How to Diversify Stock Portfolio for Long-Term Growth

True diversification is about more than just owning a bunch of different stocks. It’s about strategically spreading your investments across various assets (like stocks and bonds), different industries, and even multiple countries.

This approach is the bedrock of intelligent investing, designed to lower your overall risk while still positioning you to catch growth from all corners of the economy.

Why Diversification Is Not Just a Buzzword

Let's be real: putting all your capital into one stock or a single hot sector feels like a gamble for a good reason. It is. Diversification isn't just a defensive move to avoid losses; it's a proactive strategy for building a resilient portfolio that can thrive in almost any market condition.

At its core, it’s about making sure your financial future isn’t shackled to the fate of one company or a single economic trend.

Think of it like this: different assets react in their own unique ways to economic shifts.

- During high inflation, commodities like gold often do well, while some high-growth stocks might take a hit.

- When interest rates go up, the value of existing bonds can fall, but stocks in the financial sector might get a boost.

- In a recession, companies selling consumer staples (think toothpaste and groceries) tend to be more stable than those selling luxury cars or expensive vacations.

By holding a mix of these, you create a natural system of checks and balances within your portfolio. The assets that are performing well can help cushion the blow from those that are struggling, which helps smooth out your returns and avoid those gut-wrenching market swings.

To help clarify these concepts, here’s a quick breakdown of the core principles behind building a truly diversified portfolio.

Core Principles of Effective Portfolio Diversification

This table summarizes the key strategies that work together to create a balanced and resilient investment plan.

| Principle | Description | Primary Goal |

|---|---|---|

| Asset Class Diversification | Spreading investments across different types of assets, such as stocks, bonds, real estate, and commodities. | Reduce volatility, as different asset classes often perform differently under the same market conditions. |

| Industry & Sector Diversification | Investing in companies across various economic sectors like technology, healthcare, energy, and consumer staples. | Mitigate sector-specific risks, such as regulatory changes or shifts in consumer demand that affect one industry more than others. |

| Geographic Diversification | Holding investments in different countries and regions (e.g., North America, Europe, Asia). | Protect against country-specific economic downturns, political instability, or currency fluctuations. |

| Company-Size Diversification | Mixing investments in large-cap, mid-cap, and small-cap companies. | Capture growth potential from smaller, innovative companies while maintaining stability from large, established ones. |

Each of these principles adds another layer of protection and opportunity, strengthening your portfolio against the unexpected.

The Real-World Impact of Spreading Risk

This isn't just some textbook theory; it's a principle proven time and time again in the real world. A well-diversified portfolio is your financial shock absorber. When one part of the market zigs, another part often zags, leading to a much more stable journey toward your goals.

Recent history gave us a perfect, if painful, example. In the turbulent markets of 2022, the S&P 500 Index plunged by -18.11%. Even a classic 60/40 stock-and-bond portfolio fell -15.79%. But a more fully diversified portfolio? It saw a much smaller loss of only -11.80%. You can see a deeper analysis of this data over at Envestnet.com.

One of the most common mistakes I see is thinking that owning lots of stocks automatically means you're diversified. If all you own are 20 different tech stocks, you aren't diversified—you're just heavily concentrated in a single sector. True diversification requires a much broader view.

Adopting a Strategic Financial Mindset

Getting the 'why' behind diversification is the first, most critical step toward building a truly durable investment plan. It’s about more than just buying different things; it's about understanding how those different assets work together to protect and grow your wealth for the long haul.

This kind of strategic thinking is fundamental to financial success. Grasping these broader principles is what separates hopeful speculation from disciplined investing. If you're looking to go deeper, you can find some fantastic insights on financial wisdom and clarity that really drive these points home.

Building Your Foundation Beyond Stocks

Alright, let's move from theory to action. A truly diversified portfolio isn't just a collection of different stocks; it's a solid structure built on a foundation of different asset classes. To build something that can actually handle different economic storms, you need to look beyond equities. This is where assets like bonds, real estate, and commodities come into play, each with a unique job to do.

Think of it this way: each asset class has its own personality. When stocks are having a rough time, bonds often act as the calm, steady hand, providing stability when equities get choppy. This inverse relationship is a cornerstone of smart portfolio construction.

Likewise, things like gold can be a fantastic shield against inflation, holding their value when the cash in your wallet buys less and less. Getting a feel for these distinct roles is the first real step toward building a portfolio that’s truly built to last.

The Role of Bonds in Your Portfolio

So, what exactly are bonds? They're basically loans you make to a government or a company. In return, they pay you regular interest. For many savvy investors, bonds are the bedrock of stability in their portfolio.

When the economy gets shaky and stock markets start to dip, you'll often see a "flight to safety" where investors pile into government bonds. This flood of demand can push bond prices up, which helps cushion some of the losses you might be seeing in your stocks. Plus, their predictable income stream gives you consistent cash flow and smooths out the overall ride.

A common misconception is that bonds are "boring" or only for retirees. While they don't offer the explosive growth of a hot tech stock, their job isn't to make you rich overnight. It's about capital preservation and risk management. Think of them as the defense for your portfolio's offense.

Gaining Exposure to Real Estate and Commodities

Adding real estate and commodities brings another powerful layer of diversification because their performance often has little to do with what the stock and bond markets are doing.

- Real Estate Investment Trusts (REITs): This is a great way to get into the property game without the headache of being a landlord. REITs let you invest in a basket of income-generating properties—like apartment complexes, office towers, or malls—and they often pay out healthy dividends.

- Commodities: Assets like gold, oil, and silver can be a direct hedge against inflation. When economic anxiety climbs, you'll see investors flock to gold as a classic "safe-haven" asset, propping up its value.

We saw a perfect example of this just recently. In 2025, different asset classes went in wildly different directions. Gold, for instance, shot up by around 30% by early June, thanks to central banks buying it up and its appeal as a safe haven. Meanwhile, US stocks actually lagged behind many international markets, driving home the value of not having all your eggs in one basket.

Crafting Your Unique Asset Mix

So, what’s the right mix? That's entirely up to you. It all comes down to your personal risk tolerance and how long you plan to be invested. A young, aggressive investor in their 20s might keep their bond allocation small, while someone approaching retirement will likely want a much larger slice for stability and income.

Even if you're focused on stocks, branching out can mean exploring alternatives like venture capital. If you're considering that path, you need to understand the unique forces at play, like the 10 Key Venture Capital Industry Trends For 2025. Knowing these trends helps you make smarter bets outside of the public markets.

Building this foundation isn't a one-size-fits-all formula. It’s about creating a balanced structure that complements and supports your stock picks. This is just as fundamental as knowing when to shift between different market sectors—another powerful strategy. To get deeper into that, check out our guide to sector rotation strategy.

Diversifying Within Your Equity Holdings

Alright, let's zoom in on the stocks in your portfolio. A common pitfall I see is investors thinking that owning a dozen different stocks automatically means they're diversified. But if all twelve are high-flying tech names, you're not diversified at all. You’re just making a concentrated bet on a single industry.

Getting this distinction right is crucial to learning how to diversify your stocks correctly. Real equity diversification is about spreading your investments across different company sizes, industries, and even investment styles. This is how you build a resilient portfolio that can weather storms hitting one specific corner of the market.

Slice Your Equities by Company Size

A great place to start is by looking at market capitalization. Companies of different sizes tend to perform differently throughout various economic cycles, so owning a mix is a smart way to balance your risk and growth potential.

A well-rounded portfolio should include a blend of:

- Large-Cap Stocks: These are the established giants—think Apple or Johnson & Johnson. They bring stability and often pay dividends, but their explosive growth days might be behind them.

- Mid-Cap Stocks: I like to think of these as companies in their prime growth phase. They aren't household names yet, but they're on their way. They offer a fantastic mix of growth potential and relative stability.

- Small-Cap Stocks: These are the smaller, often younger companies with the potential for massive growth. They also come with higher risk and more volatility, but their upside can be truly substantial if you pick the right ones.

A balanced approach could mean building a foundation with large-caps, adding a healthy slice of mid-caps for growth, and then sprinkling in a smaller, strategic allocation to small-caps for that explosive potential.

Owning just one or two stocks, even if they're fantastic companies, is a huge gamble. Consider this: in a recent two-year bull market where the S&P 500 soared, over 68% of the individual stocks within that same index still had drops of at least 15% from their peaks. That really highlights the hidden risk of being too concentrated in single stocks.

Spreading Bets Across Industries and Styles

Beyond just the size of the company, you absolutely must diversify across different economic sectors. If your portfolio is 90% tech and financial stocks, any event that spooks those specific industries could be devastating to your bottom line.

Think about getting exposure to defensive sectors like healthcare and consumer staples (food, beverages, household goods). These tend to hold up much better during recessions. You can balance those with cyclical sectors like industrials and consumer discretionary (cars, travel, luxury goods), which tend to shine when the economy is booming.

Finally, layer in different investment styles. This really boils down to balancing growth stocks—companies reinvesting heavily to expand—with value stocks, which are often established companies that seem to be trading for less than they're truly worth. These two styles frequently perform well at different times, which adds another powerful layer of stability to your holdings.

As you build this out, understanding different investment philosophies and fund providers can give you a major leg up in choosing the right funds or ETFs to achieve this balance. Using a tool like ChartsWatcher, you can even set up separate watchlists for each category—large-cap value, small-cap growth, etc.—to easily keep an eye on your exposure and make sure no single area is quietly taking over your portfolio.

Unlocking Growth with Global Investing

It’s completely natural to stick with what you know. For most of us, that means investing in companies in our own backyard. But if your portfolio is confined to your home country's borders, you're likely leaving a world of opportunity on the table. This "home-country bias" is a common blind spot, one that can seriously cap your long-term returns.

Learning how to diversify a stock portfolio the right way means breaking past those familiar boundaries. Think about it: some of the planet's most innovative and rapidly expanding companies are based outside of the US. Ignoring them is like choosing to fish in just one small corner of a massive, well-stocked lake.

Developing a global mindset is key to building a genuinely resilient portfolio. This isn't just about chasing higher growth—it's also smart risk management. Different economies move in different cycles. When one country's market is in a slump, another might be soaring.

Beyond Domestic Borders

Adding international exposure to your mix brings some powerful diversification benefits. Currency fluctuations can suddenly work in your favor, different regions offer unique growth stories, and you can often find attractive valuations abroad that are tough to come by at home. This blend can boost your returns while simultaneously lowering your portfolio's overall volatility.

If you look back at market history, there have been long stretches where international stocks have dramatically outshined the US market. The leadership baton between domestic and international equities tends to pass back and forth. If you're only invested in one, you'll inevitably miss the upswing in the other.

This dynamic has become incredibly relevant lately. After a long run of US market dominance, international stocks have roared back to life. For instance, data from mid-2025 showed the Morningstar Global Markets ex-US Index posting an impressive 18.1% gain year-to-date, while the Morningstar US Market Index was up only 6.4%. You can dig deeper into this trend and see why it's not too late to add international exposure on Morningstar.com.

Developed vs. Emerging Markets

When you start looking at global investing, you'll find that countries generally fall into two main buckets, each with its own risk-and-reward profile.

-

Developed Markets: These are the economically mature countries with stable political systems and well-oiled financial markets. Think Japan, Germany, and the United Kingdom. They tend to offer lower volatility and more predictable, steady growth.

-

Emerging Markets: These are countries with developing economies that are growing at a breakneck pace. We're talking about places like Brazil, India, and parts of Southeast Asia. They bring the potential for much higher growth but also come with greater risk from things like political instability or wild currency swings.

A smart approach often involves a strategic mix of both. Developed markets can act as the stable international core of your portfolio, while a smaller, targeted allocation to emerging markets can serve as a powerful growth engine. It's really about getting the best of both worlds.

This is where a tool like ChartsWatcher becomes your best friend. You can easily set up separate watchlists for major international indexes, like the MSCI EAFE for developed markets and the MSCI Emerging Markets Index.

From there, you can use the platform's scanners to pinpoint companies within those regions that match your exact criteria for growth, value, or momentum. This kind of organized approach strips the complexity out of global investing and turns a broad concept into a concrete, actionable strategy.

How to Maintain and Rebalance Your Portfolio

Building a diversified portfolio is a huge step, but the work doesn't stop there. It's a common misconception that diversification is a "set it and forget it" strategy. I prefer to think of a portfolio less like a statue and more like a garden—it needs ongoing care to flourish. This is where the discipline of rebalancing comes in.

Left untouched, your portfolio will naturally drift. The stocks that perform well will swell, becoming a bigger piece of your overall pie, while the laggards shrink. Before you know it, you’re right back where you started: over-exposed to a few winners and negating the very diversification you worked so hard to build.

Rebalancing is simply the act of nudging your portfolio back to its original target allocations. It’s a beautifully simple concept that forces you to sell high and buy low—a strategy that sounds easy on paper but is notoriously difficult for our human brains to execute without a system. By trimming what's done well and adding to what's fallen behind, you restore your intended risk level and stay true to your long-term plan.

When and How Should You Rebalance?

There are two main schools of thought on rebalancing, and honestly, neither is universally "better." The best approach is the one you can stick with consistently. It’s all about creating a disciplined, repeatable process.

-

Calendar-Based Rebalancing: This is as straightforward as it gets. You pick a regular interval—say, quarterly, semi-annually, or annually—and on that date, you log in and adjust everything back to your target percentages. For most long-term investors, a yearly check-in is perfectly fine.

-

Percentage-Based Rebalancing (Threshold): This approach is triggered by market movement, not the calendar. You decide on a specific "drift" threshold, maybe 5%, for each asset class. If your stock allocation was targeted at 60% but grows to 65%, that’s your signal to rebalance, no matter what day it is.

The real magic of rebalancing is that it systematically yanks emotion out of the equation. It gives you a logical reason to take profits from your winners and reinvest in assets that are temporarily out of favor, enforcing the kind of discipline that is absolutely essential for long-term success.

Periodically Review Your Entire Strategy

Beyond the mechanical act of rebalancing, it’s also smart to zoom out and review your entire investment strategy from time to time. Life happens. A big promotion, a change in your family, or simply getting closer to retirement can all shift your risk tolerance and financial goals.

This big-picture review is the perfect time to ask if your overall asset allocation still makes sense for you. A strategy that was ideal five years ago might be too aggressive or far too conservative for your life today.

This kind of periodic check-up is a fundamental part of any solid investment journey. It goes hand-in-hand with your broader risk management plan. To make sure you're covering all your bases, check out our complete guide on how to master risk management in trading for essential strategies and success. When you combine disciplined rebalancing with a robust risk framework, you build a portfolio that’s truly built to last.

Even after you’ve got a handle on the basic strategy, a few questions always seem to pop up when you start learning how to diversify a stock portfolio. It's completely normal. Getting clear answers to these common sticking points is often the last step before you can confidently manage your investments.

Let's tackle some of the most frequent queries I hear from traders.

How Many Stocks Should I Own for Good Diversification?

This is the big one, and there’s no single magic number that fits everyone. However, a good rule of thumb many financial experts stand by is owning somewhere between 20 to 30 individual stocks. This range usually gives you a solid base across different industries.

Why that number? It's generally enough to soften the blow if one company has a terrible quarter, but it’s not so many that your portfolio becomes a headache to track.

Now, if you're building your portfolio with broad-market ETFs or mutual funds, the game changes. You can get incredible diversification with just a handful of core holdings. Since those funds already hold hundreds or thousands of different stocks, you get instant, widespread exposure without the hassle of buying each one yourself.

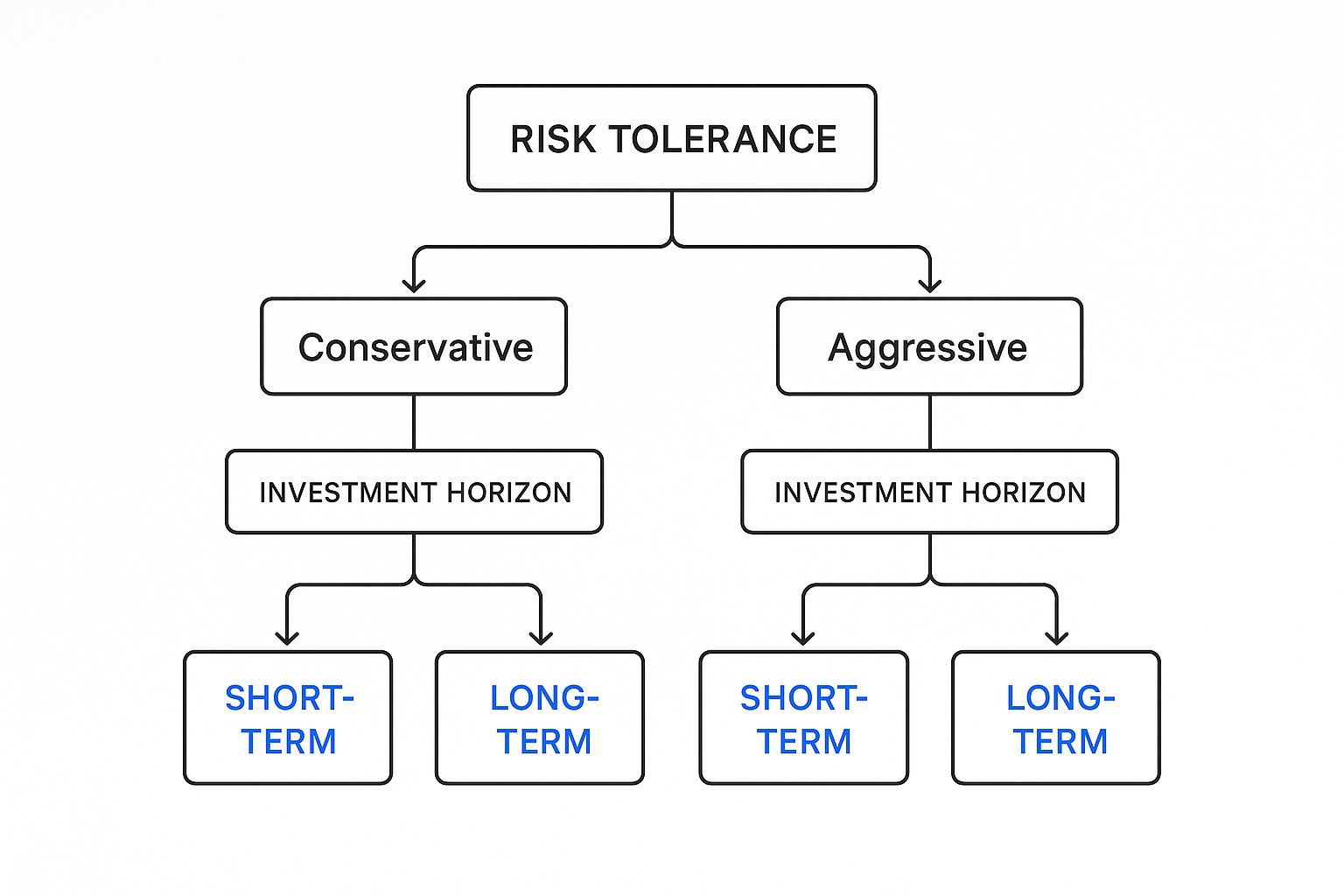

This decision tree can help you visualize how your own risk tolerance and timeline should shape your approach.

As you can see, the path you take should really flow from your personal comfort with risk and your financial goals. Those two factors will be your guide for asset allocation.

Can I Be Too Diversified?

Believe it or not, yes. There's even a term for it: "diworsification." This is the point of diminishing returns, where you own so many different assets that you start to add complexity without meaningfully reducing your risk.

When your portfolio holds hundreds of individual stocks or dozens of very similar funds, their performance can start to blend together and cancel each other out. The big wins from your best ideas get diluted by the sheer volume of other holdings. You might find your returns just start to mimic the market average, but with way more work on your end.

The goal is meaningful diversification, not maximum diversification. You want a curated collection of assets that zig when others zag, providing a real counterbalance during market shifts—not just owning more for the sake of it.

Are Diversification and Asset Allocation the Same Thing?

They're cousins, but not twins. It’s a subtle but critical distinction for building a solid investment plan.

- Asset Allocation is your big-picture strategy. It’s about how you divide your capital between major categories like stocks, bonds, and real estate. This is where you set your overall risk level.

- Diversification is the fine-tuning you do inside each of those categories. For your stock allocation, it means buying companies in different sectors, of different sizes (market caps), and in different geographic regions.

Here’s an analogy I like: think of asset allocation as deciding how much of your garden will be for vegetables versus fruits. Diversification is choosing to plant tomatoes, carrots, and lettuce within your vegetable patch instead of only planting tomatoes. Both are absolutely vital for a healthy, productive garden.

Ready to put these strategies into practice with professional-grade tools? With ChartsWatcher, you can build custom watchlists, scan for opportunities across global markets, and backtest your ideas to see how they would have performed. Take control of your portfolio and start making more informed decisions today.

Explore the powerful features of ChartsWatcher.