How to Calculate Moving Averages for Trading

Calculating a moving average is pretty straightforward. At its simplest, you're just adding up a stock's closing prices over a specific number of days and then dividing by that number. For a 10-day simple moving average, you'd sum the last 10 closing prices and divide by 10. Easy enough.

What this does is smooth out all the jerky, day-to-day price movements. It helps you see the forest for the trees, revealing the real, underlying trend.

Why Moving Averages Are a Trader's Core Tool

Before we get into the nitty-gritty of the formulas, you need to appreciate why moving averages are so fundamental to trading.

Think of it this way: trying to spot a market trend without a moving average is like trying to gauge a river's current during a storm. All you see are the chaotic waves on the surface. Moving averages calm those waves, filtering out the "noise" so you can see the true flow of the market. That smoothing effect is their primary superpower.

By tuning out the minor, insignificant price swings, these indicators help you nail several key objectives:

- Spot the Trend's Direction: Is the moving average line sloping up? You're likely in an uptrend. Angling down? Downtrend. It gives you a clean, visual read on market momentum.

- Pinpoint Support and Resistance: In a strong trend, the price will often pull back to a moving average and bounce off it. This turns the moving average into a dynamic level of support (in an uptrend) or resistance (in a downtrend), giving you potential spots to enter or exit a trade.

- Generate Trade Signals: One of the most classic trading signals is a "moving average crossover." When a faster, shorter-term moving average crosses above a slower, longer-term one, it can signal the start of a new uptrend. It's a popular way traders try to time their moves.

The Three Personalities of Moving Averages

Now, not all moving averages are created equal. The three most common types each have their own distinct personality, making them better suited for different jobs.

The Simple Moving Average (SMA) is the original and most straightforward. It treats every data point in its period equally. While this gives you a very smooth line, it can be slow to react to sudden price changes because old data carries just as much weight as new data. For a deeper dive into this smoothing technique, the folks at statisticsbyjim.com have a great explanation.

Next up is the Exponential Moving Average (EMA). This one is a bit more sophisticated. It gives more weight to the most recent prices, which makes it much more responsive to new information and sudden market shifts.

Finally, there's the Weighted Moving Average (WMA). It's similar to the EMA in that it prioritizes recent data, but it does so using a linear weighting method instead of an exponential one.

Choosing the right one often comes down to your trading style and what you're trying to accomplish.

At a Glance Comparing Moving Average Types

To make it easier to decide which moving average fits your strategy, here’s a quick breakdown of their core differences. This table should help you quickly match the tool to the task at hand.

| Moving Average Type | Key Characteristic | Best For |

|---|---|---|

| Simple (SMA) | Gives equal weight to all prices in the period. | Identifying long-term, stable trends where smoothness is more important than speed. |

| Exponential (EMA) | Gives more weight to recent prices. | Shorter-term trading where responsiveness to new price action is critical. |

| Weighted (WMA) | Gives more weight to recent prices, but linearly. | A middle-ground approach; faster than an SMA but generally less popular than an EMA. |

Ultimately, the best way to figure out which one works for you is to get them on your charts and see how they behave. There's no single "best" moving average—only the one that best complements your individual approach to the markets.

Calculating the Simple Moving Average (SMA)

Let's start with the granddaddy of them all: the Simple Moving Average. The SMA is the most fundamental trend-following indicator, and thankfully, its calculation is refreshingly simple. At its core, the SMA is just the average price of a stock over a specific period, smoothing out the day-to-day volatility so you can get a clearer look at the underlying trend.

The formula is exactly what you’d expect. You just sum up the closing prices for your chosen timeframe and divide by the number of periods. For instance, if you want a 10-day SMA, you'd add the closing prices for the last 10 trading days and divide the total by 10. Every price point gets the same weight, which is the key characteristic of the SMA.

A Practical Walkthrough with NVDA

Theory is great, but let's make this real. We'll run through a quick example using daily closing prices for a popular stock like NVIDIA (NVDA) to find its 10-day SMA.

First, you'd need the closing prices for the last 10 days. Here’s a hypothetical set to work with:

- Day 1: $880

- Day 2: $885

- Day 3: $890

- Day 4: $895

- Day 5: $900

- Day 6: $905

- Day 7: $910

- Day 8: $915

- Day 9: $920

- Day 10: $925

To get the SMA, add them all up: $880 + $885 + ... + $925 = $9,025.

Now, just divide that sum by our period (10), and you get a 10-day SMA of $902.50. Easy as that.

This chart from Investopedia does a great job of showing how the SMA line cuts through the noise of daily price action.

See how the blue SMA line is much smoother than the candlesticks? That’s its job—to give you a cleaner view of the overall trend direction.

The "moving" part of the name simply refers to how the average updates. When Day 11 rolls around, you drop the oldest price (Day 1) from the calculation and add the newest one, then recalculate. This keeps the average current with the latest price data.

Key Takeaway: The SMA excels at filtering out market noise to define longer-term trends. Its biggest weakness, however, is lag. Because it gives equal weight to all data points, both old and new, it’s often slow to react to sudden, sharp price movements.

Calculating the Exponential Moving Average (EMA)

If the Simple Moving Average is a steady, reliable cruise liner, think of the Exponential Moving Average (EMA) as a nimble speedboat. It’s built for traders who need a more responsive indicator because it gives significantly more weight to the most recent price data.

This sensitivity helps the EMA react much faster to sudden market shifts, making it a favorite for short-term analysis and day trading. It was developed to tackle the inherent lag you get with an SMA by assigning exponentially decreasing weights to older data points.

The math is a bit more involved than a simple average, but the logic is straightforward. You can dive deeper into the formulas on the Corporate Finance Institute's moving average guide, but the core idea is to create a smoother line that hugs the price action more closely.

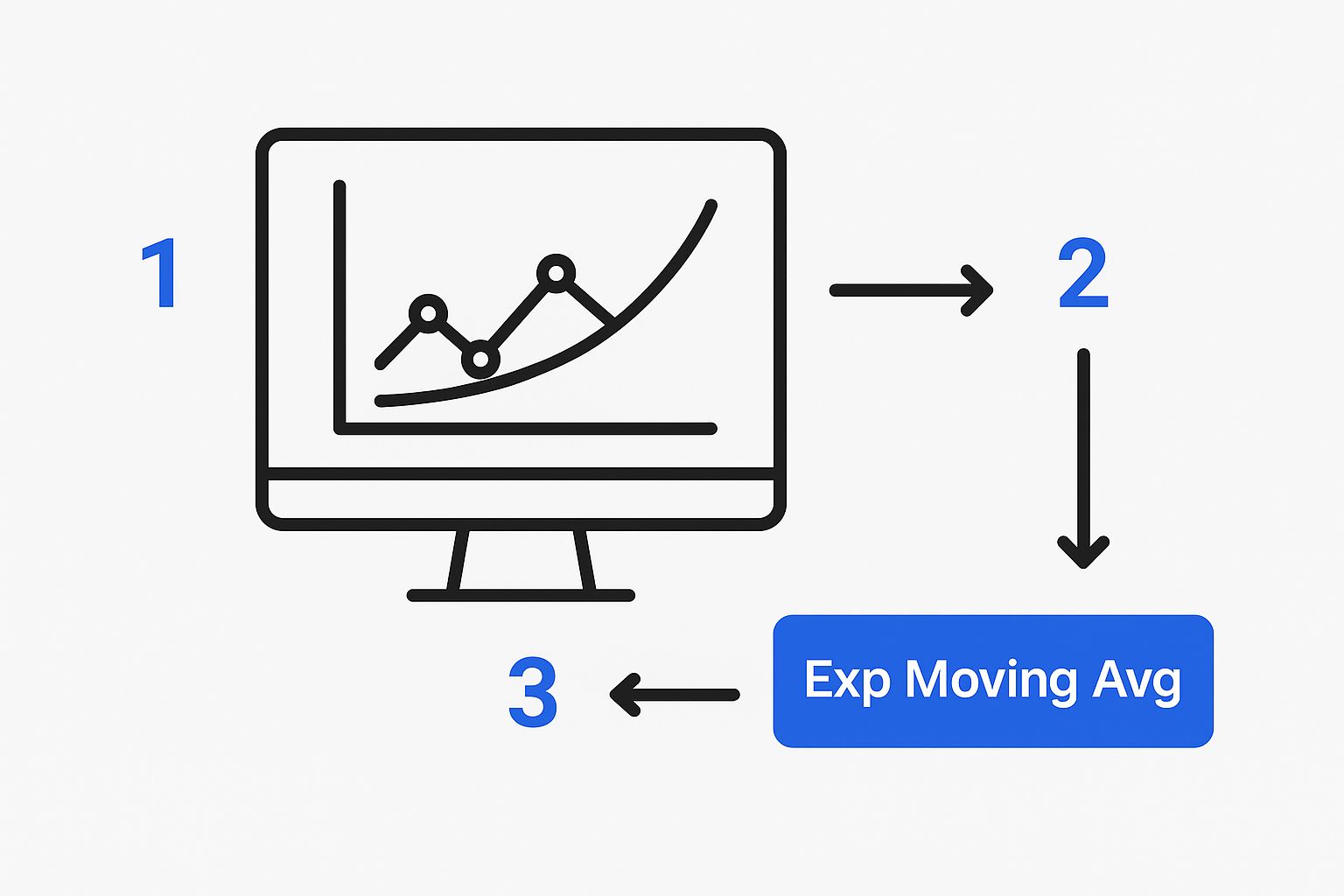

As you can see, the exponential curve reacts much more quickly to price changes, which is a direct result of its weighting mechanism.

Breaking Down the EMA Calculation

Let's walk through how to calculate a 10-day EMA for our NVDA example. Unlike the SMA, you can't just jump in on any random day. You need a starting point, which is usually the SMA for that same period.

Here’s the process:

- Establish a Starting Point: Your first EMA value is simply the 10-day SMA. Let's say from our previous SMA calculation, the first value was $902.50. This becomes our "Previous EMA" for the next day's calculation.

- Determine the Multiplier: The weighting multiplier is what gives the EMA its punch. The formula for it is: Multiplier = 2 / (Period + 1). For a 10-day EMA, this comes out to 2 / (10 + 1) = 0.1818.

- Apply the EMA Formula: Now, for each new day, you just plug the numbers into the main formula: Current EMA = (Current Price - Previous EMA) × Multiplier + Previous EMA.

Let's imagine the next day (Day 11), NVDA closes at $930. The calculation would look like this:

($930 - $902.50) * 0.1818 + $902.50 = $907.50

So, the new 10-day EMA is $907.50. From here, you just repeat the process for each new trading day.

Why This Matters: This responsiveness is exactly why specific EMAs, like the 12-day and 26-day, are the backbone of other powerful indicators like the Moving Average Convergence Divergence (MACD). Once you get how the EMA is built, you gain a much deeper appreciation for how these more complex tools actually work.

Getting to Grips with the Weighted Moving Average (WMA)

So, where does the Weighted Moving Average (WMA) fit in? Think of it as a happy medium, sitting somewhere between the steady, deliberate pace of an SMA and the hair-trigger reactions of an EMA. It shares a key trait with the EMA: it gives more attention to recent price action.

But it gets there in a totally different way. Instead of using an exponential formula, the WMA applies a simple, linear weight. The newest price gets the biggest say, the next newest gets a little less, and so on, down to the oldest price in the period, which barely gets a whisper. It's another solid tool for your arsenal, offering a distinct way to smooth out price data.

Let's Calculate a 5-Day WMA

The best way to understand the WMA is to just build one. The process is very logical. We'll walk through a 5-day WMA calculation. The logic is simple: the most recent closing price is multiplied by a weight of 5, yesterday's by 4, and we continue counting down until the oldest price is multiplied by 1.

Imagine these are the last five closing prices for a stock:

- Day 1 (Oldest): $100 (Weight = 1)

- Day 2: $102 (Weight = 2)

- Day 3: $101 (Weight = 3)

- Day 4: $104 (Weight = 4)

- Day 5 (Newest): $105 (Weight = 5)

First up, we multiply each day's price by its assigned weight and then add all those products together.

($100 × 1) + ($102 × 2) + ($101 × 3) + ($104 × 4) + ($105 × 5) = 1548

Next, we need the sum of the weights themselves. For a 5-day period, you just add them up:

5 + 4 + 3 + 2 + 1 = 15

Pro Tip: Want a shortcut? The formula for the sum of weights is n(n+1)/2, where 'n' is your period. For our 5-day example, that’s 5(6)/2 = 15. This little trick is a huge time-saver when you're working with longer periods like a 50-day or 200-day WMA.

The final step is to divide the total weighted price by the total weight.

WMA = 1548 / 15 = $103.20

And there it is. The 5-day Weighted Moving Average is $103.20. You can see how it's pulled closer to the more recent, higher prices of $104 and $105, giving you a more current read on the market's direction than a simple average would.

Putting Your Calculations into Action

Knowing how to crunch the numbers for a moving average is one thing. Actually turning those lines on a chart into a profitable trading strategy? That’s where the real work begins. The calculations themselves are just abstract data until you give them context on a live chart, translating raw numbers into tangible insights.

The very first decision you’ll have to make is picking the right period length. This choice isn't random; it's deeply personal and needs to line up perfectly with your own trading style. There's no magic number that works for everyone.

- Short-Term Traders: If you're a day trader or swing trader, you'll naturally gravitate toward shorter periods, like a 10-day or 20-day EMA. These are more sensitive and help you react quickly to shifts in price momentum.

- Long-Term Investors: On the flip side, if you're investing for the long haul, you’ll want to zoom out. Think 50-day, 100-day, or the classic 200-day SMA to identify major, overarching trend shifts.

Choosing Your Moving Average Period

To make it even clearer, I’ve put together a quick guide to help you match a moving average length to your specific approach. Think of this as a starting point for your own experimentation.

| Period Length | Common Use Case | Trader Type |

|---|---|---|

| 10 - 20 | Capturing short-term momentum and scalp entries. | Day Trader, Scalper |

| 50 | Identifying the intermediate trend. A classic swing trading tool. | Swing Trader |

| 100 | Gauging the medium-term health of a trend. | Position Trader |

| 200 | Defining the long-term bull/bear market line. | Long-Term Investor |

Ultimately, the best period is the one that consistently provides reliable signals for your chosen timeframe and strategy.

Mastering Crossovers and Dynamic Levels

One of the most powerful ways to use moving averages is by watching for crossovers. This happens when a shorter-term MA crosses above or below a longer-term one, often signaling a potential change in momentum. The most famous of these is the "golden cross," where the 50-day SMA moves above the 200-day SMA—a signal many traders see as a major bullish confirmation. You can get a much deeper look into these tactics in our guide to https://chartswatcher.com/pages/blog/master-moving-average-crossover-trading-strategies.

But don’t just think of moving averages as simple lines. I’ve found it’s far more effective to view them as dynamic zones of support or resistance. In a strong uptrend, you’ll often see the price pull back to a key moving average, like the 20-day EMA, and find buyers waiting. It’s a much more fluid and realistic way to find entry points compared to waiting for a static, horizontal price level to be hit.

Moving averages are more than just a calculation; they are a visual representation of market consensus over time. Learning to read them is like learning to read the market's underlying sentiment.

This isn’t a new concept. Analysts have been using moving averages for decades to pinpoint these exact support levels and gauge long-term momentum, with periods like the 50-day and 200-day underpinning billions in investment decisions. They serve as both a historical record of price and a forward-looking guide for potential turning points.

For those who want to get their hands dirty and automate this kind of analysis, learning to code these strategies is the next logical step. This guide on Python programming for data analysis is an excellent resource for turning these concepts into executable code, allowing you to backtest and deploy strategies with much greater speed and efficiency.

Common Questions About Moving Averages

Once you get the basics down, a few practical questions almost always pop up. Let's tackle some of the most common ones I hear from traders trying to apply these indicators effectively.

Which Moving Average Is Most Accurate?

This is the classic question, but there's no single "best" or "most accurate" moving average. The right choice depends entirely on what you're trying to accomplish with your trading.

Think of it this way: the EMA is quick on its feet. It reacts faster to recent price action, which is why it’s a favorite for short-term strategies and day trading. The SMA, on the other hand, is the slow and steady long-term thinker. It smooths out the noise, making it better for spotting stable, overarching trends.

The real key is aligning the indicator with your strategy and timeframe. Using a slow SMA for a fast-moving scalp trade is a recipe for flawed signals.

Can Moving Averages Be Used for Other Assets?

Absolutely. Moving averages are one of the most versatile tools in technical analysis. If an asset has time-series price data, you can apply a moving average to it.

This makes them useful across a huge range of markets:

- Forex pairs like EUR/USD

- Cryptocurrencies from Bitcoin to altcoins

- Commodities like gold and oil

- Major market indices like the S&P 500

The core principles of spotting trends and generating signals work the same way no matter what you're trading. Of course, testing is crucial to validate your approach on a specific asset. You can learn more about this in our essential guide on how to backtest a trading strategy.

Ready to stop calculating and start analyzing? ChartsWatcher provides powerful, customizable scanning tools that plot moving averages and generate alerts automatically. Explore our features and find the perfect plan on chartswatcher.com.