Master Your Trades With a Position Size Calculator

A position size calculator is a vital tool that helps you figure out the exact number of units—shares, lots, or contracts—to trade based on your account size and how much risk you're willing to take. It turns your abstract risk management rules into a precise, actionable trade size.

The Most Important Tool in Your Trading Arsenal

Ever tried building a house without a measuring tape? You could eyeball it, I suppose, but you'd probably end up with a crooked, unstable mess. Trading without a position size calculator is just as reckless—it’s an open invitation to financial disaster.

Many aspiring traders get fixated on finding a magical indicator or the perfect entry signal. And while those things have their place, they are miles behind the single most critical skill for survival and long-term profitability: risk management. Proper position sizing is the absolute foundation of this discipline.

Your Financial Seatbelt

Think of a position size calculator as your financial seatbelt. It won't prevent accidents (losing trades are an inevitable part of the game). Instead, its job is to make sure that when a trade goes south, the impact is a minor, manageable dent, not a catastrophic wreck that takes you out of trading for good.

This tool works by forcing strict discipline and removing the two most destructive forces in trading from your decision-making process:

- Greed: The temptation to go all-in on a "sure thing" for a massive payday.

- Fear: The knee-jerk reaction to shrink your positions after a loss, which completely sabotages your strategy.

By standardizing how much you risk on every single trade, you transform trading from a high-stakes guessing game into a methodical business. It ensures that no single loss can ever deal a fatal blow to your trading capital.

The Professional's Edge

At the end of the day, the real difference between a professional trader and a gambler isn't a better win rate. More often than not, it's a superior approach to managing losses. Professionals know their capital is their lifeblood, and protecting it is job number one.

Using a position size calculator isn't about fancy algorithms or complicated math. It’s about a simple commitment to one fundamental rule—defining your maximum loss before you ever enter a trade. This simple act keeps you disciplined, solvent, and ready to jump on the next opportunity.

What Is a Position Size Calculator and Why It Matters

Let’s cut to the chase. A position size calculator is a simple but critical tool that does one thing exceptionally well: it translates your risk into a concrete trade. It takes the abstract idea of "how much am I willing to lose?" and turns it into a precise, actionable number—how many shares to buy, how many forex lots to trade, or how many crypto units to purchase.

It answers the most important question you’ll ask before every single trade: “How much should I actually buy or sell?” Forget trying to predict the market or guarantee a win. The real goal here is much more fundamental: making sure a single bad trade can't knock you out of the game.

Think of it as a safety harness for a rock climber. The harness won’t stop you from slipping—that’s just part of climbing. But it absolutely will stop a small slip from becoming a catastrophic, account-ending fall. That's exactly what this tool does for your trading capital.

Removing Emotion and Enforcing Discipline

The two most destructive forces in any trader's career are greed and fear. A position size calculator is your defense against them, replacing impulsive gut feelings with cold, hard math. It’s the circuit breaker that stops you from going all-in on a "sure thing" or from timidly cutting your size after a string of losses, both of which can wreck a perfectly good strategy.

A position size calculator is non-negotiable for mastering risk management in trading. By forcing you to quantify and standardize your risk on every trade, you build the discipline that separates professional traders from gamblers.

This consistency is the bedrock of longevity. When you have complete confidence that no single trade can seriously hurt your account, you can execute your strategy without fear. You start focusing on the quality of your setups, not the potential for financial ruin.

The Math of Survival

Since becoming widely adopted in the early 2000s, position sizing tools have fundamentally changed how professionals approach risk. The data is clear: limiting your risk to a small, fixed percentage of your capital is the key to avoiding the dreaded "risk of ruin."

For instance, a trader with a $10,000 account who risks just 2% ($200) per trade can absorb a losing streak of roughly 7-10 trades before things get dire. Contrast that with someone risking 10% per trade—they could wipe out their entire account in just three consecutive losses. The difference is staggering.

Ultimately, proper position sizing ensures you stay in the game long enough for your edge to play out. It’s not just a tool; it’s the foundation of sound financial stewardship for any serious trader.

The Core Inputs That Drive Accurate Position Sizing

A position size calculator is a phenomenal tool, but it's not a crystal ball. Its output is only as good as the numbers you feed into it. Think of it like a high-performance engine—it needs the right fuel mix to run properly. In trading, that "fuel" is a combination of three critical inputs.

These variables work in concert, turning the abstract idea of "risk" into a concrete, actionable trade size. Getting a handle on each one—not just what it is, but why it’s so important—is what separates strategic, repeatable trading from just winging it.

Let's break down these essential components.

Your Account Equity

First up is the most straightforward piece of the puzzle: your account equity. This is simply the total current value of your trading account. It's the real, liquid capital you have on the line, and it forms the foundation for every risk calculation you make.

Remember, your account equity isn't a "set it and forget it" number. You need to use the live value, which includes any profits or losses from trades you currently have open. Using an old balance will throw off your calculations and lead to either taking on too much risk or sizing too small.

Your Risk Percentage

Next is your risk percentage. This is probably the most personal of the three inputs because it defines exactly how much you're willing to lose on any single trade. It’s a rule you set for yourself before you enter the market.

Most disciplined traders I know stick to a risk of 0.5% to 2% of their account per trade. Why so small? Because it guarantees that a string of losses—which happens to everyone—won't knock you out of the game.

A risk percentage is your non-negotiable commitment to capital preservation. By pre-defining your maximum loss, you yank emotion out of the driver's seat. No single trade can ever cause catastrophic damage. It's your number one defense.

Picking your percentage is all about playing the long game. A 1% risk on a $10,000 account means you’re prepared to lose a maximum of $100 on that specific trade. This hard limit is what gives you the discipline to focus on your strategy's edge over dozens or hundreds of trades.

Your Stop-Loss Distance

The final piece is your stop-loss distance. This is the gap between your entry price and your stop-loss price—the point where you've decided the trade idea is wrong and you need to get out.

Critically, this distance must be determined by what the chart is telling you, not what you want it to be. A logical stop-loss is based on technical analysis and market structure, such as:

- Just below a clear support level for a long position.

- Just above a major resistance level for a short position.

- Outside a recent volatility range, maybe defined by a tool like the Average True Range (ATR).

This input is what tethers your risk percentage to the reality of the market. A volatile stock might require a wider stop-loss, which naturally means your position size will be smaller to keep your dollar risk the same. On the flip side, a tighter setup on a quieter stock allows for a larger position size, all while your risk percentage stays constant.

These three inputs are the gears that make the machine work. A position size calculator simply does the math to ensure they all stay in perfect balance. Here's a quick summary of what you're plugging in and why it matters.

Inputs of a Position Size Calculator

| Input Component | What It Represents | Why It's Critical |

|---|---|---|

| Account Equity | The total current value of your trading account. | It's the baseline. All risk calculations are a percentage of this total capital. |

| Risk Percentage | The maximum portion of your equity you'll lose on one trade. | This is your primary defense, ensuring no single loss can severely damage your account. |

| Stop-Loss Distance | The price gap between your entry and your exit-if-wrong point. | This connects your abstract risk rule to the live market conditions and volatility. |

When you master providing these three pieces of information accurately, you’re not just using a calculator—you’re implementing a professional risk management system on every single trade.

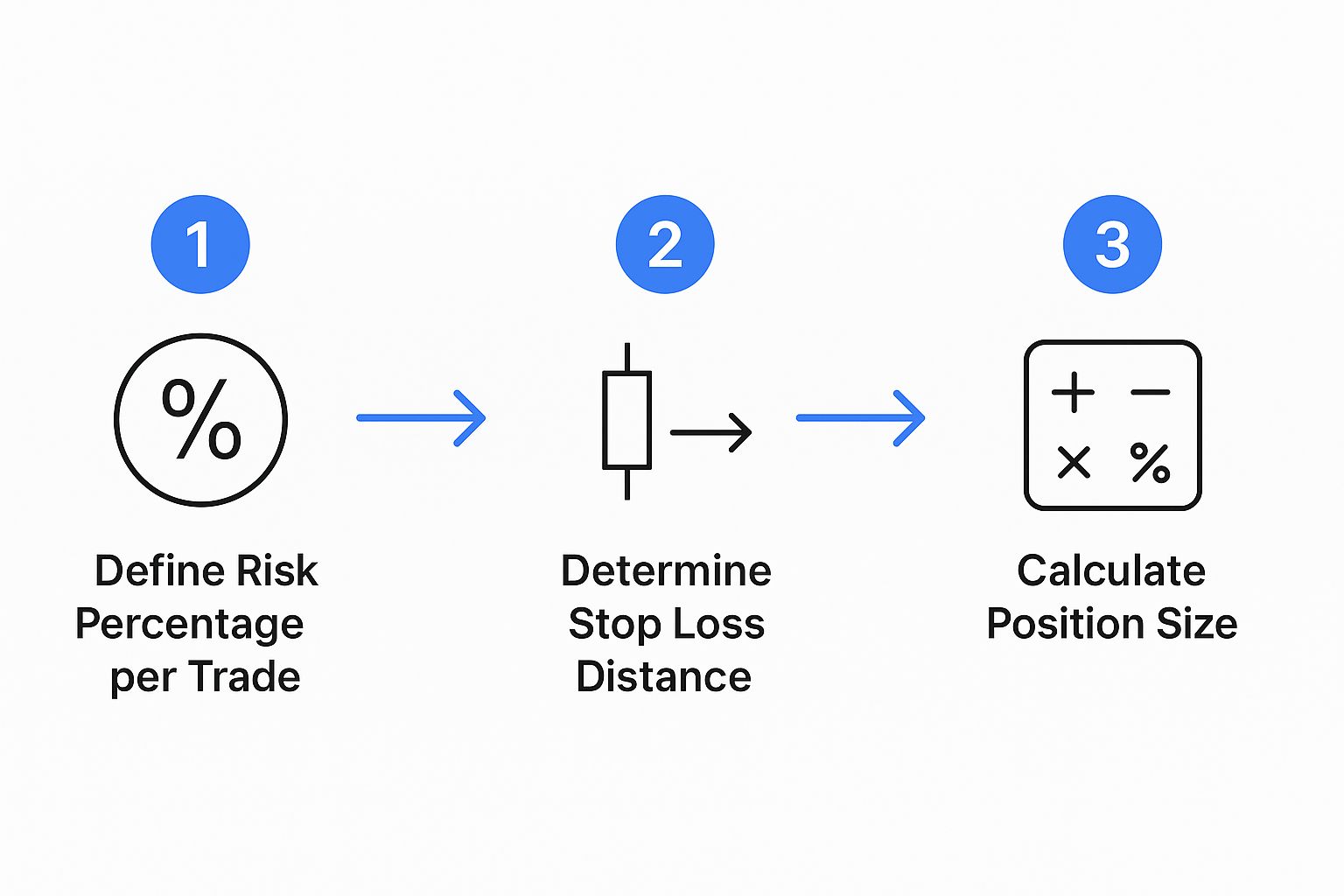

Calculating Position Size Step by Step

Alright, this is where theory hits the road. Let's walk through a real-world example to see exactly how to calculate your position size. This process is what turns abstract risk management rules into a concrete, actionable number for your trade. It gives you precise control over your potential loss.

We’ll use a pretty standard setup:

- Account Equity: $10,000

- Risk Percentage: 1%

- Trade Type: Long (you're buying)

This means the absolute maximum we're willing to lose on this one trade is 1% of $10,000, which comes out to $100. This $100 figure is our North Star for the entire calculation. No matter what we trade, the goal is to size our position so that if our stop-loss gets hit, we lose exactly $100.

This simple three-part process is all it takes to go from defining your risk to finding the perfect position size.

As you can see, position sizing isn't guesswork; it's a logical flow. It starts with your personal risk tolerance, adds in market analysis to set your stop-loss, and ends with a mathematically sound trade size.

Stock Trading Example

Let's imagine you want to buy shares of Company XYZ. After looking at the charts and doing your analysis, you've pinpointed your key price levels.

- Entry Price: You plan to buy when the stock hits $50.00 per share.

- Stop-Loss Price: If the price drops to $48.00, you’re out.

First, you need to figure out your risk per share. That's just the distance between your entry and stop-loss: $50.00 - $48.00 = $2.00. Simple. For every single share you buy, you're risking $2.00.

Now, we just plug that into the core formula:

Position Size (in Shares) = Total Risk Amount / Stop-Loss Distance Per Share

Putting our numbers in: Position Size = $100 / $2.00 = 50 shares

And that's it. To stick to your 1% risk rule, you should buy 50 shares of Company XYZ. If the trade goes against you and hits your stop-loss at $48.00, your total loss will be 50 shares multiplied by your $2.00 per-share risk, which equals $100. Exactly what you planned for.

Forex Trading Example

Let's apply the same logic to a forex trade—say, the EUR/USD pair. The principle is identical, but we swap out "shares" for "lots."

- Entry Price: You want to go long at 1.0750.

- Stop-Loss Price: Your exit point is set at 1.0700.

First, calculate the stop-loss distance in pips. A "pip" is the standard unit of movement in the forex market. The distance here is 1.0750 - 1.0700 = 0.0050, which is 50 pips.

A forex position size calculator handles the next part automatically, which is turning that pip distance into a dollar value based on your lot size. If we assume a standard lot (100,000 units) where each pip move is worth roughly $10, the calculator would figure this out:

- Risk Per Lot: 50 pips * $10/pip = $500 risk per standard lot.

- Position Size (in Lots): $100 Risk / $500 Risk Per Lot = 0.20 lots (or two mini-lots).

Whether you're trading stocks or forex, the process is the same: define your total dollar risk, figure out your per-unit risk based on your stop-loss, and then divide.

While getting this logic down is crucial, the manual steps become second nature once you learn how to backtest a trading strategy, which helps validate your risk parameters against historical data. For those looking to go deeper, advanced methods like the Kelly Criterion offer a mathematical framework for optimizing your bet size based on your perceived edge in the market.

The Real-World Impact on Your Trading Performance

Thinking about individual trades is one thing, but the real magic of a position size calculator happens over the long haul. This isn't just about playing defense; it's a forward-thinking strategy for building a stable, profitable trading career. The one thing that separates amateurs from pros is often just consistent, mathematically sound sizing. It’s what can finally smooth out your equity curve and prevent those deep, portfolio-crushing drawdowns that leave scars—both financial and psychological.

Let’s picture two traders. Trader A sizes positions based on gut feelings, often going big on what they consider "high-conviction" setups. Meanwhile, Trader B is disciplined, using a position size calculator every single time and never risking more than 1% of their capital on any one trade.

Now, imagine an unexpected market event triggers a string of five consecutive losses. Trader A, with their inconsistent bets, might be staring at a 25% hole in their account. Trader B? They’re only down about 5%.

The difference here is massive. To get back to even, Trader B just needs a small 5.3% gain. Trader A, on the other hand, needs to pull off a monumental 33% gain. That's a much, much harder climb.

Smoothing Your Equity Curve

Does your equity curve look like a volatile rollercoaster? That’s a classic sign of inconsistent risk management. Using a position size calculator is how you transform that jagged, nerve-wracking line into a much smoother, upward-sloping curve. By putting a hard cap on your downside for every single trade, you eliminate the catastrophic losses that create those terrifying drops.

This discipline builds a more predictable performance record, which is crucial for building the confidence you need to execute your strategy without hesitation. Your focus shifts from simply surviving the next trade to methodically growing your account over time. Mastering your capital, especially when considering strategies to invest in a recession, is what will protect your wealth during tough market conditions.

The Data-Backed Advantage

This isn't just a nice theory; it's backed by cold, hard data. A 2019 analysis of forex trading accounts found something fascinating. Traders who strictly limited their risk to 1-2% per trade saw average annual growth rates hover around 12-15%.

What about the others? Traders who risked over 5% per trade had average returns near zero. Why? Because their frequent, large losses constantly wiped out any gains they managed to make.

The takeaway is crystal clear: Disciplined position sizing isn't just a friendly suggestion—it's a statistical necessity if you want to achieve sustainable profitability. It directly strengthens the risk-to-reward profile of your entire trading operation.

Ultimately, this practice gives you the mental stability required for peak performance. When you know for a fact that no single trade can blow up your account, you remove fear from the equation. That psychological freedom is a must-have for anyone serious about mastering the markets. For a deeper look at this vital topic, check out our guide on essential strategies for success in trading risk management.

Common Position Sizing Questions Answered

Even after you’ve got a handle on how a position size calculator works, you'll find that a bunch of practical questions pop up the moment you start applying it to live markets. These little details can be the difference between understanding the theory and actually executing it well.

Let's dive into some of the most common hurdles traders run into. The goal here is to get past the basic formulas and talk about the real-world situations you’re going to face, building the confidence you need to use this tool on every single trade without a second thought.

Should My Risk Percentage Change with the Trade Setup?

This is a great question that gets to the heart of consistency versus adaptability. While locking in a fixed percentage is a fantastic way to build discipline—especially when you're starting out—some seasoned pros do tweak their risk based on how good the setup looks.

For example, on a high-probability trade that ticks all their boxes, they might risk 1.5% or even 2%. But for a more speculative trade or a risky counter-trend move, they might dial it way back to just 0.5%.

Be careful, though. This is an advanced move. Until you've built a solid track record and really understand your strategy's edge, sticking to a consistent risk like 1% is the smartest way to survive the learning curve. Consistency is your best friend.

What Is the Biggest Mistake Traders Make with Position Sizing?

Without a doubt, the single most destructive mistake is sizing your position based on how much money you want to make. It’s a classic rookie error that happens when a trader thinks, "I want to make $500 on this trade," and then works backward to find a position size that gets them there.

This approach throws risk management out the window and lets greed take over your decision-making. It’s a fast-track to blowing up your account.

Always, always, always start with your maximum acceptable loss. This is defined by your risk percentage and where you place your stop-loss. Your potential loss has to be the fixed number in your equation, not your potential profit. A professional manages risk; a gambler chases profit.

How Does a Calculator Handle Different Account Currencies?

This is a huge deal, especially if you're trading forex or global CFDs. Any professional-grade position size calculator will let you set your account's base currency, whether it's USD, EUR, JPY, or GBP. This isn't just for show—it's absolutely essential for accurate calculations.

The value of a price tick (like a pip in forex or a point on an index) changes depending on what you're trading and the currency your account is held in. For instance, the risk on a USD/JPY trade is calculated differently for a trader with a EUR-based account than for one with a CAD-based account.

A good calculator handles all these cross-currency conversions for you behind the scenes. It makes sure your 1% risk is actually 1% of your capital, giving you a precise and reliable number you can count on. Just make sure to double-check this setting is correct before you start trading.

Ready to stop guessing and start trading with mathematical precision? The ChartsWatcher platform integrates the tools you need to analyze the market, set your stops, and manage risk like a professional. Take control of your trading today.