How to Calculate Risk Reward Ratio: Expert Tips & Guide

To calculate your risk-reward ratio, you simply divide your potential profit on a trade by the amount you're willing to lose. It's a simple, yet powerful concept. For example, if you risk $100 on a trade with a target that could net you $300, your risk-reward ratio is a solid 1:3. This single metric is the foundation for deciding if a trade is even worth considering.

What Is the Risk Reward Ratio in Trading

Before you get lost in complex indicators and strategies, you have to nail this down. At its heart, the risk-reward ratio is a brutally honest comparison: how much could you make for every single dollar you put on the line?

Thinking this way forces you to define your exit points—both your stop-loss and your take-profit—before you even click the buy or sell button. That small act alone builds incredible discipline and stops you from making those gut-wrenching emotional decisions that wreck accounts. It's what separates a calculated business decision from a hopeful gamble.

Why It Matters for Profitability

Look, one of the most critical things you can do is divide your potential gain by your potential loss. Risking $100 to make $300? That's a 1:3 ratio. The old hands in this business will tell you to almost always seek out favorable ratios, typically 1:2 or better. Why? Because it’s the only way to build a sustainable, profitable trading career over the long haul, especially when dealing with the inevitable string of losses. The history of market performance, as detailed in research from sources like the National Bureau of Economic Research, consistently backs up the importance of sound risk principles.

This concept has a massive impact on both your trading psychology and your account balance. A higher ratio means your wins will more than make up for your losses, which allows you to be profitable even if you're right less than 50% of the time. Think about that for a second.

Key Takeaway: A favorable risk-reward ratio is your mathematical edge. It's what allows you to be wrong more often than you're right and still grow your account. This is the secret that separates professional traders from amateurs.

The table below breaks this down perfectly. It shows you the absolute minimum win rate you need just to break even at different ratios.

Understanding Different Risk Reward Ratios

This table clearly illustrates the powerful relationship between your risk-reward ratio and the win rate you need to stay in the game. As you can see, the more you stand to make relative to what you risk, the less often you need to be right to avoid losing money.

| Risk Reward Ratio | Meaning | Break-Even Win Rate Needed |

|---|---|---|

| 1:1 | You risk $1 to make $1. | 50% |

| 1:2 | You risk $1 to make $2. | 33.3% |

| 1:3 | You risk $1 to make $3. | 25% |

| 1:4 | You risk $1 to make $4. | 20% |

Notice how quickly the pressure drops. At a 1:4 ratio, you only need to win one out of every five trades to break even. Anything better than that, and you're profitable. This is the core of smart trading.

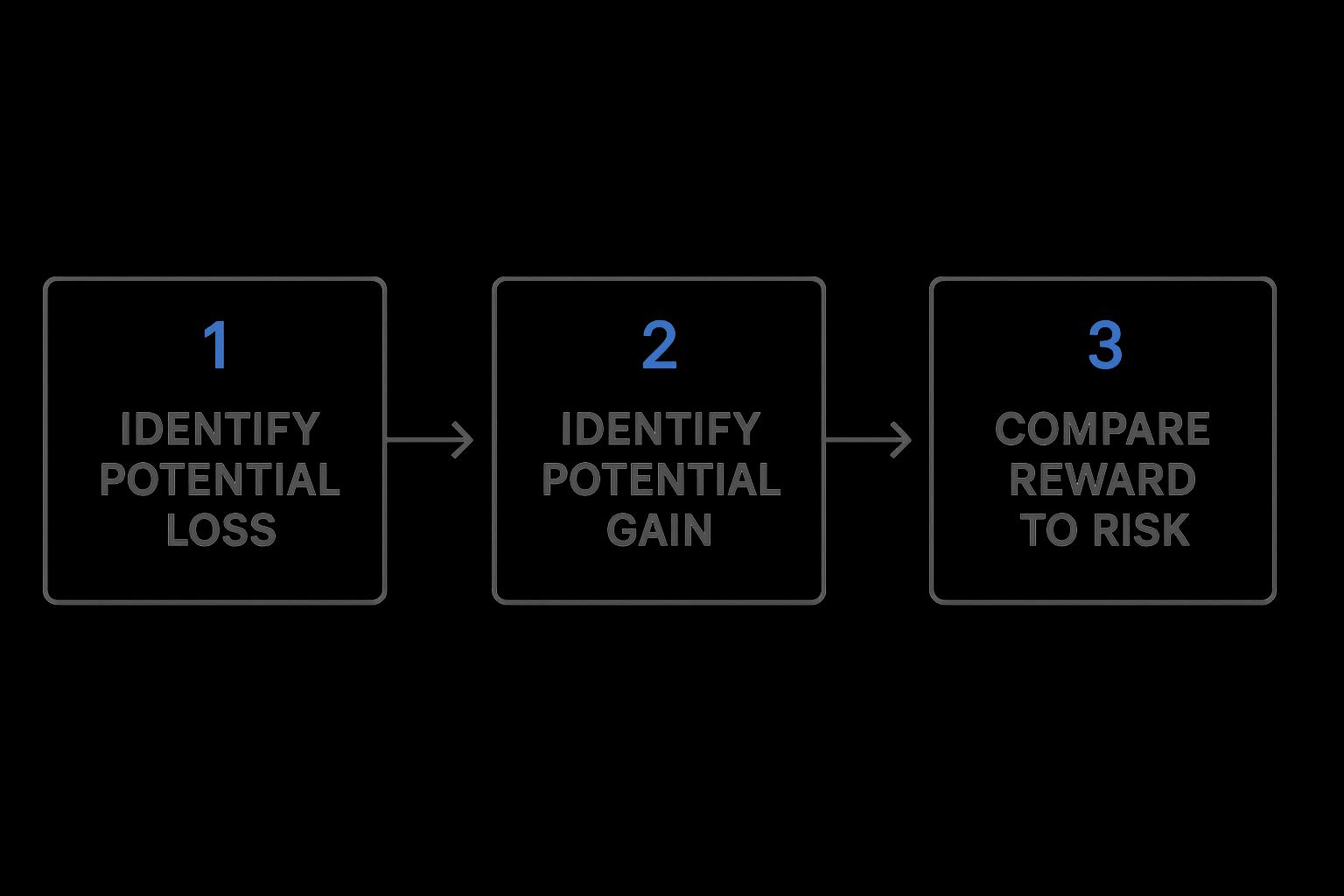

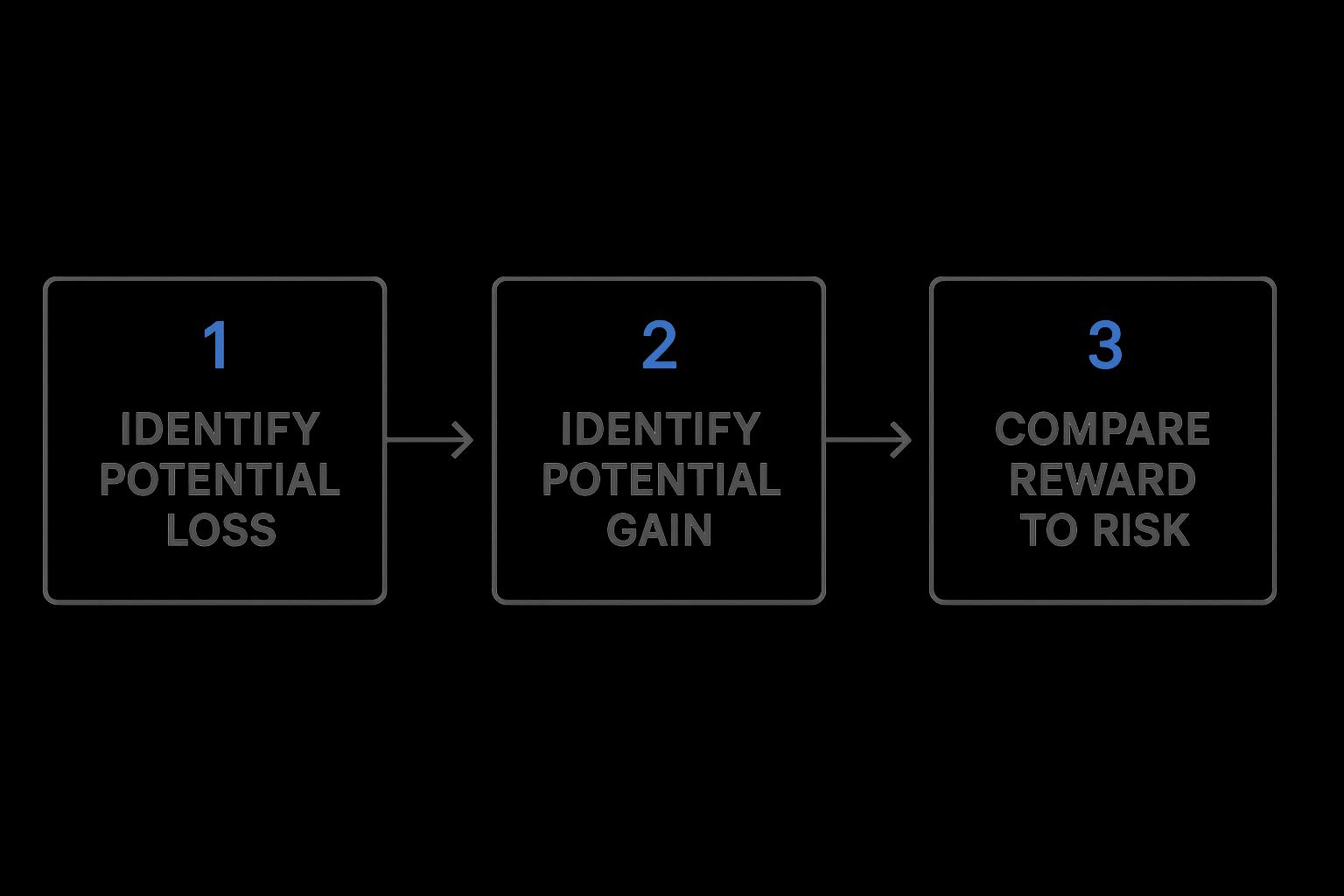

Calculating the Risk-Reward Ratio in 3 Steps

Alright, let's get practical. Moving from theory to the real world is where discipline is built. Calculating the risk-reward ratio isn't about guesswork; it's about using the hard data on your chart to define your trade before you put a single dollar on the line.

This simple breakdown shows the core process.

As you can see, the flow is straightforward: figure out your maximum loss, identify your potential profit, and then see if the reward justifies the risk.

Define Your Maximum Risk

First things first: you have to determine your potential risk. This is the absolute most you're willing to lose if the trade goes south and hits your stop-loss. A stop-loss isn't just a random number; it must be placed at a logical technical level that would prove your trade idea wrong.

I often see traders place stops:

- Slightly below a recent swing low or a key support level for a long (buy) trade.

- Just above a recent swing high or a key resistance level for a short (sell) trade.

Let's use a real-world scenario. Say you're looking to buy NVDA stock at $900. You've identified a solid support level at $880. By placing your stop-loss at $875, you give the trade some breathing room while clearly defining your risk.

Your potential risk per share is the difference: $900 (Entry) - $875 (Stop-Loss) = $25.

Identify Your Potential Reward

Next up, you need a realistic profit target. This is what defines your potential reward. Just like your stop-loss, this has to be based on technical analysis, not wishful thinking. Scan the chart for a logical spot where the price might run out of steam or reverse.

For our NVDA trade, you might spot a significant resistance level at $975. That becomes your take-profit target. Your potential reward per share is the difference between your entry and that target: $975 (Target) - $900 (Entry) = $75.

By setting your stop-loss and profit target based on market structure, you ground your trade in objective reality rather than emotion. This is a fundamental habit of consistently profitable traders.

Put It All Together

Now you have all the pieces to calculate the risk-reward ratio. You just divide your potential reward by your potential risk. It’s that simple.

- Potential Reward: $75

- Potential Risk: $25

The calculation looks like this: $75 / $25 = 3.

This gives you a risk-reward ratio of 1:3. For every $1 you're risking, you stand to make $3. This is widely considered a great ratio that can fuel a profitable strategy over the long run, even if your win rate is below 50%.

Many platforms, like the TradingView charts integrated into ChartsWatcher, have tools to visualize this right on your chart, making the process almost effortless.

This screenshot from ChartsWatcher shows exactly how an integrated charting tool can draw the risk and reward zones, giving you an instant visual check on whether a setup meets your trading plan's criteria.

Adapting Your Ratio to Different Market Conditions

One of the biggest mistakes I see new traders make is treating their risk-reward ratio as a rigid, unchanging rule. But the market isn't static; it has moods and personalities. The real skill isn't just knowing how to calculate risk reward ratio—it's knowing when to bend the rules.

Think of it this way: in a strong, trending market where prices are confidently marching in one direction, you can afford to be a bit more aggressive. On a pullback, you might take a trade with a 1:2 or even a 1:1.5 ratio. Why? Because the prevailing momentum is on your side, giving your trade a higher probability of hitting its target. This dynamic approach is a cornerstone of many successful price action trading strategies.

A volatile, choppy market is a different beast entirely. When prices are just thrashing back and forth with no clear direction, the odds of getting stopped out by random noise skyrocket. This is where you need to be far more conservative.

Adjusting for Market Volatility

In these uncertain, messy conditions, you have to demand a bigger payoff to make the risk worthwhile. This is the time to insist on a minimum ratio of 1:3 or even 1:4. It’s a defensive move. You’re acknowledging that you'll likely have more small losses from false starts, so your winners need to be big enough to more than cover them.

This adaptability also applies to your trading timeframe:

- Day Trading: The fast-paced, intraday world often calls for tighter ratios like 1:2. You're aiming to capture smaller, more frequent moves within a single session.

- Swing Trading: When you’re holding positions for days or weeks, you're playing for bigger swings. This makes ratios of 1:3 or higher not just possible, but necessary for a sound strategy.

A critical factor, especially for international traders, is currency risk. Analyses of global market data show that risk estimations can change depending on the currency used for measurement, so your ratios may need to be adjusted for currency fluctuations.

Ultimately, what separates a purely mechanical system from an intelligent trading approach is the ability to read the room. Ask yourself: is the market trending, ranging, or just plain chaotic today? Your answer should directly influence the risk you're willing to take for a potential reward.

Common Mistakes Traders Make With Risk Reward

Knowing the formula is one thing. Applying it correctly under the pressure of a live market is where the real challenge begins. I’ve seen countless traders stumble here, and the mistakes are usually the same.

The most common error? Forcing a trade just because it looks good on paper. A trader will see a potential setup and try to massage the numbers to hit their desired 1:3 ratio, even if it means setting a completely unrealistic profit target that flies in the face of obvious market structure, like a huge resistance level sitting right in the way.

Another classic pitfall is setting your stop-loss way too tight. Sure, it makes the ratio look fantastic, but it dramatically increases the odds of getting knocked out by normal market chop. A good trade needs room to breathe. An overly tight stop suffocates it before it even has a chance to play out.

Avoiding Emotional Sabotage

Ultimately, the biggest battle is psychological. When you're in a live trade and money is on the line, it’s incredibly tempting to ditch your plan. You might see the price inching toward your stop and decide to give it "a little more room," or watch it run in your favor and get greedy, canceling your take-profit order hoping for more.

This kind of emotional decision-making completely negates the whole point of calculating the risk-reward ratio in the first place.

Watch out for these classic blunders:

- Ignoring Market Structure: You place stops and targets based on a ratio you want, not on actual support and resistance levels.

- Setting Stops Too Tight: You're chasing a high ratio by placing a stop-loss so close that any minor market sneeze will take you out.

- Emotional In-Trade Adjustments: You move your stop-loss further away out of fear or abandon a profit target because of greed.

Pro Tip: One of the most effective ways to fight these tendencies is to keep a detailed trading journal. Document your planned entry, stop, and target before you enter every single trade. It forces discipline and gives you an objective record to review later, making it painfully obvious where emotion overrode your strategy.

Building this kind of discipline is a cornerstone of long-term success. To dive deeper, check out our comprehensive guide and master risk management in trading by visiting our blog: https://chartswatcher.com/pages/blog/master-risk-management-in-trading-essential-strategies-for-success.

By steering clear of these common traps, you can turn the risk-reward ratio from a simple formula into a powerful tool for consistent profitability.

Making Risk-Reward a Pillar of Your Trading Plan

A one-off risk calculation is fine, but where the magic really happens is when you start applying it consistently. This is how you build a profitable trading career. The real work starts when you bake the risk-reward ratio into the very DNA of your trading plan, turning it from a simple metric into a non-negotiable rule.

This is also where it joins forces with position sizing to create a complete risk management framework. For instance, you could forge a simple but incredibly powerful rule for yourself: “I will never enter a trade unless the potential reward is at least 2x my potential risk.” This isn't just a casual guideline; it becomes a hard-and-fast law for every single trade you even think about taking.

Building a Disciplined Framework

Discipline is what transforms the risk-reward ratio from an academic exercise into your greatest defense against emotional, seat-of-your-pants decisions. When you consistently apply a favorable ratio over hundreds of trades, you're not just trading—you're building a statistical edge. It’s this edge that can lead to sustained profitability, even if your win rate happens to dip below 50%.

Your trading plan isn't about trying to win the next trade. It’s about playing the long game to make sure you're still in the market years from now. This disciplined approach is how you survive and, eventually, thrive.

This idea isn't just for active traders; it's a cornerstone of long-term investing, too. Take the globally diversified 60/40 portfolio, a classic example of risk-reward principles applied on a macro scale. It has shown remarkably steady returns going all the way back to 1997. This kind of historical performance is proof that disciplined analysis creates a framework for enduring whatever the market throws at you. You can dive deeper into this portfolio's performance in a great analysis from Vanguard's corporate site.

Frequently Asked Questions

Even once you get the hang of the risk-reward formula, a few common questions always pop up when it's time to apply it to live trades. Let's tackle some of the most frequent ones we hear from traders.

What Is a Good Risk Reward Ratio for a Beginner?

If you're just starting out, being selective is your best friend. A solid rule of thumb for any beginner is to steer clear of any trade with a ratio below 1:2. Put simply, for every dollar you're willing to lose, you should be aiming to make at least two dollars.

This simple discipline does a couple of powerful things for you:

- It forces good habits. You'll find yourself hunting for high-quality setups instead of just taking a punt on every little market wiggle.

- It gives you a mathematical edge. You can be wrong more often than you're right and still break even or be profitable. That's a massive psychological relief when you're still finding your footing.

Sticking to a 1:2 or even a 1:3 ratio is one of the best ways to protect your capital while you clock in that valuable screen time and build experience.

Can I Use This Calculation for Crypto and Forex?

Absolutely. The risk-reward calculation is universal. Why? Because it’s based purely on price movement, not the asset itself. It doesn't matter if you're looking at a chart for Bitcoin, the EUR/USD pair, or a big-name stock—the underlying principle is identical.

You still have to do the work of identifying your entry, a logical stop-loss, and a sensible profit target based on that market's behavior. The wild swings in crypto might mean your stops need to be a bit wider, but the math for the ratio itself never changes.

Key Insight: Your win rate and your risk-reward ratio are two sides of the same coin. A high win rate can make a lower ratio like 1:1.5 profitable. On the flip side, a high ratio like 1:4 means you can be profitable even if you only win 30% of your trades. You have to consider them together when building a strategy that works for you.

Ready to stop guessing and start calculating your risk with precision? ChartsWatcher provides dynamic, professional-grade charting tools that let you map out your risk-reward ratio directly on your charts before you ever place a trade. Take control of your risk management and explore our powerful platform today. Visit https://chartswatcher.com to learn more.