7 Best Day Trading Stock Screeners for 2025

Unleash the Power of Real-Time Insights

In the fast-paced world of day trading, split-second decisions can make all the difference. Profit or loss often hinges on access to real-time data and the ability to quickly identify emerging trends. This is where a robust day trading stock screener becomes essential. Think of it as your personalized market radar. It sifts through massive amounts of data to pinpoint stocks matching your specific criteria, allowing you to seize opportunities as they arise.

Are you struggling to pinpoint the right entry and exit points? Tired of manually scanning endless charts? A quality stock screener automates the process, delivering actionable insights directly to you.

Choosing the Right Screener

Choosing the right day trading stock screener can be a challenge. Key factors include the speed of data updates, the range of available technical indicators, customization options, and the platform's overall ease of use. A truly effective screener should offer a seamless user experience, allowing you to quickly define your parameters, backtest strategies, and generate alerts for potential trades.

- Data Speed: Real-time data is crucial for day trading.

- Indicators: Access to a wide variety of technical indicators is key.

- Customization: The ability to tailor scans to your specific needs is essential.

- Ease of Use: A user-friendly platform can significantly impact your trading efficiency.

Pricing and Compatibility

Pricing models vary widely, from subscription-based services to one-time purchases. Understanding your budget and required features is crucial. Some platforms offer free versions with limited functionality, while others provide premium packages with advanced charting tools and real-time data feeds. Technical considerations, such as platform compatibility (desktop, web, mobile) and integration with your existing brokerage account, should also be factored in.

Finding the Perfect Tool

In this guide, we'll explore the top day trading stock screeners available in 2025. We'll analyze their strengths and weaknesses, highlight their unique features, and provide insights into their pricing structures. Whether you're a professional trader at a financial institution, a market analyst, an independent investor, or a stock trading educator, this list will equip you with the knowledge to select the perfect tool. Get ready to unlock a new level of market analysis and discover the screener that will help you navigate the dynamic world of day trading.

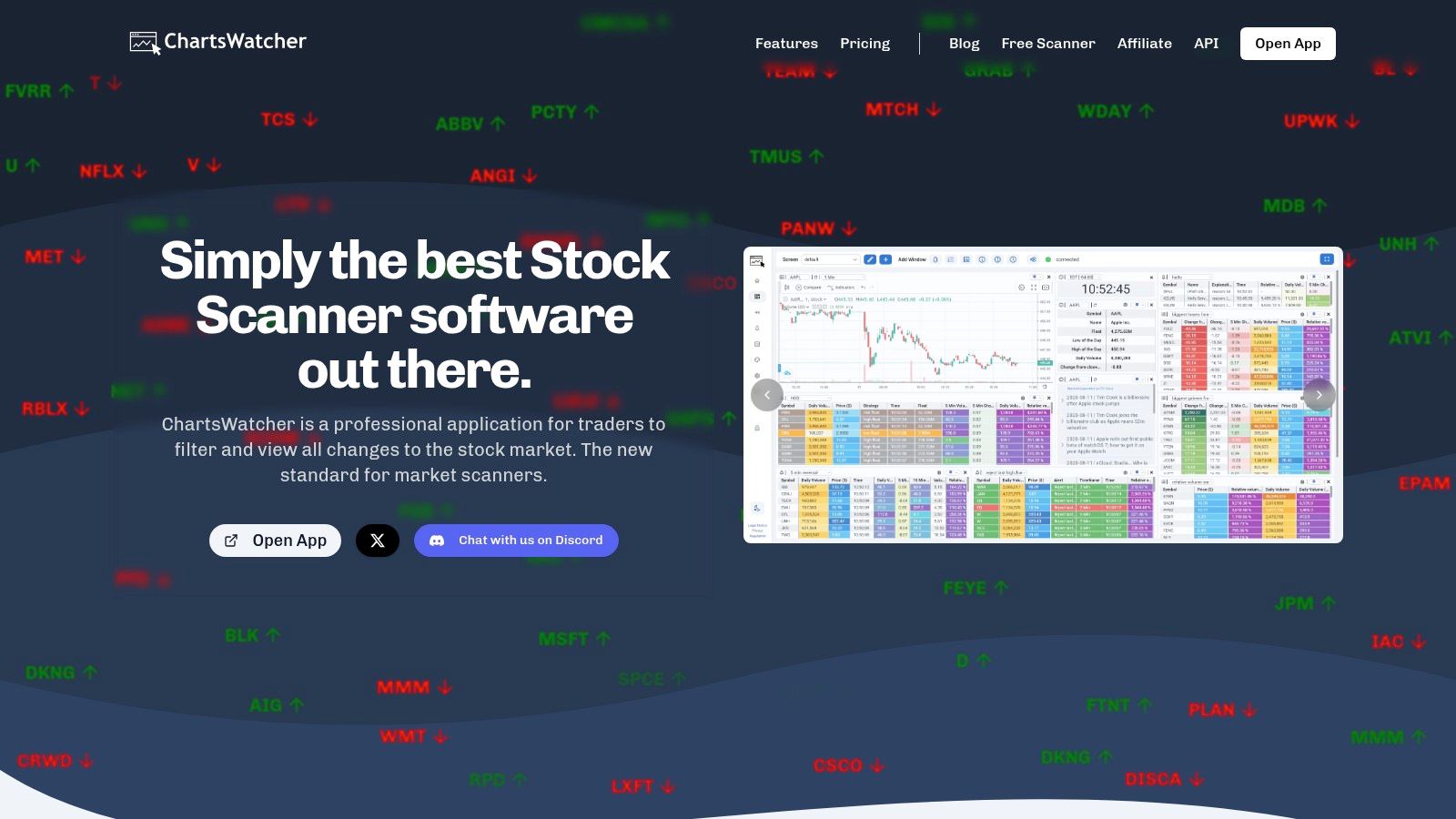

1. ChartsWatcher

ChartsWatcher is a highly customizable stock market scanning software designed for serious traders and market analysts. Its key strength lies in the flexibility of its multi-window dashboard, which can be tailored to individual trading styles. Imagine having real-time data, interactive charts, news feeds, watchlists, and custom alerts all synchronized and displayed according to your preferences. This level of personalization lets you monitor everything from rapid price fluctuations for day trading to long-term trend analysis, all within a single platform.

For day traders, ChartsWatcher's real-time data feed and advanced alert system are invaluable tools. You can set precise alerts based on price movements, technical indicators, or even news events. This allows you to capitalize on fleeting market opportunities. The platform also boasts robust backtesting capabilities, allowing you to refine your strategies by simulating trades using historical data. This helps minimize risk and maximize potential profits. Need to manage your data? ChartsWatcher's intuitive import/export functionality makes it easy. For more information on stock screeners, check out this helpful guide: Our guide on What is a Stock Screener.

While ChartsWatcher offers a free starter package perfect for beginners, the platform's true potential is unlocked with the Pro Plan. This plan provides access to the full suite of features. This tiered pricing model makes the platform accessible to traders of all levels, allowing them to scale their subscription as their needs grow. The platform's sleek design, available in both light and dark themes, further enhances the user experience, making those long trading sessions more comfortable.

Pros

- Highly customizable multi-window dashboards.

- Real-time data and advanced alerts.

- Robust backtesting and import/export capabilities.

- Flexible, tiered pricing plans with a free option.

- Sleek design with light and dark themes.

Cons

- Advanced features may have a steep learning curve for beginners.

- Extensive configuration options could feel overwhelming for some.

Website: https://chartswatcher.com

ChartsWatcher truly earns its place on this list. It offers a potent combination of customization, real-time data, and advanced analytical tools. This makes it a valuable asset for professional traders, market analysts, and anyone serious about improving their trading performance. While its advanced features may require some initial time investment, the potential rewards in terms of increased trading precision make it a worthwhile pursuit.

2. TradingView

TradingView is a popular cloud-based platform that's become a go-to resource for day traders of all skill levels. It brings together charting, screening, and social networking in one intuitive interface. This combination makes it an excellent choice for finding trading opportunities and performing detailed market analysis.

For day traders, having access to real-time data and advanced charting is essential. Imagine trying to find a stock breaking out of a wedge pattern. TradingView lets you set up a screener to look for this specific pattern across different markets and timeframes all at once. With over 100 built-in technical indicators and drawing tools, you can pinpoint entry and exit points with precision. You can even backtest strategies using historical data to refine your approach.

What sets TradingView apart is its social aspect. The platform has a built-in social network where you can connect with other traders, exchange ideas, and learn from seasoned professionals. This collaborative space is especially helpful for newer day traders looking for guidance and mentorship. Following experienced traders and discussing market trends can offer valuable perspectives and improve your trading decisions.

Features and Benefits

Here's a breakdown of what TradingView offers:

- Cloud-Based Charting: Access your charts and data from anywhere with an internet connection.

- Technical Analysis Tools: Over 100 indicators and drawing tools for in-depth charting.

- Customizable Stock Screener: Filter stocks based on technical and fundamental data.

- Pine Script: Create custom indicators and automated trading strategies with this proprietary scripting language.

- Trader Network: Connect with, learn from, and share ideas with a community of traders.

- Multi-Timeframe Analysis: Analyze price action across different timeframes for a comprehensive view.

Pros and Cons

Here's a quick look at the advantages and disadvantages:

Pros:

- User-Friendly Interface: Easy to navigate, even for beginners.

- Powerful Screening: Filter across various asset classes and markets.

- Customizable Charts and Alerts: Stay up-to-date on important price movements.

- Collaborative Community: Learn and share with experienced traders.

Cons:

- Subscription Required for Advanced Features: The free version has limitations.

- Real-Time Data Fees: Depending on the exchange, real-time data might cost extra.

- Resource Intensive: May have performance issues on older computers.

Pricing and Technical Requirements

TradingView has different subscription levels, from a free version to premium plans. The free version offers basic charting and screening, while paid plans unlock more features like additional indicators, alerts, and chart layouts. Keep in mind that real-time data fees might apply depending on the exchange.

TradingView is web-based, accessible through any modern web browser.

Implementation Tips

Here are a few tips to get started:

- Begin with the Free Version: Get familiar with the platform before upgrading.

- Explore Pre-Built Screeners: These are a great starting point for building custom screeners.

- Join the Community: Connect with other traders and engage in discussions.

- Use the Educational Resources: TradingView offers tutorials and webinars to help you learn the platform.

TradingView’s blend of charting, screening, and social features makes it a valuable tool. While the free version is a good introduction, a paid subscription unlocks the platform's full potential. This gives day traders the resources they need to identify and act on market opportunities. Its versatility, combined with the active community and educational materials, makes it a worthwhile resource for both new and experienced day traders. Visit TradingView to explore its features.

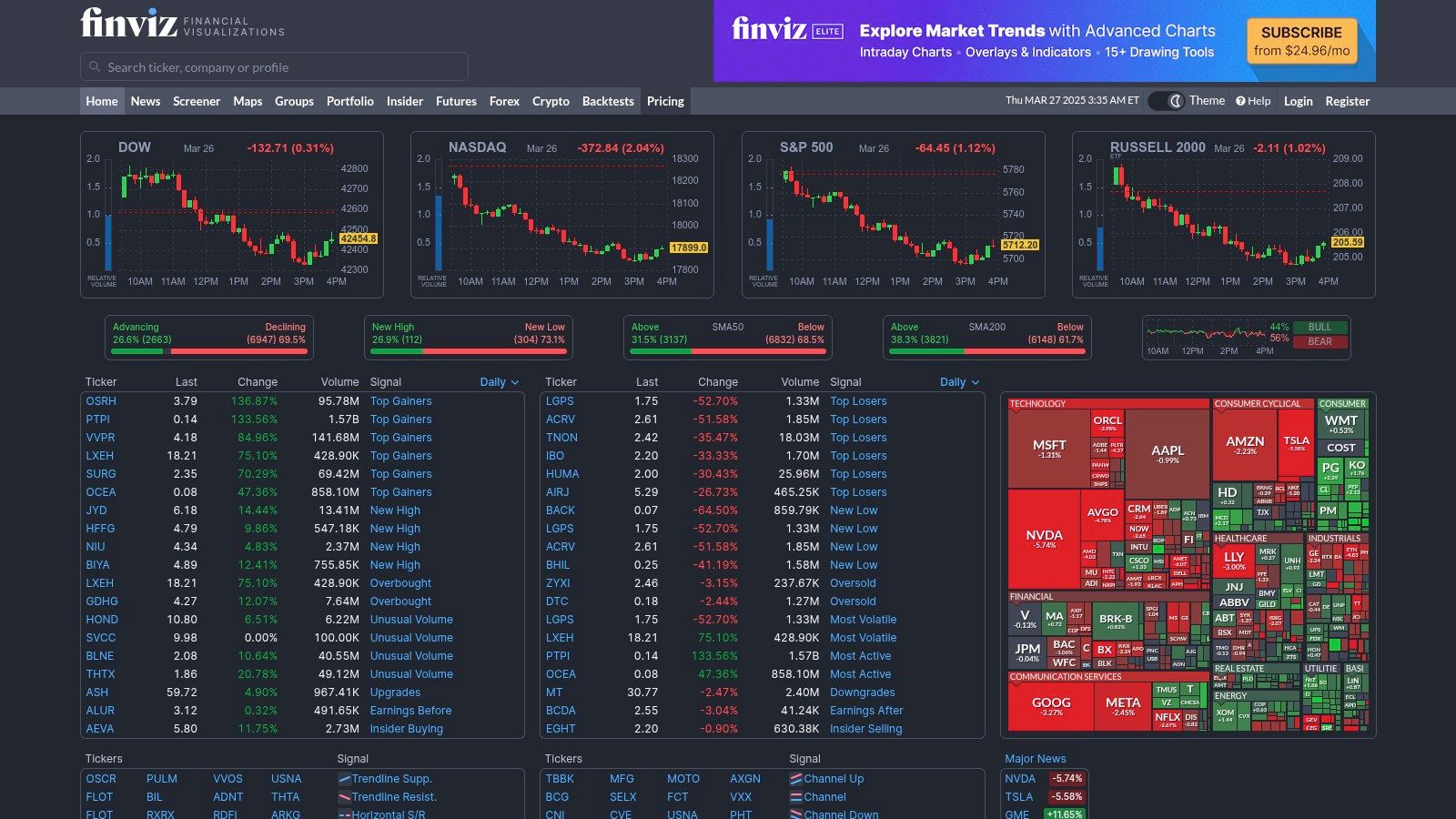

3. FinViz

FinViz (Financial Visualizations) offers a powerful way to visualize market data. This popular stock screener is a favorite among day traders, thanks to its clear visual presentation of data and advanced filtering options. These tools make it easy to quickly spot potential trading opportunities. You can scan for stocks using technical setups, price movements, fundamental metrics, and other custom criteria, all within an easy-to-use interface.

A standout feature of FinViz is its visual heatmap of market sectors and their performance. This allows traders to instantly see which sectors are doing well and which are lagging, providing valuable context for picking individual stocks. The platform's advanced technical and fundamental screening capabilities are a major plus, offering over 70 different filters. These range from simple metrics like market capitalization and price-to-earnings ratio to more complex technical indicators like Relative Strength Index (RSI) and Moving Averages. The ability to create and save custom screener presets is a huge time-saver for day traders who rely on specific strategies. FinViz also offers insights into insider trading, institutional ownership, and pattern recognition for chart formations, which can help assess market sentiment and potential breakouts.

FinViz has a robust free version with a surprisingly comprehensive set of features. This is more than enough for many day traders. For traders who need real-time data and advanced features, there's the FinViz Elite subscription. These extras include advanced charting, backtesting, and more frequent data updates. If you're looking at other options, you might find our guide on the Best Stock Scanners for 2025 helpful. While FinViz's charting isn't as in-depth as dedicated charting platforms, it’s perfectly adequate for quick analysis and confirming technical setups discovered through the screener.

Pros and Cons of FinViz

Here’s a quick breakdown of the advantages and disadvantages of using FinViz:

Pros:

- Powerful free version with comprehensive screening

- Intuitive visual displays, particularly the sector heatmap

- Fast loading times and a responsive interface

- Web-based, so no software installation is required

Cons:

- Real-time data requires the Elite subscription

- Charting capabilities are limited compared to dedicated platforms

- Currently no mobile app

Website: https://finviz.com/

FinViz combines powerful screening, intuitive visualization, and speed—all essential for successful day trading. The free version offers excellent value. The Elite subscription caters to traders who need real-time data and more advanced features. Although it lacks a mobile app and the detailed charting found on specialized platforms, its strength lies in its speed and effectiveness as a stock screener. This makes it an invaluable tool for uncovering day trading opportunities.

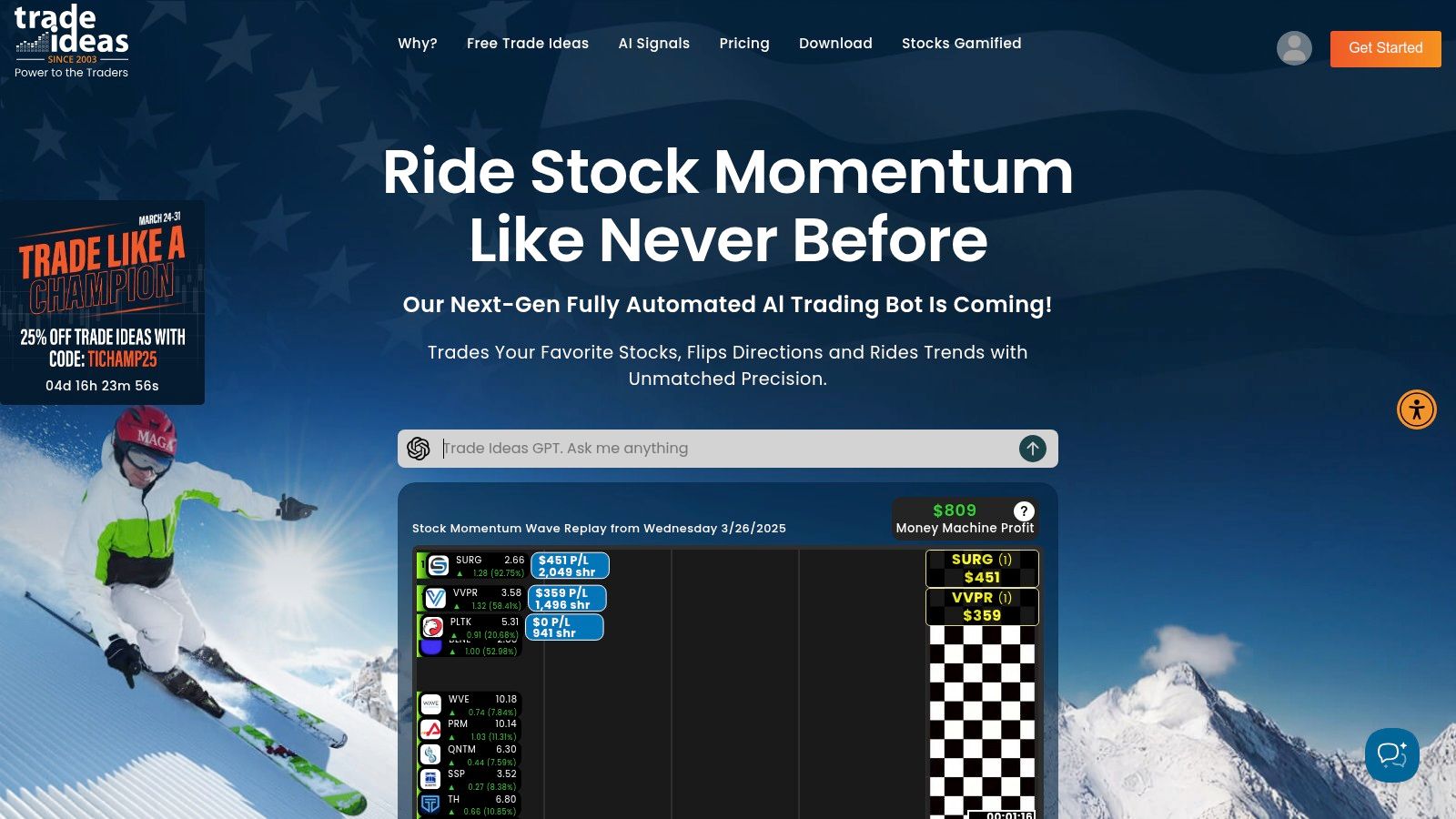

4. Trade Ideas

Trade Ideas stands out as an AI-powered stock screener designed for the fast-paced world of day trading. This platform uses artificial intelligence, through its 'Holly AI' feature, to identify potential trading opportunities as they develop. For professional traders, market analysts, and serious individual investors seeking an advantage, Trade Ideas offers a robust set of tools to identify and capitalize on market movements.

One of Trade Ideas' key strengths lies in its real-time scanning ability, powered by channel bar technology. Users can tailor scans to filter for very specific trading scenarios. These could include particular chart patterns, unusual volume spikes, and rapid momentum shifts, all adapted to their unique trading strategies. This empowers traders to swiftly pinpoint stocks meeting their exact criteria, saving valuable time and potentially boosting profits. Imagine tracking momentum and seeking stocks breaking out on high volume. Trade Ideas lets you set alerts for these specific events across thousands of stocks at once, delivering these opportunities directly to you.

Beyond real-time scanning, Trade Ideas offers backtesting capabilities. This allows traders to rigorously evaluate their strategies against historical data. This is essential for confirming a strategy’s effectiveness before using it in live trading. Moreover, the platform integrates with several brokers, allowing for smooth trade execution when an opportunity presents itself.

Key Features and Benefits

-

AI-Powered Trade Suggestions (Holly AI): Holly AI examines market data and delivers real-time trade suggestions. These are based on pre-defined or user-customized strategies. This can be particularly helpful for newer traders or those seeking a different viewpoint.

-

Real-Time Streaming Alerts and Notifications: Receive immediate notifications when a stock matches your pre-set criteria, ensuring no potential trade is overlooked.

-

Customizable Scans for Specific Trading Strategies: Filter for specific entry and exit points tailored to your individual trading style. This works whether you’re scalping, momentum trading, or swing trading.

-

Backtesting Functionality: Assess your strategies against historical data to refine and improve their performance.

-

Direct Broker Integration: Execute trades swiftly and efficiently directly within the platform.

Pros

- Advanced AI technology offers unique trading insights.

- Powerful real-time scanning capabilities.

- Highly customizable for various trading styles.

- Excellent educational resources and support.

Cons

-

Comparatively expensive than other screening tools. Various subscription tiers are available, beginning around several hundred dollars per month.

-

Steeper learning curve for new users due to the platform’s complexity.

-

The amount of data and features can initially feel overwhelming.

Implementation/Setup Tips

-

Begin with a free trial or demo to explore the platform’s interface and functionality.

-

Dedicate time to understanding how to customize scans and alerts to align with your specific trading strategy.

-

Utilize the educational resources provided by Trade Ideas to maximize your understanding of the platform.

Comparison with Similar Tools

While other stock screeners like Finviz and TradingView offer scanning functions, Trade Ideas differentiates itself through its AI-driven insights, highly detailed customization options, and real-time execution focus for day traders. It serves a more specialized niche of active traders willing to invest in advanced tools and learn the platform.

Why Trade Ideas Deserves Its Place on the List

Trade Ideas earns its spot because of its powerful AI-driven analytics, real-time scanning, and highly customizable features. While the platform has a higher price point and a learning curve, its advanced functionality makes it a valuable asset for dedicated day traders seeking a competitive advantage. Its direct broker integration and backtesting capabilities further strengthen its position as a complete solution for active traders.

Website: https://www.trade-ideas.com/

5. TC2000

TC2000 is a powerful platform built for active traders, especially those who rely on technical analysis. It combines charting, screening, and trading tools in one interface, making it ideal for day traders who need speed and precision.

For day traders, TC2000’s strength lies in its scanning capabilities. It can quickly filter through thousands of stocks based on specific technical criteria. Imagine searching for stocks breaking out of a tight pattern with high volume – a classic day trading setup. TC2000 can pinpoint those opportunities in real-time. Customizable watchlists help traders track their chosen stocks throughout the day. Real-time quotes and condition-based alerts ensure no crucial price movements are missed.

TC2000 goes beyond basic scanning, offering advanced charting with a wide array of customizable technical indicators. Traders can backtest strategies with historical data and visualize potential setups, refining their approach and boosting their chances of success.

While platforms like TradingView and StockCharts provide charting and screening, TC2000 stands out with its integrated trading functionality and the flexibility of its EasyLanguage formula writing. This allows for complex and highly specific scans that other platforms might not offer.

Features

- Advanced charting with customizable technical indicators

- Formula-based scanning for precise technical setups

- Real-time streaming quotes and alerts

- Personal criteria builder for custom scans

- Integrated order execution with supported brokers

Pros

- Powerful combination of screening and charting tools

- Fast execution of complex scans

- Excellent customer support and training resources

- Available as desktop software and web platform

Cons

- Real-time data requires higher-tier subscriptions (Silver and Gold)

- EasyLanguage has a learning curve, although resources are available

- Premium features can be expensive for individual traders

Pricing

TC2000 offers tiered subscriptions, from a free version with limited features to premium packages with real-time data and advanced tools. Check their website for specific pricing details.

Technical Requirements

TC2000 is available as a desktop application for Windows and macOS, and as a web-based platform accessible through most modern browsers.

Implementation/Setup Tips

- Start with the free version to get familiar with the platform.

- Learn EasyLanguage to maximize the platform's potential.

- Take advantage of the training resources and customer support, including tutorials, webinars, and a community forum.

- Begin with pre-built scans and customize them to match your trading strategies.

Website: https://www.tc2000.com/

6. ThinkOrSwim by TD Ameritrade

ThinkOrSwim, TD Ameritrade's flagship platform, stands out for its powerful stock screening tools designed for day traders. It's more than a basic scanner. ThinkOrSwim provides a comprehensive suite of tools for analysis, charting, and even order execution, all within a single platform.

A key feature is the Stock Hacker tool. Traders can create highly specific scans based on numerous criteria. These include technical indicators like moving averages, RSI, and MACD. You can also screen based on candlestick patterns, fundamental data such as earnings per share and P/E ratio, and even real-time news sentiment. Imagine a day trader seeking volatile momentum stocks. They could easily create a scan for stocks gapping up on unusual volume, exceeding a particular RSI threshold, and showing positive news sentiment.

What truly sets ThinkOrSwim apart is its proprietary thinkScript programming language. This allows traders to build custom indicators and scanning filters, offering a level of personalization rarely found elsewhere. Sophisticated traders can develop their own strategies and scan for highly specific setups. Think of a scanner that identifies stocks breaking out of a multi-day consolidation on increasing volume. thinkScript lets you create exactly that.

ThinkOrSwim seamlessly integrates real-time data and news, giving traders up-to-the-minute information. This is essential for day trading, where quick decisions are critical. The platform also features robust strategy backtesting and paper trading. This allows traders to refine their approach without risking real capital.

Features

- Stock Hacker Tool: Advanced technical and fundamental screening.

- Custom Scan Creation: Utilize the thinkScript programming language for exceptional flexibility.

- Real-Time Data and News: Keep current with up-to-the-minute information.

- Strategy Backtesting and Paper Trading: Test and optimize your strategies before risking real money.

- Seamless Order Execution: Trade directly from your scan results, minimizing delays.

Pros

- All-in-One Platform: Screening, analysis, charting, and trading all in one place.

- No Extra Cost: Free for TD Ameritrade customers.

- Professional-Grade Tools: Comparable to tools used by institutional traders.

- Excellent Resources and Support: Extensive documentation and tutorials are available.

Cons

- TD Ameritrade Account Required: You'll need an account to access the platform.

- Steep Learning Curve: Mastering all the features takes time and effort.

- Resource Intensive: A powerful computer is recommended.

Implementation Tips

- Start with Pre-Built Scans: Familiarize yourself with the platform using the provided templates.

- Explore thinkScript Tutorials: Learn how to create custom scans and indicators.

- Use Paper Trading: Practice your scanning strategies risk-free.

ThinkOrSwim is a powerful tool for serious day traders needing advanced scanning and a comprehensive trading platform. While it takes time to learn, it's worth the investment for those wanting a professional solution. Its integration with TD Ameritrade's brokerage services streamlines the entire process, from identifying trades to executing them, making it an excellent choice for active traders.

7. StockCharts.com: A Technical Trader's Paradise

StockCharts.com earns a place on this list as a top platform for technically-driven day trading. While it's not a comprehensive solution for all market needs, it's a powerhouse for those whose trading strategies revolve around technical analysis. Unlike screeners that blend fundamental and technical data, StockCharts.com's laser focus on technicals makes it a go-to for chart-focused traders.

Imagine searching for stocks breaking out of a tight consolidation pattern with increasing volume. StockCharts.com's StockScan feature allows you to define these precise criteria, filtering through thousands of stocks to pinpoint potential trades. You can specify moving average crossovers, candlestick patterns (like dojis or engulfing patterns), relative strength index (RSI) levels, and much more. For faster analysis, the platform also offers Predefined Scans covering common setups like bullish engulfing patterns or new 52-week highs.

Beyond scanning, StockCharts.com excels in charting. Their SharpCharts tool allows for in-depth analysis with hundreds of indicators, drawing tools, and customizable chart settings. This is essential for day traders relying on precise chart analysis to make quick decisions. You can backtest strategies, visualize complex technical setups, and develop a deeper understanding of price action.

Features

- Advanced technical charting with hundreds of indicators

- SharpCharts for detailed analysis

- Customizable technical scans with multiple criteria

- Predefined scans for common setups

- Candlestick pattern recognition

Pros

- Excellent technical analysis tools and charting

- User-friendly interface with intuitive scan building

- Strong educational content for technical analysis (especially helpful for new traders)

- Regular updates with new features and indicators

Cons

- Limited fundamental data compared to platforms like Finviz or TradingView. If you use fundamentals, you'll likely need another data source.

- Most advanced features require a paid subscription. The free version has limited functionality.

- No direct trading capabilities. You'll need a separate brokerage account to execute trades.

Implementation/Setup Tips

- Start with the free version to explore the interface and basic features.

- Explore the pre-defined scans to see how different technical criteria combine.

- Learn the StockScan tool to create custom scans for your strategies.

- Use StockCharts.com’s educational resources, including webinars, articles, and their "Chart School."

Pricing

StockCharts.com offers various subscription tiers, starting around $20/month. See their website for the latest pricing and features.

Compared to platforms like TradingView, which offers broader features including brokerage integration and social trading, StockCharts.com focuses intensely on technical capabilities. For purely technical day traders, this focus is a major advantage. However, traders needing fundamental data or integrated brokerage services might find other platforms better suited. If technical analysis is your primary tool, StockCharts.com is worth considering.

Top 7 Day Trading Stock Screeners: Quick Feature Comparison

| Product | Unique Features (✨) | Data & Alerts (★) | Value/Pricing (💰) | Target Audience (👥) |

|---|---|---|---|---|

| ChartsWatcher 🏆 | Fully customizable dashboards; multi-window views | Real-time data, advanced alerts, backtesting | Flexible: Free to Pro plans | Professional traders & analysts |

| TradingView | Customizable charting; Pine Script coding | Real-time global data; intuitive alerts | Freemium & subscription | Beginners to professionals |

| FinViz | Visual market mapping; 70+ filters | Quick scanning; responsive interface | Free version + Elite upgrade | Day traders |

| Trade Ideas | AI-powered scans with 'Holly AI' | Real-time alerts; customizable scanning | Premium pricing | Active day traders |

| TC2000 | Advanced charting; formula-based scans | Real-time quotes; timely alerts | Tiered subscriptions | Technical analysts & active traders |

| Thinkorswim | Stock Hacker tool; thinkScript customization | Comprehensive data & news integration | Free for TD Ameritrade customers | Professional traders |

| StockCharts.com | In-depth technical charting; preset scan options | Intuitive scan building | Paid subscriptions | Technical analysis enthusiasts |

Maximize Your Potential With the Right Day Trading Stock Screener

Choosing the right day trading stock screener is crucial for maximizing your trading potential. With so many powerful tools available, finding the perfect fit can significantly impact your success. From established platforms like TradingView, FinViz, Trade Ideas, TC2000, Thinkorswim, and StockCharts.com, to newer solutions like ChartsWatcher, the options can seem overwhelming.

When evaluating these different options, consider your individual trading style, experience level, and specific needs. Are you a momentum trader, a scalper, or do you prefer swing trading? Do you need advanced charting capabilities, real-time news feeds, or complex options analysis? The answers to these questions will guide your decision-making process.

Implementation and Practice

Once you’ve selected a stock screener, take the time to thoroughly explore its features. Practice using its various functionalities, including:

- Setting up alerts

- Customizing watchlists

- Backtesting strategies

Many platforms offer educational resources, tutorials, and demo accounts, which can be invaluable for getting started.

Budget and Resource Considerations

Budget and resource considerations are also important. While some screeners offer free basic packages, others require subscriptions. Evaluate the features offered at each price point and determine what aligns best with your budget. Also, consider the processing power of your computer and the speed of your internet connection, as these factors can influence the performance of real-time data feeds and complex charting tools.

Integration and Compatibility

Integration and compatibility are crucial aspects to consider. Does the screener integrate seamlessly with your existing brokerage platform? Can you import and export data easily? Check for compatibility with your operating system and other software you use to ensure a smooth and efficient workflow.

Continuous Learning and Adaptation

By using these advanced tools, you can gain a competitive edge, identify profitable opportunities, and navigate the dynamic world of day trading with greater confidence and precision. Remember that successful day trading requires continuous learning and adaptation. Explore the features, pros, and cons of each screener mentioned to discover the perfect platform to elevate your trading performance in 2025 and beyond.

ChartsWatcher: A Powerful Solution

Looking for a customizable platform to take your day trading to the next level? ChartsWatcher offers a dynamic solution with:

- Customizable windows

- Multiple screen configurations

- Real-time data

- Backtesting capabilities

- Flexible pricing plans

Designed for traders of all levels, from beginner to professional, ChartsWatcher puts you in control of your trading universe. Explore the power of ChartsWatcher today and unlock your full trading potential. Discover ChartsWatcher now