Top Tips for Day Trading to Maximize Profits in 2025

Unlocking Day Trading Success: Your 2025 Guide

This listicle delivers eight essential tips for day trading to improve your market performance. Learn how to develop a robust trading plan, manage risk effectively, use technical analysis, understand market psychology, practice proper money management, maintain a trading journal, and control your emotions. These concepts are crucial for consistent profitability in day trading. This guide provides the strategies you need to navigate the complexities of the market and enhance your trading success. Master these tips for day trading and improve your outcomes.

1. Develop a Trading Plan

Among the most crucial tips for day trading is developing a robust trading plan. A trading plan is a comprehensive strategy that acts as your personal blueprint for navigating the complexities of the stock market. It outlines your entry and exit points, risk management rules, and overall approach, fostering discipline and consistency regardless of market volatility or emotional impulses. It’s the rudder that steers your trading ship, keeping you on course even during turbulent market conditions.

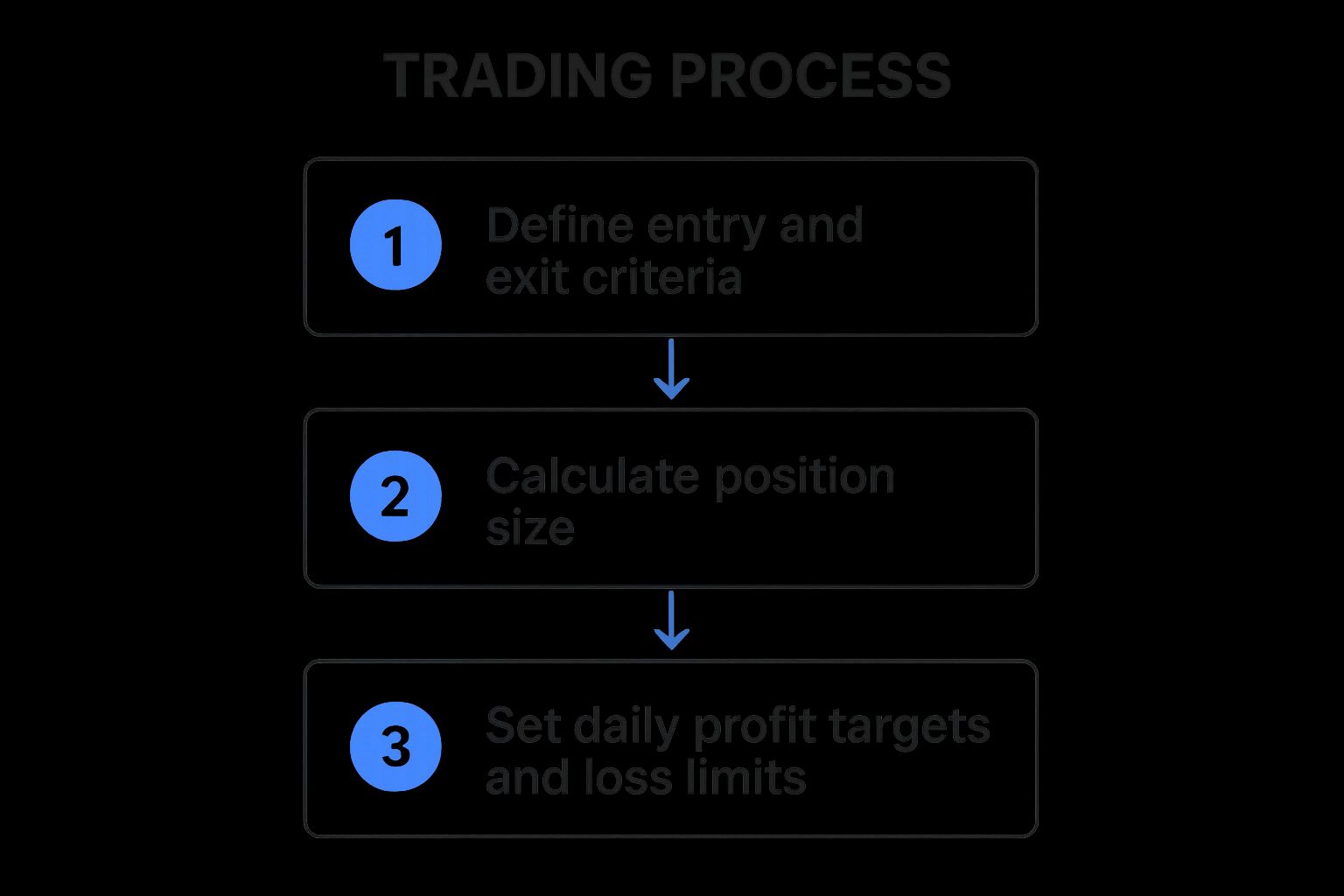

This infographic visualizes the cyclical process of developing, implementing, and refining a successful trading plan. It starts with defining your trading style and objectives, followed by developing specific entry and exit strategies, risk management rules, and backtesting your plan. The cycle continues with implementing the plan in live trading, analyzing results, and adapting the plan based on performance and market changes. This iterative process emphasizes the importance of continuous improvement and adaptation in day trading.

A well-defined trading plan provides structure to your day trading activities. It should include specific entry and exit criteria based on technical or fundamental analysis, position sizing guidelines to manage risk, and daily or weekly profit targets and loss limits. Furthermore, it should clearly outline which markets and timeframes you'll focus on. For instance, you might specialize in trading tech stocks on the NASDAQ between 9:30 am and 11:00 am EST.

Examples of successful trading plans include Mark Minervini's specific volatility contraction pattern strategy with defined entry/exit rules, and Alexander Elder's Triple Screen trading system which utilizes specific timeframe analysis. These approaches demonstrate how a structured plan can provide a framework for consistent profitability.

Developing a sound financial strategy is paramount in any venture. Even when exploring other income avenues, like affiliate marketing, a structured approach is essential. If you're interested in diversifying your income, learning how to start affiliate marketing can be a valuable starting point. A comprehensive affiliate marketing strategy can be a valuable tool for diversifying your income streams. If you're new to this approach, resources are available to guide you: How to Start Affiliate Marketing: A Step-by-Step Guide to Success from AliasLinks.

Pros of having a trading plan:

- Reduces emotional decision-making: By adhering to predefined rules, you minimize impulsive trades driven by fear or greed.

- Creates consistency: A plan provides a structured approach, leading to more predictable trading outcomes.

- Provides clear metrics: Profit targets, loss limits, and other metrics allow for objective performance evaluation.

- Helps maintain discipline: A plan helps you stay focused during periods of high market volatility.

Cons of having a trading plan:

- Time investment: Developing a comprehensive plan requires significant upfront effort.

- Regular adjustments: Market conditions change, so your plan needs periodic review and modification.

- Potential inflexibility: In certain unique market situations, strict adherence to a plan might limit potential opportunities.

Actionable Tips for Creating Your Trading Plan:

- Write your plan down and review it daily before the market opens.

- Include specific trade management rules, such as stop-loss placement and profit-taking strategies.

- Test your plan thoroughly on historical data using a simulator before risking real capital.

- Review and adjust your plan monthly based on performance metrics and market observations. Learn more about Develop a Trading Plan

This detailed approach to developing a trading plan deserves its place at the top of any list of tips for day trading because it lays the foundation for disciplined, consistent, and ultimately, more profitable trading. By providing a structured framework for your trading activities, you're not just gambling on price movements; you're engaging in a strategic process with clearly defined objectives and risk parameters. This is crucial for long-term success in the challenging world of day trading. The principles of planning and strategy emphasized here are championed by renowned trading experts such as Mark Douglas in "Trading in the Zone" and Van K. Tharp in "Trade Your Way to Financial Freedom."

2. Master Risk Management

Effective risk management is absolutely crucial for successful day trading, earning its spot as a fundamental tip for day trading. It's not about avoiding losses altogether—that's impossible. Instead, it's about controlling your exposure on each trade to ensure that inevitable losses don't cripple your trading capital and wipe you out. This principle allows you to stay in the game long enough to capitalize on winning trades and achieve consistent profitability. This involves carefully calculating how much you're willing to risk on each trade, setting strict stop-loss orders, and understanding the potential reward relative to the risk you're taking.

Risk management features several key components: precise position sizing calculations to determine the appropriate number of shares or contracts to trade; implementing stop-loss orders on every single trade to automatically exit positions at a predetermined loss level; analyzing the risk-to-reward ratio to ensure potential profits outweigh potential losses; setting maximum daily loss limits to protect your capital from significant drawdowns; and managing portfolio heat, which refers to diversifying your holdings and avoiding overexposure to any single asset or sector. These tools, when used together, form a robust defense against the inherent volatility of the market.

The benefits of diligent risk management are numerous. It preserves your trading capital during inevitable drawdowns, allowing you to weather losing streaks without devastating your account. It reduces emotional trading spurred by oversized positions, fostering disciplined and rational decision-making. Ultimately, effective risk management creates sustainability in your trading career, giving you the staying power to navigate market fluctuations and achieve long-term success. For example, legendary trader Paul Tudor Jones famously survived the 1987 Black Monday crash by adhering to strict risk management principles, demonstrating the power of this approach even in extreme market conditions. Similarly, the consistent returns of quantitative hedge fund Renaissance Technologies are attributed, in part, to their sophisticated risk management algorithms. Learn more about Master Risk Management.

While the advantages are clear, there are some potential drawbacks. Adhering to strict risk parameters may limit potential profits on individual trades. It also requires mathematical calculations before entering each trade, which can feel cumbersome for some. New traders, especially those seeking large returns quickly, might find these limitations restrictive. However, the long-term benefits of capital preservation far outweigh the potential for slightly reduced profits on individual trades.

Here are some actionable tips to implement robust risk management in your day trading strategy:

- Use position sizing calculators: Determine the precise number of shares or contracts to trade based on your account size and predetermined risk percentage (typically 1-2% per trade).

- Set hard stop-losses: Enter a stop-loss order for every trade before entering the position, ensuring you automatically exit at your predetermined loss level.

- Aim for a minimum 1:2 risk-to-reward ratio: This means your potential profit should be at least twice your potential loss.

- Implement daily loss limits: Stop trading for the day once you reach a predetermined daily loss limit (e.g., 3% of your account).

These techniques, popularized by trading giants like Paul Tudor Jones, Ray Dalio of Bridgewater Associates, and risk management expert Van K. Tharp, are essential for anyone serious about succeeding in the fast-paced world of day trading. They are particularly relevant for professional traders, stock market analysts, financial institutions, independent investors, stock trading educators, and anyone using stock scanners or screeners for day trading.

3. Focus on One or Two Markets

One of the most crucial tips for day trading success revolves around specialization. Instead of scattering your attention across numerous markets and instruments, focus on one or two markets. This targeted approach is a cornerstone of many successful day trading strategies. Why? Because it allows you to develop an intimate understanding of the specific nuances and behaviors of your chosen market(s). This focused expertise is far more valuable than superficial knowledge of a broader range of assets when it comes to the rapid-fire world of day trading.

This specialization fosters a deep knowledge of specific market characteristics, letting you recognize optimal trading times for your chosen markets and spot subtle patterns unique to specific securities. You become attuned to the typical price action around key levels in those markets, giving you an edge over traders who are spread too thin.

How it Works:

By concentrating your efforts, you can dedicate the necessary time to truly understand the forces driving your chosen market. This includes recognizing typical volatility patterns, identifying key support and resistance levels, and understanding how the market reacts to various news events or technical indicators. For example, you’ll learn whether your chosen market tends to overreact or underreact to news releases and how quickly it typically rebounds from pullbacks. This granular level of understanding is nearly impossible to achieve when trying to follow multiple, disparate markets simultaneously.

Examples of Successful Implementation:

Legendary traders like Jim Simmons of Renaissance Technologies have demonstrated the power of market specialization. Simmons primarily focuses on liquid futures markets, leveraging complex mathematical models tailored to their specific characteristics. Similarly, Linda Raschke, a highly respected trader and educator, specializes in S&P futures and select high-volume stocks, demonstrating how focused expertise can lead to consistent profitability.

Actionable Tips for Day Traders:

- Choose markets that align with your trading style and schedule: If you prefer high-volatility trading, look for markets with active price swings. If you have limited time, choose markets that are active during your available trading window.

- Select liquid markets with sufficient volatility for day trading: Liquidity ensures you can easily enter and exit trades without significant slippage, while volatility provides opportunities for profit.

- Create a watchlist of 5-10 securities maximum to follow daily: This allows for deep focus and prevents information overload.

- Spend time studying historical movements in your chosen markets: Backtesting and chart analysis are essential for understanding past performance and identifying potential future patterns.

Pros and Cons:

- Pros: Reduces information overload, allows development of specialized expertise, improves pattern recognition in familiar securities, creates more consistent execution and results.

- Cons: May miss opportunities in other markets, can lead to tunnel vision if not carefully managed, market-specific strategies may not work during certain market conditions.

When and Why to Use This Approach:

This approach is particularly beneficial for new day traders who are still developing their skills and understanding of the markets. It allows them to avoid being overwhelmed by the sheer volume of data available and to build a strong foundation of knowledge in a specific area. Experienced traders also benefit from focusing on their areas of expertise to maintain a sharp edge and consistently execute their strategies.

Why This Tip Deserves Its Place in the List:

Focusing on one or two markets is a fundamental principle for day trading success. It's a core strategy popularized by trading professionals like Linda Raschke, Peter Brandt (focused primarily on futures markets), and Steven Spencer (equities specialist at Kershner Trading). By embracing this focused approach, day traders can significantly enhance their ability to analyze market behavior, identify profitable trading setups, and ultimately, achieve consistent profitability. This tip directly addresses the challenges of information overload and promotes the development of the deep market knowledge required for successful day trading, making it an indispensable component of any comprehensive list of day trading tips.

4. Use Technical Analysis Effectively

Technical analysis is a cornerstone of successful day trading. It involves studying historical price action using charts, patterns, and indicators to anticipate future price movements. For day traders operating in fast-paced markets, technical analysis provides crucial decision-making tools for precisely timing entries and exits. Rather than relying on fundamental analysis which examines a company's intrinsic value, technical traders focus on the price chart itself, believing that all relevant information is already reflected in the price. This approach allows them to capitalize on short-term market fluctuations. Effective technical analysis, however, requires focusing on a few reliable indicators rather than cluttering charts with too many overlapping signals, which can lead to confusion and inaccurate predictions.

Technical analysis equips day traders with a diverse toolkit. This includes chart pattern recognition, such as identifying flags, triangles, head and shoulders formations, and many others. These patterns often suggest potential breakouts or reversals. Equally important is identifying support and resistance levels, which are price zones where price action tends to stall or reverse. Traders also utilize various technical indicators, including the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and moving averages, to gauge momentum, trend strength, and potential overbought/oversold conditions. Volume analysis is crucial for confirming the validity of breakouts and other price movements. Analyzing multiple timeframes offers a broader perspective, using higher timeframes to establish the overall trend and lower timeframes for precise entry and exit points. This multifaceted approach makes technical analysis indispensable for day trading, allowing for a more informed and potentially profitable trading strategy.

Pros of Using Technical Analysis:

- Provides objective entry and exit signals: Removes emotional bias from trading decisions.

- Works across different market types and conditions: Applicable to stocks, futures, forex, and other assets.

- Helps identify optimal risk/reward setups: Allows traders to define clear profit targets and stop-loss levels.

- Can be automated for scanning opportunities: Software can scan for specific patterns and indicator signals.

Cons of Using Technical Analysis:

- Steep learning curve for pattern recognition: Requires time and practice to master.

- Can lead to analysis paralysis with too many indicators: Overcomplicating charts can hinder decision-making.

- Patterns don't always play out as expected: Markets can be unpredictable, and patterns can fail.

- Lagging indicators can provide late signals: Some indicators react to price movements rather than predicting them.

Examples of Successful Implementation:

- Trader and author Thomas Bulkowski meticulously cataloged the statistical success rates of various chart patterns, providing valuable insights into their reliability.

- John Bollinger, creator of Bollinger Bands, demonstrated the effectiveness of using this indicator to identify periods of volatility contraction and expansion, which can foreshadow significant price moves.

Tips for Effective Technical Analysis in Day Trading:

- Start simple: Begin with basic price action and gradually add 2-3 indicators maximum.

- Use multiple timeframes: Higher timeframes (e.g., daily, 4-hour) for trend identification, lower timeframes (e.g., 15-minute, 5-minute) for entry and exit.

- Focus on high-probability patterns: Prioritize patterns with clear invalidation points, allowing for efficient risk management.

- Pay attention to volume: Confirm breakouts and other significant price movements with increased trading volume.

- Combine indicators that measure different aspects: Use a mix of trend, momentum, and volatility indicators for a comprehensive view of the market.

Popularized By:

- John Murphy (author of "Technical Analysis of the Financial Markets")

- Steve Nison (candlestick pattern expert)

- John Bollinger (creator of Bollinger Bands)

Technical analysis deserves a prominent place in any day trading strategy. Its ability to provide objective entry and exit signals based on historical price data is invaluable for navigating the complexities of short-term market fluctuations. By mastering the tools and techniques of technical analysis, day traders can significantly enhance their ability to identify profitable opportunities and manage risk effectively. This approach, while requiring dedication and practice, offers a structured framework for making informed trading decisions in the dynamic world of day trading.

5. Understand Market Psychology

One of the most crucial tips for day trading success revolves around understanding market psychology. This refers to the collective emotional and behavioral patterns of all market participants – from retail investors to institutional giants – that ultimately drive price movements. By grasping these often-irrational patterns, day traders can anticipate potential market reactions, make more informed decisions, and position themselves for profitable trades. This isn't about predicting the future, but rather reading the present emotional temperature of the market to gain an edge.

Market psychology manifests in recognizable phases:

- Fear: Triggers selling pressure and drives prices down.

- Greed: Fuels buying frenzies and pushes prices higher.

- Capitulation: Marks the climax of fear, where panicked selling creates a potential bottom.

- Euphoria: Represents peak greed, often preceding a market correction.

Recognizing these phases is essential for effective day trading. This understanding allows you to identify moments when the market is overreacting, presenting potential opportunities for contrarian plays. For example, during periods of extreme fear, astute traders might look for oversold assets poised for a rebound. Conversely, during euphoric rallies, they might seek out overbought conditions ripe for a pullback.

Features of Analyzing Market Psychology:

- Recognition of crowd behavior patterns: Identifying herd mentality and anticipating its effects.

- Understanding of institutional money flow: Tracking large players' actions can provide insights into potential market direction.

- Identification of market sentiment extremes: Pinpointing moments of extreme fear or greed can signal potential turning points.

- Contrarian thinking when appropriate: Going against the prevailing sentiment when logic dictates.

- Reading order flow and market depth: Analyzing real-time order book data for insights into buying and selling pressure.

Pros of Incorporating Market Psychology:

- Helps anticipate market turning points: By recognizing emotional extremes, traders can better time their entries and exits.

- Allows traders to position against the emotional crowd: Profiting from the mistakes of those driven by fear or greed.

- Provides context for technical setups: Combining technical analysis with market sentiment provides a more holistic view.

- Improves trading confidence and conviction: Understanding the "why" behind market moves strengthens decision-making.

Cons of Relying on Market Psychology:

- Difficult to quantify precisely: Sentiment is inherently subjective and challenging to measure accurately.

- Requires experience to recognize patterns effectively: Interpreting market psychology nuances takes time and practice.

- Can be overridden by external events or news: Unexpected geopolitical or economic events can quickly shift sentiment.

- Sentiment can persist longer than expected: Even when seemingly irrational, market trends can continue longer than anticipated.

Examples of Successful Implementation:

- George Soros' "breaking of the Bank of England": Soros famously profited by understanding the unsustainable position of the British pound within the European Exchange Rate Mechanism, effectively betting against the prevailing market sentiment and the Bank of England's ability to defend the currency.

- Jesse Livermore's contrarian positioning before the 1929 crash: Livermore is said to have amassed a fortune by recognizing the euphoric bubble in the stock market and taking a short position before the crash.

Actionable Tips for Day Traders:

- Study sentiment indicators like put/call ratios and VIX (Volatility Index): These provide insights into market fear and complacency.

- Look for signs of capitulation (high volume selloffs, panic): These can signal potential market bottoms.

- Monitor social media and trading forums for extreme sentiment: Though often noisy, these platforms can offer glimpses into prevailing emotional biases.

- Watch for divergences between price and sentiment: When price action contradicts prevailing sentiment, it can suggest a potential trend reversal.

- Journal market behaviors during key events for future reference: Documenting market reactions to significant news or economic releases can inform future trading decisions.

Influential Figures in Market Psychology:

- Mark Douglas (author of Trading in the Zone): Focuses on the psychological aspects of trading and overcoming mental barriers.

- Dr. Brett Steenbarger (trading psychologist): Emphasizes the importance of self-awareness and emotional control in trading.

- Richard Wyckoff (early market psychology pioneer): Developed a methodology for analyzing market behavior based on the actions of large operators.

Understanding market psychology is not merely an optional skill for day traders; it's a fundamental element for long-term success. By integrating these principles into your trading strategy, you can enhance your ability to read the market's emotional pulse, anticipate potential turning points, and ultimately, make more informed trading decisions. This nuanced understanding differentiates consistently profitable traders from those who struggle to maintain an edge in the dynamic world of day trading.

6. Practice Proper Money Management

One of the most crucial tips for day trading success, and often the most overlooked, is practicing proper money management. This goes far beyond simply setting stop-loss orders. It's a holistic approach to capital allocation that encompasses everything from determining position sizes and managing winning trades to scaling in or out of positions and handling the psychological impact of profits and losses. For professional traders, stock market analysts, financial institutions, and independent investors alike, sound money management is the cornerstone of a sustainable trading career.

Money management dictates how much of your capital you risk on any single trade and how you adjust that risk based on performance and market conditions. It’s the framework that allows you to weather inevitable drawdowns and capitalize on winning streaks without jeopardizing your entire trading account. This is why it deserves a prominent place in any list of day trading tips.

How it Works:

Money management systems generally revolve around a few key principles:

- Position Sizing: Determining the appropriate amount of capital to allocate to each trade based on factors like volatility, account size, and the trader's risk tolerance.

- Scaling In/Out: Gradually increasing or decreasing a position size to manage risk and maximize profit potential. Scaling in allows you to test the waters before fully committing, while scaling out allows you to lock in profits as a trade moves in your favor.

- Stop-Loss Orders: Predetermined exit points that limit losses on losing trades.

- Profit-Taking Protocols: Strategies for securing profits at predetermined targets or based on market dynamics.

- Drawdown Management: Techniques for minimizing losses during periods of unfavorable market conditions. This might involve reducing position sizes, tightening stop-losses, or even temporarily halting trading activity.

Features and Benefits:

- Compounding Strategies: Money management enables the implementation of compounding strategies, allowing profits to generate further returns over time. This is a powerful tool for long-term account growth.

- Drawdown Management Techniques: Protecting your capital during losing streaks is essential for longevity. Effective drawdown management minimizes the impact of inevitable market fluctuations.

- Profit-Taking Protocols: Consistent profit-taking ensures you lock in gains and prevents giving back profits due to market reversals.

- Position Scaling Methodologies: Scaling allows for flexibility and risk management, particularly in volatile markets.

- Account Growth Targets and Milestones: Setting realistic goals and tracking progress helps maintain focus and motivation.

Examples of Successful Implementation:

- Ed Seykota: Featured in "Market Wizards," Seykota is renowned for his exponential account growth achieved through meticulous position sizing. He focused on letting profits run while rigorously controlling losses.

- Karen Supertrader (pseudonym): This options trader emphasizes high-probability setups combined with strict position sizing to manage risk and consistently grow her account.

Actionable Tips for Day Traders:

- Create different position size tiers based on setup quality: Allocate more capital to high-conviction trades and less to those with lower probability.

- Scale into winning positions rather than adding to losers: Let your winners run and cut your losses short.

- Withdraw a percentage of profits regularly to 'lock in' gains: This reinforces positive trading habits and provides a tangible reward for success.

- Reduce position size after consecutive losses: This protects your capital during drawdowns and allows you to regain your footing.

- Increase size gradually after proving strategy effectiveness: Avoid dramatically increasing position size after a few winning trades. Consistent profitability over time warrants gradual increases.

Pros:

- Prevents catastrophic losses: Protects your trading capital from being wiped out by a few bad trades.

- Optimizes returns during favorable conditions: Allows you to maximize profits during winning streaks.

- Creates a sustainable trading career path: Provides a framework for long-term success in the markets.

- Reduces psychological pressure on individual trades: Knowing you're managing risk effectively reduces emotional decision-making.

Cons:

- May limit potential returns during strong market runs: Strict adherence to rules can sometimes mean missing out on exceptionally large gains.

- Requires significant self-discipline: Sticking to your money management plan requires discipline and emotional control.

- Complicated to implement with multiple concurrent positions: Managing multiple positions with varying risk parameters can be challenging.

- Needs regular adjustment as account size changes: Your money management plan should evolve as your account grows or shrinks.

By mastering the principles of money management, day traders can significantly enhance their chances of long-term success. It provides the foundation for consistent profitability and allows traders to navigate the inherent volatility of the markets with confidence. Whether you're a seasoned professional or just starting out, prioritizing money management is a non-negotiable aspect of becoming a successful day trader.

7. Keep a Trading Journal

One of the most powerful, yet often overlooked, tips for day trading is to maintain a comprehensive trading journal. This isn't just a log of your wins and losses; it's a detailed record of every trade, providing invaluable insights into your performance, psychology, and the market itself. For professional traders, stock market analysts, financial institutions, independent investors, and stock trading educators alike, a trading journal is a critical tool for continuous improvement and long-term profitability in the fast-paced world of day trading.

A trading journal goes far beyond simply noting your entry and exit points. It's a repository of information that captures the entire context of each trade, including:

- Technical Setup: What indicators or chart patterns prompted the trade?

- Entry and Exit Points: Precise price levels for entry and exit.

- Position Size: How many shares or contracts were traded?

- Market Conditions: What was the overall market sentiment and volatility like at the time of the trade?

- Psychological State: How were you feeling before, during, and after the trade? Were you confident, anxious, or impulsive?

- Trade Screenshots with Annotations: Visual records of the trade setup and execution, with added notes and analysis.

- Market Condition Notes: Observations about broader market trends and news that might have influenced the trade.

- Emotional State Documentation: Honest reflection on your emotional state during the trade. This is crucial for identifying psychological biases that may be impacting your decisions.

- Performance Metrics Tracking: Key performance indicators (KPIs) like win rate, average profit/loss, and maximum drawdown.

- Strategy Effectiveness Analysis: Evaluating the performance of specific trading strategies over time.

- Pattern Recognition Development: Identifying recurring patterns in both winning and losing trades.

This systematic documentation allows for objective self-analysis, a crucial element often missing in day trading. By diligently recording this information, traders can identify strengths and weaknesses in their approach, refine their strategies, and ultimately make data-driven decisions rather than relying on gut feeling. This process allows for continuous improvement, making it an indispensable practice for those serious about succeeding in the markets.

Examples of Successful Implementation:

- Brett Steenbarger: Dr. Steenbarger, a renowned trading psychologist, emphasizes the importance of detailed journaling for understanding trading psychology and performance. His methodology often involves analyzing emotional responses to market events and identifying cognitive biases.

- Jack Schwager's Market Wizards: In his interviews with highly successful traders, Schwager frequently reveals that many of them meticulously maintain trading journals to track their performance and refine their strategies.

Actionable Tips for Using a Trading Journal:

- Use trading journal software: Platforms like TraderSync and Edgewonk automate data capture and provide advanced analytics. This saves time and ensures consistency.

- Review journals weekly: Regular review helps identify recurring patterns and areas for improvement.

- Include market context: Noting the broader market conditions for each trade allows you to understand how external factors influence your results.

- Rate execution quality separately from outcome: Even a losing trade can have good execution. Differentiating between the two helps identify areas for technical improvement.

- Track emotional states and correlate with performance: This is crucial for identifying psychological biases that might be impacting your trading decisions.

- Categorize trades by setup type: Determine which setups have the highest probability of success.

Pros and Cons of Keeping a Trading Journal:

Pros:

- Provides objective feedback on trading performance.

- Identifies patterns in successful and unsuccessful trades.

- Helps eliminate repetitive mistakes.

- Creates accountability and transparency.

Cons:

- Time-consuming to maintain properly.

- Requires honesty and self-awareness.

- Benefits are not immediate but cumulative over time.

- Can be psychologically difficult to review losses.

Why a Trading Journal Deserves Its Place in This List:

In the volatile world of day trading, emotions can run high and objectivity can be lost. A trading journal anchors you to a data-driven approach, providing a critical feedback loop for continuous improvement. It's not just a record of your trades; it's a roadmap to becoming a more disciplined, consistent, and ultimately, profitable trader. This is why keeping a trading journal is an essential tip for day trading, crucial for anyone aiming for long-term success in the markets, whether they are professional traders, financial institutions or independent investors.

8. Control Your Emotions: The Key to Consistent Day Trading

Among the many tips for day trading, mastering your emotions stands out as the most crucial, yet often the most challenging. This isn't about eliminating emotions altogether – that's impossible. It's about recognizing their influence and developing strategies to prevent them from sabotaging your trading plan. In the fast-paced world of day trading, emotional control is the bedrock upon which successful, sustainable trading is built. This is why it deserves a prominent place on any list of day trading tips.

Emotional control, in the context of day trading, refers to the ability to make rational, objective decisions based on your pre-defined strategy, regardless of the emotional pressures of the market. It involves managing the fear of missing out (FOMO), the greed that pushes you to overextend, the hope that a losing trade will magically turn around, and the regret that follows a bad decision. These emotions can lead to impulsive entries and exits, revenge trading (trying to recoup losses through risky trades), and missed opportunities due to paralysis by analysis.

How it Works:

Controlling your emotions in day trading involves a multi-pronged approach. It begins with recognizing your emotional triggers – specific market events or personal circumstances that tend to evoke strong emotional responses. Once identified, you can develop pre-trade routines and mindfulness techniques to mitigate their impact. This might include deep breathing exercises (like Paul Tudor Jones employed before major trading decisions), meditation (a cornerstone of Ray Dalio’s trading approach), or visualization techniques. Implementing “circuit breakers” – predefined rules for stepping away from the market when experiencing heightened emotional states – is also essential. Finally, cognitive behavioral strategies can help you reframe negative thought patterns and develop a more constructive inner dialogue.

Features and Benefits:

- Recognition of emotional triggers: Identifying what sets you off allows for proactive management.

- Development of pre-trade routines: These routines help you approach each trade with a clear and focused mind.

- Implementation of circuit breakers for emotional states: Protecting yourself from emotionally-driven decisions during periods of stress or tilt.

- Mindfulness and stress management techniques: Cultivating mental resilience to navigate the market’s ups and downs.

- Cognitive behavioral strategies for trading: Reshaping your thinking to align with rational decision-making.

Pros:

- Enables consistent execution of trading plan: Sticking to your strategy, even under pressure, is key to long-term success.

- Reduces costly impulsive decisions: Avoiding emotional trades minimizes losses and maximizes potential gains.

- Improves ability to handle drawdowns: Maintaining composure during inevitable losing streaks prevents emotional spirals.

- Creates sustainable trading career: Emotional control fosters longevity in a demanding profession.

Cons:

- Difficult to master consistently: Managing emotions is an ongoing process that requires continuous effort.

- Requires ongoing self-awareness: Honest self-reflection is necessary to identify and address emotional vulnerabilities.

- Environmental factors can impact emotional control: External stressors can spill over into your trading performance.

- May require significant personality adjustment: Developing emotional discipline often involves changing ingrained habits and thought patterns.

Actionable Tips for Day Traders:

- Implement a pre-trading routine to center your emotions. This could involve reviewing your trading plan, visualizing successful trades, or practicing mindfulness.

- Use checklists to ensure rational decision-making, especially before entering and exiting trades.

- Take breaks after losing trades before reentering the market. This prevents revenge trading and allows you to regain composure.

- Practice mindfulness meditation to improve focus and emotional regulation.

- Set clear rules for when to stop trading for the day, based on both loss limits and emotional states.

- Reduce position size when feeling emotionally compromised. This minimizes potential losses during periods of suboptimal decision-making.

Popularized By:

Key figures who have emphasized the importance of emotional control in trading include Mark Douglas (author of Trading in the Zone), Ari Kiev (a psychiatrist who worked with top traders), and Dr. Andrew Menaker (a trading performance coach). Their work has helped countless traders understand and address the psychological challenges inherent in navigating the financial markets. By prioritizing emotional control, day traders can significantly enhance their chances of achieving consistent profitability and building a sustainable career in this challenging yet rewarding field.

8 Key Tips Comparison Guide

| Tips | 🔄 Implementation Complexity | 💡 Resource Requirements | 📊 Expected Outcomes | ⚡ Ideal Use Cases | ⭐ Key Advantages |

|---|---|---|---|---|---|

| Develop a Trading Plan | Medium – requires initial time and ongoing reviews | Moderate – time to write, test, and adjust plan | High – promotes discipline and consistency | Day traders seeking structured strategies | Reduces emotional decisions; clear performance metrics |

| Master Risk Management | Medium – needs calculations every trade | Moderate – tools like calculators, stop-loss setup | Very High – preserves capital over time | All traders wanting long-term capital survival | Prevents large losses; promotes sustainability |

| Focus on One or Two Markets | Low – select markets and specialize | Low – focus effort; study specific markets | Medium – better pattern recognition | Traders overwhelmed by multiple markets | Reduces overload; develops deep expertise |

| Use Technical Analysis Effectively | Medium-High – learning curve and chart setup | Moderate – charting software, indicator knowledge | High – objective entry/exit signals | Traders relying on price action and indicators | Identifies risk/reward setups; applicable across markets |

| Understand Market Psychology | High – requires experience and observation | Low-Moderate – study of sentiment indicators and behavior | Medium – anticipates turning points | Traders wanting behavioral edge | Positions against crowd; improves trading conviction |

| Practice Proper Money Management | Medium – involves scaling and compounding strategies | Moderate – tracking systems and discipline required | Very High – optimizes returns, reduces risk | Traders focused on capital growth and longevity | Prevents big losses; supports sustainable growth |

| Keep a Trading Journal | Medium – requires consistent documentation | Moderate – journal software or manual maintenance | High – clarifies strengths, weaknesses | All traders aiming for continuous improvement | Objective feedback; accountability |

| Control Your Emotions | High – ongoing mental and behavioral effort | Low-Moderate – routines, mindfulness resources | High – consistent plan execution | Traders prone to impulsive decisions | Decreases impulsivity; improves handling of drawdowns |

Elevate Your Day Trading with ChartsWatcher

Successfully navigating the fast-paced world of day trading hinges on a disciplined approach. This article has covered essential tips for day trading, from developing a robust trading plan and mastering risk management to understanding market psychology and keeping a detailed trading journal. The key takeaway is that consistent profitability in day trading relies on a combination of knowledge, strategy, and emotional control. Mastering these concepts empowers you to make informed decisions, minimize losses, and capitalize on opportunities as they arise. These tips, when applied diligently, can significantly improve your trading performance and contribute to long-term success in the market.

Remember, the most successful day traders are those who adapt and refine their approach continuously. They understand that market conditions change and that constant learning is crucial. By implementing the tips discussed and consistently honing your skills, you can transform your day trading journey from one of uncertainty to one of calculated precision and potentially increased profitability.

To enhance your day trading endeavors and take advantage of advanced charting, real-time data analysis, and other powerful tools, explore ChartsWatcher. ChartsWatcher helps you put these tips into action by providing the cutting-edge technology you need to analyze markets effectively, manage risk, and make smarter trades. Supercharge your tips for day trading and visit ChartsWatcher today to unlock your full potential.