Day trading platforms: Find the Best Tools for Real-Time Data

Let's be clear: a day trading platform isn't just an app on your phone for buying a few shares of stock. Think of it less as a simple storefront and more as an analytical cockpit, meticulously engineered for speed, data, and a decisive edge. This is where professional trading tools diverge sharply from the basic brokerage apps most people are familiar with.

What Are Day Trading Platforms Really

Let's ditch the dictionary definitions for a moment. Picture a Formula 1 driver's cockpit—every gauge, button, and screen is feeding them critical, real-time data for split-second decisions at 200 mph. That's the perfect analogy for a modern day trading platform. It’s a specialized command center built to help traders navigate the high-speed, volatile world of intraday markets.

Unlike the standard investment apps designed for long-term, set-it-and-forget-it portfolio management, these platforms are built from the ground up for active traders. Their entire game is about capitalizing on small, rapid price movements, which makes immediate, unfiltered market information an absolute necessity.

From Trading Pits to Digital Desks

The whole concept is a digital evolution of the old-school trading floors, where traders screamed orders and ran on pure adrenaline and instinct. As markets went electronic, that same chaotic energy had to be channeled into sophisticated software. The goal, however, never changed: process information faster than everyone else to gain an advantage.

Today’s platforms deliver that advantage through a suite of tools that work together seamlessly. They aren't just a random collection of features; they're interconnected components designed for a smooth analytical workflow. A typical process might look like this:

- A market scanner flags a stock with unusually high trading volume.

- Advanced charts are pulled up to analyze the nitty-gritty of its price action.

- Level 2 data reveals the live buy and sell orders stacking up behind the price.

- Customizable alerts are set to trigger the second the trader's precise entry criteria are met.

This interconnected system is what turns a simple brokerage account into a powerful decision-making engine. It empowers traders to follow a disciplined strategy instead of making reactive, emotional guesses. For a deeper look into this trading style, check out our guide on what intraday trading is to get the basics down fast.

The core purpose of a day trading platform is to minimize ambiguity and maximize decisiveness. It does this by translating raw market data into actionable insights, letting traders act with precision the moment an opportunity appears.

To help you get a clear picture, let's break down the essential pillars that define a true professional-grade platform.

Core Components of a Professional Trading Platform

| Component | Primary Function | Why It's Critical for Day Traders |

|---|---|---|

| Real-Time Data Feeds | Stream live, unfiltered price quotes, volume, and Level 2 data directly from exchanges. | Eliminates lag. A one-second delay can be the difference between profit and loss when scalping or trading momentum. |

| Advanced Charting Tools | Provide highly customizable charts with hundreds of technical indicators, drawing tools, and multi-timeframe analysis. | Allows for deep technical analysis to identify patterns, trends, and precise entry/exit points that basic charts would miss. |

| Market Scanners | Continuously scan the entire market for stocks meeting specific, user-defined criteria (e.g., gapping up, high volume). | Automates the process of finding opportunities. Instead of searching for a needle in a haystack, the platform brings the needle to you. |

| Customizable Alerts | Notify traders instantly via sound, pop-up, or mobile message when a specific price level or technical condition is met. | Frees traders from having to stare at the screen all day. You can set your conditions and wait for the platform to tell you when to act. |

| Backtesting Engines | Allow traders to test their strategies against historical market data to see how they would have performed. | Validates a strategy's effectiveness before risking real capital. It helps build confidence and refine the rules of your trading plan. |

| Direct Broker Integration | Connects the platform directly to a brokerage account for seamless, one-click order execution. | Maximizes speed and efficiency. Placing a trade directly from a chart or scanner removes friction and reduces the chance of execution errors. |

These components work in concert to create a robust ecosystem where a trader can find, analyze, and act on opportunities with incredible speed and accuracy.

The Modern Trading Ecosystem

The demand for these powerful tools is exploding. The market for stock trading and investing applications is projected to surge from USD 63.62 billion in 2025 to a massive USD 129.38 billion by 2029. This growth isn't just from big institutions; it's being driven by a wave of serious, self-directed traders demanding professional-grade tools.

Ultimately, a top-tier platform is the foundation every successful trading strategy is built on. It’s the critical link between your analysis and your execution in the live market. Without it, you're flying blind.

The Non-Negotiable Features of Top-Tier Platforms

What separates a pro-level day trading platform from your average brokerage app? The difference is far more than just a slicker interface; it’s baked into the very core of the tools you’re given. Think of it like a Formula 1 race car versus a daily driver. They both have four wheels and an engine, but one is engineered for blistering speed, pinpoint precision, and handling immense amounts of stress.

This is where dedicated day trading platforms shine. They aren't just a window to the market to place an order; they are complete analytical cockpits. These systems are built to chew through mountains of market data every millisecond and spit it back out in a way that lets you make sharp, split-second decisions.

Real-Time Data and Advanced Charting

The absolute bedrock of any serious trading platform is its data feed. In day trading, if your data is even one second late, it's ancient history. Pro platforms hook you up with direct-access, real-time data, so you’re seeing the market exactly as it moves, with zero delay. This data comes in two crucial flavors:

- Level 1 Data: This is the standard stuff you see everywhere—the current bid, ask, and last traded price. It's the tip of the iceberg.

- Level 2 Data: This is where the real action is. Level 2 cracks open the order book, showing you the full depth of buy and sell orders stacked up at different prices. You see who wants to buy and sell, and how much.

Getting a handle on this deeper layer of the market is a game-changer. If you're ready to dive in, our guide on understanding Level 2 market data breaks down exactly how to use it to find your edge.

Of course, raw data is useless without killer charting tools. A basic app might give you a simple line chart. A professional platform, on the other hand, delivers fully customizable candlestick charts loaded with hundreds of technical indicators, drawing tools, and the ability to analyze multiple timeframes at once. It’s the difference between a butter knife and a surgeon’s scalpel.

Market Scanners and Automated Alerts

Trying to find trading opportunities by hand is like trying to find a needle in a continent-sized haystack. With thousands of stocks flying around every second, you’d go crazy. That's why powerful market scanners are a must.

A good market scanner is your own personal heat-seeking missile for trades. You can tell it to constantly sweep the market for stocks that match your specific, personal criteria, like:

- Stocks gapping up or down on huge pre-market volume.

- Assets busting through a key moving average.

- Anything showing crazy volatility or sudden price spikes.

Once a scanner flags a potential play, automated alerts act as your eyes and ears. Instead of being chained to your desk, you can set alerts that ping you the second a stock hits your price target or a technical setup triggers. This automates the most tedious part of trading—the waiting—so you can focus on making the kill shot.

A professional trader doesn't hunt for trades; they build systems that bring qualified trades to them. Scanners and alerts are the core components of that system, filtering out market noise and highlighting only what matters to their strategy.

Backtesting and Latency Security

How can you be sure a new strategy isn't a total dud before you risk your hard-earned cash? Simple: backtesting. Top-tier platforms come with backtesting engines that let you run your strategy against months or years of historical market data. It shows you exactly how your rules would have performed in the real world, helping you ditch bad ideas and build real, data-driven confidence in your good ones. Flying blind is for amateurs.

Finally, none of this matters if your platform is slow or buggy. Low latency—the tiny delay between when something happens in the market and when you see it—is everything. A professional platform is engineered for raw speed to minimize slippage and get your orders filled at the price you actually clicked. The tech behind this is immense, relying on powerful APIs designed to handle a firehose of data without breaking a sweat. For a deeper look into what it takes to build these systems, check out this guide on API load testing for bulletproof applications.

These are the features that turn a simple app into a professional trading cockpit. They aren't just nice to have; they're non-negotiable.

How to Choose the Right Platform for Your Trading Style

Trying to pick a day trading platform isn't a one-size-fits-all deal. In fact, the "best" tool for another trader could be a complete disaster for you. The choice is deeply personal and has to line up perfectly with your strategy, how you handle risk, and what your daily workflow actually looks like.

It's like choosing a vehicle for a job. A Formula 1 driver needs a machine built for raw speed and hairpin turns, while a long-haul trucker needs one designed for power and endurance. Both are high-performance vehicles, but they're built for completely different missions. The same logic applies here.

Aligning Platform Features with Your Strategy

The whole game is about matching a platform's strengths to what your trading style needs most. A scalper who jumps in and out of trades for tiny profits every few seconds has a totally different set of priorities than a swing trader who might hold a position for a few days.

So, let's break down how different traders should be thinking about features.

Platform Feature Priorities by Trader Type

Matching your tools to your trading style is non-negotiable. The table below outlines which features are critical versus nice-to-have, depending on whether you're a scalper, a technical chartist, or a swing trader.

| Trader Profile | Primary Goal | Must-Have Platform Features | Secondary Features |

|---|---|---|---|

| Scalper / Momentum Trader | Speed | Direct-access routing, Level 2 data, programmable hotkeys, ultra-low latency. | Basic charting, simple alerts, integrated news feed. |

| Technical Day Trader | Analysis | Advanced charting with custom indicators, multiple timeframes, robust drawing tools. | Scanners for patterns, backtesting modules, broker integration. |

| Swing Trader | Planning | Sophisticated market scanners, powerful backtesting, advanced alerting system. | Quality news feed, fundamental data, portfolio analysis tools. |

As you can see, the right tool depends entirely on the job at hand. A scalper overpaying for a world-class backtester is wasting money, just as a swing trader trying to work with a bare-bones charting package is at a serious disadvantage.

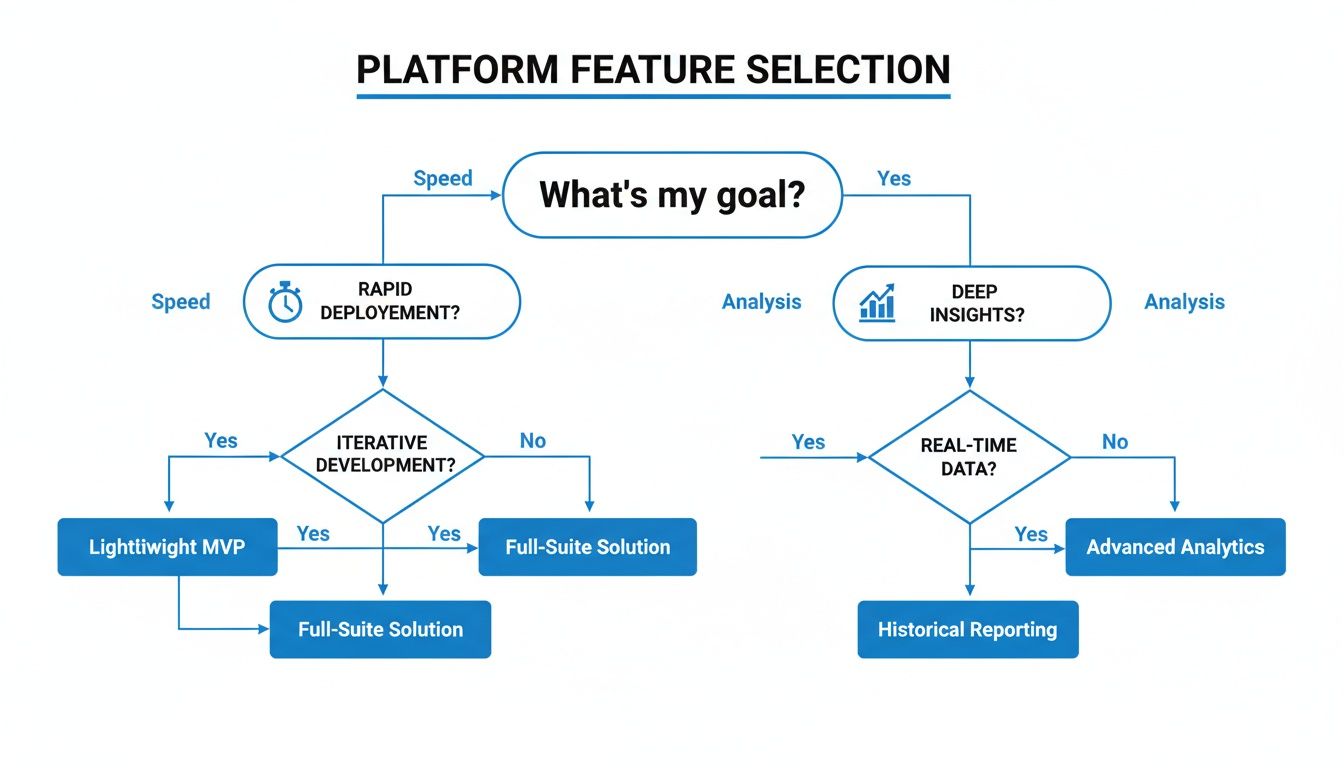

This decision tree helps visualize how your main goal—whether it's speed or deep analysis—should steer your feature selection.

As the flowchart shows, traders who live and die by speed need tools for instant execution. On the other hand, those who rely on analysis need features that support heavy-duty market research and strategy validation.

Creating Your Platform Scorecard

Don't get distracted by flashy marketing gimmicks. The smartest way to choose is to create your own personal scorecard. This forces you to objectively weigh your options based on what actually matters to your P&L, and it stops you from paying for a bunch of features you’ll never touch.

The goal isn’t to find the platform with the most features; it’s to find the one with the right features. A simple, fast platform that perfectly matches your scalping strategy is infinitely better than a complex, expensive one loaded with tools you don’t need.

Get started by listing your absolute "must-haves" in one column and your "nice-to-haves" in another. Then, as you research platforms, score each one on a scale of 1 to 5 for every item on your list. This simple exercise cuts through the noise and gives you a data-driven way to make your final call.

Evaluating Cost Structure and Stability

Finally, you have to look at the money and the machine. A platform's fee structure can eat into your profits in ways you might not expect. Look past the commission per trade and dig into the costs for data feeds, software access, and any other hidden charges.

And just as critical is stability. A platform that crashes during the opening bell is completely worthless, no matter how cheap it is. Hunt for platforms with a proven track record of solid uptime and responsive customer support. Making the right choice now will save you from massive headaches and costly mistakes down the road, letting you focus on the only thing that matters: executing your plan.

The Rise of Automated and AI-Driven Trading

There’s a massive shift happening under the surface of the markets, and it’s all being driven by automation and artificial intelligence. This isn't just a game for the big hedge funds anymore. Modern day trading platforms are dropping these incredibly powerful tools right into the hands of retail traders, and it's changing how we all compete.

Think of automation as your tireless, perfectly disciplined trading assistant. While we humans are wrestling with fear, greed, and the temptation to chase a bad trade, automated strategies just execute. They follow the rules you set with flawless consistency, operating faster and more objectively than any person ever could.

This tech lets you build your own rule-based systems right inside your platform. Using scriptable alerts and automated order execution, you can map out a strategy and then let the machine do the grunt work of watching for signals and pulling the trigger.

How Automation Is Changing the Game

The impact of this shift is impossible to ignore. Algorithmic and automated trading has become the dominant force in the markets. In fact, as of 2025, it’s estimated that over 70% of U.S. equity trades are now driven by algorithms. AI and machine learning are adding even more layers to this, changing how data is analyzed and risk is managed. You can find a deeper breakdown of the best automated trading platforms for broker-dealers on etnasoft.com.

This move toward automation is leveling the playing field, giving individual traders access to strategies that were once only available to elite institutions. You can now deploy systems that:

- Execute trades at machine speed, grabbing tiny opportunities that are completely invisible to the human eye.

- Strip emotional bias out of the equation, making sure every single trade sticks to your data-driven plan.

- Scan thousands of stocks at once, tirelessly hunting for the exact setups that match your criteria.

From Manual Analysis to AI-Powered Insights

This evolution goes way beyond simple rule-based "if-then" commands. Artificial intelligence is adding another layer of deep analysis, helping traders make sense of complex market data in the blink of an eye. Instead of just following basic instructions, AI-driven tools can spot subtle patterns and correlations that would otherwise go completely unnoticed.

The real power of AI and automation isn't about replacing the trader—it's about empowering them. These tools handle the heavy lifting of processing data and executing trades, freeing you up to focus on what really matters: developing strategy and making high-level decisions.

Think about it this way: a trader might spend hours, or even days, manually backtesting a single strategy. An automated platform can run thousands of simulations in minutes. This gives you statistically solid feedback to fine-tune your trading plan before you ever risk a single dollar of real capital. To get a sense of the broader transformation happening across the industry, this guide on automation in financial services offers some great insights.

Ultimately, learning how to integrate these tools is no longer a choice—it’s a necessity for staying competitive. Day trading platforms with robust automation and analytical features aren't just a convenience anymore. They are a critical part of a professional trader’s toolkit for navigating today's complex markets.

Building Your Professional Trading Cockpit with ChartsWatcher

A powerful day trading platform is much more than a piece of software; it's your command center, and it needs to be built with purpose. A professional trader doesn't just open a tool and start clicking around. They meticulously build a personalized "cockpit"—an environment where every single window, chart, and data feed has a specific job in their trading plan. Using ChartsWatcher, we can turn a blank screen into a high-performance analysis engine designed for your specific strategy.

The whole point is to cut through the overwhelming market noise and shine a spotlight only on the opportunities that matter to you. This means creating different layouts for different parts of the trading day. What you need for your pre-market scan is worlds apart from what you need the second the opening bell rings and volatility goes wild.

Designing Your Pre-Market Analysis Dashboard

Before the market even opens, your mission is simple: find potential targets. This is intelligence gathering, not execution time. A well-designed pre-market dashboard in ChartsWatcher should be clean and focused, built to answer one question: "Where is the smart money moving today?"

Your pre-market layout should be built around these key pieces:

- Toplists and Scanners: Set up your scanners to find stocks gapping up or down on heavy pre-market volume. This is your number one source for finding the day's potential high-momentum plays.

- News Feed: A news window synced to your scanners is non-negotiable. It gives you the "why" behind a stock's move, helping you tell the difference between a random spike and a real, catalyst-driven opportunity.

- Watchlists: Build dedicated watchlists for your "A-list" setups—these are the stocks that meet your absolute strictest criteria—and a "B-list" for secondary ideas that are worth keeping an eye on.

With this setup, by the time the market opens, you're not reacting in a panic. You're prepared with a vetted list of candidates and a clear plan of attack.

Configuring Your Open-Market Execution Screen

The moment that opening bell rings, your needs shift from analysis to execution in a heartbeat. Now, your dashboard needs to be optimized for speed and clarity when you're under pressure. This is where you track your A-list stocks in real-time, waiting for your precise entry signals to fire.

This is what a professional's multi-monitor setup, powered by a platform like ChartsWatcher, looks like when the action starts.

The big idea here is synchronized information. Each screen has a dedicated role, but they all work together to paint a complete picture of what the market is doing right now.

A professional's trading screen is an exercise in efficiency. Every element is placed with intent, ensuring that critical data for decision-making is visible at a glance without clutter or distraction.

Your open-market layout should be structured around these core components:

- Linked Charting Windows: Have multiple charts linked by symbol. When you click a stock in your watchlist, all your charts should instantly update to show different timeframes, like the 1-minute, 5-minute, and daily charts.

- Real-Time Alerts: Your pre-set alerts need to be front and center. When an alert goes off, you have to see it instantly, not go hunting for it.

- Level 2 Data and Time & Sales: For your main stock in play, having Level 2 data visible shows you the real-time supply and demand, giving you critical clues about where the price might be headed in the next few moments.

This integrated approach is what allows for rapid, informed decisions. By taking full control of your data and building an environment designed for discipline, you stop being a passive market observer and become an active, prepared participant. Your cockpit is your edge.

Why Most Traders Fail and How Professionals Succeed

Let's get one thing straight: most people who try day trading fail. It’s the harsh truth. They're pulled in by dreams of quick money and quitting their 9-to-5, only to get steamrolled by the market’s cold, hard reality. But this isn't random bad luck; it’s a predictable outcome driven by a few common, and entirely avoidable, mistakes.

The biggest blunders are almost always mental. Traders let fear and greed grab the steering wheel, leading to impulsive entries, revenge trading, and throwing a solid plan out the window at the first sign of heat. They’re trading with their gut, not with data.

Another classic mistake is showing up to a gunfight with a butter knife. Trying to day trade with a basic brokerage app is like entering a Formula 1 race in your family sedan. You just don't have the speed, the data, or the precision needed to even keep up, let alone win.

The Professional Trader Mindset

Successful traders play an entirely different game. They treat the market like a business, not a casino. Every single decision is guided by a structured, disciplined strategy that has been tested, refined, and proven over countless hours.

They know that their biggest opponent isn't another trader—it’s the person in the mirror. To win that battle, they build systems to take emotion completely out of the process. Their workflow is methodical, risk is always defined before entering a trade, and they never, ever break their rules because of a hunch.

This discipline is anchored by their reliance on institutional-grade day trading platforms. These tools aren’t just a nice-to-have; they are the absolute bedrock of a professional’s operation, giving them the critical edge needed to execute their strategy flawlessly, day in and day out.

Professional traders don't try to predict the future; they prepare for probabilities. They use advanced tools to find high-probability setups and manage their risk with surgical precision, letting their edge play out over hundreds of trades.

This approach flips trading from a high-stakes gamble into a calculated business. Pros focus on perfect execution, knowing that if they just stick to the plan, the profits will take care of themselves in the long run.

Bridging the Gap with the Right Tools

The stats tell a brutal story. Despite the boom in retail trading, only about 13% of traders are still at it after three years, and a shocking 40% quit within the first month. You can get more details on this tough reality over at fortraders.com.

This is exactly where a platform like ChartsWatcher comes in. It was built specifically to address the core reasons traders wash out, giving them the tools to build professional habits and data-driven confidence.

- Eliminating Emotional Decisions: The advanced backtesting lets you prove your strategy against historical data. This builds the rock-solid confidence you need to trust your system during a losing streak, stopping you from making panic-driven mistakes.

- Conquering FOMO (Fear of Missing Out): Customizable, real-time scanners work 24/7 to find setups that fit your specific rules. You stop chasing whatever stock is hot and instead let qualified opportunities come to you. This forces patience and discipline.

- Building a Professional Workflow: A fully customizable workspace lets you design a trading cockpit tailored to your strategy. This structured environment helps you get into a routine and maintain the focus needed to treat trading like a real business, reinforcing the habits that separate the pros from the amateurs.

By putting these capabilities in a trader's hands, the platform helps shift the focus from chasing profits to simply executing a plan—and that is the single biggest leap any trader can make on their journey to consistency.

Got Questions About Day Trading Platforms?

Even after digging into all the features, you probably still have a few questions rattling around. It’s completely normal. Let’s tackle some of the most common ones head-on to clear up any lingering confusion before you dive in.

Platform vs. Brokerage Account

This is a big one, and it causes a lot of confusion. Think of your standard brokerage account like the family minivan—it’s dependable, safe, and gets you where you need to go for basic, long-term investing. It does the job.

A professional day trading platform, on the other hand, is a Formula 1 car. It’s a high-performance machine engineered from the ground up for one thing: speed. It’s built for precision handling of massive amounts of real-time data, giving you advanced tools like Level 2 data, hyper-customizable market scanners, and sophisticated charting that most brokerages either don’t offer or present in a stripped-down, basic version. This isn't just a minor upgrade; it's a significant competitive edge for any serious trader.

Are These Platforms Only for the Pros?

Not at all. But they are for traders who are serious about getting better. The best modern platforms are designed to grow with you. When you’re starting out, you can focus on mastering the essentials, like building detailed watchlists and getting comfortable with advanced charting tools.

As your strategies get more complex, you can start layering in the more powerful features, like building custom scanners from scratch or running your ideas through a backtesting engine. The platform is just a powerful instrument; your commitment to learning and disciplined practice is what really makes it sing.

It's a classic mistake to think that advanced tools automatically print money. The hard truth is, a platform is only as good as the trader using it. Real success comes from pairing powerful features with a solid, well-researched strategy that you execute consistently.

Just How Critical Is Low Latency?

For an active day trader? It’s everything. Especially if you're scalping or trading stocks with explosive momentum. Latency is that tiny, almost imperceptible delay between a market event happening and the data showing up on your screen.

Even a delay of a few milliseconds can cause slippage—that maddening gap between the price you thought you were getting and the price you actually got. That tiny delay can single-handedly flip a winning trade into a loser. It's precisely why professional-grade platforms invest so heavily in direct, high-speed data feeds to shave every possible millisecond off that delay.

Ready to build your professional trading cockpit? ChartsWatcher provides the advanced scanning, charting, and analytical tools you need to stop chasing the market and start executing your strategy with precision. Start analyzing the market like a pro today.