12 Best Trading Ideas Scanner Tools for 2025

In today's fast-paced markets, having the right information at the right time is what separates successful traders from the rest. A sophisticated trading ideas scanner isn't just a tool; it's a command center for identifying high-potential opportunities, validating strategies, and executing trades with precision. Generic screeners that only filter by basic metrics are no longer enough. Modern traders need dynamic, real-time platforms that can cut through market noise, uncover hidden patterns, and provide actionable insights before the opportunity vanishes.

The best scanner synthesizes vast amounts of data into clear signals, effectively becoming an AI-powered partner. This ability to process complex information rapidly is critical for staying ahead; to learn more about this, explore how AI can build a competitive advantage in decision-making. Whether you're a day trader chasing momentum, a swing trader identifying trends, or a long-term investor seeking value, the right platform is crucial for your success.

This guide dives deep into the top 12 trading ideas scanner tools, moving beyond marketing hype to offer a practical, comparative analysis. We'll explore their unique strengths, expose their limitations, and provide real-world use cases, screenshots, and direct links to help you choose the platform that best aligns with your trading style and goals. Let's find the scanner that will give you your market edge.

1. ChartsWatcher

ChartsWatcher establishes itself as a premier trading ideas scanner for serious traders who require precision, speed, and deep customization. Developed in Germany, this platform moves beyond basic screening by offering a sophisticated, multi-window dashboard environment. Users can build a completely personalized workspace, synchronizing up to eight different window types, including real-time alerts, toplists, and interactive charts, all linked to a specific stock or asset.

This level of integration is what sets ChartsWatcher apart. For instance, a day trader can set up a screen that simultaneously displays a custom toplist of the day's biggest gainers, a newsfeed filtered for those specific stocks, and multiple charts showing different timeframes. An alert triggered on one chart can be visually represented across all relevant windows, providing immediate, multi-faceted context for a trading decision.

Key Features and Use Cases

The platform’s strength lies in its highly configurable alert and filter system. You aren’t limited to generic presets; instead, you can construct complex, multi-conditional rules based on technical indicators, price action, and volume. This capability allows you to build and automate the discovery of very specific trading setups that match your unique strategy.

- Backtesting Engine: A standout feature is the ability to backtest strategies against historical data (up to 20 days on the Pro plan). This allows you to validate an idea's potential profitability and refine its parameters before risking any real capital, a crucial step for disciplined strategy development.

- Interactive Charting: Charts are not just for viewing. You can integrate alerts directly onto the visual timeline, making it easy to see where and when your conditions were met historically and in real time.

- Configuration Sharing: The import/export function is a powerful tool for trading teams or educators. A senior analyst can create and distribute a finely-tuned dashboard configuration to their entire team, ensuring everyone is working with the same strategic view of the market.

Our Take: ChartsWatcher is an exceptionally robust tool that empowers traders to transition from reactive screening to proactive, strategy-driven market scanning. Its professional-grade customization and integrated backtesting provide a significant edge for those dedicated to data-driven trading.

Pricing: ChartsWatcher offers a flexible tiered model. A free plan provides access to core features, making it an excellent entry point. For advanced functionality like extended backtesting and multi-screen support, the Pro plans are required.

Pros:

- Highly customizable multi-window dashboards.

- Extensive, precise alert and filter configurations.

- Robust backtesting to validate trading strategies.

Cons:

- Advanced features require a paid subscription.

- Lacks prominent third-party awards or user testimonials on its site.

Website: https://chartswatcher.com

2. Trade Ideas

Trade Ideas is a professional-grade, AI-powered trading ideas scanner designed for active day traders who demand sophisticated, real-time market intelligence. Its standout feature is "Holly," a proprietary artificial intelligence engine that backtests millions of trading scenarios overnight to identify high-probability strategies for the current trading day. This AI-driven approach provides users with statistically-backed trade alerts, moving beyond simple technical indicator scans.

The platform offers unparalleled customization through its "Alert Windows" and "Top List Windows," allowing traders to build complex scanning formulas from scratch or use pre-configured channels. While the interface has a steeper learning curve compared to more basic tools, its power is unmatched for serious traders.

Key Features and Pricing

| Feature | Description |

|---|---|

| Holly AI | Provides AI-generated trade signals based on backtested strategies. |

| Brokerage Integration | Enables direct trade execution from the platform with supported brokers. |

| Backtesting | Allows users to test their own custom strategies against historical data. |

| Simulated Trading | A paper trading environment to practice strategies without risking real capital. |

Pricing: Trade Ideas operates on a subscription model, with two main tiers:

- Standard Plan: Around $118/month, offering core scanning and charting features.

- Premium Plan: Approximately $228/month, which includes full access to the Holly AI, backtesting, and auto-trading capabilities.

Due to its advanced nature, Trade Ideas is best for experienced traders committed to leveraging AI for an edge. For more context on how it compares to other platforms, you can explore this overview of top scanner tools.

Website: https://www.trade-ideas.com/

3. TrendSpider

TrendSpider is a powerful charting and analysis platform that functions as an intelligent trading ideas scanner through its automated technical analysis capabilities. It excels at identifying trendlines, support/resistance levels, and candlestick patterns across multiple timeframes automatically, saving traders countless hours of manual chart markup. This automation allows users to discover potential trade setups that might otherwise be missed.

The platform is designed for technical traders who rely on chart-based strategies. Its standout feature, Multi-Timeframe Analysis (MTFA), overlays indicators from different timeframes onto a single chart, providing deeper market context. This, combined with its dynamic price alerts and strategy backtesting engine, makes it a robust tool for validating and executing trading ideas. While its brokerage integration is more limited than some competitors, its analytical prowess is top-tier.

Key Features and Pricing

| Feature | Description |

|---|---|

| Automated Analysis | Automatically draws trendlines and recognizes chart patterns. |

| Multi-Timeframe Analysis | View technical indicators from multiple timeframes on one chart. |

| Strategy Tester | Backtest custom trading strategies without writing any code. |

| Dynamic Price Alerts | Set complex, multi-conditional alerts based on indicators or trendlines. |

Pricing: TrendSpider offers several subscription plans, often with discounts for annual prepayment:

- Essential: Around $44/month, offering core automated analysis and multi-timeframe charting.

- Elite: Approximately $87/month, adding backtesting, more alerts, and advanced features.

- Advanced: Roughly $131/month, for power users requiring the highest limits and feature access.

TrendSpider is ideal for systematic traders who want to automate their technical analysis workflow and find high-probability setups efficiently.

Website: https://www.trendspider.com/

4. TradingView

TradingView has become a dominant force in the financial markets, blending advanced charting, a powerful trading ideas scanner, and a vibrant social network for traders. It stands out by offering a comprehensive, web-based solution that caters to everyone from beginners to seasoned professionals across stocks, forex, and crypto. Its stock screener is highly customizable, allowing users to filter assets based on hundreds of fundamental and technical metrics to uncover potential opportunities. The platform’s biggest differentiator is its community-driven approach, where millions of users publish their analyses and trade ideas directly on charts.

This social integration makes it more than just a tool; it's a collaborative ecosystem for market analysis. The user interface is exceptionally intuitive and modern, making sophisticated charting accessible to a wider audience. While its core features are available for free, a subscription is necessary to unlock the platform's full potential, such as using multiple indicators per chart and accessing more real-time data.

Key Features and Pricing

| Feature | Description |

|---|---|

| Advanced Charting | Offers a vast library of drawing tools, indicators, and chart types. |

| Stock Screener | A highly flexible scanner for stocks, forex, and crypto with numerous filters. |

| Social Network | A large community where traders share charts, ideas, and scripts. |

| Multi-Asset Support | Provides data and tools for a wide range of global markets. |

Pricing: TradingView uses a freemium model with several paid tiers:

- Basic Plan: Free, with ads and limitations on indicators and data speed.

- Pro Plans: Starting around $14.95/month, these plans remove ads and increase the limits on indicators, alerts, and layouts. Higher-tier plans add more features and faster data.

TradingView is ideal for traders who value community insights and top-tier charting tools in a single, user-friendly package.

Website: https://www.tradingview.com/

5. Benzinga Pro

Benzinga Pro is a real-time news and research platform that excels as a trading ideas scanner for traders who prioritize news-driven catalysts. Its core strength lies in delivering actionable information faster than competitors, combining a lightning-fast news feed with an advanced stock screener. This allows traders to react instantly to market-moving headlines, SEC filings, and press releases, creating a unique edge based on informational arbitrage.

The platform integrates news, charts, and scanning into a single, customizable workspace. Its standout feature, the Audio Squawk, broadcasts critical headlines and analysis aloud, ensuring subscribers never miss a key event even when looking away from the screen. While there is a learning curve to mastering the integrated tools, it is invaluable for traders whose strategies depend on speed and timely data.

Key Features and Pricing

| Feature | Description |

|---|---|

| Real-Time News Feed | A low-latency feed delivering press releases, SEC filings, and news. |

| Audio Squawk | Live audio broadcast of the most critical market-moving headlines. |

| Advanced Screener | Filter stocks by technicals, fundamentals, and news-related catalysts. |

| Custom Alerts | Set up notifications for price movements, news keywords, or specific stocks. |

Pricing: Benzinga Pro offers several subscription tiers to cater to different needs:

- Basic Plan: A limited, free version with delayed data.

- Essential Plan: Around $177/month, providing the core real-time news feed, Squawk, and chat.

- Pro & Options Mentorship: Higher-priced tiers adding advanced features and mentorship.

Benzinga Pro is best suited for day traders and swing traders who build strategies around news events. To see how it measures up against other tools, check out this review of the best stock scanners.

Website: https://pro.benzinga.com/

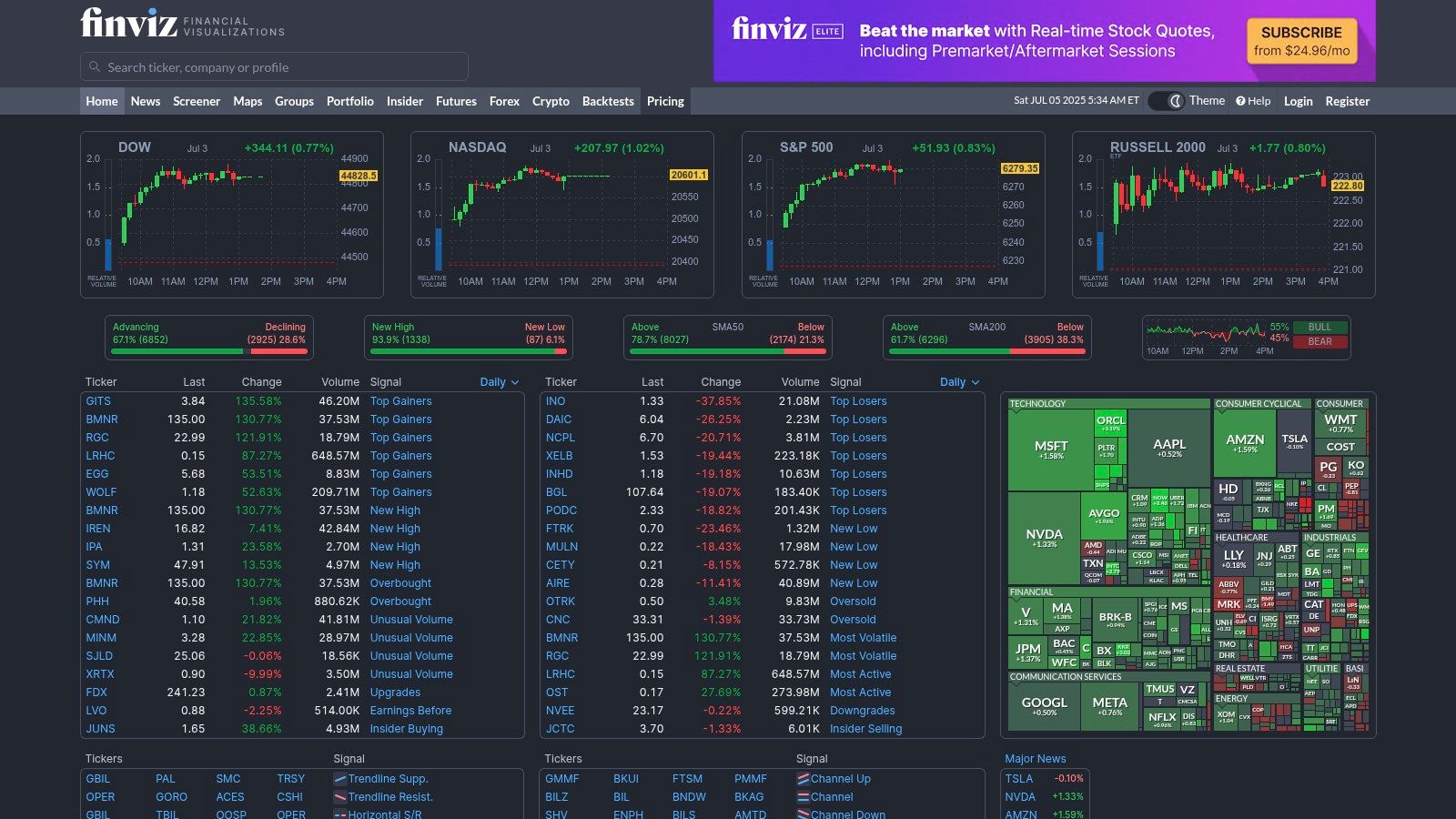

6. Finviz

Finviz is a powerful and widely-used browser-based trading ideas scanner known for its highly visual approach to market data and an exceptionally robust free offering. It excels at providing a quick, comprehensive overview of the market through its signature heat maps, which display sector and industry performance at a glance. The platform is especially valuable for swing traders and investors who rely on a blend of fundamental and technical analysis to find opportunities.

Its core strength lies in its versatile screener, which allows users to filter stocks using a vast array of descriptive, fundamental, and technical criteria. While the free version provides delayed data, it remains one of the most functional no-cost tools available, making it an ideal starting point for new traders or a quick research tool for seasoned professionals.

Key Features and Pricing

| Feature | Description |

|---|---|

| Stock Screener | A comprehensive tool with dozens of technical and fundamental filters. |

| Market Heat Maps | Visualizes market and sector performance in an intuitive, color-coded map. |

| Insider Trading Data | Tracks recent stock purchases and sales by corporate insiders. |

| News Aggregation | Pulls headlines from various financial news sources for specific tickers. |

Pricing: Finviz offers a compelling free version and a straightforward premium tier:

- Free Plan: Includes delayed quotes, standard charts, and full screener access with ads.

- Elite Plan: Approximately $39.50/month (or $299.50 annually), providing real-time data, advanced charting, backtesting, and an ad-free experience.

Finviz is best for traders who appreciate data visualization and need a powerful, easy-to-use screener without the complexity of downloadable software.

Website: https://finviz.com/

7. Stock Rover

Stock Rover is a robust research platform that serves as a powerful trading ideas scanner for investors who prioritize deep fundamental analysis over short-term technical signals. It distinguishes itself by offering an extensive library of over 650 financial metrics, allowing users to screen for long-term opportunities based on valuation, financial health, growth, and profitability. This makes it an ideal tool for value investors and analysts seeking undervalued companies.

The platform integrates its powerful screener with comprehensive portfolio management tools, enabling users to analyze and track their holdings with the same depth as their research. While it lacks the real-time data and advanced charting of a day trading tool, its strength lies in providing a holistic view of a stock's financial standing and long-term potential.

Key Features and Pricing

| Feature | Description |

|---|---|

| Fundamental Screening | Screen stocks using over 650 financial, operational, and pricing metrics. |

| Portfolio Analysis | Import and analyze portfolios to gain insights on performance and risk. |

| Financial Data | Access up to 10 years of detailed historical financial statement data. |

| Ratings & Research | Provides fair value, margin of safety, and quality scores for stocks. |

Pricing: Stock Rover offers a freemium model with several paid tiers:

- Essentials Plan: Around $7.99/month, offering 260+ metrics and 5 years of historical data.

- Premium Plan: Approximately $17.99/month, unlocking over 650 metrics and advanced screening.

- Premium Plus Plan: About $27.99/month, adding advanced features like stock ratings and custom metrics.

Stock Rover is best suited for long-term investors who need an affordable yet powerful tool for fundamental research and portfolio management.

Website: https://www.stockrover.com/

8. TC2000

TC2000 is a highly regarded all-in-one platform known for its exceptional charting capabilities and its powerful trading ideas scanner, EasyScan. It excels at providing traders with a fast, reliable environment for analysis and execution, primarily focusing on US stocks and options. Its key differentiator is the seamless integration of high-quality charting, flexible scanning, and direct trading, eliminating the need to switch between multiple applications. This makes it a favorite among technical traders who value speed and efficiency.

The platform’s EasyScan feature allows users to build complex scans using a simple, condition-based interface without any coding required. You can scan the entire market for specific chart patterns, indicator conditions, or fundamental criteria in real-time. The user interface is clean and intuitive, making sophisticated analysis accessible even to less experienced traders.

Key Features and Pricing

| Feature | Description |

|---|---|

| EasyScan | A powerful real-time scanner for creating complex custom conditions without coding. |

| Advanced Charting | Award-winning charting tools with a vast library of technical indicators and drawing tools. |

| Integrated Trading | Place trades directly from charts or watchlists through TC2000 Brokerage services. |

| Options Analysis | Tools for scanning, analyzing, and trading stock options. |

Pricing: TC2000 offers tiered subscription plans, with pricing dependent on the data feed selected:

- Silver Plan: Around $9.99/month, providing basic charting and delayed data.

- Gold Plan: Approximately $29.99/month, adding real-time data, alerts, and the full EasyScan feature set.

- Platinum Plan: Roughly $89.98/month, which includes historical condition testing and more extensive options tools.

Website: https://www.tc2000.com/

9. MetaStock

MetaStock is a premium-grade charting and analysis platform that doubles as a powerful trading ideas scanner, catering to serious technical analysts and system traders. Its core strength lies in its extensive toolkit, which goes far beyond basic scanning to include robust backtesting, forecasting, and expert advisor integrations. The platform is designed for traders who want to build, test, and deploy highly specific, rule-based trading systems across global markets.

Unlike simpler scanners, MetaStock’s "Explorer" tool allows users to scan thousands of securities using over 350 technical indicators and custom formulas. This makes it ideal for identifying opportunities that fit a precise and well-tested trading methodology. While its interface is more complex and less intuitive for beginners, its analytical depth is a significant advantage for experienced traders.

Key Features and Pricing

| Feature | Description |

|---|---|

| The Explorer™ | Scans entire markets to find securities matching your specific technical or fundamental criteria. |

| System Tester™ | Allows for comprehensive backtesting of trading strategies against historical data to verify viability. |

| Forecaster | Uses patented technology to analyze historical events and forecast future price probabilities. |

| Expert Advisors | Provides commentary and alerts based on the methodologies of trading experts. |

Pricing: MetaStock offers several products, often purchased as a one-time license or monthly subscription:

- MetaStock D/C (End-of-Day): Around $59/month or a one-time purchase of $499, requires a separate data feed subscription.

- MetaStock R/T (Real-Time): Starts at approximately $100/month, plus the cost of a real-time data feed.

Given its higher cost and complexity, MetaStock is best for dedicated technical traders and analysts who require sophisticated testing and forecasting tools.

Website: https://www.metastock.com/

10. Black Box Stocks

Black Box Stocks carves out a unique niche by combining a real-time trading ideas scanner with a vibrant, community-driven trading environment. It's designed for traders who value collaborative insights, offering powerful stock and options scanners alongside live chat rooms where members share strategies and alerts. The platform excels at identifying unusual options activity and institutional order flow, providing an edge that goes beyond standard technical analysis.

This blend of algorithmic scanning and human collaboration is its core strength. Users not only receive automated alerts for potential trades but can also discuss them in real-time with experienced moderators and a large community. This makes it a great tool for traders who want to learn and grow while actively participating in the market.

Key Features and Pricing

| Feature | Description |

|---|---|

| Hybrid Scanning | Real-time scanners for both stocks and options, including unusual activity. |

| Community & Chat | Integrated Discord and proprietary chat rooms with live moderator alerts. |

| Integrated News | A real-time news feed to quickly correlate market moves with catalysts. |

| Educational Resources | Regular webinars, boot camps, and classes to help traders improve their skills. |

Pricing: Black Box Stocks is a subscription-based service, typically costing around $99.97 per month, with an annual option available at a discounted rate of approximately $959.

The platform is best suited for traders who thrive in a social setting and want to combine algorithmic data with community-vetted ideas. However, the constant activity in the chat rooms might be a distraction for traders who prefer a more solitary approach.

Website: https://www.blackboxstocks.com/

11. StockCharts

StockCharts is a renowned platform that excels in technical analysis, offering a powerful trading ideas scanner deeply integrated with its industry-leading charting tools. It is built for traders who prioritize visual analysis and want to identify opportunities based on specific chart patterns and technical indicator signals. The platform’s strength lies in its ability to translate complex technical criteria into scannable conditions, making it a favorite among chartists and technical traders.

Unlike AI-driven platforms, StockCharts empowers users with direct control. Its scanner uses a proprietary syntax that, while requiring a slight learning curve, allows for highly specific and customizable queries. The platform also offers numerous pre-defined scans created by expert technicians like John Murphy and Arthur Hill, providing a solid starting point for new users.

Key Features and Pricing

| Feature | Description |

|---|---|

| Advanced Technical Scans | Build custom scans using a wide range of technical indicators, patterns, and price data. |

| Pre-defined Scans | Access a library of expert-curated scans for common bullish and bearish setups. |

| Comprehensive Charting | Industry-standard charting tools, including PerfCharts, Seasonality, and Point & Figure. |

| Educational Resources | Extensive "ChartSchool" articles and blogs to help users master technical analysis. |

Pricing: StockCharts offers a tiered subscription model alongside a free version with limited capabilities:

- Basic: Around $24.95/month for more real-time data and advanced scanning.

- Extra: Approximately $39.95/month, adding more historical data and alert capabilities.

- PRO: About $59.95/month for the highest level of data access and features.

StockCharts is ideal for traders who build their strategies around technical analysis and want a scanner that is fully integrated with top-tier charting software.

Website: https://stockcharts.com/

12. TipRanks

TipRanks serves as a unique trading ideas scanner by aggregating and analyzing vast amounts of alternative data rather than focusing solely on technical indicators. It provides investors with a "Smart Score," which is a data-driven stock rating based on eight key market factors, including analyst ratings, financial blogger opinions, hedge fund activity, and insider trading. This approach offers a powerful, sentiment-based perspective for identifying investment opportunities.

The platform excels at making complex data accessible and actionable through a clean, user-friendly interface. Instead of requiring users to build complex scans, TipRanks presents curated lists like "Top Analyst Stocks" and "Top Smart Score Stocks," making it easy to find high-conviction ideas backed by expert and insider consensus.

Key Features and Pricing

| Feature | Description |

|---|---|

| Smart Score | A proprietary 1-10 rating that synthesizes multiple data points for at-a-glance evaluation. |

| Analyst Ratings | Aggregates and ranks Wall Street analyst recommendations and price targets. |

| Insider Trading | Tracks the buying and selling activity of corporate insiders to gauge sentiment. |

| Hedge Fund Activity | Shows which stocks top-performing hedge fund managers are buying and selling. |

Pricing: TipRanks offers a freemium model with robust premium options:

- Basic: Free, with limited access to data and features.

- Premium: Around $359/year, providing full data access, advanced screeners, and daily insights.

- Ultimate: Approximately $599/year, adding unlimited portfolio tracking and exclusive data sets.

TipRanks is best suited for fundamental and long-term investors who want to validate their ideas with data from financial professionals and corporate insiders.

Website: https://www.tipranks.com/

Trading Ideas Scanner: Feature & Performance Comparison

| Software | Core Features & Customizability | User Experience & Quality ★ | Value & Pricing 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| 🏆 ChartsWatcher | Multi-window dashboards, real-time alerts, backtesting | ★★★★☆ Robust, configurable UI | Free basic + scalable Pro plans 💰 | Pro traders, analysts, investors 👥 | Backtesting, import/export, multi-theme ✨ |

| Trade Ideas | AI-driven trade ideas, brokerage integration | ★★★★☆ Advanced AI-based alerts | Premium plans; higher cost 💰 | AI-driven traders, active traders 👥 | AI "Holly" for trade setups, broker links ✨ |

| TrendSpider | Automated trendline detection, multi-timeframe | ★★★★☆ Efficient automated tools | Subscription required 💰 | Technical traders, pattern seekers 👥 | Raindrop charts, automation ✨ |

| TradingView | Advanced charts, stock screener, social community | ★★★★☆ User-friendly & social | Free + paid tiers 💰 | All trader levels, social traders 👥 | Large community, multi-asset support ✨ |

| Benzinga Pro | Real-time news, stock screener, audio squawk | ★★★★☆ Timely & integrated | Premium plans 💰 | News-focused traders, institutions 👥 | Audio squawk, earnings calendars ✨ |

| Finviz | Stock screener, market maps, insider data | ★★★☆☆ User-friendly but ads | Free + premium 💰 | Beginners & experienced traders 👥 | Free version, fundamental & technical filtering ✨ |

| Stock Rover | Fundamental analysis, portfolio management | ★★★★☆ In-depth financial data | Affordable subscriptions 💰 | Long-term investors, analysts 👥 | 650+ metrics, portfolio tools ✨ |

| TC2000 | Advanced charts, EasyScan screening, trading | ★★★★☆ Fast & all-in-one | Paid plans only 💰 | US market-focused traders 👥 | EasyScan no coding, options analysis ✨ |

| MetaStock | 350+ indicators, backtesting, forecasting | ★★★★☆ Powerful & comprehensive | Higher cost 💰 | Advanced analysts, multi-asset 👥 | Expert advisors, strong backtesting ✨ |

| Black Box Stocks | Real-time stock/options scanning, community | ★★★☆☆ Strong community | Subscription required 💰 | Options & stock traders 👥 | Combined scanning, webinars & chat rooms ✨ |

| StockCharts | Technical charts, customizable scans, education | ★★★★☆ User-friendly & educational | Free + paid tiers 💰 | Technical analysts, educators 👥 | Extensive education, market summaries ✨ |

| TipRanks | Analyst ratings, insider data, smart score | ★★★☆☆ Alternative data focused | Some paid features 💰 | Investors seeking alternative data 👥 | Smart Score, hedge fund tracking ✨ |

Making Your Final Decision: The Right Scanner for Your Strategy

Navigating the crowded market for a trading ideas scanner can feel as complex as analyzing the market itself. Throughout this guide, we've explored a dozen powerful platforms, from the AI-driven prowess of Trade Ideas to the foundational, accessible screening of Finviz. The key takeaway is that there is no single "best" tool; there is only the best tool for your specific strategy, budget, and workflow.

Your decision-making process should be a deliberate reflection of your trading identity. Are you a high-frequency day trader who demands instantaneous, real-time data and pre-market alerts? Platforms like Benzinga Pro or the lightning-fast TC2000 might be your ideal co-pilots. Are you a long-term investor focused on deep fundamental analysis and portfolio management? The comprehensive reports and fair value metrics of Stock Rover would serve you exceptionally well.

Key Factors for Your Final Selection

Before committing to a subscription, filter your options through these critical lenses:

- Trading Style Alignment: A swing trader's needs are fundamentally different from a scalper's. Your chosen scanner must have filters, timeframes, and data types that directly support your methodology. Don't pay for features you'll never use.

- Data Latency and Quality: For active traders, real-time data is non-negotiable. For others, a 15-minute delay (like on Finviz's free plan) is perfectly acceptable for end-of-day analysis. Verify the data source and its speed during a trial period.

- Ease of Use vs. Customization: A powerful tool like MetaStock offers immense customization but requires a significant time investment to master. Conversely, a platform like ChartsWatcher strikes a balance, offering deep customizability within an intuitive, user-friendly interface that shortens the learning curve.

- Budget and True ROI: Don't just look at the monthly price. Consider the return on investment. A premium trading ideas scanner that helps you find just one or two extra winning trades per month can easily justify its cost.

Implementation and Next Steps

Once you've narrowed down your choices, the real work begins. We strongly recommend taking advantage of free trials or demos for your top two or three contenders. This hands-on experience is invaluable. Test each platform against your current strategy. Try to replicate your favorite scans, explore their unique features, and assess how seamlessly each one integrates into your daily routine.

Beyond evaluating features, understanding effective software procurement best practices can enhance your investment in trading tools, ensuring you get the most value and support from your chosen platform. The ideal trading ideas scanner should feel like an extension of your own analytical mind, empowering you to identify opportunities with greater speed, accuracy, and confidence.

Ready to experience a scanner that combines deep customization with an intuitive, multi-window interface? ChartsWatcher provides a robust and scalable platform designed to help you find your next great trade without the steep learning curve. Explore our powerful features and see how our tools can elevate your trading strategy by visiting ChartsWatcher today.