism.

This isn't a suggestion—it's an unbreakable law.

- On a $10,000 account at 1% risk: Your maximum loss is $100. Period.

- On a $50,000 account at 2% risk: Your maximum loss is $1,000. Period.

This one rule makes it mathematically impossible for a single bad idea to blow up your account. It forces you to be disciplined and ensures you can survive the losing streaks that every single trader inevitably faces.

Choose Your Position Sizing Method

Next up, you need a system to translate that maximum risk percentage into an actual position size. This is the calculation that tells you how many shares, contracts, or units to buy while still honoring your risk limit. There are a few ways to do it, but two are the most common.

Position sizing is the bridge between your abstract risk limit and your concrete actions in the market. It’s how you apply your capital preservation rule to every single trade.

Different methods suit different styles. To explore which approach works best for your needs, our deep dive into risk management frameworks can help you structure these rules perfectly.

To help you decide, let's compare the two most popular approaches.

Comparing Position Sizing Methods

| Feature | Fixed Fractional Sizing | Fixed Dollar Risk Sizing |

|---|---|---|

| How it Works | You risk a fixed percentage (e.g., 1%) of your total account on every trade. | You risk a fixed dollar amount (e.g., $100) on every trade, regardless of account size. |

| Position Size | Size grows as your account grows and shrinks as it shrinks. Automatically compounds. | Size remains constant until you manually adjust the dollar amount you're risking. |

| Best For | Traders who want their risk to scale automatically with their performance (compounding). | Traders who prefer consistency and want to keep their risk psychologically stable. |

| Psychology | Can feel aggressive during winning streaks and discouraging during drawdowns. | Very stable and predictable, which can help reduce emotional trading decisions. |

Ultimately, your choice here comes down to whether you prefer your risk to compound automatically or remain steady and predictable. There's no wrong answer, only what's right for you.

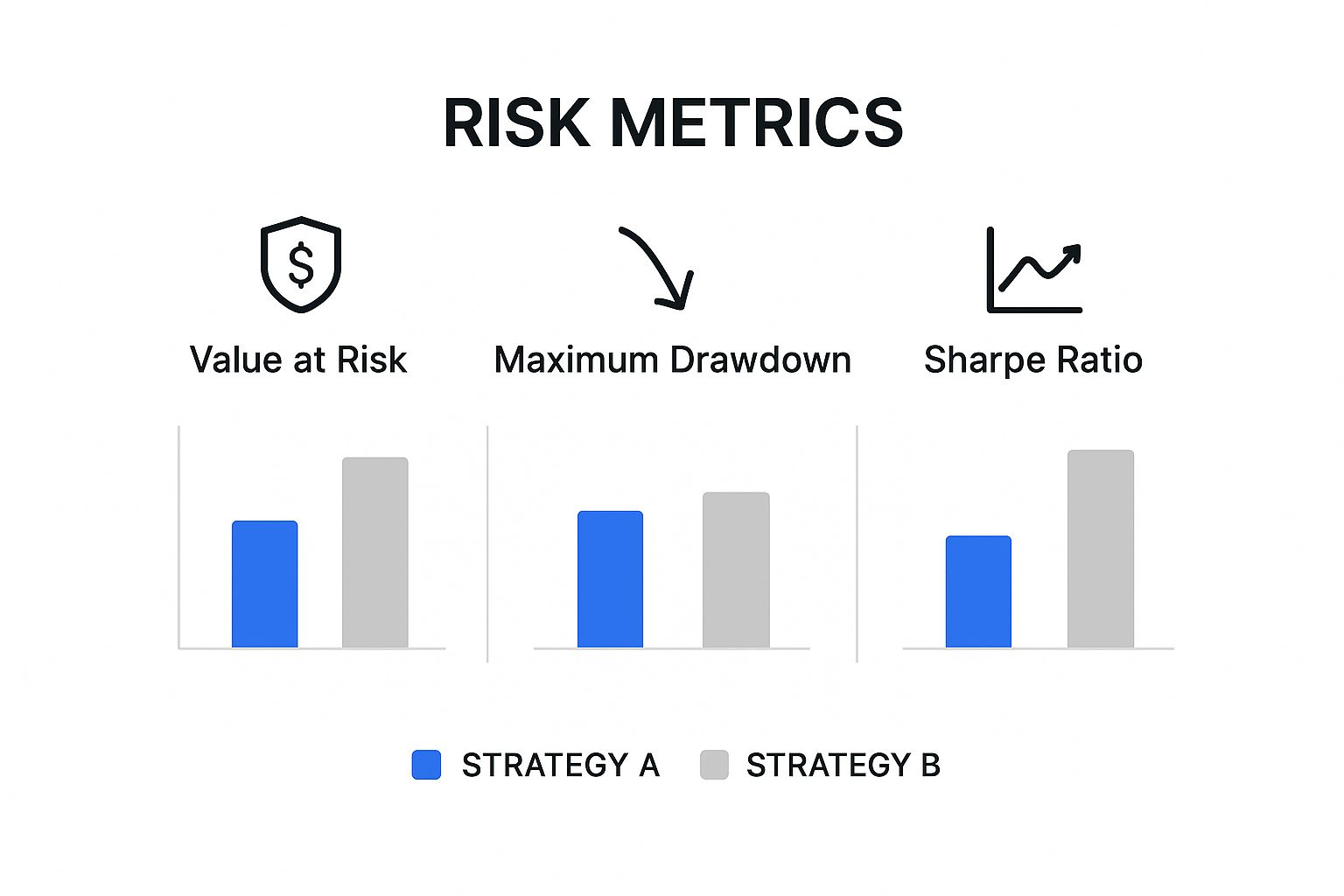

This infographic shows how different risk metrics like Value at Risk, Maximum Drawdown, and the Sharpe Ratio can play out across two very different trading strategies.

As you can see, a high-growth strategy might boast a better Sharpe Ratio but also comes with a much scarier Maximum Drawdown. This highlights the trade-offs you have to weigh when building your own plan.

Establish Your Minimum Risk-to-Reward Ratio

Your next rule acts as a filter, deciding which trades are even worth your time and capital. You must set a minimum acceptable risk-to-reward ratio. This ensures the potential upside of a trade is always mathematically justified by the risk you’re taking. A solid starting point for most is 1:2, meaning you only take a trade if the potential profit is at least double the potential loss.

- Risk: $100 (the distance from your entry to your stop-loss)

- Reward: Must be at least $200 (the distance from your entry to your take-profit)

Strictly enforcing this rule has a massive impact on your long-term profitability. It actually allows you to be wrong more often than you are right and still make money. This mathematical edge is a core pillar of professional risk management and trading.

Document Everything in a Formal Trading Plan

Finally, you have to write all of this down. Your trading plan is your business plan—it needs to be clear, concise, and easy to reference. It becomes your anchor during the trading day, reminding you of the commitments you made when you were thinking rationally and objectively.

Your plan must include:

- Your Risk Tolerance: The honest answer from your Sleep-at-Night Test.

- Maximum Risk Per Trade: Your non-negotiable percentage (e.g., 1%).

- Position Sizing Formula: The exact calculation you'll use every time.

- Minimum Risk-to-Reward Ratio: Your entry filter (e.g., 1:2 or higher).

- Strategy-Specific Rules: Your criteria for entry, exit, and managing trades.

This document is your shield against emotion. When the market is going wild and your gut is screaming at you to break your rules, you pull out the plan. It’s your commitment to discipline and the single most important tool for building a lasting career in trading.

Taking Your Risk Management Game to the Next Level

Once you’ve got the basics down, the world of risk management and trading really opens up. This is where you move beyond the simple stop-loss on a single trade and start thinking like a true portfolio manager.

These advanced strategies are what allow seasoned traders to not only protect their capital but thrive in volatile markets. It's less about individual wins and losses and more about building a smoother, more predictable equity curve over the long haul. This involves layering different defensive tactics to guard your portfolio from a whole range of market shocks.

Beyond Just Owning Different Stocks

Most traders get the idea of basic diversification—don’t pile all your money into tech stocks, for instance. But advanced risk management takes this a giant leap further by diversifying across non-correlated strategies.

This means you’re running multiple trading systems that are designed to perform differently under various market conditions. Think of it like this:

- You might have a trend-following strategy that crushes it when the market is making strong, sustained moves in one direction.

- At the same time, you could run a mean-reversion strategy that profits when the market is choppy and bouncing around in a range.

When one strategy is taking a hit, the other is likely doing well, which helps smooth out your overall returns. It's a powerful internal hedge that makes your portfolio far less dependent on any single market behavior. For more ways to protect your capital, check out our guide on mastering day trading risk management.

Using Hedging as a Strategic Insurance Policy

Hedging isn't about trying to predict the future; it's about buying insurance. The goal is to take an offsetting position in a related asset to shield your main portfolio from a nasty price swing. Options are a classic and highly effective tool for this.

Let's say you're holding a large position in an S&P 500 ETF, but you're getting nervous about a potential short-term pullback. Instead of dumping your core holding (and potentially missing out on more upside), you could buy put options on that same ETF.

- If the market tanks, the value of your put options will skyrocket, offsetting a good chunk of the losses from your stock position.

- If the market keeps climbing, you only lose the small premium you paid for the options, while your main position continues to grow.

This strategic use of hedging lets you protect your downside without having to sacrifice your long-term upside potential. It's a calculated cost for some much-needed peace of mind.

What if 2008 Happened Again? Stress Testing Your Portfolio

How would your portfolio hold up during another global financial crisis or a sudden geopolitical shock? This isn't just a hypothetical question; it's one you absolutely must be able to answer. Risk scenario analysis, or stress testing, is the process of simulating how your positions would react to extreme, out-of-the-blue market events.

This forces you to confront the worst-case scenarios and uncover hidden weak spots in your strategy. You might simulate things like a sudden 20% market crash, a rapid spike in interest rates, or a currency crisis. By running these fire drills, you can adjust your positions or create contingency plans before disaster actually strikes.

The need for this kind of robust planning is obvious when you look at massive, fast-moving markets. The global foreign exchange (FX) market, for instance, sees an incredible $7.5 trillion change hands every single day as of April 2022. This enormous scale means insane liquidity, but it also brings substantial counterparty and settlement risks. In that kind of environment, advanced risk management isn't just a good idea—it's essential for survival. You can dig into the FX market data yourself over at the Bank for International Settlements.

How Major Market Events Shaped Modern Risk Management

Your personal trading rules didn't just appear out of thin air. They are the direct result of decades of painful, market-altering lessons learned by others.

Every principle of risk management and trading that protects your portfolio today is a miniature version of the same systems designed to stop the entire global financial structure from collapsing. History gives us the ultimate case studies.

The 2008 financial crisis was a brutal, real-world lesson in what happens when risk is misunderstood and mispriced on a massive scale. The fallout wasn't just a market crash; it was a near-total meltdown of trust and stability, forcing a complete overhaul of financial regulations.

The crisis proved that the complex, shadowy web of over-the-counter (OTC) derivatives could act as a super-spreader for financial contagion, passing risk from one bank to the next until the whole system was on life support.

A Global Shift Towards Transparency

In the aftermath, regulators worldwide scrambled to prevent a repeat disaster. The core idea was simple but revolutionary: drag these risky, private transactions out into the open.

This led to a huge push toward two key defensive measures:

- Central Clearing Counterparties (CCPs): Instead of firms dealing directly and taking on each other's risk, a CCP steps into the middle of the trade. It guarantees the transaction, effectively neutralizing the danger of one side defaulting.

- Transparent Trading Venues: New rules forced more derivatives trading onto regulated exchanges. This move dramatically improved price transparency and made sure everyone was playing by the same rules.

This regulatory overhaul completely reshaped derivatives trading. Post-crisis reforms spurred a massive migration toward standardized, exchange-traded products. To put a number on it, open interest in exchange-traded derivatives grew from $58 trillion in June 2009 to $85.3 trillion by June 2020. This was a clear signal that the market was moving toward safer, centrally cleared venues. You can find a full analysis of how OTC markets have evolved on ISDA.org.

The Cornerstone of Your Trading Career

Understanding this history gives your personal risk rules a much deeper meaning. Your stop-loss, your position sizing, your dedication to a trading plan—these aren't just "best practices." They are your personal defense against the very same forces that can topple giants.

Disciplined risk management is the true cornerstone of a lasting trading career. It transforms you from a market participant into a market survivor, ready to navigate the inevitable storms with strategy and control.

When you embrace this, you're aligning yourself with the most important lesson the markets have ever taught us: survival always comes first. Protect your capital with the same intensity that regulators now protect the system, and you'll build a foundation strong enough to support long-term success.

Common Questions About Risk Management and Trading

As you get deeper into trading, a lot of the same questions tend to pop up, whether you're just starting out or have been at it for years. Let's tackle some of the most common ones and get you some straight, practical answers.

What Is the Single Most Important Rule for Beginners?

Forget everything else for a moment. The most critical rule, the one that will keep you in the game, is simple: never risk more than you can comfortably afford to lose.

Seriously. Before you even think about fancy strategies or indicators, you have to burn this into your brain. Your trading capital is not infinite. The best way to put this into practice is with the 1% Rule, where no single trade ever risks more than 1% of your total account balance. This isn't just advice; it's your survival guide.

Why Is the 1% Rule So Effective?

The power of the 1% Rule is pure math—it's your defense against emotional decisions and bad luck. Imagine hitting a nasty losing streak of five trades. If you're risking 1%, you're only down about 5%. That's a manageable setback, something you can recover from.

Now, imagine you were risking 10% per trade. Those same five losses would obliterate nearly half your account. A blow like that isn't just financial; it's psychologically devastating and incredibly hard to come back from.

The 1% Rule makes it mathematically impossible for one or two bad trades to end your career. It forces discipline and buys you the time you need to learn and grow. Longevity is the real name of the game.

How Does Leverage Impact My Risk?

Leverage is like pouring gasoline on a fire—it makes things bigger, faster, for better or for worse. It magnifies both your wins and your losses. Using 10x leverage means a tiny 1% move against your position instantly becomes a 10% loss of your equity.

While it can supercharge your gains, it dramatically speeds up how fast you can lose your capital. Always, always treat leverage with extreme caution and understand that it massively dials up your risk profile.

Should I Change My Strategy During Volatility?

When the market goes wild, it's tempting to panic and throw your strategy out the window. Don't. Your plan was built with a clear, rational mind. Making impulsive changes in the middle of chaos is a recipe for emotional mistakes.

A much smarter approach is to simply reduce your position size. Stick to your tested strategy, but cut your risk. It's the most disciplined way to navigate the storm without abandoning the very rules designed to protect you.

Ready to put these principles into action with professional-grade tools? ChartsWatcher gives you a dynamic platform with advanced alerts, backtesting, and customizable dashboards to help you manage risk like a pro. Track the market with total clarity and take control of your trading strategy. Discover how ChartsWatcher can sharpen your edge today.