How to Automate Trading Strategy: Proven Blueprint

The Foundations of Successful Trading Automation

Automating your trading strategy offers some compelling advantages. It can take the emotion out of trading, allowing for disciplined execution based on predefined rules. Automated systems can also react to market shifts incredibly fast, sometimes in milliseconds, potentially taking advantage of short-lived opportunities a human trader might miss.

However, it's important to remember that automation isn't a guaranteed path to riches. Understanding its limitations is key for long-term success. This means acknowledging that even the most sophisticated algorithms can't perfectly predict the future.

The history of automated trading strategies is quite fascinating. The practice began in the 1970s with the introduction of simple rule-based systems primarily designed for best-price execution. The New York Stock Exchange (NYSE) was a pioneer in this area, developing a program trading system that automatically executed orders based on preset market conditions.

This early NYSE system included market, limit, and stop-loss orders, a notable step towards automated trading. By the late 1970s, similar systems were adopted by other exchanges, paving the way for the more complex algorithms we see today. Though limited in their market analysis capabilities, these early systems laid the groundwork for future advancements. Explore this topic further to learn more about the history of algorithmic trading.

Key Considerations for Automation

When thinking about automating your trading strategy, there are two main approaches: fully automated and semi-automated. Fully automated systems execute trades without any human involvement, strictly adhering to pre-programmed logic.

This approach is often used in high-frequency trading and strategies requiring extremely fast execution. However, it requires careful design and extensive testing to ensure it performs as intended. Semi-automated systems, conversely, blend automated elements with human oversight.

For example, a trader might use an algorithm to identify potential trades but maintain the final decision on whether to execute them. This approach offers more flexibility and control, which can be especially valuable in volatile market conditions. It allows traders to combine the speed and efficiency of automation with their own experience and judgment.

Core Components of an Automated Trading Strategy

Regardless of which approach you choose, certain fundamental elements are critical for successful trading automation. These components work in concert to form a robust and effective strategy:

- Clear Entry and Exit Rules: Defining precise rules for when to enter and exit trades is paramount. These rules should be data-driven and thoroughly backtested.

- Position Sizing: Knowing how much to invest in each trade is crucial for managing risk and optimizing potential returns. Automated systems can dynamically adjust position size based on market conditions.

- Risk Management: Implementing solid risk management procedures is essential. This should include measures like stop-loss orders and maximum drawdown limits to protect capital during unforeseen market events.

- Backtesting and Optimization: Rigorous backtesting allows you to evaluate the historical performance of your strategy. Optimization involves refining parameters to enhance profitability and overall robustness.

By understanding and implementing these core components, traders can create a strong foundation for successful automated trading, regardless of their chosen platform or specific market.

Choosing Your Automation Platform: What Actually Works

The trading platform you select for automating your strategies is a critical decision. It's the bedrock of your automated system, directly influencing its performance and your overall trading success. Choosing wisely involves carefully evaluating several key factors.

Essential Platform Features

Your trading platform is your central command. It must offer the tools and functions needed to execute your strategy flawlessly. Here are some must-have features:

-

Execution Speed: Rapid execution is essential, especially in volatile markets. Delays can cause slippage, resulting in less favorable buy or sell prices than you anticipated. Platforms offering direct market access often provide the best execution speeds.

-

Reliability: Your platform needs stability and dependability, even during high market activity. Downtime or system errors can be expensive, especially if your automated system responds to sudden market shifts.

-

Programming Language Accessibility: The platform's programming language must be powerful enough for your strategy's complexity, yet easy enough for you to use effectively. Popular choices include MQL4/5 for MetaTrader and Python for more general platforms.

Evaluating Leading Platforms

Let's examine some of the leading trading automation platforms:

-

MetaTrader: Favored for Forex trading, MetaTrader offers a user-friendly interface, robust charting tools, and a large library of existing Expert Advisors (EAs). However, its MQL programming language might have limitations for highly complex strategies.

-

NinjaTrader: Known for advanced charting and analysis, NinjaTrader is popular among futures traders. It provides a more sophisticated programming environment than MetaTrader, but can be steeper to learn.

-

TradeStation: A comprehensive platform suitable for stocks, options, and futures, TradeStation offers powerful backtesting and optimization tools. It uses EasyLanguage, its proprietary programming language designed specifically for trading.

To help visualize the differences, let's look at a comparison table:

To help you compare these and other platforms, here's a table summarizing key information:

Comparison of Top Trading Automation Platforms A detailed comparison of the most popular platforms for automated trading, showing their key features, programming languages, costs, and suitability for different trader levels.

| Platform | Programming Language | Ease of Use | Cost | Broker Integration | Community Support | Best For |

|---|---|---|---|---|---|---|

| MetaTrader | MQL4/5 | Beginner | Variable | Extensive | Large | Forex, Beginners |

| NinjaTrader | NinjaScript | Intermediate | Variable | Selective | Medium | Futures, Advanced |

| TradeStation | EasyLanguage | Intermediate | Variable | Good | Medium | Stocks, Options, Futures |

| cTrader Automate | C# | Advanced | Variable | Selective | Growing | Advanced Traders |

| Interactive Brokers | Python, Java, etc. | Advanced | Variable | Excellent | Large | Professionals |

As you can see, each platform offers unique benefits and drawbacks. Consider your trading style, experience level, and specific needs when making your choice.

Hidden Costs and Broker Integration

Look beyond the initial platform price and consider potential hidden fees. Some platforms charge per-trade commissions or monthly data feed fees. These costs can significantly affect your long-term profitability.

Broker integration is also critical. Ensure compatibility between your chosen platform and your preferred broker. Confirm that the API integration is seamless and reliable. Problems with order execution or data retrieval can damage your entire automation setup. For instance, platform-broker communication issues during high-volume trading could lead to missed trades or, worse, unintended transactions.

Community Support and Troubleshooting

Even with the best platform, technical issues can arise. A strong community forum or dedicated customer support can be incredibly valuable. Access to experienced users and developers who can help you resolve problems and answer questions keeps your automated trading strategy running effectively. Choosing a platform with robust community support is like having a readily available network of trading automation experts.

From Trading Logic to Working Code: Practical Steps

Transforming your trading ideas into functional code may seem like a huge undertaking, but it's a process you can absolutely tackle. This section breaks down the steps involved, providing practical guidance for both seasoned coders and those just beginning their coding journey.

Structuring Your Code for Clarity and Efficiency

For automated trading strategies, experienced traders know that well-structured code is crucial. This means organizing your code into logical blocks, using clear variable names, and incorporating comments to explain intricate sections.

For instance, in MQL4/5, functions can be used to encapsulate specific tasks like calculating indicators or generating trading signals. MQL4/5 offers a robust environment for developing automated trading systems. Similarly, Python allows for modular design through classes and imported libraries. This structured approach not only improves readability but also makes debugging and future modifications much easier.

Implementing Key Trading Components

Building an automated trading strategy involves coding several essential elements. First, you need to define precise entry signals. These signals can be based on technical indicators, price action, or other market data. This might involve coding rules based on moving averages, relative strength index (RSI), or specific candlestick patterns.

Next, you'll need to program adaptive exit rules that respond to changing market conditions. These could include trailing stops, profit targets, or time-based exits. Dynamic position sizing, where the investment amount is adjusted based on market volatility or account balance, is another vital component.

Finally, incorporate robust error handling to deal with unexpected situations. These might include connection failures or invalid data. This often involves logging errors, sending alerts, or safely shutting down the system.

No-Code Alternatives for Beginners

If coding isn't your forte, several no-code platforms offer a way to automate your trading strategies. These platforms often provide visual interfaces for defining trading rules and linking to brokerage accounts.

While these platforms might have limitations compared to custom coding, they provide an accessible starting point for those without programming experience. They allow you to experiment with automation and learn the basic principles before venturing into coding.

Debugging and Transitioning to Live Trading

Before deploying your automated system, thorough testing is paramount. Debugging techniques, like using print statements or debuggers within your chosen platform, help pinpoint and correct errors.

A gradual shift from manual to automated trading is recommended. Start by paper trading or using a demo account to test your system in a simulated environment. This helps identify any potential issues without risking real capital.

Once you have confidence in your system's performance, gradually increase the amount of capital traded automatically. Start with a small portion of your portfolio and incrementally increase it as your confidence grows. ChartsWatcher offers tools to monitor and track your automated system's performance, helping you refine your strategy and effectively manage risk. With careful planning and execution, automating your trading strategy can empower you to trade more efficiently and potentially achieve your trading goals.

Validating Your Strategy: Beyond Basic Backtesting

Many automated trading strategies appear incredibly promising during backtesting. However, they often fall short when implemented in live market conditions. This difference underscores a critical element of successful strategy development: robust validation. This section explores methods to go beyond simple backtesting and utilize more refined techniques to truly assess your strategy's potential. Want a deeper dive into backtesting itself? Check out this helpful resource: How to master backtesting your trading strategy.

The Danger of Curve-Fitting

A frequent trap for traders is curve-fitting. This happens when a strategy becomes overly tailored to historical data. It can create a misleading impression of high profitability. Unfortunately, such a strategy often fails to adapt to the real-world market.

Imagine adjusting parameters to perfectly mirror past market activity. Your backtests might look impeccable. However, this approach is unlikely to handle the unpredictability of future market changes.

Advanced Validation Techniques

To avoid curve-fitting and build a reliable automated trading strategy, consider these advanced validation methods:

-

Walk-Forward Analysis: This technique divides your historical data into separate segments. You optimize the strategy on one segment and then test its performance on the following segment. This simulates a real-world deployment, showing how your strategy would have fared under various market conditions.

-

Monte Carlo Simulations: Running thousands of simulated trades, each with randomized market variations, provides a comprehensive performance evaluation across a wide array of possible scenarios. This method can highlight potential weaknesses and help you assess the risk of substantial drawdowns.

-

Parameter Sensitivity Testing: This method systematically varies the parameters of your strategy. It reveals how these changes impact overall performance. For example, if a small adjustment to a moving average period dramatically affects profitability, it indicates the strategy is overly sensitive to minor market fluctuations.

Before putting your hard-earned capital at risk, it's vital to thoroughly assess the viability of your trading strategy. The following table provides a summary of key metrics to focus on during backtesting.

Key Backtesting Metrics and Their Importance

| Metric | Description | Target Range | Warning Signs | Importance |

|---|---|---|---|---|

| Sharpe Ratio | Measures risk-adjusted return. | >1.0 (generally) | <1.0 or negative | Indicates whether returns are worth the risk taken. |

| Maximum Drawdown | Largest peak-to-trough decline during the backtesting period. | As low as possible | >20% (often considered high) | Reveals the strategy's resilience to losses. |

| Profit Factor | Gross profit divided by gross loss. | >1.5 (ideally) | <1.0 | Shows overall profitability relative to losses. |

| Win Rate | Percentage of winning trades. | Not solely reliant on this, but higher is generally preferred. | Extremely high win rates with low average win size can be risky. | Important, but consider in conjunction with average win/loss size. |

| Average Win/Loss Ratio | Average winning trade size divided by average losing trade size. | >1.0 (preferably significantly higher) | <1.0 | Essential for long-term profitability; ideally larger wins than losses. |

Analyzing these metrics offers valuable insight into the potential strengths and weaknesses of your automated trading strategy.

From Statistical Significance to Practical Profitability

While statistical significance is valuable, practical profitability is the ultimate goal. A strategy demonstrating statistically significant returns in backtests might still fail in live trading due to transaction costs, slippage, and other real-world factors.

A strategy excelling in specific market conditions might falter in others. Testing your strategy across various market environments – bull markets, bear markets, periods of high and low volatility – is critical. This provides a realistic assessment of its long-term potential. Platforms like ChartsWatcher facilitate this analysis, helping you evaluate your strategy’s adaptability and refine it for consistent returns.

By incorporating these advanced validation techniques, you're not just creating strategies that shine in backtests. You're building robust systems that can navigate the complexities of live trading. This meticulous approach significantly improves your prospects for sustained profitability in the ever-changing world of financial markets.

Building Bulletproof Risk Management Safeguards

A robust automated trading strategy isn't just about profits; it's about protecting your capital. Unexpected market events and system malfunctions can lead to significant losses, even with thorough backtesting. This section explores essential risk management protocols for safe and efficient automated trading.

Implementing Essential Risk Protocols

Protecting your capital begins with core risk management features acting as automatic safety nets during unfavorable market conditions or system deviations. Learn more in our article about how to master day trading risk management.

-

Tiered Emergency Stops: Implement multiple stop-loss orders at progressively deeper loss thresholds. This nuanced approach allows for responses to market fluctuations, preventing a complete exit on minor corrections while protecting against catastrophic losses.

-

Maximum Drawdown Protection: Define an acceptable maximum drawdown limit as a percentage of your total capital. When the system reaches this limit, trading ceases, preserving remaining capital. A 20% maximum drawdown means halting trading if losses hit 20% of the initial capital.

-

Volatility-Adjusted Position Sizing: Dynamically adjust trade size based on current market volatility. Reduce position size in volatile markets, minimizing potential losses, and increase it during calmer periods to maximize gains.

Real-Time Monitoring and System Health

Actively monitor your automated system's performance through real-time alerts and dashboards to track key metrics and identify unusual activity.

-

Real-Time Alerts: Configure alerts for drawdown limits, unusual trading volume, or unexpected price movements. These alerts enable swift intervention to address potential problems.

-

System Health Monitoring: Track metrics like the Sharpe ratio, win rate, and average trade duration. Deviations from historical norms could indicate system logic issues or market shifts.

Circuit Breakers and Stress Testing

Incorporate circuit breakers and stress testing to prevent substantial losses during extreme market events.

-

Circuit Breakers: Implement "circuit breakers" to automatically pause trading when predefined risk thresholds are crossed. This cool-down period prevents impulsive trades during volatile situations.

-

Stress Testing: Regularly simulate extreme market scenarios like flash crashes to assess your system's behavior under duress. This reveals vulnerabilities and improves resilience to future market turbulence.

By prioritizing these risk management techniques, you can transform your automated trading strategy into a reliable tool for long-term wealth building. This proactive approach ensures safe and efficient system operation, protecting and steadily growing your capital.

Mastering Expert Advisors for 24/7 Forex Automation

The forex market's 24/7 operation and global scope create exciting opportunities for automated trading. However, this also presents unique challenges that demand specialized tools and strategies. This is where Expert Advisors (EAs), also known as forex trading robots, come into play. EAs are automated systems designed to analyze market conditions and execute trades without human involvement.

Their development took off in the 1980s and 1990s alongside advances in computing. Today's top forex robots can process market data thousands of times faster than humans. This speed makes them invaluable for traders looking to reduce emotional decision-making and boost efficiency. While EAs excel in speed and disciplined execution, they lack the adaptability and intuition of human traders, especially in unforeseen market events. The integration of machine learning is enhancing the ability of these robots to adjust to changing market conditions. Learn more about the world of forex robots here.

Addressing Forex Market Specifics

Successfully automating forex trading requires a deep understanding of the market's nuances. Spread variation is a key factor. Spreads, the difference between buy and sell prices, can change significantly throughout the trading day, directly impacting profits. Your EA must be designed to handle these fluctuations, potentially by avoiding trades during periods of high spread.

Economic announcements are another crucial element. These announcements often trigger major volatility. Your EA should be programmed to either steer clear of trading during these volatile periods or to leverage the volatility strategically. This could involve integrating economic calendars into the EA's logic.

Execution timing plays a vital role in minimizing costs. Brokers offer different execution speeds and slippage (the difference between the expected price of a trade and the price at which the trade is executed). Selecting a broker optimized for automated trading and programming your EA to execute during optimal liquidity periods can greatly reduce transaction costs.

Strategy Selection and Implementation

Some strategies are particularly well-suited to the forex market. Trend-following strategies, designed to profit from sustained price movements, are often a popular choice. Mean-reversion strategies, which capitalize on prices returning to their average, can also be effective. The true success of any strategy hinges on meticulous implementation.

The MetaTrader platform is widely used in forex trading. It provides a robust environment for EA development using its MQL4/5 language. This language allows for complex trading logic, but proper coding is essential. Errors like incorrect order types or poorly defined risk parameters can significantly hinder performance.

Practical Considerations for Forex Automation

Choosing the right broker is paramount for automated forex trading. Consider these factors:

- Commission Structure: Opt for a broker with competitive commission rates, especially for high-frequency trading.

- Execution Speed and Slippage: Minimize slippage with a broker known for fast, reliable order execution.

- API Integration: Verify that the broker's API is compatible with your platform and allows for smooth automated trading.

Managing requotes and slippage is another critical aspect. Requotes occur when a broker can't execute a trade at the requested price. Your EA should handle these situations effectively, either by accepting a slightly adjusted price or canceling the trade.

Maintaining system stability during market events is vital. This ensures your EA can withstand unexpected price swings and high trading volume without crashing. Regular stress testing and robust error handling in the EA's code are key to system resilience. Addressing these points helps create EAs that can navigate the complexities of the forex market. Platforms like ChartsWatcher can enhance your automated trading strategy by providing real-time data and charting tools for building and refining automated systems.

Maintaining Your Edge: System Monitoring and Evolution

Launching your automated trading strategy is just the first step. Maintaining its effectiveness requires continuous monitoring and adaptation. This section explores best practices from institutional algorithmic trading to help your system perform at its peak.

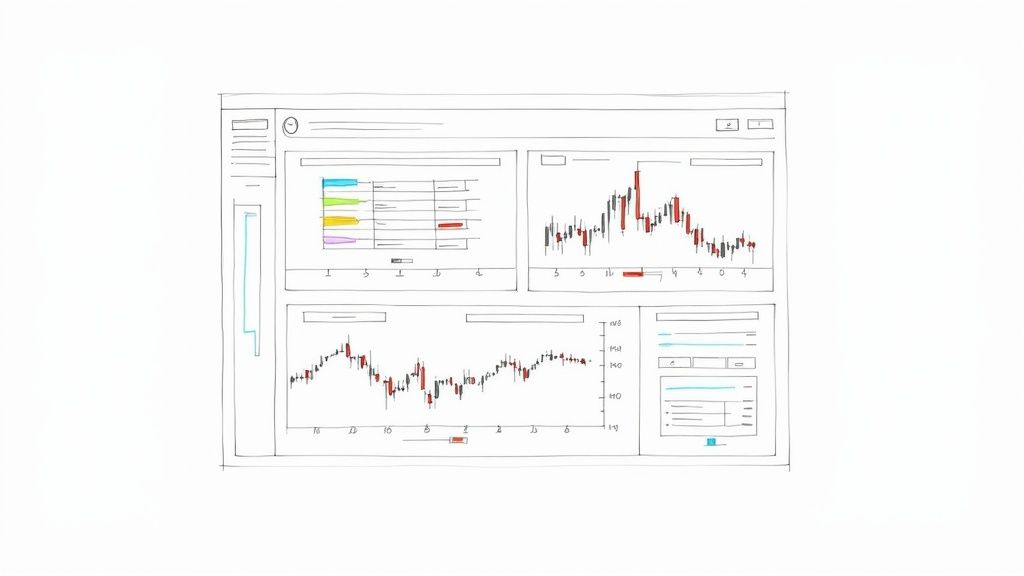

Developing Monitoring Dashboards

A well-designed monitoring dashboard provides a real-time overview of your system's performance. It should highlight key metrics, alerting you to potential issues before they impact your results. Think of it as your trading command center.

-

Key Performance Indicators (KPIs): Include metrics like profit/loss, win rate, maximum drawdown, and the Sharpe ratio. These offer a snapshot of your system's health.

-

Real-time Alerts: Set alerts for crucial events, like exceeding drawdown limits or unusual trading volume. This allows for quick action to minimize potential losses.

-

Visualizations: Charts and graphs help spot trends and anomalies. A sudden drop in win rate, for example, could indicate a problem with your strategy.

Essential Maintenance Procedures

Regular maintenance keeps your system running smoothly. This includes monitoring for performance degradation. Track key metrics over time and investigate any deviations from the norm. This might indicate a need to adjust your strategy.

Market regime identification is also important. Markets shift between trending and range-bound periods. Your system should adapt to perform well in different regimes. This might involve adjusting parameters or switching strategies.

Finally, systematic strategy updates are essential. Regularly review your strategy's performance and make adjustments as needed. This could involve tweaking rules or adding new ones to capitalize on market opportunities.

Documentation, Version Control, and Contingency Planning

Thorough documentation is vital for tracking changes and understanding your system's evolution. Log all code modifications and the reasons behind them. This simplifies troubleshooting and allows you to revert to previous versions.

Using version control for your code is highly recommended. This lets you track changes, revert to earlier versions, and test different versions simultaneously. GitHub offers robust version control capabilities.

A contingency plan for disruptions is also essential. This plan should outline steps to take in case of outages or other unforeseen events. A backup system and a clear recovery procedure can prevent significant losses.

Updating vs. Retiring Strategies

Knowing when to update a strategy versus retiring it is crucial. If performance consistently declines despite adjustments, consider retiring it. If a strategy shows promise but needs fine-tuning, updating it might be better. Consider factors like market conditions, new opportunities, and your strategy's complexity.

ChartsWatcher provides the tools and flexibility to monitor your strategies, adapt to market changes, and maintain your edge in finance. Discover how ChartsWatcher can enhance your automated trading strategy.