How to Trade Pre Market Like a Pro

To trade pre-market, you need a broker that offers extended-hours access and you absolutely must use limit orders to control your entry price. I can't stress that enough. The game is all about hunting for stocks with unusually high relative volume and a clear news catalyst—these are the factors that drive the most predictable moves before the opening bell.

Success here hinges on navigating the treacherous waters of lower liquidity and wider spreads with a disciplined, well-rehearsed strategy.

Understanding The Pre Market Trading Arena

Before you even think about placing a trade, it's critical to understand what makes the pre-market session so different from the regular 9-to-5 grind. Think of it as an early-access period where the rules of engagement are fundamentally altered. The game is faster, the players are fewer, and the risks are magnified.

This unique environment is almost entirely driven by news and events that happen after the previous day's close. We're talking about earnings reports, merger announcements, surprise FDA approvals, or major geopolitical events. These all act as powerful catalysts, causing significant price gaps before most people have had their morning coffee.

Key Characteristics Of Pre Market Trading

The pre-market trading session for U.S. equities officially runs from 4:00 a.m. to 9:30 a.m. Eastern Time. For traders, this period is defined by two critical traits you have to respect: lower liquidity and higher volatility.

With fewer people trading, there just aren't as many shares being bought and sold, which means order books are thin. This low volume can lead to exaggerated price swings on relatively small orders, creating a much more slippery environment.

Historically, pre-market activity accounts for a tiny slice—roughly 1% to 5%—of the total daily trading volume. This thin market causes bid-ask spreads to widen significantly, often ballooning to two to five times what you'd see during regular hours. Understanding these dynamics is crucial for survival. For a deeper dive, you can check out the specifics of pre-market activity on the official Nasdaq website.

Key Takeaway: The pre-market is a landscape of both opportunity and risk. Lower liquidity means you can get trapped in a position, while higher volatility means prices can move dramatically for or against you in a matter of minutes.

To help clarify the differences, here’s a quick breakdown of what you're up against.

Pre Market vs Regular Market Hours A Comparison

| Characteristic | Pre-Market Trading (4:00 AM - 9:30 AM ET) | Regular Market Trading (9:30 AM - 4:00 PM ET) |

|---|---|---|

| Liquidity | Low to very low. Fewer buyers and sellers. | High. Active participation from all market players. |

| Volatility | High to extreme. Small orders can cause large price swings. | Generally lower and more predictable (outside of major news). |

| Bid-Ask Spread | Wide. The gap between buy and sell prices is larger. | Narrow. Spreads are tight due to high volume. |

| Order Types | Primarily limit orders. Market orders are risky. | All order types are viable (market, limit, stop). |

| Key Drivers | Overnight news, earnings reports, global events. | Broader market trends, economic data, sector rotation. |

| Participants | Institutional investors, active retail traders, market makers. | Everyone, including passive funds and casual investors. |

As you can see, treating the pre-market like a simple extension of the regular session is a recipe for disaster. The playbook is entirely different.

Who Trades In The Pre Market?

The pre-market isn't just for retail traders trying to get a head start. It’s a dynamic arena with several key players whose actions dictate those early price movements. Recognizing their roles helps you interpret the action you see on your screen.

- Institutional Investors: Big funds and institutions often use the pre-market to adjust their positions based on overnight news or to execute massive block trades without causing as much disruption as they would during regular hours.

- Retail Traders: We're a major force here. Individual traders, often reacting to breaking news or earnings releases, are what drive the momentum in many of the popular "gapper" stocks.

- Market Makers: These professional traders provide liquidity by quoting both a bid and an ask price. Their presence is less dominant than during the main session, though, which is a big reason for those wider spreads.

By understanding this ecosystem, you can better anticipate how a stock might behave. An institution slowly accumulating shares looks very different on the tape than a swarm of retail traders chasing a news headline. This foundational knowledge is your first real step toward learning how to trade the pre-market effectively.

Building Your Pre-Market Trading Setup

Success in the pre-market isn’t just about having a good strategy; it’s about having the right tools configured for speed and precision. If your setup is clunky or slow, you’ll constantly be playing catch-up. A well-oiled trading environment, on the other hand, puts critical data right at your fingertips, letting you act decisively before the opening bell even rings.

The absolute foundation of your setup is your broker. You need one that offers extended-hours trading, but more importantly, you need direct market access (DMA) and lightning-fast execution. Without those, you're at a serious disadvantage, likely staring at slow fills and wider spreads than necessary.

Choosing The Right Broker And Tools

When you're shopping for a broker, don't just get fixated on commissions. For a pre-market trader, these features are what really matter:

- Reliable Extended-Hours Access: Make sure their pre-market session starts early. You want to be in the game by 4:00 a.m. ET to catch the absolute earliest moves.

- Level 2 Data: This is non-negotiable. You have to see the order book to get a feel for supply and demand, which is especially crucial when liquidity is thin.

- Advanced Charting: Your platform needs to clearly display pre-market data on your charts. This is how you'll map out key support and resistance levels before the 9:30 a.m. ET open.

After your broker, a powerful scanning tool is your next most important asset. A platform like ChartsWatcher is built for this. It lets you create custom filters that zero in on stocks with the highest potential. Let's be honest, a generic free scanner just won't cut it here—they almost always lack the real-time data and specific filters you need for the pre-market grind.

Configuring Your Pre-Market Scanner

Setting up your scanner isn't a "set it and forget it" kind of deal. You need to dial it in to find stocks that have a real catalyst and enough liquidity to actually be tradable. A good starting point is filtering for a significant price change, but you have to immediately add volume criteria to weed out those deceptive low-float traps.

Your goal is a streamlined dashboard. On one screen, have your primary scanner running. On another, set up linked windows for your charts, Level 2 data, and a real-time news feed. With this kind of integration, clicking a symbol in your scanner instantly populates the chart, order book, and any relevant news. Those seconds you save are precious.

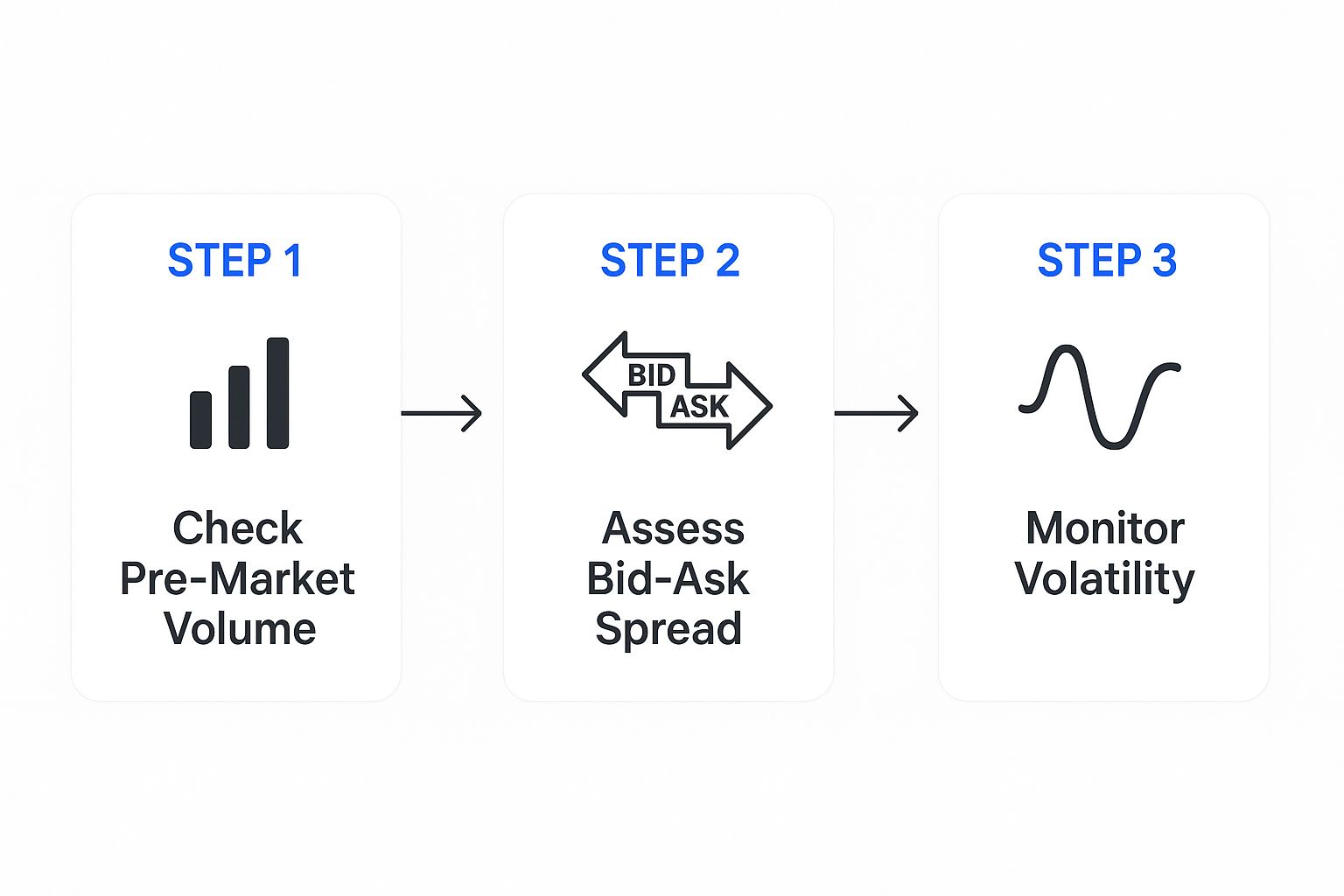

This is the basic workflow I use for every single stock that hits my scanner.

This visual guide breaks down the three-step validation process you need to run, making sure you only waste your time on setups with real liquidity and manageable risk.

A classic rookie mistake is chasing a huge percentage gapper without ever checking the volume. A stock that’s up 50% on only 1,000 shares isn't a real opportunity—it’s a trap waiting to spring. A well-configured scanner filters out this noise automatically.

By the end, your setup should feel like a command center, giving you a crystal-clear, real-time view of what's moving. You’re hunting for stocks with a compelling story—driven by news or earnings—and backed by volume that proves other traders are paying attention. A proper setup makes finding these gems a systematic process, not just a matter of luck.

How to Find Winning Stocks Before the Bell

The real edge in pre-market trading isn't just about waking up early. It's about knowing exactly what to hunt for before the chaos of the opening bell erupts. This is where a systematic approach to scanning becomes your greatest ally, turning a firehose of market noise into a focused stream of actionable ideas.

Forget the generic advice you've heard. A successful pre-market scan demands specific, non-negotiable criteria. Without them, you're just gambling. My personal scanner settings are dialed in to find stocks with a legitimate reason to move—the kind backed by real institutional interest, not just fleeting retail hype.

Defining Your Scanner Criteria

First things first, you have to establish a baseline for what even qualifies as a "tradable" stock in these early hours. This means setting strict minimums to automatically weed out the low-volume traps that snare so many inexperienced traders.

Here are the core filters I run in my ChartsWatcher setup every single morning:

- Minimum Pre-Market Volume: I set this to 100,000 shares. Anything less tells me there isn't enough broad interest to sustain a move, making it risky and painfully illiquid if I need to get out.

- Minimum Price Change: I'm looking for stocks gapping up or down by at least +5% or -5%. This ensures the stock is making a move that's actually statistically significant.

- Price Range: My sweet spot is between $5 and $100. This helps me avoid the wild, unpredictable penny stocks and the expensive names that require too much capital for a quick trade.

- Relative Volume: It's not enough for a stock to have volume; that volume needs to be unusual. The stock’s pre-market volume should be dramatically higher than its average for that time of day.

These settings are your first line of defense. They ensure that only stocks with genuine, early momentum even make it onto your screen. Mastering how to find momentum stocks is a foundational skill, and it all starts with filters like these.

The rise of electronic communication networks (ECNs) has completely changed the game for pre-market activity. For large-cap U.S. stocks, average pre-market volume has surged by roughly 20% annually over the last decade. It's not uncommon to see the most liquid names trade millions of shares before the open. You can find more insights on this trend and how exchanges are adapting on the Cboe Global Markets website.

Differentiating Movers from Traps

Once your scanner starts flagging potential candidates, the real work begins. A stock popping up on your list isn't an automatic buy signal; it's an invitation to dig deeper and figure out why it's moving. The absolute key is to find a powerful, verifiable news catalyst.

Let's walk through a real-world scenario. Stock A is ripping higher, up 20% on 200,000 shares. A quick news check reveals a major FDA approval for a new drug. That's a fundamental catalyst—the kind that attracts institutional money and has a high probability of follow-through.

Now, consider Stock B. It's also up 20% on similar volume, but there’s no news anywhere. This is a huge red flag. It's likely a low-float stock being manipulated or moving on pure, unsubstantiated hype. This is a low-probability trade and a classic pre-market trap.

Your process should be automatic: scanner alert triggers, and you immediately cross-reference it with a real-time news feed. You're looking for concrete events, things like:

- Earnings reports (big beats or ugly misses)

- FDA announcements

- Merger and acquisition news

- Significant analyst upgrades or downgrades

By insisting on a strong catalyst, you filter out the speculative noise and focus your capital on stocks with a real story driving their price action. This disciplined approach is how you build a focused, high-probability watchlist each morning and truly learn how to trade pre market.

Executing Trades with Discipline and Precision

Finding a stock with a powerful catalyst is only half the battle. Let's be honest, perfect execution is what separates the consistently profitable traders from everyone else, especially in the wild west of the pre-market.

Once you’ve locked in a high-conviction setup, your entire focus needs to shift to discipline and precision. This is where the real money is made—or lost.

Never Use Market Orders

If you take only one thing away from this guide, let it be this: never, ever use market orders when trading pre-market. Seriously. During these low-liquidity hours, hitting the market buy button is an open invitation for disastrous slippage.

You could get filled at a price so far from what you intended that your trade is instantly in a deep hole. It’s the fastest way to get chewed up by volatility before your idea even has a chance to play out.

Your Best Friend: The Limit Order

A limit order is your primary tool for controlling risk and your absolute must-use order type here. It allows you to specify the maximum price you're willing to pay for a stock, period. This ensures you don't get a terrible fill in a fast-moving environment.

If the stock’s price is already flying past your limit, your order simply won’t execute. That’s a good thing! It’s your built-in mechanism to prevent you from chasing a runaway move fueled by FOMO.

The strategic importance of this becomes crystal clear when you look at the data. A huge percentage of U.S. economic data is released before the opening bell, and the futures markets often react violently. As analysts frequently point out, using limit orders is the only way to avoid catastrophic fills during that initial volatility. You can learn more about how pre-market indicators set the stage for the trading day on markets.business-insider.com.

Define Your Plan Before You Click

With your order type set, the next step is to map out your trade with absolute clarity. Know your entry, your target, and your escape route before you even think about clicking "buy." This entire plan should be based on the key price levels you found during your earlier analysis.

- Entry Point: Look for entries near pre-market support levels. This could be the low of the first significant pullback or a clear area of consolidation. Whatever you do, avoid buying at the absolute peak of a parabolic spike.

- Profit Target: Where did the stock struggle to break through earlier? That pre-market resistance level is a logical, realistic place to consider taking some or all of your profits.

- Stop-Loss: This is completely non-negotiable. Place your stop-loss just below a key support level. If that level breaks, your trade idea is probably invalid. Get out, take the small, manageable loss, and move on.

A well-executed trade isn't just about making money; it's about sticking to your plan, win or lose. A small, planned loss is a victory for your discipline. An unplanned, emotional exit is always a failure.

Finally, adjust your position size. Pre-market stocks can swing wildly, so using smaller position sizes than you normally would during regular hours is just smart capital protection. Your goal is to survive the session's volatility, not hit a home run on every single trade.

Mastering Pre Market Risk Management

Executing a clean trade is one thing, but in the wild west of the pre market, elite risk management is what keeps you in the game. This session is a high-stakes environment where one bad move can easily wipe out a week's worth of hard-earned gains. To survive and thrive here, you have to move beyond basic stop-losses and adopt a more sophisticated framework for sizing up risk.

The pre market has its own unique structure—thin liquidity and wide spreads—that creates specific traps for the unprepared. We've all seen them: chasing a stock that’s already gapped up 100%, getting tunnel vision on a single ticker because it's the "only thing moving," or completely ignoring a dangerously wide bid-ask spread. These are unforced errors. Your primary job before 9:30 a.m. ET isn't just to find winners, but to actively sidestep these obvious losers.

A disciplined approach to risk is the only sustainable edge you'll ever have. For a much deeper dive, our guide on mastering day trading risk management lays out proven strategies to protect your capital.

Judging the Quality of a Pre Market Move

Let's be clear: not all pre market gaps are created equal. Your ability to tell the difference between a high-quality, sustainable move and a flimsy, speculative pop is a core risk management skill. The secret is in the relationship between volume and price action.

A strong, healthy trend will show consistent, supportive volume as the price climbs. In contrast, a parabolic price spike on fading volume is a massive red flag. This signals exhaustion. It tells you the initial wave of buyers is running out of steam, making the move vulnerable to a sharp, painful reversal. Don't let a big percentage gain fool you; listen to the story the volume is telling.

Pro Tip: A classic trap is the "gap and crap." A stock opens strong, sucks in breakout chasers at the highs, and then bleeds out for the rest of the day. A key tell is weak, unconvincing volume on that opening drive, which suggests a lack of real institutional backing.

The Gap and Go vs. Gap and Crap Checklist

To avoid getting steamrolled at the opening bell, you need a quick mental checklist to run through for every potential trade. This isn't about gut feelings; it's about objectively assessing whether a gapper has the fuel to continue or if it's about to fall apart.

Signs of a 'Gap and Go' (Continuation):

- Strong News Catalyst: The move is backed by real, fundamental news—think a major contract win or blowout earnings.

- High Relative Volume: The stock is trading at a multiple of its average volume for that time of day. This shows real interest.

- Orderly Pullbacks: Any dips in the pre market happen on lower volume and are bought up quickly, carving out clear support levels.

Signs of a 'Gap and Crap' (Reversal):

- No Clear Catalyst: The stock is moving on pure hype, a vague rumor, or it’s just a "sympathy play" riding another stock's coattails.

- Thin, Erratic Volume: The price is spiking on low volume. This is a sign that it’s easy to manipulate and lacks genuine conviction.

- Parabolic Price Action: The chart looks like a vertical line with no healthy consolidation. These moves rarely end well.

By using this simple framework, you shift from chasing hype to methodically selecting high-probability setups. This kind of disciplined evaluation is the cornerstone of mastering pre market risk and ensuring you're around to trade tomorrow.

Getting Your Pre-Market Questions Answered

Jumping into the pre-market session can feel like stepping into a different world. The rules are a little different, the risks are higher, and it’s natural to have a lot of questions. Let's clear up some of the most common ones I hear from traders.

One of the first things people run into is order types. During pre-market hours, most brokers will only let you use limit orders. This isn't just a random restriction; it's a built-in safety net to protect you from the wild price swings and potentially disastrous fills that can happen with thin liquidity.

Does Pre-Market Trading Count Towards Day Trades?

Yes, it absolutely does. Any trade you make in the pre-market session is treated just like a trade made during regular market hours.

If you’re in the U.S. and the Pattern Day Trader (PDT) rule applies to you, a round trip—that is, buying and then selling the same stock—completed before the 9:30 a.m. ET opening bell counts as one of your day trades. This is critical to track if your account is hovering around that $25,000 minimum. You have to plan your pre-market moves carefully to avoid getting your account flagged and restricted.

How Important Is News in the Pre-Market?

News isn't just important in the pre-market; it's everything. It's the fuel for almost every significant move you'll see before the opening bell. With less background noise from the broader market, a single piece of company-specific news can send a stock flying—or falling—in an instant.

A powerful news catalyst, like a surprise earnings beat or a big FDA approval, is what separates a legitimate pre-market move from pure speculation. Without real, verifiable news, a big price gap is often just a trap waiting to spring.

Think of news as the "why" behind the price action. It's what draws in the volume and institutional interest needed to create a real, sustainable trend. Trading a pre-market gapper without understanding the news behind it is like driving blind. You see the motion, but you have no idea what’s causing it or where it’s headed.

What Are The Biggest Risks I Should Watch Out For?

Volatility is the obvious risk, but there are a couple of specific traps that new pre-market traders often fall into. Knowing what they are is the first step to protecting your capital.

- Low-Float Mania: Be incredibly careful with stocks that have a small number of shares available to trade (a low float). These stocks are notoriously easy to manipulate on low volume, leading to massive, short-lived spikes that can collapse in a flash, trapping anyone who bought near the top.

- Ignoring the Spread: The spread is the gap between the bid (what buyers will pay) and the ask (what sellers will accept). In the pre-market, these spreads can get dangerously wide. If you jump into a trade with a huge spread, you’re starting out with an instant, significant loss. Always, always check the spread before you even think about placing an order.

By keeping these risks front and center and sticking to stocks with real news and decent volume, you can dramatically stack the odds in your favor.

Stop guessing in the pre-market chaos. Use the powerful, real-time scanning tools from ChartsWatcher to pinpoint high-probability setups before everyone else. Build your professional trading dashboard today at chartswatcher.com.