Create Stock Watchlist: Find Winning Trades Easily

A stock watchlist is your personal research lab. It's where you track promising companies, analyze their moves, and pinpoint the ideal time to jump in—before you commit a single dollar. This simple tool shifts you from reactive trading, often driven by hype, to proactive, intelligent investing.

Why a Watchlist Is Your Secret Investing Weapon

Forget about chasing the latest market fad or making an impulsive trade because of a catchy headline. A well-built stock watchlist is the single most effective tool for disciplined investing. It’s your filter for all the market noise, letting you zero in on companies that actually fit your strategy.

Think of it like a sports team's bullpen. You wouldn't send a player into a big game without seeing how they perform in practice, right? A watchlist is the exact same concept for your portfolio. It's the designated space where you can monitor potential investments without the pressure of an immediate buy or sell decision.

Fostering Patience and Discipline

The biggest win from using a watchlist is the discipline it builds. Instead of getting spooked by daily swings, you can patiently track stocks until they hit a price or valuation that makes perfect sense for your goals. This methodical approach is a cornerstone of long-term success.

A watchlist turns you from a market reactor into a market strategist. It empowers you to act on your own analysis and timeline, not on fear or greed driven by the crowd.

This process naturally leads to a much deeper understanding of the companies on your list. Over time, you’ll get a real feel for their normal trading ranges, how they react to news, and their overall financial health. That kind of firsthand knowledge is priceless when it's finally time to make a move.

Turning Volatility into Opportunity

When the market gets choppy, most investors panic. But an investor with a curated watchlist? They see opportunities. A market-wide downturn might drag a fundamentally solid company on your list down to a bargain price—a buying opportunity you’d almost certainly miss otherwise.

A disciplined watchlist helps you:

- Cut through the noise by focusing only on companies you've already vetted.

- Stay true to your strategy, whether you're hunting for growth, value, or dividends.

- Make data-driven decisions based on your own research, not on hype.

By dedicating a little time to building and maintaining a stock watchlist, you're laying the foundation for more intentional and, ultimately, more profitable investing. It’s a simple habit that truly separates casual market participants from serious investors.

Building Your Investment Blueprint

Before you start plugging tickers into a watchlist, you need a plan. A watchlist without a strategy is just a random list of companies; a watchlist built on a solid blueprint is a powerful tool for finding real opportunities. So, let's start by defining your personal investment framework.

What's your primary goal? Are you hunting for long-term compounders that can grow steadily for decades? Or maybe you're focused on generating consistent dividend income to supplement your cash flow. Some traders have a higher risk appetite and are searching for short-term growth plays in emerging sectors. Your answer dictates the DNA of your entire watchlist.

Finding Your First Stock Ideas

Great investment ideas are all around you. You don't always need a complex stock screener to find initial prospects. Just look around.

- Industry Trends: Think about the major shifts happening in the world. Renewable energy, artificial intelligence, and new healthcare treatments are all creating massive tailwinds. Companies leading these transformations are often excellent candidates.

- Disruptive Technologies: Which new technologies are fundamentally changing how we live and work? A company with a strong patent or a first-mover advantage can offer incredible growth potential.

- Everyday Brands: Pay attention to the products and services you use and love. If you and everyone you know are loyal to a specific brand, there's a good chance its parent company has a strong competitive moat.

Filtering for Quality and Potential

Once you have a list of initial ideas, it's time to get critical. Not every interesting company is a good investment. This is where you need to roll up your sleeves and do some research. You might find that working from an ultimate due diligence checklist helps structure your analysis and ensure you don't miss anything important.

A carefully curated list is what separates the pros from the amateurs. The long-term historical returns of the U.S. stock market prove that a strategic approach pays off. While performance varies, the S&P 500's average annual return has been about 10% since 1928, with standout years like 1995 delivering a whopping 37.2% return. This just reinforces the power of capturing major growth trends.

This process of defining your goals and filtering for quality ensures that every single stock on your watchlist deserves to be there. It's the foundational step that transforms a simple list into a strategic asset.

So, you have your investment strategy mapped out. Now what? It's time to turn that blueprint into a living, breathing tool that works for you. This is where a well-built stock watchlist in a platform like ChartsWatcher becomes your command center, giving you the critical information you need at a glance. The goal is to graduate from a simple, static list of tickers to a dynamic dashboard that actively supports your trading.

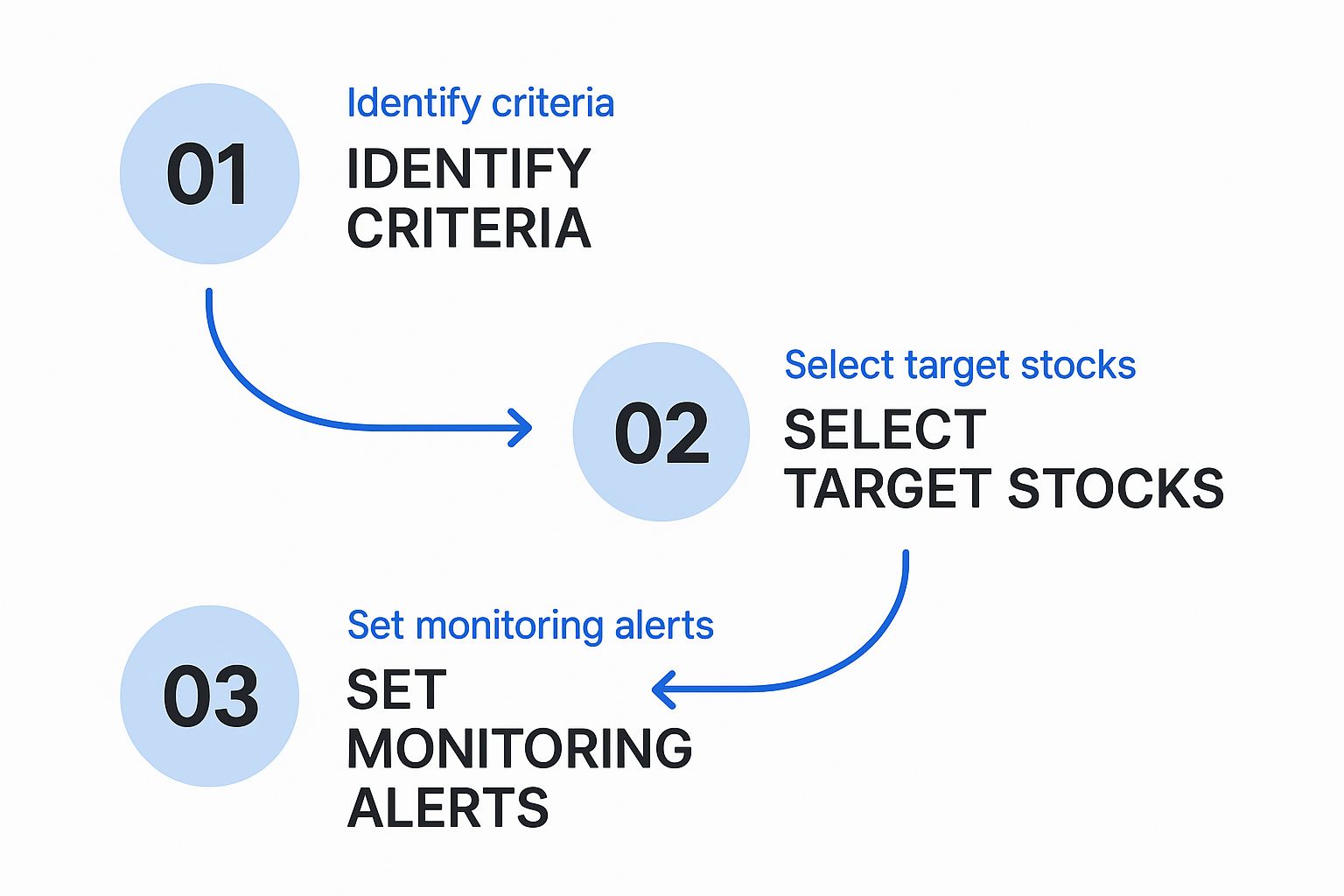

This whole process is about creating a repeatable system. You're not just picking stocks; you're defining criteria, selecting candidates, and then monitoring them efficiently.

As the visual shows, a good watchlist isn't a one-and-done task. It's an ongoing cycle of identification, selection, and active monitoring.

Getting Your First List Dialed In

First things first, let's get you set up in ChartsWatcher. It's incredibly straightforward. You'll start by creating a blank watchlist and, most importantly, giving it a name that actually means something. Please don't just call it "My Stocks." Get specific. Think in terms of your strategies, like "High-Growth Tech Plays" or "Q3 Dividend Aristocrats."

This kind of segmentation is non-negotiable. It keeps you from making apples-to-oranges comparisons, like putting a speculative biotech startup next to a sleepy utility company. They live in different universes with totally different risk profiles. Your "High-Growth" list will be all about revenue acceleration and price momentum, while your dividend list needs columns for dividend yield, payout ratio, and dividend history right up front.

A well-organized watchlist is a direct reflection of your trading strategy. By customizing which data columns you see—things like P/E ratios, trading volume, or analyst ratings—you're essentially telling the platform, "This is the information I need to make a decision."

Once you've created and named your list, adding tickers is as easy as it gets. Just type the symbol and hit enter. The platform will immediately pull in the default data for that stock.

Customizing Columns for Real Insights

Here’s where you separate yourself from the pack. A default watchlist view is fine for a beginner, but a personalized view is a genuine competitive edge. The real power in a tool like ChartsWatcher is the ability to add, remove, and reorder data columns so they perfectly align with your strategy.

For example, think about what data you actually need for different approaches:

- Growth Investors: You’ll want to see columns like "YTD % Change," "52-Week High," and "Relative Volume" to spot momentum.

- Value Investors: Your world revolves around fundamentals, so columns like "P/E Ratio," "Price-to-Book (P/B)," and "Debt-to-Equity" should be front and center.

- Dividend Investors: Make your life easier with columns for "Dividend Yield," "Payout Ratio," and the "Ex-Dividend Date."

A lot of traders I know find their initial stock ideas elsewhere, maybe from a news story or a tip, and then drop them into a watchlist for close monitoring. If you're struggling to find new stocks to track in the first place, you should really understand what a stock screener is and how it can fill your pipeline with high-potential candidates. This two-step dance—discovery followed by focused monitoring—is the true backbone of any solid trading system.

Using Your Watchlist to Spot Entry Points

Okay, you've built your custom watchlist in ChartsWatcher. That's a great first step, but a static list of stocks is just a list. A dynamic one, on the other hand, can be a goldmine. Now the real work begins: turning that passive observation into decisive action.

This is where you start connecting the dots. You’re no longer just looking at ticker symbols; you’re analyzing each stock's story. How does it behave when the whole market tanks? Does it show relative strength when everything else is red? This is how you transform your list into an active tool for spotting timely buying opportunities.

Analyzing Price Action and Volume

Your main job now is to watch for specific signals that scream "it's time." Your most reliable storytellers? Price and volume. They cut through the noise.

Think about it. A stock you like pulls back to a key support level, but the volume is incredibly low. That's a classic sign that selling pressure is drying up—a potential launchpad for the next move higher. On the flip side, a breakout above a tough resistance level on unusually high volume tells you the big players are piling in, giving you confirmation of the upward momentum.

The core idea is simple: let the price action guide your decisions. Stop guessing and start reacting to the clear signals the market is giving you. This is how your watchlist becomes a powerful trading dashboard.

Timing is everything. A disciplined watchlist strategy helps you prepare for these moments, separating you from traders who chase headlines. This approach forces you to be proactive, not reactive.

This is why having a plan is so crucial. A watchlist helps you apply a structured approach, which is a stark contrast to the emotional, gut-feeling decisions that often lead to losses.

Watchlist Strategy vs Reactive Investing

| Characteristic | Watchlist Investing | Reactive Investing |

|---|---|---|

| Decision Basis | Proactive, based on pre-defined criteria | Emotional, based on news or fear of missing out |

| Timing | Strategic entries at support or breakouts | Chasing momentum after a big move |

| Risk Management | Planned entry, stop-loss, and target levels | No clear plan, often buying high and selling low |

| Focus | Disciplined monitoring of select stocks | Constantly jumping between "hot" stocks |

| Outcome | Consistent, data-driven approach | Erratic, often leading to unnecessary losses |

Ultimately, a watchlist investor waits for the market to come to them, while a reactive investor chases the market and usually gets burned.

Cross-Referencing With Key Indicators

Price and volume are powerful, but don't use them in a vacuum. The real edge comes from cross-referencing what you see with the technical indicators you've already added to your ChartsWatcher columns.

-

Moving Averages: Is your stock bouncing off its 50-day moving average? This is a textbook sign of institutional support and a favorite entry point for swing traders. It shows the big money is defending that level.

-

Relative Strength Index (RSI): A dip into oversold territory (below 30) on a fundamentally strong company you've been tracking can be a fantastic buying opportunity. You're essentially buying a great company while it's temporarily on sale.

By combining price, volume, and a couple of key indicators, you build a multi-layered case for every trade. This allows you to act with informed confidence, not on a whim or a hot tip.

Fine-Tuning Your Watchlist: Advanced Management Techniques

A great watchlist isn't something you create once and forget about. It's a living, breathing tool that needs to evolve right along with your trading knowledge and the market itself. To build a list that genuinely gives you an edge, you have to actively manage it. This goes way beyond just adding tickers; it's about curating your list to keep it sharp, relevant, and packed with high-potential ideas.

The real power of your watchlist comes from making it dynamic. A huge part of this is setting up intelligent alerts in ChartsWatcher for key events. For instance, instead of just watching a price, try setting an alert for when a stock you're following gets close to a major support or demand zone. This is like automating part of your analysis, letting the market tell you exactly when it's time to pay close attention.

If you want to get better at spotting these levels, our detailed guide can help you master supply and demand zone trading strategies.

Pruning and Refreshing Your List

Let's be honest: a cluttered watchlist is an ineffective one. You've got to audit your list regularly—I find monthly or quarterly works well—and be ruthless.

Cut out companies that no longer fit your investment criteria. Did a company's growth story hit a wall? Did the fundamental reason you added it in the first place change? If the answer is yes, get it off the list.

This cleanup process does more than just tidy up; it creates valuable mental and digital space for fresh prospects. Think of it this way: active curation ensures your watchlist remains a high-quality, focused source of investment ideas, not a graveyard of forgotten trades. It forces you to constantly re-evaluate your thesis and stay disciplined.

Screening for Relative Strength

During a market downturn, your watchlist becomes one of your most valuable tools. Instead of panicking with the crowd, you can systematically screen your hand-picked list for companies showing relative strength. These are the stocks that are either falling less than the broader market or, even better, holding their ground.

These are often the resilient, high-quality companies poised to lead the pack when the market inevitably turns around. It’s a simple yet powerful way to spot future winners when everyone else is focused on the losers.

As you get more comfortable with managing your list, you might want to explore more sophisticated tools. Digging into various advanced portfolio analysis tools can give you a much broader perspective on your current holdings and potential new additions. This kind of advanced management transforms your watchlist from a simple list of stocks into a powerful instrument for finding top-tier opportunities, no matter what the market is doing.

Common Watchlist Questions Answered

Even with a solid game plan, a few questions always pop up when you're in the trenches building and managing a stock watchlist. Let's tackle some of the most common ones I hear, so you can sidestep the usual pitfalls.

One of the first things traders ask is, "How many stocks should I have on my watchlist?" There’s no magic number here, but the goal is to keep it focused. If your list swells to over 50 tickers, you're heading straight for analysis paralysis. On the other hand, too few might leave you waiting forever for a good setup.

From my experience, the sweet spot for most active traders is somewhere between 20 and 40 stocks. This gives you enough diversity to find opportunities without being so overwhelming that you can't keep up with the news and price action for each company.

It's also critical to remember what a watchlist is for. It's a list of potential trades, not your actual portfolio.

Watchlist vs. Portfolio: What’s The Difference?

It’s surprisingly easy to mix these two up, but they serve completely different purposes. I like to think of it like this:

- Your Watchlist: This is your research bench—a dynamic list of stocks you're actively stalking for the perfect entry. No money is on the line.

- Your Portfolio: This is the main event. It’s the collection of stocks you've actually bought and invested real capital in.

The entire point is to "promote" a stock from your watchlist to your portfolio, but only when it meets every single one of your entry criteria. Once a trade plays out and you've taken profits, the job isn't done. You'll need to know how to calculate Capital Gains Tax (CGT) on your investments, a vital step in managing your real returns.

So, how often should you clean up your list? For any active trader, a quick daily glance is a must. But the real work happens with a deeper review, which I recommend doing weekly. This is your dedicated time to cut stocks that are no longer valid setups and add fresh candidates that have just hit your scanners. A disciplined routine here is what separates consistently profitable traders from the rest.

Ready to build a watchlist that gives you a real edge? ChartsWatcher provides the powerful, customizable tools you need to monitor the market, spot opportunities, and execute your strategy with precision. Start building your professional-grade watchlist today.