What Is Paper Trading and How to Start Risk-Free

Ever heard the saying "practice makes perfect"? In the world of trading, that practice happens through paper trading.

Think of it as a flight simulator, but for the financial markets. It’s a simulation that lets you buy and sell stocks, crypto, or any other asset using virtual money—all while experiencing real-time market conditions. You get to learn the ropes, test out your brilliant (or not-so-brilliant) ideas, and make all the classic rookie mistakes without losing a single real dollar.

What Exactly Is Paper Trading?

At its heart, paper trading is all about taking financial risk completely off the table while you're learning. It’s designed to mimic a live trading account as closely as possible, showing you real-time price charts and letting you place orders just like you would with actual cash. It’s the perfect way to build your skills and, just as importantly, your confidence.

The name "paper trading" is a throwback to the old days. Before everything went digital, traders would literally write down their buys and sells on a piece of paper to track their hypothetical portfolio. Today, platforms offer incredibly sophisticated paper trading accounts that feel just like the real thing. You can dive deeper into its history and evolution over at IG.com.

What Can You Actually Do With It?

A virtual account gives you a safe playground to get your hands dirty and master the fundamentals. It’s an ideal training ground for a few key things:

- Learning Your Way Around: You can get comfortable with a trading platform, like the one inside ChartsWatcher, without worrying that a wrong click will cost you.

- Trying Out New Strategies: Have a new trading idea or want to experiment with different indicators? This is the place to see what works and what doesn't, based on your own style.

- Building Good Habits: It’s one thing to have a trading plan, but another to stick to it. Paper trading lets you practice discipline and risk management without the emotional rollercoaster of having real money on the line.

A paper trading account is your personal sandbox. It's where you can make mistakes, figure out why they happened, and fine-tune your approach, all completely risk-free. For anyone serious about trading, it's a non-negotiable first step.

Why Every Trader Should Start with Paper Trading

Imagine trying to learn how to fly a plane in a real cockpit, with real passengers, on your very first day. It sounds absurd, right? The same logic applies to trading. Jumping into the live markets without practice is like trying to navigate rush hour traffic on your first driving lesson—the room for error is incredibly small and the consequences can be severe.

Paper trading is your flight simulator. It’s a safe, controlled environment where you can learn the controls, understand the rules of the road, and even crash a few times without any real-world damage.

For anyone just starting, this practice is non-negotiable. It’s the sandbox where you figure out the fundamental mechanics, like the difference between a market order and a limit order, or how to apply your first technical indicators. You're building crucial platform muscle memory, getting comfortable with the software so you can execute trades quickly and confidently when real money is on the line.

A Lab for Strategy and Discipline

But don't think for a second that paper trading is only for rookies. Experienced traders lean on it all the time. It becomes a personal laboratory for testing new, complex strategies before risking a single dollar of actual capital. Want to see how a new options strategy holds up during a period of high volatility? Or maybe test the waters in a new asset class like commodities? A simulated account is the perfect place to experiment and gather hard data.

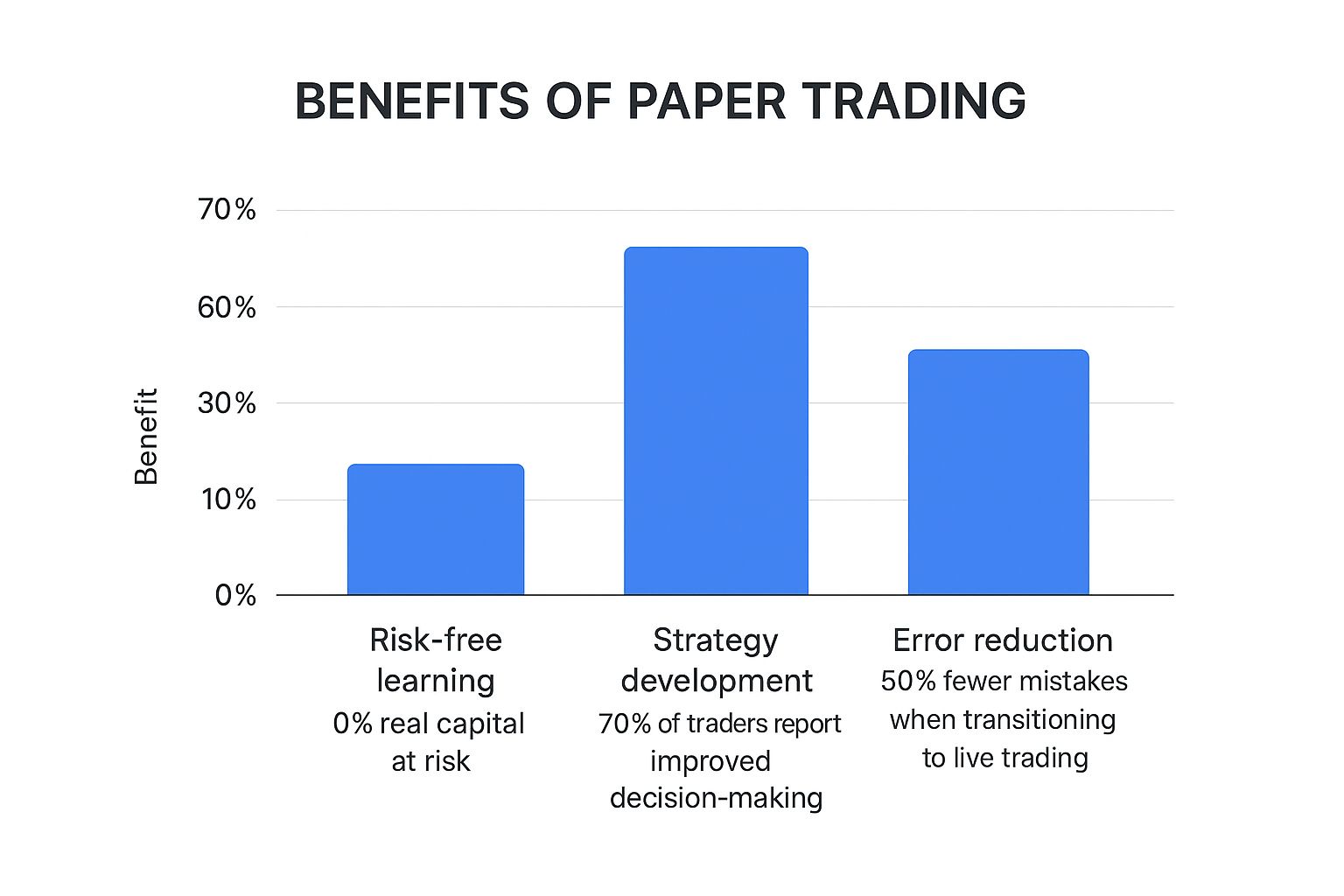

This visual breaks down why it's such a staple for traders at every level.

The benefits are pretty clear: you get to test your ideas, improve your decision-making, and iron out execution errors, all without the financial sting.

This isn't just a niche practice; it's a widely adopted standard. Brokerage data reveals that a staggering 70-80% of new traders spend time in a paper account before committing real funds. They're often spending 15-30 minutes a day just honing their skills and building discipline. You can dive deeper into these trends by checking out some insights on trading practices on intrinio.com.

At its core, paper trading isn’t just about making pretend trades. It’s about building a repeatable process, learning to manage your emotions, and proving to yourself that your strategy actually has an edge before you put your hard-earned money to work.

Bridging the Gap From Virtual to Real Money Trading

Paper trading is a fantastic training ground. It lets you test strategies, learn a platform, and build confidence without risking a dime. But it has one giant, glaring weakness: it’s emotionally sterile.

Racking up wins in a simulation is great, but it can’t prepare you for the gut-punch of a real loss or the genuine thrill of a real win. This is the psychological chasm every trader must eventually cross.

When your own money is on the line, two powerful emotions take over your decision-making: fear and greed. Fear might cause you to jump out of a winning trade far too early or freeze up when a perfect setup appears. Greed can trick you into holding a loser for way too long, praying for a comeback, or over-leveraging a position and blowing up your account.

This emotional void is exactly why a strategy that looks like a sure thing on paper can feel impossible to follow in a live market.

Treating Simulation Like a Business

To start closing this gap, you have to approach your paper trading with the seriousness of a real business. The goal isn't just to make fake money; it’s to forge the discipline needed to follow your system, no matter what.

Begin by setting your virtual account to a realistic size—the same amount of capital you actually plan to trade with. From there, build a rock-solid trading plan with non-negotiable rules. For a deep dive into this, check out our guide on how to master risk management in trading.

The biggest hurdle in trading isn't mastering the charts; it's mastering yourself. A profitable paper trading record is worthless if you haven't built the discipline to replicate it when real emotions are in the driver's seat.

Planning Your Transition to Live Trading

Moving from a demo account to real money shouldn't be a sudden leap of faith. It’s better to think of it as a gradual process, letting yourself slowly acclimate to the emotional pressure. Research backs this up—while paper trading reduces stress in simulations, an estimated 60-70% of new traders find the transition incredibly difficult because they underestimate the psychological weight of real financial risk.

Here’s a simple framework to help make that transition smoother:

- Set Clear Goals: Before you even think about going live, define what consistent success looks like in your paper account. Maybe it’s staying profitable for 60 straight days or hitting a certain number of trades while following your rules perfectly.

- Start Small: When you do go live, start with an account size you are genuinely okay with losing. This keeps the emotional stakes manageable while you find your footing.

- Focus on Process, Not Profit: With your first live account, your only job is to execute your trading plan flawlessly. The profit and loss are secondary to proving you can stick to your system under pressure.

How to Start Paper Trading on ChartsWatcher

Alright, enough theory. Let's get our hands dirty. The best way to learn is by doing, and getting started with paper trading on ChartsWatcher is refreshingly simple. The platform is designed to get you into a simulated market fast, so you can start honing your skills immediately.

What I really like is that the paper trading feature isn’t some separate, watered-down tool. It's built right into the main interface. This means you’re practicing in the exact same environment you’d use for live trading, which is a huge advantage for building muscle memory and getting comfortable with the platform from the get-go.

Navigating the Trading Dashboard

Your command center for all this practice is the ChartsWatcher dashboard. You can set up your workspace just how you like it, with all your charts, scanners, and a summary of your virtual portfolio right in front of you.

Here’s a glimpse of what a typical setup can look like. Notice how you can keep an eye on several assets and indicators at once.

This kind of integrated view is powerful. You can spot a potential trade on a scanner and execute it in your paper account in a matter of seconds.

Ready to place your first trade? Just pick an asset, decide on your order type (like a market or limit order), and set the quantity. Your account comes with a pre-set amount of virtual cash—do yourself a favor and treat it like it's real. All of the ChartsWatcher features are at your fingertips, so you can use the full suite of advanced charting and analysis tools to back up your practice trades.

The real aim here isn't just to click buttons. It’s about running through your entire trading process—from scanning the market and doing your analysis to pulling the trigger and reviewing your portfolio—all within one clean platform.

Monitoring Your Virtual Performance

Once you’ve got a few trades under your belt, your virtual portfolio will start updating in real-time, showing your profits and losses. This is your feedback loop, and it's absolutely crucial for sharpening your strategy.

Here’s a simple way to track your progress and actually learn from it:

- Review Your Trade History: Make a habit of looking at your closed positions. Ask yourself what went right and, more importantly, what went wrong.

- Track Key Metrics: Keep an eye on your win rate, average profit, and average loss. These numbers tell a story.

- Adjust Your Strategy: Use the data you're gathering to make smart, informed tweaks to your trading plan.

By following these steps, you turn paper trading from a simple game into a powerful learning tool. It becomes your personal trading lab, a place to build the habits and discipline you’ll need when real money is on the line.

Avoiding Common Mistakes in Paper Trading

Paper trading is an incredible tool for honing your skills, but it comes with a catch. If you don't approach it with the right mindset, it can easily teach you bad habits that are a nightmare to unlearn once real money is on the line.

The most common trap? Treating it like a video game. With no real financial risk, the temptation to take huge, reckless bets just to "see what happens" is strong. This "nothing to lose" attitude completely defeats the purpose, which is to build the discipline needed for live markets.

Another classic error is starting with an unrealistic pile of virtual cash. If you practice with a $1,000,000 paper account but plan to trade with $5,000 in real life, you're creating a dangerous disconnect. You won't learn a thing about proper risk management or how to size your positions for the capital you actually have.

Forging Realistic Trading Habits

To get the most out of paper trading, you have to treat it like the real deal. Your goal is to simulate actual trading conditions as closely as you possibly can. This means building a repeatable, disciplined process that you can carry over when you go live.

Let's break down some of the most common pitfalls and how to steer clear of them right from the start.

Mistakes To Avoid In Paper Trading

Getting paper trading right from the beginning is all about building good habits. The table below highlights the most frequent blunders traders make and offers simple, actionable fixes to ensure your practice sessions translate into real-world success.

| Common Mistake | Why It's a Problem | How to Fix It |

|---|---|---|

| Using Unrealistic Capital | Distorts your sense of risk and position sizing. A $100 loss feels like nothing in a $1M account but is significant in a $5,000 account. | Set your starting balance to the exact amount you plan to deposit into your live account. Trade as if every dollar is your own. |

| Ignoring Risk Management | Fosters recklessness. Without stop-losses or defined risk, you're not practicing how to protect your capital—the most critical trading skill. | Before entering any trade, define your stop-loss and take-profit levels. Stick to a firm risk-per-trade rule (e.g., never risk more than 1-2% of your account). |

| "YOLO" Trading | Encourages a gambling mindset instead of a strategic one. It's easy to go "all-in" on a whim when the money isn't real, a habit that would be catastrophic with real capital. | Follow a strict trading plan. Every trade should have a clear reason for entry based on your strategy, not just a gut feeling or boredom. |

| Over-Trading | Leads to burnout and reinforces poor decision-making. Taking dozens of trades a day without a clear edge is just clicking buttons, not practicing a strategy. | Limit yourself to a set number of high-quality trades per day or week that perfectly match your trading plan's criteria. Focus on quality, not quantity. |

By consciously avoiding these traps, you'll ensure your time spent paper trading is productive.

Paper trading isn’t about winning fake money. It's about proving to yourself that you can follow your rules with absolute discipline, trade after trade.

This approach transforms the simulator from a simple game into a serious training ground. You’ll build the foundational habits that are essential for navigating the psychological pressures of the live markets when you're ready to make the leap.

Got Questions About Paper Trading? We've Got Answers.

Alright, we've walked through the what and why of paper trading. But it’s natural to still have a few questions bubbling up. Let's tackle some of the most common ones that traders ask before they take the plunge into a practice account.

How Long Should I Paper Trade Before Going Live?

There’s no one-size-fits-all answer, but a good rule of thumb is to stick with it for at least 3 to 6 months of consistent practice. The real objective here isn't just about making pretend money; it's about proving to yourself that you can follow your trading plan without caving to emotion.

When you can stick to your rules, manage your risk properly, and execute your strategy day in and day out—even when things get boring or frustrating—you're probably building the right habits. The goal is to validate your process, not just your profit and loss statement.

The real test isn't if you can make a profit; it's if you can be consistent. Can you follow your own rules, through wins and losses, for an entire quarter? When you can honestly say yes, you’re ready to think about live trading.

Can I Practice on Markets Like Crypto and Forex?

You bet. Any decent paper trading platform will give you access to a whole menu of markets, which is perfect for figuring out where you fit in. This isn't just about stocks anymore.

You can typically practice trading:

- Stocks and ETFs: The classic way to learn the equity markets.

- Forex pairs: A great way to get your feet wet in currency trading.

- Cryptocurrencies: Perfect for testing your nerves in a notoriously wild market.

- Commodities: Think gold, oil, and other resources that march to their own beat.

This variety lets you experiment and find the markets that click with your personality and strategy, all without putting a single dollar on the line. You can discover what works for you before you commit.

Is Paper Trading Actually Free?

Yes, for the most part, paper trading is completely free. Good trading platforms and brokerages offer it as a core educational tool. They see it as an investment in you—helping you learn the ropes of their software and build solid trading skills in a totally safe environment.

It’s always a good idea to double-check with the specific platform you're interested in, but you should never expect to pay for a paper trading account. It's a standard feature, not some premium upsell.

Ready to stop reading and start doing? ChartsWatcher has a powerful and seamless paper trading feature built right in, letting you practice your skills with live market data. It’s the perfect place to build your strategy risk-free. Check out our features and get started today at https://chartswatcher.com.